CNET Networks, Inc. (Nasdaq:CNET) today reported results for the

first quarter ended March 31, 2007. �CNET Networks� first quarter

results demonstrate our unique ability to build, grow, and monetize

media brands that serve millions of people across multiple areas of

passion,� said Neil Ashe, chief executive officer of CNET Networks.

�We operate some of the most influential brands in the world, and

are focused on realizing their potential, while at the same

identifying new opportunities for growth.� Total revenues for the

first quarter were $92.1 million, a 10 percent increase compared to

revenues of $83.7 million for the same period of 2006. Excluding

revenue generated by businesses closed in late 2006, total revenue

would have increased 15 percent in the first quarter of 2007.

Operating income totaled a loss of $8.5 million during the first

quarter of 2007 compared to an operating loss of $2.3 million in

the year ago quarter. Reported operating loss also reflects $4.4

million in costs related to the Company's recently concluded

restatement and stock option investigation and related ongoing

matters. Operating income before depreciation, amortization, and

stock compensation expense was $7.3 million for the first quarter

of 2007 compared to $10.0 million in the year ago quarter.

Excluding stock option investigation costs of $4.4 million,

operating income before depreciation, amortization, and stock

compensation expense was $11.8 million, an 18 percent increase

compared to $10.0 million during the first quarter of 2006. The

profit margin of operating income before depreciation,

amortization, and stock compensation expense was 8 percent as

compared to 12 percent in the first quarter of 2006. Excluding

stock option investigation costs, the profit margin of operating

income before depreciation, amortization, and stock compensation

expense was 13 percent compared to 12 percent in the year ago

quarter. Net cash provided by operating activities for the first

quarter of 2007 was $11.0 million, down from $29.2 million for the

first quarter of 2006. Free cash flow for the first quarter of 2007

was $3.8 million. Free cash flow is defined as cash flow from

operating activities less net capital expenditures. On a reported

basis, net loss for the first quarter of 2007 was a loss of $9.1

million, or $0.06 per diluted share. This compares with net loss of

$1.3 million, or $0.01 per diluted share during the first quarter

of 2006. Reported net loss for the first quarter of 2007 was

negatively impacted by $4.4 million in stock option investigation

costs. Excluding stock compensation expense, stock option

investigation costs, realized gains on investments and loss from

discontinued operations, adjusted net income for the first quarter

of 2007 was $474,000, or breakeven on a diluted share basis,

compared to $3.0 million, or $0.02 per diluted share, during the

same period of 2006. A reconciliation of the non-GAAP measures used

in this release to the most comparable GAAP measure and further

information regarding the Company's stock compensation expense,

discontinued operations and unusual gains are included in the

accompanying "Operating Loss Reconciliation" and "Reconciliation of

Loss from Unusual Items." Business Review �2007 is a transition

year for CNET Networks,� said Ashe. �We are strategically

well-positioned and making the changes necessary to thrive in the

evolving media landscape.� -- CNET Networks' global network of

Internet properties reached an average of 144 million unique

monthly users during the first quarter of 2007, an increase of 23

percent from the first quarter of 2006. Average daily page views

were over 81 million during the first quarter, down 18 percent from

the year-ago quarter. -- CNET Networks recently announced findings

from a proprietary research study designed to demystify influence,

social networks, and communication. Results provide new insights

about today's brokers of influence and information - who they are,

what motivates them, and how they share information and advice with

others. Building on the Company's foundation of industry-leading

