SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

April 9, 2021

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name into

English)

Av. Eduardo Madero 1182

Buenos Aires C1106ACY

Tel: 54 11 5222 6500

(Address of registrant’s principal executive

offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

INDEX

Translation of a submission from Banco Macro to

the CNV dated on April 9, 2021.

Buenos Aires, April 9th 2021

To:

CNV / BYMA / MAE

Re. Relevant Event.

Please find attached hereto the letter sent on

the date hereof to Fondo de Garantía de Sustentabilidad – Administración Nacional de Seguridad Social (ANSES)

in compliance with the information requirement related to the General and Special Shareholders’ Meeting of Banco Macro S.A. to be

held on April 30th 2021.

Sincerely,

|

Jorge Francisco Scarinci

Head of Market Relations

|

|

Buenos Aires, April 9th 2021

To

Fondo de Garantía de Sustentabilidad

Administración Nacional de la Seguridad Social (ANSES)

Dr. Benjamín Navarro

Tucumán 500, mezzanine

S __________ _____ /__________ ___________D

Re.: NOTE N° NO-2021-29532700-ANSES-DGAS#ANSES

Dear Sirs,

We write to you in reply to your request of information

regarding the General and Special Shareholders’ Meeting of Banco Macro S.A. called for April 30th 2021. In that respect, please

be advised as follows:

1. Detailed description of the shareholders

structure to date.

Please find below the shareholding structure as

of March 31st 2021:

SHAREHOLDER’S

NAME/

CORPORATE

NAME

|

Class A

Shares

|

Class B

Shares

|

Capital Stock

|

Participating

Interest

|

Voting

Interest

|

|

Other Shareholders (Foreign Stock Exchange)

|

|

169,191,550

|

169,191,550

|

26.46%

|

24.72%

|

|

ANSES-F.G.S. Law No. 26425

|

|

184,120,650

|

184,120,650

|

28.80%

|

26.90%

|

|

Delfin Jorge Ezequiel Carballo

|

4,900,397

|

106,824,523

|

111,724,920

|

17.47%

|

19.19%

|

|

Fideicomiso Trust JHB

|

5,995,996

|

104,473,881

|

110,469,877

|

17.28%

|

19.65%

|

|

Other Shareholders (Local Stock Exchange)

|

339,277

|

63,567,134

|

63,906,411

|

9.99%

|

9.54%

|

|

TOTAL

|

11,235,670

|

628,177,738

|

639,413,408

|

100.00%

|

100.00%

|

2. Executed copy of the Minutes of the Board

of Directors’ Meeting calling the General and Special Shareholders’ Meeting.

Please be advised that the wording of the minutes

of the Board of Directors’ Meeting calling a General and Special Shareholders’ Meeting for April 30th 2021 at 11 AM is available

in the Financial Information Highway (or AIF for its acronym in Spanish) of the CNV or Securities and Exchange Commission of the Republic

of Argentina.

3. Current composition of the Board of Directors

(regular and alternate members) including the designation dates and effective term of office.

The current composition of the Board of Directors

is as follows:

|

Name

|

Position

|

Designation

Date

|

Designation Expiry Date – Shareholders’ Meeting evaluating the Financial Statements of the fiscal year

|

|

Delfín Jorge Ezequiel Carballo

|

Chairman

|

04/27/2018

|

12/31/2020

|

|

Jorge Pablo Brito

|

Vice Chairman

|

04/30/2019

|

12/31/2021

|

|

Carlos Alberto Giovanelli

|

Regular Director

|

04/30/2019

|

12/31/2021

|

|

Nelson Damián Pozzoli

|

Regular Director

|

04/30/2019

|

12/31/2021

|

|

Fabián Alejandro de Paul (1)

|

Regular Director

|

04/30/2019

|

12/31/2021

|

|

Guillermo Merediz (1)

|

Regular Director

|

04/30/2020

|

12/31/2021

|

|

Constanza Brito

|

Regular Director

|

04/27/2018

|

12/31/2020

|

|

Mario Luis Vicens (1)

|

Regular Director

|

04/27/2018

|

12/31/2020

|

|

Guillermo Eduardo Stanley

|

Regular Director

|

04/27/2018

|

12/31/2020

|

|

Mariano Ignacio Elizondo (1)

