UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(RULE 14D-100)

Tender Offer Statement Pursuant to Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

Eneti Inc.

(Name of Subject Company)

Cadeler A/S

(Offeror)

(Names of Filing Persons)

Common stock, par value $0.01 per share

(Title of Class of Securities)

Y2294C107

(CUSIP Number of Class of Securities)

Puglisi & Associates

850 Library Ave., Suite 204

Newark, DE 19711

Tel.: (302)-738-6680

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing persons)

with copies to:

| |

Connie I. Milonakis

Davis Polk & Wardwell London LLP

5 Aldermanbury Square

London, EC2V 7HR

United Kingdom

Tel.: +44-20-7418-1327

|

|

|

Emanuele Lauro

Eneti Inc.

L’Exotique

99 Boulevard Jardin Exotique

98000 Monaco

Tel: +377-9798-5715

|

|

|

Edward S. Horton

Nick Katsanos

Seward & Kissel LLP

One Battery Park Plaza

New York, NY 10004

Tel: (212) 574-1265

|

|

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

☒

third-party tender offer subject to Rule 14d-1.

☐

issuer tender offer subject to Rule 13e-4.

☐

going-private transaction subject to Rule 13e-3.

☐

amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

This Tender Offer Statement on Schedule TO is filed by Cadeler A/S, a company incorporated under the laws of Denmark (“Cadeler” or the “Offeror”). This Schedule TO relates to the offer by the Offeror to exchange for each outstanding share of Eneti Inc., a company incorporated under the laws of the Republic of the Marshall Islands (“Eneti”), par value $0.01 per share (“Eneti Common Stock”), validly tendered and not validly withdrawn in the offer, American Depositary Shares (“ADSs”), representing, in the aggregate, 3.409 shares of Cadeler, nominal value DKK 1 per share (the “Cadeler Shares”) with each ADS representing four (4) Cadeler Shares (the “Cadeler ADSs”), subject to payment of cash compensation with respect to any fractional Cadeler ADSs, without interest and subject to reduction for any applicable withholding taxes (such consideration, the “Transaction Consideration,” and such offer, on the terms and subject to the conditions and procedures set forth in the prospectus/offer to exchange, dated November 7, 2023 (the “Prospectus/Offer to Exchange”), and in the related letter of transmittal (the “Letter of Transmittal”), together with any amendments or supplements thereto, the “Offer”).

Cadeler has filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form F-4 dated October 31, 2023 and which became effective on November 7, 2023, relating to the offer and sale of the Cadeler Shares and a Registration Statement on Form F-6 relating to the registration of the Cadeler ADSs to be issued to holders of shares of Eneti Common Stock validly tendered and not validly withdrawn in the Offer (the “Registration Statement”). The terms and conditions of the Offer are set forth in the Prospectus/Offer to Exchange, which is a part of the Registration Statement, and the Letter of Transmittal, which are filed as Exhibits (a)(4) and (a)(1)(i), respectively, hereto. Pursuant to General Instruction F to Schedule TO, the information contained in the Prospectus/Offer to Exchange and the Letter of Transmittal, including any prospectus supplement or other supplement thereto related to the Offer hereafter filed with the SEC by Cadeler, is hereby expressly incorporated into this Schedule TO by reference in response to Items 1 through 11 of this Schedule TO and is supplemented by the information specifically provided for in this Schedule TO. The Business Combination Agreement, dated as of June 16, 2023, by and between Cadeler and Eneti, a copy of which is attached as Exhibit (d)(1) to this Schedule TO, is incorporated into this Schedule TO by reference.

Item 1. Summary Term Sheet.

The information set forth in the sections of the Prospectus/Offer to Exchange entitled “Summary” and “Questions and Answers About the Offer and the Merger” is incorporated into this Schedule TO by reference.

Item 2. Subject Company Information.

(a) The subject company and issuer of the securities subject to the Offer is Eneti Inc., a company incorporated under the laws of the Republic of the Marshall Islands. Its principal executive office is located at 99 Boulevard du Jardin Exotique, 98000 Monaco and its telephone number at that location is +377-9798-5715.

(b) As of November 6, 2023, there were 38,647,119 shares of Eneti Common Stock, par value $0.01 per share, issued and outstanding.

