CNET Networks Special Committee Reports Findings and Recommendations of Stock Options Investigation

October 11 2006 - 9:00AM

Business Wire

CNET Networks, Inc. (Nasdaq:CNET) (www.cnetnetworks.com) today

announced that a special committee of its board of directors (the

�Special Committee�) has reported its findings on the Company�s

options granting practices and procedures to the Board of

Directors. As previously announced, on May 22, 2006 the Special

Committee was established by CNET Networks� Board of Directors to

conduct an independent investigation relating to past option

grants, the timing of such grants and related accounting matters.

The Special Committee consists of two independent members of CNET

Networks� audit committee of the Board of Directors -- Peter Currie

and Betsey Nelson, chair of the audit committee. The Special

Committee was assisted in the investigation by outside legal

counsel Davis Polk & Wardwell and accountants from Navigant

LLC. The Special Committee reviewed and analyzed more than 700,000

documents and emails, and conducted over thirty interviews of

current and former officers, directors, employees and advisors to

CNET Networks over the last four months. As previously announced,

the Special Committee and the Company continue to cooperate with

the Securities and Exchange Commission, the NASD and the United

States Attorney�s Office for the Northern District of California.

�The completion of the Special Committee report represents an

important step forward for CNET Networks,� said Neil Ashe, the

Company�s newly elected chief executive officer. �We are committed

to ensuring that the highest standards of business conduct,

financial reporting and internal controls are maintained, and we

are focused on quickly implementing the recommendations of the

Special Committee. Under the leadership of our CFO, George

Mazzotta, we look to complete the restatement of historical

financial statements related to past stock option grants as soon as

practicable.� Key findings of the Special Committee�s report

include: There were deficiencies with the process by which options

were granted at CNET, including in some instances the backdating of

option grants, during the period from the Company�s IPO in 1996

through at least 2003. These deficiencies resulted in accounting

errors, which the Company has previously announced will result in a

restatement. A number of executives of the Company, including the

former CFO and the recently resigned CEO, General Counsel and SVP

of Human Resources, bear varying degrees of responsibility for

these deficiencies. The report does not conclude that any current

employees of the Company or any recently resigned employees engaged

in intentional wrongdoing. Since 2003, the Company has taken steps

to remedy these deficiencies through personnel changes and improved

internal controls. The Special Committee recommended a number of

additional remedial measures. The recently resigned executives and

the directors who received improperly priced options have agreed

voluntarily to have these options repriced to fair market value on

the appropriate measurement date. The Special Committee reported

that it believes that the Compensation Committee relied upon

management to establish and maintain appropriate procedures with

respect to stock option grants. The report stated that it would

have been better practice if the Compensation Committee had

encouraged management to adopt more rigorous procedures and

controls during the 1996-2003 period. In a separate press release

also issued today, the Company also announced that Shelby Bonnie,

CNET�s co-founder and the company�s chairman of the board and chief

executive officer from 2000 to the present, has resigned as

chairman and CEO. He will remain a director. The Company�s general

counsel and head of Human Resources have also resigned. With regard

to Mr. Bonnie, Mr. Jarl Mohn, chairman of the Board of Directors,

commented, �We extend our appreciation to Shelby for his founding

role and many years of service, and for his willingness to work

with the Board and the Company in assisting with this transition.

Shelby�s lasting legacy will be the innumerable positive actions he

undertook to make CNET Networks the successful industry leader it

is today." �I apologize for the option-related problems that

happened under my leadership,� said Shelby Bonnie. �I believe that

the company has come a long way since 2003 in addressing these

deficiencies, but am deeply disappointed it happened nonetheless.�

The Company and its independent auditors are reviewing the findings

of the Special Committee investigation. Management continues to

expect that CNET Networks will need to restate its historical

financial statements to record non-cash charges for compensation

expense relating to past stock option grants. The Company and its

independent auditors are reviewing recent accounting guidance

published by the SEC, and have not yet determined the amount of

such charges, the resulting tax and accounting impact, or which

periods may require restatement. (The Company issued a separate

release today announcing Neil Ashe�s appointment as CEO. In

addition, the Company also issued a press release today announcing

that it has modified and extended its solicitation of consents from

holders of its 0.75% Senior Convertible Notes due 2024 and updated

its third quarter and full year guidance.) About CNET Networks,

Inc. CNET Networks, Inc. (Nasdaq: CNET, www.cnetnetworks.com) is an

interactive media company that builds brands for people and the

things they are passionate about, such as gaming, music,

entertainment, technology, business, food, and parenting. The

Company�s leading brands include CNET, GameSpot, TV.com, MP3.com,

Webshots, CHOW, ZDNet and TechRepublic. Founded in 1993, CNET

Networks has a strong presence in the US, Asia and Europe. CNET

Networks, Inc. (Nasdaq:CNET) (www.cnetnetworks.com) today announced

that a special committee of its board of directors (the "Special

Committee") has reported its findings on the Company's options

granting practices and procedures to the Board of Directors. As

previously announced, on May 22, 2006 the Special Committee was

established by CNET Networks' Board of Directors to conduct an

independent investigation relating to past option grants, the

timing of such grants and related accounting matters. The Special

Committee consists of two independent members of CNET Networks'