|

Regular Director

|

05/27/2020

|

12/31/2020

|

|

Delfín Federico Ezequiel Carballo

|

Regular Director

|

04/30/2020

|

12/31/2022

|

|

Ramiro Tosi (1)

|

Regular director

|

04/30/2020

|

12/31/2022

|

|

Santiago Horacio Seeber

|

Regular Director

|

11/30/2020

|

12/31/2021 (2)

|

|

Alan Whamond (1)

|

Alternate Director

|

04/30/2019

|

12/31/2021

|

|

Juan Santiago Fraschina (1)

|

Alternate Director

|

05/27/2020

|

12/31/2021

|

|

|

(1)

|

Independent Director.

|

|

|

(2)

|

Corresponds to the expiry of the original office as Alternate Director. He

shall act as Regular Director until the next General Shareholders’ Meeting, pursuant to the provisions of section 14 of the by-laws.

|

|

|

4.

|

Express indication of the personnel authorized and/or empowered by the company to execute and deliver

this request, attaching a copy of the document evidencing such authorization (if too long, please attach a copy of the relevant part of

such authorizing document).

|

The person singing these presents is

acting in his capacity as attorney-in-fact of Banco Macro S.A. as evidenced by the power of attorney executed and delivered through the

notarial deed No. 337 dated August 22nd 2017 and entered on Folio 1604 of the notarial registry No. 1214 owned by the Notary

Public Alejandro Senillosa, a copy of which is attached hereto.

5. As to the following

items of the Agenda, we request the following:

a. (Item 3) “Evaluate the documentation

provided for in section 234, subsection 1 of Law No. 19550, for the fiscal year ended December 31st 2020”. Please provide a copy

of the accounting documentation under section 234 of Law No. 19550 as duly approved and executed by the Board of Directors, Syndics and

Independent Auditor.

The CNV, in its General Resolution No. 777/2018,

established that issuers subject to CNV’s supervision must apply to their annual statements or intermediate or special periods ending

as of and including December 31st 2018, the Financial Statement re-expression method in homogeneous currency under IAS 29.

In this context, please confirm whether the

financial statements for the fiscal year 2020 submitted to this shareholders' meeting should be restated in constant currency. If so,

please describe in detail the index used.

Please provide information regarding any changes

in the composition of the company’s staff during the period comprised between 2018 and 2020.In addition, please provide any other

information you consider relevant to evaluate this item of the Agenda.

All the documentation provided for in section

234, subsection 1 of Law 19550 to be submitted to and evaluated by the next General and Special Shareholders’ Meeting was made available

to the public in due time and manner and is currently available in the AIF.

As described in Note 3 to the Consolidated Financial

Statements for the fiscal year ended 31 December 2020, such financial statements have been adjusted so that the same are expressed in

purchasing power currency to such date, as provided for in IAS 29 and taking into account, as well, the specific rules of the BCRA contained

in Communiqués “A” 6651, 6849, as amended and supplemented. The above mentioned rules and standards established the

compulsory application of such accounting method as of the financial statements for years beginning January 1st 2020. In order

to carry out such re-expression the index to be applied is the national consumer price index (CPI) published by Instituto Nacional

de Estadísticas y Censos (INDEC).

The company’s staff totaled 8,164, 8,711

and 8,489 employees for the years 2018, 2019 and 2020, respectively.

b. (Item 4) “Evaluate the management

of the Board and the Supervisory Committee”. Information regarding the administration and actions performed by the Board and by

the Supervisory Committee expressly identifying its members.

