UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| TURTLE BEACH CORPORATION |

(Name of Registrant as Specified in Its Charter)

|

| |

THE DONERAIL

GROUP LP

the donerail

master fund lp

William wyatt

harbert donerail

fund gp llc

donerail group

gp llc

HARBERT FUND

ADVISORS, Inc.

HARBERt management

corporation

scw capital,

lp

scw capital

qp, lp

scw capital

management, lp

trinity investment

group, llc

robert cathey

terry jimenez

kimberly kreuzberger

katherine l.

scherping

brian stech

michelle d.

wilson

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

The Donerail Group, LP,

a Delaware limited partnership (“Donerail”), together with the other participants named herein, has filed a definitive proxy

statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes

to elect its slate of six highly-qualified director nominees at the 2022 annual meeting of shareholders (the “Annual Meeting”),

of Turtle Beach Corporation, a Nevada corporation (the “Company”).

Item 1: On April 29,

2022, Donerail issued the following press release and open letter to shareholders of the Company, which included a link to a letter to

the Company’s Board of Directors, dated August 21, 2021, which is attached hereto as Exhibit 1 and incorporated herein by reference:

The Donerail Group Releases Correspondences

That Expose the Turtle Beach Board’s Lack of Credibility

Believes That Shareholders Will Read

Written Correspondence and Recognize the Current Board is Entrenched and Refused Potential Bona Fide Suitor

Notes Turtle Beach Alleges Donerail

Has Made “Omissions” Regarding Engagement, So Donerail Is Compelled to Release Emails and Private Letter to Correct the Record

Reinforces That Change is Badly Needed

and Urges Shareholders to Vote the WHITE Proxy Card TODAY to Elect Donerail’s Full Slate of Highly Qualified Directors

LOS ANGELES--(BUSINESS WIRE)— The

Donerail Group LP (together with its affiliates, "Donerail," "we" or "us"), one of the largest shareholders

of Turtle Beach Corporation (NASDAQ: HEAR) ("Turtle Beach" or the "Company") and, who together with the other participants

in its solicitation, beneficially owns approximately 8.5% of the outstanding shares of Turtle Beach, released the following letter to

shareholders today:

***

Dear Fellow Shareholders,

Today is an important day for all Turtle

Beach stakeholders, as it marks the first day that shareholders have the opportunity to vote for sorely needed boardroom change at the

2022 Annual Meeting of Shareholders (the “Annual Meeting”). We believe that your vote will have a profound impact on Turtle

Beach and your investment in the Company. After years of abysmal governance, dismal capital allocation and poor share price performance,

time is of the essence.

When the current CEO, Juergen Stark, took

the helm over eight years ago, Turtle Beach was already the dominant market leader in its primary category, with best-in-class profitability.

But since Mr. Stark took the job, the Company’s performance has suffered across every major metric. We contend the Company has failed

operationally, failed strategically and failed for shareholders:

| - | The Company’s total shareholder return (TSR) has underperformed its own industry peer set by

more than 200% and shares have declined by over 65% in aggregate1 |

| - | EBITDA margin, a widely regarded metric for corporate profitability, has been cut in half2 |

| - | Revenue growth has slowed to 0% at the midpoint of the guided annual range3 |

| - | The Company has written down more than $100 million of Stark-led investment initiatives4 |

1 Per Bloomberg. Proxy peer group includes 2021 Peer Group companies listed in Company’s 2022 proxy statement that were public when Parametric Sound completed its merger with Turtle Beach

2 Per the Company’s March 2, 2022 press release guiding to 9% - 11% EBITDA margins for 2022, compared to Turtle Beach’s 2012 EBITDA margins of over 22%, per the Company’s September 26, 2013 investor presentation

3 Per the Company’s March 2, 2022 press release

4 Per the Company’s 2016 10-K related to its HyperSound business.

We

believe that shareholders should have no doubt: the current leadership team has failed shareholders, and the current Board has simply

not held management accountable. The Board needs a full reset with highly qualified directors who are committed to ensuring the best

interests of shareholders are paramount at Turtle Beach.

In

addition to the critical function of selecting Company leadership, Turtle Beach’s Board is also responsible for engaging with bona

fide potential acquirors of the Company to explore whether immediate, certain, and attractive risk-adjusted value can be achieved for

shareholders.

We

believe that there are multiple parties that would be willing to acquire Turtle Beach at an attractive premium but based on our experience

trying to meaningfully engage with the Board regarding our premium all-cash offers, we are highly concerned that the Board has failed

to fully explore third party acquisition overtures in a manner fitting of a public company.

As

has been reported publicly, we have historically made attempts to acquire the entirety of Turtle Beach, and while we believe that we put

our best foot forward to engage with the Board and the Company’s advisors to finalize our offer, the Company has stated that we

have made “repeated misstatements and omissions” regarding our acquisition attempts of the Company.

