Charles Schwab Ranks #1 in Large Plan Segment in J.D. Power Retirement Plan Participant Satisfaction Study for Second Year in...

May 30 2019 - 9:00AM

Business Wire

Charles Schwab has earned the highest ranking in overall

satisfaction in the J.D. Power 2019 Retirement Plan Participant

Satisfaction Study in the large plan segment. Schwab also ranked

highest in the J.D. Power 2018 Group Retirement Satisfaction Study

in the large plan segment.

With an overall satisfaction score of 821 on a 1000-point scale,

Schwab scored 10 points higher than the nearest competitor and 48

points higher than the industry average in the large plan segment.

Schwab also received the highest score in five of the six factors

included in the overall satisfaction score:

- Communications

- Plan features

- Investment and service offerings

- Information resources

- Interaction

In addition, Schwab earned the highest rating in three of the

six key brand image categories, including:

- Customer-driven

- Good reputation

- Financially stable

“Earning this top ranking two years in a row demonstrates the

strength of our 'through clients’ eyes' approach to service. Our

ongoing investments in financial wellness, personalized 401(k)

advice resources and the overall user experience are hitting the

mark for participants and resonating with plan sponsors as well,”

said Steve Anderson, president, Schwab Retirement Plan Services.

“The study affirms our focus on these key areas that we believe can

truly make a difference in helping to drive improved retirement

outcomes.”

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube, and LinkedIn.

Disclosures

Charles Schwab received the highest numerical score in the Large

Plan segment in the J.D. Power 2018-2019 US Retirement Plan

Participant Studies of plan holders’ satisfaction with their group

retirement firm. The study was based on 8,332 responses from group

retirement plan participants surveyed in February 2019 and March

2019. Your experiences may vary. Visit jdpower.com/awards.

Retirement plan investment advice is formulated and provided by

an independent third-party advisor, which is not affiliated with or

an agent of Schwab Retirement Plan Services, Inc. (SRPS); or any of

its affiliates. Plan sponsors must elect to make the retirement

plan investment advice service available for their plan. The term

"personalized advice" refers to personal participant data such as

age, salary, and plan account balance, which will form the basis by

which the independent third-party advisor will establish the

participant’s investment strategy.

The Charles Schwab Corporation (Charles Schwab) provides

services to retirement and other benefit plans and participants

through its separate but affiliated companies and subsidiaries:

Charles Schwab Bank; Charles Schwab & Co., Inc.; and Schwab

Retirement Plan Services, Inc. Trust, custody, and deposit products

and services are available through Charles Schwab Bank. Schwab

Retirement Plan Services, Inc. is not a fiduciary to retirement

plans or participants and only provides recordkeeping and related

services.

Through its operating subsidiaries, The Charles Schwab

Corporation (NYSE: SCHW) provides a full range of securities

brokerage, banking, money management and financial advisory

services to individual investors and independent investment

advisors. Its broker-dealer subsidiary, Charles Schwab & Co.,

Inc. (member SIPC, www.sipc.org), and affiliates offer a complete

range of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

compliance and trade monitoring solutions; referrals to independent

fee-based investment advisors; and custodial, operational and

trading support for independent, fee-based investment advisors

through Schwab Advisor Services. Its banking subsidiary, Charles

Schwab Bank (member FDIC and an Equal Housing Lender), provides

banking and lending services and products. More information is

available at www.schwab.com and www.aboutschwab.com.

Brokerage Products: Not FDIC Insured · No Bank

Guarantee · May Lose Value

©2019 Schwab Retirement Plan Services, Inc. All rights

reserved.

(0519-9W7D)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190530005125/en/

Mike PetersonCharles

Schwab330-908-4334mike.peterson@schwab.com

Mike GelorminoIntermarket

Communications212-909-4780mgelormino@intermarket.com

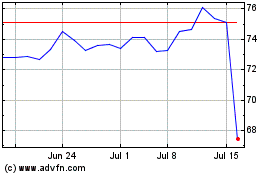

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

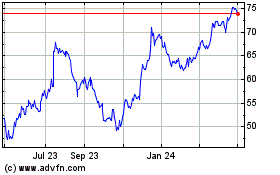

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024