Note 20. Subsequent events

On June 1, 2021, the Company completed the previously announced sale of the majority of the Company's Alliance Healthcare business as well as a portion of the Company’s retail pharmacy international businesses in Europe, per the Share Purchase Agreement with AmerisourceBergen. See Note 2 Discontinued Operations for further information. The Company estimates the fair value of the proceeds from the Transaction to be approximately $6.8 billion to $6.9 billion (subject to net cash and working capital adjustments), the gain before currency translation adjustments to be approximately $1.0 billion to $1.1 billion and net gain on disposal to be approximately $0.3 billion to $0.4 billion. As of the date of this report, the Company has not completed the calculation of net gain on disposal of discontinued operations and therefore estimates presented are subject to further refinement and may result in changes.

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

Item 2. Management’s discussion and analysis of financial condition and results of operations

The following discussion and analysis of our financial condition and results of operations should be read together with the financial statements and the related notes included elsewhere herein and the Consolidated Condensed Financial Statements, accompanying notes and management’s discussion and analysis of financial condition and results of operations and other disclosures contained in the Walgreens Boots Alliance, Inc. Annual Report on Form 10-K for the fiscal year ended August 31, 2020. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those discussed in forward-looking statements. Factors that might cause a difference include, but are not limited to, those discussed below under “Cautionary note regarding forward-looking statements”, and in item 1A, risk factors, in our Form 10-K for the fiscal year ended August 31, 2020. References herein to the “Company”, “we”, “us”, or “our” refer to Walgreens Boots Alliance, Inc. and its subsidiaries, except as otherwise indicated or the context otherwise requires.

Certain amounts in the management's discussion and analysis of financial condition and results of operations may not add due to rounding. All percentages have been calculated using unrounded amounts for the three and nine months ended May 31, 2021 and May 31, 2020.

INTRODUCTION AND SEGMENTS

Walgreens Boots Alliance, Inc. and its subsidiaries (“Walgreens Boots Alliance” or the “Company”) is a global leader in retail pharmacy. Its operations are conducted through two reportable segments:

•United States; and

•International

See Note 15 Segment reporting and Note 16 Sales to the Consolidated Condensed Financial Statements for further information.

RECENT DEVELOPMENTS

Pharmaceutical Wholesale Transaction

On January 6, 2021, the Company entered into a Share Purchase Agreement with AmerisourceBergen. Pursuant to the terms and subject to the conditions set forth in the Share Purchase Agreement, AmerisourceBergen agreed to purchase the majority of the Company's Alliance Healthcare business as well as a portion of the Company’s retail pharmacy international businesses in Europe for approximately $6.5 billion, comprised of $6.275 billion in cash, subject to certain purchase price adjustments, and 2 million shares of AmerisourceBergen common stock. Alliance Healthcare’s investment in China and Italy and its operations in Germany are not part of the Transaction. The Company's retail pharmacy international operations in The Netherlands, Norway and Lithuania are part of the Transaction. On June 1, 2021 the Company completed the previously announced sale of the Company's Alliance Healthcare business per the Share Purchase Agreement with AmerisourceBergen. After giving effect to the Transaction, the Company beneficially owns approximately 28.4% of AmerisourceBergen’s outstanding common stock, based on the share count publicly reported by AmerisourceBergen in its most recent Quarterly Report on Form 10-Q. See Note 20 Subsequent events to the Consolidated Condensed Financial Statements for further information.

The Disposal Group met the criteria to be reported as discontinued operations. Therefore, the related assets, liabilities and operating results of the Disposal Group are reported as discontinued operations for all periods presented.

In connection with the closing of the Transaction, the Company and AmerisourceBergen also agreed to (i) a three-year extension through 2029 of the U.S. pharmaceutical distribution agreement pursuant to which branded and generic pharmaceutical products are sourced from AmerisourceBergen in the U.S., (ii) a three-year extension of the agreement, that provides AmerisourceBergen the ability to access generics pharmaceutical products through Walgreens Boots Alliance Development GmbH, the Company’s global sourcing enterprise, (iii) a distribution agreement pursuant to which AmerisourceBergen will supply branded and generic pharmaceutical products to the Company’s Boots UK business following the closing of the Transaction and (iv) explore a series of strategic initiatives designed to create incremental growth and efficiencies in sourcing, logistics and distribution.

See Note 2 Discontinued operations to the Consolidated Condensed Financial Statements for additional information.

VillageMD investment

On January 6, 2021, the Company and VillageMD announced that the Company had accelerated its investment in VillageMD to support the opening of 600 to 700 Village Medical at Walgreens primary care clinics in more than 30 U.S. markets within the next four years, with the intent to build hundreds more thereafter.

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

In July 2020, the Company and VillageMD announced an expansion of their partnership and the intent to open 500 to 700 clinics over a five-year period, supported by the Company’s investment in VillageMD over three years of $1.0 billion in equity and convertible debt, which included an initial $250 million equity investment. The Company completed the remaining $750 million investment during the nine months ended May 31, 2021, which allows the Company to increase the minimum number of clinics to 600 and expand the rollout at a faster pace.

iA acquisition

On December 29, 2020, the Company acquired a majority equity interest in Innovation Associates, Inc. for a cash consideration of $451 million. Innovation Associates, Inc. is a leading-edge provider of software enabled automation solutions for retail, hospital and federal healthcare and mail-order pharmacy markets. The Company accounted for this acquisition as a business combination and consolidates Innovation Associates, Inc. within the United States segment in its financial statements. See Note 3 Acquisitions to the Consolidated Condensed Financial Statements for further information. Considering the contractual terms related to the remaining noncontrolling interest, it is classified as redeemable noncontrolling interest in the Consolidated Condensed Balance Sheets. See Note 19 Supplemental information for more details on redeemable noncontrolling interest. The goodwill arising from this acquisition reflects the expected operational synergies and cost savings to be derived as a result of this acquisition.

Pharmaceutical Wholesale business in Germany

On November 1, 2020, the Company and McKesson Corporation closed a transaction to form a combined pharmaceutical wholesale business in Germany, as part of a strategic alliance. The Company owns a 70% controlling equity interest in the combined business which is consolidated by the Company and reported within the International segment in its financial statements. The Company accounted for this acquisition as a business combination involving noncash purchase consideration of $296 million consisting of the issuance of an equity interest in the combined business. See Note 3 Acquisitions to the Consolidated Condensed Financial Statements for further information.

FACTORS AFFECTING OUR RESULTS AND COMPARABILITY

The Company has been, and we expect it to continue to be affected by a number of factors that may cause actual results to differ from our historical results or current expectations. These factors include: the impact of the COVID-19 pandemic (“COVID-19”) on our operations and financial results; the financial performance of our equity method investees, including AmerisourceBergen; the influence of certain holidays; seasonality; foreign currency rates; changes in vendor, payer and customer relationships and terms and associated reimbursement pressure; strategic transactions and acquisitions, dispositions, joint ventures and other strategic collaborations; changes in laws, including U.S. tax law changes; changes in trade, tariffs, including trade relations between the U.S. and China, and international relations, including the UK's withdrawal from the European Union and its impact on our operations and prospects and those of our customers and counterparties; the timing and magnitude of cost reduction initiatives, including under our Transformational Cost Management Program (as defined below); the timing and severity of the cough, cold and flu season; fluctuations in variable costs; the impacts of looting, natural disasters, war, terrorism and other catastrophic events, and changes in general economic conditions in the markets in which the Company operates. These and other factors can affect the Company’s operations and net earnings for any period and may cause such results not to be comparable to the same period in previous years. The results presented in this report are not necessarily indicative of future operating results.

