UNITEDSTATES

SECURITIESANDEXCHANGECOMMISSION

Washington,D.C.20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-21972

Name of Fund: BlackRock Credit Allocation Income Trust IV (BTZ)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Anne F. Ackerley, Chief Executive Officer, BlackRock

Credit Allocation Income Trust IV, 55 East 52

nd

Street, New York, NY 10055.

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 10/31/2010

Date of reporting period: 07/31/2010

Item 1 – Schedule of Investments

Schedule of Investments

July 31, 2010 (Unaudited)

BlackRock Credit Allocation Income Trust IV (BTZ)

(Percentages shown are based on Net Assets)

|

|

|

|

|

Common Stocks

|

Shares

|

Value

|

|

Commercial Banks — 0.8%

|

|

|

|

Citizens Banking Corp. (a)

|

6,406,596

|

$ 5,792,844

|

|

Total Common Stocks – 0.8%

|

|

5,792,844

|

|

|

Par

|

|

|

Corporate Bonds

|

(000)

|

|

|

Aerospace & Defense — 2.7%

|

|

|

|

BE Aerospace, Inc., 8.50%,

|

|

|

|

7/01/18

|

$ 3,575

|

3,887,813

|

|

Bombardier, Inc., 7.75%,

|

|

|

|

3/15/20 (b)

|

4,500

|

4,848,750

|

|

United Technologies Corp., 5.70%,

|

|

|

|

4/15/40

|

10,000

|

11,180,590

|

|

|

|

19,917,153

|

|

Airlines — 0.7%

|

|

|

|

Continental Airlines Pass-Through

|

|

|

|

Certificates, Series 2009-2,

|

|

|

|

Class B, 9.25%, 5/10/17

|

2,225

|

2,341,812

|

|

Delta Air Lines, Inc., Series 02G1,

|

|

|

|

6.72%, 7/02/24

|

2,461

|

2,356,274

|

|

|

|

4,698,086

|

|

Auto Components — 0.6%

|

|

|

|

Icahn Enterprises LP:

|

|

|

|

7.75%, 1/15/16

|

1,700

|

1,704,250

|

|

8.00%, 1/15/18

|

2,500

|

2,493,750

|

|

|

|

4,198,000

|

|

Beverages — 0.5%

|

|

|

|

Constellation Brands, Inc., 7.25%,

|

|

|

|

5/15/17

|

3,230

|

3,359,200

|

|

|

|

|

|

Building Products — 0.2%

|

|

|

|

Building Materials Corp. of

|

|

|

|

America, 7.00%, 2/15/20 (b)

|

1,100

|

1,108,250

|

|

Capital Markets — 1.8%

|

|

|

|

Ameriprise Financial, Inc., 5.30%,

|

|

|

|

3/15/20

|

4,500

|

4,812,637

|

|

The Goldman Sachs Group, Inc.,

|

|

|

|

7.50%, 2/15/19

|

6,850

|

7,959,159

|

|

Lehman Brothers Holdings, Inc. (a)(c):

|

|

|

|

3.95%, 11/10/09

|

105

|

22,313

|

|

4.38%, 11/30/10

|

325

|

69,062

|

|

|

|

12,863,171

|

|

Chemicals — 0.3%

|

|

|

|

CF Industries, Inc., 7.13%,

|

|

|

|

5/01/20

|

1,850

|

1,974,875

|

|

Commercial Banks — 0.1%

|

|

|

|

Kazkommerts Finance 2 BV,

|

|

|

|

9.20% (d)(e)

|

500

|

395,000

|

|

|

|

|

|

|

Par

|

|

|

Corporate Bonds

|

(000)

|

Value

|

|

Commercial Services &

|

|

|

|

Supplies — 2.5%

|

|

|

|

Browning-Ferris Industries, Inc.,

|

|

|

|

7.40%, 9/15/35

|

$ 4,420

|

$ 5,290,974

|

|

Clean Harbors, Inc., 7.63%, 8/15/16

|

2,500

|

2,581,250

|

|

Corrections Corp. of America,

|

|

|

|

7.75%, 6/01/17

|

4,835

|

5,161,363

|

|

Waste Management, Inc., 6.13%,

|

|

|

|

11/30/39

|

4,750

|

5,085,179

|

|

|

|

18,118,766

|

|

Communications Equipment —

|

|

|

|

0.8%

|

|

|

|

Brocade Communications Systems,

|

|

|

|

Inc., 6.88%, 1/15/20 (b)

|

3,580

|

3,660,550

|

|

CC Holdings GS V LLC, 7.75%,

|

|

|

|

5/01/17 (b)

|

1,725

|

1,884,563

|

|

|

|

5,545,113

|

|

Consumer Finance — 3.0%

|

|

|

|

Capital One Bank USA NA, 8.80%,

|

|

|

|

7/15/19

|

3,950

|

5,028,022

|

|

Inmarsat Finance Plc, 7.38%,

|

|

|

|

12/01/17 (b)

|

2,975

|

3,049,375

|

|

SLM Corp., 4.00%, 7/25/14 (e)

|

15,852

|

13,410,475

|

|

|

|

21,487,872

|

|

Containers & Packaging — 1.1%

|

|

|

|

Ball Corp.:

|

|

|

|

7.13%, 9/01/16

|

2,000

|

2,150,000

|

|

6.75%, 9/15/20

|

3,575

|

3,753,750

|

|

Owens-Brockway Glass Container,

|

|

|

|

Inc., 6.75%, 12/01/14

|

1,110

|

1,129,425

|

|

Rock-Tenn Co., 9.25%, 3/15/16

|

800

|

869,000

|

|

|

|

7,902,175

|

|

|

|

|

|

Diversified Financial

|

|

|

|

Services — 1.7%

|

|

|

|

GMAC, Inc., 8.30%, 2/12/15 (b)

|

3,700

|

3,894,250

|

|

ING Groep NV, 5.78% (d)(e)

|

10,000

|

8,150,000

|

|

Stan IV Ltd., 2.48%, 7/20/11 (e)

|

283

|

240,550

|

|

|

|

12,284,800

|

|

Diversified Telecommunication

|

|

|

|

Services — 3.3%

|

|

|

|

AT&T Inc., 6.30%, 1/15/38

|

5,000

|

5,565,325

|

|

New Communications Holdings,

|

|

|

|

Inc., 8.50%, 4/15/20 (b)

|

4,500

|

4,803,750

|

|

Qwest Corp., 8.38%, 5/01/16

|

3,285

|

3,736,687

|

|

Verizon Communications, Inc.,

|

|

|

|

7.35%, 4/01/39

|

4,700

|

5,932,796

|

|

Windstream Corp.:

|

|

|

|

8.63%, 8/01/16

|

1,250

|

1,303,125

|

|

7.88%, 11/01/17

|

2,700

|

2,747,250

|

|

|

|

24,088,933

|

Portfolio Abbreviations

To simplify the listings of portfolio holdings in the Schedule of Investments, the names and descriptions of many of the securities have been abbreviated

according to the following list:

GO

General Obligation Bonds

RB

Revenue Bonds

BLACKROCK CREDIT ALLOCATION INCOME TRUST IV

JULY 31, 2010

1

Schedule of Investments

(continued)

BlackRock Credit Allocation Income Trust IV (BTZ)

(Percentages shown are based on Net Assets)

|

|

|

|

|

|

Par

|

|

|

Corporate Bonds

|

(000)

|

Value

|

|

Electric Utilities — 1.4%

|

|

|

|

Progress Energy Inc., 7.00%,

|

|

|

|

10/30/31

|

$ 5,000

|

$ 6,077,375

|

|

Southern California Edison Co.,

|

|

|

|

5.50%, 3/15/40

|

3,850

|

4,210,707

|

|

|

|

10,288,082

|

|

Electronic Equipment, Instruments

|

|

|

|

& Components — 0.3%

|

|

|

|

Jabil Circuit Inc., 8.25%, 3/15/18

|

2,000

|

2,180,000

|

|

Energy Equipment &

|

|

|

|

Services — 4.8%

|

|

|

|

Compagnie Generale de

|

|

|

|

Geophysique-Veritas, 7.75%,

|

|

|

|

5/15/17

|

2,500

|

2,437,500

|

|

Halliburton Co., 7.45%, 9/15/39

|

13,076

|

16,664,551

|

|

Hornbeck Offshore Services, Inc.,

|

|

|

|

Series B, 6.13%, 12/01/14

|

2,750

|

2,468,125

|

|

Transocean, Inc., 6.00%, 3/15/18

|

14,400

|

13,473,648

|

|

|

|

35,043,824

|

|

Food & Staples Retailing — 4.4%

|

|

|

|

CVS Caremark Corp.:

|

|

|

|

4.75%, 5/18/20

|

10,000

|

10,412,670

|

|

6.30%, 6/01/62 (e)

|

7,800

|

7,176,000

|

|

Wal-Mart Stores, Inc.:

|

|

|

|

5.25%, 9/01/35

|

2,650

|

2,759,477

|

|

6.20%, 4/15/38

|

10,000

|

11,720,850

|

|

|

|

32,068,997

|

|

Food Products — 0.8%

|

|

|

|

Kraft Foods, Inc.:

|

|

|

|

6.50%, 8/11/17

|

1,985

|

2,340,758

|

|

6.13%, 8/23/18

|

1,990

|

2,314,336

|

|

Smithfield Foods, Inc., 10.00%,

|

|

|

|

7/15/14 (b)

|

1,250

|

1,396,875

|

|

|

|

6,051,969

|

|

Gas Utilities — 0.7%

|

|

|

|

Nisource Finance Corp., 6.13%,

|

|

|

|

3/01/22

|

4,750

|

5,228,282

|

|

Health Care Equipment &

|

|

|

|

Supplies — 1.9%

|

|

|

|

Fresenius US Finance II, Inc.,

|

|

|

|

9.00%, 7/15/15 (b)

|

4,250

|

4,760,000

|

|

Medtronic, Inc.:

|

|

|

|

6.50%, 3/15/39

|

1,050

|

1,291,970

|

|

5.55%, 3/15/40

|

7,058

|

7,853,712

|

|

|

|

13,905,682

|

|

Health Care Providers &

|

|

|

|

Services — 2.7%

|

|

|

|

Aetna, Inc., 6.75%, 12/15/37

|

4,075

|

4,619,958

|

|

HCA, Inc.:

|

|

|

|

8.50%, 4/15/19

|

2,000

|

2,210,000

|

|

7.25%, 9/15/20

|

3,600

|

3,807,000

|

|

Tenet Healthcare Corp. (b):

