Kevin P. Brady & E. Wayne Nordberg Conclude their Service as Members of the Board of Annaly Capital Management, Inc. in Line ...

May 22 2019 - 4:15PM

Business Wire

Annaly Capital Management, Inc. (NYSE: NLY) (“Annaly” or

the “Company”) announced today that directors Kevin P. Brady and E.

Wayne Nordberg stepped down from the Company’s Board of Directors

(the “Board”) upon the scheduled expiration of their terms at the

Company’s Annual Meeting of Stockholders held on May 22, 2019 (the

“Annual Meeting”). Mr. Brady joined the Board prior to the

Company’s initial public offering in 1997 and Mr. Nordberg joined

the Board in 2004. Prior to the Annual Meeting, Mr. Brady had

served as Chair of Annaly’s Audit Committee and as a member of the

Nominating/Corporate Governance (“NCG”) Committee and Risk

Committee, and Mr. Nordberg had served as a member of the Audit

Committee, Compensation Committee and NCG Committee.

“Kevin Brady joined Annaly’s Board prior to the Company’s

initial public offering and has played a critical role in Annaly’s

growth and success since that time. We are immensely grateful for

Kevin’s guidance and support, including his exceptional leadership

as Chair of the Company’s Audit Committee,” said Kevin Keyes,

Annaly’s Chairman, Chief Executive Officer and President. “We are

equally indebted to Wayne Nordberg, whose expertise in multiple

asset classes and specifically in mortgage-related markets and

products has helped transform Annaly into the industry leader we

are today. On behalf of the entire Board, I want to publicly thank

Kevin and Wayne for their many years of dedicated service to the

Company and wish them the best in their future endeavors.”

Messrs. Brady and Nordberg stepped down as directors in line

with the Company’s recently-adopted Board refreshment policy, which

provides that independent directors may not stand for re-election

to the Board following the earlier of their 12th anniversary of

Board service or their 73rd birthday. Following the Annual Meeting,

Annaly’s Board is comprised of 11 directors, 82% of whom are

independent and 45% of whom are women. Independent director Kathy

Hopinkah Hannan has been appointed as Chair of Annaly’s Audit

Committee following Mr. Brady’s departure. Annaly’s Audit and Risk

Committees will further benefit from the experience of Thomas

Hamilton, another recently appointed independent director who was

re-elected by stockholders at the Annual Meeting. The Directors who

have joined the Board over the past few years align with the

Company’s continued strategic evolution and ensure Annaly maintains

a diverse, highly experienced and engaged Board.

About Annaly

Annaly is a leading diversified capital manager that invests in

and finances residential and commercial assets. Annaly’s principal

business objective is to generate net income for distribution to

its stockholders and to preserve capital through prudent selection

of investments and continuous management of its portfolio. Annaly

has elected to be taxed as a real estate investment trust, or REIT,

for federal income tax purposes. Annaly is externally managed by

Annaly Management Company LLC. Additional information on the

company can be found at www.annaly.com.

Forward-Looking Statements

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as "may," "will," "believe," "expect,"

"anticipate," "continue," or similar terms or variations on those

terms or the negative of those terms. Actual results could differ

materially from those set forth in forward-looking statements due

to a variety of factors, including, but not limited to, changes in

interest rates; changes in the yield curve; changes in prepayment

rates; the availability of mortgage-backed securities and other

securities for purchase; the availability of financing and, if

available, the terms of any financing; changes in the market value

of our assets; changes in business conditions and the general

economy; our ability to grow our commercial real estate business;

our ability to grow our residential mortgage credit business; our

ability to grow our middle market lending business; credit risks

related to our investments in credit risk transfer securities,

residential mortgage-backed securities and related residential

mortgage credit assets, commercial real estate assets and corporate

debt; risks related to investments in mortgage servicing rights;

our ability to consummate any contemplated investment

opportunities; changes in government regulations and policy

affecting our business; our ability to maintain our qualification

as a REIT for U.S federal income tax purposes; and our

ability to maintain our exemption from registration under the

Investment Company Act of 1940, as amended. For a discussion of the

risks and uncertainties which could cause actual results to differ

from those contained in the forward-looking statements, see "Risk

Factors" in our most recent Annual Report on Form 10-K and any

subsequent Quarterly Reports on Form 10-Q. We do not undertake, and

specifically disclaim any obligation, to publicly release the

result of any revisions which may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190522005049/en/

Annaly Capital Management, Inc.Investor

Relations1-888-8Annalywww.annaly.com

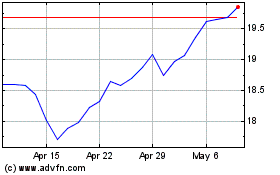

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

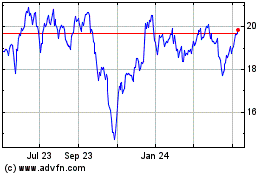

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024