Oil Prices Steady Ahead of U.S. Inventory Data

March 05 2019 - 5:20PM

Dow Jones News

By Dan Molinski and Sarah McFarlane

-- U.S. oil prices declined slightly Tuesday, sticking to a

narrow trading range as stock markets moved sideways and investors

awaited weekly government data on U.S. oil inventories.

-- West Texas Intermediate futures, the U.S. oil standard, ended

0.1% lower at $56.56 a barrel on the New York Mercantile

Exchange.

-- Brent crude, the global oil benchmark, closed 0.3% higher at

$65.86 a barrel on London's Intercontinental Exchange.

HIGHLIGHTS

Close Quarters: WTI has been trading in a tight range roughly

between $55 and $57 a barrel for the past two weeks, and prices

remained hemmed inside that band most of the session on Tuesday.

"The complex remains in a consolidation phase and while today's

push to above yesterday's $57 highs per nearby WTI offered some

solace to the bulls, upside follow through will likely require a

decided bullish surprise out of tomorrow's EIA report," said

analysts at Ritterbusch & Associates in a research note,

referring to the U.S. Energy Information Administration's weekly

petroleum status report.

Last week's EIA data provided just such a surprise, as the

administration reported a large and unexpected 8.6-million-barrel

decline in U.S. oil inventories for the previous week. But price

gains after that report stalled out quickly, leading some analysts

to question whether prices may soon fall back toward $50 a

barrel.

This week's EIA report is due Wednesday morning, and a survey by

The Wall Street Journal indicates crude stockpiles may have risen

by 1.6 million barrels last week.

The American Petroleum Institute, an industry group, said late

Tuesday that its own data for the week showed a 7.3-million-barrel

increase in crude supplies, a 391,000-barrel fall in gasoline

stocks and a 3.1-million-barrel decrease in distillate inventories,

according to a market participant.

China Slowdown: Oil prices had turned lower during the overnight

session after the world's second-largest economy cut its 2019

economic growth target to between 6% and 6.5% on Tuesday, lower

than the 6.6% it achieved last year, causing concern over the

outlook for Chinese oil demand. "The Chinese figures do matter, the

market is strongly focused on Chinese demand expectations," said

Hans van Cleef, energy economist at ABN Amro. While this was

negative for oil prices, a more supportive development has been the

progress toward a trade deal between the U.S. and China after

months of tension, Mr. van Cleef added. China and the U.S. are in

the final stages of completing a deal.

INSIGHT

Permian Push: Chevron Corp. and Exxon Mobil Corp. plan to

significantly ramp up production in the Permian oil field of Texas

and New Mexico that lies at the heart of the American fracking

boom. Exxon said Tuesday it would increase its Permian output to

one million barrels of oil and gas a day by as early as 2024, while

Chevron expects to more than double its Permian production to

900,000 barrels of oil and gas a day in the next five years.

"Both Exxon and Chevron are trying to one-up each other over how

fast they intend to grow there," said Stewart Glickman, energy

equity analyst at CFRA Research. "Why is this hard-baked patch of

earth relevant? Because the Permian Basin is on the verge of

hitting 4.0 million barrels of oil per day in supply, which, if it

were a country and part of the OPEC-Plus Consortium, would rank

fourth in size, after Saudi Arabia, Russia and Iraq."

AHEAD

-- The EIA releases its weekly petroleum status report at 10:30

a.m. ET Wednesday.

-- Baker Hughes releases its weekly rig count on Friday.

Bradley Olson contributed to this article.

Write to Dan Molinski at Dan.Molinski@wsj.com and Sarah

McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

March 05, 2019 17:05 ET (22:05 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

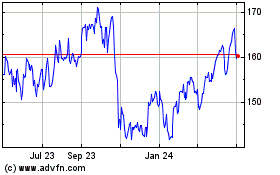

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

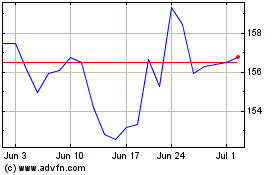

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024