- Record fourth quarter sales and margin performance

- Sales and core organic growth up 4%

- Reported operating income of $104 million and core adjusted

EBITDA of $126 million, up 18% versus prior year

- Initiated full year 2024 outlook

ESAB Corporation (“ESAB” or the “Company”) (NYSE: ESAB), a

focused premier industrial compounder, today announced record

financial results for the fourth quarter of 2023.

ESAB reported fourth quarter sales of $689 million, an increase

of 4% on an as reported basis or 4% higher core organic growth

before acquisitions and currency translation impacts, as compared

to the prior year. ESAB also reported fourth quarter net income

from continuing operations attributable to ESAB of $58 million or

$0.96 diluted earnings per share and core adjusted net income of

$69 million or $1.13 diluted earnings per share. Core adjusted

EBITDA of $126 million rose 18% and margins expanded 200 basis

points to 19.4%, both as compared to the prior year quarter.

“ESAB’s team continues to execute well and delivered

record-breaking sales, profit, and cash flow during the fourth

quarter to conclude the year. Our exciting new innovative products

are driving growth and EBX initiatives are expanding margins and

generating strong cash flow," stated Shyam P. Kambeyanda, President

and CEO of ESAB Corporation. "As a company, we have consistently

delivered on our commitments and are investing to strategically

position the company for sustained growth and margin expansion. We

step into 2024 with confidence in our ability to deliver strong

shareholder returns and make continued strides toward our 2028

goals.”

ESAB 2024 Outlook

ESAB expects core organic growth of 2.5% to 4.5% and total core

sales growth of 1.5% to 3.5% in 2024, which reflects approximately

(1.0%) currency headwinds. ESAB is expecting core adjusted EBITDA

of $495 to $515 million, core adjusted EPS of $4.65 to $4.85 and

cash conversion of greater than 95%.

Conference Call and

Webcast

The Company will hold a conference call to discuss its fourth

quarter 2023 results beginning at 8:00 a.m. Eastern on Thursday,

February 29, 2024, which will be open to the public by calling

+1-888-550-5302 (U.S. callers) and +1-646-960-0685 (International

callers) and referencing the conference ID number 4669992 and

through webcast via ESAB’s website www.ESABcorporation.com under

the “Investors” section. Access to a supplemental slide

presentation can also be found on ESAB's website under the same

heading. Both the audio of this call and the slide presentation

will be archived on the website later today and will be available

until the next quarterly call. To view this press release and

associated financials in a PDF format click here. The

Company’s annual report on Form 10-K for the fiscal year ended

December 31, 2023, filed February 29, 2024, is also available on

ESAB’s website under the “Investors” section.

About ESAB Corporation

Founded in 1904, ESAB Corporation (NYSE: ESAB) is a focused

premier industrial compounder. The Company’s rich history of

innovative products, workflow solutions and business system ESAB

Business Excellence, enables its purpose of Shaping the World We

ImagineTM. ESAB Corporation is based in North Bethesda, Maryland

and employs approximately 9,000 associates and serves customers in

approximately 150 countries. To learn more, visit

www.ESABcorporation.com.

Non-GAAP Financial Measures and Other

Adjustments

ESAB has provided in this press release financial information

that has not been prepared in accordance with accounting principles

generally accepted in the United States of America (“non-GAAP”).

ESAB presents some of these non-GAAP financial measures including

and excluding Russia due to economic and political volatility

caused by the war in Ukraine, which results in enhanced investor

interest in this information. Core non-GAAP financial measures

excludes Russia for the three months and year ended December 31,

2023, and the three months and year ended December 31, 2022. These

non-GAAP financial measures may include one or more of the

following: adjusted net income from continuing operations, core

adjusted net income from continuing operations, adjusted EBITDA

(earnings before interest, taxes, pension settlement gains,

Restructuring and other related charges, separation costs,

acquisition-amortization and other related charges and depreciation

and other amortization), core adjusted EBITDA, organic sales

growth, core organic sales growth, adjusted free cash flow, and

ratios based on the foregoing measures. ESAB also provides adjusted

EBITDA and adjusted EBITDA margin on a segment basis, as well as

core adjusted EBITDA and core adjusted EBITDA margin on a segment

basis.

