CNET Networks, Inc. (NASDAQ:CNET) announced today that it has

modified and extended its solicitation of consents for its

outstanding $125.0 million principal amount of 0.75% Senior

Convertible Notes due 2024. The Company also updated its outlook

for it revenues for the third quarter of 2006 and for the full

year. Modified and Extended Consent Offering The consent

solicitation has been modified to offer holders a two-year

extension of the call protection period so that such period would

end on April 20, 2011 rather than April 20, 2009. The offer, which

was scheduled to expire midnight, New York City time, on October

11, 2006, will now expire at midnight, New York City time, on

Wednesday, October 18, 2006. The solicitation is being made upon

the terms, and is subject to the conditions, set forth in the

Company's Consent Solicitation Statement, dated September 13, 2006,

and in the accompanying form of consent, as amended by the

supplement to Consent Solicitation Statement dated October 11,

2006. The proposed amendments and waivers require the consent of

holders of 70% of aggregate principal amount of the notes

outstanding. The Company will give five days prior notice by press

release of its intention to file any delinquent reports with the

Securities and Exchange Commission, provided that the obligation to

provide any such notice will cease upon the expiration or

termination of the Consent Solicitation. Requests for additional

copies of the Consent Solicitation Statement, the Letter of Consent

or other related documents should be directed to D.F. King &

Co., Inc., the information and tabulation agent, at (800) 829-6551

(toll-free) or (212) 269-5550 (collect). Questions regarding the

consent solicitation should be directed to the Convertibles Sales

Department of Banc of America Securities LLC, the solicitation

agent, at 800-654-1666 (toll-free) or 212-583-8206 (collect). This

announcement is not a solicitation of consents with respect to any

securities. The consent solicitation is being made solely by the

Consent Solicitation Statement dated September 13, 2006, as amended

by the Supplement dated October 11, 2006. Business Outlook In April

2006 the Company revised its outlook noting several industry trends

in the technology and video game industries. These factors continue

to impact CNET Networks� business, and accordingly, the Company has

further revised its outlook. For the third quarter of 2006, CNET

Networks estimates total revenues were approximately $92.8 million.

Previously, the Company had expected total revenues of $93 million

to $96 million. For the full-year 2006, CNET Networks expects total

revenues of $376 million to $386 million. Previously, the Company

had expected full year total revenues of $386 million to $403

million. The Company will not be in a position to file its

Quarterly Report on Form 10-Q for the quarter ended September 30,

2006 on a timely basis, pending the completion of its financial

restatements related to its independent investigation of stock

option granting practices and of the requisite audit procedures by

the Company�s independent registered public accountants.

Consequently, CNET Networks is not in a position to provide actual

results or guidance regarding operating expense, operating income,

net income or earnings per share. The Company said that it expects

to release its revenue results for the third-quarter ended

September 30, 2006 and cash position, on Monday, October 23, 2006.

The Company will hold its quarterly conference call to discuss

third-quarter revenue results on Monday, October 23, 2006 at 5:00

p.m. ET (2:00 p.m. PT). To listen to the discussion, please visit

http://ir.cnetnetworks.com and click on the link provided for the

webcast conference call or dial (800) 344-1035 (international

dial-in: (706) 679-3076). A replay of the call will be available

either through an archived webcast at http://ir.cnetnetworks.com or

telephone by dialing (800) 642-1687 (international: (706) 645-9291)