Estimated COVID-19 impacts and uncertainties

COVID-19 has severely impacted, and is expected to continue to impact, the economies of the U.S., the UK and other countries around the world. COVID-19 has created significant public health concerns as well as significant volatility, uncertainty and economic disruption in every region in which we operate, all of which have been adversely affected and may again adversely affect our industries and our business operations. Further, financial and credit markets have experienced and may again experience volatility. Policies and initiatives designed to reduce the transmission of COVID-19 have resulted in, among other things, temporary closure or reduced hours of operation of certain store locations in U.S., the UK and other countries, reduced customer traffic and sales in our retail pharmacies and the adoption of work-from-home policies.

COVID-19 continued to affect global economic conditions during the three months ended May 31, 2021. The situation surrounding COVID-19 remains fluid, and we are actively managing our response in collaboration with customers, government officials, team members and business partners and assessing potential impacts to our financial position and operating results, as well as developments in our business. As COVID-19 impacts the economies of the U.S., the UK and other countries around the world, the Company has put preparedness plans in place at our facilities to maintain continuity of our operations, while also taking steps to keep our team members healthy and safe.

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

In response to COVID-19, various domestic and foreign federal, state and local governmental legislation, regulations, orders, policies and initiatives have been implemented that are designed to reduce the transmission of COVID-19, as well as to help address economic and market volatility and instability resulting from COVID-19. The Company has assessed and will continue to assess the impact of these governmental actions on the Company. It has participated in certain of these programs, including for example availing itself to certain tax deferrals which were introduced by the CARES Act in the U.S. and certain tax deferral and benefit and employee wage support in the UK, and may continue to do so in the future.

During the three months ended May 31, 2021, sales growth within the United States segment was aided by the acceleration of COVID-19 vaccination rollout and retail recovery as store traffic accelerated with key markets continuing to reopen. The International segment experienced a rebound in retail sales resulting from the phased reopening of the UK high street and less severe COVID-19 restrictions. However, store transactions remain below pre-COVID-19 levels due to the slower pace of reopening in the UK. The Company incurred labor and other costs related to the vaccination program and continued to take measures to keep stores open, incurring incremental selling, general and administrative expenses to safeguard store environments. The Company continued to take certain actions during the three months ended May 31, 2021 to partly mitigate the impact of COVID-19 through cost containment across the International segment, including reducing rent at some locations.

The Company continues to play a critical role in fighting the COVID-19 pandemic. To continue to work with customers and manage through the pandemic, the Company launched a COVID-19 testing program in fiscal 2020. Since the launch of the program, the Company has administered more than 8 million COVID-19 tests in the U.S. as part of its Test & Protect efforts, including over-the counter self tests. In the International segment, Boots administered more than 3 million COVID-19 tests in the UK, mostly undertaken in partnership with the National Health Service (“NHS”). Boots UK also have a growing private test offering with several at home and in-store tests available, in addition to testing partnerships with several major airlines.

The Company has worked with the Centers for Disease Control and Prevention (“CDC”), U.S. Department of Health and Human Services (“HHS”) and the U.S. government to help administer COVID-19 vaccines to high priority groups, including long-term care facility residents and staff. The United States segment also expanded vaccination models to ensure convenient access, including same-day and walk-in appointments, mobile clinics, employer partnerships and extended hours at over 4,000 locations. As of the date of this report, the United States segment has provided more than 25 million, COVID-19 vaccination, including 17 million in the three months ended May 31, 2021. The Company expects a lower level of COVID-19 vaccination in the three months ending August 31, 2021 compared to the three months ended May 31, 2021.

The Company anticipates additional mandates and directives, including revisions thereto, from foreign, federal, state, county and city authorities throughout the continuation of the COVID-19 pandemic and for some time thereafter. The impact of this activity on the U.S. and global economies and consumer, customer and health care utilization patterns depends upon the evolving factors and future developments related to COVID-19. As a result, the financial and/or operational impact these COVID-19 related governmental actions and inactions will have on our businesses, operating results, cash flows and/or financial condition is uncertain, but the impact, singularly or collectively, could be material and adverse.

The Company’s current expectations described above are forward-looking statements and our actual results may differ. Factors that might cause a difference include, but are not limited to, those discussed below under “Cautionary note regarding forward-looking statements” and in Item 1A, Risk factors, in our Form 10-K for the fiscal year ended August 31, 2020.

The potential impacts of Brexit

As a result of a referendum in June 2016, the UK withdrew from the European Union (“Brexit”) on January 31, 2020. It began a transition period in which to negotiate a new trading relationship for goods and services that ended on December 31, 2020. On December 24, 2020, the EU and UK agreed to a trade deal with no tariffs nor quotas on products, regulatory and customs cooperation mechanisms as well as provisions ensuring a level playing field for open and fair competition. Given the lack of comparable precedent, it is uncertain what financial, trade, regulatory and legal implications the agreed Brexit trade deal will have on our business, particularly our UK and other European operations; however, Brexit and its related effects could have a material adverse impact on the Company’s consolidated financial position and results of operations.

TRANSFORMATIONAL COST MANAGEMENT PROGRAM

On December 20, 2018, the Company announced a transformational cost management program that was expected to deliver in excess of $2.0 billion of annual cost savings by fiscal 2022 (the “Transformational Cost Management Program”). The Company continues to expect to deliver in excess of $2.0 billion of annual cost savings by fiscal 2022 from continuing operations, after excluding amounts related to the Disposal Group.

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

The Transformational Cost Management Program, which is multi-faceted and includes divisional optimization initiatives, global smart spending, global smart organization and the transformation of the Company’s information technology (IT) capabilities, is designed to help the Company achieve increased cost efficiencies. To date, the Company has taken actions across all aspects of the Transformational Cost Management Program. The actions under the Transformational Cost Management Program focus on the two reportable segments and the Company’s corporate and global functions. Divisional optimization within each of the Company’s segments includes activities such as optimization of stores including current plans to close approximately 200 Boots stores in the UK and approximately 250 stores in the U.S.

The Company currently estimates that the Transformational Cost Management Program will result in cumulative pre-tax charges to its generally accepted accounting principles in the U.S. (“GAAP”) financial results of approximately $2.1 billion to $2.3 billion, subject to approval, of which $1.8 billion to $2.0 billion are expected to be recorded as exit and disposal activities. The Company estimates that approximately 85% of the cumulative pre-tax charges will be associated with cash expenditures, primarily related to employee severance and business transition costs, IT transformation costs and lease and real estate payments.