Adjusted net income from continuing operations represents Net

income from continuing operations, excluding Restructuring and

other related charges, acquisition-amortization and other related

charges, separation costs and pension settlement gains. Adjusted

net income includes the tax effect of non-GAAP adjusting items at

applicable tax rates. ESAB also presents adjusted net income margin

from continuing operations, which is subject to the same

adjustments as adjusted net income from continuing operations.

Adjusted net income per diluted share from continuing operations is

a calculation of adjusted net income from continuing operations

over the weighted-average diluted shares outstanding. ESAB also

presents Core adjusted net income from continuing operations and

Core adjusted net income per share - diluted from continuing

operations which are subject to the same adjustments as Adjusted

net income from continuing operations and Adjusted net income per

diluted share from continuing operations, further removing the

impact of Russia for the three months and year ended December 31,

2023, and December 31, 2022.

Adjusted EBITDA, excludes from Net income from continuing

operations, the effect of Income tax expense, Interest expense

(income) and other, net, Pension settlement gains, Restructuring

and other related charges, separation costs,

acquisition-amortization and other related charges and depreciation

and other amortization. ESAB presents adjusted EBITDA margins,

which are subject to the same adjustments as adjusted EBITDA.

Further, ESAB presents these non-GAAP performance measures on a

segment basis, which excludes the impact of Restructuring and other

related charges, separation costs, acquisition-amortization and

other related charges and depreciation and other amortization from

operating income. ESAB also presents Core adjusted EBITDA and Core

adjusted EBITDA margins which are subject to the same adjustments

as Adjusted EBITDA and Adjusted EBITDA margins, respectively,

further removing the impact of Russia for the three months and year

ended December 31, 2023, and December 31, 2022.

ESAB presents organic sales growth which excludes the impact of

acquisitions and foreign exchange rate fluctuations and presents

core organic sales growth which further excludes the impact of the

Russia business for the three months and year ended December 31,

2023, and December 31, 2022 from core organic sales growth.

Adjusted free cash flow represents cash flows from operating

activities excluding cash outflows related to the Company’s

separation from Enovis Corporation and discontinued operations,

less Purchases of property, plant and equipment net proceeds from

sale of certain properties. Cash conversion represents Adjusted

free cash flow divided by Adjusted net income from continuing

operations.

These non-GAAP financial measures assist ESAB management in

comparing its operating performance over time because certain items

may obscure underlying business trends and make comparisons of

long-term performance difficult, as they are of a nature and/or

size that occur with inconsistent frequency or relate to unusual

events or discrete restructuring plans and other initiatives that

are fundamentally different from the ongoing productivity and core

business of the Company. ESAB management also believes that

presenting these measures allows investors to view its performance

using the same measures that the Company uses in evaluating its

financial and business performance and trends.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

calculated in accordance with GAAP. Investors are encouraged to

review the reconciliation of these non-GAAP measures to their most

directly comparable GAAP financial measures. A reconciliation of

non-GAAP financial measures presented above to GAAP results has

been provided in the financial tables included in this press

release.

Forward Looking

Statements

This press release includes forward-looking statements,

including forward-looking statements within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements include, but are not limited to,

statements concerning the Company’s plans, goals, objectives,

outlook, expectations, and intentions, and other statements that

are not historical or current fact. Forward-looking statements are

based on the Company’s current expectations and involve risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied in such forward-looking statements,

including general risks and uncertainties such as market

conditions, economic conditions, geopolitical events, changes in

laws, regulations or accounting rules, fluctuations in interest

rates, terrorism, wars or conflicts, major health concerns, natural

disasters or other disruptions of expected business conditions.