and entering the conference ID number 7747781. (The Company issued

a separate release today reporting findings of the Special

Committee of its Board of Directors on the Company�s options

granting practices and procedures. In addition, the Company also

issued a press release today announcing Neil Ashe�s appointment as

CEO.) This Business Outlook section contains forward-looking

statements concerning the Company�s expected revenues for the third

quarter of 2006 and the full year and its expected restatement of

its historical financials statements. There can be no assurance

concerning the Company�s actual third quarter or full year revenues

or the outcome or timing of the restatement of CNET Networks�

historical financial statements. Important factors that could cause

actual revenue results to differ materially include: a lack of

growth or a decrease in marketing spending on the Internet due to

failure of marketers to adopt the Internet as an advertising medium

at the rate that we currently anticipate; a lack of growth or

decrease in marketing spending on CNET Networks� properties in

particular, which could be prompted by competition from other media

outlets, both on and off the Internet, dissatisfaction with CNET

Networks� services, or economic difficulties in our clients�

businesses; economic conditions such as weakness in corporate or

consumer spending, which could prompt a reduction in overall

advertising expenditures or expenditures specifically on our

properties; the failure of existing advertisers to meet or renew

their advertising commitments as we anticipate, which would cause

us to not meet our financial projections; the failure to attract

advertisers outside of our traditional technology and consumer

electronics categories, which would cause us to not meet our

financial projections; a continued decline in revenues from our

print publications as advertising dollars shift to other media; and

general risks associated with our business. The outcome and timing

of the restatement may be impacted by actions that may be taken or

required as a result of the investigation concerning matters

relating to CNET Networks� stock option grants. Forward-looking

statements are made as of the date of this press release and,

except as required by law, the Company does not undertake an

obligation to update its forward-looking statements to reflect

future events or circumstances. About CNET Networks, Inc. CNET

Networks, Inc. (Nasdaq: CNET, www.cnetnetworks.com) is an

interactive media company that builds brands for people and the

things they are passionate about, such as gaming, music,

entertainment, technology, business, food, and parenting. The

Company�s leading brands include CNET, GameSpot, TV.com, MP3.com,

Webshots, CHOW, ZDNet and TechRepublic. Founded in 1993, CNET

Networks has a strong presence in the US, Asia and Europe. CNET

Networks, Inc. (NASDAQ:CNET) announced today that it has modified

and extended its solicitation of consents for its outstanding

$125.0 million principal amount of 0.75% Senior Convertible Notes

due 2024. The Company also updated its outlook for it revenues for

the third quarter of 2006 and for the full year. Modified and

Extended Consent Offering The consent solicitation has been

modified to offer holders a two-year extension of the call

protection period so that such period would end on April 20, 2011

rather than April 20, 2009. The offer, which was scheduled to

expire midnight, New York City time, on October 11, 2006, will now

expire at midnight, New York City time, on Wednesday, October 18,

2006. The solicitation is being made upon the terms, and is subject

to the conditions, set forth in the Company's Consent Solicitation

Statement, dated September 13, 2006, and in the accompanying form

of consent, as amended by the supplement to Consent Solicitation

Statement dated October 11, 2006. The proposed amendments and

waivers require the consent of holders of 70% of aggregate

principal amount of the notes outstanding. The Company will give

five days prior notice by press release of its intention to file

any delinquent reports with the Securities and Exchange Commission,

provided that the obligation to provide any such notice will cease

upon the expiration or termination of the Consent Solicitation.

Requests for additional copies of the Consent Solicitation

Statement, the Letter of Consent or other related documents should

be directed to D.F. King & Co., Inc., the information and

tabulation agent, at (800) 829-6551 (toll-free) or (212) 269-5550

(collect). Questions regarding the consent solicitation should be

directed to the Convertibles Sales Department of Banc of America

Securities LLC, the solicitation agent, at 800-654-1666 (toll-free)

or 212-583-8206 (collect). This announcement is not a solicitation

of consents with respect to any securities. The consent

solicitation is being made solely by the Consent Solicitation

Statement dated September 13, 2006, as amended by the Supplement

dated October 11, 2006. Business Outlook In April 2006 the Company

revised its outlook noting several industry trends in the

technology and video game industries. These factors continue to

impact CNET Networks' business, and accordingly, the Company has

further revised its outlook. -- For the third quarter of 2006, CNET

Networks estimates total revenues were approximately $92.8 million.