research, this study provides a greater understanding of the role

these influencers play in shaping opinions and consideration. CNET

Networks is using these insights to create better opportunities for

its marketing partners to connect and activate these influential

audiences. -- During the first quarter, CNET Networks continued to

realize the potential of its existing brands with partnerships that

further extended brand reach and visibility, as well as added new

features that further allowed its properties to continue to

super-serve their passionate audiences. -- TV.com (www.tv.com) took

part in the launch of the CBS Interactive Audience Network, along

with other leading interactive companies. As part of the program,

TV.com will create an interactive environment for CBS's hit show,

CSI, that lets TV.com's 19 million users deepen their bonds with

the show and connect with other fans. Millions of people visit

TV.com each week to discuss CSI, and this partnership feeds the

TV.com audience's desire for more CSI content and a richer

interactive experience. -- CNET (www.cnet.com) had another

impressive showing at the annual 2007 International Consumer

Electronics Show. As the authoritative voice of the show, CNET

produced over 300 product reviews and over 80 video packages,

contributing to a 30 percent increase in product review pages from

the 2006 show and more than 2 million streams. In addition, CNET

editors were once again sought out by national and international

media, including CNN, CNBC, NBC Nightly News, National Public

Radio, and the BBC, to provide their expert, unbiased opinion on

the latest technology news, products, and trends. -- GameSpot

(www.gamespot.com) continued to be the premier destination for

gamers, delivering access to content and information about the most

anticipated games and exclusive coverage of key industry events.

GameSpot was selected as the exclusive North American partner for

the multi-phased Lord of the Rings Online Beta, distributing more

than 100,000 beta keys to gamers looking for exclusive sneak peaks

and game-related content directly from the developer. GameSpot also

provided extensive coverage of the Game Developers Conference (GDC)

in March, including exclusive coverage of the Sony keynote and the

GDC Awards, plus hundreds of game reviews, news and preview

articles, and videos that drove nearly one million streams. --

Internationally, we continue to have success with the introduction

of CNET Networks' leading U.S. brands to international markets.

GameSpot, which has launched in the UK, Japan, Australia and China,

and CNET, which has launched in Australia, France, and the UK, are

showing positive trends in their local markets. -- CNET Networks

continued to identify new opportunities for growth, launching BNET

(www.bnet.com), the latest addition to its business portfolio.

Launched in March, the completely new BNET delivers practical

insight and straightforward tools that address the challenges

business managers face every day. BNET now hosts the web's largest

non-IT business resource directory. The site gives marketers

another outlet to reach business professionals who are passionate

about keeping informed, building knowledge, and sharing insights to

master their lives at work. New charter sponsors include Sprint,

Verizon, Research in Motion, Dell, Adobe, and Dow Chemical. --

During the first quarter, CNET Networks continued to expand its

customer base, adding more general consumer advertisers to the

network. Advertiser renewal rates remained strong, with 96 percent

of CNET Networks' top 100 customers renewing during the quarter.

General consumer advertisers during the quarter included Procter

& Gamble, Daimler Chrysler, and Wrigley. By combining its broad

reach as one of the world's largest Internet properties, its

engagement with influential audiences around their areas of

passion, and the high level of service and attention it gives

consumers, CNET Networks is well positioned to gain further share

of general consumer dollars in 2007 and beyond. -- CNET Networks'