The Company currently estimates that it will recognize aggregate pre-tax charges to its GAAP financial results in continuing operations related to Transformational Cost Management Program as follows:

|

|

|

|

|

|

|

|

Transformational Cost Management Program Activities

|

Range of Charges

|

|

Lease obligations and other real estate costs1

|

$450 to 500 million

|

|

Asset impairments2

|

$275 to 300 million

|

|

Employee severance and business transition costs

|

$800 to 850 million

|

|

Information technology transformation and other exit costs

|

$275 to 300 million

|

|

Total cumulative pre-tax exit and disposal costs

|

$1.8 to 2.0 billion

|

|

Other IT transformation costs

|

$300 to 350 million

|

|

Total estimated pre-tax costs

|

$2.1 to 2.3 billion

|

1Includes impairments relating to operating lease right-of-use and finance lease assets.

2Primarily related to asset write-offs from store closures and other asset write-offs.

In addition to the impacts discussed above, as a result of the actions related to store closures taken under the Transformational Cost Management Program, the Company recorded $508 million of transition adjustments to decrease retained earnings due to the adoption of the new lease accounting standard (Topic 842) on September 1, 2019.

Since the inception of the Transformational Cost Management Program to May 31, 2021, the Company has recognized aggregate cumulative pre-tax charges to its financial results in accordance with GAAP of $1.4 billion, of which $1.2 billion are recorded as exit and disposal activities. See Note 4 Exit and disposal activities, to the Consolidated Condensed Financial Statements for additional information. These charges included $293 million related to lease obligations and other real estate costs, $245 million in asset impairments, $517 million in employee severance and business transition costs, $153 million of information technology transformation and other exit costs and $175 million other IT costs.

Costs from continuing operations under the Transformational Cost Management Program, which were primarily recorded in selling, general and administrative expenses for the three and nine months ended May 31, 2021 and May 31, 2020, were as follows (in millions):

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended May 31, 2021

|

United States

|

|

International

|

|

Corporate and Other

|

|

Walgreens Boots Alliance, Inc.

|

|

Lease obligations and other real estate costs

|

$

|

15

|

|

|

$

|

6

|

|

|

$

|

—

|

|

|

$

|

21

|

|

|

Asset impairments

|

5

|

|

|

9

|

|

|

—

|

|

|

14

|

|

|

Employee severance and business transition costs

|

(19)

|

|

|

2

|

|

|

14

|

|

|

(2)

|

|

|

Information technology transformation and other exit costs

|

1

|

|

|

10

|

|

|

|

|

11

|

|

|

Total pre-tax exit and disposal costs

|

$

|

2

|

|

|

$

|

27

|

|

|

$

|

14

|

|

|

$

|

44

|

|

|

Other IT transformation costs

|

10

|

|

|

6

|

|

|

—

|

|

|

16

|

|

|

Total pre-tax costs

|

$

|

13

|

|

|

$

|

33

|

|

|

$

|

14

|

|

|

$

|

60

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended May 31, 2021

|

United States

|

|

International

|

|

Corporate and Other

|

|

Walgreens Boots Alliance, Inc.

|

|

Lease obligations and other real estate costs

|

$

|

56

|

|

|

$

|

6

|

|

|

$

|

—

|

|

|

$

|

62

|

|

|

Asset impairment

|

9

|

|

|

10

|

|

|

—

|

|

|

19

|

|

|

Employee severance and business transition costs

|

92

|

|

|

36

|

|

|

44

|

|

|

172

|

|

|

Information technology transformation and other exit costs

|

14

|

|

|

11

|

|

|

1

|

|

|

26

|

|

|

Total pre-tax exit and disposal charges

|

$

|

172

|

|

|

$

|

63

|

|

|

$

|

44

|

|

|

$

|

279

|

|

|

Other IT transformation costs

|

42

|

|

|

17

|

|

|

—

|

|

|

59

|

|

|

Total pre-tax charges

|

$

|

213

|

|

|

$

|

80

|

|

|

$

|

44

|

|

|

$

|

338

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended May 31, 2020

|

United States

|

|

International

|

|

Corporate and Other

|

|

Walgreens Boots Alliance, Inc.

|

|

Lease obligations and other real estate costs

|

$

|

170

|

|

|

$

|

3

|

|

|

$

|

—

|

|

|

$

|

173

|

|

|

Asset impairments

|

19

|

|

|

10

|

|

|

—

|

|

|

29

|

|

|

Employee severance and business transition costs

|

47

|

|

|

(2)

|

|

|

11

|

|

|

56

|

|

|

Information technology transformation and other exit costs

|

17

|

|

|

16

|

|

|

—

|

|

|

33

|

|

|

Total pre-tax exit and disposal costs

|

$

|

253

|

|

|

$

|

27

|

|

|

$

|

11

|

|

|

$

|

290

|

|

|

Other IT transformation costs

|

17

|

|

|

4

|

|

|

—

|

|

|

20

|

|

|

Total pre-tax costs

|

$

|

269

|

|

|

$

|

30

|

|

|

$

|

11

|

|

|

$

|

310

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended May 31, 2020

|

United States

|

|

International

|

|

Corporate and Other

|

|

Walgreens Boots Alliance, Inc.

|

|

Lease obligations and other real estate costs

|

$

|

179

|

|

|

$

|

5

|

|

|

$

|

—

|

|

|

$

|

184

|

|

|

Asset impairment

|

31

|

|

|

13

|

|

|

—

|

|

|

44

|

|

|

Employee severance and business transition costs

|

111

|

|

|

33

|

|

|

18

|

|

|

162

|

|

|

Information technology transformation and other exit costs

|

27

|

|

|

26

|

|

|

12

|

|

|

65

|

|

|

Total pre-tax exit and disposal charges

|

$

|

348

|

|

|

$

|

76

|

|

|

$

|

31

|

|

|

$

|

455

|

|

|

Other IT transformation costs

|

43

|

|

|

11

|

|

|

—

|

|

|

53

|

|

|

Total pre-tax charges

|

$

|

390

|

|

|

$

|

87

|

|

|

$

|

31

|

|

|

$

|

508

|

|

The amounts and timing of all estimates are subject to change until finalized. The actual amounts and timing may vary materially based on various factors. See “Cautionary note regarding forward-looking statements” below.

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

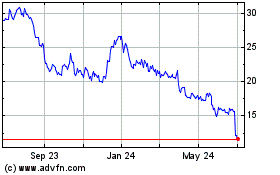

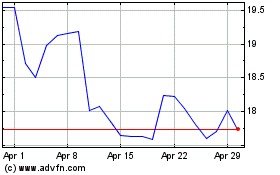

INVESTMENT IN AMERISOURCEBERGEN

As of May 31, 2021, the Company owned 56,854,867 shares of AmerisourceBergen common stock, representing approximately 27.7% of its outstanding common stock based on the share count publicly reported by AmerisourceBergen in its most recent Quarterly Report on Form 10-Q, and may, subject to certain conditions, acquire up to an additional 8,398,752 AmerisourceBergen shares in the open market.