The Board’s administration and the actions

of the Supervisory Committee were in accordance with the provisions of the Argentine Business Company Law No. 19550, the Capital Market

Act No. 26831, the Rules and Regulations of the Comisión Nacional de Valores (Argentine Securities and Exchange Commission) and

the rules and regulations of the Central Bank of the Republic of Argentina (BCRA). The members of the Board are listed on item 3 of this

letter. The members of the Supervisory Committee are the following:

|

Name

|

Position

|

Designation

Date

|

Designation Expiry Date – Shareholders’ Meeting evaluating the Financial Statements of the fiscal year

|

|

Alejandro Almarza

|

Regular Syndic

|

04/30/2020

|

12/31/2020

|

|

Carlos Javier Piazza

|

Regular Syndic

|

04/30/2020

|

12/31/2020

|

|

Enrique Alfredo Fila

|

Regular Syndic

|

04/30/2020

|

12/31/2020

|

|

Alejandro Carlos Piazza

|

Alternate Syndic

|

04/30/2020

|

12/31/2020

|

|

Leonardo Pablo Cortigiani

|

Alternate Syndic

|

04/30/2020

|

12/31/2020

|

|

Gustavo Macagno

|

Alternate Syndic

|

04/30/2020

|

12/31/2020

|

c. (Item 5) “Evaluate the application

of the negative retained earnings for the fiscal year ended 31 December 2020 of AR$ 50,602,847,744.91 and de personal property tax

on business corporations of AR$ 311,943,788.14 which the Board proposes may be absorbed as follows: a) AR$ 30,268,993,306.90

with the Income for the year 2020; b) AR$ 442,037.35 with the Optional Reserve Fund and c) AR$ 20,645,356,188.80 with the optional reserve

fund for future profit distributions Figures are expressed in constant currency as of December 31st 2020.” Please confirm

whether the motion to be evaluated at the shareholders’ meeting is the one mentioned in this item of the Agenda.

In connection with the application of the optional

Reserve Fund for future profit distributions, please inform the grounds for such motion and the reasonableness thereof, as well as any

additional information you consider relevant. In addition, please determine the term within which you estimate the same will be released

in order to make the distribution of dividends effective.

On the other hand, please provide a statement

of changes in the Optional Reserve Fund for Future Profit Distributions, if there is one. Please provide information of the current composition

of such fund, its creation date and the latest transactions or operations. Finally, please specify whether the Company has any restriction

applicable to profit distributions in force at the time of this Shareholders’ Meeting.

Since Resolution No. 777/18 issued by the CNV

(Argentine Securities Exchange Commission) provides that the distribution of profits shall be treated in the currency of the date on which

the relevant Shareholders’ Meeting is held applying the CIP for the month immediately preceding such meeting, please confirm whether

the motion informed in this answer as well as in the Annual Report to the Financial Statements would be restated. If such were the case,

then provide the applicable Index and the updated amounts.

Please be advised that there shall be no changes

to the proposal submitted by the Board in connection with the application of the retained earnings for the fiscal year ended 31 December

2020.

In connection with

the application of the Optional Reserve Fund for Future Distribution of Profits, pursuant to Note 40 to the financial statements for the

year ended 31 December 2020, the rules on Profit Distribution issued by the BCRA (including Communiqué “A” 6464, as

supplemented) establish that the Company may only distribute profits provided it is not subject to certain circumstances, among which

the company must not register any financial assistance from the above mentioned entity due to lack of liquidity, or register any deficiencies

regarding paid in capital or minimum cash or be subject to any provision under sections 34 and 35bis of the Financial Entities Act (sections

regarding any plans aimed at curing or regularizing or restructuring the Company), among other conditions described in the above mentioned

communiqué that must be met. In addition, pursuant to the provisions established in Communiqué “A” 6768 of the

BCRA, the distribution of profits to be approved by the Company’s Shareholders’ meeting may only be carried out after obtaining

the authorization from the Superintendencia de Entidades Financieras y Cambiaraias of the BCRA, who shall evaluate, among other elements,

the potential effects or impact of the application of the IFRS standards under Communiqué “A” 6430 (Item 5.5 of IFRS

9 – Impairment of Financial Assets), the deduction of the lower allowances and higher RPC resulting from the treatments established

in point 2. of Communiqué “A” 6946 and amendments, for financing to MSMEs for the payment of salaries and the restatement

of financial statements provided for by Communiqué "A" 6651, in accordance with the accounting provisions established

by Communiqué "A" 6847 and the guidelines for applying the procedure for restatement of financial statements in accordance

with Communiqué "A" 6849.

