- Aerie achieves all-time high third quarter revenue and

operating profit

- Actions to right size inventory and expenses fuel sequential

profit improvement

- Operating profit of $118 million exceeded pre-pandemic 2019

levels

- Continuing to prioritize profit recovery and cash

generation

American Eagle Outfitters, Inc. (NYSE: AEO) today announced

financial results for the third quarter ended October 29, 2022.

“I’m pleased to deliver a third quarter that exceeded our

expectations, with profit margins meaningfully improved from the

first half of the year. Bold actions to rationalize inventory and

reduce expenses are paying off. Our inventory is in good shape, up

8% to last year, with progress continuing into the fourth quarter.

We are staying disciplined and focused on improving profitability

and cash flow, while maintaining a healthy balance sheet,”

commented Jay Schottenstein, AEO’s Executive Chairman of the Board

and Chief Executive Officer.

“As we navigate the current macro environment, we remain focused

on our strategic initiatives — leading with innovation and

judiciously investing in capabilities that will differentiate us in

the long-run. Our organization is strong and I have tremendous

confidence in the resilience of our brands. We are excited about

upcoming merchandise collections and look forward to delivering an

exceptional customer experience across brands and channels this

holiday season,” Jay continued.

Third Quarter 2022 Results:

- Total net revenue of $1.2 billion was down 3% to the third

quarter of 2021. Our supply chain business, Quiet Platforms,

contributed approximately 2 percentage points to revenue growth.

Brand revenue declined 5%, better than the company’s expectation

for a high single digit decline.

- Aerie revenue of $350 million rose 11% versus third quarter

2021, reflecting a 24% 3-year revenue CAGR. Comp sales declined 3%

versus third quarter 2021 and was up 59% to third quarter

2019.

- American Eagle revenue of $838 million declined 11% versus

third quarter 2021 reflecting a negative 1% 3-year revenue CAGR.

Comp sales declined 10% versus third quarter 2021 and was flat to

third quarter 2019.

- Consolidated store revenue declined 4%. Total digital revenue

declined 5%. Compared to pre-pandemic third quarter 2019, store

revenue increased 3% and digital revenue increased 35%.

- Gross profit of $480 million compared to $565 million in the

third quarter of 2021 and reflected a gross margin rate of 38.7%

compared to 44.3% last year. Higher markdowns and increased product

costs drove approximately 400 basis points of the rate decline and

Quiet Platforms had a 70 basis point impact as that business

continues to scale. Rent and warehousing also deleveraged,

partially offset by lower incentive compensation.

- Selling, general and administrative expense of $311 million

decreased 1% due to lower incentive compensation. SG&A

increased 50 basis points as a rate to sales versus third quarter

2021.

- Operating income of $118 million reflected a 9.5% margin. This

included an approximately $10 million loss from Quiet

Platforms.

- GAAP diluted EPS of $0.42 includes an approximately $1 million

addback to net income of interest expense associated with the

company’s convertible notes.

- GAAP average diluted shares outstanding were 196 million

including 8 million shares of unrealized dilution associated with

the company’s convertible notes

Inventory

Total ending inventory at cost increased 8% to $798 million

compared to $740 million last year, with units up 7%. This reflects

a meaningful improvement from last quarter’s increase of 36%,

reflecting actions to bring receipts more in line with demand.

Inventory is current for the holiday season. The company continues

to expect fourth quarter ending inventory to be down to last

year.

Capital Expenditures

Capital expenditures totaled $71 million in the third quarter

and $199 million year-to-date. Management continues to expect

full-year spend to approximate $250 million.

Quiet Platforms

The logistics subsidiary is providing significant operational

efficiencies and needed capacity for our brands. The third party

customer base is ramping up as other brands look to upgrade their

supply chain operations and drive efficiencies across their

business to better compete in the current retail environment. As we

evaluate our plans for Quiet, we are exploring different options to

support future growth.

Shareholder Returns

The quarterly cash dividend remains paused to support financial

flexibility, while navigating the near-term macro environment.

Year-to-date, the company has returned $265 million in cash to

shareholders through dividends and share repurchases, reflecting

its highest level of returns since 2015.

Outlook

For the fourth quarter, the company is guiding brand revenue

down in the mid single digits, and expects brand comps to be

consistent with the third quarter. The company is also guiding

fourth quarter gross margin in the range of 32% to 33%, at the

higher end of previous guidance. While significant progress has

been made in right-sizing inventory, management is taking a

cautious view given what is likely to be a highly promotional

Holiday season.

Management continues to drive expense reductions across store

payroll, corporate expense, professional services and advertising.

The company remains on track to deliver $100 million in reductions

to the original plan and expects SG&A dollars in the fourth

quarter to be approximately flat to last year.