leading brands continued to gain recognition from outside sources

for its leadership and expertise. Avenue A / Razorfish, a leading

advertising agency, recognized CNET as "Publisher of the Year" in

the Technology Category. The distinction is given to publishers who

have the best combination of audience, service, performance and

creativity, and is part of Avenue A / Razorfish's 2007 Digital

Outlook Report. CNET TV also received two winner and two finalist

awards in the Television News category by the Aegis Video &

Film Production Awards, the industry's premier competition for peer

recognition of outstanding video productions and non-network TV

commercials. Business Outlook For the second quarter of 2007,

management anticipates total revenues of $97 million to $102

million. Including approximately $5.5 million in non-cash stock

compensation expense, management estimates an operating income in

the range of a loss of $3.0 million to income of $1.0 million for

the second quarter. Management expects operating income before

depreciation, amortization, and stock compensation expense of

between $13 million and $17 million for the quarter. Including

stock compensation expense of approximately $0.04 per diluted

share, earnings per share is expected to be in the range of a loss

of $0.03 to breakeven in the second quarter. For 2007, management

estimates total annual revenues to be in the range of $425 million

to $445 million. Including $23 million in stock compensation

expense, management estimates operating income between $23 million

and $38 million. Management expects operating income before

depreciation, amortization and stock compensation expense to be

between $90 million and $105 million. Including stock compensation

expense of approximately $0.15 per diluted share and tax benefit of

approximately $1.23 per share related to the potential release of a

portion of the company�s deferred tax valuation allowance in the

fourth quarter of 2007, earnings per share is expected to be in the

range of $1.37 to $1.47 for the year. Operating income guidance for

the second quarter and full-year 2007 does not consider ongoing

fees associated with the Company's stock option investigation. More

detailed guidance, as well as a table that reconciles operating

income before depreciation, amortization, and stock compensation

guidance to operating income (loss) guidance can be found on the

"Guidance to the Investment Community" sheet that accompanies this

press release. Conference Call and Webcast CNET Networks will host

a conference call to discuss its first quarter financial results

and business outlook beginning at 5:00 pm ET (2:00 pm PT), today,

April 26, 2007. To listen to the discussion, please visit

http://ir.cnetnetworks.com and click on the link provided for the

webcast conference call or dial (800) 344-1035 (international

dial-in: (706) 679-3076). A replay of the conference call will be

available via webcast at the URL listed above or by calling (800)

642-1687 (international dial-in: (706) 645-9291) and entering the

conference ID number 4227514. The Company's past financial news

releases, related financial and operating information, and access

to all Securities and Exchange Commission filings, can also be

accessed at http://ir.cnetnetworks.com. Safe Harbor This press

release and its attachments include forward-looking information and

statements that are subject to risks and uncertainties that could

cause actual results to differ materially. These forward-looking

statements include the statements under the sections entitled

"Business Outlook" and "Guidance to the Investment Community" which

set forth our estimated financial performance for the second

quarter and full year of 2007, and statements regarding our growth

prospects and expectations regarding the future success of our

products and services. In addition, management expects to provide

forward-looking information statements on the conference call to be

held shortly following the issuance of this release, which are also

subject to risks and uncertainties that could cause actual results

to differ materially. The forward-looking statements in this

release and on the conference call are identified by the words

"expect," "estimate," "target," "believe," "goal," "anticipate,"

"intend" and similar expressions or are otherwise identified in the

context in which they are made as being forward-looking. These

statements are only effective as of the date of this release and we

undertake no duty to publicly update these forward-looking

statements, whether as a result of new information, future

developments or otherwise. The risks and uncertainties that could

cause actual results to differ materially from those projected

include: a lack of growth or a decrease in marketing spending on

the Internet due to failure of marketers to adopt the Internet as

an advertising medium at the rate that we currently anticipate; a

lack of growth or decrease in marketing spending on CNET Networks'

properties in particular, which could be prompted by competition

from other media outlets, both on and off the Internet;

dissatisfaction with CNET Networks' services, or economic

difficulties in our clients' businesses; an increase in the

competitiveness of the market for qualified employees or changes in

our stock price or volatility, both of which could increase our

estimated stock compensation expenses for 2007; economic conditions

such as weakness in corporate or consumer spending, which could

prompt a reduction in overall advertising expenditures or

expenditures specifically on our properties; the failure of

existing advertisers to meet or renew their advertising commitments

as we anticipate, which would cause us to not meet our financial

projections; the failure to attract advertisers outside of our

traditional technology and consumer electronics categories, which

would cause us to not meet our financial projections; a continued

decline in revenues from our print publications as advertising

dollars shift to other media; the acquisition of businesses or the

launch of new lines of business, which could decrease our cash

position, increase operating expense, and dilute operating margins;

an increase in intellectual property licensing fees, which could

increase operating expense, including amortization; the risk of

future impairment of our intangible assets, goodwill or investments

based on a decline in our business or investments; and general

risks associated with our business. For additional discussion

regarding the risks related to CNET Networks' business, see its

Annual Report on Form 10-K for the year ended December 31, 2006

delete and subsequent Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K, including disclosures under the captions "Risk