The Company accounts for its investment in AmerisourceBergen using the equity method of accounting, subject to a two-month reporting lag, with the net earnings (loss) attributable to the investment classified within the operating income of the Company’s United States segment. During the nine months ended May 31, 2021, the Company recognized equity losses in AmerisourceBergen of $1,196 million, which included a loss of $1,373 million recognized during the three months ended November 30, 2020. These equity losses were primarily due to AmerisourceBergen recognition of $5.6 billion, net of tax, and charges related to its ongoing opioid litigation in its financial statements for the three months period ended September 30, 2020.

On January 6, 2021, the Company entered into a Share Purchase Agreement with AmerisourceBergen pursuant to which AmerisourceBergen agreed to purchase the majority of the Company's pharmaceutical wholesale operations, as well as a portion of the Company’s retail pharmacy international businesses in Europe among other assets, for $6.275 billion in cash (subject to customary purchase price adjustments) and 2 million shares of common stock of AmerisourceBergen. On June 1, 2021 the Company completed the previously announced sale of the Company's Alliance Healthcare business per the Share Purchase Agreement with AmerisourceBergen. After giving effect to the Transaction, the Company beneficially owns approximately 28.4% of AmerisourceBergen’s outstanding common stock, based on the share count publicly reported by AmerisourceBergen in its most recent Quarterly Report on Form 10-Q. See Recent developments above and Note 2 Discontinued operations to the Consolidated Condensed Financial Statements for additional information.

The financial performance of AmerisourceBergen will impact the Company’s results of operations. Additionally, a substantial and sustained decline in the price of AmerisourceBergen’s common stock could trigger an impairment evaluation of our investment. These considerations may materially and adversely affect the Company’s financial condition and results of operations.

For more information, see Note 6 Equity method investments to the Consolidated Condensed Financial Statements.

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY

The following table presents certain key financial statistics.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions, except per share amounts)

|

|

|

Three months ended May 31,

|

|

Nine months ended May 31,

|

|

|

2021

|

|

2020

|

|

2021

|

|

2020

|

|

Sales

|

$

|

34,030

|

|

|

$

|

30,364

|

|

|

$

|

98,247

|

|

|

$

|

91,612

|

|

|

Gross profit

|

7,153

|

|

|

5,959

|

|

|

20,564

|

|

|

19,753

|

|

|

Selling, general and administrative expenses

|

6,116

|

|

|

7,884

|

|

|

17,936

|

|

|

19,663

|

|

|

Equity earnings (loss) in AmerisourceBergen

|

97

|

|

|

243

|

|

|

(1,196)

|

|

|

284

|

|

|

Operating income (loss)

|

1,134

|

|

|

(1,683)

|

|

|

1,432

|

|

|

374

|

|

|

Adjusted operating income (Non-GAAP measure)1

|

1,459

|

|

|

798

|

|

|

3,881

|

|

|

3,724

|

|

|

Earnings (loss) before interest and income tax provision

|

1,294

|

|

|

(1,715)

|

|

|

1,905

|

|

|

407

|

|

|

Net earnings attributable to Walgreens Boots Alliance, Inc. - continuing operations (GAAP)

|

1,105

|

|

|

(1,794)

|

|

|

1,636

|

|

|

(157)

|

|

|

Adjusted net earnings attributable to Walgreens Boots Alliance, Inc. - continuing operations (Non-GAAP measure)1

|

1,194

|

|

|

618

|

|

|

3,237

|

|

|

2,985

|

|

|

Diluted net earnings (loss) per common share - continuing operations (GAAP)

|

1.27

|

|

|

(2.05)

|

|

|

1.89

|

|

|

(0.18)

|

|

|

Adjusted diluted net earnings per common share - continuing operations (Non-GAAP measure)1

|

1.38

|

|

|

0.71

|

|

|

3.74

|

|

|

3.37

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage increases (decreases)

|

|

|

Three months ended May 31,

|

|

Nine months ended May 31,

|

|

|

2021

|

|

2020

|

|

2021

|

|

2020

|

|

Sales

|

12.1

|

|

0.1

|

|

7.2

|

|

1.4

|

|

Gross profit

|

20.0

|

|

(14.4)

|

|

4.1

|

|

(7.7)

|

|

Selling, general and administrative expenses

|

(22.4)

|

|

35.4

|

|

(8.8)

|

|

12.0

|

|

Operating income

|

NM

|

|

NM

|

|

282.6

|

|

(90.5)

|

|

Adjusted operating income (Non-GAAP measure)1

|

82.9

|

|

(50.0)

|

|

4.2

|

|

(26.2)

|

|

Earnings before interest and income tax provision

|

NM

|

|

NM

|

|

368.3

|

|

(90.3)

|

|

Net earnings attributable to Walgreens Boots Alliance, Inc. - continuing operations (GAAP)

|

NM

|

|

NM

|

|

NM

|

|

NM

|

|

Adjusted net earnings attributable to Walgreens Boots Alliance, Inc. - continuing operations (Non-GAAP measure)1

|

93.1

|

|

(50.4)

|

|

8.4

|

|

(25.0)

|

|

Diluted net earnings per common share - continuing operations (GAAP)

|

NM

|

|

NM

|

|

NM

|

|

NM

|

|

Adjusted diluted net earnings per common share - continuing operations (Non-GAAP measure)1

|

95.1

|

|

(48.4)

|

|

10.7

|

|

(21.1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percent to sales

|

|

|

Three months ended May 31,

|

|

Nine months ended May 31,

|

|

|

2021

|

|

2020

|

|

2021

|

|

2020

|

|

Gross margin

|

21.0

|

|

19.6

|

|

20.9

|

|

21.6

|

|

Selling, general and administrative expenses

|

18.0

|

|

26.0

|

|

18.3

|

|

21.5

|

1See “--Non-GAAP Measures” below for a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP and related disclosures.

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

NM - Not meaningful. Percentage increases/decreases when one period includes income and other period includes loss are considered not meaningful.

WALGREENS BOOTS ALLIANCE RESULTS OF OPERATIONS

Net earnings from continuing operations

Net earnings attributable to the Company for the three months ended May 31, 2021 was $1.1 billion compared to net loss of $1.8 billion for the prior year quarter. Diluted net earnings per share was $1.27 compared to diluted net loss per share of $2.05 for the prior year quarter. The increases in net earnings and diluted net earnings per share are primarily due to $2.0 billion non-cash impairment charges in the International segment, related to goodwill and intangible assets in the prior year period, increased operating income in the United States and International Segments and earnings related to the Company's equity method investment in HC Group Holdings I, LLC (“HC Group Holdings”) partially offset by higher effective tax rate in the quarter.

Net earnings attributable to the Company for the nine months ended May 31, 2021 was $1.6 billion compared to net loss of $157 million for the prior year period. Diluted net earnings per share was $1.89 compared to diluted net loss per share of $0.18 for the prior year period. The increases in net earnings and diluted net earnings per share are primarily due to $2.0 billion non-cash impairment charges in the International segment, related to goodwill and intangible assets in the prior year period, earnings related to the Company's equity method investee HC Group Holdings and gain on partial sale of ownership interest in Option Care Health by the Company's equity method investee HC Group Holdings partially offset by equity losses in AmerisourceBergen of $1.4 billion during the three months ended November 30, 2020.

