UNITEDSTATES

SECURITIESANDEXCHANGECOMMISSION

Washington,D.C.20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21972

Name of Fund: BlackRock Credit Allocation Income Trust IV (BTZ)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Anne F. Ackerley, Chief Executive Officer, BlackRock

Credit Allocation Income Trust IV, 55 East 52

nd

Street, New York, NY 10055.

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 10/31/2010

Date of reporting period: 04/30/2010

Item 1 – Report to Stockholders

Semi-Annual Report

APRIL 30, 2010 I (UNAUDITED)

BlackRock Credit Allocation Income Trust I, Inc. (PSW)

BlackRock Credit Allocation Income Trust II, Inc. (PSY)

BlackRock Credit Allocation Income Trust III (BPP)

BlackRock Credit Allocation Income Trust IV (BTZ)

BlackRock Floating Rate Income Trust (BGT)

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

|

|

|

|

Table of Contents

|

|

|

|

Page

|

|

Dear Shareholder

|

3

|

|

Semi-Annual Report:

|

|

|

Fund Summaries

|

4

|

|

The Benefits and Risks of Leveraging

|

9

|

|

Derivative Financial Instruments

|

10

|

|

Financial Statements:

|

|

|

Schedules of Investments

|

11

|

|

Statements of Assets and Liabilities

|

38

|

|

Statements of Operations

|

39

|

|

Statements of Changes in Net Assets

|

40

|

|

Statement of Cash Flows

|

42

|

|

Financial Highlights

|

44

|

|

Notes to Financial Statements

|

48

|

|

Officers and Directors

|

58

|

|

Additional Information

|

59

|

2 SEMI-ANNUAL REPORT

APRIL 30, 2010

Dear Shareholder

Although overall global economic and financial conditions have generally improved over the past year, the period ended with high levels of market volatility

and diminishing investor confidence sparked by the sovereign debt crisis in Europe, concerns over the strength of the economic recovery and uncertainty

surrounding the future of interest rate policies. Additionally, as the period drew to a close, the increasing likelihood of more stringent financial market regula-

tions added to the overall sense of investment uncertainty. Despite the uneven nature of recent market conditions, we continue to believe that the “Great

Recession” likely ended at some point last summer, thanks primarily to massive fiscal and monetary stimulus, and that the global economy remains in

recovery mode.

Global equity markets bottomed in early 2009 and since that time have moved unevenly higher as investors were lured back into the markets by depressed

valuations, desire for higher yields and improvements in corporate earnings prospects. There have been several corrections along the way and volatility levels

have remained elevated — reflections of mixed economic data, lingering deflation issues (especially in Europe) and uncertainty surrounding financial regula-

tions. On balance, however, improving corporate revenues and profits and a positive macro backdrop helped push stock prices higher over the last twelve

and six months. From a geographic perspective, US equities have outpaced their international counterparts in recent months, as the domestic economic

recovery has been more pronounced and as credit-related issues have held European markets down.

Within fixed income markets, yields have been moving unevenly as improving economic conditions have been acting to push Treasury yields higher (and

prices correspondingly lower), while concerns over ongoing deflation threats have acted as a counterweight. As the period drew to a close, Treasury yields

were falling as investors flocked to the “safe haven” asset class in the face of escalating uncertainty. Over the course of the last twelve and six months,

however, Treasuries underperformed other areas of the bond market, particularly the high yield sector, which has been benefiting from increased investor

demand. Meanwhile, municipal bonds slightly outperformed taxable sectors over both the six- and twelve-month periods thanks to continued high demand

levels, but have continued to face the headwinds of ongoing state and local budget problems. As in the taxable arena, high yield municipals have been out-

performing the rest of the market.

Regarding cash investments, yields on money market securities remain near all-time lows (producing returns only marginally above zero percent), with

the Federal Open Market Committee reiterating that economic circumstances are likely to necessitate an accommodative interest rate stance for an

“extended period.”

|

|

|

|

|

Against this backdrop, the major market averages posted the following returns:

|

|

|

|

Total Returns as of April 30, 2010

|

6-month

|

12-month

|

|

US equities (S&P 500 Index)

|

15.66%

|

38.84%

|

|

Small cap US equities (Russell 2000 Index)

|

28.17

|

48.95

|

|

International equities (MSCI Europe, Australasia, Far East Index)

|

2.48

|

34.43

|

|

3-month Treasury bill (BofA Merrill Lynch 3-Month Treasury Bill Index)

|

0.04

|

0.15

|

|

US Treasury securities (BofA Merrill Lynch 10-Year US Treasury Index)

|

(0.54)

|

(1.32)

|

|

Taxable fixed income (Barclays Capital US Aggregate Bond Index)

|

2.54

|

8.30

|

|

Tax-exempt fixed income (Barclays Capital Municipal Bond Index)

|

3.68

|

8.85

|

|

High yield bonds (Barclays Capital US Corporate High Yield 2% Issuer Capped Index)

|

11.60

|

42.53

|

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

Global financial markets continue to show signs of improvement, but questions about the strength and sustainability of the recovery abound. Through

periods of uncertainty, as ever, BlackRock’s full resources are dedicated to the management of our clients’ assets. For additional market perspective and

investment insight, visit

www.blackrock.com/shareholdermagazine

, where you’ll find the most recent issue of our award-winning

Shareholder®

magazine,

as well as its quarterly companion newsletter,

Shareholder Perspectives

. As always, we thank you for entrusting BlackRock with your investments, and we

look forward to your continued partnership in the months and years ahead.

THIS PAGE NOT PART OF YOUR FUND REPORT

3

Fund Summary

as of April 30, 2010

BlackRock Credit Allocation Income Trust I, Inc.

Investment Objective

BlackRock Credit Allocation Income Trust I, Inc. (PSW) (formerly BlackRock Preferred and Corporate Income Strategies Fund, Inc.) (the “Fund”)

seeks to

provide shareholders with high current income and capital appreciation. The Fund seeks to achieve its objectives by investing primarily in credit-related securi-

ties, including, but not limited to, investment grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds or derivatives with

economic characteristics similar to these credit-related securities.

Effective November 13, 2009, BlackRock Preferred and Corporate Income Strategies Fund, Inc. was renamed BlackRock Credit Allocation Income Trust I, Inc.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the six months ended April 30, 2010, the Fund returned 17.86% based on market price and 16.40% based on net asset value (“NAV”). For the same

period, the closed-end Lipper Income & Preferred Stock Funds category posted an average return of 22.64% on a market price basis and 15.18% on a

NAV basis. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between

performance based on price and performance based on NAV. In accordance with a change to its investment policies the Fund transitioned its portfolio away

from primarily investing in preferred securities and corporate bonds into a broader spectrum of securities across the capital structure. Performance has been

driven by the strong rebound in preferred securities, along with asset allocation decisions within the preferred sector. In particular, the Fund benefited from

an overweight allocation to institutional corporate securities and hybrid securities as those sectors continued their dramatic outperformance versus $25 par

preferred securities, in which the Fund was underweight. The Fund’s performance also benefited from participation in several additional issuer-related ten-

ders in preferred equity exchanges, along with an overweight in the European banking sector. On the other hand, markets experienced substantial volatility

over the period, most notably during the first three months of 2010. Markets were robust in early January as improving economic conditions left investors

feeling underinvested and scrambling to purchase assets. The rally met an abrupt end in mid-January due to rising Greek default risk and the unexpected

tightening of monetary policy in China. Markets declined over the ensuing weeks until a European Union-led finance package for Greece was announced.

