0001042187

Yunhong CTI LTD.

false

--12-31

FY

2021

0

0

170,000

170,000

170,000

170,000

170,000

170,000

5,000,000

5,000,000

0

0

3,000,000

3,000,000

500,000

500,000

500,000

500,000

5,000,000

5,000,000

0

0

170,000

170,000

170,000

170,000

170,000

170,000

1,700,000

1,700,000

0

0

170,000

170,000

170,000

170,000

170,000

170,000

1,700,000

1,700,000

0

0

170,000

170,000

170,000

170,000

170,000

1,700,000

1,700,000

0

0

50,000,000

50,000,000

5,930,408

5,827,304

5,886,750

5,783,646

43,658

43,658

5,878,887

10

154,951

1

0

0

8.7

0

100,000

0

0

0

0

0

0.30

5

0

0

21,059

1.0

00010421872021-01-012021-12-31

iso4217:USD

00010421872021-06-30

xbrli:shares

00010421872022-03-25

thunderdome:item

00010421872021-12-31

00010421872020-12-31

iso4217:USDxbrli:shares

0001042187us-gaap:SeriesAPreferredStockMember2021-12-31

0001042187us-gaap:SeriesAPreferredStockMember2020-12-31

0001042187us-gaap:SeriesBPreferredStockMember2021-12-31

0001042187us-gaap:SeriesBPreferredStockMember2020-12-31

0001042187us-gaap:SeriesCPreferredStockMember2021-12-31

0001042187us-gaap:SeriesCPreferredStockMember2020-12-31

0001042187us-gaap:SeriesDPreferredStockMember2021-12-31

0001042187us-gaap:SeriesDPreferredStockMember2020-12-31

00010421872020-01-012020-12-31

0001042187us-gaap:CommonStockMember2019-12-31

0001042187us-gaap:AdditionalPaidInCapitalMember2019-12-31

0001042187us-gaap:RetainedEarningsMember2019-12-31

0001042187us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-31

0001042187us-gaap:TreasuryStockMember2019-12-31

0001042187us-gaap:NoncontrollingInterestMember2019-12-31

00010421872019-12-31

0001042187us-gaap:ConvertiblePreferredStockMemberus-gaap:PreferredStockMember2020-01-012020-12-31

0001042187us-gaap:ConvertiblePreferredStockMemberus-gaap:CommonStockMember2020-01-012020-12-31

0001042187us-gaap:ConvertiblePreferredStockMember2020-01-012020-12-31

0001042187ctib:ConversionOfAccountsPayableToConvertiblePreferredStockMemberus-gaap:PreferredStockMember2020-01-012020-12-31

0001042187ctib:ConversionOfAccountsPayableToConvertiblePreferredStockMember2020-01-012020-12-31

0001042187ctib:ConversionFromSeriesAPreferredStockToCommonStockMemberus-gaap:PreferredStockMember2020-01-012020-12-31

0001042187ctib:ConversionFromSeriesAPreferredStockToCommonStockMemberus-gaap:CommonStockMember2020-01-012020-12-31

0001042187ctib:ConversionFromSeriesAPreferredStockToCommonStockMemberus-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-31

0001042187us-gaap:PreferredStockMember2020-01-012020-12-31

0001042187us-gaap:CommonStockMember2020-01-012020-12-31

0001042187us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-31

0001042187us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2020-01-012020-12-31

0001042187us-gaap:SeriesAPreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-31

0001042187us-gaap:SeriesBPreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-31

0001042187us-gaap:SeriesBPreferredStockMember2020-01-012020-12-31

0001042187us-gaap:RetainedEarningsMember2020-01-012020-12-31

0001042187us-gaap:NoncontrollingInterestMember2020-01-012020-12-31

0001042187us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-31

0001042187us-gaap:TreasuryStockMember2020-01-012020-12-31

0001042187us-gaap:PreferredStockMember2020-12-31

0001042187us-gaap:CommonStockMember2020-12-31

0001042187us-gaap:AdditionalPaidInCapitalMember2020-12-31

0001042187us-gaap:RetainedEarningsMember2020-12-31

0001042187us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-31

0001042187us-gaap:TreasuryStockMember2020-12-31

0001042187us-gaap:NoncontrollingInterestMember2020-12-31

0001042187us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2020-12-31

0001042187us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2021-01-012021-12-31

0001042187us-gaap:SeriesDPreferredStockMember2021-01-012021-12-31

0001042187us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2021-01-012021-12-31

0001042187us-gaap:SeriesCPreferredStockMember2021-01-012021-12-31

0001042187us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2021-01-012021-12-31

0001042187us-gaap:SeriesBPreferredStockMember2021-01-012021-12-31

0001042187us-gaap:CommonStockMember2021-01-012021-12-31

0001042187us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-31

0001042187us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2021-01-012021-12-31

0001042187us-gaap:SeriesAPreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-31

0001042187us-gaap:SeriesBPreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-31

0001042187us-gaap:SeriesCPreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-31

0001042187us-gaap:RetainedEarningsMember2021-01-012021-12-31

0001042187us-gaap:NoncontrollingInterestMember2021-01-012021-12-31

0001042187us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-31

0001042187us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2021-12-31

0001042187us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2021-12-31

0001042187us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2021-12-31

0001042187us-gaap:SeriesDPreferredStockMemberus-gaap:PreferredStockMember2021-12-31

0001042187us-gaap:CommonStockMember2021-12-31

0001042187us-gaap:AdditionalPaidInCapitalMember2021-12-31

0001042187us-gaap:RetainedEarningsMember2021-12-31

0001042187us-gaap:TreasuryStockMember2021-12-31

0001042187ctib:ConversionOfDebtToSeriesAPreferredMember2021-01-012021-12-31

0001042187ctib:ConversionOfDebtToSeriesAPreferredMember2020-01-012020-12-31

0001042187ctib:StockPlacementAgentMember2021-01-012021-12-31

0001042187ctib:StockPlacementAgentMember2020-01-012020-12-31

utr:Y

0001042187us-gaap:BuildingMembersrt:MinimumMember2021-01-012021-12-31

0001042187us-gaap:BuildingMembersrt:MaximumMember2021-01-012021-12-31

0001042187us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2021-01-012021-12-31

0001042187us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2021-01-012021-12-31

0001042187ctib:ProjectLifeMembersrt:MinimumMember2021-01-012021-12-31

0001042187ctib:ProjectLifeMembersrt:MaximumMember2021-01-012021-12-31

0001042187ctib:LightMachineryMembersrt:MinimumMember2021-01-012021-12-31

0001042187ctib:LightMachineryMembersrt:MaximumMember2021-01-012021-12-31

0001042187ctib:HeavyEquipmentMembersrt:MinimumMember2021-01-012021-12-31

0001042187ctib:HeavyEquipmentMembersrt:MaximumMember2021-01-012021-12-31

0001042187us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2021-01-012021-12-31

0001042187us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2021-01-012021-12-31

0001042187us-gaap:IntellectualPropertyMembersrt:MinimumMember2021-01-012021-12-31

0001042187us-gaap:IntellectualPropertyMembersrt:MaximumMember2021-01-012021-12-31

0001042187us-gaap:LeaseholdImprovementsMembersrt:MinimumMember2021-01-012021-12-31

0001042187us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2021-01-012021-12-31

0001042187ctib:FurnitureAndEquipmentAtCustomerLocationsMembersrt:MinimumMember2021-01-012021-12-31

0001042187ctib:FurnitureAndEquipmentAtCustomerLocationsMembersrt:MaximumMember2021-01-012021-12-31

00010421872019-01-012021-12-31

0001042187us-gaap:RevolvingCreditFacilityMemberctib:PNCAgreementsMemberctib:PNCMember2017-12-31

0001042187ctib:PNCAgreementsMemberctib:PNCMemberctib:TermLoanMember2017-12-31

0001042187us-gaap:RevolvingCreditFacilityMemberctib:LineFinancialAgreementMemberctib:LineFinancialMember2021-09-30

