- Announces quarterly dividend of $0.03 per share

- Announces $200 million share-repurchase authorization

- AMC’s most senior officers voluntarily choose to take immediate

salary and other compensation reductions in exchange for

out-of-the-money share equivalent grant

AMC Entertainment Holdings, Inc. (NYSE: AMC) (“AMC” or “the

Company”), the largest theatrical exhibition company in the world,

today announced that, in conjunction with an updated capital

allocation strategy, its Board of Directors has authorized the

taking of three major actions.

QUARTERLY DIVIDEND

The Company declared a dividend for the quarter ended December

31, 2019, of $0.03 per share on shares of Class A and Class B

common stock. The dividend is payable in cash on March 23, 2020, to

shareholders of record on March 9, 2020. While the Company has

ample cash and liquidity currently to pay a higher dividend for the

just completed quarter, the Company believes that given recent

trading ranges for AMC shares, it is wiser to return cash to

shareholders in the form of share repurchases.

$200 MILLION COMPANY SHARE BUYBACK AUTHORIZATION

Concurrent with the decision to increase the proportion of

capital allocated to share buybacks, the Board has authorized up to

$200 million of Class A common stock repurchases over the next

three years.

AMC is committed to a balanced capital allocation approach to

achieve that highest long-term risk adjusted return for

shareholders. This includes investing in the business, reducing

leverage, and returning cash to shareholders through either

dividends or share buybacks. After reviewing the company’s capital

allocation strategy, the Board has determined that there is an

opportunity to enhance shareholder returns by increasing the

proportion of capital allocated to deleveraging and to share

buybacks. The dividend decrease of $0.17 per share compared to the

fourth quarter of 2018, reduces the total dividend payout for the

quarter by approximately $18.0 million, providing capital that can

be deployed towards share purchases and the decrease of net

debt.

Repurchases may be made at management’s discretion from time to

time through open market transactions including block purchases,

through privately negotiated transactions, or otherwise over the

next three years in accordance with all applicable securities laws

and regulations. The extent to which AMC repurchases its shares,

and the timing of such repurchases, will depend upon a variety of

factors, including liquidity, capital needs of the business, market

conditions, regulatory requirements and other corporate

considerations, as determined by AMC’s management team. Repurchases

may or may not be made under a Rule 10b5-1 plan, which would permit

common stock to be repurchased when the Company might otherwise be

precluded from doing so under insider trading laws. The repurchase

program does not obligate the Company to repurchase any minimum

dollar amount or number of shares and may be suspended for periods

or discontinued at any time. The Company had approximately 52.5

million shares of Class A common stock outstanding as of February

21, 2020.

SENIOR OFFICERS TAKE IMMEDIATE PAY REDUCTIONS IN EXCHANGE FOR

OUT-OF-THE-MONEY SHARE EQUIVALENT GRANTS

Believing that AMC shares are significantly undervalued, all of

the relevant senior officers of AMC have voluntarily signed on to a

new compensation program dependent on a one-time share equivalent

grant that is considerably out-of-the-money at present.

The current total target compensation of AMC’s participating

senior officers will be immediately reduced by an amount equal to

the sum of 15% of their cash salaries plus 15% of their target cash

bonus opportunity. This compensation decrease will be split into

thirds and applied evenly as reductions across each of three

categories: one-third lowering combined cash salary & cash

bonus, one-third lowering at-market restricted share equivalent

grant amounts that time vest and one-third lowering at-market

performance share equivalent grant amounts that vest based on

performance. Importantly, these sacrifices in lowered cash salary

and cash bonus, as well as in lowered restricted share equivalent

grant and performance share equivalent grant levels, will continue

at the new lower totals in each of the coming three years.

In exchange, the officers reducing their pay will receive now a

one-time grant of AMC share equivalents that with certain

exceptions has a 3-year time vesting provision and requires that

the AMC share price rise materially in order for vesting to occur.

This share equivalent grant is split into six equal tranches.

Initial vesting will not occur until the AMC share price recovers

on a 20-day VWAP basis to $12 per share, a 102% premium to

yesterday’s market close. The second tranche will vest only when

the AMC share price rises to $16, a 170% premium. The third tranche

vests at $20, a 237% premium. The subsequent tranches vest at $24,

$28 and $32, premiums of 305%, 372%, and 440% respectively.

All of the Company’s senior officers have signed on to this

program, excepting only those who are expected to retire prior to

the 3-year time vesting requirement. Twelve long-time existing

senior officers, led by the Company’s CEO and President, are taking

the aforementioned pay reductions. Two recent new-hire officers

agreed to lower compensation than they were earning previously

elsewhere in order to join AMC and to receive their

out-of-the-money share equivalent grants. The recently announced

out-of-the-money share equivalent grant of the Company’s new Chief

Financial Officer will be homogenized with the various vesting

requirements for all in the senior officer corps described

herein.

While the total compensation reductions equal to 15% of cash

salary and cash bonus as detailed here are envisioned to be in

effect for each of calendar years 2020, 2021 and 2022, the

Compensation Committee of the AMC Board of Directors will retain

its complete flexibility to set future compensation levels for any

individual AMC officer or officers as it sees fit at its sole

discretion. More detail on this program will be contained in an 8-k

filing by the Company.

