Adams Natural Resources Fund Declares Year-End Distribution; Exceeds Its Annual 6% Minimum Distribution Rate Commitment

November 10 2022 - 4:10PM

Adams Natural Resources Fund, Inc. (NYSE: PEO) declared today a

year-end distribution of $1.33 per share. The total distributions

by the Fund for 2022 will be $1.63, including the distributions

totaling $0.30 per share made prior to today’s announcement. The

annual distribution rate represented by these distributions is

8.1%.

The year-end distribution consists of the following:

- $0.53 per share from 2022 net investment income; and

- $0.80 per share from net capital

gains realized during 2022, of which $0.15 was short-term gain and

$0.65 was long-term gain.

This marks the 71st consecutive year that the Fund has paid out

capital gains and the 88th consecutive year it has paid out

dividends to its shareholders.

Commenting on the year-end distribution, Mark E. Stoeckle, CEO

of Adams Natural Resources Fund, said: “Once again, energy’s strong

performance over the year contributed positively to our long

history of providing a substantial distribution to our

shareholders. While future market conditions are uncertain, we are

pleased to announce our 2022 distribution rate of 8.1%. This

exceeds our commitment to distribute at least 6% of the Fund’s

trailing 12-month average month-end market price to

shareholders.”

The payable date for the distribution is December 16, 2022, the

record date is November 21, 2022, and the ex-dividend date is

November 18, 2022. The year-end distribution is payable in stock

and/or cash at the option of each shareholder.

Details regarding the annual distribution rates and the Fund’s

6% minimum distribution commitment can be found at

adamsfunds.com.

About Adams Funds

Since 1929, Adams Funds has consistently helped generations of

investors reach their investment goals. Adams Funds is comprised of

two closed-end funds, Adams Diversified Equity Fund, Inc. (NYSE:

ADX) and Adams Natural Resources Fund, Inc. (NYSE: PEO). The Funds

are actively managed by an experienced team with a disciplined

approach and have paid dividends for more than 80 years across many

market cycles. The Funds are committed to paying an annual

distribution rate of 6% or more, providing reliable income to

long-term investors. Shares can be purchased through our transfer

agent or through a broker. For more information about Adams Funds,

please visit: adamsfunds.com.

For further information contact us:

800.638.2479 │

adamsfunds.com/about/contact

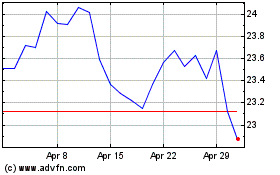

Adams Natural Resources (NYSE:PEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

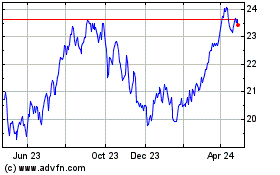

Adams Natural Resources (NYSE:PEO)

Historical Stock Chart

From Apr 2023 to Apr 2024