0001042187ctib:LineFinancialAgreementMemberctib:LineFinancialMemberctib:TermLoanMember2021-09-30

0001042187ctib:LFInternationalPteMemberus-gaap:ConvertiblePreferredStockMemberctib:EquityFinancingArrangementMember2020-01-012020-01-31

0001042187ctib:LFInternationalPteMemberctib:EquityFinancingArrangementMember2020-01-31

0001042187ctib:LFInternationalPteMemberctib:EquityFinancingArrangementMember2020-01-012020-01-31

0001042187ctib:LFInternationalPteMemberctib:EquityFinancingArrangementMember2020-02-012020-02-29

0001042187ctib:LFInternationalPteMemberus-gaap:CommonStockMemberctib:EquityFinancingArrangementMember2020-02-012020-02-29

0001042187ctib:LFInternationalPteMemberctib:EquityFinancingArrangementMember2020-04-012020-04-30

0001042187ctib:LFInternationalPteMemberus-gaap:CommonStockMemberctib:EquityFinancingArrangementMember2020-04-012020-04-30

0001042187ctib:LFInternationalPteMemberctib:EquityFinancingArrangementMember2020-06-012020-06-30

0001042187us-gaap:ConvertiblePreferredStockMemberctib:EquityFinancingArrangementMember2020-01-012020-01-31

0001042187ctib:OtherInvestorMemberus-gaap:ConvertiblePreferredStockMemberctib:EquityFinancingArrangementMember2020-01-012020-04-30

0001042187us-gaap:SeriesBPreferredStockMember2020-11-012020-11-30

0001042187us-gaap:SeriesBPreferredStockMember2020-11-30

0001042187us-gaap:SeriesCPreferredStockMember2021-01-012021-01-31

0001042187us-gaap:SeriesCPreferredStockMember2021-01-31

0001042187us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberctib:LakeBarringtonFacilityMember2021-04-23

0001042187us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberctib:LakeBarringtonFacilityMember2021-04-232021-04-23

0001042187ctib:PNCAgreementsMemberctib:PNCMemberctib:TermLoanMember2021-04-23

0001042187ctib:LakeBarringtonFacilityLeaseMember2021-04-23

0001042187ctib:UnrelatedThirdPartyMemberus-gaap:SeriesDPreferredStockMember2021-06-012021-06-30

xbrli:pure

0001042187us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-31

0001042187us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberctib:CustomerOneMember2021-01-012021-12-31

0001042187us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberctib:CustomerTwoMember2021-01-012021-12-31

0001042187us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-31

0001042187us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberctib:CustomerOneMember2020-01-012020-12-31

0001042187us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberctib:CustomerTwoMember2020-01-012020-12-31

0001042187us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberctib:TwoCustomersMember2021-12-31

0001042187us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberctib:TwoCustomersMember2020-12-31

0001042187us-gaap:SubordinatedDebtMembersrt:OfficerMember2021-12-31

0001042187us-gaap:SubordinatedDebtMembersrt:OfficerMember2020-12-31

0001042187ctib:NotesPayableRelatedPartyMember2021-12-31

0001042187ctib:NotesPayableRelatedPartyMember2020-12-31

0001042187ctib:TermLoanMember2021-12-31

0001042187ctib:TermLoanMember2020-12-31

0001042187us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-12-31

0001042187us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-12-31

0001042187ctib:PNCAgreementsMemberctib:PNCMember2021-04-232021-04-23

0001042187ctib:PNCAgreementsMemberctib:PNCMember2021-09-302021-09-30

0001042187ctib:PNCAgreementsMemberctib:PNCMember2021-01-012021-12-31

0001042187ctib:LineFinancialAgreementMemberus-gaap:PrimeRateMember2021-09-30

0001042187ctib:LineFinancialAgreementMemberus-gaap:PrimeRateMember2021-09-302021-09-30

0001042187ctib:LineFinancialAgreementMember2021-09-30

0001042187ctib:LineFinancialAgreementMember2021-09-302021-09-30

0001042187ctib:LineFinancialAgreementMembersrt:MaximumMember2021-09-302021-09-30

0001042187ctib:PromissoryNoteMemberctib:JohnHSchwanMember2019-01-01

0001042187ctib:ConversionOfRelatedPartyDebtToEquityMember2019-01-012019-01-31

00010421872019-01-31

0001042187ctib:PromissoryNoteMemberctib:JohnHSchwanMember2019-01-31

0001042187ctib:JohnHSchwanMember2021-12-31

0001042187ctib:JohnHSchwanMember2020-12-31

0001042187ctib:PromissoryNoteMemberctib:JohnHSchwanMember2021-01-012021-12-31

0001042187ctib:PromissoryNoteMemberctib:JohnHSchwanMember2020-01-012020-12-31

0001042187ctib:PromissoryNoteMemberctib:JohnHSchwanMember2021-10-012021-12-31

0001042187ctib:PromissoryNoteMemberctib:JohnHSchwanMember2020-10-012020-12-31

0001042187ctib:PromissoryNoteMemberctib:AlexFengMember2021-12-31

0001042187ctib:PaycheckProtectionProgramCARESActMember2020-04-302020-04-30

0001042187us-gaap:DomesticCountryMemberus-gaap:InternalRevenueServiceIRSMember2021-12-31

0001042187us-gaap:StateAndLocalJurisdictionMember2021-12-31

0001042187ctib:SchwanIncorporatedMember2021-01-012021-12-31

0001042187ctib:SchwanIncorporatedMember2020-01-012020-12-31

0001042187srt:BoardOfDirectorsChairmanMember2019-07-01

0001042187us-gaap:NotesReceivableMemberctib:CleverContainerMember2020-01-012020-12-31

0001042187ctib:VentureLeasingLLCMember2010-01-012010-12-31

0001042187ctib:VentureLeasingMexicoSADeRLMember2010-01-012010-12-31

0001042187ctib:VentureLeasingLLCMember2010-12-31

0001042187ctib:VentureLeasingLLCMember2010-01-012010-12-31

iso4217:MXN

0001042187ctib:VentureLeasingMexicoSADeRLMemberctib:FlexoUniversalMember2016-05-312016-05-31

0001042187ctib:CleverContainerMember2016-12-31

00010421872019-07-012019-12-31

0001042187ctib:CleverContainerCompanyLlcMember2019-01-012019-03-31

0001042187ctib:FlexoUniversalMember2019-01-012019-03-31

0001042187us-gaap:AccountingStandardsUpdate201602Member2019-01-01

0001042187us-gaap:SeriesAPreferredStockMemberctib:LFInternationalOfferingMember2020-01-032020-01-03

0001042187us-gaap:SeriesAPreferredStockMemberctib:LFInternationalOfferingMember2020-01-03

0001042187us-gaap:SeriesAPreferredStockMemberctib:AdditionalSharesOfferingMember2020-01-032020-01-03

0001042187us-gaap:SeriesAPreferredStockMemberctib:AdditionalSharesOfferingMember2020-01-03

0001042187us-gaap:SeriesAPreferredStockMemberctib:EquityFinancingArrangementMember2020-01-032021-06-30

0001042187ctib:ConversionOfAccountsReceivableOwedToInvestorToPreferredStockMember2020-01-032021-06-30

0001042187ctib:ConversionOfAccountsReceivableOwedToInvestorToPreferredStockMemberus-gaap:SeriesAPreferredStockMember2020-01-032021-06-30

0001042187us-gaap:CommonStockMemberctib:LFInternationalOfferingMember2020-01-032020-06-30

0001042187us-gaap:SeriesAPreferredStockMember2020-01-032020-12-31

0001042187us-gaap:SeriesBPreferredStockMember2020-12-012021-12-31

00010421872021-09-30

0001042187us-gaap:SeriesDPreferredStockMember2021-10-012021-12-31

0001042187ctib:WarrantsInConnectionWithSeriesDPreferredStockMember2021-10-012021-12-31

