CNET Networks, Inc. (Nasdaq:CNET): -- Total Revenues of $92.0

million -- Cash Balance of $143.3 million -- 116.2 Million Monthly

Unique Users CNET Networks, Inc. (Nasdaq:CNET) today reported

revenue results for the second quarter ended June 30, 2006. "We are

pleased with the growth of our business during the second quarter,"

said Shelby Bonnie, chairman and chief executive officer of CNET

Networks. "We continued to expand our audience and customer base

across the U.S., Europe and Asia by growing our core brands and

adding new ones, enhancing our position as Internet ad spending

continues to increase." -- Total revenues for the second quarter

were $92.0 million, a 14 percent increase compared to revenues of

$80.4 million for the same period of 2005. Revenues for 2005 and

2006 exclude revenues related to Computer Shopper magazine, which

was sold in the first quarter of 2006 and consequently has been

treated as a discontinued operation in our financial results in

both periods. -- Cash balances, which includes cash, investments

and restricted cash, at the end of the quarter were $143.3 million,

compared to $138.5 million at March 31, 2006. -- As previously

announced, the company's Board of Directors has established a

special committee of independent directors to review the company's

stock option practices and related accounting. The special

committee has reached a preliminary conclusion that the actual

measurement dates for certain past stock options granted by the

company differ from the recorded measurement dates. Accordingly,

the company will be required to restate certain previously issued

financial statements to record non-cash charges for stock-based

compensation. The company does not expect that the anticipated

restatement will have any impact on its previously reported

revenues or cash positions. The company will not be in a position

to provide operating expense, operating income, net income or

earnings per share information on a historical basis or as part of

its business outlook pending the completion of the special

committee's review. Further information regarding these matters is

set forth in the company's Current Report on Form 8-K filed July

10, 2006. Business Review "Our focus during the second quarter was

on expanding our portfolio with smart additions that leverage our

expertise in building global brands for people and the things they

are passionate about. We are beginning to capitalize on lifestyle

media categories and through the re-launch of Chowhound and the

acquisition of Urban Baby, we are gaining great, established brands

in the food and parenting categories. We also acquired xcar.com.cn

in China, building on our strong presence in China while expanding

our footprint into the automobile market," said Bonnie. -- CNET

Networks' global network of Internet properties reached an average

of 116.2 million unique monthly users during the second quarter of

2006(1), an increase of 1 percent from the second quarter of 2005.

Average daily page views were over 92.8 million during the second

quarter(1), down 5 percent from the year-ago quarter. -- CNET

Networks entered two lifestyle categories during the second quarter

of 2006 -- food and parenting -- that align directly with its goal

to provide brands for people and the things they are passionate

about. Through the well-received beta re-launch of Chowhound

(www.chowhound.com) following the acquisition of that site during

the first quarter, and through the acquisition of Urban Baby

(www.urbanbaby.com), the company expects to expand its demographic

profile and its appeal to new advertising segments. -0- *T -- In

the third quarter of 2006, CNET Networks plans to build on this

positive entry into the food category by launching Chow

(www.chow.com), which will be Chowhound's parent brand, bringing

the established food community together with renowned original

content. Chow's goal is to be a different kind of food site "for

those who live to eat." In June, the company re-launched Chowhound,

the community of people who doggedly seek out amazing food and

drink experiences, then share the treasures they find. The new

Chowhound, with dramatic improvements, from its new look and feel

to new features and functionality, was enthusiastically received by

its discerning community. -- In May, the company entered the

parenting category with its acquisition of Urban Baby, a stylish

insider's guide to what's new for busy expecting and new moms.

Combining original and member-contributed content, Urban Baby arms

new moms with timely and useful information on what to buy and what

to do. Launched out of New York City, Urban Baby has a local

community focus and plans to expand into new markets. Urban Baby

enhances CNET Networks' reach into the female demographic. The

company plans to re-launch the site later this year. *T -- During

the quarter, CNET Networks expanded its established presence in

Europe and Asia with launches and acquisitions of interactive media

properties that target passionate audiences in some of the

fastest-growing global markets. -0- *T -- In China, CNET Networks

acquired xcar.com.cn, one of the country's leading online

automobile destinations that provides independent reviews and

information for consumers considering car purchases. This

acquisition, which closed in July, builds on CNET Networks'

established online presence in China, and positions the company to

benefit from the nascent, yet fast growing, automobile market in

China. -- In Europe, the company launched localized versions of

some of its popular United States sites, responding to increasing

user and advertiser demand in key markets. In April, CNET Networks

launched a localized version of the site, uk.gamespot.com. With its

pre-existing market, GameSpot UK has become one of the leading UK

gaming sites. It offers gamers the benefit of localized content,

while enabling UK gaming and consumer advertisers reach into this

valuable, geographically targeted audience. A similar localization

approach was taken with the launches of CNET CarTech.fr and News.fr

in France, translating the value and relevance of CNET Networks'