Factors that could cause the Company’s results to differ materially

from current expectations include, but are not limited to, risks

related to the Company’s ability to operate as a stand-alone public

company; the Company’s ability to achieve the intended benefits

from the Company’s separation from Enovis; the impact of the war in

Ukraine and escalating geopolitical tensions; impact of supply

chain disruptions; the impact on creditworthiness and financial

viability of customers; other impacts on the Company’s business and

ability to execute business continuity plans; and the other factors

detailed in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023 filed with the U.S Securities and Exchange

Commission (“SEC”) on February 29, 2024, as well as other risks

discussed in the Company’s filings with the SEC. In addition, these

statements are based on assumptions that are subject to change.

This press release speaks only as of the date hereof. The Company

disclaims any duty to update the information herein.

ESAB CORPORATION

CONSOLIDATED AND COMBINED

STATEMENTS OF OPERATIONS

Dollars in thousands, except

per share data

(Unaudited)

Three Months Ended

Year Ended

December 31, 2023

December 31, 2022

December 31, 2023

December 31, 2022

Net sales

$

689,348

$

664,127

$

2,774,766

$

2,593,480

Cost of sales

434,623

439,738

1,759,015

1,707,950

Gross profit

254,725

224,389

1,015,751

885,530

Selling, general and administrative

expense

144,639

139,343

587,475

533,369

Restructuring and other related

charges

6,368

6,467

24,110

23,096

Operating income

103,718

78,579

404,166

329,065

Pension settlement gain

—

(5,836

)

—

(9,136

)

Interest expense (income) and other,

net

26,243

18,434

85,074

37,950

Income from continuing operations before

income taxes

77,475

65,981

319,092

300,251

Income tax expense

17,921

5,541

95,727

69,170

Net income from continuing operations

59,554

60,440

223,365

231,081

(Loss) income from discontinued

operations, net of taxes

(8,082

)

1,830

(12,341

)

(3,068

)

Net income

51,472

62,270

211,024

228,013

Less: Income attributable to

noncontrolling interest, net of taxes

1,233

1,563

5,739

4,266

Net income attributable to ESAB

Corporation

$

50,239

$

60,707

$

205,285

$

223,747

Earnings (loss) per share – basic

Income from continuing operations

$

0.96

$

0.97

$

3.59

$

3.75

Income (loss) on discontinued

operations

$

(0.13

)

$

0.03

$

(0.20

)

$

(0.05

)

Net income per share

$

0.83

$

1.00

$

3.39

$

3.70

Earnings (loss) per share – diluted

Income from continuing operations

$

0.96

$

0.97

$

3.56

$

3.74

Income (loss) on discontinued

operations

$

(0.13

)

$

0.03

$

(0.20

)

$

(0.05

)

Net income per share – diluted

$

0.83

$

1.00

$

3.36

$

3.69

ESAB CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

Dollars in millions, except

per share data

(Unaudited)

Three Months Ended

Year Ended

December 31, 2023

December 31, 2022

December 31, 2023

December 31, 2022

Adjusted Net Income

(Dollars in

millions)(1)

Net income from continuing operations

(GAAP)

$

59.6

$

60.4

$

223.4

$

231.1

Less: Income attributable to

noncontrolling interest, net of taxes

1.2

1.6

5.7

4.3

Net income from continuing operations

attributable to ESAB Corporation (GAAP)

$

58.4

$

58.9

$

217.7

$

226.8

Restructuring and other related charges –

pretax(2)

6.4

6.5

24.1

23.1

Acquisition - amortization and other

related charges – pretax(3)

9.0

11.7

36.9

34.2

Separation costs – pretax(4)

—

6.6

—

16.3

Pension settlement gain – pretax

—

(5.8

)

—

(9.1

)

Tax effect on the above items(5)

(3.7

)

(6.8

)

(14.7

)