0001042187ctib:WarrantsInConnectionWithSeriesDPreferredStockMember2021-12-31

0001042187ctib:SeriesAPreferredStockWarrantsMember2020-01-012020-12-31

0001042187ctib:SeriesAPreferredStockWarrantsMember2020-12-31

0001042187ctib:CashlessExchangeWarrantMember2020-01-012020-12-31

0001042187ctib:CashlessExchangeWarrantMember2020-12-31

0001042187ctib:CashlessExchangeWarrantMember2021-01-012021-02-28

0001042187ctib:CashlessExchangeWarrantMember2021-02-28

0001042187ctib:WarrantsInConnectionWithSeriesDPreferredStockMember2021-06-012021-06-30

0001042187ctib:WarrantsInConnectionWithSeriesDPreferredStockMember2021-06-30

0001042187us-gaap:MeasurementInputPriceVolatilityMembersrt:MinimumMember2020-12-31

0001042187us-gaap:MeasurementInputPriceVolatilityMembersrt:MaximumMember2020-12-31

0001042187us-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MinimumMember2020-12-31

0001042187us-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MaximumMember2020-12-31

0001042187us-gaap:MeasurementInputExpectedTermMember2020-12-31

0001042187us-gaap:MeasurementInputExpectedDividendRateMember2020-12-31

0001042187us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMemberctib:EquityFinancingArrangementMember2020-01-012020-12-31

0001042187us-gaap:CommonStockMemberctib:EquityFinancingArrangementMember2020-01-012020-12-31

0001042187ctib:EquityFinancingArrangementMember2020-01-012020-12-31

0001042187us-gaap:SeriesAPreferredStockMember2020-01-012020-12-31

0001042187ctib:ConversionOfAccountsReceivableOwedToInvestorIntoSeriesAPreferredStockMember2020-04-012020-04-01

0001042187us-gaap:SeriesAPreferredStockMember2021-01-012021-12-31

0001042187us-gaap:SeriesAPreferredStockMember2020-06-052020-06-05

0001042187us-gaap:SeriesAPreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2020-06-052020-06-05

0001042187ctib:ConversionFromSeriesAPreferredStockToCommonStockMember2020-01-012020-12-31

0001042187ctib:ConversionFromSeriesAPreferredStockToCommonStockMember2021-01-012021-12-31

0001042187us-gaap:SeriesCPreferredStockMember2021-01-012021-03-31

0001042187ctib:LFInternationalPteMember2020-01-012020-12-31

0001042187ctib:GardenStateSecuritiesMember2020-01-012020-12-31

0001042187us-gaap:RestrictedStockMemberctib:FormerChiefExecutiveOfficerMember2020-01-012020-12-31

0001042187us-gaap:RestrictedStockMember2020-12-31

0001042187us-gaap:RestrictedStockMember2021-12-31

0001042187us-gaap:RestrictedStockMemberus-gaap:SubsequentEventMembersrt:ChiefExecutiveOfficerMember2022-01-012022-03-25

0001042187ctib:StockIncentivePlan2009Member2009-04-10

0001042187ctib:StockIncentivePlan2018Member2018-06-08

0001042187ctib:SeriesAPreferredStockWarrantsMember2021-01-012021-01-31

0001042187ctib:SeriesDPreferredStockWarrantsMember2021-06-012021-12-31

0001042187ctib:SeriesDPreferredStockWarrantsMembersrt:MaximumMember2021-12-31

0001042187us-gaap:MeasurementInputRiskFreeInterestRateMember2021-12-31

0001042187us-gaap:MeasurementInputRiskFreeInterestRateMember2020-12-31

0001042187ctib:WarrantsMemberus-gaap:MeasurementInputExpectedTermMember2021-12-31

0001042187ctib:WarrantsMemberus-gaap:MeasurementInputExpectedTermMember2020-12-31

0001042187ctib:Warrants2020Member2021-12-31

0001042187ctib:SeriesDPreferredStockWarrantsMember2021-01-012021-12-31

0001042187ctib:FoilBalloonsMember2021-01-012021-12-31

0001042187ctib:FoilBalloonsMember2021-12-31

0001042187ctib:FoilBalloonsMember2020-01-012020-12-31

0001042187ctib:FoilBalloonsMember2020-12-31

0001042187ctib:LatexBalloonsMember2021-01-012021-12-31

0001042187ctib:LatexBalloonsMember2021-12-31

0001042187ctib:LatexBalloonsMember2020-01-012020-12-31

0001042187ctib:LatexBalloonsMember2020-12-31

0001042187ctib:FilmProductsMember2021-01-012021-12-31

0001042187ctib:FilmProductsMember2021-12-31

0001042187ctib:FilmProductsMember2020-01-012020-12-31

0001042187ctib:FilmProductsMember2020-12-31

0001042187ctib:OtherProductsMember2021-01-012021-12-31

0001042187ctib:OtherProductsMember2021-12-31

0001042187ctib:OtherProductsMember2020-01-012020-12-31

0001042187ctib:OtherProductsMember2020-12-31

0001042187ctib:BenchmarkInvestmentsIncVYunhongCTILtdMember2021-03-162021-03-16

0001042187ctib:BenchmarkInvestmentsIncVYunhongCTILtdMember2021-12-31

0001042187ctib:EngieResourcesLlcCaseMemberus-gaap:SubsequentEventMember2022-02-012022-02-28

0001042187ctib:EngieResourcesLlcCaseMemberus-gaap:SubsequentEventMember2022-03-012022-03-31

0001042187ctib:CTIEuropeMember2019-12-31

0001042187ctib:CtiBalloonsAndCtiEuropeMember2019-12-31

0001042187ctib:CtiBalloonsAndCtiEuropeMember2021-01-012021-12-31

0001042187ctib:CtiBalloonsAndCtiEuropeMember2020-01-012020-12-31

0001042187us-gaap:SegmentDiscontinuedOperationsMemberctib:ZiplocProductLineMember2020-01-012020-12-31

0001042187us-gaap:SegmentDiscontinuedOperationsMemberctib:ZiplocProductLineMember2019-01-012019-12-31

0001042187us-gaap:SegmentDiscontinuedOperationsMemberctib:FlexoUniversalMember2021-10-012021-12-31

0001042187us-gaap:SegmentDiscontinuedOperationsMemberctib:FlexoUniversalMember2021-12-31

0001042187ctib:CtiBalloonsAndCtiEuropeMember2020-12-31

0001042187us-gaap:SubsequentEventMember2022-04-14

0001042187srt:MinimumMemberus-gaap:SubsequentEventMember2022-04-14

0001042187srt:MinimumMemberus-gaap:SubsequentEventMember2022-01-012022-04-14

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________to_________

Commission File Number

000-23115

YUNHONG CTI LTD.

(Exact name of registrant as specified in its charter)

| Illinois | | 36-2848943 |

| (State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

| incorporation or organization) | | |

| | | |

| 22160 N. Pepper Road | | |

| Lake Barrington, Illinois | | 60010 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (847) 382-1000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Ticker symbol(s) | Name of each exchange on which registered |

| Common Stock, no par value per share | CTIB | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller Reporting Company ☑ | Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has fi led a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting fi rm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Based upon the closing price of $2.60 per share of the Registrant’s Common Stock as reported on NASDAQ Capital Market tier of The NASDAQ Stock Market on June 30, 2021, the aggregate market value of the voting common stock held by non-affiliates of the Registrant was then approximately $7,192,000. (The determination of stock ownership by non-affiliates was made solely for the purpose of responding to the requirements of the Form and the Registrant is not bound by this determination for any other purpose.)

The number of shares outstanding of the Registrant’s Common Stock as of March 25, 2022 was 5,911,750 (excluding treasury shares).