Pursuant to the minutes of the General and Special

Shareholders’ Meeting held on April 16th 2012 as published in the AIF, the Company created an “Optional Reserve Fund for Future

Profit Distributions” on the amount of AR$ 2,443,140,742.68. In addition, we inform that the “Optional Reserve Fund for Future

Profit Distributions” account was increased as a result of the resolution approved by the General Shareholders’ Meeting dated

April 11th 2013 and the General and Special Shareholders’ Meetings dated April 29th 2014, April 23rd 2015, April 26th 2016, April

28th 2017, April 28th 2018 and April 30th 2019, which added to such account, the amount of AR$ 1,170,680,720.00; AR$ 1,911,651,322.50,

AR$ 2,736,054,342.94, AR$ 3,903,591,780.29, AR$ 5,371,581,684.69, AR$ 7,511,017,454.84 and AR$ 12,583,394,397.30, respectively. In turn,

the Shareholders’ Meetings held on April 29th 2014, April 23rd 2015, April 26th 2016, April 28th 2017, April 28th 2018 and April

30th 2019 resolved to separate a portion of such reserve fund equal to AR$ 596,254,288.56, AR$ 596,254,288.56, AR$ 643,019,330.80,

AR$ 701,475,633.60, AR$ 3,348,315,105.00 and AR$ 6,393,977,460.00, respectively, in order to pay a cash dividend. Pursuant to section

64 of Law No. 26831, in the fiscal years 2018 the Company applied AR$ 4,407,907,175.42 and in the fiscal year 2019 such reserve was increased

by the amount of AR$ 30,265,275 as a result of the capital reduction approved by the General and Special Shareholders’ Meeting held

on April 30th 2019. In the fiscal year 2016 such optional reserve fund was adjusted in AR$ 368,546,288.56, since the BCRA authorized

the payment of a cash dividend of AR$ 227,708,000 for the year 2014, which was paid in March 2016. All the above-mentioned resolutions

were published in the AIF in due time and manner according to law. Finally, please be advised that the total reserve as restated in constant

currency of December 31st 2020 is AR $ 70,446,357,678.12.

We inform that Communiqué “A”

7181 issued by the BCRA on December 17th 2020 provided the extension of the suspension of profit distributions by financial

entities until June 30th 2021.

As to the re-expression of the amount proposed

to be distributed as dividends, please be advised that to the date hereof the BCRA has not yet made a decision in this regard.

d. (Item 6) “Separate a portion of the

optional reserve fund for future profit distributions, which as of December 31st 2020 and expressed in constant currency totals

AR$ 70,446,357,678.11, in order to allow the application of AR$ 10,000,425,701.12 to the payment of a cash dividend or dividend in kind,

in this case valued at market price, or in any combination of both alternatives, subject to prior authorization by the Central Bank of

the Republic of Argentina. Delegate to the Board the decision as to how, when and under what terms shall such dividend be made available

to the shareholders. The dividend is calculated on figures expressed in constant currency as of December 31st 2020.”

Please inform the grounds for this motion and the reasonableness thereof, as well as any additional information you consider relevant

in that connection. As to the delegation to the Board of the power to determine the date of the effective availability of the cash dividend,

please provide any relevant information regarding this issue.

The motion to separate a portion of the optional

reserve fund for future profit distributions in order to allow the application of up to AR$ 10,000,425,701.12 to the payment of a cash

dividend or dividend in kind, in this case valued at market price, or in any combination of both alternatives, subject to prior authorization

by the Central Bank of the Republic of Argentina is grounded on the changes in the results and the preservation of satisfactory liquidity

and solvency indicators.

As mentioned in C. above, in its Communiqué

“A” 7181 the BCRA provided for the extension of the suspension of profit distributions by financial entities until June 30th

2021. Therefore, due to the decision made by the regulatory authority of financial entities, there is a legal impairment to comply with

the payment of dividends within10 business days from the approval thereof by the Shareholders’ Meeting. The Board shall make such

dividends available once the applicable authorization by the BCRA has been duly obtained.

e. (Item 7) “Evaluate the remunerations

of the members of the Board of Directors for the fiscal year ended December 31st 2020 within the limits as to profits, pursuant to section

261 of Law No. 19550 and the Rules of the Comisión Nacional de Valores (Argentine Securities Exchange Commission).”

