Becton Dickinson Seeks to Raise About $1.7 Billion Through Debt Offerings

February 10 2021 - 7:08AM

Dow Jones News

By Dave Sebastian

Becton, Dickinson & Co. said it seeks to raise about $1.7

billion through dollar and euro debt offerings to repay its

outstanding notes.

The New Jersey-based medical-technology company Wednesday said

it has entered into an agreement with U.S. underwriters for the

offer and sale of $1 billion in 1.957% notes due 2031. It said it

expects to use net proceeds of the U.S. offering, with cash on

hand, to repay the $1 billion principal amount outstanding in its

3.125% notes due 2021.

The company expects to complete the U.S. offering by Thursday,

it said.

Together with a subsidiary, the company also entered into an

agreement with underwriters for the offer and sale of 600 million

euros ($727.6 million) in 1.213% notes due 2036, guaranteed on a

senior unsecured basis. The company said it expects to use net

proceeds, together with cash on hand, to repay its EUR600 million

principal amount outstanding in its 0.174% euro notes due 2021.

It expects to complete the euro offering by Friday, it said.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

February 10, 2021 06:53 ET (11:53 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

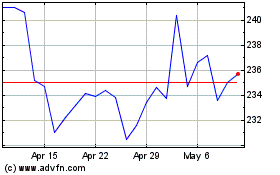

Becton Dickinson (NYSE:BDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

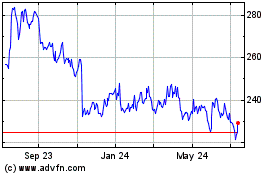

Becton Dickinson (NYSE:BDX)

Historical Stock Chart

From Apr 2023 to Apr 2024