(c) The information concerning the principal market in which the shares of Eneti Common Stock are traded and certain high and low sales prices for the shares of Eneti Common Stock in that principal market is set forth in “Comparative Per Share Market Price and Dividend Information” in the Prospectus/Offer to Exchange and is incorporated into this Schedule TO by reference.

Item 3. Identity and Background of Filing Person.

(a), (b) The information set forth in the sections of the Prospectus/Offer to Exchange entitled “Summary — The Companies — Cadeler” and “Information about Cadeler” is incorporated into this Schedule TO by reference.

(c) As required by General Instruction C to Schedule TO, the name, current principal occupation or employment and material occupations, positions, offices or employment for the past five years of each director and executive officer of Cadeler are set forth below. Unless otherwise indicated below, the current business address of each director and executive officer is Arne Jacobsens Allé 7, 7th floor, DK-2300

Copenhagen S, Denmark. Unless otherwise indicated below, the current business telephone number of each director and executive officer is +(45) 3246 3100.

During the past five years, none of the directors and executive officers of Cadeler listed below has (a) been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (b) been a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

The biographical information for Mikkel Gleerup (age: 45), Chief Executive Officer of Cadeler, and Peter Brogaard Hansen (age: 58), Chief Financial Officer of Cadeler, set forth in the section of the Prospectus/Offer to Exchange entitled “Directors and Officers of the Combined Company — Senior Management of the Combined Company After the Business Combination” is incorporated into this Schedule TO by reference.

The biographical information for Cadeler board members Andreas Sohmen-Pao (age: 52), Chairperson, Andrea Abt (age: 63), Jesper T. Lok (age: 55) and Ditlev Wedell-Wedellsborg (age: 62) set forth in the section of the Prospectus/Offer to Exchange entitled “Directors and Officers of the Combined Company — Directors of Cadeler after the Business Combination” is incorporated into this Schedule TO by reference.

Item 4. Terms of the Transaction.

(a) The information set forth in the sections of the Prospectus/Offer to Exchange entitled “Questions and Answers About the Offer and the Merger,” “The Offer,” “Comparison of Rights of Cadeler Shareholders and Eneti Stockholders,” “Material Tax Consequences” is incorporated into this Schedule TO by reference.

Item 5. Past Contacts, Transactions, Negotiations and Agreements.

(a), (b) The information set forth in the sections of the Prospectus/Offer to Exchange entitled “The Companies,” “The Offer — Background for the Offer,” “The Offer — Cadeler’s Reasons for the Offer,” “The Offer — Eneti’s Reasons for the Offer,” “The Offer — Interests of Eneti and its Directors and Officers,” “Business Combination Agreement” and “Other Transaction Agreements” is incorporated into this Schedule TO by reference.

Item 6. Purposes of the Transaction and Plans or Proposals.

(a), (c)(1-7) The information set forth in the sections of the Prospectus/Offer to Exchange entitled “Questions and Answers About the Offer and the Merger,” “The Offer,” “Business Combination Agreement,” “Other Transaction Agreements” and “Directors and Officers of the Combined Company” is incorporated into this Schedule TO by reference.

Item 7. Source and Amount of Funds or Other Consideration.

(a)

The information set forth in the sections of the Prospectus/Offer to Exchange entitled “The Offer — The Offer,” is incorporated into this Schedule TO by reference. The cash in lieu of any fractional Cadeler ADSs will be paid from Cadeler’s cash on hand.

(b)

There is no financing condition to the Offer.

(d)

Not applicable.

Item 8. Interest in Securities of the Subject Company.

(a), (b) The information set forth in the section of the Prospectus/Offer to Exchange entitled “The Offer — Certain Relationships with Eneti” is incorporated into this Schedule TO by reference.

Item 9. Persons/Assets Retained, Employed, Compensated or Used.

(a) The information set forth in the sections of the Prospectus/Offer to Exchange entitled “The Offer — Procedure for Tendering Eneti Common Stock,” “The Offer — Acceptance of Eneti Common

Stock,” “The Offer — Fees and Commissions,” “The Offer — Cadeler ADSs,” “The Offer — Fees and Expenses” and “Description of American Depositary Shares” is incorporated into this Schedule TO by reference.