|

|

|

|

10.00%, 5/01/18

|

2,175

|

2,471,344

|

|

8.88%, 7/01/19

|

1,825

|

2,007,500

|

|

UnitedHealth Group, Inc., 6.88%,

|

|

|

|

2/15/38

|

4,075

|

4,729,828

|

|

|

|

19,845,630

|

|

|

|

|

|

|

Par

|

|

|

Corporate Bonds

|

(000)

|

Value

|

|

Household Durables — 0.6%

|

|

|

|

Cemex Espana Luxembourg,

|

|

|

|

9.25%, 5/12/20 (b)

|

$ 4,947

|

$ 4,439,933

|

|

IT Services — 0.7%

|

|

|

|

International Business Machines

|

|

|

|

Corp., 5.60%, 11/30/39

|

4,400

|

4,883,569

|

|

Insurance — 3.3%

|

|

|

|

Liberty Mutual Group, Inc., 6.70%,

|

|

|

|

8/15/16 (b)

|

1,495

|

1,559,219

|

|

Lincoln National Corp., 6.25%,

|

|

|

|

2/15/20

|

4,075

|

4,348,673

|

|

Northwestern Mutual Life

|

|

|

|

Insurance, 6.06%, 3/30/40 (b)

|

5,500

|

6,126,120

|

|

Principal Financial Group, Inc.,

|

|

|

|

8.88%, 5/15/19

|

1,145

|

1,430,188

|

|

Prudential Financial, Inc., 6.63%,

|

|

|

|

12/01/37

|

4,075

|

4,368,718

|

|

QBE Insurance Group Ltd., 9.75%,

|

|

|

|

3/14/14 (b)

|

4,973

|

6,028,405

|

|

|

|

23,861,323

|

|

Life Sciences Tools &

|

|

|

|

Services — 1.5%

|

|

|

|

Bio-Rad Laboratories, Inc., 8.00%,

|

|

|

|

9/15/16

|

5,480

|

5,863,600

|

|

Life Technologies Corp., 6.00%,

|

|

|

|

3/01/20

|

4,800

|

5,292,034

|

|

|

|

11,155,634

|

|

Machinery — 1.3%

|

|

|

|

Ingersoll-Rand Global Holding Co.,

|

|

|

|

Ltd., 9.50%, 4/15/14

|

4,075

|

5,033,497

|

|

Navistar International Corp.,

|

|

|

|

8.25%, 11/01/21

|

3,975

|

4,203,563

|

|

|

|

9,237,060

|

|

Media — 6.2%

|

|

|

|

CSC Holdings LLC:

|

|

|

|

8.50%, 6/15/15

|

2,300

|

2,475,375

|

|

8.63%, 2/15/19

|

1,950

|

2,130,375

|

|

Comcast Corp., 6.30%, 11/15/17

|

4,075

|

4,715,403

|

|

Cox Communications, Inc., 8.38%,

|

|

|

|

3/01/39 (b)

|

4,075

|

5,459,579

|

|

DISH DBS Corp.:

|

|

|

|

7.00%, 10/01/13

|

1,950

|

2,028,000

|

|

7.88%, 9/01/19

|

1,850

|

1,965,625

|

|

Gannett Co., Inc., 9.38%,

|

|

|

|

11/15/17 (b)

|

3,100

|

3,363,500

|

|

Intelsat Corp., 9.25%, 6/15/16

|

2,000

|

2,135,000

|

|

News America, Inc., 6.15%,

|

|

|

|

3/01/37

|

4,850

|

5,105,503

|

|

Time Warner Cable, Inc., 6.75%,

|

|

|

|

6/15/39

|

4,675

|

5,324,231

|

|

Time Warner, Inc., 7.70%,

|

|

|

|

5/01/32

|

4,900

|

5,987,839

|

|

UPC Germany GmbH, 8.13%,

|

|

|

|

12/01/17 (b)

|

1,225

|

1,252,562

|

|

Virgin Media Secured Finance Plc,

|

|

|

|

6.50%, 1/15/18 (b)

|

3,175

|

3,286,125

|

|

|

|

45,229,117

|

2 BLACKROCK CREDIT ALLOCATION INCOME TRUST IV

JULY 31, 2010

|

|

|

Schedule of Investments

(continued)

|

BlackRock Credit Allocation Income Trust IV (BTZ)

(Percentages shown are based on Net Assets)

|

|

|

|

|

|

|

|

Par

|

|

|

Corporate Bonds

|

|

(000)

|

Value

|

|

Metals & Mining — 1.3%

|

|

|

|

|

AK Steel Corp., 7.63%, 5/15/20

|

$ 2,250

|

$ 2,258,438

|

|

Aleris International, Inc., 10.00%,

|

|

|

|

|

12/15/16 (a)(c)

|

|

5,000

|

2,000

|

|

Phelps Dodge Corp., 7.13%, 11/01/27

|

3,500

|

3,790,139

|

|

Teck Resources Ltd., 10.75%, 5/15/19

|

2,000

|

2,497,600

|

|

United States Steel Corp., 7.38%,

|

|

|

|

|

4/01/20

|

|

550

|

551,375

|

|

|

|

|

9,099,552

|

|

Multi-Utilities — 2.6%

|

|

|

|

|

CenterPoint Energy, Inc.:

|

|

|

|

|

5.95%, 2/01/17

|

|

3,600

|

3,900,082

|

|

6.50%, 5/01/18

|

|

3,950

|

4,445,610

|

|

Dominion Resources, Inc., 8.88%,

|

|

|

|

|

1/15/19

|

|

8,000

|

10,665,288

|

|

|

|

|

19,010,980

|

|

Multiline Retail — 3.1%

|

|

|

|

|

Dollar General Corp., 10.63%, 7/15/15

|

4,225

|

4,647,500

|

|

J.C. Penney Co., Inc., 5.65%,

|

|

|

|

|

6/01/20

|

|

17,700

|

17,788,500

|

|

|

|

|

22,436,000

|

|

Oil, Gas & Consumable

|

|

|

|

|

Fuels — 3.4%

|

|

|

|

|

BP Capital Markets Plc, 3.88%,

|

|

|

|

|

3/10/15

|

|

3,085

|

2,949,133

|

|

Chesapeake Energy Corp., 6.25%,

|

|

|

|

|

1/15/18

|

|

2,200

|

2,249,500

|

|

Enbridge Energy Partners LP,

|

|

|

|

|

9.88%, 3/01/19

|

|

2,425

|

3,259,857

|

|

Enterprise Products Operating LLC,

|

|

|

|

|

6.65%, 4/15/18

|

|

4,800

|

5,567,117

|

|

Kinder Morgan Energy Partners LP,

|

|

|

|

|

6.85%, 2/15/20

|

|

4,800

|

5,686,805

|

|

ONEOK Partners LP, 8.63%,

|

|

|

|

|

3/01/19

|

|

4,075

|

5,223,857

|

|

|

|

|

24,936,269

|

|

Paper & Forest Products — 2.4%

|

|

|

|

|

Georgia-Pacific LLC, 8.25%,

|

|

|

|

|

5/01/16 (b)

|

|

3,955

|

4,291,175

|

|

International Paper Co.:

|

|

|

|

|

7.50%, 8/15/21

|

|

3,950

|

4,738,452

|

|

8.70%, 6/15/38

|

|

3,100

|

4,080,893

|

|

7.30%, 11/15/39

|

|

4,075

|

4,670,357

|

|

|

|

|

17,780,877

|

|

Pharmaceuticals — 8.9%

|

|

|

|

|

Abbott Laboratories:

|

|

|

|

|

6.15%, 11/30/37

|

|

942

|

1,110,246

|

|

6.00%, 4/01/39

|

|

9,405

|

10,923,945

|

|

Bristol-Myers Squibb Co.:

|

|

|

|

|

5.88%, 11/15/36

|

|

8,015

|

9,021,139

|

|

6.13%, 5/01/38

|

|

2,353

|

2,747,676

|

|

Eli Lilly & Co., 5.95%, 11/15/37

|

|

2,353

|

2,694,039

|

|

GlaxoSmithKline Capital, Inc.,

|

|

|

|

|

6.38%, 5/15/38

|

|

10,100

|

12,154,815

|

|

Merck & Co., Inc., 6.50%,

|

|

|

|

|

12/01/33

|

|

2,885

|

3,523,592

|

|

Pfizer, Inc., 7.20%, 3/15/39

|

|

10,000

|

13,422,820

|

|

Schering-Plough Corp., 6.55%,

|

|

|

|

|

9/15/37

|

|

6,945

|

8,681,805

|

|

|

|

|

64,280,077

|

|

|

|

|

|

|

Par

|

|

|

Corporate Bonds

|

(000)

|

Value

|

|

Real Estate Investment Trusts

|

|

|

|

(REITs) — 1.8%

|

|

|

|

AvalonBay Communities, Inc.,

|

|

|

|

6.10%, 3/15/20

|

$ 4,075

|

$ 4,610,500

|

|

ERP Operating LP:

|

|

|

|

5.38%, 8/01/16

|

3,925

|

4,261,494

|

|

5.75%, 6/15/17

|

4,080

|

4,510,056

|

|

|

|

13,382,050

|

|

Semiconductors & Semiconductor

|

|

|

|

Equipment — 3.3%

|

|

|

|

Advanced Micro Devices, Inc.,

|

|

|

|

7.75%, 8/01/20 (b)(f)

|

1,300

|

1,313,000

|

|

KLA-Tencor Corp., 6.90%, 5/01/18

|

2,208

|

2,471,041

|

|

National Semiconductor Corp.:

|

|

|

|

3.95%, 4/15/15

|

16,750

|

17,248,848

|

|

6.60%, 6/15/17

|

2,770

|

3,125,372

|

|

|

|

24,158,261

|

|

Specialty Retail — 0.8%

|

|

|

|

AutoNation, Inc., 6.75%, 4/15/18

|

2,775

|

2,795,812

|

|

AutoZone, Inc., 7.13%, 8/01/18

|

1,550

|

1,842,344

|

|

Limited Brands, Inc., 7.00%,

|

|

|

|

5/01/20

|

1,370

|

1,414,525

|

|

|

|

6,052,681

|

|

Tobacco — 2.9%

|

|

|

|

Altria Group, Inc.:

|

|

|

|

9.70%, 11/10/18

|

4,075

|

5,338,894

|

|

9.25%, 8/06/19

|

3,950

|

5,082,180

|

|

10.20%, 2/06/39

|

7,400

|

10,451,612

|

|

|

|

20,872,686

|

|

Wireless Telecommunication

|

|

|

|

Services — 3.6%

|

|

|

|

Cricket Communications, Inc.,

|

|

|

|

7.75%, 5/15/16

|

780

|

807,300

|

|

Nextel Communications, Inc.,

|

|

|

|

Series E, 6.88%, 10/31/13

|

2,890

|

2,875,550

|

|

SBA Tower Trust, 5.10%,

|

|

|

|

4/15/42 (b)

|

21,250

|

22,732,207

|

|

|

|

26,415,057

|

|

Total Corporate Bonds – 84.0%

|

|

609,784,986

|

|

Investment Companies

|

Shares

|

|

|

ProShares UltraShort Real Estate

|

30,000

|

707,400

|

|

Total Investment Companies – 0.1%

|

|

707,400

|

|

Preferred Securities

|

|

|

|

|

Par

|

|

|

Capital Trusts

|

(000)

|

|

|

Capital Markets — 2.8%

|

|

|

|

Credit Suisse Guernsey Ltd.,

|

|

|

|

5.86% (d)(e)

|

$ 1,050

|

955,500

|

BLACKROCK CREDIT ALLOCATION INCOME TRUST IV

JULY 31, 2010

3

Schedule of Investments

(continued)

BlackRock Credit Allocation Income Trust IV (BTZ)

(Percentages shown are based on Net Assets)

|

|

|

|

|

|

Par

|

|

|

Capital Trusts

|

(000)

|

Value

|

|

Capital Markets — (concluded)

|

|

|

|

State Street Capital Trust III,

|

|

|

|

8.25% (d)(e)

|

$ 1,740

|

$ 1,766,013

|

|

State Street Capital Trust IV,

|

|

|

|

1.54%, 6/01/67 (e)

|

25,245

|

17,528,790

|

|

|

|

20,250,303

|

|

Commercial Banks — 12.0%

|

|

|

|

BB&T Capital Trust IV, 6.82%,

|

|

|

|

6/12/77 (e)

|

15,300

|

14,764,500

|

|

Barclays Bank Plc (b)(d)(e):

|

|

|

|

5.93%

|

4,000

|

3,370,000

|

|

6.86%

|

11,500

|

9,890,000

|

|

Commonwealth Bank of Australia,

|

|

|

|

6.02% (b)(d)(e)

|

20,000

|

18,983,320

|

|

HSBC Capital Funding

|

|

|

|

LP/Jersey Channel Islands,

|

|

|

|

10.18% (b)(d)(e)

|

7,000

|

8,715,000

|

|

National City Preferred Capital

|

|

|

|

Trust I, 12.00% (d)(e)

|

3,713

|

4,126,257

|

|

Shinsei Finance II (Cayman) Ltd.,

|

|

|

|

7.16% (b)(d)(e)

|

1,005

|

658,903

|

|

Standard Chartered Bank,

|

|

|

|

7.01% (b)(d)(e)

|

5,000

|

4,710,645

|

|

USB Capital XIII Trust, 6.63%,

|

|

|

|

12/15/39

|

4,100

|

4,293,848

|

|

Wells Fargo & Co., Series K,

|

|

|

|

7.98% (d)(e)

|

12,985

|

13,374,550

|

|

Wells Fargo Capital XIII,

|

|

|

|

Series GMTN, 7.70% (d)(e)

|

3,900

|

3,997,500

|

|

|

|

86,884,523

|

|

Consumer Finance — 0.8%

|

|

|

|

Capital One Capital V, 10.25%,

|

|

|

|

8/15/39

|

5,460

|

5,910,450

|

|

Diversified Financial

|

|

|

|

Services — 3.4%

|

|

|

|

JPMorgan Chase Capital XXI,

|

|

|

|

Series U, 1.42%, 1/15/87 (e)

|

12,875

|

9,502,497

|

|

JPMorgan Chase Capital XXIII,

|

|

|

|

1.44%, 5/15/77 (e)

|

20,695

|

14,808,059

|

|

|

|

24,310,556

|

|

Electric Utilities — 0.5%

|

|

|

|

PPL Capital Funding, 6.70%,

|

|

|

|

3/30/67 (e)

|

3,900

|

3,480,750

|

|

Insurance — 9.3%

|

|

|

|

AXA SA, 6.46% (b)(d)(e)

|

12,000

|

9,480,000

|

|

Ace Capital Trust II, 9.70%,

|

|

|

|

4/01/30

|

4,000

|

4,859,744

|

|

The Allstate Corp., 6.50%,

|

|

|

|

5/15/67 (e)

|

4,000

|

3,660,000

|

|

Aon Corp., 8.21%, 1/01/27

|

4,000

|

4,202,000

|

|

Chubb Corp., 6.38%, 3/29/67 (e)

|

4,000

|

3,900,000

|

|

Liberty Mutual Group, Inc.,

|

|

|

|

10.75%, 6/15/88 (b)(e)

|

4,000

|

4,380,000

|

|

Lincoln National Corp., 7.00%,

|

|

|

|

5/17/66 (e)

|

4,255

|

3,848,222

|

|

MetLife, Inc., 6.40%, 12/15/66

|

4,550

|

4,220,125

|

|

Nationwide Life Global Funding I,

|

|

|

|

6.75%, 5/15/67

|

4,000

|

3,207,600

|

|

Reinsurance Group of America,

|

|

|

|

6.75%, 12/15/65 (e)