Factors" and "Management's Discussion and Analysis of Financial

Conditions and Results of Operations," which are filed with the

Securities and Exchange Commission and are available on the SEC's

website at www.sec.gov. About CNET Networks, Inc. CNET Networks,

Inc. (Nasdaq:CNET)(www.cnetnetworks.com) is an interactive media

company that builds brands for people and the things they are

passionate about, such as gaming, music, entertainment, technology,

business, food, and parenting. The Company's leading brands include

CNET, GameSpot, TV.com, MP3.com, Webshots, CHOW, UrbanBaby, ZDNet,

BNET, and TechRepublic. Founded in 1992, CNET Networks has a strong

presence in the US, Asia, and Europe. (1) CNET Networks Internal

Log Data, January 2007 to March 2007. Consolidated Statements of

Operations Unaudited (in thousands, except per share data) Three

Months Ended March 31, 2007� 2006� � Revenues $ 92,097� $ 83,650� �

Operating expenses: Cost of revenues (1) 43,482� 41,419� Sales and

marketing (1) 25,926� 22,963� General and administrative (1)

16,080� 14,029� Stock option investigation and related matters

4,429� -� Depreciation 7,489� 4,822� Amortization of intangible

assets 3,220� 2,739� Total operating expenses 100,626� 85,972� �

Operating loss (8,529) (2,322) � Non-operating income (expense):

Realized gains on investments -� 500� Interest income 638� 1,152�

Interest expense (1,346) (659) Other, net 301� 140� Total

non-operating income (expense) (407) 1,133� Loss from continuing

operations before income taxes (8,936) (1,189) Income tax expense

182� 76� Loss from continuing operations (9,118) (1,265) Loss from

discontinued operations -� (37) � Net loss $ (9,118) $ (1,302) �

Basic and diluted net loss per share $ (0.06) $ (0.01) � Shares

used in calculating basic and diluted net loss per share 150,386�

148,733� � (1) Includes stock compensation expense, which was

allocated as follows: Cost of revenues $ 1,765� $ 1,964� Sales and

marketing 843� 896� General and administrative 2,555� 1,896� $

5,163� $ 4,756� � Consolidated Balance Sheets Unaudited (in

thousands) March 31, December 31, 2007� 2006� ASSETS Current

Assets: Cash and cash equivalents $ 45,282� $ 31,327� Investments

in marketable debt securities 24,881� 30,372� Accounts receivable,

net 76,190� 89,265� Other current assets 12,740� 10,512� Total

current assets 159,093� 161,476� � Investments in marketable debt

securities 2,500� 13,915� Restricted cash 2,216� 2,200� Property

and equipment, net 75,719� 72,625� Other assets 15,685� 15,554�

Intangible assets, net 35,981� 34,978� Goodwill 140,888� 133,059�

Total assets $ 432,082� $ 433,807� � LIABILITIES AND STOCKHOLDERS'

EQUITY Current liabilities: Accounts payable $ 7,831� $ 10,055�

Accrued liabilities 51,989� 80,335� Revolving credit facility

60,000� 60,000� Current portion of long-term debt 11,521� 13,850�

Total current liabilities 131,341� 164,240� Commitments and

contingencies Non-current liabilities: Long-term debt 5,483� 4,498�

Other liabilities 4,325� 726� Total liabilities 141,149� 169,464� �

Stockholders' equity: Common stock; 400,000 shares authorized;

152,546 outstanding at March 31, 2007 and 151,315 outstanding at

December 31, 2006 � � 15� 15� Additional paid-in-capital 2,892,237�

2,857,238� Accumulated other comprehensive loss (10,909) (11,357)

Treasury stock, at cost; 1,510 shares outstanding at March 31, 2007

and December 31, 2006 (30,453) (30,453) Cumulative effect on

retained earnings due to change in accounting principle 261� -�

Accumulated deficit (2,560,218) (2,551,100) Total stockholders'

equity 290,933� 264,343� Total liabilities and stockholders' equity

$ 432,082� $ 433,807� � Statements of Cash Flows Unaudited (in

thousands) Three Months ended March 31, 2007� 2006� Cash flows from

operating activities: Net loss $ (9,118) $ (1,302) Adjustments to

reconcile net loss to net cash provided by operating activities: �

Depreciation and amortization 10,709� 7,561� Noncash stock

compensation expense 5,163� 4,756� Asset disposals -� 52� Noncash

interest expense (59) (126) Provision for doubtful accounts 363�

837� Gain on sale of business, net -� (778) Gains on sales of

privately held investments -� (500) Changes in operating assets and

liabilities, net of acquisitions: Accounts receivable 13,611�

19,727� Other assets (2,992) 3,211� Accounts payable (2,573) (217)

