UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of

1934

For the month of November

2023

Commission File Number

1-14732

COMPANHIA SIDERÚRGICA

NACIONAL

(Exact name of registrant

as specified in its charter)

National Steel Company

(Translation of registrant’s

name into English)

Av. Brigadeiro Faria Lima

3400, 20th Floor

São Paulo, SP, Brazil

04538-132

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F

_______

Indicate by

check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

Announcement of Tender Offer for Any and All 2026

Notes by CSN Resources S.A.

São Paulo, November 29, 2023 –

Companhia Siderúrgica Nacional (“CSN”) (NYSE: SID) announced today that its subsidiary, CSN Resources S.A.

(“CSN Resources”), has commenced a cash tender offer (the “Tender Offer”) for any and all of its

outstanding 7.625% Senior Unsecured Guaranteed Notes due 2026 (the “Notes”). The Notes are fully, unconditionally and

irrevocably guaranteed by CSN.

The following table sets forth the material pricing

terms of the Tender Offer:

| Title of Security |

CUSIP / ISIN |

Principal Amount Outstanding |

Purchase Price(1) |

| 7.625% Senior Unsecured Guaranteed Notes due 2026 |

144A: 12644VAC2 / US12644VAC28

Regulation S: L21779AD2 / USL21779AD28 |

US$300,000,000 |

US$1,010.00 |

__________________

| (1) | The amount to be paid for each US$1,000 principal amount of Notes validly tendered and accepted for purchase. In addition, accrued

interest up to, but excluding, the settlement date (“Accrued Interest”) will be paid. |

The Tender Offer is scheduled to expire at

5:00 p.m., New York City time, on December 5, 2023, unless extended or earlier terminated as described in this press release (such time,

as may be extended, the “Expiration Time”). Holders of Notes who validly tender (and do not validly withdraw) their

Notes or deliver a properly completed and duly executed notice of guaranteed delivery (the “Notice of Guaranteed Delivery”)

at or prior to the Expiration Time will be eligible to receive the purchase price set forth in the table above for each US$1,000 principal

amount of Notes validly tendered and accepted for purchase, plus Accrued Interest. Validly tendered Notes may be validly withdrawn

at any time at or prior to the Expiration Time, unless extended or earlier terminated as described below, but not thereafter.

CSN Resources’ obligation to purchase Notes

validly tendered pursuant to the Tender Offer is subject to market conditions and the satisfaction or waiver of certain conditions described

in the Offer to Purchase, dated November 29, 2023 (the “Offer to Purchase”), including the completion by CSN Resources

of new debt financing on satisfactory terms and conditions. However, the Tender Offer is not conditioned on any minimum amount of Notes

being tendered. Subject to applicable law, CSN Resources expressly reserves the right, in its sole discretion, to amend or terminate the

Tender Offer in its sole discretion, subject to disclosure and other requirements under applicable law, including if any of the conditions

set forth in the Offer to Purchase are not satisfied. If the Tender Offer is terminated at any time, Notes tendered will be promptly returned

to the tendering holders without compensation or cost to such holders and will remain outstanding. Furthermore, CSN Resources reserves

the right, in its sole discretion, not to accept any tenders of Notes for any reason.

CSN Resources and its affiliates reserve the absolute

right, in their sole discretion, from time to time to redeem or purchase any Notes that remain outstanding after the Expiration Time through

open market purchases, privately negotiated transactions, tender offers, exchange offers or otherwise, upon such terms and at such prices

as they may determine, which may be more or less than the price to be paid pursuant to the Tender Offer.

Settlement of the Tender Offer is expected to

occur on the third business day following the Expiration Time, unless the Tender Offer is terminated prior to such date. Tendered Notes

may be withdrawn at any time at or prior to the earlier of the Expiration Time and, in the event that the Tender Offer is extended, the

tenth business day after commencement of the Tender Offer. Tendered Notes may be withdrawn at any time after the 60th business day after

commencement of the Tender Offer if for any reason the Tender Offer has not been consummated within 60 business days after commencement.