Conference Call and Supplemental Financial

Information

Management will host a conference call and real time webcast

today at 11:00 a.m. Eastern Time. To listen to the call, dial

1-877-407-0789 or internationally dial 1-201-689-8562 or go to

www.aeo-inc.com to access the webcast and audio replay.

Additionally, a financial results presentation is posted on the

company’s website.

* * * *

About American Eagle Outfitters, Inc.

American Eagle Outfitters, Inc. (NYSE: AEO) is a leading global

specialty retailer offering high-quality, on-trend clothing,

accessories and personal care products at affordable prices under

its American Eagle® and Aerie® brands. Our purpose is to show the

world that there’s REAL power in the optimism of youth. The company

operates stores in the United States, Canada, Mexico, Hong Kong and

Japan, and ships to 81 countries worldwide through its websites.

American Eagle and Aerie merchandise also is available at more than

260 international locations operated by licensees in 26 countries.

In 2022, AEO released its first annual Building a Better World

report, which outlines two decades of ESG achievements through the

company’s Planet, People and Practices initiatives. For more

information, please visit www.aeo-inc.com.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995

This release and related statements by management contain

forward-looking statements (as such term is defined in the Private

Securities Litigation Reform Act of 1995), which represent our

expectations or beliefs concerning future events, including fourth

quarter and annual fiscal 2022 results. All forward-looking

statements made by the company involve material risks and

uncertainties and are subject to change based on many important

factors, some of which may be beyond the company’s control. Words

such as "estimate," "project," "plan," "believe," "expect,"

"anticipate," "intend," “potential,” and similar expressions may

identify forward-looking statements. Except as may be required by

applicable law, we undertake no obligation to publicly update or

revise any forward-looking statements whether as a result of new

information, future events or otherwise and even if experience or

future changes make it clear that any projected results expressed

or implied therein will not be realized. The following factors, in

addition to the risks disclosed in Item 1A., Risk Factors, of our

Annual Report on Form 10-K for the fiscal year ended January 29,

2022 and in any other filings that we may make with the Securities

and Exchange Commission in some cases have affected, and in the

future could affect, the company's financial performance and could

cause actual results for fiscal 2022 and beyond to differ

materially from those expressed or implied in any of the

forward-looking statements included in this release or otherwise

made by management: the negative impacts of the COVID-19 pandemic

and related operational disruptions; the risk that the company’s

operating, financial and capital plans may not be achieved; our

inability to anticipate customer demand and changing fashion trends

and to manage our inventory commensurately; seasonality of our

business; our inability to achieve planned store financial

performance; our inability to react to raw material cost, labor and

energy cost increases; our inability to gain market share in the

face of declining shopping center traffic; our inability to respond

to changes in e-commerce and leverage omni-channel demands; our

inability to expand internationally; difficulty with our

international merchandise sourcing strategies; challenges with

information technology systems, including safeguarding against

security breaches; and global economic, public health, social,

political and financial conditions, and the resulting impact on

consumer confidence and consumer spending, as well as other changes

in consumer discretionary spending habits, which could have a

material adverse effect on our business, results of operations and

liquidity.

AMERICAN EAGLE OUTFITTERS, INC. CONSOLIDATED BALANCE

SHEETS (Dollars in thousands) (unaudited)

October 29,

2022 January 29, 2022 October 30, 2021

Assets Current assets: Cash and cash equivalents $

82,133

$

434,770

$

740,668

Merchandise inventory

797,731

553,458

739,808

Accounts receivable, net

250,879

286,683

228,461

Prepaid expenses and other

146,362

122,013

66,593

Total current assets

1,277,105

1,396,924

1,775,530

Operating lease right-of-use assets

1,148,832

1,193,021

1,148,108

Property and equipment, at cost, net of accumulated depreciation

789,809

728,272

665,408

Goodwill, net

271,209

271,416

16,389

Intangible assets, net

96,530

102,701

52,943

Non-current deferred income taxes

34,135

44,167

57,753

Other assets

54,857

50,142

33,884

Total assets $

3,672,477

$

3,786,643

$

3,750,015

Liabilities and Stockholders' Equity Current liabilities:

Accounts payable $

188,448

$

231,782

$

314,561

Current portion of operating lease liabilities

332,160

311,005

299,693

Unredeemed gift cards and gift certificates

47,531

71,365

42,070

Accrued compensation and payroll taxes

36,436

141,817

123,588

Accrued income taxes and other

13,056

16,274

33,570

Other current liabilities and accrued expenses

67,799

70,628

56,090

Total current liabilities

685,430

842,871

869,572

Non-current liabilities: Non-current operating lease liabilities

1,089,710

1,154,481

1,123,681

Long-term debt, net

411,911

341,002

336,249

Other non-current liabilities

22,894

24,617

23,816

Total non-current liabilities

1,524,515

1,520,100

1,483,746

Commitments and contingencies

-

-

-

Stockholders' equity: Preferred stock

-

-

-

Common stock

2,496

2,496

2,496

Contributed capital

389,726

636,355

627,264

Accumulated other comprehensive loss

(41,267

)