Accrued liabilities (3,298) (4,010) Other liabilities (770) (33)

Net cash provided by operating activities 11,036� 29,178� � Cash

flows from investing activities: Purchase of marketable debt

securities (6,372) (18,043) Proceeds from sales of marketable debt

securities 24,161� 10,070� Proceeds from sales of investments in

privately held companies -� 2,562� Investments in privately held

companies -� (31) Purchases of other intangible assets (181) -�

Cash paid for acquisitions, net of cash acquired (14,108) (840)

Sale of leasehold improvements 2,349� -� Purchases of property and

equipment (9,540) (8,711) Net cash used in investing activities

(3,691) (14,993) � Cash flows from financing activities: Net

proceeds from issuance of stock 6,454� 4,293� Net cash provided by

financing activities 6,454� 4,293� Net increase in cash and cash

equivalents 13,799� 18,478� Effect of exchange rate changes on cash

and cash equivalents 156� (215) Cash and cash equivalents at the

beginning of the period 31,327� 55,895� Cash and cash equivalents

at the end of the period $ 45,282� $ 74,158� Quarterly Statistical

Highlights Unaudited Q1-07 Q4-06 Q3-06 Q2-06 Q1-06 � Total

Quarterly Revenue ($mm) $ 92.1� $ 118.0� $ 93.3� $ 92.4� $ 83.7� �

Revenue Distribution (%) (a) Marketing Services 87% 89% 86% 86% 85%

Licensing, Fees and User 13% 11% 14% 14% 15% � Segment Revenue

($mm) U.S. Media $ 74.2� $ 93.5� $ 73.5� $ 72.8� $ 67.8�

International Media 17.9� 24.5� 19.8� 19.6� 15.9� � Advertiser

Metrics CNET Networks Top 100 US Advertisers' Renewal Rate (Q-to-Q)

96% 96% 96% 100% 96% CNET Networks Top 100 US Advertisers' % of

Network Revenue 57% 57% 54% 55% 53% � Select Business Metrics

Network Unique Users (mm) 143.7� 135.8� 124.5� 116.2� 116.8�

Network Average Daily Page Views (mm) 81.2� 84.8� 86.3� 92.8� 98.7�

� Balance Sheet Highlights ($mm) Cash $ 45.3� $ 31.3� $ 78.7� $

79.0� $ 74.2� Marketable Debt Securities � 27.4� � 44.3� � 60.9� �

62.0� � 62.1� Total Cash and Investments $ 72.7� $ 75.6� $ 139.6� $

141.0� $ 136.3� � Days Sales Outstanding (DSO) 74� 69� 73� 67� 70�

� Total Debt $ 77.0� $ 78.3� $ 143.3� $ 143.3� $ 141.7� � (a)

Marketing Services - sales of advertisements on our Internet

network through impression-based and activity-based advertising,

and sales of advertisements in our print publications. Licensing,

Fees and User - licensing our product database, online content,

subscriptions to online services, subscription and newsstand sales

of print publications, and other paid services. Business Segments �

CNET Networks' primary areas of measurement and decision-making

include two principal business segments, U.S. Media and

International Media. U.S. Media consists of an online media network

focused on topics that people are highly interested in such as

technology, entertainment, community and business. International

Media includes media properties under several of the same brands as

our sites in the United States with additional brands represented

in markets such as China and the Untied Kingdom and several print

publications in China. Management believes that segment operating

income (loss) before depreciation, amortization, stock

investigation and related matters and stock compensation expenses

is an appropriate measure of evaluating the operating performance

of the company's segments. However, segment operating income (loss)