From that point, markets rallied on stronger economic data, including the first month of job creation (in March) and upward revisions to the previous three

months’ jobs data. The preferred market was largely immune from this volatility, however, as prices rose whether the broader market was rallying or selling

off. This was due to the previously discussed positive effect of market tenders in the European banking sector.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

|

|

Fund Information

|

|

|

|

|

Symbol on New York Stock Exchange (“NYSE”)

|

PSW

|

|

|

Initial Offering Date

|

August 1, 2003

|

|

|

Yield based on Closing Market Price as of April 30, 2010 ($9.32)

1

|

7.73%

|

|

|

Current Monthly Distribution per Common Share

2

|

$0.06

|

|

|

Current Annualized Distribution per Common Share

2

|

$0.72

|

|

|

Leverage as of April 30, 2010

3

|

29%

|

1

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price.

Past performance does not guarantee future results.

2

The monthly distribution per Common Share, declared on June 1, 2010, was decreased to $0.057. The yield on the Closing Market Price, Current

Monthly Distribution per Common Share and Current Annualized Distribution per Common Share do not reflect the new distribution rate. The

distribution rate is not constant and is subject to further change in the future. A portion of the distribution may be deemed a tax return of capital or

net realized gain.

3

Represents reverse repurchase agreements and Auction Market Preferred Shares (“Preferred Shares”) as a percentage of total managed assets,

which is the total assets of the Fund (including any assets attributable to any borrowings and Preferred Shares) minus the sum of liabilities (other

than borrowings representing financial leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks

of Leveraging on page 9.

The table below summarizes the changes in the Fund’s market price and NAV per share:

|

|

|

|

|

|

|

|

|

4/30/10

|

10/31/09

|

Change

|

High

|

Low

|

|

Market Price

|

$ 9.32

|

$8.24

|

13.11%

|

$ 9.40

|

$7.93

|

|

Net Asset Value

|

$10.40

|

$9.31

|

11.71%

|

$10.40

|

$9.22

|

The following charts show the portfolio composition and credit quality allocations of the Fund’s long-term investments:

|

|

|

|

|

Portfolio Composition

|

|

|

|

|

4/30/10

|

10/31/09

|

|

Corporate Bonds

|

67%

|

18%

|

|

Preferred Securities

|

32

|

82

|

|

Taxable Municipal Bonds

|

1

|

—

|

|

|

|

|

|

Credit Quality Allocations

4

|

|

|

|

|

4/30/10

|

10/31/09

|

|

AA/Aa

|

9%

|

—

|

|

A

|

27

|

26%

|

|

BBB/Baa

|

48

|

62

|

|

BB/Ba

|

13

|

8

|

|

B

|

1

|

2

|

|

CCC/Caa

|

1

|

—

|

|

Not Rated

|

1

|

2

|

4

Using the higher of Standard & Poor’s (“S&P’s”) or Moody’s Investor

Service (“Moody’s”) ratings.

4 SEMI-ANNUAL REPORT

APRIL 30, 2010

Fund Summary

as of April 30, 2010

BlackRock Credit Allocation Income Trust II, Inc.

Investment Objective

BlackRock Credit Allocation Income Trust II, Inc. (PSY) (formerly BlackRock Preferred Income Strategies Fund, Inc.) (the “Fund”)

seeks to provide share-

holders with current income and capital appreciation. The Fund seeks to achieve its objectives by investing primarily in credit-related securities, including,

but not limited to, investment grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds or derivatives with economic

characteristics similar to these credit-related securities.

Effective November 13, 2009, BlackRock Preferred Income Strategies Fund, Inc. was renamed BlackRock Credit Allocation Income Trust II, Inc.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the six months ended April 30, 2010, the Fund returned 21.75% based on market price and 18.47% based on net asset value (NAV). For the same

period, the closed-end Lipper Income & Preferred Stock Funds category posted an average return of 22.64% on a market price basis and 15.18% on a

NAV basis. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between

performance based on price and performance based on NAV. In accordance with a change to its investment policies the Fund transitioned its portfolio away

from primarily investing in preferred securities into a broader spectrum of securities across the capital structure. Performance has been driven by the strong

rebound in preferred securities, along with asset allocation decisions within the sector. In particular, the Fund benefited from an overweight allocation to

institutional corporate securities and hybrid securities as those sectors continued their dramatic outperformance versus $25 par preferred securities, in

which the Fund was underweight. The Fund’s performance also benefited from participation in several additional issuer-related tenders in preferred equity

exchanges, along with an overweight in the European banking sector. On the other hand, markets experienced substantial volatility over the period, most

notably during the first three months of 2010. Markets were robust in early January as improving economic conditions left investors feeling underinvested

and scrambling to purchase assets. The rally met an abrupt end in mid-January due to rising Greek default risk and the unexpected tightening of monetary

policy in China. Markets declined over the ensuing weeks until a European Union-led finance package for Greece was announced. From that point, markets

rallied on stronger economic data, including the first month of job creation (in March) and upward revisions to the previous three months’ jobs data. The

preferred market was largely immune from this volatility, however, as prices rose whether the broader market was rallying or selling off. This was due to the

previously discussed positive effect of market tenders in the European banking sector.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

|

|

Fund Information

|

|

|

|

|

Symbol on NYSE

|

PSY

|

|

|

Initial Offering Date

|

March 28, 2003

|

|

|

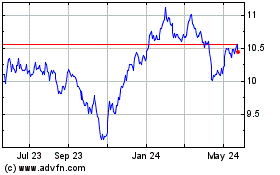

Yield on Closing Market Price as of April 30, 2010 ($10.35)

1

|

8.70%

|

|

|

Current Monthly Distribution per Common Share

2

|

$0.075

|

|

|

Current Annualized Distribution per Common Share

2

|

$0.900

|

|

|

Leverage as of April 30, 2010

3

|

28%

|

1

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price.

Past performance does not guarantee future results.

2

The monthly distribution per Common Share, declared on June 1, 2010, was decreased to $0.0635. The yield on the Closing Market Price, Current

Monthly Distribution per Common Share and Current Annualized Distribution per Common Share do not reflect the new distribution rate. The distribu-

tion rate is not constant and is subject to further change in the future. A portion of the distribution may be deemed a tax return of capital or net

realized gain.

3

Represents reverse repurchase agreements and Preferred Shares as a percentage of total managed assets, which is the total assets of the Fund

(including any assets attributable to any borrowings and Preferred Shares) minus the sum of liabilities (other than borrowings representing financial

leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 9.