(15.2

)

Discrete tax adjustments(6)

0.7

(3.5

)

20.8

(7.2

)

Adjusted net income from continuing

operations (non-GAAP)

$

70.8

$

67.6

$

284.8

$

268.9

Adjusted net income from continuing

operations attributable to Russia (non-GAAP)(7)

2.1

3.5

12.9

19.2

Core adjusted net income from continuing

operations (non-GAAP)

$

68.7

$

64.1

$

271.8

$

249.7

Adjusted net income margin from continuing

operations

10.3

%

10.2

%

10.3

%

10.4

%

Adjusted Net Income Per Share

Net income per share - diluted from

continuing operations (GAAP)

$

0.96

$

0.97

$

3.56

$

3.74

Restructuring and other related charges –

pretax(2)

0.10

0.11

0.40

0.38

Acquisition - amortization and other

related charges – pretax(3)

0.15

0.19

0.61

0.57

Separation costs – pretax(4)

—

0.11

—

0.27

Pension settlement gain – pretax

—

(0.10

)

—

(0.15

)

Tax effect on the above items(5)

(0.06

)

(0.11

)

(0.24

)

(0.25

)

Discrete tax adjustments(6)

0.01

(0.06

)

0.34

(0.12

)

Adjusted net income per share - diluted

from continuing operations (non-GAAP)

$

1.16

$

1.11

$

4.67

$

4.44

Adjusted net income per share - diluted

from continuing operations attributable to Russia (non-GAAP)(7)

0.03

0.06

0.21

0.32

Core adjusted net income per share -

diluted from continuing operations (non-GAAP)

1.13

1.05

4.46

4.12

__________

(1)

Numbers may not sum due to

rounding.

(2)

Includes severance and other

termination benefits, including outplacement services as well as

the cost of relocating associates, relocating equipment, lease

termination expenses, and other costs in connection with the

closure and optimization of facilities and product lines.

(3)

Includes transaction expenses,

amortization of intangibles, fair value charges on acquired

inventories and integration expenses.

(4)

Includes non-recurring charges

and employee costs related to the planning and execution of the

separation from Enovis. ESAB does not anticipate any further costs

associated with the separation after 2023.

(5)

This line item reflects the

aggregate tax effect of all non-tax adjustments reflected in the

proceeding line items of the table. ESAB estimates the tax effect

of each adjustment item by applying ESAB’s overall estimated

effective tax rate to the pretax amount, unless the nature of the

item and/or tax jurisdiction in which the item has been recorded

requires application of a specific tax rate or tax treatment, in

which case the tax effect of such item is estimated by applying

such specific tax rate or tax treatment.

(6)

Discrete tax adjustments for ESAB

include the impact of net discrete tax expenses related to law

changes, certain dividend withholding taxes and the impact of

unrecognized tax benefits due to adverse court ruling in a foreign

jurisdiction.

(7)

Numbers were calculated following

the same definition of Adjusted Net Income and Adjusted Net Income

per share for total Company.

ESAB CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

Dollars in millions

(Unaudited)

Three Months Ended December

31, 2023

Year Ended December 31,

2023

Americas

EMEA & APAC

Total

Americas

EMEA & APAC

Total

(Dollars in

millions)(1)

Net income from continuing operations

(GAAP)

$

59.6

$

223.4

Income tax expense

17.9

95.7

Interest expense and other, net

26.2

85.1

Operating income (GAAP)

$

50.1

$

53.6

$

103.7

$

182.5

$

221.7

$

404.2

Adjusted to add:

Restructuring and other related

charges(2)

1.1

5.3

6.4

6.5

17.6

24.1

Acquisition - amortization and other

related charges (3)

5.0

4.0

9.0

20.9

15.9

36.9

Depreciation and other amortization

3.7

5.7

9.4

14.8

21.2

36.0

Adjusted EBITDA (non-GAAP)