Previously, the Company had expected total revenues of $93 million

to $96 million. -- For the full-year 2006, CNET Networks expects

total revenues of $376 million to $386 million. Previously, the

Company had expected full year total revenues of $386 million to

$403 million. The Company will not be in a position to file its

Quarterly Report on Form 10-Q for the quarter ended September 30,

2006 on a timely basis, pending the completion of its financial

restatements related to its independent investigation of stock

option granting practices and of the requisite audit procedures by

the Company's independent registered public accountants.

Consequently, CNET Networks is not in a position to provide actual

results or guidance regarding operating expense, operating income,

net income or earnings per share. The Company said that it expects

to release its revenue results for the third-quarter ended

September 30, 2006 and cash position, on Monday, October 23, 2006.

The Company will hold its quarterly conference call to discuss

third-quarter revenue results on Monday, October 23, 2006 at 5:00

p.m. ET (2:00 p.m. PT). To listen to the discussion, please visit

http://ir.cnetnetworks.com and click on the link provided for the

webcast conference call or dial (800) 344-1035 (international

dial-in: (706) 679-3076). A replay of the call will be available

either through an archived webcast at http://ir.cnetnetworks.com or

telephone by dialing (800) 642-1687 (international: (706) 645-9291)

and entering the conference ID number 7747781. (The Company issued

a separate release today reporting findings of the Special

Committee of its Board of Directors on the Company's options

granting practices and procedures. In addition, the Company also

issued a press release today announcing Neil Ashe's appointment as

CEO.) This Business Outlook section contains forward-looking

statements concerning the Company's expected revenues for the third

quarter of 2006 and the full year and its expected restatement of

its historical financials statements. There can be no assurance

concerning the Company's actual third quarter or full year revenues

or the outcome or timing of the restatement of CNET Networks'

historical financial statements. Important factors that could cause

actual revenue results to differ materially include: a lack of

growth or a decrease in marketing spending on the Internet due to

failure of marketers to adopt the Internet as an advertising medium

at the rate that we currently anticipate; a lack of growth or

decrease in marketing spending on CNET Networks' properties in

particular, which could be prompted by competition from other media

outlets, both on and off the Internet, dissatisfaction with CNET

Networks' services, or economic difficulties in our clients'

businesses; economic conditions such as weakness in corporate or

consumer spending, which could prompt a reduction in overall

advertising expenditures or expenditures specifically on our

properties; the failure of existing advertisers to meet or renew

their advertising commitments as we anticipate, which would cause

us to not meet our financial projections; the failure to attract

advertisers outside of our traditional technology and consumer

electronics categories, which would cause us to not meet our

financial projections; a continued decline in revenues from our

print publications as advertising dollars shift to other media; and

general risks associated with our business. The outcome and timing

of the restatement may be impacted by actions that may be taken or

required as a result of the investigation concerning matters

relating to CNET Networks' stock option grants. Forward-looking

statements are made as of the date of this press release and,

except as required by law, the Company does not undertake an

obligation to update its forward-looking statements to reflect

future events or circumstances. About CNET Networks, Inc. CNET

Networks, Inc. (Nasdaq: CNET, www.cnetnetworks.com) is an

interactive media company that builds brands for people and the

things they are passionate about, such as gaming, music,

entertainment, technology, business, food, and parenting. The

Company's leading brands include CNET, GameSpot, TV.com, MP3.com,

Webshots, CHOW, ZDNet and TechRepublic. Founded in 1993, CNET

Networks has a strong presence in the US, Asia and Europe.

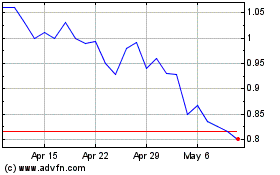

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

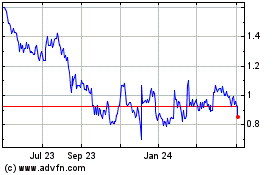

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024