The table below summarizes the changes in the Fund’s market price and NAV per share:

|

|

|

|

|

|

|

|

|

4/30/10

|

10/31/09

|

Change

|

High

|

Low

|

|

Market Price

|

$10.35

|

$ 8.90

|

16.29%

|

$10.49

|

$8.53

|

|

Net Asset Value

|

$11.35

|

$10.03

|

13.16%

|

$11.35

|

$9.91

|

The following charts show the portfolio composition and credit quality allocations of the Fund’s long-term investments:

|

|

|

|

|

Portfolio Composition

|

|

|

|

|

4/30/10

|

10/31/09

|

|

Corporate Bonds

|

56%

|

3%

|

|

Preferred Securities

|

43

|

97

|

|

Taxable Municipal Bonds

|

1

|

—

|

|

|

|

|

|

Credit Quality Allocations

4

|

|

|

|

|

4/30/10

|

10/31/09

|

|

AA/Aa

|

7%

|

1%

|

|

A

|

26

|

26

|

|

BBB/Baa

|

50

|

56

|

|

BB/Ba

|

13

|

14

|

|

B

|

2

|

3

|

|

CCC/Caa

|

1

|

—

|

|

Not Rated

|

1

|

—

|

|

4

Using the higher of S&P’s or Moody’s ratings.

|

|

SEMI-ANNUAL REPORT

APRIL 30, 2010

5

Fund Summary

as of April 30, 2010

BlackRock Credit Allocation Income Trust III

Investment Objective

BlackRock Credit Allocation Income Trust III (BPP) (formerly BlackRock Preferred Opportunity Trust) (the “Fund”)

seeks high current income consistent

with capital preservation. The Fund seeks to achieve its objectives by investing primarily in credit-related securities, including, but not limited to, investment

grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds or derivatives with economic characteristics similar to these

credit-related securities.

Effective November 13, 2009, BlackRock Preferred Opportunity Trust was renamed BlackRock Credit Allocation Income Trust III.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the six months ended April 30, 2010, the Fund returned 13.05% based on market price and 12.74% based on net asset value (NAV). For the same

period, the closed-end Lipper Income & Preferred Stock Funds category posted an average return of 22.64% on a market price basis and 15.18% on a

NAV basis. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between

performance based on price and performance based on NAV. In accordance with a change to its investment policies the Fund transitioned its portfolio away

from primarily investing in preferred securities into a broader spectrum of securities across the capital structure. Performance has been driven by the strong

rebound in preferred securities, along with asset allocation decisions within the preferred sector. In particular, the Fund benefited from an overweight alloca-

tion to institutional corporate securities and hybrid securities as those sectors continued their dramatic outperformance versus $25 par preferred securities,

in which the Fund was underweight. The Fund’s performance also benefited from participation in several additional issuer-related tenders in preferred equity

exchanges, along with an overweight in the European banking sector. On the other hand, markets experienced substantial volatility over the period, most

notably during the first three months of 2010. Markets were robust in early January as improving economic conditions left investors feeling underinvested

and scrambling to purchase assets. The rally met an abrupt end in mid-January due to rising Greek default risk and the unexpected tightening of monetary

policy in China. Markets declined over the ensuing weeks until a European Union-led finance package for Greece was announced. From that point, markets

rallied on stronger economic data, including the first month of job creation (in March) and upward revisions to the previous three months’ jobs data. The

preferred market was largely immune from this volatility, however, as prices rose whether the broader market was rallying or selling off. This was due to the

previously discussed positive effect of market tenders in the European banking sector.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

|

|

Fund Information

|

|

|

|

|

Symbol on NYSE

|

BPP

|

|

|

Initial Offering Date

|

February 28, 2003

|

|

|

Yield on Closing Market Price as of April 30, 2010 ($10.78)

1

|

8.07%

|

|

|

Current Monthly Distribution per Common Share

2

|

$0.0725

|

|

|

Current Annualized Distribution per Common Share

2

|

$0.8700

|

|

|

Leverage as of April 30, 2010

3

|

24%

|

1

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price.

Past performance does not guarantee future results.

2

The monthly distribution per Common Share, declared on June 1, 2010, was decreased to $0.066500. The yield on the Closing Market Price, Current

Monthly Distribution per Common Share and Current Annualized Distribution per Common Share do not reflect the new distribution rate. The distribu-

tion rate is not constant and is subject to further change in the future. A portion of the distribution may be deemed a tax return of capital or net

realized gain.

3

Represents reverse repurchase agreements and Preferred Shares as a percentage of total managed assets, which is the total assets of the Fund

(including any assets attributable to any borrowings and Preferred Shares) minus the sum of liabilities (other than borrowings representing financial

leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 9.

The table below summarizes the changes in the Fund’s market price and NAV per share:

|

|

|

|

|

|

|

|

|

4/30/10

|

10/31/09

|

Change

|

High

|

Low

|

|

Market Price

|

$10.78

|

$ 9.94

|

8.45%

|

$10.85

|

$ 9.56

|

|

Net Asset Value

|

$11.95

|

$11.05

|

8.14%

|

$11.95

|

$10.92

|

The following charts show the portfolio composition and credit

quality allocations of the Fund’s long-term investments:

|

|

|

|

|

Portfolio Composition

|

|

|

|

|

4/30/10

|

10/31/09

|

|

Corporate Bonds

|

58%

|

10%

|

|

Preferred Securities

|

40

|

90

|

|

Municipal Bonds

|

2

|

—

|

|

|

|

|

|

Credit Quality Allocations

4

|

|

|

|

|

4/30/10

|

10/31/09

|

|

AA/Aa

|

7%

|

4%

|

|

A

|

32

|

28

|

|

BBB/Baa

|

40

|

45

|

|

BB/Ba

|

18

|

13

|

|

B

|

2

|

5

|

|

CCC/Caa

|

1

|

5

|

|

4

Using the higher of S&P’s or Moody’s ratings.

|

|

6 SEMI-ANNUAL REPORT

APRIL 30, 2010

Fund Summary

as of April 30, 2010

BlackRock Credit Allocation Income Trust IV

Investment Objective

BlackRock Credit Allocation Income Trust IV (BTZ) (formerly BlackRock Preferred and Equity Advantage Trust) (the “Fund”)

seeks to achieve high

current income, current gains and capital appreciation. The Fund seeks to achieve its objectives by investing primarily in credit-related securities, including,

but not limited to, investment grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds or derivatives with economic char-

acteristics similar to these credit-related securities.

Effective November 13, 2009, BlackRock Preferred and Equity Advantage Trust was renamed BlackRock Credit Allocation Income Trust IV.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the six months ended April 30, 2010, the Fund returned 20.86% based on market price and 16.29% based on net asset value (NAV). For the same

period, the closed-end Lipper Income & Preferred Stock Funds category posted an average return of 22.64% on a market price basis and 15.18% on a

NAV basis. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between

performance based on price and performance based on NAV. In accordance with a change to its investment policies the Fund transitioned its portfolio away

from primarily investing in preferred and equity securities into a broader spectrum of securities across the capital structure. In addition, the Fund no longer

employs an option-writing strategy. Performance has been driven by the strong rebound in preferred securities, along with asset allocation decisions within

the preferred sector. In particular, the Fund benefited from an overweight allocation to institutional corporate securities and hybrid securities as those sec-

tors continued their dramatic outperformance versus $25 par preferred securities, in which the Fund was underweight. The Fund’s performance also bene-

fited from participation in several additional issuer-related tenders in preferred equity exchanges, along with an overweight in the European banking sector.

On the other hand, markets experienced substantial volatility over the period, most notably during the first three months of 2010. Markets were robust in

early January as improving economic conditions left investors feeling underinvested and scrambling to purchase assets. The rally met an abrupt end in mid-

January due to rising Greek default risk and the unexpected tightening of monetary policy in China. Markets declined over the ensuing weeks until a

European Union-led finance package for Greece was announced. From that point, markets rallied on stronger economic data, including the first month of

job creation (in March) and upward revisions to the previous three months’ jobs data. The preferred market was largely immune from this volatility, however,

as prices rose whether the broader market was rallying or selling off. This was due to the previously discussed positive effect of market tenders in the

European banking sector.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

|

|

Fund Information

|

|

|

|

|

Symbol on NYSE

|

BTZ

|

|

|

Initial Offering Date

|

December 27, 2006

|

|

|

Yield on Closing Market Price as of April 30, 2010 ($12.59)

1

|

9.53%

|

|

|

Current Monthly Distribution per Common Share

2

|

$0.10

|

|

|

Current Annualized Distribution per Common Share

2

|

$1.20

|

|

|

Leverage as of April 30, 2010

3

|

29%

|

1

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price.