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant’s definitive Proxy Statement for the Annual Meeting of Stockholders (the “2022 Proxy Statement”) is incorporated by reference in Part III of this Form 10-K to the extent stated herein. The 2022 Proxy Statement, or an amendment to this Form 10-K, will be filed with the SEC within 120 days after December 31, 2021. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as a part hereof.

TABLE OF CONTENTS

INDEX

FORWARD LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes both historical and “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. We have based these forward-looking statements on our current expectations and projections about future results. Words such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” or similar words are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Although we believe that our opinions and expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements, and our actual results may differ substantially from the views and expectations set forth in this Annual Report on Form 10-K. We disclaim any intent or obligation to update any forward-looking statements after the date of this Annual Report on Form 10-K to conform such statements to actual results or to changes in our opinions or expectations. These forward-looking statements are affected by factors, risks, uncertainties and assumptions that we make, including, without limitation, our participation in highly competitive markets, potential changes in the cost or availability of raw materials, our dependence on a limited number of suppliers, the possible inability to obtain an adequate supply of raw materials, our reliance on a limited number of key customers, the loss of one or more of our key customers, changing consumer demands, developments or changes in technology, risks of international operations and political environments, dependence on our intellectual property, compliance with federal, state or local regulations, the resolution of litigation or other legal proceedings to which we may become involved, restrictions included in the Company’s credit facility, the availability of funds under the Company’s credit facility, damage to or destruction of one or both of the Company’s principal plants, our ability to service our indebtedness, our ability to invest in needed plant or equipment.

PART I

Item No. 1 –Business

Business Overview

We develop, produce, distribute and sell a number of consumer products throughout the United States and in several other countries, and we produce film products for commercial and industrial uses in the United States. Many of our products utilize flexible films and, for a number of years, we have been a leading developer of innovative products which employ flexible films including novelty balloons, pouches and films for commercial packaging applications.

Our principal lines of products include:

Novelty Products consisting principally of foil and latex balloons and other inflatable toy items; and

Flexible Films for food and other commercial and packaging applications.

In addition to these principal product lines, for the past several years, we have engaged in the assembly and sale of Candy Blossoms (small gift bouquets of arranged candy items often including ribbons and/or a small foil balloon).

We leverage our technology to design and develop proprietary products which we develop, market and sell for our customers. We have been engaged in the business of developing flexible film products for over 40 years and have acquired significant technology and know-how in that time. We currently hold several patents related to flexible film products, including specific films, zipper closures, valves and other features of these products.

We print, process and convert flexible film into finished products and we produce latex balloons and novelty items. Our principal production processes include:

| |

● |

Coating and laminating rolls of flexible film. Generally, we adhere polyethylene film to another film such as nylon or polyester; |

| |

● |

Printing film and latex balloons. We print both plastic and latex films, with a variety of graphics, for use as packaging film or for balloons; |

| |

● |

Converting printed film to balloons; |

| |

● |

Converting film to flexible containers; |

| |

● |

Producing or reselling latex balloons and other latex novelty items; and |

| |

● |

Assembling and inflating of novelty products and balloons and Candy Blossoms. |

In 1978, we began manufacturing metalized balloons (often referred to as "foil" balloons), which are balloons made of a base material (usually nylon or polyester) often having vacuum deposited aluminum and polyethylene coatings. These balloons remain buoyant when filled with helium for much longer periods than latex balloons and permit the printing of graphic designs on the surface. In 1985, we began marketing latex balloons and, in 1988, we began manufacturing latex balloons. In 1999, we acquired an extrusion coating and laminating machine and began production of coated and laminated films, which we have produced since that time.

For more than 20 years, we have been engaged in the coating, laminating and printing of flexible films for our novelty and container products and for the production of laminated and printed films we supply to others.

We market and sell our foil and latex balloons and related novelty items throughout the United States, Canada and Mexico and in a number of other countries. We supply directly to retail stores and chains and through distributors, who in turn sell to retail stores and chains. Our balloon and novelty products are sold to consumers through a wide variety of retail outlets including general merchandise, discount and drugstore chains, grocery chains, card and gift shops and party goods stores, as well as through florists and balloon decorators.

Most of our foil balloons contain printed characters, designs and social expression messages, such as “Happy Birthday,” “Get Well” and similar items. We may obtain licenses from time to time for well-known characters and print those characters and messages on our balloons.

We provide customized laminated films and printed films to customers who utilize the film to produce bags or pouches for the packaging of food, liquids and other items. In 2014, we began assembling and producing Candy Blossoms - containers including candy items and, often, air-inflated balloons.

In 2021, our revenues from our product lines, as a percent of total revenues were:

| |

● |

Novelty Products |

76% of revenues |

| |

● |

Flexible Film Products |

10% of revenues |

| |

● |

Candy Blossoms and Other Products |

14% of revenues |

We are an Illinois corporation with our principal offices and plant at 22160 N. Pepper Road, Lake Barrington, Illinois.

Business Strategies and Developments

Our business strategies, and recent developments related to our business, include:

| |

● |

Management. During December 2019, Mr. Frank Cesario, who joined CTI during 2017 as Chief Financial Officer, became both President and Chief Executive Officer. During 2020 we changed our name to Yunhong CTI Ltd., as we received a significant investment from LF International Pte, Ltd. Mr. Yubao Li, Chairman of the Yunhong China Group, became a director and then Chairman of Yunhong CTI Ltd. He replaced Mr. Cesario in September 2020 as Chief Executive Officer, at which time Mr. Cesario retired from the Company. During 2020 Ms. Jana Schwan became our Chief Operating Officer after having served as Vice President of Operations and a number of other roles during her 20 years with the Company. During 2021, Mr. Cesario rejoined the Company’s Board of Directors. During January 2022, Mr. Cesario rejoined the Company as Chief Executive Officer, with Mr. Li retaining the role of Chairman of the Board of Directors. |

| |

● |

Financing. From 2018 through 2020 we had multiple events of default with our primary lender, resulting in the Company incurring substantial penalties and fees. In addition, the Company had to enter into several forbearance agreements, pursuant to which the lender agreed to not take action against the Company for its default. During 2020 we entered into several individual securities purchase agreements with certain accredited investors for the purchase of shares of our Series A and B Convertible Preferred Stock. We sold Series C and D Convertible Preferred Stock during 2021 and executed a sale / leaseback transaction of our Lake Barrington, IL property. We entered into a smaller credit facility with a new entity during September 2021 as we repaid our prior lender and terminated that prior credit facility. |

| |

● |

Strategy. Our management determined to focus on achieving growth and profitability within the current scope of our core product lines – foil balloons and related products – from our United States based business. We reviewed our operations and, during 2019, decided to sell or liquidate our subsidiaries in the UK and Europe. We attempted to sell our subsidiary in Mexico in early 2020 and it was ultimately not successful at the time (during to the Covid-19 pandemic). That effort was ultimately completed during October 2021. In an attempt to increase profitability, we announced an intention to relocate our warehousing and light assembly facility from Lake Zurich, IL to Laredo, TX during 2020. Due to certain factors including the Covid-19 pandemic, we instead relocated this facility to Elgin, IL during March 2021 and are no longer pursuing a relocation to Texas. |

| |

● |

Focus on our Core Assets and Expertise. We have been engaged in the development, production and sale of film and container products for 40 years and have developed assets, technology and expertise which, we believe, enable us to develop, manufacture, purchase, market and sell innovative products of high quality within our areas of knowledge and expertise. We have focused our efforts on these core assets and areas of expertise – film novelty products, specialty film products, laminated films and printed films – to develop new products, to market and sell our products and to build our revenues. |

| |

● |

Develop New Products, Product Improvements and Technologies. We engage in research, design, innovation and development for the purpose of developing and improving products, materials, methods and technologies within our core product categories. We work to develop and identify new products, to improve existing products and to develop new technologies within our core product areas in order to enhance our competitive position and increase our sales. We seek to leverage our technology to develop innovative and proprietary products. In our novelty product lines, our development work includes new designs, new character licenses, new product developments, new materials and improved production methods. We work with customers to develop custom film products which serve the unique needs or requirements of the customer. Now that we are connected to the Yunhong China Group, we plan to look for opportunities to add value and grow with group members. |

| |

● |

Develop New Channels of Distribution and New Sales Relationships. We seek to organically develop new channels of distribution and new sales relationships, both for existing and new products. Over the past several years, we have developed new distributors and customers for our products in the United States and in Europe, Mexico, Latin America and Australia. We also look to leverage resources within the Yunhong China Group for a wide range of topics, from sales to sourcing. |

| |

● |

Product and Line Extensions. We intend to pursue new product lines and product line extensions, through internal developments. |

Products

Foil Balloons. We have designed, produced and sold foil balloons since 1979 and, we believe, are one of the largest manufacturers of foil balloons in the United States. Currently, we produce several hundred foil balloon designs, in different shapes and sizes.