Item 10. Financial Statements.

(a), (b) The information set forth in the sections of the Prospectus/Offer to Exchange entitled “Selected Historical Consolidated Financial Information of the Cadeler Group,” “Comparative Historical and Pro Forma Share Information,” “Selected Unaudited Pro Forma Combined Financial Information” and “Unaudited Pro Forma Condensed Combined Financial Information” is incorporated into this Schedule TO by reference, and the consolidated financial statements of Cadeler and the accompanying notes included in the Prospectus/Offer to Exchange, are incorporated into this Schedule TO by reference.

Item 11. Additional Information.

(a), (c) The information set forth in the sections of the Prospectus/Offer to Exchange entitled “The Offer — Interests of Eneti and its Directors and Officers,” “The Offer — Certain Relationships with Eneti,” “The Offer — Regulatory Approvals Required for the Transactions,” “Business Combination Agreement,” “Other Transaction Agreements” and the Letter of Transmittal is incorporated into this Schedule TO by reference.

Item 12. Exhibits.

Exhibit

|

Exhibit No.

|

|

|

Description

|

|

|

(a)(1)(A)

|

|

|

Prospectus/Offer to Exchange (incorporated by reference to Cadeler’s Prospectus/Offer to Exchange filed on November 7, 2023 pursuant to Rule 424(b)(3) under the Securities Act of 1933, as amended)

|

|

|

(a)(1)(B)

|

|

|

|

|

|

(a)(1)(C)

|

|

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated by reference to Exhibit 99.2 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(a)(1)(D)

|

|

|

Form of Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated by reference to Exhibit 99.3 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(a)(4)

|

|

|

Incorporated by reference herein as Exhibit (a)(1)(A)

|

|

|

(a)(5)(A)

|

|

|

Communication by Cadeler in relation to the announcement of the business combination agreement, dated as of June 16, 2023 (incorporated by reference to Cadeler’s filing pursuant to Rule 425 on June 16, 2023)

|

|

|

(a)(5)(B)

|

|

|

|

|

|

(a)(5)(C)

|

|

|

Communication by Cadeler and Eneti in relation to the signing of the business combination agreement, dated as of June 16, 2023 (incorporated by reference to Cadeler’s filing pursuant to Rule 425 on June 16, 2023)

|

|

|

(a)(5)(D)

|

|

|

|

|

|

(a)(5)(E)

|

|

|

Notice of upcoming webcast presenting the combination of Cadeler and Eneti, dated as of June 16, 2023 (incorporated by reference to Cadeler’s filing pursuant to Rule 425 on June 16, 2023)

|

|

|

(a)(5)(F)

|

|

|

|

|

|

Exhibit No.

|

|

|

Description

|

|

|

(a)(5)(G)

|

|

|

Communication by Cadeler regarding the combination of Cadeler and Eneti, dated as of June 16, 2023 (incorporated by reference to Cadeler’s filing pursuant to Rule 425 on June 16, 2023)

|

|

|

(a)(5)(H)

|

|

|

Certain announcements by Cadeler in relation to the combination of Cadeler and Eneti, dated as of June 16, 2023 (incorporated by reference to Cadeler’s filing pursuant to Rule 425 on June 16, 2023)

|

|

|

(a)(5)(I)

|

|

|

Announcement by Cadeler regarding a notice convening an extraordinary general meeting of Cadeler, dated as of June 21, 2023 (incorporated by reference to Cadeler’s filing pursuant to Rule 425 on June 21, 2023)

|

|

|

(a)(5)(J)

|

|

|

Notice convening an extraordinary general meeting of Cadeler, dated as of June 21, 2023 (incorporated by reference to Cadeler’s filing pursuant to Rule 425 on June 21, 2023)

|

|

|

(a)(5)(K)

|

|

|

Announcement by Cadeler of the results of the extraordinary general meeting held on July 14, 2023, dated as of July 14, 2023 (incorporated by reference to Cadeler’s filing pursuant to Rule 425 on July 14, 2023)

|

|

|

(a)(5)(L)