audit committee of the Board of Directors -- Peter Currie and

Betsey Nelson, chair of the audit committee. The Special Committee

was assisted in the investigation by outside legal counsel Davis

Polk & Wardwell and accountants from Navigant LLC. The Special

Committee reviewed and analyzed more than 700,000 documents and

emails, and conducted over thirty interviews of current and former

officers, directors, employees and advisors to CNET Networks over

the last four months. As previously announced, the Special

Committee and the Company continue to cooperate with the Securities

and Exchange Commission, the NASD and the United States Attorney's

Office for the Northern District of California. "The completion of

the Special Committee report represents an important step forward

for CNET Networks," said Neil Ashe, the Company's newly elected

chief executive officer. "We are committed to ensuring that the

highest standards of business conduct, financial reporting and

internal controls are maintained, and we are focused on quickly

implementing the recommendations of the Special Committee. Under

the leadership of our CFO, George Mazzotta, we look to complete the

restatement of historical financial statements related to past

stock option grants as soon as practicable." Key findings of the

Special Committee's report include: -- There were deficiencies with

the process by which options were granted at CNET, including in

some instances the backdating of option grants, during the period

from the Company's IPO in 1996 through at least 2003. -- These

deficiencies resulted in accounting errors, which the Company has

previously announced will result in a restatement. -- A number of

executives of the Company, including the former CFO and the

recently resigned CEO, General Counsel and SVP of Human Resources,

bear varying degrees of responsibility for these deficiencies. --

The report does not conclude that any current employees of the

Company or any recently resigned employees engaged in intentional

wrongdoing. -- Since 2003, the Company has taken steps to remedy

these deficiencies through personnel changes and improved internal

controls. The Special Committee recommended a number of additional

remedial measures. -- The recently resigned executives and the

directors who received improperly priced options have agreed

voluntarily to have these options repriced to fair market value on

the appropriate measurement date. The Special Committee reported

that it believes that the Compensation Committee relied upon

management to establish and maintain appropriate procedures with

respect to stock option grants. The report stated that it would

have been better practice if the Compensation Committee had

encouraged management to adopt more rigorous procedures and

controls during the 1996-2003 period. In a separate press release

also issued today, the Company also announced that Shelby Bonnie,

CNET's co-founder and the company's chairman of the board and chief

executive officer from 2000 to the present, has resigned as

chairman and CEO. He will remain a director. The Company's general

counsel and head of Human Resources have also resigned. With regard

to Mr. Bonnie, Mr. Jarl Mohn, chairman of the Board of Directors,

commented, "We extend our appreciation to Shelby for his founding

role and many years of service, and for his willingness to work

with the Board and the Company in assisting with this transition.

Shelby's lasting legacy will be the innumerable positive actions he

undertook to make CNET Networks the successful industry leader it

is today." "I apologize for the option-related problems that

happened under my leadership," said Shelby Bonnie. "I believe that

the company has come a long way since 2003 in addressing these

deficiencies, but am deeply disappointed it happened nonetheless."

The Company and its independent auditors are reviewing the findings

of the Special Committee investigation. Management continues to

expect that CNET Networks will need to restate its historical

financial statements to record non-cash charges for compensation

expense relating to past stock option grants. The Company and its

independent auditors are reviewing recent accounting guidance

published by the SEC, and have not yet determined the amount of

such charges, the resulting tax and accounting impact, or which

periods may require restatement. (The Company issued a separate

release today announcing Neil Ashe's appointment as CEO. In

addition, the Company also issued a press release today announcing

that it has modified and extended its solicitation of consents from

holders of its 0.75% Senior Convertible Notes due 2024 and updated

its third quarter and full year guidance.) About CNET Networks,

Inc. CNET Networks, Inc. (Nasdaq: CNET, www.cnetnetworks.com) is an

interactive media company that builds brands for people and the

things they are passionate about, such as gaming, music,

entertainment, technology, business, food, and parenting. The

Company's leading brands include CNET, GameSpot, TV.com, MP3.com,

Webshots, CHOW, ZDNet and TechRepublic. Founded in 1993, CNET

Networks has a strong presence in the US, Asia and Europe.

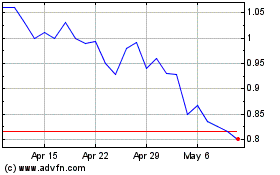

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

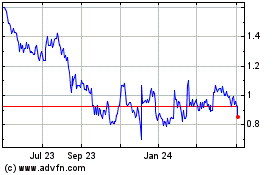

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024