Please provide proposal regarding the remuneration of the members of the Board for their work during the fiscal year 2020. Please inform

the aggregate amount of remunerations to the Board and a breakdown by technical and administrative functions. Also, please inform the

number of Board members that are paid any remuneration and how many of them are paid for technical and administrative tasks. Please further

inform whether the remunerations of the Board include fees to the members of the Audit Committee or other committee. If so, please inform

how many of them are also paid any remuneration for being members of such committee. Please inform whether there are Directors employed

by the Bank and, in case there are, please inform the salary amount paid in each case. Additionally, provide the amounts paid as Board

fees and fees for technical and administrative functions for the fiscal years 2020, 2019 and 2018 breaking them down as described above

and using, if possible, the following model.

On the other hand, please inform the computable

profit for the year submitted for consideration. In this sense, please specifically inform the adjustments made to the result of the year

to obtain such computable profit. All this in order to be able to verify compliance with the limits provided for under Section 261 of

the Argentine Business Company Law No. 19550 in connection with the relationship between the proposed fees and dividends and such computable

profit. Finally, please confirm the aggregate amount approved for the fiscal years 2018 and 2019.

The proposed remuneration for the directors for

the above mentioned fiscal year was made available to the public in due time and manner according to law through the publication of the

proposed remuneration in the AIF, pursuant to the Rules of the Argentine Securities and Exchange Commission (CNV).

In the financial statements for the year ended

31 December 2020 the amount of AR$1,579,649,159.69 is recorded in the Statement of Income as fees and remunerations payable to the Board

of Directors. Such proposal, as in previous years, does not exceed the limits established under section 261 of Law 19550 and the rules

of the CNV.

Please be advised that such amount corresponds

to the aggregate amount of remunerations to the Board recorded in the statement of income for the year ended 31 December 2020 (including

fees and salaries). The amounts at nominal value total AR $ 1,381,124,320 and the adjustment to restate such amounts in constant currency

of December 31st 2020 amounts to AR $ 198,524,839.69.

During the fiscal years 2020, all directors perform

technical and administrative functions, except Messrs. Ramiro Tosi, Guillermo Merediz and Mariano Elizondo.

The members of the Audit Committee are not paid

any additional fees apart from those they are paid as directors.

There is only one director employed by the Company.

As evidenced by the spreadsheet showing the allocations

to directors published in the Financial Information Highway (or AIF for its acronym in Spanish language), the income for the fiscal year

ended 31 December 2020 totals AR $ 31,848,642,466.59. Through its Communiques “A” 6651 and 6849, the BCRA provided for the

application, as of the fiscal years beginning on 1/1/2020, of IAS 29 “Restatement of Financial Statements” setting as transition

date 12/31/2018. In addition, through its Communiqué “A” 6114, the BCRA established specific guidelines within the

framework of the convergence process to the International Financial Reporting Standards (IFRS), by which the BCRA defined, among other

issues, the transitory exception to the application of section 5.5 (Impairment of Financial Assets) of IFRS 9 “Financial Instruments”

(paragraphs B5.5.1 to B5.5.55) until the fiscal years beginning 1/1/2020, establishing as well 12/31/2018 as transition date. As a result

of the initial application of both standards at Banco Macro S.A., the Company registered a negative amount of AR $ 50,602,847,744.91.

However, the Company has sufficient Optional Reserves at the beginning of the year to absorb such negative impact.

As evidenced by the Minutes of the Shareholders’

Meetings published in the AIF, the global amounts paid as Board fees to the directors for the fiscal years 2018 and 2019 were AR $ 659,862,001

and AR $ 1,710,824,255.51, respectively. Please be advised that the amount for the year 2019 includes the amount of AR $ 31,612,734.51

corresponding to fees paid to the directors of Banco del Tucumán S.A., a company absorbed by Banco Macro S.A. during such fiscal

year.

f. (Item 8) “Evaluate the remunerations

of the members of the Supervisory Committee for the fiscal year ended December 31st 2020.” As to the proposal regarding the remunerations

of the members of the Supervisory Committee, please provide a breakdown of such proposed amount; a breakdown of such proposed amount

by member of the Supervisory Committee and of any advance payment by member during the year 2020. In addition, please inform the amount

approved for the Fiscal Years 2018 and 2019.