Rather

than attempt to address each of the Board’s misstatements about us, we believe that shareholders deserve the right to judge for

themselves who has been misstating the record.

As

such, we are including with this press release the following correspondences with Turtle Beach:

| i. | A private

letter5 that we sent to a subset of the Board

in August 2021 that comprehensively details our efforts to acquire the Company over the summer of 2021; and |

| ii. | Emails that we sent to the Company and its representatives this

past winter in which we requested to sign an NDA to receive confidential information. |

We encourage all shareholders

to read these emails and assess for yourselves if i) we attempted to put our best foot forward; ii) if you, as a shareholder, would have

wanted the Board to engage with us in a constructive fashion; and iii) if this is the Board that you want to be watching out for your

interests.

If,

after reading these emails, it is not yet clear that the current Board is highly conflicted and entrenched, we would encourage you to

pay special attention to the information that we will be releasing in the coming weeks. We believe that by the Annual Meeting on June

7, it will be overwhelmingly evident that the current Board has lost its way and must be replaced to end the status quo of extremely poor

governance and massive underperformance.

As

one of the largest shareholders of the Company, we have partnered up with another large shareholder of Turtle Beach, SCW Capital Management,

to recruit leading executives to replace the current members of the Board.

5 https://resetturtlebeach.com/wp-content/uploads/2022/04/Donerail_Letter-to-the-HEAR-Board_21-Aug-2021.pdf

Such

candidates represent the best and brightest in their fields and have historical experience in video game operations, marketing, brand-building,

capital allocation and M&A. Importantly, each prospective member of the Board brings a commitment to integrity and transparency.

Please feel free to learn more about each of our nominees to the Board at www.ResetTurtleBeach.com.

Today

is the day to vote for change, and we encourage you to do so immediately herein:

We

urge you to vote the WHITE proxy card to send the message to Turtle Beach Corporation’s leadership and Board

that shareholders deserve better. Vote the WHITE proxy card TODAY to support a superior slate of highly qualified

individuals, who will be better stewards of your investment. Please vote each and every WHITE proxy card you receive,

as you may own shares in more than one account. If you voted a Blue card from Turtle Beach, you have every right to change your vote by

voting on the enclosed WHITE proxy card. Only your latest dated vote counts.

Sincerely,

William Z. Wyatt

Managing Partner

The Donerail Group

The emails below include

the more notable interactions between Donerail, the Company, and its representatives regarding Donerail’s December 2021 acquisition

offer for the Company. The following emails below have been presented in sequential order and are unedited, except for the redaction of

certain identifying details, where appropriate. Emphasis our own.

From: Wyatt, William

Sent: Thursday, December 23, 2021 2:38 PM

To: Hung, Yie-Hsin

Cc: [REDACTED]

Subject: RE: Donerail: NB LOI to Acquire Turtle Beach

Yie-Hsin,

As we have committed to do, please find attached an NDA for

your counsel’s review. Executing this NDA will allow us to progress in our acquisition efforts to acquire the Company at an

attractive price for all shareholders.

To show a sign of good faith, we chose to take the Turtle Beach

NDA template that you have previously provided us and edit it appropriately. To expedite matters and minimize unproductive back-and-forth,

we have requested Olshan to revise your document in accordance with precedent NDAs that Olshan has seen whereby a shareholder is interested

in both i) potentially acquiring the company; and ii) keen to reserve the right to nominate directors at an upcoming annual meeting.

They have done so.

Nothing in this document should be out of the ordinary, and

if you have any questions, [REDACTED] should feel free to direct to them to [REDACTED].

In response to Mr. Song’s additional requests found

in his December 20 email, please note that we are willing to provide you with all the information requested: additional relevant financing

details, contact information of financing partners, operating partner rosters, consultants on retainer, due diligence requests, and any

other information that you deem pertinent, but we can only provide such information when this NDA has been signed by both parties.

Unfortunately, the Company’s proven willingness to publish

select information that we have provided – in a presumed effort to discredit our offer – has now limited the amount of information

that we can provide to you ahead of an NDA being signed. I’m sure you understand. In the spirit of being productive

and answering a question where we can, however, we are willing to detail that our expected diligence period for operational matters will

be less than 30 days.

Lastly, as it relates to our revised offer, we admit that we

do find ourselves in a highly regrettable position. As you know, we have not been supportive of certain actions of this Board and

its representatives since we began engagement. This earned distrust of the Board married with the clear recognition that your largest

shareholders have reported confusion about actions you are (or aren’t) taking to optimize shareholder value mandates that we require

public clarity before allocating the meaningful time, energy and resources in our effort to acquire the Company.

This Board publicly announcing that a transparent and robust

Strategic Review process is underway is the only thing that will afford us the confidence to enter into this NDA with you and to negotiate

a transaction in good faith.

Our revised offer price stands at a 51% premium to the closing

price of the shares on December 14th, the day prior to news of our continued interest in acquiring the Company.