Other income for the three and nine months ended May 31, 2021 was $159 million and $473 million respectively. Other income for the three and nine months ended May 31, 2020 was an expense of $32 million and an income of $32 million respectively. Increase in Other income is mainly due to a partial sale of ownership interest in Option Care Health by the Company's equity method investee HC Group Holdings.

Interest was a net expense of $545 million and $817 million for the three and nine months ended May 31, 2021, respectively, compared to $148 million and $463 million for the three and nine months ended May 31, 2020, respectively. The increases in interest expense included $419 million related to the early extinguishment of debt related to Company's cash tender offer to partially purchase and retire $3.3 billion of long-term debt in advance of its maturity.

The effective tax rate for the three months ended May 31, 2021 was 32.8%, compared to 2.3% for the three months ended May 31, 2020. The tax rate for the current period includes a discrete tax expense on equity earnings of $576 million from HC Group Holdings. The effective tax rate for the prior period reflects a tax benefit on a pretax loss and is primarily driven by the impact of a non-deductible goodwill impairment charge. The effective tax rate for the nine months ended May 31, 2021 was 7.4% compared to 230.0% in prior period, primarily due to the discrete tax effect of equity losses in AmerisourceBergen, partially offset by the tax effect of equity earnings of HC Group Holdings.

Adjusted net earnings from continuing operations (Non-GAAP measure)

Adjusted net earnings attributable to the Company for the three months ended May 31, 2021 increased 93.1% compared with the prior year quarter to $1.2 billion. Adjusted diluted net earnings per share increased 95.1% compared with the year-ago quarter to $1.38. Adjusted diluted net earnings and adjusted diluted net earnings per share were both positively impacted by 1.5 percentage points, respectively, as a result of currency translation.

The increases in adjusted net earnings and adjusted diluted net earnings per share for the three months ended May 31, 2021 primarily reflect strong adjusted gross profit growth across both pharmacy and retail in the United States and a rebound in International sales and profitability due to less severe COVID-19 restrictions in the UK. Adjusted diluted net earnings per share for the three months ended May 31, 2021 benefited from a lower number of shares outstanding compared with the prior year quarter. See “--Non-GAAP Measures” below for a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP and related disclosures.

Adjusted net earnings attributable to the Company for the nine months ended May 31, 2021 increased 8.4% compared with the prior year period to $3.2 billion. Adjusted diluted net earnings per share increased compared with the year-ago period 10.7% to $3.74. Adjusted diluted net earnings and adjusted diluted net earnings per share were both positively impacted by 0.8 percentage points as a result of currency translation.

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

The increases in adjusted net earnings and adjusted diluted net earnings per share for the nine months ended May 31, 2021 primarily reflect growth in operating income due to less severe impacts from COVID-19 and lower interest expense. Adjusted diluted net earnings per share for the nine months ended May 31, 2021 benefited from a lower number of shares outstanding compared with the prior year period. See “--Non-GAAP Measures” below for a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP and related disclosures.

RESULTS OF OPERATIONS BY SEGMENT

United States

The Company's United States segment includes the Walgreens business which includes the operations of retail drugstores, health and wellness services, and mail and central specialty pharmacy services, and its equity method investment in AmerisourceBergen. Sales for the segment are principally derived from the sale of prescription drugs and a wide assortment of retail products, including health and wellness, beauty, personal care and consumables and general merchandise.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL PERFORMANCE

|

(in millions, except location amounts)

|

|

|

Three months ended May 31,

|

|

Nine months ended May 31,

|

|

|

2021

|

|

2020

|

|

2021

|

|

2020

|

|

Sales

|

$

|

28,743

|

|

|

$

|

27,357

|

|

|

$

|

83,250

|

|

|

$

|

80,734

|

|

|

Gross profit

|

6,093

|

|

|

5,275

|

|

|

17,434

|

|

|

16,816

|

|

|

Selling, general and administrative expenses

|

4,971

|

|

|

4,990

|

|

|

14,695

|

|

|

14,595

|

|

|

Equity earnings (loss) in AmerisourceBergen

|

97

|

|

|

243

|

|

|

(1,196)

|

|

|

284

|

|

|

Operating income

|

1,219

|

|

|

528

|

|

|

1,543

|

|

|

2,505

|

|

|

Adjusted operating income (Non-GAAP measure)1

|

1,471

|

|

|

979

|

|

|

3,789

|

|

|

3,704

|

|

|

Number of prescriptions2

|

214.1

|

|

|

196.9

|

|

|

613.9

|

|

|

623.2

|

|

|

30-day equivalent prescriptions2,3

|

312.1

|

|

|

287.0

|

|

|

898.1

|

|

|

877.7

|

|

|

Number of locations at period end

|

8,992

|

|

|

9,095

|

|

|

8,992

|

|

|

9,095

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage increases (decreases)

|

|

|

Three months ended May 31,

|

|

Nine months ended May 31,

|

|

|

2021

|

|

2020

|

|

2021

|

|

2020

|

|

Sales

|

5.1

|

|

3.2

|

|

3.1

|

|

2.9

|

|

Gross profit

|

15.5

|

|

(9.7)

|

|

3.7

|

|

(6.4)

|

|

Selling, general and administrative expenses

|

(0.4)

|

|

4.0

|

|

0.7

|

|

1.3

|

|

Operating income

|

130.8

|

|

(48.5)

|

|

(38.4)

|

|

(31.6)

|

|

Adjusted operating income (Non-GAAP measure)1

|

50.3

|

|

(32.6)

|

|

2.3

|

|

(19.2)

|

|

|

|

|

|

|

|

|

|

|

Comparable sales4

|

6.4

|

|

3.1

|

|

4.1

|

|

2.5

|

|

Pharmacy sales

|

6.3

|

|

4.6

|

|

5.1

|

|

4.3

|

|

Comparable pharmacy sales4

|

8.4

|

|

3.5

|

|

6.0

|

|

3.3

|

|

Retail sales

|

1.4

|

|

(0.7)

|

|

(2.6)

|

|

(1.0)

|

|

Comparable retail sales4

|

1.7

|

|

2.1

|

|

(0.5)

|

|

0.7

|

|

Comparable number of prescription2,4

|

9.8

|

|

(5.8)

|

|

—

|

|

(1.2)

|

|

Comparable 30-day equivalent prescriptions2,3,4

|

9.8

|

|

0.4

|

|

3.8

|

|

2.7

|

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percent to sales

|

|

|

Three months ended May 31,

|

|

Nine months ended May 31,

|

|

|

2021

|

|

2020

|

|

2021

|

|

2020

|

|

Gross margin

|

21.2

|

|

19.3

|

|

20.9

|

|

20.8

|

|

Selling, general and administrative expenses

|

17.3

|

|

18.2

|

|

17.7

|

|

18.1

|

1See “--Non-GAAP Measures” below for a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP and related disclosures.