|

15,000

|

12,654,510

|

|

|

|

|

|

|

Par

|

|

|

Capital Trusts

|

(000)

|

Value

|

|

Insurance (concluded)

|

|

|

|

Swiss Re Capital I LP,

|

|

|

|

6.85% (b)(d)(e)

|

$ 3,000

|

$ 2,599,098

|

|

The Travelers Cos., Inc., 6.25%,

|

|

|

|

3/15/67 (e)

|

4,000

|

3,790,956

|

|

White Mountains Re Group Ltd.,

|

|

|

|

7.51% (b)(d)(e)

|

4,400

|

3,504,160

|

|

ZFS Finance (USA) (b)(e):

|

|

|

|

Trust IV, 5.88%, 5/09/32

|

599

|

533,038

|

|

Trust V, 6.50%, 5/09/67

|

3,331

|

3,031,210

|

|

|

|

67,870,663

|

|

Multi-Utilities — 0.2%

|

|

|

|

Puget Sound Energy, Inc., Series A,

|

|

|

|

6.97%, 6/01/67 (e)

|

1,575

|

1,466,797

|

|

Oil, Gas & Consumable

|

|

|

|

Fuels — 1.1%

|

|

|

|

Enterprise Products Operating

|

|

|

|

LLC, 8.38%, 8/01/66 (e)

|

4,500

|

4,584,375

|

|

TransCanada PipeLines Ltd.,

|

|

|

|

6.35%, 5/15/67 (e)

|

4,000

|

3,640,000

|

|

|

|

8,224,375

|

|

Real Estate Investment Trusts

|

|

|

|

(REITs) — 1.5%

|

|

|

|

Sovereign Real Estate Investment

|

|

|

|

Corp., 12.00% (b)(d)

|

10

|

10,950,000

|

|

Total Capital Trusts – 31.6%

|

|

229,348,417

|

|

Preferred Stocks

|

Shares

|

|

|

Diversified Financial

|

|

|

|

Services — 0.8%

|

|

|

|

Falcons Funding Trust I, 8.88% (b)

|

5,650

|

5,808,906

|

|

Insurance — 2.1%

|

|

|

|

Aspen Insurance Holdings Ltd.,

|

|

|

|

7.40%

|

487,487

|

10,870,960

|

|

Axis Capital Holdings Ltd., Series B,

|

|

|

|

7.50%

|

51,200

|

4,416,000

|

|

|

|

15,286,960

|

|

Wireless Telecommunication

|

|

|

|

Services — 1.4%

|

|

|

|

Centaur Funding Corp., 9.08%

|

10,000

|

10,575,000

|

|

Total Preferred Stocks – 4.3%

|

|

31,670,866

|

|

Trust Preferreds

|

|

|

|

Insurance — 0.2%

|

|

|

|

W.R. Berkley Capital Trust II,

|

|

|

|

6.75%, 7/26/45 (g)

|

60,755

|

1,462,087

|

|

Total Trust Preferreds – 0.2%

|

|

1,462,087

|

|

Total Preferred Securities – 36.1%

|

|

262,481,370

|

4 BLACKROCK CREDIT ALLOCATION INCOME TRUST IV

JULY 31, 2010

Schedule of Investments

(continued)

BlackRock Credit Allocation Income Trust IV (BTZ)

(Percentages shown are based on Net Assets)

|

|

|

|

|

|

|

|

Par

|

|

|

Taxable Municipal Bonds

|

|

(000)

|

Value

|

|

City of Chicago Illinois, RB, Build

|

|

|

|

|

America Bonds, 6.85%,

|

|

|

|

|

1/01/38

|

$ 5,000

|

$ 5,162,350

|

|

Metropolitan Transportation

|

|

|

|

|

Authority, RB, Build America

|

|

|

|

|

Bonds, 6.55%, 11/15/31

|

|

4,075

|

4,195,987

|

|

State of California, GO, Build

|

|

|

|

|

America Bonds, 7.35%,

|

|

|

|

|

11/01/39

|

|

2,050

|

2,151,168

|

|

State of Illinois, GO, Pension,

|

|

|

|

|

5.10%, 6/01/33

|

|

4,075

|

3,323,855

|

|

Total Taxable Municipal Bonds – 2.0%

|

|

14,833,360

|

|

U.S. Treasury Obligations

|

|

|

|

|

U.S. Treasury Notes (h):

|

|

|

|

|

1.75%, 7/31/15

|

|

60,000

|

60,440,400

|

|

4.63%, 2/15/40

|

|

75,000

|

83,402,325

|

|

Total U.S. Treasury Obligations – 19.8%

|

|

143,842,725

|

|

Total Long-Term Investments

|

|

|

|

|

(Cost – $1,044,380,796) – 142.8%

|

|

1,037,442,685

|

|

Short-Term Securities

|

|

Shares

|

|

|

BlackRock Liquidity Funds,

|

|

|

|

|

TempFund, Institutional Class,

|

|

|

|

|

0.23% (i)(j)