In addition to size and shape, a principal element of our foil balloon products is the printed design or message contained on the balloon. These designs may include figures and licensed characters, but frequently are of our own design. We recognize that consumer trends and preferences, and competing products, are constantly changing. In order to compete effectively in this product line we must constantly innovate and develop new designs, shapes and products.

Latex Balloons. Our former subsidiary in Guadalajara, Mexico, Flexo Universal, S. de R.L. de C.V. (“Flexo Universal”) manufactures latex balloons in a wide variety of sizes and colors. Many of these balloons are marketed under the name Partyloons® and balloons are also marketed on a private label basis. We also manufactured toy balloon products including punch balls, water bombs and "Animal Twisties." Flexo Universal was sold during October 2021. The Company currently sources latex products from a foreign supplier and resells those products to customers that seek both foil and latex solutions.

Packaging Films and Custom Film Products. A large and increasing number of both consumer and commercial products are packaged in pouches or containers utilizing flexible films. Often such containers include printed labels and designs. We produce and sell films that may be utilized for the packaging of a wide variety of products and liquids. We laminate, extrusion coat and adhesive coat flexible films for these purposes and we provide flexographic printing for the films we produce. We can produce a variety of customized film products, and printing services, to meet the specific packaging needs of a wide variety of customers.

Other Products. In 2014, we began assembly and sale of our Candy Blossom product line (typically a presentation of candy with a balloon in a decorate arrangement for gifting). We have since supplemented this product line with related products.

Markets

Foil Balloons

The foil balloon came into existence in the late 1970s. During the 1980s, the market for foil balloons grew rapidly. Initially, the product was sold principally to individual vendors, small retail outlets and at fairs, amusement parks, shopping centers and other outdoor facilities and functions. Foil balloons remain buoyant when filled with helium for extended periods of time and they permit the printing and display of graphics and messages. As a result, the product has significant appeal as a novelty and message item. Foil balloons became part of the "social expression" industry, carrying graphics designs, characters and messages like greeting cards. In the mid-1980s, we and other participants in the market began licensing character and cartoon images for printing on the balloons and directed marketing of the balloons to retail outlets including grocery, general merchandise, discount and drug store chains, card and gift shops, party goods stores as well as florists and balloon decorators. These outlets now represent the principal means for the sale of foil balloons throughout the United States and in a number of other countries, although individual vendors remain a means of distribution in certain areas.

Foil balloons are now sold in virtually every region of the world. The United States remains the largest market for these products.

Foil balloons are sold in the United States and foreign countries directly by producers to retail outlets and through distributors and wholesalers. Often the sale of foil balloons by the wholesalers/distributors is accompanied by related products including latex balloons, floral supplies, candy containers, mugs, plush toys, baskets and a variety of party goods.

Latex Balloons

For a number of years, latex balloons and related novelty/toy latex items have been marketed and sold throughout the United States and in many other countries. Latex balloons are sold as novelty/toy items for decorative purposes, as part of floral designs and as party goods and favors. In addition to standard size and shape balloons, inflatable latex items include punch balls, water bombs, balloons to be twisted into shapes, and other specialty designs. Often, latex balloons include printed messages or designs.

Latex balloons are sold principally in retail outlets, including party goods stores, general merchandise stores, discount chains, gift stores and drugstore chains. Latex balloons are also purchased by balloon decorators and floral outlets for use in decorative or floral designs. Printed latex balloons are sold both in retail outlets and for balloon decoration purposes including floral designs.

Latex balloons are sold both through distributors and directly to retail outlets by the producers.

Printed and Specialty Films

The industry and market for printed and specialty films are fragmented and include many participants. There are hundreds of manufacturers of printed and specialty film products in the United States and in other markets. In many cases, companies who provide food and other products in film packages also produce or process the films used for their packages. The market for the Company's film products consists principally of companies who utilize the films for the packaging of their products, including food products and other items, usually by converting the film to a flexible container.

Marketing, Sales and Distribution

Balloon Products

We work in collaboration with our customers on designs, promotions, and other elements of marketing and selling. Our customers are typically retailers who sell our products to individual consumers. These relationships generally can be terminated unilaterally by either us or our customers. We must maintain good relationships with our customers if this sales model is to be successful.

We market and sell our foil balloon, latex balloon and related novelty products throughout the United States and in a number of other countries. We maintain marketing, sales and support staff and a customer service department in the United States. We sell directly to foreign customers from the United States.

We sell and distribute our balloon products (i) through our sales staff and customer service personnel in the United States, (ii) through a network of distributors and wholesalers, (iii) through several groups of independent sales representatives, and (iv) to retail chains. Our balloon products are generally sold through retail outlets including grocery, general merchandise and drug store chains, card and gift shops, party goods stores as well as florists and balloon decorators.

We sometimes engage in advertising and promotional activities to promote the sale of our balloon products. We produce catalogs of our balloon products, and also prepare various flyers and brochures for special or seasonal products, which we disseminate to customers, potential customers and others. We maintain websites which show images of our products.

Printed and Specialty Films

We market and sell printed and laminated films directly and through independent sales representatives throughout the United States. We sell laminated and printed films to companies that utilize these films to produce packaging for a variety of products, including food products, in both solid and liquid form, such as cola syrup, coffee, juices and other items. We seek to identify and maintain customer relationships in which we provide added value in the form of technology or systems.

Other Products

Other products are sold by our internal sales force directly to customers and also by independent sales representatives. These products are generally sold directly to consumers or to retail outlets.

Production and Operations

We conduct our operations at our facilities including: (i) our 68,000 square feet facility in Lake Barrington, Illinois, incorporating our headquarters office, production and warehouse space, (ii) our 69,000 square foot facility in Elgin, Illinois consisting of warehouse, packaging and office space, and (iii) a 73,000 square foot facility in Guadalajara, Mexico, consisting of office, warehouse and production space for Flexo Universal which remained with Flexo Universal upon the sale of that entity in October 2021.

Our production operations include (i) lamination and extrusion coating of films, (ii) slitting of film rolls, (iii) printing on film and on latex balloons, (iv) converting film to completed products including balloons, flexible containers and pouches, (v) producing latex balloon products (until Flexo Universal was sold in October 2021), (vi) inflating of air-filled balloons, and (vii) assembling Candy blossoms. We perform all of the lamination, extrusion coating and slitting activities in our Lake Barrington, Illinois plant and produced all of our latex balloon products at our Guadalajara, Mexico plant. We print on films in Lake Barrington, Illinois and we printed on latex balloons in Guadalajara, Mexico. We complete air-filling and assembly of balloons in all our facilities except Lake Barrington, Illinois. We assemble Candy blossoms in our Elgin, Illinois facility.