CarTech and News.com sites to the passionate, fast growing online

audiences in France. *T -- CNET's new video-on-demand (VOD)

service, CNET TV (www.cnettv.com), launched in beta online last

month and has received enthusiastic response from users, both via

their feedback on blogs and as represented by the time spent on the

site. The site's interface features a virtual remote control that

lets users browse video content by channel, create personalized

playlists, start and stop videos, and set viewing preferences, such

as switching to a full screen environment. CNET TV online is part

of a two-phased VOD roll-out aimed at both enhancing the CNET user

experience and introducing the CNET brand to more people through

new channels. CNET achieved an important step toward the latter

goal earlier in the month when its video content launched with

partners Cox Communications and TiVo, Inc through their on-demand

services. CNET TV is expected to officially launch, complete with

advertising, during the third quarter. -- During the quarter,

Webshots launched AllYouCanUpload.com, a service that provides free

unlimited photo uploading and hosting without the need for

registration. AllYouCanUpload leverages Webshots' powerful

technology infrastructure, letting users upload up to 10 images at

a time with no limits on size of photos, and automatically

generates codes to display images that can be pasted into popular

social networking, blog, and auction sites. AllYouCanUpload is

designed for people seeking a quick, easy, one-click solution for

hosting images. Users interested in a more robust experience,

including archiving photos for future use, have the option of

registering for a free Webshots.com account. -- GameSpot had an

active second quarter, with continued momentum and growth in its

presence at the Electronic Entertainment Exposition (E3), and

increased user traction and sponsorship interest in its gaming

tournaments. -0- *T -- During E3, users watched nearly 18 million

on-demand video streams, and page views to the GameSpot site

increased by nearly 32 percent compared to page views during the

2005 E3 conference. GameSpot's exclusive online coverage of the

Sony PLAYSTATION 3 press conference, and its live streaming of

Nintendo's Wii press conference contributed to its unprecedented E3

success. -- GameSpot's multi-player online gaming tournaments have

begun to gain traction among users and the interest of sponsors.

GameSpot has been hosting a new tournament each month, such as

Nascar Petal to the Metal Challenge, Operation: Sniper Storm

Tournament, and Battle of Nations with hundreds of participants and

tens of thousands of spectators. In response to the success and

demand for tournaments, Game Spot will increase their frequency. *T

-- CNET Networks' brands continued to receive awards and accolades

during the second quarter, including several prestigious Webby and

Maggie awards. -0- *T -- In April, the company won four "Maggie

Awards" for its outstanding editorial content as part of the 55th

Annual Western Publications Association (WPA) award event. CNET

News.com won Best Publication Website/Consumer; CNET.com won for

Best Regularly Featured Web Column/Consumer; and CNET.com and CNET

News.com tied for Best Web Article/Consumer. -- In May, CNET

Networks won three People's Voice Awards as part of the Tenth

Annual Webby Awards, the leading international honor for Web sites.

CNET.com won in the Guides/Ratings/Reviews category; CNET

Download.com won in the IT Hardware/Software category; and GameSpot

won in the Games-related category. *T Business Outlook -- For the

third quarter of 2006, management anticipates total revenues of $93

million to $96 million. -- For the full-year 2006, management is

estimating total revenues of $386 million to $403 million. The

company will not be in a position to provide guidance regarding

operating expense, operating income, net income or earnings per

share pending the completion of the special committee's review.

Conference Call and Webcast CNET Networks will host a conference

call to discuss its second quarter 2006 the foregoing revenue

results and business outlook beginning at 5:00 p.m. ET (2:00 p.m.

PT), today, July 24, 2006. To listen to the discussion, please

visit http://ir.cnetnetworks.com and click on the link provided for

the webcast conference call or dial (800) 344-1035 (international

dial-in: (706) 679-3076). A replay of the conference call will be

available via webcast at the URL listed above or by calling (800)

642-1687 (international dial-in: (706) 645-9291) and entering the

conference ID number 2851562. The company's past financial news

releases, related financial and operating information, and access

to all Securities and Exchange Commission filings, can also be

accessed at http://ir.cnetnetworks.com. Safe Harbor This press

release and its attachments include forward-looking information and

statements that are subject to risks and uncertainties that could

cause actual results to differ materially. These forward-looking

statements include the statements under the sections entitled

"Business Outlook" which sets forth our estimated financial

performance for the third quarter and full year of 2006, and

statements regarding our growth prospects and expectations

regarding the future success of our products and services. In

addition, management expects to provide forward-looking information

statements on the conference call to be held shortly following the

issuance of this release, which are also subject to risks and

uncertainties that could cause actual results to differ materially.