(40,845

)

(39,049

)

Retained earnings

2,080,852

2,203,772

2,185,393

Treasury stock

(969,275

)

(1,378,106

)

(1,379,407

)

Total stockholders' equity

1,462,532

1,423,672

1,396,697

Total liabilities and stockholders' equity $

3,672,477

$

3,786,643

$

3,750,015

Current ratio

1.86

1.66

2.04

AMERICAN EAGLE OUTFITTERS, INC. CONSOLIDATED STATEMENTS

OF OPERATIONS (Dollars and shares in thousands, except per

share amounts) (unaudited)

GAAP Basis 13 Weeks

Ended

October 29,

2022

% of

Revenue

October 30,

2021

% of

Revenue

Total net revenue $

1,240,583

100.0

%

$

1,274,078

100.0

%

Cost of sales, including certain buying, occupancy andwarehousing

expenses

760,810

61.3

%

709,554

55.7

%

Gross profit

479,773

38.7

%

564,524

44.3

%

Selling, general and administrative expenses

311,101

25.1

%

313,890

24.6

%

Depreciation and amortization expense

51,124

4.1

%

40,947

3.2

%

Operating income

117,548

9.5

%

209,687

16.5

%

Interest expense, net

3,878

0.3

%

8,612

0.7

%

Other expense (income), net

782

0.1

%

(3,130

)

-0.2

%

Income before income taxes

112,888

9.1

%

204,205

16.0

%

Provision for income taxes

31,616

2.5

%

51,981

4.1

%

Net income $

81,272

6.6

%

$

152,224

11.9

%

Net income per basic share $

0.44

$

0.91

Net income per diluted share $

0.42

$

0.74

Weighted average common shares outstanding - basic

186,305

167,637

Weighted average common shares outstanding - diluted

195,776

205,013

GAAP Basis 39 Weeks Ended

October 29,

2022

% of

Revenue

October 30,

2021

% of

Revenue

Total net revenue $

3,493,745

100.0

%

$

3,502,848

100.0

%

Cost of sales, including certain buying, occupancy andwarehousing

expenses

2,255,929

64.5

%

1,999,743

57.1

%

Gross profit

1,237,816

35.5

%

1,503,105

42.9

%

Selling, general and administrative expenses

917,687

26.3

%

872,320

24.9

%

Depreciation and amortization expense

146,664

4.2

%

119,674

3.4

%

Operating income

173,465

5.0

%

511,111

14.6

%

Debt related charges

60,066

1.7

%

-

0.0

%

Interest expense, net

11,887

0.3

%

26,038

0.7

%

Other income, net

(5,501

)

-0.2

%

(6,354

)

-0.2

%

Income before income taxes

107,013

3.2

%

491,427

14.1

%

Provision for income taxes

36,466

1.2

%

122,226

3.6

%

Net income $

70,547

2.0

%

$

369,201

10.5

%

Net income per basic share $

0.39

$

2.20

Net income per diluted share $

0.36

$

1.78

Weighted average common shares outstanding - basic

178,637

168,062

Weighted average common shares outstanding - diluted

207,499

207,032

AMERICAN EAGLE OUTFITTERS, INC. BASIC AND DILUTED

EARNINGS PER SHARE RECONCILIATION (Dollars and shares in

thousands) (unaudited)

13 Weeks Ended 39 Weeks

Ended Numerator: October 29, 2022 October 30,

2021 October 29, 2022 October 30, 2021 Net income

and numerator for basic EPS

$

81,272

$

152,224

$

70,547

$

369,201

Add: Interest expense, net of tax, related to the 2025 Notes (1)

529

-

4,897

-

Numerator for diluted EPS

$

81,801

$

152,224

$

75,444

$

369,201

Denominator: Denominator for basic EPS - weighted

average shares

186,305

167,637

178,637

168,062

Add: Dilutive effect of the 2025 Notes (1)

8,418

33,687

27,280

34,616

Add: Dilutive effect of stock options and non-vested restricted

stock

1,053

3,689

1,582

4,354

Denominator for diluted EPS - adjusted weighted average shares

195,776

205,013

207,499

207,032

(1) During the 39 weeks ended October 29, 2022, the

Company adopted ASU 2020-06 under the modified retrospective

method, which requires the Company to utilize the "if-converted"

method of calculated diluted EPS.