|

|

|

Announcement by Cadeler of the filing of Form F-4 with the SEC, dated as of October 19, 2023 (incorporated by reference to Cadeler’s filing pursuant to Rule 425 on October 20, 2023)

|

|

|

(a)(5)(M)

|

|

|

Stock exchange announcement by Cadeler of the commencement of the Offer, dated as of November 7, 2023 (incorporated by reference to Cadeler’s filing pursuant to Rule 425 on November 7, 2023)

|

|

|

(a)(5)(N)

|

|

|

Press release by Cadeler related to the commencement of the Offer, dated as of November 7, 2023 (incorporated by reference to Cadeler’s filing pursuant to Rule 425 on November 7, 2023)

|

|

|

(a)(5)(O)

|

|

|

Form of Summary Advertisement*

|

|

|

(d)(1)

|

|

|

Business Combination Agreement, dated as of June 16, 2023, by and between Cadeler and Eneti (incorporated by reference to Exhibit 2.1 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(2)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Scorpio Holdings Limited (incorporated by reference to Exhibit 10.5 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(3)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Scorpio Services Holding Limited (incorporated by reference to Exhibit 10.6 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(4)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Robert Bugbee (incorporated by reference to Exhibit 10.7 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(5)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Roberto Giorgi (incorporated by reference to Exhibit 10.8 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(6)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Christian M. Gut (incorporated by reference to Exhibit 10.9 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(7)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Berit Ledel Henriksen (incorporated by reference to Exhibit 10.10 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(8)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Emanuele A. Lauro (incorporated by reference to Exhibit 10.11 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(9)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and James B. Nish (incorporated by reference to Exhibit 10.12 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

Exhibit No.

|

|

|

Description

|

|

|

(d)(10)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Einar Michael Steimler (incorporated by reference to Exhibit 10.13 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(11)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Aileen Tan (incorporated by reference to Exhibit 10.14 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(12)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Hugh Baker (incorporated by reference to Exhibit 10.15 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(13)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Filippo Lauro (incorporated by reference to Exhibit 10.16 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(14)

|

|

|

Tender and Support Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Cameron Mackey (incorporated by reference to Exhibit 10.17 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(15)

|

|

|

Voting Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and BW Altor Pte. Ltd. (incorporated by reference to Exhibit 10.18 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(16)

|

|

|

Voting Agreement, dated as of June 16, 2023, entered into by and among, Cadeler and Swire Pacific Limited (incorporated by reference to Exhibit 10.19 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(d)(17)

|

|

|

Confidentiality Agreement, dated February 1, 2023, by and between Cadeler and Eneti (incorporated by reference to Exhibit 99.5 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

(h)(1)

|

|

|

Opinion of Davis Polk & Wardwell LLP confirming the disclosure regarding the U.S. federal income tax consequences of the Business Combination (incorporated by reference to Exhibit 8.1 to Cadeler’s Registration Statement on Form F-4 filed on October 31, 2023)

|

|

|

107

|

|

|

Filing Fee Table*

|

|

*

Filed herewith.

Item 13. Information Required by Schedule 13E-3.

Not applicable.

SIGNATURES

After due inquiry and to the best of their knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: November 7, 2023

CADELER A/S

By:

/s/ Mikkel Gleerup

Name:

Mikkel Gleerup

Title:

Chief Executive Officer

Exhibit (a)(5)(O)

This announcement is neither an offer to purchase

nor a solicitation of an offer to sell shares of Eneti Common Stock (as defined below), nor is it an offer to purchase or a solicitation

of an offer to sell Cadeler ADSs (as defined below) or Cadeler Shares (as defined below), and is not a prospectus under the Regulation

(EU) 2017/1129 on prospectuses (the “EU Prospectus Regulation” and has been prepared on the basis that any offers of securities

referred to herein in any member state of the European Economic Area will be made pursuant to an exemption under the EU Prospectus Regulation,

and the statements herein are subject in their entirety to the terms and conditions of the Offer (as defined below). The Offer is made

solely by the Prospectus/Offer to Exchange (as defined below) and the related letter of transmittal, and any amendments or supplements

thereto. The Offer is being made to all holders of shares of Eneti Common Stock. The Offer is not being made to (nor will tenders be accepted

from or on behalf of) holders of shares of Eneti Common Stock in any jurisdiction in which the making of the Offer or the acceptance thereof

would not be in compliance with the securities, “blue sky” or other laws of such jurisdiction. In those jurisdictions where

applicable laws require the Offer to be made by a licensed broker or dealer, the Offer will be deemed to be made on behalf of Cadeler

(as defined below) by one or more registered brokers or dealers licensed under the laws of such jurisdiction to be designated by Cadeler.