Past performance does not guarantee future results.

2

The monthly distribution per Common Share, declared on June 1, 2010, was decreased to $0.079. The yield on the Closing Market Price, Current

Monthly Distribution per Common Share and Current Annualized Distribution per Common Share do not reflect the new distribution rate. The distribu-

tion rate is not constant and is subject to further change in the future. A portion of the distribution may be deemed a tax return of capital or net

realized gain.

3

Represents reverse repurchase agreements and Preferred Shares as a percentage of total managed assets, which is the total assets of the Fund

(including any assets attributable to any borrowings and Preferred Shares) minus the sum of liabilities (other than borrowings representing financial

leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 9.

The table below summarizes the changes in the Fund’s market price and NAV per share:

|

|

|

|

|

|

|

|

|

4/30/10

|

10/31/09

|

Change

|

High

|

Low

|

|

Market Price

|

$12.59

|

$10.96

|

14.87%

|

$12.65

|

$10.66

|

|

Net Asset Value

|

$13.97

|

$12.64

|

10.52%

|

$13.97

|

$12.55

|

The following charts show the portfolio composition of the Fund’s long-term investments and credit quality allocations of the Fund’s

long-term investments excluding Common Stocks:

|

|

|

|

|

Portfolio Composition

|

|

|

|

|

4/30/10

|

10/31/09

|

|

Corporate Bonds

|

51%

|

6%

|

|

Preferred Securities

|

38

|

84

|

|

U.S. Treasury Obligations

|

8

|

—

|

|

Taxable Municipal Bonds

|

2

|

—

|

|

Common Stocks

|

1

|

10

|

|

|

|

|

|

Credit Quality Allocations

4

|

|

|

|

|

4/30/10

|

10/31/09

|

|

AA/Aa

|

7%

|

4%

|

|

A

|

31

|

33

|

|

BBB/Baa

|

40

|

53

|

|

BB/Ba

|

11

|

6

|

|

B

|

2

|

4

|

|

CCC/Caa

|

1

|

—

|

|

Not Rated

|

8

|

—

|

|

4

Using the higher of S&P’s or Moody’s ratings.

|

|

SEMI-ANNUAL REPORT

APRIL 30, 2010

7

Fund Summary

as of April 30, 2010

BlackRock Floating Rate Income Trust

Investment Objective

BlackRock Floating Rate Income Trust (BGT)

seeks to provide a high level of current income and to seek the preservation of capital. The Fund seeks to

achieve its objective by investing in a global portfolio of primarily floating and variable rate securities.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the six months ended April 30, 2010, the Fund returned 22.72% based on market price and 10.90% based on net asset value (NAV). For the same

period, the closed-end Lipper Loan Participation Funds category posted an average return of 29.63% on a market price basis and 11.27% on a NAV basis. All

returns reflect reinvestment of dividends. (The performance of the Lipper category does not necessarily correlate to that of the Fund, as the Lipper group com-

prises both closed-end funds that employ leverage and continuously offered closed-end funds that do not. For this reporting period, those Lipper peers that do

not employ leverage were at a disadvantage given the market rally.) The Fund moved from a discount to NAV to a premium by period-end, which accounts for

the difference between performance based on price and performance based on NAV. The Fund's use of leverage produced positive absolute performance but

accounted for the Fund’s underperformance versus its Lipper category, as many of the funds in the category employ higher levels of leverage. Conversely, the

Fund’s allocation to high yield bonds outperformed bank loans during the period and added to performance. Relative to its Lipper peers, the Fund continues to

focus on higher-quality sectors and structures, which underperformed in the market rally that favored riskier assets.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

|

|

Fund Information

|

|

|

|

|

Symbol on NYSE

|

BGT

|

|

|

Initial Offering Date

|

August 30, 2004

|

|

|

Yield on Closing Market Price as of April 30, 2010 ($15.00)

1

|

5.40%

|

|

|

Current Monthly Distribution per Common Share

2

|

$0.0675

|

|

|

Current Annualized Distribution per Common Share

2

|

$0.8100

|

|

|

Leverage as of April 30, 2010

|

22%

|

1

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price.

Past performance does not guarantee future results.

2

The monthly distribution per Common Share, declared on June 1, 2010, was increased to $0.07. The yield on the Closing Market Price, Current

Monthly Distribution per Common Share and Current Annualized Distribution per Common Share do not reflect the new distribution rate. The distri-

bution rate is not constant and is subject to further change in the future. A portion of the distribution may be deemed a tax return of capital or net

realized gain.

3

Represents loan outstanding and Preferred Shares as a percentage of total managed assets, which is the total assets of the Fund (including any

assets attributable to any borrowings and Preferred Shares) minus the sum of liabilities (other than borrowings representing financial leverage).

For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 9.

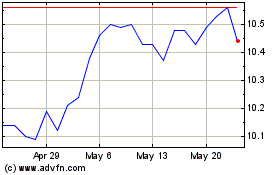

The table below summarizes the changes in the Fund’s market price and NAV per share:

|

|

|

|

|

|

|

|

|

4/30/10

|

10/31/09

|

Change

|

High

|

Low

|

|

Market Price

|

$15.00

|

$12.58

|

19.24%

|

$15.93

|

$12.55

|

|

Net Asset Value

|

$14.32

|

$13.29

|

7.75%

|

$14.32

|

$13.20

|

The following charts show the portfolio composition of the Fund’s long-term investments and credit quality allocations of the

Fund’s long-term investments excluding Common Stocks and Floating Rate Loan Interests:

|

|

|

|

|

Portfolio Composition

|

|

|

|

|

4/30/10

|

10/31/09

|

|

Floating Rate Loan Interests

|

76%

|

76%

|

|

Corporate Bonds

|

17

|

20

|

|

Foreign Government Obligations

|

6

|

3

|

|

Other Interests

|

1

|

1

|

|

|

|

|

|

Credit Quality Allocations

4

|

|

|

|

|

4/30/10

|

10/31/09

|

|

AAA/Aaa

|

—

|

16%

|

|

A

|

5%

|

4

|

|

BBB/Baa

|

23

|

27

|

|

BB/Ba

|

28

|

17

|

|

B

|

27

|

22

|

|

CCC/Caa

|

2

|

6

|

|

C

|

—

|

5

|

|

D

|

—

|

1

|

|

Not Rated

|

15

5

|

2

|

4

Using the higher of S&P’s or Moody’s ratings.

5

The investment advisor has deemed certain of these non-rated securi-

ties to be of investment grade quality. As of April 30, 2010, the mar-

ket value of these securities was $6,503,550 representing 6% of the

Fund’s long-term investments.

8 SEMI-ANNUAL REPORT

APRIL 30, 2010

The Benefits and Risks of Leveraging

The Funds may utilize leverage to seek to enhance the yield and NAV of their

Common Shares. However, these objectives cannot be achieved in all interest

rate environments.

