SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of May, 2019

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

AMBEV S.A.

CNPJ [National Register of Legal Entities] No. 07.526.557/0001-00

NIRE [Corporate Registration Identification Number] 35.300.368.941

(“

Company

”)

Extract of the Minutes of the Meeting of the Board of Directors of Ambev S.A. held on May 15, 2019, drawn up in summary form

1.

Date, Time and Venue

.

On May 15, 2019, starting at 08:30 a.m., at

Av. Macacha Guemes

, 351, Puerto Madero, Buenos Aires, Argentina.

2.

Call and Attendance

.

Call notice duly made pursuant to the Company’s bylaws. Meeting with attendance of

Messrs.

Victorio Carlos De Marchi and Carlos Alves de Brito, copresidents, and Messrs. Milton Seligman,

Roberto Moses Thompson Motta, Vicente Falconi Campos, Nelson José Jamel, Antonio Carlos Augusto Ribeiro Bonchristiano and Marcos de Barros Lisboa.

3.

Board

.

Chairman: Victorio Carlos De Marchi; Secretary: Letícia Rudge Barbosa Kina.

4.

Resolutions

.

It was unanimously and unrestrictedly resolved by the Directors who joined the meeting:

4.1.

Manual on Disclosure and Use of Information and Securities Trading Policy

. To approve the changes to the “Manual on Disclosure and Use of Information and Securities Trading Policy”, according to the draft which was initialed by the board and filed at the Company's headquarters.

4.2.

Equity Swap

. To approve the execution of equity swap agreements, by and between the Company, or a

controlled entity

, and financial institutions - to be determined by the Board of Officers, with reference in the shares issued by the Company or

ADRs referenced in such shares, according to the terms provided on

Exhibit I

to this minutes, prepared pursuant to article 5 of CVM Ruling No. 567/15 and Annex 30-XXXVI of CVM Ruling No. 480/09, without prejudice to the liquidation, within the regulatory term, of the agreements still in force as authorized at the Board of Directors. The agreements hereby authorized may result in an exposure of up to 80 million common shares (of which all or part may be through ADRs), with a limit value of up to R$1.5 billion and, together with the

balance of the agreements executed, as approved by the Board of Directors and not yet settled, do not exceed the limit set forth on article 8 of CVM Ruling No. 567/15.

5.

Closure

.

With no further matters to be discussed, these Minutes hereof were drawn up and duly executed

.

São Paulo, May 15, 2019.

|

/s/ Victorio Carlos De Marchi

|

/s/

Carlos Alves de Brito

|

|

/s/ Milton Seligman

|

/s/

Roberto Moses Thompson Motta

|

|

/s/ Vicente Falconi Campos

|

/s/ Nelson José Jamel

|

|

/s/ Antonio Carlos Augusto Ribeiro Bonchristiano

|

/s/ Marcos de Barros Lisboa

|

|

|

/s/

Letícia Rudge Barbosa Kina

Secretary

|

Exhibit I

Trading in Shares of its Own Issue

1. Purpose and the expected economic effects of the disposal:

The Company has share-based payment programs that allow the directors, officers or employees of the Company or of its direct or indirect controlled entities, to receive compensation based on shares issued by the Company, under certain conditions.

Through the approved equity swap transaction, the Company, or its controlled entities, will receive the price variation related to the shares issued by the Company or to the American Depositary Receipts representing such shares (“ADRs”) issued by the Company and traded on the stock exchange, aiming to neutralize the possible effects of the stock prices’ oscillation considering the share-based payment programs of the Company.

2. To inform the number of (i) outstanding shares and (ii) shares already held in treasury:

There are

343,742.744

outstanding shares, in accordance with the definition provided by article 8, paragraph 3, of CVM Ruling No. 567/2015. The Company (and its controlled entities) holds

369,550

shares in treasury.

3. To inform the number of shares that may be purchased or disposed of:

As the transaction involves equity swap, with exclusive financial settlement, there will not be any purchase or disposal of shares neither ADRs by the Company or its controlled entities. The contracts may result in an exposure of up to 80 million common shares (of which all or part may be through ADRs), with a limit value of up to R$ 1.5 billion and, together with the balance of the agreements executed in the context of the approvals of December 21

st

, 2017, May 15

th

, 2018 and Dezember 20

th

, 2018 and not yet settled, may result in an exposure of up to

210,784,853

common shares.