|

|

2,100,903

|

2,100,903

|

|

Total Short-Term Securities

|

|

|

|

|

(Cost – $2,100,903) – 0.3%

|

|

|

2,100,903

|

|

Total Investments

|

|

|

|

|

(Cost – $1,046,481,699*) – 143.1%

|

|

1,039,543,588

|

|

Preferred Shares at Redemption Value – (31.8)%

|

(231,064,276)

|

|

Liabilities in Excess of Other Assets – (11.3)%

|

(82,202,679)

|

|

Net Assets Applicable to Common Shares – 100.0%

|

$ 726,276,633

|

|

* The cost and unrealized appreciation (depreciation) of investments as

|

|

of July 31, 2010, as computed for federal income tax purposes, were as

|

|

Aggregate follows: cost

|

|

|

$ 1,059,627,737

|

|

Gross unrealized appreciation

|

|

|

$ 45,860,572

|

|

Net Gross unrealized unrealized depreciation depreciation

|

|

|

$ (20,084,149) (65,944,721)

|

|

(a) Non-income producing security.

|

|

|

|

|

|

|

|

(b) Security exempt from registration under Rule 144A of the Securities Act

|

|

of 1933. These securities may be resold in transactions exempt from

|

|

registration to qualified institutional investors.

|

|

|

(c) Issuer filed for bankruptcy and/or is in default of interest payments.

|

|

(d) Security is perpetual in nature and has no stated maturity date.

|

|

(e) Variable rate security. Rate shown is as of report date.

|

|

|

(f) When-issued security. Unsettled when-issued transactions were as

|

|

follows:

|

|

|

|

|

|

Unrealized

|

|

Counterparty

|

Value

|

Appreciation

|

|

JPMorgan Securities, Inc.

|

$ 1,313,000 $

|

13,000

|

|

|

|

|

|

|

|

|

(g) Convertible security.

|

|

|

|

|

(h) All or a portion of security has been pledged as collateral in connection

|

|

|

with open reverse repurchase agreements.

|

|

|

|

(i)

|

Investments in companies considered to be an affiliate of the Fund

|

|

|

during the period, for purposes of Section 2(a)(3) of the Investment

|

|

|

Company Act of 1940, as amended, are as follows:

|

|

|

|

|

Shares Held

|

|

Shares Held

|

|

|

|

|

at October

|

Net

|

at July 31,

|

|

|

|

Affiliate

|

31, 2009

|

Activity

|

2010

|

Income

|

|

|

BlackRock

|

|

|

|

|

|

|

Liquidity Funds,

|

|

|

|

|

|

|

TempFund,

|

|

|

|

|

|

|

Institutional

|

|

|

|

|

|

|

Class

|

267,832,781 (265,731,878)

|

2,100,903

|

$170,352

|

|

(j)

|

Represents the current yield as of report date.

|

|

|

• For Fund compliance purposes, the Fund's industry classifications refer to

any one or more of the industry sub-classifications used by one or more

widely recognized market indexes or rating group indexes, and/or as

defined by Fund management. This definition may not apply for purposes

of this report, which may combine such industry sub-classifications for

reporting ease.

• Reverse repurchase agreements outstanding as of July 31, 2010 were

as follows:

|

|

|

|

|

|

|

|

Counter-

|

Interest

|

Trade

|

Maturity

|

Net Closing

|

Face

|

|

party

|

Rate

|

Date

|

Date

|

Amount

|

Amount

|

|

Credit

|

|

|

|

|

|

|

Suisse

|

|

|

|

|

|

|

International 0.21%

|

7/30/10

|

Open

|

$60,151,053

|

$

60,150,000

|

|

JPMorgan

|

|

|

|

|

|

|

Securities,

|

|

|

|

|

|

|

Inc.

|

0.22%

|

7/30/10

|

8/02/10 $54,180,993

|

54,180,000

|

|

Total

|

|

|

|

$

114,330,000

|

• Financial futures contracts purchased as of July 31, 2010 were as follows:

|

|

|

|

|

|

|

|

|

Expiration

|

Face

|

Unrealized

|

|

Contracts

|

Issue

|

Date

|

Value

|

Appreciation

|

|

357

|

10-Year U.S.

|

September

|

|

|

|

|

Treasury Bonds

|

2010

|

$ 43,275,879

|

$

925,184

|

|

29

|

30-Year U.S.

|

September

|

|

|

|

|

Treasury Bond

|

2010

|

$ 3,607,107

|

125,736

|

|

Total

|

|

|

$ 1,050,920

|

|

|

|

|

|

|

|

|

•

|

Credit default swaps on single-name issues - buy protection outstanding as of July 31, 2010

|

|

|

were as follows:

|

|

|

|

|

|

|

|

|

|

Notional

|

|

|

|

|

Pay

|

|

Amount

|

Unrealized

|

|

|

Issuer

|

Rate

|

Counterparty

|

Expiration (000)

|

Depreciation

|

|

|

Nordstrom, Inc.

|

5.20%

|

Deutsche Bank AG

|

June 2014 $ 4,000

|

$

(640,819)

|

BLACKROCK CREDIT ALLOCATION INCOME TRUST IV

JULY 31, 2010

5

Schedule of Investments

(concluded)

BlackRock Credit Allocation Income Trust IV (BTZ)

•Fair Value Measurements - Various inputs are used in determining the fair value of investments and

derivatives, which are as follows:

•Level 1 — price quotations in active markets/exchanges for identical assets and liabilities

•Level 2 — other observable inputs (including, but not limited to: quoted prices for similar assets or

liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in

markets that are not active, inputs other than quoted prices that are observable for the assets or

liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit

risks and default rates) or other market-corroborated inputs)

•Level 3 — unobservable inputs based on the best information available in the circumstances, to the

extent observable inputs are not available (including the Fund's own assumptions used in

determining the fair value of investments and derivatives)

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk

associated with investing in those securities. For information about the Fund's policy regarding valuation

of investments and other significant accounting policies, please refer to the Fund’s most recent financial

statements as contained in its annual report.