2Includes immunizations.

3Includes the adjustment to convert prescriptions greater than 84 days to the equivalent of three 30-day prescriptions. This adjustment reflects the fact that these prescriptions include approximately three times the amount of product days supplied compared to a normal prescription.

4Comparable sales are defined as sales from stores that have been open for at least twelve consecutive months without closure for seven or more consecutive days, including due to looting or store damage, and without a major remodel or being subject to a natural disaster, in the past twelve months as well as e-commerce sales. E-commerce sales include digitally initiated sales online or through mobile applications. Relocated stores are not included as comparable sales for the first twelve months after the relocation. Acquired stores are not included as comparable sales for the first twelve months after acquisition or conversion, when applicable, whichever is later. Comparable sales, comparable pharmacy sales, comparable retail sales, comparable number of prescriptions and comparable number of 30-day equivalent prescriptions refer to total sales, pharmacy sales, retail sales, number of prescriptions and number of 30-day equivalent prescriptions, respectively. Comparable retail sales for previous periods have been restated to include e-commerce sales. The method of calculating comparable sales varies across the retail industry and our method of calculating comparable sales may not be the same as other retailers’ methods.

Sales for the three months ended May 31, 2021 and May 31, 2020

The United States segment's sales for the three months ended May 31, 2021 increased 5.1% compared with the year-ago quarter to $28.7 billion. Sales in comparable stores increased 6.4% compared with the year-ago quarter.

Pharmacy sales increased 6.3% for the three months ended May 31, 2021 and represented 75.7% of the segment’s sales. The increase is primarily due to higher brand inflation, COVID-19 vaccination volume and increased prescription volume partially offset by higher generic utilization and lower reimbursement. In the year-ago quarter, pharmacy sales increased 4.6% and represented 74.9% of the segment’s sales. Comparable pharmacy sales increased 8.4% for the three months ended May 31, 2021 compared to increase of 3.5% in the year-ago quarter. The effect of generic drugs, which have a lower retail price, replacing brand name drugs reduced prescription sales by 0.5% in the three months ended May 31, 2021 compared to a reduction of 2.7% in the year-ago quarter. The effect of generics mix on segment sales caused a reduction of 0.4% for the three months ended May 31, 2021 compared to a reduction of 1.9% for the year-ago quarter. Third party sales, where reimbursement is received from managed care organizations, governmental agencies, employers or private insurers, were 97.5% of prescription sales for the three months ended May 31, 2021 compared to 95.4% in the year-ago quarter. The total number of prescriptions (including immunizations) filled for the three months ended May 31, 2021 was 214.1 million compared to 196.9 million in the year-ago quarter. Prescriptions (including immunizations) filled adjusted to 30-day equivalents were 312.1 million in the three months ended May 31, 2021 compared to 287.0 million in the year-ago quarter.

Retail sales for the three months ended May 31, 2021 increased 1.4%, including the impact of the store closures, and were 24.3% of the segment’s sales. In the year-ago quarter, retail sales decreased 0.7% and comprised 25.1% of the segment’s sales. Comparable retail sales increased 1.7% in the three months ended May 31, 2021 compared to increase of 2.1% in the year-ago quarter. The increase in the current quarter is driven primarily by an increase in health and wellness excluding cough, cold and flu and beauty categories reflecting mass personalization and improved traffic trends partially offset by a decline in consumables and general merchandise categories.

Operating income for the three months ended May 31, 2021 and May 31, 2020

The United States segment’s operating income for the three months ended May 31, 2021 increased 130.8% to $1.2 billion including $97 million from the Company’s share of equity earnings in AmerisourceBergen. The increase was primarily driven by higher gross profit from pharmacy reflecting improved pharmacy margin entirely due to product mix from COVID-19 vaccinations, and higher gross profit from retail reflecting favorable product mix, higher costs related to Transformational Cost Management program in the year ago quarter, partially offset by incremental costs related to the vaccination program.

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

Gross margin was 21.2% for the three months ended May 31, 2021 compared to 19.3% in the year-ago quarter. Gross margin was positively impacted in the current quarter by increased pharmacy margin due to favorable mix from vaccinations and retail margin expansion due to product mix.

Selling, general and administrative expenses as a percentage of sales were 17.3% in the three months ended May 31, 2021 compared to 18.2% in the year-ago quarter. As a percentage of sales, expenses were lower in the current quarter primarily due to higher costs related to Transformational Cost Management Program in the year ago quarter and savings this year from Transformational Cost Management program partially offset by incremental COVID-19 related costs, mainly related to the vaccination program as well as higher growth investments.

Adjusted operating income (Non-GAAP measure) for the three months ended May 31, 2021 and May 31, 2020

The United States segment’s adjusted operating income, which included $145 million from the Company’s share of adjusted earnings in AmerisourceBergen, was $1.5 billion for the three months ended May 31, 2021, an increase of 50.3% from the year-ago quarter. The increase was primarily driven by higher gross profit from pharmacy reflecting improved pharmacy margin entirely due to product mix from COVID-19 vaccinations, and higher gross profit from retail reflecting favorable product mix and costs savings from the Transformational Cost Management Program, offset by costs related to the COVID-19 vaccination program and higher growth investments. See “--Non-GAAP Measures” below for a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP and related disclosures.

Sales for the nine months ended May 31, 2021 and May 31, 2020

The United States segment’s sales for the nine months ended May 31, 2021 increased 3.1% compared with the year-ago period to $83.3 billion. Sales in comparable stores increased 4.1% compared with the year-ago period.

Pharmacy sales increased 5.1% for the nine months ended May 31, 2021 and represented 75.8% of the segment’s sales. The increase is primarily due to higher brand and generic inflation and COVID-19 vaccination partially offset by pharmacy reimbursements and COVID-19 impacts. In the year-ago period, pharmacy sales increased 4.3% and represented 74.4% of the segment’s sales. Comparable pharmacy sales increased 6.0% for the nine months ended May 31, 2021 compared to increase of 3.3% in the year-ago period. The effect of generic drugs, which have a lower retail price, replacing brand name drugs reduced prescription sales by 0.4% in the nine months ended May 31, 2021 compared to a reduction of 2.6% in the year-ago period. The effect of generics mix on segment sales caused a reduction of 0.3% for the nine months ended May 31, 2021 compared to a reduction of 1.8% for the year-ago period. Third party sales, where reimbursement is received from managed care organizations, governmental agencies, employers or private insurers, were 97.5% of prescription sales for the nine months ended May 31, 2021 compared to 97.2% in the year-ago period. The total number of prescriptions (including immunizations) filled for the nine months ended May 31, 2021 was 613.9 million compared to 623.2 million in the year-ago period. Prescriptions (including immunizations) filled adjusted to 30-day equivalents were 898.1 million in the nine months ended May 31, 2021 compared to 877.7 million in the year-ago period.

