CVS Eases Doubts About Aetna Acquisition -- WSJ

May 02 2019 - 3:02AM

Dow Jones News

By Sharon Terlep and Anna Wilde Mathews

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 2, 2019).

CVS Health Corp. delivered stronger-than-expected results in its

first full quarter as a combined health-care company, taking a step

toward selling skeptical investors on its acquisition of insurer

Aetna Inc.

The nearly $70 billion acquisition, which closed in November,

created an industry giant that combines a retail pharmacy,

pharmacy-benefit manager and Aetna's insurance businesses.

CVS said Wednesday that the insurance business performed well in

the latest period while its drugstores notched increased sales and

higher profit on brand-name drugs.

The first-quarter results mark a shift from February when the

Woonsocket, R.I.-based company offered a downbeat earnings

projection for 2019 that sent shares tumbling. The latest

performance also distinguishes CVS from rival Walgreens Boots

Alliance Inc., which reported weaker profits in the most recent

quarter and lowered its forecast citing weaker profit from

generic-drug sales.

"Considering that expectations have been low, we see this as the

first positive catalyst that restores investor confidence in this

management team," SVB Leerink analyst Ana Gupte said.

Investors have been pressing CVS for a clearer picture of its

growth prospects, and the company has promised to detail its plans

in an investors day presentation set for June 4.

CVS shares lost a third of their value after the completion of

the Aetna deal, erasing roughly $34 billion of market value. On

Wednesdays, the shares were up 5% at about $57 in afternoon

trading.

"None of us are happy with where our stock price is," CVS Chief

Executive Larry Merlo said in an interview. "From our perspective

we're very early. We're creating a pathway that no one has gone on

in an effort to make health care more local and make it more

simple."

Shareholder discontent was evident at a lunch meeting that Mr.

Merlo and finance chief Eva Boratto held with investors in early

March. The discussion was tense, according to an investor who

attended, with the audience pressing the company for more clarity

on its long-term financial expectations.

Commenting on the March meeting, UBS analyst Kevin Caliendo said

in its wake that there appeared to be a "growing credibility issue

with investors on how the company is framing the organic path

forward for the retail, and consternation that synergy realization

isn't flowing enough to the bottom line to generate accretion from

the deal."

The company's first-quarter results and call with analysts "will

help investor sentiment," Mr. Caliendo said Wednesday. "The next

big hurdle is going to be visibility on 2020 earnings and earnings

growth."

Analysts said many of the challenges for CVS are tied to broad

policy issues affecting its core businesses. Shares of health

insurers have slumped -- even for those with strong earnings -- as

debate over the industry's future has highlighted Democratic

interest in universal government-provided insurance.

CVS has said its deal to conjoin drugstores, a pharmacy-benefit

manager and an insurer would help cut health-care costs and improve

care. Mr. Merlo has talked about how the merged company will help

ease the fragmented health-care experience for consumers.

CVS is also remaking some of its stores into health hubs,

offering a broader range of services, many aimed at people with

chronic health conditions such as diabetes. The company has said it

hopes to save money and bolster care by improving patients'

adherence to their prescriptions and having lower-cost sites

provide care, instead of emergency rooms.

"Our first full quarter of combined operations was a success in

many ways," Mr. Merlo said in a statement.

CVS reported a first-quarter profit of $1.4 billion, or $1.09

cents a share, up from $998 million, or 98 cents a share, a year

earlier. Revenue jumped 35% to $61.6 billion. Analysts polled by

Refinitv were expecting $1.05 a share in earnings for the latest

period on revenue of $60.39 billion.

The company, which realigned its reporting structure to reflect

last year's acquisition, said Aetna contributed $16.6 billion in

revenue to its health-benefits segment with a boost from strong

sales of Medicare products.

Same-store sales for its retail chain increased 3.8%, beating

the FactSet estimate of a 1.2% increase. The company credited its

selling more health-focused offerings, and an increase in pharmacy

claims. Prescription volume grew 5.5% from the same period a year

earlier, though Mr. Merlos said lower margins on prescription drugs

will last throughout the year.

CVS raised it forecast, saying it expects adjusted earnings per

share of $6.75 to $6.90, up from $6.68 to $6.88. The improved

outlook remains below analyst expectations headed into 2019.

Write to Sharon Terlep at sharon.terlep@wsj.com and Anna Wilde

Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

May 02, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

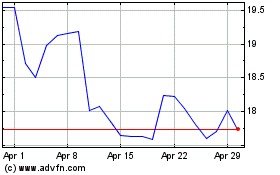

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

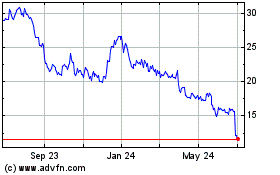

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Apr 2023 to Apr 2024