The following tables summarize the inputs used as of July 31, 2010 in determining the fair valuation of

the Fund's investments and derivatives:

|

|

|

|

|

|

|

|

|

|

Valuation Inputs

|

|

|

Level 1

|

Level 2

|

|

Level 3

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

|

Investments in Securities:

|

|

|

|

|

|

|

|

Long-Term Investments:

|

|

|

|

|

|

|

|

Common Stocks

|

|

$ 5,792,844

|

—

|

|

—

|

$ 5,792,844

|

|

Corporate Bonds

|

|

— $ 609,544,436

|

$ 240,550

|

609,784,986

|

|

Investment Companies

|

|

707,400

|

—

|

|

—

|

707,400

|

|

Preferred Securities

|

|

12,333,047

|

250,148,323

|

|

—

|

262,481,370

|

|

Taxable Municipal Bonds

|

|

—

|

14,833,360

|

|

—

|

14,833,360

|

|

U.S. Treasury Obligations

|

|

—

|

143,842,725

|

|

—

|

143,842,725

|

|

Short-Term Securities

|

|

2,100,903

|

—

|

|

—

|

2,100,903

|

|

Total

|

|

$ 20,934,194

|

$ 1,018,368,844

|

$ 240,550

|

$ 1,039,543,588

|

|

|

|

|

Derivative Financial Instruments

1

|

|

|

|

Valuation Inputs

|

|

Level 1

Level 2

|

Level 3

|

Total

|

|

Assets:

|

|

|

|

|

|

|

|

|

Interest rate

|

|

|

|

|

|

|

|

|

contracts

|

$ 1,050,920

|

—

|

|

—

|

$ 1,050,920

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

Credit contracts

|

|

|

—

|

(640,819)

|

|

—

|

(640,819)

|

|

Total

|

$ 1,050,920

|

$

(640,819)

|

|

—

|

$ 410,101

|

1

Derivative financial instruments are financial futures contracts and swaps, which are shown at the

unrealized appreciation/depreciation on the instrument.

The following table is a reconciliation of Level 3 investments for which

significant unobservable inputs were used in determining fair value:

|

|

|

|

|

Corporate

|

|

|

Bonds

|

|

Assets:

|

|

|

Balance, as of October 31, 2009

|

$ 240,550

|

|

Accrued discounts/premiums

|

(574)

|

|

Net realized gain (loss)

|

—

|

|

Net change in unrealized appreciation/depreciation

|

574

|

|

Purchases

|

—

|

|

Sales

|

—

|

|

Transfers in

2

|

—

|

|

Transfers out

2

|

—

|

|

Balance, as of July 31, 2010

|

$ 240,550

|

2

The change in unrealized appreciation/depreciation on securities still held at July 31,

2010 was $574.

6 BLACKROCK CREDIT ALLOCATION INCOME TRUST IV

JULY 31, 2010

Item 2 – Controls and Procedures

2(a) – The registrant's principal executive and principal financial officers or persons performing

similar functions have concluded that the registrant's disclosure controls and procedures (as

defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the

“1940 Act”)) are effective as of a date within 90 days of the filing of this report based on the

evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act

and Rule 13a-15(b) under the Securities Exchange Act of 1934, as amended.

2(b) – There were no changes in the registrant's internal control over financial reporting (as defined

in Rule 30a-3(d) under the 1940 Act) that occurred during the registrant's last fiscal quarter

that have materially affected, or are reasonably likely to materially affect, the registrant's

internal control over financial reporting.

Item 3 – Exhibits

Certifications – Attached hereto

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment

Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

BlackRock Credit Allocation Income Trust IV

By:

/s/ Anne F. Ackerley

Anne F. Ackerley

Chief Executive Officer of

BlackRock Credit Allocation Income Trust IV

Date: September 27, 2010

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment

Company Act of 1940, this report has been signed below by the following persons on behalf

of the registrant and in the capacities and on the dates indicated.

By:

/s/ Anne F. Ackerley

Anne F. Ackerley

Chief Executive Officer (principal executive officer) of

BlackRock Credit Allocation Income Trust IV

Date: September 27, 2010

By:

/s/ Neal J. Andrews

Neal J. Andrews

Chief Financial Officer (principal financial officer) of

BlackRock Credit Allocation Income Trust IV

Date: September 27, 2010

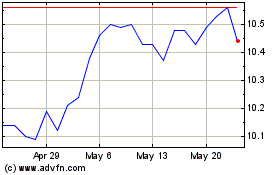

BlackRock Credit Allocat... (NYSE:BTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

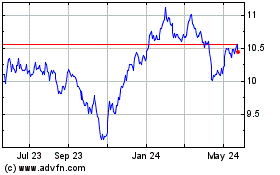

BlackRock Credit Allocat... (NYSE:BTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024