More Canadians Planning to Spend Less this Holiday Season

November 04 2019 - 6:00AM

In advance of Black Friday more than half of Canadians (55 per

cent) say they will be spending less on holiday gifts this year,

according to a recent survey* by Equifax Canada. This comes

following Equifax Canada’s Q2 Consumer Credit Trends Report, which

showed total debt per consumer rose by +1.9 per cent at the end of

the second quarter in 2019.

According to the survey, women were more likely to say they

would be spending significantly less at 61 per cent versus 48 per

cent of men. Canadians under the age of 55 were significantly more

likely to agree they will limit their spending because they are

already carrying too much debt, and they have a lot of anxiety

about their current level of debt. Survey respondents between

35-44 had the most concern about current debt levels (58 per cent

compared to 46 per cent for the general population) and the most

anxiety (49 per cent compared to 39 per cent for the general

population). The majority of people surveyed, however, are

working towards being financially fit for the holidays with 58 per

cent of them planning to prepare a holiday budget.

“These survey results illustrate that many people are feeling

the pinch and plan to rein in their holiday purchases this year,”

said Julie Kuzmic, Equifax Canada’s Director of Consumer Advocacy.

“If there’s a silver lining here, it’s the fact that most Canadians

remain conscious of their debt obligations and want to avoid adding

too much debt heading into the new year. This is not surprising, as

we have seen higher interest rates impacting consumers over the

last 18 months. Bankruptcies have also jumped significantly and

even credit card spending growth has tailed off in 2019.”

When asked how long it would take to catch-up on their holiday

spending, one-in-three (36 per cent) of survey respondents said it

takes them a month or more. As a further indication of where

Canadians stand with their debt obligations, Equifax Canada’s Q2

Consumer Credit Trends Report found the rate at which consumers

were missing monthly payments was higher and bankruptcies also

continued to rise as compared to last year. Newfoundland

(+11%), Alberta (+7.9%) and Ontario (+7.8%) led the way higher in

90+ day delinquency rates in a year-over-year comparison.

FINANCIAL LITERACY AND PREVENTING ID THEFT

Beyond examining concerns about debt, Equifax also asked survey

respondents about their financial literacy and the steps they have

taken to avoid becoming a victim of identity theft. The results

indicate Canadians appear to be taking the threat more seriously.

In a similar survey conducted three years ago, 64 per cent

indicated they feel vulnerable to fraudsters and identity thieves.

This number has significantly dropped to 45 per cent in 2019 likely

owing to the increased steps consumers have taken to help protect

their personal data:

|

2019 |

Steps Taken by Consumers |

2016 |

|

85 per cent |

Review credit card statements for fraudulent activity |

79 per cent |

|

60 per cent |

Check my credit report |

28 per cent |

|

60 per cent |

Limit purchases made online |

57 per cent |

|

52 per cent |

Avoid using public Wi-Fi |

47 per cent |

|

51 per cent |

Updated security passwords |

44 per cent |

“Identity thieves and fraudsters never take a holiday,” said

Kuzmic. “It’s certainly encouraging to see more people taking

precautionary steps to help stop identity theft and fraud before it

happens. This includes checking your credit report, which

once again we are pleased to see more people doing compared to

three short years ago.”

CREDIT SCORE(S) TO HELP ASSESS FINANCIAL WELLNESS

In addition to checking their credit reports, survey respondents

indicated they are also obtaining their credit scores. Almost half

(48 per cent) said they obtain their score at least annually, while

three-in-ten (28 per cent) said they obtain their scores

monthly. Younger adults (18-34) are significantly more likely

to check their credit scores monthly versus those over the age of

45 (36 per cent versus 25 per cent).

“Checking your credit reports and obtaining credit scores is a

good way to assess the credit aspect of your financial well being,”

Kuzmic added. “It’s important for people to remember that

there have always been a variety of credit scores in the

marketplace, and the situation is no different today. Different

algorithms and weightings in the score calculations mean that you

might see your credit scores varying from one source to the next.

The bottom line is knowing your scores can serve you well in your

financial planning.”

To learn more about how credit works, consumers are encouraged

to visit Equifax Canada’s education hub. The site offers insights

on how different actions can affect their credit scores and

provides resources to improve their financial literacy.

*An online survey of 1,566 Canadians was completed between

September 20-23, 2019, using Leger’s online panel. The margin of

error for this study was +/-2.5%, 19 times out of 20.

About EquifaxEquifax is a global data,

analytics, and technology company and believes knowledge drives

progress. The Company blends unique data, analytics, and technology

with a passion for serving customers globally, to create insights

that power decisions to move people forward. Headquartered in

Atlanta, Equifax operates or has investments in 24 countries in

North America, Central and South America, Europe and the Asia

Pacific region. It is a member of Standard & Poor's (S&P)

500® Index, and its common stock is traded on the New York Stock

Exchange (NYSE) under the symbol EFX. Equifax employs approximately

11,000 employees worldwide. For more information, visit Equifax.ca

and follow the company’s news on Twitter and LinkedIn.

Media Contacts:

|

Andrew FindlaterSELECT Public Relationsafindlater@selectpr.ca(416)

659-1197 |

Heather AggarwalEquifax CanadaMediaRelationsCanada@equifax.com

(416) 227-8711 |

An infographic accompanying this announcement is available

at

https://www.globenewswire.com/NewsRoom/AttachmentNg/b26191db-dc5c-491a-958d-a6867e12b14f

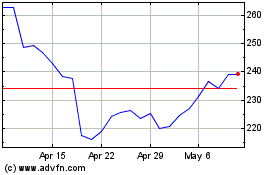

Equifax (NYSE:EFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

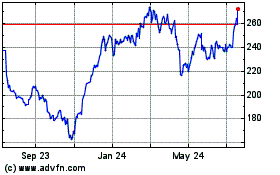

Equifax (NYSE:EFX)

Historical Stock Chart

From Apr 2023 to Apr 2024