Current Report Filing (8-k)

March 05 2021 - 5:13PM

Edgar (US Regulatory)

false 0001276187 0001276187 2021-03-05 2021-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): March 5, 2021

Energy Transfer LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-32740

|

|

30-0108820

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

8111 Westchester Drive, Suite 600

Dallas, Texas 75225

(Address of principal executive office) (Zip Code)

(214) 981-0700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Units

|

|

ET

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Merger Agreement

On March 5, 2021, Energy Transfer LP, a Delaware limited partnership (“ET”), agreed to undertake an internal reorganization by causing Energy Transfer Operating, L.P., a Delaware limited partnership (“ETO”) and subsidiary of ET, to merge with and into ETO Merger Sub LLC, a Delaware limited liability company and a direct wholly owned subsidiary of ET (“Merger Sub”), with ETO surviving (the “Merger”) as a wholly owned subsidiary of ET.

Pursuant to the terms of the Agreement and Plan of Merger (the “Merger Agreement”), at the closing, each issued and outstanding preferred unit representing a limited partner interest in ETO will be converted into the right to receive one newly created preferred unit representing a limited partner interest in ET with substantially equivalent preferences, rights, powers, duties and obligations as the ETO preferred unit for which it is exchanged. Specifically, each issued and outstanding:

|

|

•

|

|

6.250% Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ETO will convert into the right to receive one newly created 6.250% Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ET (the “ET Series A Preferred Units”);

|

|

|

•

|

|

6.625% Series B Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ETO will convert into the right to receive one newly created 6.625% Series B Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ET (the “ET Series B Preferred Units”);

|

|

|

•

|

|

7.375% Series C Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ETO will convert into the right to receive one newly created 7.375% Series C Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ET (the “ET Series C Preferred Units”);

|

|

|

•

|

|

7.625% Series D Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ETO will convert into the right to receive one newly created 7.625% Series D Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ET (“the “ET Series D Preferred Units”);

|

|

|

•

|

|

7.600% Series E Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ETO will convert into the right to receive one newly created 7.600% Series E Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ET (the “ET Series E Preferred Units”);

|

|

|

•

|

|

6.750% Series F Fixed-Rate Reset Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ETO will convert into the right to receive one newly created 6.750% Series F Fixed-Rate Reset Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ET (the “ET Series F Preferred Units”); and

|

|

|

•

|

|

7.125% Series G Fixed-Rate Reset Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ETO will convert into the right to receive one newly created 7.125% Series G Fixed-Rate Reset Cumulative Redeemable Perpetual Preferred Unit representing a limited partner interest in ET (the “ET Series G Preferred Units”).

|

2

In addition, each of the issued and outstanding Class K Units, Class L Units, Class M Units and Class N Units (the “Hook Units”), each representing a limited partner interest in ETO and all of which are held by ETP Holdco Corporation, a Delaware corporation and wholly owned subsidiary of ETO, will convert into the right to receive, in the aggregate, 675,625,000 newly created Class B Units representing limited partner interests in ET (the “Class B Units” and, together with the ET Series A Preferred Units, the ET Series B Preferred Units, the ET Series C Preferred Units, the ET Series D Preferred Units, the ET Series E Preferred Units, the ET Series F Preferred Units and the ET Series G Preferred Units, the “New ET Units”).

The common units representing limited partner interests in ETO, all of which are held by ET, will be unaffected by the Merger and remain outstanding. The general partner interest in ETO, will be unaffected by the Merger and remain outstanding.

The completion of the Merger is subject to the satisfaction or waiver of customary closing conditions.

Pursuant to the terms of the Merger Agreement, ET has agreed to amend its Third Amended and Restated Agreement of Limited Partnership, dated as of February 8, 2006, as amended, at the closing of the Merger in order to provide for the issuance of the New ET Units.

The Merger Agreement is attached hereto as Exhibit 2.1 and is incorporated by reference.

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The description of the issuance of New ET Units in connection with the closing of the Merger described under Item 1.01 above is incorporated into this Item 3.02. The Class B Units will be issued to the holder of the Hook Units in a private offering pursuant to the exemption from registration in Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Regulation D promulgated thereunder. The Class B Units will not be registered under the Securities Act and may not be offered or sold in the United States absent registration with the Securities and Exchange Commission (the “SEC”) or an applicable exemption from the registration requirements.

Cautionary Statement Regarding Forward-Looking Statements

This report includes “forward-looking” statements. Forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. Statements using words such as “anticipate,” “believe,” “intend,” “project,” “plan,” “expect,” “continue,” “estimate,” “goal,” “forecast,” “may” or similar expressions help identify forward-looking statements. ET cannot give any assurance that expectations and projections about future events will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions. These risks and uncertainties include the risks that the proposed transaction may not be consummated or the benefits contemplated therefrom may not be realized. These and other risks and uncertainties are discussed in more detail in filings made by ET and ETO with the SEC, which are available to the public. ET and ETO undertake no obligation to update publicly or to revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

In connection with the proposed transaction, ET will file a registration statement on Form S-4 with the SEC. INVESTORS AND SECURITY HOLDERS OF ET AND ETO ARE ADVISED TO CAREFULLY READ THE REGISTRATION STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION, THE PARTIES TO THE TRANSACTION AND THE RISKS ASSOCIATED WITH THE TRANSACTION. Investors and

3

security holders may obtain a free copy of the registration statement (when available) and other relevant documents filed by ET and ETO with the SEC from the SEC’s website at www.sec.gov. Security holders and other interested parties will also be able to obtain, without charge, a copy of the registration statement and other relevant documents (when available) from www.energytransfer.com under the tab “Investor Relations” and then under the heading “SEC Filings.”

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

*

|

Schedules and exhibits to this Exhibit omitted pursuant to Regulation S-K Item 601(b)(2). ET agrees to furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon request.

|

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ENERGY TRANSFER LP

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

LE GP, LLC,

|

|

|

|

|

|

|

|

its general partner

|

|

|

|

|

|

|

Date: March 5, 2021

|

|

|

|

By:

|

|

/s/ Bradford D. Whitehurst

|

|

|

|

|

|

Name:

|

|

Bradford D. Whitehurst

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

5

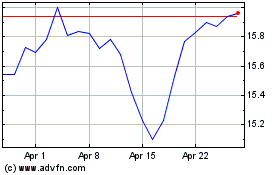

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Apr 2023 to Apr 2024