We warehouse raw materials in Lake Barrington, Illinois and we warehouse finished goods at our facilities in Lake Barrington, Illinois and Elgin, Illinois. We maintain customer service and fulfillment operations at each of our warehouse locations. We conduct sales operations for the United States and for all other markets at the Lake Barrington, Illinois facility. In addition to warehouse and sales activities at these locations, we engage in some assembly, balloon inflation and related activities.

We maintain a graphic arts and development department at our Lake Barrington, Illinois facility which designs our balloon products and graphics. Our creative department operates a networked, computerized graphic arts system for the production of these designs and of printed materials including catalogues, advertisements and other promotional materials. As many of our products are custom designed or created to fulfill promotional schedules, we sometimes have excess inventory that must be sold at a discount or disposed of. Any such disposition will typically negatively impact our profit margin.

We conduct administrative and accounting functions at our headquarters in Lake Barrington, Illinois.

Raw Materials

The principal raw materials we use in manufacturing our products are (i) petroleum or natural gas-based films, (ii) petroleum or natural gas-based resin, (iii) latex, and (iv) printing inks. The cost of raw materials represents a significant portion of the total cost of our products, with the result that fluctuations in the cost of raw materials have a material effect on our profitability. During the past several years, we have experienced significant fluctuations in the cost of these raw materials. We do not have any long-term agreements for the supply of raw materials and may experience wide fluctuations in the cost of raw materials in the future. Further, although we have been able to obtain adequate supplies of raw materials in the past, there can be no assurance that we will be able to obtain adequate supplies of one or more of our raw materials in the future.

Many of the foil balloons we produce and sell are intended to be filled with helium in order to be buoyant. Over the past several years, the price of helium has fluctuated substantially and the availability of helium has, on occasion, been limited. During 2018 and 2019, the availability of helium declined and the cost of helium increased. The supply of helium has since improved significantly. Any future occurrence of limited availability and/or an increase in the cost of helium could adversely affect our sales of foil balloons.

Competition

The balloon and novelty industry is highly competitive, with numerous competitors. We believe the principal manufacturers of foil balloons whose products are sold in the United States including Anagram International, Inc., Pioneer Balloon Company, Convertidora International S.A. de C.V., and Betallic, LLC. Several companies market and sell foil balloons designed by them and manufactured by others for them. In addition, there are several additional foil balloon manufacturers in Europe and China who participate in our markets.

We compete for the sale of latex balloons in the United States, Canada, Mexico, Latin America, the United Kingdom, Australia and Europe. There are a number of other companies situated in the United States, Mexico, Asia, South America and Europe who manufacture latex balloons and with whom we compete in the markets in which we participate. The markets are highly competitive with respect to price, quality and terms.

The market for films, packaging, and custom products is fragmented, and competition in this area is difficult to gauge. However, there are numerous participants in this market and the Company can expect to experience intense quality and price competition.

Many of the companies in these markets offer products and services that are the same or similar to those offered by us and our ability to compete depends on many factors within and outside our control. There are a number of well-established competitors in each of our product lines, several of which possess substantially greater financial, marketing and technical resources and have established extensive, direct and indirect channels of distribution for their products and services. As a result, such competitors may be able to respond more quickly to new developments and changes in customer requirements, or devote greater resources to the development, promotion and sale of their products and services than we can. Competitive pressures include, among other things, price competition, new designs and product development and copyright licensing.

Patents, Trademarks and Copyrights

We have developed or acquired a number of intellectual property rights which we believe are significant to our business. As of December 31, 2021, we held 6 issued patents in the United States and 7 issued patents in foreign countries. These patents are scheduled to expire at various times during the 2020s. While these intellectual property rights are helpful, their degree of protection is uncertain. Competitors may violate our intellectual property rights, forcing us to decide whether to challenge them. Such rights may or may not withstand challenge. Conversely, entities may charge us with violating their intellectual property rights. Failure to protect our rights, or conflict with the rights of one or more other entities, may negatively impact our financial and competitive position.

Proprietary Designs and Copyright Licenses. We design the shapes and graphic designs of most of our foil balloon products.

Trademarks. We own five registered trademarks in the United States relating to our balloon products. Some of these trademarks are registered in foreign countries, principally in the European Union.

Patent Rights. We own, or have license rights under, or have applied for, patents related to our balloon products, certain film products and certain flexible container products.

Research and Development

We maintain a product development and research group for the development or identification of new products, product designs, product components and sources of supply. Research and development includes (i) creative product development and design, (ii) creative marketing, and (iii) engineering development. During each of the fiscal years ended December 31, 2021 and 2020, we estimate that the total amount spent on research and development activities was approximately $206,000 and $317,000, respectively.

Employees

As of December 31, 2021, the Company had 66 full-time employees in the United States, of whom 16 are executive or supervisory, 2 are in sales, 35 are in manufacturing or warehouse functions and 13 are clerical. The Company is not a party to any collective bargaining agreement in the United States, has not experienced any work stoppages, and believes that its relationship with its employees is satisfactory.

Beginning November 2018, the Company experienced severe difficulty in securing adequate seasonal workers in its US operations, forcing it to pay substantially higher costs in the form of overtime and a holiday premium. The Company expects its local labor market in the US (near Chicago) to continue to become more costly over time, which, if not changed, would negatively impact its future profitability.

Regulatory Matters

Our manufacturing operations in the United States are subject to the U.S. Occupational Safety and Health Act ("OSHA"). We believe we are in material compliance with OSHA. The Company generates liquid, gaseous and solid waste materials in its operations in Lake Barrington, Illinois and the generation, emission or disposal of such waste materials are, or may be, subject to various federal, state and local laws and regulations regarding the generation, emission or disposal of waste materials. We believe we are in material compliance with applicable environmental rules and regulations. Several states have enacted laws limiting or restricting the release of helium filled foil balloons. We do not believe such legislation will have any material effect on our operations.

An increasing number of regulations and actions relate to the integrity and security of individually identifiable data. Additionally, we require the effective use of data in running our business. While we are not aware of losses in the past, access of such data by unauthorized persons may expose us to costs, fines, penalties, and loss of customer confidence.

International Operations

We conducted operations in one location outside of the United States until October 2021:

| |

● |

Flexo Universal, a 99%-owned subsidiary in Guadalajara, Mexico. Flexo Universal maintains a plant, offices and warehouse in Guadalajara, Mexico where it produces latex and foil balloons and print latex balloons. Flexo Universal conducts sales, warehousing and fulfillment operations, servicing principally the Company and other customers in the United States, Mexico, Latin America and certain customers in Europe. |

Available Information

We maintain our corporate website at www.ctiindustries.com and we make available, free of charge, through this website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports that we file with, or furnish to, the Securities and Exchange Commission (“SEC”), as soon as reasonably practicable after we electronically file that material with, or furnish it to, the SEC. You may also read and copy material filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549, and you may obtain information on the operation of the Public Reference Room by calling the SEC in the U.S. at 1-800-SEC-0330. In addition, the SEC maintains an Internet website, www.sec.gov, which contains reports, proxy and information statements and other information that we file electronically with the SEC. Our website also includes corporate governance information, including our Code of Ethics and our Board Committee Charters. The information contained on our website does not constitute a part of this report.

Item No. 1A – Risk Factors

Our business and results of operations have been and may continue to be negatively impacted by the spread of COVID-19.

We sell our products throughout the United States and in many foreign countries and may be impacted by public health crises beyond our control. This could disrupt our operations and negatively impact consumer spending and confidence levels, and supply availability and costs, all of which can affect our financial results, condition, and outlook. Our customers, suppliers and distributors may experience similar disruption. Importantly, the global pandemic resulting from COVID-19 has disrupted global health, economic and market conditions

Throughout 2021 and into 2022 the landscape improved from 2020, but the issue continues to drive elements of disruption in the ability to travel, attract and retain workers, manage production configurations and protocols, the supply chain and customer base. While we cannot predict the duration or scope of the COVID-19 pandemic, the resurgence of infections in one or more markets, or the impact of vaccines across the globe, the COVID-19 pandemic has negatively impacted our business and is expected to continue to impact our financial results, condition and outlook in a way that may be material.