Upon the terms and subject to the conditions of

the Tender Offer set forth in the Offer to Purchase, all Notes validly tendered and not validly withdrawn or with respect to which a properly

completed and duly executed Notice of Guaranteed Delivery (as described in the Offer to Purchase) is delivered at or prior to the Expiration

Time, as applicable, will be accepted for purchase. The complete terms and conditions of the Tender Offer are described in the Offer to

Purchase and the Notice of Guaranteed Delivery, copies of which may be obtained from D.F. King & Co., Inc., the tender agent and information

agent (the “Tender Agent and Information Agent”) for the Tender Offer, at www.dfking.com/csn, by telephone at +1 (800) 967-7574

(U.S. toll free) or +1 (212) 269-5550 (collect), in writing to 48 Wall Street, 22nd Floor, New York, NY 10005, Attention: Michael Horthman,

or by email to csn@dfking.com.

CSN Resources has engaged Banco Bradesco BBI S.A.,

Banco BTG Pactual S.A. – Cayman Branch, Citigroup Global Markets Inc., Credit Agricole Securities (USA) Inc., J.P. Morgan Securities

LLC, Morgan Stanley & Co. LLC, Santander US Capital Markets LLC, and UBS Securities LLC to act as the dealer managers (the “Dealer

Managers”) in connection with the Tender Offer. Questions regarding the terms of the Tender Offer may be directed to Banco Bradesco

BBI S.A., at +55 (11) 2169-4528 (collect); Banco BTG Pactual S.A. – Cayman Branch, at +1 (212) 293-4600 (collect); Citigroup Global

Markets, at +1 (212) 723-6106 (collect) or +1 (800) 558-3745 (toll Free); Credit Agricole Securities (USA) Inc., at +1 (866) 807-6030

(toll Free); J.P. Morgan Securities LLC, at +1 (212) 834-7279 (collect) or +1 (866) 846-2874 (toll Free); Morgan Stanley & Co. LLC,

at +1 (800) 624-1808 (toll free) or +1 (212) 761-1057 (collect); Santander US Capital Markets LLC, at +1 212-407-0930; and UBS Securities

LLC, at +1 (212) 882-5723 (collect).

Disclaimer

None of CSN, CSN Resources, the Tender Agent

and Information Agent, the Dealer Managers or the trustee for the Notes, or any of their respective affiliates, is making any recommendation

as to whether holders should tender any Notes in the Tender Offer or expressing any opinion as to whether the terms of the Tender Offer

are fair to any holder. Holders must make their own decision as to whether to tender any Notes and, if so, the principal amount of Notes

to tender. Please refer to the Offer to Purchase for a description of the offer terms, conditions, disclaimers and other information applicable

to the Tender Offer.

This press release is for informational purposes

only and does not constitute an offer to purchase or the solicitation of an offer to sell any securities. The Tender Offer is being made

solely by means of the Offer to Purchase. The Tender Offer is not being made to holders of Notes in any jurisdiction in which the making

or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. In those jurisdictions

where the securities, blue sky or other laws require any tender offer to be made by a licensed broker or dealer, the Tender Offer will

be deemed to be made on behalf of CSN Resources by the Dealer Managers or one or more registered brokers or dealers licensed under the

laws of such jurisdiction.

This press release may contain forward-looking

statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange

Act of 1934, as amended, including those related to the Tender Offer. Forward-looking information involves important risks and uncertainties

that could significantly affect anticipated results in the future, and, accordingly, such results may differ from those expressed in any

forward-looking statements.

COMPANHIA SIDERÚRGICA

NACIONAL

Marcelo Cunha Ribeiro

Chief Financial and Investor

Relations Officer

SIGNATURES

Pursuant to the requirements

of the U.S. Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

|

| November 29, 2023 |

Companhia Siderúrgica Nacional |

| |

By:

|

/s/ Benjamin Steinbruch

Benjamin Steinbruch |

| |

|

Title: |

Chief Executive Officer |

| |

| |

By:

|

/s/ Marcelo Cunha Ribeiro

Marcelo Cunha Ribeiro |

| |

|

Title: |

Chief Financial and Investor Relations Officer |

| |

|

|

|

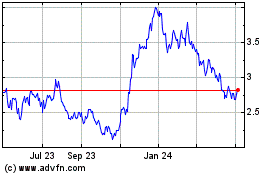

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Oct 2024 to Nov 2024

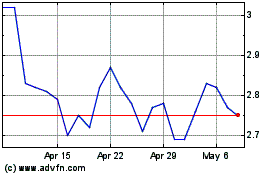

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Nov 2023 to Nov 2024