before depreciation, amortization, stock investigation and related

matters and stock compensation expense should not be considered a

substitute for operating income, cash flows or other measures of

financial performance prepared in accordance with generally

accepted accounting principles. � (Unaudited) (in thousands) � �

U.S. Media International Media Other (1) Total Three Months Ended

March 31, 2007 Revenues $ 74,233� $ 17,864� $ -� $ 92,097�

Operating expenses 59,981� 20,344� 20,301� 100,626� � Operating

loss $ 14,252� $ (2,480) $ (20,301) $ (8,529) � Three Months Ended

March 31, 2006 Revenues $ 67,763� $ 15,887� $ -� $ 83,650�

Operating expenses 56,519� 17,137� 12,316� 85,972� � Operating loss

$ 11,244� $ (1,250) $ (12,316) $ (2,322) � (1) For the three months

ended March 31, 2007, Other includes operating expenses related to

depreciation of $7.5 million, amortization of $3.2 million,

expenses of $4.4 million related to our stock option investigation

and related matters and non-cash stock compensation expense of $5.2

million. For the three months ended March 31, 2006, Other includes

operating expenses related to depreciation of $4.8 million,

amortization of $2.7 million and non-cash stock compensation

expense of $4.8 million. Guidance to the Investment Community Q1-07

Q2-07 estimate FY 2007 estimate $ in millions, except per share

Actual Low - High Low - High � � Total Revenues $92.1� $97.0 -

$102.0� $425.0 - $445.0� � Operating income before depreciation,

amortization, stock option investigation and related matters and

stock compensation expense � � $11.8� $13.0 - $17.0� $90.0 -

$105.0� � Depreciation expense $7.5� $7.5� $32.0� � Amortization

expense $3.2� $3.0� $12.0� � Stock compensation expense $5.2� $5.5�

$23.0� � Stock option investigation and related matters $4.4� -� -�

� Operating income (loss) ($8.5) ($3.0) - $1.0� $23.0 - $38.0� �

Interest income (expense), net ($0.7) ($0.5) ($2.0) � Other income

(expense), net $0.3� -� $0.3� � Tax (expense) benefit ($0.2) ($0.5)