The Funds may utilize leverage through borrowings, including by entering

into reverse repurchase agreements, or through the issuance of Preferred

Shares. In general, the concept of leveraging is based on the premise that

the cost of assets to be obtained from leverage will be based on short-

term interest rates, which normally will be lower than the income earned

by each Fund on its longer-term portfolio investments. To the extent that

the total assets of each Fund (including the assets obtained from leverage)

are invested in higher-yielding portfolio investments, each Fund’s Common

Shareholders will benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from lever-

age is paid to Common Shareholders in the form of dividends, and the

value of these portfolio holdings is reflected in the per share NAV of each

Fund’s Common Shares. However, in order to benefit Common Shareholders,

the yield curve must be positively sloped; that is, short-term interest rates

must be lower than long-term interest rates. If the yield curve becomes

negatively sloped, meaning short-term interest rates exceed long-term

interest rates, income to Common Shareholders will be lower than if the

Funds had not used leverage.

To illustrate these concepts, assume a Fund’s Common Shares capitalization

is $100 million and it borrows and/or issues Preferred Shares for an addi-

tional $50 million, creating a total value of $150 million available for invest-

ment in long-term securities. If prevailing short-term interest rates are 3%

and long-term interest rates are 6%, the yield curve has a strongly positive

slope. In this case, the Fund pays interest expense and/or dividends on

the $50 million of Preferred Shares based on the lower short-term interest

rates. At the same time, the securities purchased by the Fund with assets

received from the borrowings and/or issuance of Preferred Shares can earn

income based on long-term interest rates. In this case, the interest expense

and/or dividends paid to Preferred Shareholders are significantly lower

than the income earned on the Fund’s long-term investments, and there-

fore the Common Shareholders are the beneficiaries of the incremental

net income.

If short-term interest rates rise, narrowing the differential between short-

term and long-term interest rates, the incremental net income pickup on

the Common Shares will be reduced or eliminated completely. Furthermore,

if prevailing short-term interest rates rise above long-term interest rates of

6%, the yield curve has a negative slope. In this case, the Fund pays divi-

dends on the higher short-term interest rates whereas the Fund’s total port-

folio earns income based on lower long-term interest rates.

Furthermore, the value of a Fund’s portfolio investments generally varies

inversely with the direction of long-term interest rates, although other factors

can influence the value of portfolio investments. In contrast, the redemption

value of the Funds’ borrowings and/or Preferred Shares does not fluctuate

in relation to interest rates. As a result, changes in interest rates can influ-

ence the Funds’ NAV positively or negatively in addition to the impact on

Fund performance from leverage from borrowings.

The use of leverage may enhance opportunities for increased income to the

Funds and Common Shareholders, but as described above, it also creates

risks as short- or long-term interest rates fluctuate. Leverage also will gener-

ally cause greater changes to each Fund’s NAV, market price and dividend

rates than a comparable portfolio without leverage. If the income derived

from securities purchased with assets received from leverage exceeds the

cost of leverage, each Fund’s net income will be greater than if leverage had

not been used. Conversely, if the income from the securities purchased is

not sufficient to cover the cost of leverage, each Fund’s net income will be

less than if leverage had not been used, and therefore the amount available

for distribution to shareholders will be reduced. Each Fund may be required

to sell portfolio securities at inopportune times or at distressed values in

order to comply with regulatory requirements applicable to the use of lever-

age or as required by the terms of leverage instruments which may cause

a Fund to incur losses. The use of leverage may limit each Fund’s ability to

invest in certain types of securities or use certain types of hedging strate-

gies, such as in the case of certain restrictions imposed by ratings agencies

that rate Preferred Shares issued by each Fund. Each Fund will incur

expenses in connection with the use of leverage, all of which are borne by

the Common Shareholders and may reduce income on the Common Shares.

Under the Investment Company Act of 1940, BGT is permitted to borrow

through a credit facility up to 33

1

/

3

% of its total managed assets and the

Funds are permitted to issue Preferred Shares in an amount of up to 50%

of their total managed assets at the time of issuance. Under normal cir-

cumstances, each Fund anticipates that the total economic leverage from

Preferred Shares, reverse repurchase agreements and credit facility borrow-

ings will not exceed 50% of its total managed assets at the time such lever-

age is incurred. As of April 30, 2010, the Funds had economic leverage from

Preferred Shares, reverse repurchase agreements and/or credit facility bor-

rowings as a percentage of their total managed assets as follows:

|

|

|

|

|

Percent of

|

|

|

Leverage

|

|

PSW

|

29%

|

|

PSY

|

28%

|

|

BPP

|

24%

|

|

BTZ

|

29%

|

|

BGT

|

22%

|

SEMI-ANNUAL REPORT

APRIL 30, 2010

9

Derivative Financial Instruments

The Funds may invest in various derivative instruments, including financial

futures contracts, swaps, foreign currency exchange contracts and options,

as specified in Note 2 of the Notes to Financial Statements, which consti-

tute forms of economic leverage. Such instruments are used to obtain

exposure to a market without owning or taking physical custody of securi-

ties or to hedge market, equity, credit, interest rate and/or foreign currency

exchange rate risks. Such derivative instruments involve risks, including the

imperfect correlation between the value of a derivative instrument and the

underlying asset, possible default of the counterparty to the transaction

and illiquidity of the derivative instrument. Each Fund’s ability to success-

fully use a derivative instrument depends on the investment advisor’s

ability to accurately predict pertinent market movements, which cannot be

assured. The use of derivative instruments may result in losses greater than

if they had not been used, may require the Funds to sell or purchase port-

folio securities at inopportune times or at distressed values, may limit the

amount of appreciation the Funds can realize on an investment or may

cause the Funds to hold a security that they might otherwise sell. The

Funds’ investments in these instruments are discussed in detail in the

Notes to Financial Statements.

10 SEMI-ANNUAL REPORT

APRIL 30, 2010

Schedule of Investments

April 30, 2010 (Unaudited)

BlackRock Credit Allocation Income Trust I, Inc. (PSW)

(Percentages shown are based on Net Assets)

|

|

|

|

|

|

Par

|

|

|

Corporate Bonds

|

(000)

|

Value

|

|

Aerospace & Defense — 3.7%

|

|

|

|

BE Aerospace, Inc., 8.50%, 7/01/18

|

$ 560

|

$ 599,200

|

|

Bombardier, Inc., 7.75%, 3/15/20 (a)

|

720

|

765,000

|

|

United Technologies Corp., 5.70%, 4/15/40

|

2,500

|

2,610,327

|

|

|

|

3,974,527

|

|

Airlines — 0.4%

|

|

|

|

Continental Airlines Pass-Through Certificates,

|

|

|

|

Series 2009-2, Class B, 9.25%, 5/10/17

|

375

|

401,250

|

|

Auto Components — 0.6%

|

|

|

|

Icahn Enterprises LP (a):

|

|

|

|

7.75%, 1/15/16

|

200

|

194,500

|

|

8.00%, 1/15/18

|

500

|

486,250

|

|

|

|

680,750

|

|

Beverages — 0.4%

|

|

|

|

Constellation Brands, Inc., 7.25%, 5/15/17

|

460

|

469,200

|

|

Capital Markets — 1.7%

|

|

|

|

Ameriprise Financial, Inc., 5.30%, 3/15/20

|

750

|

780,626

|

|

Morgan Stanley, 7.30%, 5/13/19

|

900

|

988,270

|

|

|

|

1,768,896

|

|

Chemicals — 0.2%

|

|

|

|

CF Industries, Inc., 7.13%, 5/01/20

|

250

|

263,125

|

|

Commercial Services & Supplies — 2.6%

|

|

|

|

Browning-Ferris Industries, Inc., 7.40%, 9/15/35

|

865

|

987,136

|

|

Corrections Corp. of America, 7.75%, 6/01/17

|

775

|

821,500

|

|

Waste Management, Inc., 6.13%, 11/30/39

|

900

|

937,159

|

|

|

|

2,745,795

|

|

Communications Equipment — 0.7%

|

|

|

|

Brocade Communications Systems, Inc.,

|

|

|

|

6.88%, 1/15/20 (a)