Commenting on the out-of-the-money share equivalent grant

program, AMC CEO and President Adam Aron said, “All the relevant

senior officers of AMC have deep conviction about AMC’s future, and

therefore each of us is putting our money where our mouth is. We

are voluntarily and enthusiastically trading immediate reductions

in current cash salary and cash bonus dollars along with reductions

in current at-market share equivalent grants in exchange for AMC

stock that will not vest until the AMC share price approximately

doubles and triples or more. We have every confidence that will

occur and will be doing all in our power to make that happen.”

About AMC Entertainment Holdings, Inc.

AMC is the largest movie exhibition company in the United

States, the largest in Europe and the largest throughout the world

with more than 1,000 theatres and more than 11,000 screens across

the globe. AMC has propelled innovation in the exhibition industry

by: deploying its Signature power-recliner seats; delivering

enhanced food and beverage choices; generating greater guest

engagement through its loyalty and subscription programs, web site

and mobile apps; offering premium large format experiences and

playing a wide variety of content including the latest Hollywood

releases and independent programming. AMC operates among the most

productive theatres in the United States' top markets, having the

#1 or #2 market share positions in 21 of the 25 largest

metropolitan areas of the United States. AMC is also #1 or #2 in

market share in 12 of the 15 countries it serves in North America,

Europe and the Middle East. For more information, visit

www.amctheatres.com.

Website Information

This press release, along with other news about AMC, is

available at www.amctheatres.com. We routinely post information

that may be important to investors in the Investor Relations

section of our website, www.investor.amctheatres.com. We use this

website as a means of disclosing material, non-public information

and for complying with our disclosure obligations under Regulation

FD, and we encourage investors to consult that section of our

website regularly for important information about AMC. The

information contained on, or that may be accessed through, our

website is not incorporated by reference into, and is not a part

of, this document. Investors interested in automatically receiving

news and information when posted to our website can also visit

www.investor.amctheatres.com to sign up for E-mail Alerts.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“forecast,” “plan,” “estimate,” “will,” “would,” “project,”

“maintain,” “intend,” “expect,” “anticipate,” “prospect,”

“strategy,” “future,” “likely,” “may,” “should,” “believe,”

“continue,” “opportunity,” “potential,” and other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters. These

forward-looking statements are based on information available at

the time the statements are made and/or management’s good faith

belief as of that time with respect to future events, and are

subject to risks, trends, uncertainties and other facts that could

cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. These

risks, trends, uncertainties and facts include, but are not limited

to, risks related to: the timing, price, or amount of repurchases,

if any, under the Company’s share repurchase program; general

volatility of the capital markets and the market price of the

Company’s Class A common stock; motion picture production and

performance; AMC’s lack of control over distributors of films;

intense competition in the geographic areas in which AMC operates;

AMC Stubs A-List may not meet anticipated revenue projections which

could negatively impact projected operating results; increased use

of alternative film delivery methods or other forms of

entertainment; shrinking exclusive theatrical release windows;

general and international economic, political, regulatory and other

risks, including risks related to the United Kingdom’s exit from

the European Union or widespread health emergencies, such as the

novel coronavirus or other pandemics or epidemics; risks and

uncertainties relating to AMC’s significant indebtedness; AMC’s

ability to execute cost cutting and revenue enhancement

initiatives; box office performance; limitations on the

availability of capital; certain covenants in the agreements that

govern AMC’s indebtedness may limit its ability to take advantage

of certain business opportunities; AMC’s ability to refinance its

indebtedness on favorable terms; optimizing AMC’s theatre circuit

through construction and the transformation of its existing

theatres may be subject to delay and unanticipated costs; failures,

unavailability or security breaches of AMC’s information systems;

risks relating to impairment losses, including with respect to

goodwill and other intangibles, and theatre and other closure

charges; AMC’s ability to utilize interest expense deductions,

interest deduction carry forwards and net operating loss

carryforwards to reduce its future tax liability or valuation

allowances taken with respect to deferred tax assets; our ability

to recognize certain international deferred tax assets which do not

have a valuation allowance recorded; review by antitrust

authorities in connection with acquisition opportunities; risks

relating to the incurrence of legal liability including costs

associated with recently filed class action lawsuits; general

political, social and economic conditions and risks, trends,

uncertainties and other factors discussed in the reports AMC has

filed with the SEC. Should one or more of these risks, trends,

uncertainties or facts materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by the forward-looking

statements contained herein. Accordingly, you are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date they are made. Forward-looking statements

should not be read as a guarantee of future performance or results

and will not necessarily be accurate indications of the times at,

or by, which such performance or results will be achieved. For a

detailed discussion of risks, trends and uncertainties facing AMC,

see the section entitled “Risk Factors” in AMC’s reports on Forms

10-K and Form 10-Q filed with the SEC, and the risks, trends and

uncertainties identified in its other public filings. AMC does not

intend, and undertakes no duty, to update any information contained

herein to reflect future events or circumstances, except as

required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200227005928/en/

INVESTOR RELATIONS: John Merriwether, 866-248-3872

InvestorRelations@amctheatres.com MEDIA CONTACT: Ryan

Noonan, (913) 213-2183 rnoonan@amctheatres.com

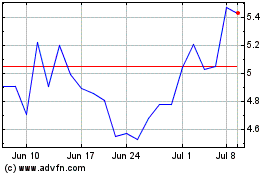

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

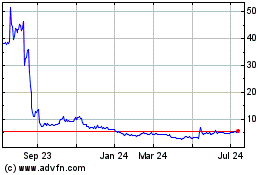

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024