COVID-19 has also delayed certain strategic transactions the Company intended to close during 2020, most notably its attempted sale of Flexo Universal which was ultimately realized during October 2021 and the potential relocation of certain activities to the Laredo, Texas area, which is no longer a consideration of the Company.

Our business and results of operations have been and may continue to be negatively impacted by supply chain disruptions and inflationary pressure.

2021 saw material shortages, supply chain interruption, and reduced ability to transport goods throughout the United States and on a global scale. These pressures forced us to take steps to ensure the availability of product, including buying materials at higher prices and more aggressively managing lead times. Despite these efforts, our ability to fulfill customer demands was challenged. We also were forced to pass cost increases on to customers in the form of price increases, which threatened our ability to maintain sales volume. While we believe we were largely successful in passing along these increased costs, such pressures may negatively impact our financial results and book of business going forward.

Item No. 1B – Unresolved Staff Comments

As of the filing of this Annual report on Form 10-K, we had no unresolved comments from the staff of the Securities and Exchange Commission.

Item No. 2 – Properties

We executed a sale and leaseback transaction during 2021 on our principal plant and offices located in Lake Barrington, Illinois, approximately 45 miles northwest of Chicago, Illinois. The facility includes approximately 68,000 square feet of office, manufacturing and warehouse space. The lease is for ten years, and annual rent increases from $500,000 the first year to $652,000 during the final year.

During 2021 we entered into a sublease agreement, expiring on August 30, 2022 to rent approximately 69,000 square feet of warehouse and assembly space in Elgin, Illinois. The annual lease cost for this facility is $408,000. The Company is currently engaged in discussions to extend that lease.

In 2017, Flexo Universal entered into a 5-year lease agreement, expiring March 2022, for the lease of approximately 73,000 square feet of manufacturing, warehouse and office space in Guadalajara, Mexico. The lease cost for these premises is 493,090 Mexican Pesos per month (approximately $20,000 per month). This property continues with Flexo Universal after the October 2021 sale of that subsidiary.

We believe that our properties have been adequately maintained, are in generally good condition and are suitable for our business as presently conducted. We believe our existing facilities provide sufficient production capacity for our present needs and for our presently anticipated needs in the foreseeable future. We also believe that, with respect to leased properties, upon the expiration of our current leases, we will be able to either secure renewal terms or to enter into leases for alternative locations at market terms.

Item No. 3 – Legal Proceedings

The Company may be party to certain lawsuits or claims arising in the normal course of business. The ultimate outcome of these matters is unknown but, in the opinion of management, we do not believe any of these proceedings will have, individually or in the aggregate, a material adverse effect upon our financial condition, cash flows or future results of operation.

Benchmark Investments, Inc. v. Yunhong CTI Ltd., Case No. 1:21-cv-02279, was filed a case in the United States District Court for the Southern District of New York on March 16, 2021 and served on the Company on March 31, 2021. The complaint seeks damages in excess of $500,000. The Company has filed its Answer and Counterclaim to the complaint. The matter is currently still pending. The Company is currently unable to estimate the probability of any potential loss and thus no accrual has been recorded.

During February 2022, Engie Resources LLC filed a claim against the Company, seeking payment of $94,000 related to utilities provided during 2019. During March 2022, the parties agreed to settle all claims for a series of payments to be made by the Company during 2022 totaling $75,000.

Item No. 4. – Mine Safety Disclosures

Not Applicable.

PART II

Item No. 5 – Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

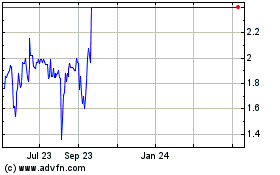

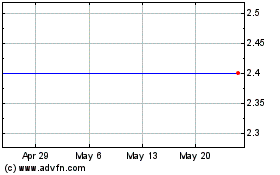

The Company's common stock was admitted to trading on the NASDAQ SmallCap Market (now the NASDAQ Capital Market) under the symbol “CTIB” on November 5, 1997.

As of December 31, 2021 there were approximately 400 holders of record of the Company’s Common Stock. The Company’s total number of beneficial owners of common stock of the Company was approximately 30.

The Company did not pay any cash dividends on its Common Stock during 2021 or 2020 and has no plans to pay dividends in the foreseeable future. Under the terms of the Company’s current loan agreements, the amount of dividends the Company may pay is limited by the terms of the financial covenants. During 2022 the Company received two deficiency notices from NASDAQ – one for the failure to hold an annual meeting of shareholders during 2021, and the other for failure to maintain the required $1 bid price during a 30 day period in 2022. The Company must hold, and plans to hold, an annual meeting on or before June 17, 2022 to satisfy the first deficiency, and has 180 days, with a possible further extension of 180 days, to satisfy the bid price issue. On March 30, 2022, the NASDAQ informed the Company that it had regained compliance with the minimum bid price issue and that the matter was resolved.

On March 28, 2022, our common stock closed at $1.19 per share.

Equity Compensation Plan Information

There were no stock option incentive plans outstanding as of December 31, 2021. Effective January 2022, the Company issued an inducement grant to its newly hired Chief Executive Officer for 250,000 shares of restricted stock. 25,000 of those shares vested during January 2022, while the remaining shares are subject to achievement of certain performance conditions.

Item No. 6 – Selected Financial Data

We are a smaller reporting company, as defined by Rule 12b-2 of the Securities Exchange Act of 1934, as amended, and are not required to provide the information required under this item.

Item No. 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations

Overview

The Company produces film products for novelty, packaging container and custom film product applications. These products include foil balloons, latex balloons (sourced from an external party) and related products, films for packaging applications, and custom film products. We produce all of our film products for packaging and container applications at our facilities in Lake Barrington, Illinois. Substantially all of our film products for packaging applications and flexible containers for packaging and storage are sold to customers in the United States. We market and sell our novelty items – principally foil balloons and latex balloons – in the United States and a number of additional countries. In addition, the Company assembles and sells Candy Blossoms (containers of arranged candy items) in the United States.

As determined by the Board of Directors beginning in 2019, we have been exiting our foreign operations in order to focus on our North America operations, particularly on foil balloons and related products. The sales entity in the UK was liquidated in 2019. The sales and distribution entity in Germany was fully closed during 2021. As noted herein, we sold Flexo Universal, our Mexican manufacturing subsidiary, during October 2021. Additionally, we stopped selling our vacuum sealing products as of March 30, 2020, after allowing the related license agreement to expire. More discussion is available in discontinued operations in this Annual Report on Form 10-K (see Note 23).

We have also changed our capital structure, beginning January 2020. This includes:

Series A Preferred Stock

On January 3, 2020, the Company entered into a stock purchase agreement (as amended on February 24, 2020 and April 13, 2020 (the “LF Purchase Agreement”)), pursuant to which the Company agreed to issue and sell, and LF International Pte. Ltd., a Singapore private limited company (“LF International”), which is controlled by Company Chairman, Mr. Yubao Li, agreed to purchase, up to 500,000 shares of the Company’s newly created shares of Series A Preferred Stock (“Series A Preferred”), with each share of Series A Preferred initially convertible into ten shares of the Company’s common stock, at a purchase price of $10.00 per share, for aggregate gross proceeds of $5,000,000 (the “LF International Offering”). As permitted by the Purchase Agreement, the Company may, in its discretion issue up to an additional 200,000 shares of Series A Preferred for a purchase price of $10.00 per share (the “Additional Shares Offering,” and collectively with the LF International Offering, the “Offering”). Approximately $1 million of Series A Preferred has been sold as of June 30, 2021, including to an investor which converted an account receivable of $478,000 owed to the investor by the Company in exchange for 48,200 shares of Series A Preferred. The Company completed several closings with LF International from January 2020 through June 2020. The majority of the funds received reduced our bank debt. We issued a total of 400,000 shares of common stock to LF International and, pursuant to the LF Purchase Agreement, changed our name from CTI Industries Corporation to Yunhong CTI Ltd. LF International had the right to name three directors to serve on our Board. They were Mr. Yubao Li, Ms. Wan Zhang and Ms. Yaping Zhang, the latter two of whom retired from our Board of Directors during January 2022.