|

700

|

722,750

|

|

Consumer Finance — 5.2%

|

|

|

|

American Express Co., 8.13%, 5/20/19

|

925

|

1,132,932

|

|

Capital One Bank USA NA, 8.80%, 7/15/19

|

775

|

950,341

|

|

Inmarsat Finance Plc, 7.38%, 12/01/17 (a)

|

520

|

542,100

|

|

SLM Corp., 4.00%, 7/25/14 (b)

|

3,200

|

2,979,168

|

|

|

|

5,604,541

|

|

Containers & Packaging — 1.0%

|

|

|

|

Ball Corp.:

|

|

|

|

7.13%, 9/01/16

|

400

|

425,000

|

|

6.75%, 9/15/20

|

405

|

414,113

|

|

Bemis Co., Inc., 6.80%, 8/01/19

|

200

|

227,786

|

|

|

|

1,066,899

|

|

Diversified Financial Services — 2.5%

|

|

|

|

Bank of America Corp., 7.63%, 6/01/19

|

1,575

|

1,797,891

|

|

GMAC, Inc., 8.30%, 2/12/15 (a)

|

800

|

835,000

|

|

|

|

2,632,891

|

|

Diversified Telecommunication Services — 3.7%

|

|

|

|

AT&T, Inc., 6.30%, 1/15/38

|

1,000

|

1,038,919

|

|

New Communications Holdings, Inc.,

|

|

|

|

8.50%, 4/15/20 (a)

|

700

|

721,000

|

|

Qwest Corp., 8.38%, 5/01/16

|

390

|

444,600

|

|

Verizon Communications, Inc., 7.35%, 4/01/39

|

925

|

1,098,394

|

|

Windstream Corp.:

|

|

|

|

8.63%, 8/01/16

|

250

|

255,938

|

|

7.88%, 11/01/17

|

400

|

397,000

|

|

|

|

3,955,851

|

|

|

|

|

|

|

Par

|

|

|

Corporate Bonds

|

(000)

|

Value

|

|

Electric Utilities — 1.7%

|

|

|

|

Progress Energy Inc., 7.00%, 10/30/31

|

$ 1,000

|

$ 1,142,424

|

|

Southern California Edison Co., 5.50%, 3/15/40

|

650

|

661,578

|

|

|

|

1,804,002

|

|

Food & Staples Retailing — 3.9%

|

|

|

|

CVS Caremark Corp., 6.30%, 6/01/62 (b)

|

1,500

|

1,447,500

|

|

Wal-Mart Stores, Inc., 6.20%, 4/15/38

|

2,500

|

2,752,035

|

|

|

|

4,199,535

|

|

Food Products — 0.8%

|

|

|

|

Kraft Foods, Inc.:

|

|

|

|

6.50%, 8/11/17

|

385

|

436,215

|

|

6.13%, 8/23/18

|

390

|

430,336

|

|

|

|

866,551

|

|

Gas Utilities — 0.9%

|

|

|

|

Nisource Finance Corp., 6.13%, 3/01/22

|

900

|

955,581

|

|

Health Care Equipment & Supplies — 1.7%

|

|

|

|

Medtronic, Inc., 5.55%, 3/15/40

|

1,765

|

1,822,583

|

|

Health Care Providers & Services — 2.4%

|

|

|

|

Aetna, Inc., 6.75%, 12/15/37

|

800

|

881,674

|

|

HCA, Inc./DE, 8.50%, 4/15/19 (a)

|

400

|

439,500

|

|

Tenet Healthcare Corp., 10.00%, 5/01/18 (a)

|

350

|

398,563

|

|

UnitedHealth Group, Inc., 6.88%, 2/15/38

|

800

|

878,953

|

|

|

|

2,598,690

|

|

Insurance — 4.9%

|

|

|

|

Lincoln National Corp.:

|

|

|

|

8.75%, 7/01/19

|

400

|

498,973

|

|

6.25%, 2/15/20

|

800

|

855,095

|

|

Northwestern Mutual Life Insurance,

|

|

|

|

6.06%, 3/30/40 (a)

|

900

|

929,587

|

|

Principal Financial Group, Inc., 8.88%, 5/15/19

|

225

|

277,550

|

|

Prudential Financial, Inc., 6.63%, 12/01/37

|

800

|

881,974

|

|

QBE Insurance Group Ltd., 9.75%, 3/14/14 (a)

|

1,484

|

1,807,461

|

|

|

|

5,250,640

|

|

Life Sciences Tools & Services — 1.8%

|

|

|

|

Bio-Rad Laboratories, Inc., 8.00%, 9/15/16

|

865

|

923,387

|

|

Life Technologies Corp., 6.00%, 3/01/20

|

1,000

|

1,052,160

|

|

|

|

1,975,547

|

|

Machinery — 1.5%

|

|

|

|

Ingersoll-Rand Global Holding Co., Ltd.,

|

|

|

|

9.50%, 4/15/14

|

800

|

980,878

|

|

Navistar International Corp., 8.25%, 11/01/21

|

600

|

633,000

|

|

|

|

1,613,878

|

|

Media — 19.3%

|

|

|

|

CSC Holdings, Inc., 8.63%, 2/15/19 (a)

|

275

|

300,438

|

|

CSC Holdings LLC, 8.50%, 6/15/15 (a)

|

400

|

426,000

|

|

Comcast Corp., 6.30%, 11/15/17

|

800

|

886,715

|

|

Cox Communications, Inc., 8.38%, 3/01/39 (a)

|

10,800

|

14,023,940

|

|

DISH DBS Corp.:

|

|

|

|

7.00%, 10/01/13

|

450

|

465,750

|

|

7.88%, 9/01/19

|

250

|

262,500

|

|

Intelsat Corp., 9.25%, 6/15/16

|

350

|

369,250

|

|

News America, Inc., 6.15%, 3/01/37

|

950

|

972,633

|

|

Time Warner Cable, Inc., 6.75%, 6/15/39

|

925

|

999,820

|

|

Time Warner, Inc., 7.70%, 5/01/32

|

950

|

1,114,834

|

|

UPC Germany GmbH, 8.13%, 12/01/17 (a)

|

240

|

244,800

|

|

Virgin Media Secured Finance Plc, 6.50%, 1/15/18 (a)

|

600

|

603,000

|

|

|

|

20,669,680

|

|

|

|

|

|

|

|

Portfolio Abbreviations

|

|

|

|

|

|

To simplify the listings of portfolio holdings in the Schedules of

|

EUR

|

Euro

|

GO

|

General Obligation Bonds

|

|

Investments, the names of many of the securities have been

|

FKA

|

Formerly Known As

|

RB

|

Revenue Bonds

|

|

abbreviated according to the following list:

|

GBP

|

British Pound

|

USD

|

US Dollar

|

|

See Notes to Financial Statements.

|

|

|

|

|

SEMI-ANNUAL REPORT

APRIL 30, 2010

11

Schedule of Investments (continued)