Please be advised that the amount proposed as

fees to the members of the Supervisory Committee in nominal currency amounts to AR $ 2,340,000 and the adjustment to restate such amount

in constant currency of 31 December 2020 is AR $ 412,314.10.

As to the breakdown of the amount to be paid to

each member of the Supervisory Committee during the year 2020, we shall comply in due time with all the provisions set forth in section

75 of Decree No. 1023/2013, as provided under the Interpretation Criterion No. 45 of the CNV.

As evidenced by the Minutes of the Shareholders’

Meetings published in the AIF, the amounts approved for the fiscal years 2018 and 2019 were AR $ 1,305,540 and AR $ 2,851,338, respectively.

Please be advised that the amount for the year 2019 includes the amount of AR $ 942,363 corresponding to fees paid to the members of the

Supervisory Committee of Banco del Tucumán S.A., a company absorbed by Banco Macro S.A. during such fiscal year.

g. (Item 9) “Evaluate the remuneration

of the independent auditor for the fiscal year ended December 31st 2020”. Please provide the proposal of the remuneration to be

paid to the independent auditor for the audit of the financial statements of the year 2020, indicating whether there were any changes

in tasks as compared with those performed for the immediately preceding financial statements. If there is a considerable increase, please

provide an explanation for such increase. In addition, please inform the amounts approved for the Fiscal Years 2018 and 2019.

The independent auditor´s fees for the year

ended 31 December 20120amounts to AR$ 49,679,160 plus VAT.

Please be advised there have been no changes in

tasks or functions compared to those performed for the immediately preceding financial statements.

As evidenced by the Minutes of the General and

Special Shareholders’ Meetings held on April 30th 2019 and 2020, as published in the AIF, the amount approved for the fiscal years

2018 and 2019 was AR$ 24,716,000 and AR$ 37,074,000, respectively.

h. (Item 10) “Ratification of the appointment

of Mr. Santiago Horacio Seeber as regular director until the expiration of the designation of the deceased director Jorge Horacio Brito,

in accordance with the provisions of Section 14 of the Company’s by-laws.” Please provide information regarding this item

of the Agenda, with the relevant background information and/or resumes evidencing his eligibility for such office.

Please be advised that Mr. Seeber was duly authorized

by the BCRA to hold office as director pursuant to the Revised Text “Financial Entity Authorities”.

Below we include a detailed description of the

background information of the proposed nominee:

Santiago Horacio Seeber

was born on March 27th 1977. Mr. Seeber was appointed Alternate Director of Banco Macro S.A. on April 27th 2018

and took office as Regular Director on November 30th 2020 due to the death of Jorge Horacio Brito. Before that, he acted as

Alternate Director of the Bank from April 2012 to April 2016 and as Advisor to the President from 2002. He is also Chairman of the Board

of LAB Real Estate S.A. and New Lines S.A., Vice Chairman of the Board of Anglia Sociedad Anónima Financiera de Mandatos y Servicios

y de Comercio Interior S.A. and Chairman of the Board of Inversora Juramento S.A., Frigorífico Bermejo S.A. and Mediainvest S.A.

i.(Item 11) “Appoint five regular directors

who shall hold office for three fiscal years to fill the vacancies existing due to the expiration of the relevant terms of office.”

Please provide the proposed designation under this item of the Agenda, with the relevant background information and/or resumes evidencing

their eligibility for such offices.

As evidenced by the relevant event published in

the AIF last April 5th, Messrs. Delfín Jorge Ezequiel Carballo, acting in his capacity as shareholder of Banco Macro

S.A., and Jorge Pablo Brito, as Chairman of the Board of Fiduciaria JHB S.A., the trustee of the shareholder Fideicomiso Trust JHB, informed

that, in connection with the next General and Special Shareholders’ Meeting of the Bank, they intend to propose as regular directors,

to hold office for three fiscal years, the designation of Messrs. Delfín Jorge Ezequiel Carballo, Constanza Brito, Mario Luis Vicens

and Sebastián Palla.