4. To describe the main characteristics of the derivative instruments that the Company may use, if any:

The equity swap allows the Company or its controlled entities to receive the price variation related to its shares traded on the stock exchange or ADRs and pay CDI or LIBOR plus a fee, during the term of the relevant agreement, as applicable. Such agreements will be financially settled and will be negotiated on the over-the-counter market.

These instruments may provide that, in the event of a share price depreciation of 50% or more, the contracted financial institutions may terminate the relevant agreements. To the Company shall be guaranteed the option to terminate the contracts at any time, at its sole discretion.

5. To describe, if any, any agreements or voting guidelines that exist between the company and the counterparty of the transactions:

The Company, or its controlled entities, will not enter into the equity swap with persons with whom it has voting agreements or guidelines, nor intend to enter into such agreements or guidelines with the counterparty in the equity swap.

6. In case of transactions processed outside organized securities markets, to inform:

a. the maximum (minimum) price by which the shares will be acquired (sold); and

b. if applicable, the reasons justifying the operation at prices more than 10% (ten percent) higher, in the case of acquisition, or more than 10% (ten percent) lower, in the case of sale, to the average of the quoted price, weighted by the volume, in the previous 10 (ten) trading sessions;

Payments made or received by the Company or its controlled entities will be determined on the variation of the share price (or ADR) between certain periods, and the

underlying

price of the shares (or ADR) in the initial term of each of these periods will not be more than 10% higher or 10% lower than the average of the quoted price, weighted by the volume, in the previous 10 trading sessions.

7. To inform, if any, the impacts that the trading will produce on the control composition or the administrative structure of the Company:

The operation will not have any impact on the control composition or of the administrative structure of the Company.

8. To identify the counterparties, if known, and, in case of a related party of the Company, as defined by the accounting rules, also provide the information required by article 8 of CVM Ruling No. 481/2009:

The equity swap counterparties shall be defined by the Company's Directors, but shall not be related parties to the Company.

9. To indicate the destination of the resources obtained, if applicable:

Due to the nature of the transaction, it is not possible to previously define whether or not the Company will receive resources. In case the Company receives resources, there is no predetermined destination for them.

10. To indicate the maximum term for settlement of the authorized operations:

The settlement of the approved equity swap transactions will

take place

within a maximum period of 18 months from this date,

i.e.

, up to November 15

th

, 2020.

11. To identify institutions that will act as intermediaries, if any:

Not applicable.

12. To specify the available resources to be used, in the form of article 7, paragraph 1, of CVM Ruling No. 567/2015:

Not applicable, as the equity swap transactions will not be

physically settled

.

13. To specify the reasons why the members of the Board of Directors are comfortable that the repurchase of shares will not affect the performance of the obligations assumed with creditors nor the payment of mandatory, fixed or minimum dividends.

The members of the Board of Directors believe that the Company's current financial situation is compatible with the contracting of equity swap operations under the approved conditions and are comfortable that the operation will not affect the Company's compliance regarding the obligations assumed with creditors, nor the payment of mandatory dividends calculated in accordance with the law and approved by the general meeting.

The purpose of the transaction is to neutralize the possible effects of any changes in the amounts to be spent in order to face the share-based payment programs, as a result of

stock prices’ oscillation

. This way, eventual disbursements made due to the variation of the share price will correspond to a lower cost in the purchase of shares (or ADRs) to be used in share-based payment programs, as well as the resources received will correspond to a higher cost in purchase of shares (or ADRs).

***

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 15, 2019

|

|

|

|

|

|

AMBEV S.A.

|

|

|

|

|

|

|

By:

|

/s/

Fernando Mommensohn Tennenbaum

|

|

|

Fernando Mommensohn Tennenbaum

Chief Financial and Investor Relations Officer

|

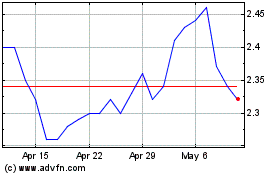

Ambev (NYSE:ABEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

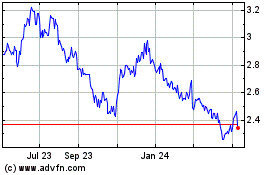

Ambev (NYSE:ABEV)

Historical Stock Chart

From Apr 2023 to Apr 2024