Terns Pharmaceuticals Sets IPO at 6.25 Million Shares; Sees Pricing at $15-$17 Each

February 01 2021 - 9:24AM

Dow Jones News

By Colin Kellaher

Terns Pharmaceuticals Inc. Monday said it plans to sell 6.25

million shares at between $15 and $17 apiece in its initial public

offering.

At the $16 midpoint of that range, the Foster City, Calif.,

clinical-stage biopharmaceutical company backed by Eli Lilly &

Co. said it expects net proceeds of about $89.5 million, or roughly

$103.5 million if the underwriters exercise their option to buy an

additional 937,500 shares.

Terns said it believes the proceeds, coupled with its existing

resources, will enable it to fund its operating expenses and

capital-spending needs into 2024.

In a filing with the U.S. Securities and Exchange Commission,

Terns said it would have about 23.7 million shares outstanding

after the IPO, assuming exercise of the overallotment option, for a

market capitalization of roughly $379 million at the $16-a-share

pricing midpoint.

Terns said it has applied to list its shares on the Nasdaq

Global Market under the symbol TERN.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

February 01, 2021 09:09 ET (14:09 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

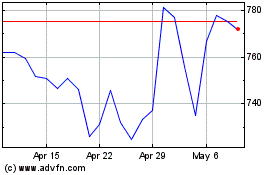

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Apr 2023 to Apr 2024