Please be advised that Delfín Jorge Ezequiel

Carballo, Constanza Brito and Mario Luis Vicens are regular directors of the Company and were duly authorized by the BCRA to hold office

as directors pursuant to the Revised Text “Financial Entity Authorities”.

Below we include a detailed description of the

background information of the proposed nominees:

Delfín Jorge

Ezequiel Carballo was born on November 21st 1952 and is a lawyer graduated from Universidad Católica Argentina.

Mr. Carballo was appointed Chairman of the Board on November 30th 2020. In addition, he acted as Vice Chairman of the Company’s

Board from April 39th 2020 to November 30th 2020, as Chairman of the Board from April 27th 2018 to April

30th 2020 and, before that, he was Vice Chairman of the Company until April 27th 2018. Mr. Carballo is also Chairman

of the Board of Santa Genoveva S.A. and Alternate Director of Bolsas y Mercados Argentinos S.A.

Constanza Brito was born on October 2nd

1981 and graduated from Universidad del Salvador with a degree in Human Resources. At present, she acts as Regular Director of the Company,

an office she holds since April 27th 2018. Before that, she acted as Alternate Director from April 26th 2016 to

April 27th 2018 and as Regular Director from November 2007 to April 2016. Ms. Brito was the Head of the Human Resources Department

at the Company until November 2007 and acted as Alternate Director of Banco del Tucumán S.A. until its merger into Banco Macro

S.A. in the year 2019.

Mario Luis Vicens

was born on July 14th 1951. Mr. Vicens graduated from Universidad Católica Argentina with a degree in Economy and completed

the Advanced Course in Monetary and Banking Economy at Universidad Católica Argentina. He is Regular Director of the Company since

April 26th 2016. Within the financial activity, he worked investment project assessment at Caja Nacional de Ahorro y Seg./Consejo Federal

de Inversiones (1975-1978). In the public administration, he worked at Banco Central de la República Argentina as member of the

permanent staff of economists (1980-1981) and acted as Regular Director (1986-1988) and as Secretary of Treasury within the Ministry of

Economy (1999-2001). In the banking sector, he acted as Head of the Planning Department at Banco de Crédito Argentino (1981-1986),

Regular Director of Banco Sudameris (2001-2002), CEO of Asociación de Bancos de la Argentina (2002-2011), Regular Director of Federación

Latinoamericana de Bancos (2002-2004/2008-2010), Regular Director of Seguro de Depósitos S.A. (2008-2011), Regular Director of

BBVA Consolidar Seguros S.A. (2012-2016), Regular Director of Generali Arg. Cia. de Seguros (2014-2015), Regular Director of PSA Finance

Arg. Cia. Financiera S.A. (2012), Regular Director of Rombo Cía. Financiera S.A. (2012-2016) and Regular Director of BBVA Francés

S.A. (2012-2016). He also rendered advisory services to companies and banks in the economy and financial areas (1989-1999).

Sebastián Palla

was born on June 12th 1974. Mr. Palla graduated from Universidad Torcuato Di Tella with a degree in Economy y holds an International General

Certificate of School Education (IGCSE) issued by Cambridge University. At present he is Chief Procurement Officer at Telecom S.A

since August 2016. Before that, he acted as advisor to the President of the Bank from February 2009 to July 2010, Head of Investment and

New Projects Department from July 2010 to March 2015 and Head of Government Banking from April 2015 to July 2016. At the same time, he

acted as President of Unión de Administradoras de Fondos de Jubilaciones y Pensiones from April 2007 to January 2009 and

as CEO from February 2006 to April 2007. Palla also worked in the public administration as Undersecretary of Finance at the Secretary

of Finance of the Ministry of Economy from May 2993 to November 2005 and as Chief Advisor to the Secretary of Finance of the Ministry

of Economy from May 2002 to May 2003. Additionally, he is member of The Forum of Young Global Leaders since 2005 and was 2008 Eisenhower

Fellow.

j. (Item 12) “Appoint one alternate director to fill the vacancy

generated after the appointment of Mr. Santiago Horacio Seeber as regular director until completion of the term of office.”) Please

provide the proposed designation under this item of the Agenda, with the relevant background information and/or resumes evidencing his

eligibility for such office.