Notice of Offer by

CADELER A/S

to Exchange Each Outstanding Share of the Common

Stock of

ENETI INC.

for American Depositary Shares Representing

an Aggregate of 3.409 Shares of Cadeler A/S

(subject to the terms and conditions described

in the Prospectus/Offer to Exchange and letter of transmittal)

Cadeler A/S, a public limited liability company incorporated under

the laws of Denmark (“Cadeler”), is offering to exchange for each outstanding share of Eneti Inc., a company incorporated

under the laws of the Republic of the Marshall Islands (“Eneti”), par value $0.01 per share (the “Eneti Common Stock”),

validly tendered in the offer and not validly withdrawn, 0.85225 American Depositary Shares (the “Cadeler ADSs”), each one

(1) Cadeler ADS representing four (4) shares of Cadeler providing for an exchange ration of 3.409 shares of Cadeler, nominal value DKK

1 per share (the “Cadeler Shares”) for each share of Eneti Common Stock, subject to payment of cash compensation with respect

to any fractional Cadeler ADSs, without interest and subject to reduction for any applicable withholding taxes (such offer, on the terms

and subject to the conditions and procedures set forth in the Prospectus/Offer to Exchange, dated November 7, 2023 (the “Prospectus/Offer

to Exchange”), and in the related letter of transmittal, together with any amendments or supplements thereto, the “Offer”).

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE

AT 5:30 P.M., EASTERN TIME, ON DECEMBER 7, 2023, UNLESS EXTENDED OR TERMINATED. SHARES TENDERED PURSUANT TO THE OFFER MAY BE WITHDRAWN

AT ANY TIME PRIOR TO THE EXPIRATION OF THE OFFER.

The Offer is being made pursuant to the Business Combination Agreement,

dated as of June 16, 2023 (as it may be amended from time to time, the “Business Combination Agreement”), by and between Cadeler

and Eneti. The Business Combination Agreement provides, among other things, that Cadeler will make the Offer and, subject to the satisfaction

or waiver of certain conditions, Cadeler will accept for exchange, and promptly thereafter exchange, shares of Eneti Common Stock validly

tendered in the Offer and not validly withdrawn. The Business Combination Agreement is more fully described in the Prospectus/Offer to

Exchange.

Following consummation of the Offer, subject to the terms and conditions

set forth in the Business Combination Agreement, Cadeler intends to as promptly as practicable consummate a merger of a wholly owned subsidiary

of Cadeler (“Merger Sub”) with and into Eneti with Merger Sub surviving the Merger (the “Merger”). The purpose

of the Merger is for Cadeler to acquire all shares of Eneti Common Stock that it did not acquire in the Offer. Upon the consummation of

the Merger, the Eneti business will be held by a wholly owned subsidiary of Cadeler, and the holders of Eneti Common Stock other than

Cadeler (the “Eneti Stockholders”) will no longer have any direct ownership interest in the Eneti business (though those Eneti

Stockholders who accept the Offer and tender their shares of Eneti Common Stock to Cadeler pursuant to the Offer will continue to have

an indirect ownership interest in the Eneti business through their ownership interest in Cadeler). If the Offer is completed, the Merger

will be governed by Sections 95 and 100 of the Business Corporations Act of the Republic of the Marshall Islands (the “BCAMI”).

Eneti Stockholders who do not tender their shares of Eneti Common Stock in the Offer will receive compensation in the Merger. The consideration

to be paid to non-tendering Eneti Stockholders in the Merger will be determined pursuant to the laws and regulations of the Republic of

the Marshall Islands and will represent at least fair value as contemplated by the BCAMI, however, the consideration may be different

in form and/or value from the consideration offered to tendering Eneti Stockholders in the Offer. No appraisal rights are available to

Eneti Stockholders in connection with the Offer, and no appraisal rights are expected to be available to Eneti Stockholders in connection

with the Merger.

