Coca-Cola FEMSA Places US$2.15 Billion of Senior Notes in the International Capital Markets

November 19 2013 - 7:49PM

Marketwired

Coca-Cola FEMSA Places US$2.15 Billion of Senior Notes in the

International Capital Markets

MEXICO CITY, MEXICO--(Marketwired - Nov 19, 2013) - Coca-Cola

FEMSA, S.A.B. de C.V. (BMV: KOFL) (NYSE: KOF) ("Coca-Cola FEMSA" or

the "Company"), the largest franchise bottler of Coca-Cola products

in the world, announces the placement of three tranches of U.S.

dollar-denominated bonds in the international capital markets (the

"Senior Notes").

The Company successfully sold US$ 1.0 billion of 5-year bonds at

a yield of US Treasury + 105 basis points, with a coupon of 2.375%;

US$ 750 million of 10-year bonds at a yield of US Treasury + 135

basis points, with a coupon of 3.875%; and US$ 400 million of

30-year bonds at a yield of US Treasury + 155 basis points, with a

coupon of 5.250%. The transaction was multiple times oversubscribed

with broad participation from investment grade dedicated

investors.

This issuance received credit ratings of A2 from Moody's, A-

from Standard & Poor's, and A from Fitch Ratings.

The proceeds will be used for general corporate purposes,

including partial debt refinancing. As a result of this issuance,

Coca-Cola FEMSA will increase the average life of its debt maturity

profile from 4.1 years to 7.9 years.

This press release does not constitute an offer to sell or the

solicitation of an offer to purchase with respect to the Senior

Notes or other securities, nor shall there be any sales of the

Senior Notes in any jurisdiction in which such offer, solicitation

or purchase would be unlawful prior to registration or

qualification under the securities laws of any jurisdiction. The

Senior Notes have been issued pursuant to the Company's

Registration Statement on Form F-3 (No. 333-187275) previously

filed by the Company with the Securities and Exchange Commission

(the "Commission"). The Registration Statement is effective. Copies

of the applicable prospectus supplement and accompanying prospectus

relating to the offering may be obtained when available by

contacting Citigroup Global Markets Inc. at 800-831-9146, Goldman,

Sachs & Co. at 866-471-2526, HSBC Securities (USA) Inc. at

866-811-8049, J.P. Morgan Securities LLC at 866-846-2874 or

Mitsubishi UFJ Securities (USA), Inc. at 877-649-6848; or by

visiting the Commission's website at http://www.sec.gov.

Coca-Cola FEMSA, S.A.B. de C.V. produces and distributes

Coca-Cola, Fanta, Sprite, Del Valle, and other trademark beverages

of The Coca-Cola Company in Mexico (a substantial part of central

Mexico, including Mexico City, as well as southeast and northeast

Mexico), Guatemala (Guatemala City and surrounding areas),

Nicaragua (nationwide), Costa Rica (nationwide), Panama

(nationwide), Colombia (most of the country), Venezuela

(nationwide), Brazil (greater São Paulo, Campiñas, Santos, the

state of Mato Grosso do Sul, the state of Paraná, part of the state

of Goias, part of the state of Rio de Janeiro and part of the state

of Minas Gerais), Argentina (federal capital of Buenos Aires and

surrounding areas) and Philippines (nationwide), along with bottled

water, juices, teas, isotonics, beer, and other beverages in some

of these territories. The Company has 67 bottling facilities and

serves 338 million consumers through more than 2,800,000 retailers

with more than 120,000 employees worldwide.

For Further Information: Investor Relations Jose Castro Email

Contact (5255) 1519-5120 / 5121 Roland Karig Email Contact (5255)

1519-5186 Miguel Murcio Email Contact (5255) 1519-5148

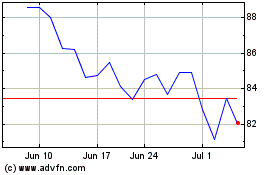

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Oct 2024 to Nov 2024

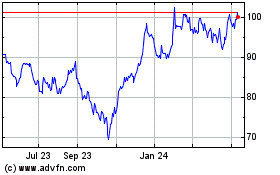

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Nov 2023 to Nov 2024