Retail sales for the nine months ended May 31, 2021 decreased 2.6% and were 24.2% of the segment’s sales. In the year-ago period, retail sales decreased 1.0% and comprised 25.6% of the segment’s sales. Comparable retail sales decreased 0.5% in the nine months ended May 31, 2021 compared to increase of 0.7% in the year-ago period. The decrease in the current period was driven by slight declines in discretionary categories.

Operating income for the nine months ended May 31, 2021 and May 31, 2020

The United States segment’s operating income for the nine months ended May 31, 2021 decreased 38.4% compared to the year-ago period to $1.5 billion, including a loss of $1.2 billion from the Company’s share of equity earnings in AmerisourceBergen. Excluding the Company's share of equity earnings in AmerisourceBergen, the increase was primarily due to cost savings from the Transformation Cost Management Program.

Gross margin was 20.9% for the nine months ended May 31, 2021 compared to 20.8% in the year-ago period. Gross margin was impacted in the current fiscal year by pharmacy margins, which includes adverse impact of specialty, and higher retail margins.

Selling, general and administrative expenses as a percentage of sales were 17.7% in the nine months ended May 31, 2021 compared to 18.1% in the year-ago period. As a percentage of sales, expenses were lower in the current period primarily due to savings related to the Transformational Cost Management Program partially offset by incremental COVID-19 related costs, mainly related to the vaccination program as well as higher growth investments.

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

Adjusted operating income (Non-GAAP measure) for the nine months ended May 31, 2021 and May 31, 2020

The United States segment’s adjusted operating income was $3.8 billion and $3.7 billion for the nine months ended May 31, 2021 and May 31, 2020, respectively. See “--Non-GAAP Measures” below for a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP and related disclosures.

International

The Company's International segment consists of pharmacy-led health and beauty retail businesses outside the U.S. and pharmaceutical wholesaling and distribution business in Germany. Pharmacy-led health and beauty retail businesses include Boots branded stores in the UK, the Republic of Ireland and Thailand, the Benavides brand in Mexico and the Ahumada brand in Chile. Sales for these businesses are principally derived from the sale of prescription drugs and health and wellness, beauty, personal care and other consumer products.

The International segment operates in currencies other than the U.S. dollar, including the British pound sterling, Euro, Chilean peso and Mexican peso and therefore the segment’s results are impacted by movements in foreign currency exchange rates. See Item 3, “Quantitative and qualitative disclosure about market risk, foreign currency exchange rate risk”, for further information on currency risk.

The Company presents certain information related to current period operating results in “constant currency,” which is a non-GAAP financial measure. Comparable sales in constant currency, comparable pharmacy sales in constant currency and comparable retail sales in constant currency exclude the effects of fluctuations in foreign currency exchange rates. See “--Non-GAAP Measures.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL PERFORMANCE

|

(in millions, except location amounts)

|

|

|

Three months ended May 31,

|

|

Nine months ended May 31,

|

|

|

2021

|

|

2020

|

|

2021

|

|

2020

|

|

Sales

|

$

|

5,288

|

|

|

$

|

3,008

|

|

|

$

|

14,998

|

|

|

$

|

10,878

|

|

|

Gross profit

|

1,060

|

|

|

684

|

|

|

3,130

|

|

|

2,936

|

|

|

Selling, general and administrative expenses

|

1,025

|

|

|

2,835

|

|

|

2,949

|

|

|

4,895

|

|

|

Operating income (loss)

|

36

|

|

|

(2,151)

|

|

|

181

|

|

|

(1,960)

|

|

|

Adjusted operating income (loss) (Non-GAAP measure)1

|

94

|

|

|

(135)

|

|

|

326

|

|

|

155

|

|

|

|

|

|

|

|

|

|

|

|

Number of locations at period end

|

4,062

|

|

|

4,265

|

|

|

4,062

|

|

|

4,265

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage increases (decreases)

|

|

|

Three months ended May 31,

|

|

Nine months ended May 31,

|

|

|

2021

|

|

2020

|

|

2021

|

|

2020

|

|

Sales

|

75.8

|

|

(21.1)

|

|

37.9

|

|

(8.1)

|

|

Gross profit

|

55.0

|

|

(38.8)

|

|

6.6

|

|

(14.5)

|

|

Selling, general and administrative expenses

|

(63.9)

|

|

183.9

|

|

(39.8)

|

|

61.3

|

|

Operating income (loss)

|

NM

|

|

NM

|

|

NM

|

|

NM

|

|

Adjusted operating income (loss) (Non-GAAP measure)1

|

NM

|

|

NM

|

|

109.7

|

|

(72.5)

|

|

|

|

|

|

|

|

|

|

|

Comparable sales in constant currency2

|

21.0

|

|

(22.8)

|

|

0.7

|

|

(8.2)

|

|

Pharmacy sales

|

15.2

|

|

(11.5)

|

|

5.2

|

|

(4.6)

|

|

Comparable pharmacy sales in constant currency2

|

6.0

|

|

(2.2)

|

|

4.8

|

|

(0.1)

|

|

Retail sales

|

55.9

|

|

(44.6)

|

|

(0.1)

|

|

(16.4)

|

|

Comparable retail sales in constant currency2

|

35.7

|

|

(36.1)

|

|

(1.9)

|

|

(12.5)

|

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percent to sales

|

|

|

Three months ended May 31,

|

|

Nine months ended May 31,

|

|

|

2021

|

|

2020

|

|

2021

|

|

2020

|

|

Gross margin

|

20.1

|

|

22.7

|

|

20.9

|

|

27.0

|

|

Selling, general and administrative expenses

|

19.4

|

|

94.3

|

|

19.7

|

|

45.0

|

1See “--Non-GAAP Measures” below for a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP and related disclosures.

2Comparable sales in constant currency are defined as sales from stores that have been open for at least twelve consecutive months without closure for seven or more consecutive days, including due to looting or store damage, and without a major remodel or being subject to a natural disaster, in the past twelve months as well as e-commerce sales. Comparable sales in constant currency exclude wholesale sales. E-commerce sales include digitally initiated sales online or through mobile applications. Relocated stores are not included as comparable stores for the first twelve months after the relocation. Acquired stores are not included as comparable sales for the first twelve months after acquisition or conversion, when applicable, whichever is later. Comparable sales in constant currency, comparable pharmacy sales in constant currency and comparable retail sales in constant currency refer to total sales, pharmacy sales and retail sales, respectively. Comparable retail sales in constant currency for previous periods have been restated to include e-commerce sales. The method of calculating comparable sales in constant currency varies across the retail industry and our method of calculating comparable sales in constant currency may not be the same as other retailers’ methods.

NM - Not meaningful. Percentage increases/decreases when one period includes income and other period includes loss are considered not meaningful.

Sales for the three months ended May 31, 2021 and May 31, 2020

The International segment’s sales for the three months ended May 31, 2021 increased 75.8% from the year-ago quarter to $5.3 billion, resulting from an increase in the Company’s combined wholesale and distribution business in Germany which were consolidated as of November 2020. The favorable impact of currency translation was 17.1 percentage points. Comparable sales, which exclude pharmaceutical wholesale sales in Germany, increased 21.0%, mainly due to higher sales in Boots UK and Republic of Ireland driven by recovery in store foot traffic as COVID-19 restrictions eased.