The Offer and withdrawal rights will expire at 5:30 p.m., Eastern Time,

on December 7, 2023 (the “Expiration Date,” unless Cadeler has extended the period during which the Offer is open in accordance

with the Business Combination Agreement, in which event the term “Expiration Date” will mean the latest time and date at which

the Offer, as so extended by Cadeler, shall expire).

The Offer is not subject to any financing condition. The Offer is conditioned

upon, among other things, there having been validly tendered and not validly withdrawn in accordance with the terms of the Offer a number

of shares of Eneti Common Stock that, upon the consummation of the Offer, together with any shares of Eneti Common Stock then owned by

Cadeler, would represent at least 85.01% of the aggregate voting power of the shares of Eneti Common Stock outstanding immediately after

the consummation of the Offer (the “Minimum Condition”), receipt of required regulatory approvals, lack of legal prohibitions,

no material adverse effect (as defined in the Business Combination Agreement) having occurred with respect to Eneti since the date of

the Business Combination Agreement that is continuing as of immediately prior to the Expiration Date, the accuracy of Eneti’s representations

and warranties made in the Business Combination Agreement (subject to specified materiality standards), Eneti being in compliance in all

material respects with its covenants under the Business Combination Agreement, the Cadeler ADSs to be issued in the Offer, and the Cadeler

Shares underlying such Cadeler ADSs, being authorized for listing on the New York Stock Exchange, subject to official notice of issuance,

the Cadeler Shares to be issued in the Offer being eligible for trading on the Oslo Stock Exchange and the Business Combination Agreement

not having been terminated in accordance with its terms. The Offer is also subject to other conditions as set forth in the Business Combination

Agreement and described in the Prospectus/Offer to Exchange (together with the conditions described above, the “Offer Conditions”).

The board of directors of Eneti has unanimously (i) determined that

the terms of the Business Combination Agreement and the transactions contemplated by the Business Combination Agreement, including the

Offer and the Merger, are fair to, and in the best interests of, Eneti and the Eneti Stockholders; (ii) determined that it is in the best

interests of Eneti and the Eneti Stockholders and declared it advisable to enter into the Business Combination Agreement; (iii) approved

the execution and delivery by Eneti of the Business Combination Agreement, the performance by Eneti of its covenants and agreements contained

in the Business Combination Agreement and the consummation of the Offer, the Merger and the other transactions contemplated by the Business

Combination Agreement upon the terms and subject to the conditions contained in the Business Combination Agreement; and (iv) resolved

to recommend, and recommended, that the Eneti Stockholders accept the Offer and tender their shares of Eneti Common Stock to Cadeler pursuant

to the Offer.

Under certain circumstances, as set forth in the Business Combination

Agreement and summarized in the Prospectus/Offer to Exchange, Cadeler may be required to extend the Offer and the previously scheduled

expiration date. In the case of any extension, any such announcement will be issued no later than 9:00 a.m., Eastern Time, on the next

business day following the previously scheduled Expiration Date. Subject to applicable law (including Rules 14d-4(c) and 14d-6(d) under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which require that any material change in the information

published, sent or given to stockholders in connection with the Offer be promptly disseminated to stockholders in a manner reasonably

designed to inform them of such change) and without limiting the manner in which Cadeler may choose to make any public announcement, Cadeler

assumes no obligation to publish, advertise or otherwise communicate any such public announcement of this type other than by issuing a

press release. During any extension, shares of Eneti Common Stock previously validly tendered and not validly withdrawn will remain subject

to the Offer, subject to the right of each Eneti Stockholder to withdraw previously tendered shares of Eneti Common Stock. No subsequent

offering period will be available following the Expiration Date without the prior written consent of Eneti, other than in accordance with

the extension provisions set forth in the Business Combination Agreement.

Subject to the terms and conditions of the Business Combination Agreement,

Cadeler also reserves the right to waive any Offer Condition or modify the terms of the Offer.

Neither the U.S. Securities and Exchange Commission nor any state securities

commission has approved or disapproved of the securities to be issued as consideration in the Offer or passed on upon the adequacy or

accuracy of the Prospectus/Offer to Exchange. Any representation to the contrary is a criminal offense.