Series B Preferred Stock

In November 2020, we issued 170,000 shares of Series B Preferred for an aggregate purchase price of $1,500,000. The Series B Preferred have an initial stated value of $10.00 per share and liquidation preference over common stock. The Series B Preferred is convertible into shares of our common stock equal to the number of shares determined by dividing the sum of the stated value and any accrued and unpaid dividends by the conversion price of $1.00. The Series B Preferred accrues dividends at a rate of 8 percent per annum, payable at our election either in cash or shares of the Company’s common stock. Initially, the Series B Preferred, in whole or part, was redeemable at the option of the holder (but not mandatorily redeemable) at any time on or after November 30, 2021 for the stated value, plus any accrued and unpaid dividends and thus was classified as mezzanine equity and initially recognized at fair value of $1.5 million (the proceeds on the date of issuance). In March 2021, the terms of the Series B Preferred were modified to eliminate the ability of the holder to redeem the Series B Preferred.

Series C Preferred Stock

In January 2021 we entered into an agreement with a related party, LF International Pte. Ltd. which is controlled by Company director, Chairman, President and Chief Executive Officer, Mr. Yubao Li, to purchase shares of Series C Preferred stock. We issued 170,000 shares of Series C Preferred for an aggregate purchase price of $1,500,000. The Series C Preferred have an initial stated value of $10.00 per share and liquidation preference over common stock. The Series C Preferred is convertible into shares of our common stock equal to the number of shares determined by dividing the sum of the stated value and any accrued and unpaid dividends by the conversion price of $1.00.

Series D Preferred Stock

In June 2021, the Company received $1.5 million from an unrelated third party as an advance on a proposed sale of Series D Redeemable Convertible Preferred Stock, which was ultimately completed. The Series D Preferred have an initial stated value of $10.00 per share and liquidation preference over common stock. The Series D Preferred is convertible into shares of our common stock equal to the number of shares determined by dividing the sum of the stated value and any accrued and unpaid dividends by the conversion price of $1.00. We issued 170,000 shares of Series D Preferred for an aggregate price of $1.5 million. Additionally, 128,000 warrants were issued pursuant to this transaction which are convertible into our common stock at the lesser of $1.75 per share or 85% of the volume weighted average price of the shares over the ten trading days prior to conversion.

Our revenues from continuing operations from each of our product categories in each of the past two years have been as follows:

| |

|

Twelve Months Ended |

|

| |

|

December 31, 2021 |

|

|

December 31, 2020 |

|

| |

|

|

$ |

|

|

% of |

|

|

|

$ |

|

|

% of |

|

| Product Category |

|

(000) Omitted |

|

|

Net Sales |

|

|

(000) Omitted |

|

|

Net Sales |

|

| D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foil Balloons |

|

|

18,235 |

|

|

|

76 |

% |

|

|

16,853 |

|

|

|

80 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Latex Balloons |

|

|

94 |

|

|

|

0 |

% |

|

|

7 |

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Film Products |

|

|

2,386 |

|

|

|

10 |

% |

|

|

804 |

|

|

|

4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

|

3,370 |

|

|

|

14 |

% |

|

|

3,395 |

|

|

|

16 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

24,086 |

|

|

|

100 |

% |

|

|

21,059 |

|

|

|

100 |

% |

Our primary expenses include the cost of products sold and selling, general and administrative expenses.

Cost of products sold primarily consists of expenses related to raw materials, labor, quality control and overhead expenses such as supervisory labor, depreciation, utilities expense and facilities expense directly associated with production of our products, warehousing and fulfillment expenses and shipping costs relating to the shipment of products to customers. Cost of products sold is impacted by the cost of the raw materials used in our products, the cost of shipping, along with our efficiency in managing the production of our products.

Selling, general and administrative expenses include the compensation and benefits paid to our employees, all other selling expenses, marketing, promotional expenses, travel and other corporate administrative expenses. These other corporate administrative expenses include professional fees, depreciation of equipment and facilities utilized in administration, occupancy costs, communication costs and other similar operating expenses. Selling, general and administrative expenses can be affected by a number of factors, including staffing levels and the cost of providing competitive salaries and benefits, the cost of regulatory compliance and other administrative costs.

Purchases by a limited number of customers represent a significant portion of our total revenues. During 2021 and 2020, respectively, sales to our top 10 customers represented 85% and 85%, respectively, of net revenues for each year. During 2021 and 2020, there were two customers to whom our sales represented more than 10% of net revenues.

Our principal customer sales for 2021 and 2020 were:

| Customer |

|

Product |

|

2021 Sales |

|

|

% of 2021 Revenues |

|

|

2020 Sales |

|

|

% of 2020 Revenues |

|

| Wal-Mart |

|

Balloons; Candy Blossoms |

|

$ |

4,537,000 |

|

|

|

19 |

% |

|

$ |

4,973,000 |

|

|

|

24 |

% |

| Dollar Tree Stores |

|

Balloons |

|

$ |

13,813,000 |

|

|

|

57 |

% |

|

$ |

12,826,000 |

|

|

|

61 |

% |

The loss of one or both of these principal customers, or a significant reduction in purchases by one or both of them, could have a material adverse effect on our business.

We generally do not have agreements with our customers under which customers are obligated to purchase any specific or minimum amount of product from us.

Year Ended December 31, 2021 Compared to Year Ended December 31, 2020

Net Sales

For the fiscal year ended December 31, 2021, consolidated net sales from continuing operations of the sale of all products were $24,086,000 compared to consolidated net sales of $21,059,000 for the year ended December 31, 2020, an increase of 14% as more fully described below.

Sales of foil balloons from continuing operations were $18,235,000 in 2021 and $16,853,000 in 2020, a increase of 8%. Our largest customer for foil balloons was Dollar Tree Stores. The remaining sales were made to hundreds of customers including distributors and retail stores.

Sales of latex balloons from continuing operations were less than $100,000 in each period. The decrease from prior years resulted principally from the sale of Flexo Universal, our latex balloon manufacturing facility. We intend to continue to sell outsourced latex balloons in order to offer a complete product line, but it will be much smaller than prior years.

Sales of film products from continuing operations were $2,386,000 in 2021 and $804,000 in 2021, an increase of nearly 200%. Our largest customer in this area underwent a merger and has now come back with more regular purchases. The inability for some vendors to meet customer requirements has also helped us gain more business in this area.

Sales of other products from continuing operations decreased to $3,370,000 in 2021 from $3,395,000 in 2020, for virtually no difference from year to year. This category includes sales of Candy Blossoms.

Cost of Sales

Cost of sales from continuing operations increased to $20,321,000 in 2021 from $17,970,000 in 2020, an increase of 13%. The increase in cost of sales was primarily attributable to the increase in sales, and secondarily related to the broad increase in prices during 2021, which occurred faster than the Company could effectively update its pricing.

General and Administrative Expenses

General and administrative expenses from continuing operations increased to $3,815,000 in 2021 from $3,655,000 in 2020, an increase of 5%. We had financial services consulting expenses, forbearance costs, and other financing costs of approximately $0.8 million that concluded when we changed lenders in September 2021.

Selling and Marketing

Selling expenses from continuing operations increased to $131,000 in 2021 from $129,000 in 2020, as total sales increased. Marketing and advertising expense decreased to $323,000 in 2021, from $350,000 in 2020, a decrease of 8%. This area was also impacted by increased sales volume, but with fewer ancillary expenses as many customers were coming back from Covid related issues.