BlackRock Credit Allocation Income Trust I, Inc. (PSW)

(Percentages shown are based on Net Assets)

|

|

|

|

|

|

Par

|

|

|

Corporate Bonds

|

(000)

|

Value

|

|

Metals & Mining — 1.2%

|

|

|

|

Phelps Dodge Corp., 7.13%, 11/01/27

|

$ 700

|

$ 724,585

|

|

Teck Resources Ltd., 10.75%, 5/15/19

|

400

|

498,000

|

|

United States Steel Corp., 7.38%, 4/01/20

|

75

|

77,062

|

|

|

|

1,299,647

|

|

Multi-Utilities — 1.5%

|

|

|

|

CenterPoint Energy, Inc.:

|

|

|

|

5.95%, 2/01/17

|

750

|

789,789

|

|

6.50%, 5/01/18

|

775

|

844,879

|

|

|

|

1,634,668

|

|

Multiline Retail — 0.8%

|

|

|

|

Dollar General Corp., 10.63%, 7/15/15

|

750

|

833,438

|

|

Oil, Gas & Consumable Fuels — 3.7%

|

|

|

|

Enbridge Energy Partners LP, 9.88%, 3/01/19

|

475

|

628,835

|

|

Enterprise Products Operating LLC, 6.65%, 4/15/18

|

1,000

|

1,139,448

|

|

Kinder Morgan Energy Partners LP, 6.85%, 2/15/20

|

1,000

|

1,151,640

|

|

ONEOK Partners LP, 8.63%, 3/01/19

|

800

|

1,004,031

|

|

|

|

3,923,954

|

|

Paper & Forest Products — 2.5%

|

|

|

|

Georgia-Pacific LLC, 8.25%, 5/01/16 (a)

|

785

|

859,575

|

|

International Paper Co.:

|

|

|

|

7.50%, 8/15/21

|

775

|

910,322

|

|

7.30%, 11/15/39

|

800

|

886,953

|

|

|

|

2,656,850

|

|

Pharmaceuticals — 11.5%

|

|

|

|

Abbott Laboratories:

|

|

|

|

6.15%, 11/30/37

|

235

|

262,297

|

|

6.00%, 4/01/39

|

1,177

|

1,296,250

|

|

Bristol-Myers Squibb Co.:

|

|

|

|

5.88%, 11/15/36

|

2,014

|

2,127,447

|

|

6.13%, 5/01/38

|

588

|

641,962

|

|

Eli Lilly & Co., 5.95%, 11/15/37

|

588

|

639,820

|

|

GlaxoSmithKline Capital, Inc., 6.38%, 5/15/38

|

1,690

|

1,913,246

|

|

Merck & Co., Inc., 6.50%, 12/01/33

|

475

|

549,138

|

|

Pfizer, Inc., 7.20%, 3/15/39

|

2,500

|

3,102,572

|

|

Schering-Plough Corp., 6.55%, 9/15/37

|

1,504

|

1,754,663

|

|

|

|

12,287,395

|

|

Real Estate Investment Trusts (REITs) — 3.1%

|

|

|

|

AvalonBay Communities, Inc.:

|

|

|

|

5.70%, 3/15/17

|

775

|

830,277

|

|

6.10%, 3/15/20

|

800

|

866,981

|

|

ERP Operating LP:

|

|

|

|

5.38%, 8/01/16

|

775

|

817,385

|

|

5.75%, 6/15/17

|

800

|

857,885

|

|

|

|

3,372,528

|

|

Semiconductors & Semiconductor Equipment — 1.0%

|

|

|

|

KLA-Tencor Corp., 6.90%, 5/01/18

|

461

|

509,796

|

|

National Semiconductor Corp., 6.60%, 6/15/17

|

539

|

593,609

|

|

|

|

1,103,405

|

|

Specialty Retail — 1.0%

|

|

|

|

AutoNation, Inc., 6.75%, 4/15/18

|

445

|

446,669

|

|

AutoZone, Inc., 7.13%, 8/01/18

|

300

|

346,753

|

|

Ltd. Brands, Inc., 7.00%, 5/01/20 (c)

|

230

|

234,600

|

|

|

|

1,028,022

|

|

Tobacco — 1.8%

|

|

|

|

Altria Group, Inc.:

|

|

|

|

9.70%, 11/10/18

|

800

|

1,006,073

|

|

9.25%, 8/06/19

|

775

|

957,343

|

|

|

|

1,963,416

|

|

|

|

|

|

|

Par

|

|

|

Corporate Bonds

|

(000)

|

Value

|

|

Wireless Telecommunication Services — 4.0%

|

|

|

|

Cricket Communications, Inc., 7.75%, 5/15/16

|

$ 155

|

$ 160,813

|

|

Nextel Communications, Inc., Series E,

|

|

|

|

6.88%, 10/31/13

|

535

|

525,637

|

|

SBA Tower Trust, 5.10%, 4/15/42 (a)

|

3,500

|

3,605,019

|

|

|

|

4,291,469

|

|

Total Corporate Bonds — 93.7%

|

|

100,437,954

|

|

Preferred Securities

|

|

|

|

Capital Trusts

|

|

|

|

Building Products — 0.3%

|

|

|

|

C8 Capital SPV Ltd., 6.64% (a)(b)(d)

|

490

|

357,426

|

|

Capital Markets — 4.6%

|

|

|

|

Ameriprise Financial, Inc., 7.52%, 6/01/66 (b)

|

500

|

505,000

|

|

Lehman Brothers Holdings Capital Trust V,

|

|

|

|

2.09% (d)(e)(f)

|

1,600

|

160

|

|

State Street Capital Trust III, 8.25% (b)(d)

|

725

|

744,423

|

|

State Street Capital Trust IV, 1.26%, 6/01/67 (b)

|

4,740

|

3,653,663

|

|

|

|

4,903,246

|

|

Commercial Banks — 3.2%

|

|

|

|

Bank of Ireland Capital Funding II, LP,

|

|

|

|

5.57% (a)(b)(d)(e)(f)

|

429

|

304,590

|

|

Bank of Ireland Capital Funding III, LP,

|

|

|

|

6.11% (a)(b)(d)(e)(f)

|

740

|

525,400

|

|

Barclays Bank Plc, 5.93% (a)(b)(d)

|

500

|

452,500

|

|

First Empire Capital Trust II, 8.28%, 6/01/27

|

910

|

844,943

|

|

National City Preferred Capital Trust I, 12.00% (b)(d)

|

300

|

347,226

|

|

SunTrust Preferred Capital I, 5.85% (b)(d)

|

135

|

105,638

|

|

USB Capital XIII Trust, 6.63%, 12/15/39

|

825

|

867,578

|

|

|

|

3,447,875

|

|

Diversified Financial Services — 3.0%

|

|

|

|

Farm Credit Bank of Texas, Series 1, 7.56% (b)(d)

|

1,000

|

853,270

|

|

JPMorgan Chase Capital XXIII, 1.25%, 5/15/77 (b)(g)

|

3,085

|

2,395,900

|

|

|

|

3,249,170

|

|

Electric Utilities — 0.4%

|

|

|

|

PPL Capital Funding, 6.70%, 3/30/67 (b)

|

500

|

457,500

|

|

Insurance — 10.6%

|

|

|

|

AXA SA, 6.38% (a)(b)(d)

|

1,000

|

890,000

|

|

Ace Capital Trust II, 9.70%, 4/01/30

|

500

|

606,907

|

|

The Allstate Corp., 6.50%, 5/15/67 (b)