Upon the terms of the Offer and subject to the satisfaction or waiver

of the Offer Conditions (including, if the Offer is extended or amended, the terms and conditions of any such extension or amendment in

accordance with the Business Combination Agreement), promptly after the Expiration Date, Cadeler will accept for exchange, and will thereafter

promptly exchange, shares of Eneti Common Stock validly tendered and not validly withdrawn prior to the Expiration Date. In all cases,

an Eneti Stockholder will receive consideration for tendered shares of Eneti Common Stock only after timely receipt by the exchange agent

of certificates for those shares, if any, or a confirmation of a book-entry transfer of those shares into the exchange agent’s account

at The Depository Trust Company (“DTC”), a properly completed and duly executed letter of transmittal or an agent’s

message in connection with a book-entry transfer and any other required documents.

For purposes of the Offer, Cadeler will be deemed to have accepted

for exchange shares of Eneti Common Stock validly tendered and not validly withdrawn if and when it notifies the exchange agent of its

acceptance of those shares pursuant to the Offer. The exchange agent will deliver to the applicable Eneti Stockholders any Cadeler ADSs

representing Cadeler Shares issuable in exchange for shares of Eneti Common Stock validly tendered and accepted pursuant to the Offer

promptly after receipt of such notice. The exchange agent will act as the agent for tendering Eneti Stockholders for the purpose of receiving

Cadeler ADSs representing Cadeler Shares from Cadeler and transmitting such Cadeler ADSs to the tendering Eneti Stockholders.

Eneti Stockholders may withdraw tendered shares of Eneti Common Stock

at any time until the Expiration Date and, if Cadeler has not agreed to accept the shares for exchange on or prior to January 8, 2024,

Eneti Stockholders may thereafter withdraw their shares from tender at any time after such date until Cadeler accepts shares for exchange.

For the withdrawal of shares to be effective, the exchange agent must

receive a written notice of withdrawal from the Eneti Stockholder at one of the addresses set forth in the Prospectus/Offer to Exchange,

prior to the Expiration Date. The notice must include the Eneti Stockholder’s name, address and social security number, the certificate

number(s), if any, the number of shares to be withdrawn and the name of the registered holder, if it is different from that of the person

who tendered those shares, and any other information required pursuant to the Offer or the procedures of DTC, if applicable.

Cadeler is not providing for guaranteed delivery procedures and therefore

Eneti Stockholders who hold their shares through a DTC participant must allow sufficient time for the necessary tender procedures to be

completed during normal business hours of DTC prior to the Expiration Date. Eneti Stockholders must tender their shares of Eneti Common

Stock in accordance with the procedures set forth in the Prospectus/Offer to Exchange and related letter of transmittal.

The information required to be disclosed by paragraph (d)(1) of Rule

14d-6 of the General Rules and Regulations under the Exchange Act is contained in the Prospectus/Offer to Exchange and is incorporated

herein by reference.

Eneti has provided Cadeler with the list of Eneti Stockholders and

security position listings for the purpose of disseminating the Prospectus/Offer to Exchange, the related letter of transmittal and other

related materials to Eneti Stockholders. The Prospectus/Offer to Exchange and related letter of transmittal will be mailed to record holders

of shares of Eneti Common Stock and to brokers, dealers, commercial banks, trust companies and similar persons whose names, or the names

of whose nominees, appear on the stockholder list or, if applicable, who are listed as participants in a clearing agency’s security

position listing for subsequent transmittal to beneficial owners of shares of Eneti Common Stock.

Each Eneti Stockholder should read the discussion under “Material

Tax Consequences—Material U.S. Federal Income Tax Considerations” in the Prospectus/Offer to Exchange and should consult its

own tax advisor as to the particular tax consequences of the Offer and the Merger to such stockholder.

The Prospectus/Offer to Exchange and the related letter of transmittal

contain important information. Holders of shares of Eneti Common Stock should carefully read both documents in their entirety before any

decision is made with respect to the Offer.