$

59.8

$

68.6

$

128.5

$

224.7

$

276.4

$

501.1

Adjusted EBITDA attributable to Russia

(non-GAAP)(4)

—

2.7

2.7

—

18.4

18.4

Core adjusted EBITDA (non-GAAP)

$

59.8

$

65.9

$

125.8

$

224.7

$

258.0

$

482.7

Adjusted EBITDA margin (non-GAAP)

19.5

%

18.0

%

18.6

%

18.5

%

17.7

%

18.1

%

Core adjusted EBITDA margin

(non-GAAP)(5)

19.5

%

19.3

%

19.4

%

18.5

%

18.4

%

18.4

%

(1)

Numbers may not sum due to rounding.

(2)

Includes severance and other termination

benefits, including outplacement services as well as the cost of

relocating associates, relocating equipment, lease termination

expenses, and other costs in connection with the closure and

optimization of facilities and product lines.

(3)

Includes transaction expenses,

amortization of intangibles, fair value charges on acquired

inventories and integration expenses.

(4)

Numbers calculated following the same

definition as Adjusted EBITDA for total Company.

(5)

Net sales were $39.4 million and $153.8

million relating to Russia for the three months and year ended

December 31, 2023, respectively.

ESAB CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

Dollars in millions

(Unaudited)

Three Months Ended December

31, 2022

Year Ended December 31,

2022

Americas

EMEA & APAC

Total

Americas

EMEA & APAC

Total

(Dollars in

millions)(1)

Net income from continuing operations

(GAAP)

$

60.4

$

231.1

Income tax expense

5.5

69.2

Interest expense (income) and other,

net

18.4

38.0

Pension settlement gain

(5.8

)

(9.1

)

Operating income (GAAP)

$

33.7

$

44.9

$

78.6

$

136.2

$

192.8

$

329.1

Adjusted to add (deduct):

Restructuring and other related

charges(2)

2.3

4.1

6.5

11.4

11.7

23.1

Separation costs(3)(4)

2.8

3.8

6.6

7.5

8.1

15.5

Acquisition-amortization and other related

charges(5)

7.8

3.9

11.7

20.1

14.1

34.2

Depreciation and other amortization

3.3

5.4

8.7

13.4

21.5

34.9

Other(6)

(0.3

)

0.2

(0.1

)

—

—

—

Adjusted EBITDA (non-GAAP)

$

49.6

$

62.3

$

112.0

$

188.6

$

248.2

$

436.8

Adjusted EBITDA attributable to Russia

(non-GAAP)(7)

—

5.0

5.0

—

28.4

28.4

Core adjusted EBITDA (non-GAAP)

$

49.6

$

57.3

$

107.0

$

188.6

$

219.8

$

408.4

Adjusted EBITDA margin (non-GAAP)

17.5

%

16.4

%

16.9

%

16.7

%

16.9

%

16.8

%

Core adjusted EBITDA margin

(non-GAAP)(8)

17.5

%

17.3

%

17.4

%

16.7

%

16.9

%

16.8

%

(1)

Numbers may not sum due to

rounding.

(2)

Includes severance and other

termination benefits, including outplacement services as well as

the cost of relocating associates, relocating equipment, lease

termination expenses, and other costs in connection with the

closure and optimization of facilities and product lines.

(3)

Includes non-recurring charges

and employee costs related to the planning and execution of the

separation from Enovis within the Selling, general and

administrative expense line within the Consolidated and Combined

Statements of Operations.

(4)

Amounts are allocated to the

segments as a percentage of revenue as the costs or gain are not

discrete to either segment.

(5)

Includes transaction expenses,

amortization of intangibles, fair value changes on acquired

inventories and integration expenses.

(6)

Relates to the adjustment for

certain items included within the Interest expense (income) and

other, net line within the Consolidated and Combined Statements of

Operations.

(7)

Numbers calculated following the

same definition as Adjusted EBITDA for total Company.