AMERICAN EAGLE OUTFITTERS,

INC. GAAP TO NON-GAAP RECONCILIATION (Dollars in

thousands, except per share amounts) (unaudited)

13 Weeks

Ended October 30, 2021 Interest expense, net

Net income Diluted earnings per common share GAAP

Basis

$

8,612

$

152,224

$

0.74

% of Revenue

0.7

%

11.9

%

Less: Convertible debt (1)

4,569

3,330

0.02

Non-GAAP Basis

$

4,043

$

155,554

$

0.76

% of Revenue

0.3

%

12.2

%

(1) Amortization of the non-cash discount on the Company's

convertible notes

AMERICAN EAGLE OUTFITTERS, INC. RESULTS

BY SEGMENT (Dollars in thousands) (unaudited)

American Eagle Aerie Corporate and Other (1)

Total 13 weeks ended October 29, 2022 Total net

revenue

$

837,575

$

349,712

$

53,296

$

1,240,583

Operating income (loss)

$

174,129

$

56,487

$

(113,068

)

$

117,548

% of revenue

20.8

%

16.2

%

9.5

%

Capital expenditures

$

20,477

$

24,404

$

26,626

$

71,507

13 weeks ended October 30, 2021 Total net revenue

$

940,992

$

315,049

$

18,037

$

1,274,078

Operating income (loss)

$

261,225

$

52,021

$

(103,559

)

$

209,687

% of revenue

27.8

%

16.5

%

16.5

%

Capital expenditures

$

13,298

$

24,867

$

20,036

$

58,201

American Eagle Aerie Corporate and Other

(1) Total 39 Weeks Ended October 29, 2022 Total

net revenue

$

2,301,051

$

1,043,129

$

149,565

$

3,493,745

Operating income (loss)

$

387,213

$

111,414

$

(325,162

)

$

173,465

% of revenue

16.8

%

10.7

%

5.0

%

Capital expenditures

$

55,000

$

85,663

$

58,701

$

199,364

39 Weeks Ended October 30, 2021 Total net revenue

$

2,513,700

$

947,851

$

41,297

$

3,502,848

Operating income (loss)

$

611,650

$

191,341

$

(291,880

)

$

511,111

% of revenue

24.3

%

20.2

%

14.6

%

Capital expenditures

$

36,093

$

48,164

$

60,148

$

144,405

(1) Corporate and Other includes revenue and operating

results of the Todd Snyder and Unsubscribed brands, and Quiet

Platforms (net of intersegment eliminations), which have been

identified as operating segments but are not material to disclose

as separate reportable segments. Corporate operating costs

represents certain costs that are not directly attributable to

another reportable segment.

AMERICAN EAGLE OUTFITTERS, INC.

STORE INFORMATION (unaudited)

Third Quarter

YTD Third Quarter

2022

2022

Consolidated stores at beginning of period

1,160

1,133

Consolidated stores opened during the period AE Brand (2)

8

19

Aerie (incl. OFFL/NE) (3)

16

51

Todd Snyder

-

1

Unsubscribed

-

1

Consolidated stores closed during the period AE Brand (2)

(5

)

(23

)

Aerie (incl. OFFL/NE) (3)

-

(3

)

Total consolidated stores at end of period

1,179

1,179

AE Brand (2)

876

Aerie (incl. OFFL/NE) (3)

292

Todd Snyder

6

Unsubscribed

5

Total gross square footage at end of period (in '000)

7,309

7,309

International license locations at end of period (1)

261

261

(1) International license locations (retail stores and

concessions) are not included in the consolidated store data or the

total gross square footage calculation. (2) AE Brand includes AE

stand alone locations, AE/Aerie side-by side locations, AE/OFFL/NE

side-by-side locations, and AE/Aerie/OFFL/NE side-by-side

locations. (3) Aerie (incl. OFFL/NE) includes Aerie stand alone

locations, OFFL/NE stand alone locations, and Aerie/OFFL/NE

side-by-side locations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221121005868/en/

Olivia Messina 412-432-3300 LineMedia@ae.com

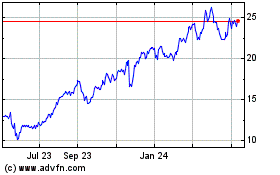

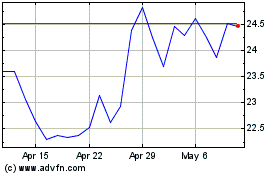

American Eagle Outfitters (NYSE:AEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Eagle Outfitters (NYSE:AEO)

Historical Stock Chart

From Apr 2023 to Apr 2024