The forward-looking statements in this release and on the

conference call are identified by the words "expect," "estimate,"

"target," "believe," "goal," "anticipate," "intend" and similar

expressions or are otherwise identified in the context in which

they are made as being forward-looking. These statements are only

effective as of the date of this release and we undertake no duty

to publicly update these forward-looking statements, whether as a

result of new information, future developments or otherwise. The

risks and uncertainties that could cause actual results to differ

materially from those projected include: a lack of growth or a

decrease in marketing spending on the Internet due to failure of

marketers to adopt the Internet as an advertising medium at the

rate that we currently anticipate; a lack of growth or decrease in

marketing spending on CNET Networks' properties in particular,

which could be prompted by competition from other media outlets,

both on and off the Internet, dissatisfaction with CNET Networks'

services, or economic difficulties in our clients' businesses; a

decrease in user activity on our sites due to competition or other

factors, which could reduce advertising revenue generated by such

user activities; reduced consumer activity or manufacturer

marketing due to product lifecycles or product launch delays in the

company's content categories; economic conditions such as weakness

in corporate or consumer spending, which could prompt a reduction

in overall advertising expenditures or expenditures specifically on

our properties; the failure of existing advertisers to meet or

renew their advertising commitments as we anticipate; the failure

to attract advertisers outside of our traditional technology and

consumer electronics categories; a continued decline in revenues

from our print publications as advertising dollars shift to other

media; the acquisition of businesses or the launch of new lines of

business, which could decrease our cash position, increase

operating expense, and dilute operating margins; and general risks

associated with our business. In addition, the special committee's

review of stock option matters referenced in this release is

ongoing, and the company's expectation announced on July 10, 2006

that it will restate its financial statements for 2003, 2004 and

2005 contained in the company's Annual Report on Form 10-K filed in

March 2006 and the Company's balance sheet as of March 31, 2006 was

based upon the special committee's preliminary review of only some

of the company's option grants. The final result of the special

committee's review will depend upon a number of important factors,

including further analysis of option grants already reviewed and a

review and analysis of other option grants not yet reviewed. For

additional information about risks to CNET Networks' business, see

its Annual Form 10-K for the year ended December 31, 2005 and

subsequent Forms 10-Q and 8-K, including disclosures under the

captions "Risk Factors" and "Management's Discussion and Analysis

of Financial Conditions and Results of Operations," which are filed

with the Securities and Exchange Commission and are available on

the SEC's website at www.sec.gov. About CNET Networks, Inc. CNET

Networks is a global media company with some of the most important

and valuable brands on the Web targeting passionate audiences. The

company's brands -- such as CNET, GameSpot, TV.com, MP3.com,

Webshots, BNET and ZDNet -- serve the technology, games and

entertainment, business, and community categories. CNET Networks

was founded in 1993 and has always been "a different kind of media

company" creating engaging media experiences through a combination

of world-class content and technology infrastructure. (1) CNET

Networks April 2006 - June 2006 (internal log data) -0- *T

Quarterly Statistical Highlights (a) Unaudited Q2-06 Q1-06 Q4-05

Q3-05 Q2-05 ------- ------- ------- ------- ------- Total Quarterly

Revenue ($mm) $ 92.0 $ 83.4 $103.3 $ 81.9 $ 80.4 Revenue

Distribution (%)(b)(c) Marketing Services 86% 85% 89% 86% 86%

Licensing, Fees and User 14% 15% 11% 14% 14% Segment Revenue U.S.

Media $ 72.8 $ 67.8 $ 82.9 $ 65.9 $ 63.4 International Media $ 19.2

$ 15.6 $ 20.4 $ 16.0 $ 17.0 Advertiser Metrics CNET Networks Top

100 US Advertisers' Renewal Rate (Q-to-Q) 100% 96% 100% 97% 95%

CNET Networks Top 100 US Advertisers' % of Network Revenue 55% 53%

55% 55% 55% Select Business Metrics Network Unique Users (mm) 116.2

116.8 116.1 110.1 115.1 Network Average Daily Page Views (mm) 92.8

98.7 103.6 99.4 97.7 Balance Sheet Highlights ($mm) Cash $ 79.1 $

74.2 $ 55.9 $ 69.8 $ 42.2 Marketable Debt Securities 62.0 62.1 54.1

38.3 32.1 Restricted Cash 2.2 2.2 2.2 4.6 19.8 ------ ------ ------

------ ------ Total Cash and Equivalents $143.3 $138.5 $112.2

$112.7 $ 94.1 Total Debt $143.3 $141.7 $141.8 $141.3 $146.4 Days

Sales Outstanding (DSO) 67 70 71 66 67 (a) The company will not be

in a position to disclose operating expense, operating income, net

income or earnings per share information pending the completion of

the company's financial statement restatement as described in the

company's Current Report on Form 8-K filed July 10, 2006. (b)

Results for 2005 and 2006 exclude revenue related to Computer

Shopper due to the sale of the Computer Shopper magazine business

in February 2, 2006 and resulting discontinued operations

treatment. (c) Due to the sale of Computer Shopper magazine on

February 2, 2006, CNET Networks no longer reports publishing

revenue. The company's international publishing revenue is now

distributed in the marketing services and licensing, fee and user

lines as described below: Marketing Services - sales of

advertisements on our Internet network through impression-based and

activity-based advertising, and sales of advertisements in our

print publications. Licensing, Fees and User - licensing our

product database, online content, subscriptions to online services,

subscription and newsstand sales of print publications, and other

paid services. *T

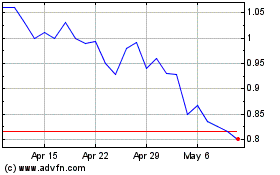

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

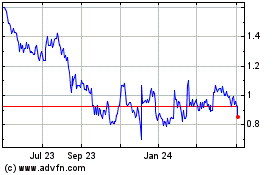

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024