As evidenced by the relevant event published in

the AIF last April 5th, Messrs. Delfín Jorge Ezequiel Carballo, acting in his capacity as shareholder of Banco Macro

S.A., and Jorge Pablo Brito, as Chairman of the Board of Fiduciaria JHB S.A., the trustee of the shareholder Fideicomiso Trust JHB, informed

that, in connection with the next General and Special Shareholders’ Meeting of the Bank, they intend to propose as alternate director,

to hold office for one fiscal year, the designation of Mr. Marcos Brito.

Please be advised that Mr. Marcos Brito was duly

authorized by the BCRA to hold office as alternate director pursuant to the Revised Text “Financial Entity Authorities”.

Below we include a detailed description of the

background information of the proposed nominee:

Marcos Brito was born on October 5th 1982.

Mr. Brito graduated from Universidad Torcuato Di Tella with a degree in Economy. He is currently the Chairman of the Board of Argenpay

SAU from May 2019 and of Macro Fiducia S.A. since April 2016. Before that, he acted as Regular Director of Banco Macro S.A. from April

2009 to April 2020 and as Alternate Director from November 2007 to April 2009. He was also Regular Director of Nuevo Banco Bisel S.A.

from November 2007 to August 2009, Regular Director of Banco Privado de Inversiones S.A. from September 2010 to December 2013 and Alternate

Director of Banco del Tucumán S.A. from January 2014 to December 2018.

k. (Item 13) “Establish the number and

designate the regular and alternate members of the Supervisory Committee who shall hold office for one fiscal year”. Please provide

information regarding the members who shall compose the Supervisory Committee, with the relevant background information and/or resumes

evidencing their eligibility for such offices.

The proposal shall be made by the shareholders

at the General and Special Shareholders’ Meeting called for April 30th 2021.

l. (Item

14) “Appoint the independent auditor for the fiscal year to end on December 31st 2021”. Please provide the proposed designation

under this item of the Agenda, with the relevant background information and/or resumes evidencing his eligibility for such office.

Pursuant to the sworn statements published in

the AIF, the Accountants Leonardo Daniel Troyelli and Pablo Mario Moreno, members of the audit company Pistrelli, Henry Martin y Asociados

S.R.L., shall be proposed as candidates to be designated as Regular Independent Auditor and Alternate Independent Auditor, respectively.

m. (Item 15) “Determine the Audit Committee’s

budget.” Please inform the amount of the Budget for the Audit Committee for the year 2021, as well as the amount actually disbursed

under this description during the fiscal year 2020. Finally confirm the amount approved for the fiscal year 2018, 2019 and 2020.

The proposed budget of the Audit Committee for the year 2021 shall

be $ 2,822,000

The amount actually disbursed under this description

during the fiscal year 2020 was AR$ 1,810,000.

As evidenced by the Minutes of the General and

Special Shareholders’ Meeting published in the AIF, the amount approved for the fiscal year 2018 was AR$ 1,384,000, For the fiscal

year 2019 was AR$ 1,890,000 and for the fiscal year 2020 was AR$ 2,764,000.

n. (Item 20) “Authorization to carry

out all acts and filings that are necessary to obtain the administrative approval and registration of the resolutions adopted at the Shareholders’

Meeting.” Please provide the names of the persons authorized as well as a detail description of the powers thereof.

The proposal shall be made by the shareholders

at the General and Special Shareholders’ Meeting called for next April 30th.

Sincerely,

|

Gustavo Alejandro Manríquez

Attorney-in-fact

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: April 9, 2021

|

|

MACRO BANK INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jorge Francisco Scarinci

|

|

|

|

Name: Jorge Francisco Scarinci

|

|

|

|

Title: Chief Financial Officer

|

|

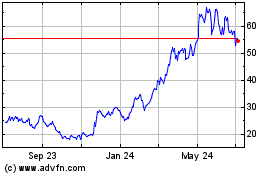

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

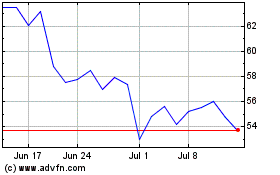

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Apr 2023 to Apr 2024