(8)

Net sales were $49.9 million and

$163.6 million relating to Russia for the three months and year

ended December 31, 2022, respectively.

ESAB CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

Change in Sales

Dollars in millions

(Unaudited)

Sales Growth(1)

Americas

EMEA & APAC

Total ESAB

$

Change %

$

Change %

$

Change %

For the three months ended December 31,

2022

$

283.6

$

380.6

$

664.1

Components of Change:

Existing businesses (organic sales

growth)(2)

25.1

8.8

%

5.6

1.5

%

30.7

4.6

%

Acquisitions(3)

2.2

0.8

%

2.1

0.6

%

4.3

0.6

%

Foreign Currency translation(4)

(3.5

)

(1.2

)%

(6.2

)

(1.6

)%

(9.7

)

(1.5

)%

Total sales growth

23.8

8.4

%

1.5

0.4

%

25.3

3.8

%

For the three months ended December 31,

2023

$

307.3

$

382.0

$

689.4

(1)

Numbers may not sum due to

rounding.

(2)

Excludes the impact of

acquisitions and foreign exchange rate fluctuations, thus providing

a measure of change due to organic growth factors such as price,

product mix and volume.

(3)

Represents the incremental sales

in comparison to the portion of the prior period during which we

did not own the business.

(4)

Represents the difference between

prior year sales valued at the actual prior year foreign exchange

rates and prior year sales valued at current year foreign exchange

rates.

Core Sales

Growth(1)(2)

Americas

EMEA & APAC

ESAB

$

Change %

$

Change %

$

Change %

For the three months ended December 31,

2022

$

283.6

$

330.7

$

614.2

Components of Change:

Existing businesses (core organic sales

growth)(3)

25.1

8.8

%

0.2

0.1

%

25.3

4.1

%

Acquisitions(4)

2.2

0.8

%

2.1

0.6

%

4.3

0.7

%

Foreign Currency translation(5)

(3.5

)

(1.2

)%

9.6

2.9

%

6.1

1.0

%

Total core sales growth(6)

23.8

8.4

%

11.9

3.6

%

35.7

5.8

%

For the three months ended December 31,

2023

$

307.3

$

342.6

$

649.9

(1)

Numbers may not sum due to

rounding

(2)

Excludes Russia related sales of

$39.4 million and $49.9 million for the three months ended December

31, 2023, and December 31, 2022.

(3)

Excludes the impact of

acquisitions and foreign exchange rate fluctuations, thus providing

a measure of change due to organic growth factors such as price,

product mix and volume.

(4)

Represents the incremental sales

in comparison to the portion of the prior period during which we

did not own the business.

(5)

Represents the difference between

prior year sales valued at the actual prior year foreign exchange

rates and prior year sales valued at current year foreign exchange

rates.

(6)

Numbers calculated following the

same definition as total sales growth for total Company.

ESAB CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

Change in Sales

Dollars in millions

(Unaudited)

Sales Growth

Americas

EMEA & APAC

Total ESAB(1)

$

Change %

$

Change %

$

Change %

For the year ended December 31, 2022

$

1,128.3

$

1,465.2

$

2,593.5

Components of Change:

Existing businesses (organic sales

growth)(1)

60.5

5.4

%

101.1

6.9

%

161.6

6.2

%

Acquisitions(2)

43.7

3.9

%

20.2

1.4

%

63.9

2.5

%

Foreign Currency translation(3)

(17.5

)

(1.5

)%

(26.7

)

(1.8

)%

(44.2

)

(1.7

)%

Total sales growth

86.7

7.7

%

94.6

6.5

%

181.3

7.0

%

For the year ended December 31, 2023

$

1,215.0

$

1,559.8

$

2,774.8

(1)

Excludes the impact of

acquisitions and foreign exchange rate fluctuations, thus providing

a measure of change due to organic growth factors such as price,

product mix and volume.

(2)

Represents the incremental sales

in comparison to the portion of the prior period during which we

did not own the business.