|

500

|

480,000

|

|

Chubb Corp., 6.38%, 3/29/67 (b)(h)

|

500

|

500,625

|

|

Farmers Exchange Capital, 7.05%, 7/15/28 (a)

|

500

|

471,639

|

|

Genworth Financial, Inc., 6.15%, 11/15/66 (b)

|

750

|

600,000

|

|

Great West Life & Annuity Insurance Co.,

|

|

|

|

7.15%, 5/16/46 (a)(b)

|

500

|

480,000

|

|

Liberty Mutual Group, Inc., 10.75%, 6/15/88 (a)(b)

|

500

|

582,500

|

|

Lincoln National Corp., 7.00%, 5/17/66 (b)

|

500

|

462,500

|

|

MetLife, Inc., 6.40%, 12/15/66

|

500

|

472,500

|

|

Nationwide Life Global Funding I, 6.75%, 5/15/67

|

500

|

427,500

|

|

Progressive Corp., 6.70%, 6/15/67 (b)

|

500

|

495,481

|

|

Reinsurance Group of America, 6.75%, 12/15/65 (b)

|

700

|

662,754

|

|

The Travelers Cos., Inc., 6.25%, 3/15/67 (b)

|

500

|

491,739

|

|

ZFS Finance (USA) (a)(b):

|

|

|

|

Trust II, 6.45%, 12/15/65

|

1,800

|

1,737,000

|

|

Trust IV, 5.88%, 5/09/32

|

146

|

139,485

|

|

Trust V, 6.50%, 5/09/67

|

1,097

|

1,050,377

|

|

Zenith National Insurance Capital Trust I,

|

|

|

|

8.55%, 8/01/28 (a)

|

1,000

|

865,000

|

|

|

|

11,416,007

|

See Notes to Financial Statements.

12 SEMI-ANNUAL REPORT

APRIL 30, 2010

Schedule of Investments (continued)

BlackRock Credit Allocation Income Trust I, Inc. (PSW)

(Percentages shown are based on Net Assets)

|

|

|

|

|

|

Par

|

|

|

Capital Trusts

|

(000)

|

Value

|

|

Multi-Utilities — 1.4%

|

|

|

|

Dominion Resources Capital Trust I,

|

|

|

|

7.83%, 12/01/27 (g)

|

$ 500

|

$ 516,467

|

|

Dominion Resources, Inc., 7.50%, 6/30/66 (b)

|

500

|

507,500

|

|

Puget Sound Energy, Inc., Series A,

|

|

|

|

6.97%, 6/01/67 (b)

|

475

|

451,473

|

|

|

|

1,475,440

|

|

Oil, Gas & Consumable Fuels — 1.3%

|

|

|

|

Enterprise Products Operating LLC,

|

|

|

|

8.38%, 8/01/66 (b)

|

825

|

858,000

|

|

TransCanada PipeLines Ltd., 6.35%, 5/15/67 (b)

|

500

|

480,821

|

|

|

|

1,338,821

|

|

Total Capital Trusts — 24.8%

|

|

26,645,485

|

|

Preferred Stocks

|

Shares

|

|

|

Commercial Banks — 1.8%

|

|

|

|

First Tennessee Bank NA, 3.75% (a)(b)

|

1,176

|

752,640

|

|

Provident Financial Group, Inc., 7.75%

|

42,000

|

1,044,750

|

|

Royal Bank of Scotland Group Plc, Series M, 6.40%

|

5,000

|

66,700

|

|

|

|

1,864,090

|

|

Diversified Financial Services — 1.0%

|

|

|

|

Falcons Funding Trust I, 8.88% (a)(b)

|

1,100

|

1,096,906

|

|

Electric Utilities — 3.3%

|

|

|

|

Alabama Power Co., 6.50%

|

25,000

|

649,750

|

|

Entergy Arkansas, Inc., 6.45%

|

28,800

|

683,102

|

|

Entergy Louisiana LLC, 6.95%

|

22,650

|

2,216,047

|

|

|

|

3,548,899

|

|

Insurance — 3.6%

|

|

|

|

Aspen Insurance Holdings Ltd., 7.40% (b)

|

55,000

|

1,276,000

|

|

Axis Capital Holdings Ltd.:

|

|

|

|

Series A, 7.25%

|

35,000

|

853,650

|

|

Series B, 7.50% (b)

|

9,000

|

850,500

|

|

Endurance Specialty Holdings Ltd., Series A, 7.75%

|

35,200

|

854,304

|

|

|

|

3,834,454

|

|

Real Estate Investment Trusts (REITs) — 2.7%

|

|

|

|

BRE Properties, Inc., Series D, 6.75%

|

10,000

|

228,200

|

|

iStar Financial, Inc., Series I, 7.50%

|

59,500

|

952,000

|

|

Public Storage:

|

|

|

|

Series F, 6.45%

|

10,000

|

235,400

|

|

Series I, 7.25%

|

40,000

|

1,016,400

|

|

Series M, 6.63%

|

20,000

|

491,600

|

|

|

|

2,923,600

|

|

Wireless Telecommunication Services — 2.8%

|

|

|

|

Centaur Funding Corp., 9.08%

|

2,720

|

2,992,850

|

|

Total Preferred Stocks — 15.2%

|

|

16,260,799

|

|

Trust Preferreds

|

|

|

|

Consumer Finance — 1.4%

|

|

|

|

Capital One Capital II, 7.50%, 6/15/66

|

63,034

|

1,514,729

|

|

Insurance — 2.8%

|

|

|

|

ABN AMRO North America Capital Funding Trust II,

|

|

|

|

0.31% (a)(b)(d)

|

80,000

|

1,586,536

|

|

Lincoln National Capital VI, Series F, 6.75%, 9/11/52

|

58,966

|

1,396,139

|

|

|

|

2,982,675

|

|

Total Trust Preferreds — 4.2%

|

|

4,497,404

|

|

Total Preferred Securities — 44.2%

|

|

47,403,688

|

|

|

Par

|

|

|

Taxable Municipal Bonds

|

(000)

|

Value

|

|

Metropolitan Transportation Authority, RB,

|

|

|

|

Build America Bonds, 6.55%, 11/15/31

|

$ 800

|

$ 843,440

|

|

State of California, GO, Build America Bonds,

|

|

|

|

7.35%, 11/01/39

|

400

|

432,152

|

|

State of Illinois, GO, Pension, 5.10%, 6/01/33

|

775

|

668,461

|

|

Total Taxable Municipal Bonds — 1.8%

|

|

1,944,053

|

|

Total Long-Term Investments

|

|

|

|

(Cost — $149,969,746) — 139.7%

|

|

149,785,695

|

|

Short-Term Securities

|

Shares

|

|

|

BlackRock Liquidity Funds, TempFund,

|

|

|

|

Institutional Class, 0.13% (i)(j)

|

124,379

|

124,379

|

|

Total Short-Term Securities

|

|

|

|

(Cost — $124,379) — 0.1%

|

|

124,379

|

|

Total Investments (Cost — $150,094,125*) — 139.8%

|

|

149,910,074

|

|

Liabilities in Excess of Other Assets — (2.2)%

|

|

(2,398,252)

|

|

Preferred Shares, at Redemption Value — (37.6)%

|

|

(40,259,152)

|

|

Net Assets Applicable to Common Shares — 100.0%

|

|

$107,252,670

|