$188.0� � GAAP EPS (including stock ($0.06) ($0.03) - $0.00� $1.37

- $1.47� compensation expense) � � � � Note: Operating income

guidance for the second quarter and full year 2007 does not

consider ongoing fees related to the stock option investigation and

related matters. � � Note: Earnings per share guidance for the full

year 2007 reflects the non-cash financial statement impact of the

likely release of a portion of the deferred tax asset related

valuation allowance in the fourth quarter of 2007. As a result,

CNET Networks expects to report a tax benefit of approximately $189

million in the fourth quarter of 2007. 2007 earnings guidance

excluding the tax benefit would be in the range of $0.13 to $0.23

per share. � � � � Operating Loss Reconciliation (Unaudited) (in

thousands) Three Months Ended March 31, 2007� 2006� Operating loss

$ (8,529) $ (2,322) Stock compensation expense 5,163� 4,756�

Depreciation 7,489� 4,822� Amortization of intangible assets 3,220�

2,739� Operating income before depreciation, amortization and stock

compensation expense 7,343� 9,995� � Stock option investigation and

related matters 4,429� -� Operating income before depreciation,

amortization, stock compensation expense and stock option

investigation and related matters � $ 11,772� $ 9,995� � We believe

that "operating income before depreciation, amortization and stock

compensation expense" is useful to management and investors as a

supplement to our GAAP (generally accepted accounting principles in

the United States) financial measures for evaluating the ability of

the business to generate cash from operations. Depreciation and

amortization are non-cash items and included within them are

amounts related to past transactions and expenditures that are not

necessarily reflective of the current cash or capital requirements

of the business. Exlcuding non-cash stock compensation expense

allows management to make financial and operational decisions and

evaluate the business based on recurring operating results. �

Management refers to "operating income before depreciation,

amortization, stock compensation expense and stock option

investigation and related matters" in making operating decisions

and for planning and compensation purposes. A limitation associated

with this measure is that is does not reflect the costs of certain

capitalized tangible and intangible assets used in generating

revenue and the cash costs associated with our stock option

investigation and related matters. Management compensates for these

limitations by relying primarily on our GAAP financial measures,

such as capital expenditures and operating income (loss), and using

"operating income before depreciation, amortization, stock

compensation expense and stock option investigation and related

matters" only on a supplemental basis. Although depreciation and

amortization are non-cash charges, the capitalized assets being

depreciated and amortized will often have to be replaced in the

future, and "operating income before depreciation and amortization"

does not reflect any cash requirements for such replacements. This

measure also does not take into account interest expense, or the

cash requirements necessary to service interest or principle

payments on our debt. Nor does the measure reflect changes in, or

cash requirements for, our working capital needs. "Operating income

before depreciation, amortization, stock compensation expense and

stock option investigation and related matters" should be

considered in addition to, and not as a substitute for, other

measures of financial performance prepared in accordance with GAAP.

Net Loss Reconciliation (Unaudited) (in thousands, except per share

data) � Three Months Ended March 31, 2007� � � 2006� � Net loss $

(9,118) $ (1,302) � Stock compensation expense (1) 5,163� 4,756�

Stock option investigation and related matters (2) 4,429� -�

Realized gain on investments (3) -� (500) Loss from discontinued

operations (4) -� 37� Effect on earnings from stock compensation,

stock option investigation and related matters, gains on

investments and discontinued operations � 9,592� 4,293� � Net

income excluding stock compensation, stock option investigation and

related matters, gains on investments and discontinued operations �

$ 474� $ 2,991� � Diluted net income per share excluding stock

compensation expense, stock option investigation and related

matters, gain on investments and discontinued operations � $ 0.00�

$ 0.02� Shares used in calculating diluted net income per share

152,192� 155,598� � (1) During the three months ended March 31,

2007 and 2006, the Company recorded $5.2 million and $4.8 million

of stock compensation expense, respectively. (2) During the three

months ended March 31, 2007, $4.4 million of charges related to our

stock option investigation and related matters were incurred. (3)

The Company recognized gains of $0.5 million on sales of privately

held investments during the three months ended March 31, 2006. (4)

The Company recognized a loss from discontinued operations of

$37,000 for the quarter ended March 31, 2006. � The Company

believes that the information presented above is useful to

investors because these items are infrequent in nature and may

affect the comparability of the current quarter results to other

quarter results. For additional discussion of the uses and

limitations of this information, see "Operating Loss

Reconciliation." Free Cash Flows (Unaudited) (in thousands) Three

Months Ended March 31, 2007� 2006� � Cash flows from operating

activities $ 11,036� $ 29,178� � Capital expenditures (1) (7,191)

(8,711) � Free cash flow $ 3,845� $ 20,467� � Stock option

investigation and related matters 4,429� -� � � Free cash flow

excluding stock option investigation and related matters $ 8,274� $

20,467� � (1) Capital expenditures for the three months ended March

31, 2007 are net of $2,349 in cash proceeds under a sale-leaseback

transaction related to certain leasehold improvements made during

the period. � Free Cash Flow is defined as net cash provided by

operating activities less net capital expenditures. The Company

believes that free cash flow provides useful information about the

amount of cash generated by the business after the purchase of

property and equipment. A limitation of free cash flow is that is

does not represent the total increase or decrease in the cash

balance for the period. Free cash flow should be considered in

addition to, and not as a substitute for, other measures of

financial performance prepared in accordance with US GAAP.

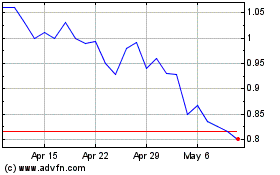

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

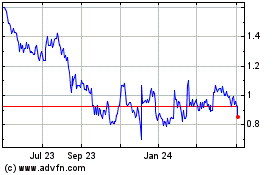

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024