(3)

Represents the difference between

prior year sales valued at the actual prior year foreign exchange

rates and prior year sales valued at current year foreign exchange

rates.

Core Sales Growth(1)

Americas

EMEA & APAC

ESAB

$

Change %

$

Change %

$

Change %

For the year ended December 31, 2022

$

1,128.3

$

1,301.6

$

2,429.9

Components of Change:

Existing businesses (core organic sales

growth)(2)

60.5

5.4

%

83.6

6.4

%

144.1

5.9

%

Acquisitions(3)

43.7

3.9

%

20.2

1.6

%

63.9

2.6

%

Foreign Currency translation(4)

(17.5

)

(1.5

)%

0.5

—

%

(17.0

)

(0.7

)%

Total core sales growth(5)

86.7

7.7

%

104.3

8.0

%

191.0

7.9

%

For the year ended December 31, 2023

$

1,215.0

$

1,405.9

$

2,620.9

(1)

Excludes Russia related sales of

$153.8 million and $163.6 million for the year ended December 31,

2023, and December 31, 2022.

(2)

Excludes the impact of

acquisitions and foreign exchange rate fluctuations, thus providing

a measure of change due to organic growth factors such as price,

product mix and volume.

(3)

Represents the incremental sales

in comparison to the portion of the prior period during which we

did not own the business.

(4)

Represents the difference between

prior year sales valued at the actual prior year foreign exchange

rates and prior year sales valued at current year foreign exchange

rates.

(5)

Numbers calculated following the

same definition as total sales growth for total Company.

ESAB CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

Adjusted Free Cash

Flow

Dollars in millions

(Unaudited)

Three Months Ended

Year Ended

December 31, 2023

December 31, 2022

December 31, 2023

December 31, 2022

Net cash provided by operating activities

(GAAP)

$

122.4

$

91.4

$

330.5

$

214.4

Purchases of property, plant and equipment

(GAAP)

(19.3

)

(18.2

)

(48.2

)

(40.2

)

Proceeds from the sale of certain

properties(1)

—

—

2.8

2.5

Payments related to the Separation(2)

—

5.8

4.4

19.0

Payments related to discontinued

operations

2.8

3.8

15.0

23.1

Adjusted free cash flow (non-GAAP)

$

105.9

$

82.8

$

304.5

$

218.8

(1)

Includes proceeds from the sale

of certain properties related to restructuring efforts for which

previous cash outlays were included in Net cash used in investing

activities.

(2)

Separation payments relate to

one-time non-recurring professional fees and employee costs

incurred in the planning and execution of the Separation from

Enovis.

ESAB CORPORATION

2024 Outlook

Dollars in millions

(Unaudited)

ESAB 2024 Outlook

2023 Core net sales

$

2,620.9

Organic growth

2.5%-4.5%

Currency

(1.0%)

2024 Core net sales growth

range

1.5%-3.5%

2023 Core adjusted EBITDA

$

482.7

2024 Core adjusted EBITDA range

$495-$515

ESAB CORPORATION

CONSOLIDATED BALANCE

SHEETS

Dollars in thousands

(Unaudited)

December 31, 2023

December 31, 2022

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

102,003

$

72,024

Trade receivables, less allowance for

credit losses of $25,477 and $23,471

385,198

374,329

Inventories, net

392,858

416,829

Prepaid expenses

61,771

56,637

Other current assets

55,890

68,851

Total current assets

997,720

988,670

Property, plant and equipment, net

294,305

284,226

Goodwill

1,588,331

1,529,767

Intangible assets, net

499,535

517,167

Lease assets - right of use

95,607

92,033

Other assets

353,131

342,152

Total assets

$

3,828,629

$

3,754,015

LIABILITIES AND EQUITY

CURRENT LIABILITIES:

Accounts payable

$

306,593

$

316,265

Accrued liabilities

313,489

285,310

Total current liabilities

620,082

601,575

Long-term debt

1,018,057

1,218,643

Other liabilities

542,833

545,339

Total liabilities

2,180,972

2,365,557

Equity:

Common stock - $0.001 par value -

Authorized 600,000,000; 60,295,634 and 60,094,725 shares issued and

outstanding as of December 31, 2023 and December 31, 2022,

respectively

60

60

Additional paid-in capital

1,881,054

1,865,904

Retained earnings

350,557

159,231

Accumulated other comprehensive loss

(624,272

)

(674,988

)

Total ESAB Corporation equity

1,607,399

1,350,207

Noncontrolling interest

40,258

38,251

Total equity

1,647,657

1,388,458

Total liabilities and equity

$

3,828,629

$

3,754,015

ESAB CORPORATION

CONSOLIDATED AND COMBINED

STATEMENTS OF CASH FLOWS

Dollars in thousands

(Unaudited)

Year Ended

December 31, 2023

December 31, 2022

Cash flows from operating

activities:

Net income

$

211,024

$

228,013

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, amortization and other

impairment charges

75,034

65,978

Stock-based compensation expense

16,122

12,964

Deferred income tax

(25,408

)

(20,199

)

Non-cash interest expense

1,195

1,972

Pension settlement gain

—

(9,136

)

Changes in operating assets and

liabilities:

Trade receivables, net

(6,006

)

(8,142

)

Inventories, net

17,958

(10,066

)

Accounts payable

(19,819

)

(28,794

)

Other operating assets and liabilities

60,394

(18,232

)

Net cash provided by operating

activities

330,494

214,358

Cash flows from investing

activities:

Purchases of property, plant and

equipment

(48,178

)

(40,243

)

Proceeds from sale of property, plant and

equipment

4,600

4,849

Acquisitions, net of cash received

(18,665

)

(149,029

)

Net cash used in investing

activities

(62,243

)

(184,423

)

Cash flows from financing

activities:

Proceeds from borrowings on term credit

facility

—

1,000,000

Repayments of borrowings on term credit

facility

(12,500

)

—

Proceeds from borrowings on revolving

credit facility and other

574,150

805,881

Repayments of borrowings on revolving

credit facility and other

(763,173

)

(585,491

)

Payment of deferred financing fees and

other

(972

)

(4,706

)

Payment of deferred consideration

—

(1,500

)

Payment of dividends

(13,342

)

(6,054

)

Consideration to Former Parent in

connection with the Separation

—

(1,200,000

)

Distributions to noncontrolling interest

holders

(3,880

)

(3,420

)

Transfers from (to) Former Parent, net

—

2,847

Net cash provided by (used in)

financing activities

(219,717

)

7,557

Effect of foreign exchange rates on Cash

and cash equivalents

(18,555

)

(6,677

)

Increase in Cash and cash

equivalents

29,979

30,815

Cash and cash equivalents, beginning of

period

72,024

41,209

Cash and cash equivalents, end of

period

$

102,003

$

72,024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240229439014/en/

Investor Relations Contact:

Mark Barbalato Vice President, Investor Relations E-mail:

investorrelations@esab.com Phone: 1-301-323-9098

Media Contact: Tilea Coleman

Vice President, Corporate Communications E-mail:

mediarelations@esab.com Phone: 1-301-323-9092

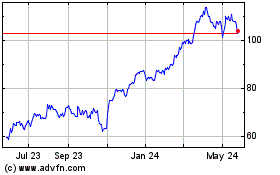

ESAB (NYSE:ESAB)

Historical Stock Chart

From Dec 2024 to Jan 2025

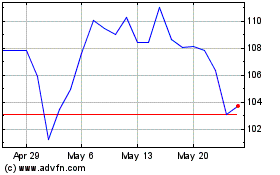

ESAB (NYSE:ESAB)

Historical Stock Chart

From Jan 2024 to Jan 2025