Pharmacy sales increased 15.2% in the three months ended May 31, 2021 and represented 18.1% of the segment’s sales. The favorable impact of currency translation on pharmacy sales was 13.0 percentage points. Comparable pharmacy sales increased 6.0% from the year-ago quarter primarily due to stronger pharmacy services, and favorable timing of National Health Service (“NHS”) reimbursement in the UK as well as growth in Mexico, partially offset by the impact of lower prescription volumes in the UK.

Retail sales increased 55.9% for the three months ended May 31, 2021 and represented 27.4% of the segment’s sales. The favorable impact of currency translation on retail sales was 17.0 percentage points. Comparable retail sales increased 35.7%, from the year-ago quarter reflecting higher Boots UK and Republic of Ireland retail sales driven by recovery in store foot traffic as COVID-19 restrictions eased, as well as strong performance of Boots.com.

Operating income for the three months ended May 31, 2021 and May 31, 2020

The International segment’s operating income for the three months ended May 31, 2021 was $36 million, compared to a loss of $2.2 billion in the year-ago quarter. The increase was primarily due to goodwill and intangible asset impairment charges in the Boots reporting unit in the year ago quarter, higher gross profit attributable to higher sales from less severe COVID-19 restrictions in the UK, as well as decisive cost management actions and strong performance of Boots.com.

Gross profit increased 55.0% from the year-ago quarter. Gross profit was favorably impacted by 16.3 percentage points ($111 million) of currency translation. Excluding the impact of currency translation, the increase was primarily due to higher retail sales in the UK as a result of the recovery in store foot traffic as COVID-19 restrictions eased, as well as incremental gross profit associated with the Germany combined business.

Selling, general and administrative expenses decreased 63.9% from the year-ago quarter. Expenses were impacted by 3.8 percentage points ($108 million) as a result of currency translation. Excluding the impact of currency translation, the decrease was mainly due to goodwill and intangible asset impairment charges in the Boots reporting unit in the year ago quarter, cost

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

savings from the Transformational Cost Management Program, partly offset by lower short term mitigation actions as COVID-19 restrictions eased and higher selling, general and administrative expenses associated with the Germany combined business. As a percentage of sales, selling, general and administrative expenses were 19.4% in the three months ended May 31, 2021 compared to 94.3% in the year-ago quarter.

Adjusted operating income (Non-GAAP measure) for the three months ended May 31, 2021 and May 31, 2020

International segment’s adjusted operating income for the three months ended May 31, 2021 was $94 million, an increase of $229 million compared with the year-ago quarter. Adjusted operating income was positively impacted by 5.1 percentage points ($7 million) of currency translation. Excluding the impact of currency translation, the increase in adjusted operating income was primarily due to higher sales as a result of the recovery in store foot traffic as COVID-19 restrictions eased, strong performance of Boots.com and decisive cost mitigation actions. See “--Non-GAAP Measures” below for a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP and related disclosures.

Sales for the nine months ended May 31, 2021 and May 31, 2020

The International segment’s sales for the nine months ended May 31, 2021, increased 37.9% compared to the prior year period to $15.0 billion, resulting from an increase from the Company’s combined wholesale and distribution business in Germany which were consolidated as of November 2020. Sales were favorably impacted in the period by 9.6 percentage points ($1.0 billion) as a result of currency translation. Comparable sales in constant currency, which exclude pharmaceutical wholesale sales in Germany, increased 0.7%, primarily due to growth in Ireland and Mexico partially offset by lower sales in Boots UK, including adverse COVID-19 impacts.

Pharmacy sales increased 5.2% for the nine months ended May 31, 2021 compared to the prior year period and represented 18.6% of the segment’s sales. The favorable impact of currency translation on pharmacy sales in the period was 5.8 percentage points. Comparable pharmacy sales in constant currency increased 4.8% from the prior year period primarily due to favorable timing of NHS reimbursement and stronger pharmacy services in the UK, and pharmacy volumes in Mexico. This is partially offset by lower prescription volume in the UK.

Retail sales decreased 0.1% for the nine months ended May 31, 2021 compared to the prior year period and represented 30.7% of the segment’s sales. The favorable impact of currency translation on retail sales in the period was 5.6% percentage points. Comparable retail sales in constant currency decreased 1.9% from the prior year period reflecting lower store retail sales in Boots UK, including COVID-19 impacts, partially offset by higher retail sales in Ireland as well as the ongoing strong performance of Boots.com.

Operating income for the nine months ended May 31, 2021 and May 31, 2020

The International segment’s operating income for the nine months ended May 31, 2021 was $181 million, compared to an operating loss in the prior year period of $2.0 billion. The increase was primarily due to goodwill and intangible asset impairment charges in the Boots reporting unit in the year ago period, decisive cost management actions and strong performance of Boots.com, partly offset by lower sales from lower store foot traffic from the relative duration of COVID-19 restrictions.

Gross profit increased 6.6% from the prior year period. Gross profit in the period was favorably impacted by 6.5 percentage points ($190 million) as a result of currency translation. Excluding the impact of currency translation, the increase was primarily due to incremental gross profit associated with the Germany combined business and favorable timing of NHS reimbursement, largely offset by lower retail sales in Boots UK.

Selling, general and administrative expenses decreased 39.8% from the prior year period. Expenses in the period were adversely impacted by 3.6 percentage points ($177 million) as a result of currency translation. Excluding the impact of currency translation, the decrease was largely due to goodwill and intangible asset impairment charges in the Boots reporting unit in the prior year period, cost savings from the Transformational Cost Management Program and short term cost mitigation, partly offset by higher selling, general and administrative expenses associated with the Germany combined business. As a percentage of sales, selling, general and administrative expenses were 19.7% in the nine months ended May 31, 2021 compared to 45.0% in the prior year period.

Adjusted operating income (Non-GAAP measure) for the nine months ended May 31, 2021 and May 31, 2020

The International segment’s adjusted operating income for the nine months ended May 31, 2021 increased compared to the prior year period to $326 million. Adjusted operating income in the period was positively impacted by 12.0 percentage points

WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS

($19 million) as a result of currency translation. Excluding the impact of currency translation, the increase was mainly due to decisive cost mitigation actions and strong performance of Boots.com, partially offset by the impact of lower store foot traffic, compared to the prior year period. See “--Non-GAAP Measures” below for a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP and related disclosures.

NON-GAAP MEASURES

The following information provides reconciliations of the supplemental non-GAAP financial measures, as defined under the rules of the SEC, presented herein to the most directly comparable financial measures calculated and presented in accordance with GAAP. The Company has provided the non-GAAP financial measures, which are not calculated or presented in accordance with GAAP, as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. See notes to the “Net Earnings (loss) From Continuing Operations (GAAP)” to “Adjusted diluted net earnings per common share (Non-GAAP measure)” reconciliation table for definitions of non-GAAP financial measures and related adjustments presented below.