Questions and requests for assistance may be directed to the information

agent at its address and telephone number set forth below. Requests for copies of the Prospectus/Offer to Exchange, the letter of transmittal

and other exchange offer materials may be directed to the information agent. Stockholders may also contact brokers, dealers, commercial

banks or trust companies for assistance concerning the Offer. Cadeler will reimburse brokers, dealers, commercial banks and trust companies

and other nominees, upon request, for customary clerical and mailing expenses incurred by them in forwarding offering materials to their

customers. Except as set forth above, Cadeler will not pay any fees or commissions to any broker, dealer or other person for soliciting

tenders of shares of Eneti Common Stock pursuant to the Offer.

The Information Agent for the Offer is:

D.F. King & Co., Inc.

48 Wall Street, 22nd floor

New York, NY 10005

Shareholders Call Toll Free: (800) 967-4607

Banks & Brokers Call Collect: (212) 269-5550

Email: NETI@dfking.com

November 7, 2023

Exhibit 107

Calculation of Filing Fee Tables

SC TO-T

(Form Type)

Cadeler A/S

(Exact Name of Registrant as Specified in its Charter)

Table 1: Transaction Valuation

| | |

Transaction Valuation(1) | | |

Fee Rate | | |

Amount of Filing Fee(2) | |

| Fees to Be Paid | |

$ | 382,527,388.11 | | |

| 0.0001476 | | |

$ | 56,461.04 | |

| Fees Previously Paid | |

$ | 0 | | |

| | | |

$ | 0 | |

| Total Transaction Valuation | |

$ | 382,527,388.11 | | |

| | | |

| | |

| Total Fees Due for Filing | |

| | | |

| | | |

$ | 56,461.04 | |

| Total Fees Previously Paid | |

| | | |

| | | |

$ | 0 | |

| Total Fee Offsets | |

| | | |

| | | |

$ | 56,461.04 | |

| Net Fee Due | |

| | | |

| | | |

$ | 0 | |

(1) Estimated solely for

the purpose of calculating the registration fee pursuant to Rule 0-11(d) under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), the transaction value was calculated as the product obtained by multiplying (i) $9.89, the average of the high and low sales

prices per share of Eneti Inc. (“Eneti”) common stock on November 1, 2023, as reported by the New York Stock Exchange, and

(ii) 38,678,199, which is the sum of (A) 38,647,119, the number of shares of Eneti common stock outstanding as of November 1, 2023, and

(B) 31,080, the maximum number of shares of Eneti common stock authorized for issuance pursuant to Eneti’s existing equity plan

or otherwise permitted to be issued pursuant to the terms of the business combination agreement described herein.

(2) The amount of the filing

fee was calculated in accordance with Rule 0-11(d) under the Exchange Act and Fee Rate Advisory No. 1 for Fiscal Year 2023

beginning on October 1, 2023, issued August 26, 2022, as the product obtained by multiplying the transaction value by 0.0001476.

Table 2: Fee Offset Claims and Sources

| |

|

Registrant or

filer name |

|

Form or filing

type |

|

File

number |

|

Initial

filing date |

|

Filing

date |

|

Fee offset

claimed |

|

|

Fee paid with fee

offset source |

|

| Fee Offset Claims |

|

|

|

F-4 |

(1) |

333-275092 |

|

October 19, 2023 |

|

|

|

$ |

56,461.04 |

|

|

|

|

| Fee Offset Sources |

|

Cadeler A/S |

|

F-4 |

(1) |

333-275092 |

|

|

|

October 19, 2023 |

|

|

|

|

$ |

57,888.15 |

|

(1) The Registrant paid $57,888.15

with the submission of its Registration Statement on Form F-4, filed with the Securities and Exchange Commission on October 19, 2023 (File

No. 333-275092).

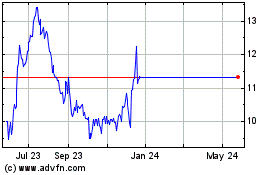

Eneti (NYSE:NETI)

Historical Stock Chart

From Apr 2024 to May 2024

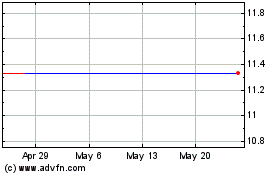

Eneti (NYSE:NETI)

Historical Stock Chart

From May 2023 to May 2024