Since that news, Turtle Beach shares have rallied over 12%.

Shareholders are sending you and this Board a clear message that the Company should publicly announce a Strategic Review process and engage

with us as quickly as possible on our revised offer.

We are standing by to expeditiously move forward subject to

the above, and our entire team has allocated the time to work over the holidays to quickly complete diligence, negotiate and announce

a transaction.

Will

From: Wyatt, William

Sent: Wednesday, December 29, 2021 3:02 AM

To: Hung, Yie-Hsin

Cc: [REDACTED]

Subject: Re: Donerail: NB LOI to Acquire Turtle Beach

Circling back on the below request.

As noted, we are keen to enter the data room, we believe time

is of the essence, and we are anxiously awaiting the opportunity to finalize our diligence and negotiate and announce a transaction.

We continue to stand by - please let us know if anything is

requested from us.

From: Song, Steve

Sent: Wednesday, December 29, 2021 7:24 AM

To: Wyatt, William

Cc: [REDACTED]

Subject: RE: Donerail:

NB LOI to Acquire Turtle Beach

Will,

The Board of Turtle Beach

has asked BofA Securities to follow up again regarding your proposal. In order for the Board to assess your proposal, please provide BofA

Securities with the following information:

• Additional

details of your financing plan to acquire the Company, including a breakdown of expected sources of funds that would be dedicated towards

an acquisition of the Company and their amounts, that in the aggregate, provide sufficient funding for the equity purchase price of the

proposal (a customary sources and uses table). Please attach any unredacted documentation that provide support of such financing plan.

• The

identities and contact information of the parties providing each component of financing, so that the financing plan as laid out above

can be verified.

• Proposed

timeline (that further describes “as promptly as practicable”) to complete your due diligence and to consummate a transaction,

including a description of any material conditions affecting your timing.

• An

unredacted request list you need to complete your due diligence, that provides further detail behind the high-level topics that were listed

in the proposal.

• The

resources (including any external consultants and advisors) you are planning to utilize as part of your due diligence, if any, beyond

the legal counsel information provided in the proposal letter.

• A

description of any other contingencies that may impact Donerail’s ability and/or willingness to continue dialogue with the Company

as an acquirer and consummate the acquisition according to the terms laid out in your proposal

Best regards,

BofA Team

From: Wyatt, William

Sent: Wednesday, December 29, 2021 10:38 AM

To: Song, Steve

Cc: [REDACTED]

Subject:

Re: Donerail: NB LOI to Acquire Turtle Beach

Steve,

As

I said in my email from December 23 to Yie-Hsin addressing these same exact comments, we are prepared to provide you all the information

requested below, subject to the terms already articulated, including the signing of an NDA.

We

are forced to provide you this information only under an NDA given the Board’s historic publishing of past information provided,

without receiving our consent. I’m sure you understand our concerns.

As

you know, in the signing an NDA, we are willingly restricting ourselves in many uncomfortable ways. We do this to highlight our desire

to acquire the Company. Moreover, we offered up a revised version of the Turtle Beach NDA, rather than sending you our own draft, to both

expedite engagement and create a clear path forward to acquire the Company.

In

your response this morning, you simply cut and pasted your previous request, which is not productive. Are we to interpret this action

as a sign that you are unwilling to sign an NDA with us, even though we can provide you this information immediately after the signing

of such NDA?

Thanks

Will

From: Song, Steve

Sent: Wednesday, December 29, 2021 4:51 PM

To: Wyatt, William

Cc: [REDACTED]

Subject:

RE: Donerail: NB LOI to Acquire Turtle Beach

Will,

The

Board continues to ask for BofA’s assistance in assessing Donerail’s LOI. Per our previous emails to you on 12/20/21, 12/22/21

and 12/29/21, we kindly request that you provide the key items that were laid out in our bid instructions letter but excluded from your

December 20 LOI so that we can work on qualifying your offer.

Sincerely,

The

BofA Team

From: Wyatt, William

Date: Thursday, Dec 30, 2021, 1:17 PM

To: Song, Steve, Chan, Tony

Cc: [REDACTED]

Subject:

RE: Donerail: NB LOI to Acquire Turtle Beach

As

you know, prior to your involvement Steve, we worked with one of your colleagues, [REDACTED], on this exact exercise with his colleague

[REDACTED] and [REDACTED] had similar questions to the ones you have recently posed in an effort to educate the Board about our credibility,

and we answered them all comprehensively and completely.

In

doing so, we introduced [REDACTED] to a number of our potential financing partners, and we provided support documentation. (You are aware

of [REDACTED] efforts because one of the financing documents that we presented to them was the redacted document that you just chose to

publish without our authorization.) All information was presented in full to the Board months ago.

Following

this process, we were informed that the Board had approved our financing package as “credible” and “fundable”

in a multi-person conference call, and [REDACTED] requested that we increase our offer from $36.50 per share alongside sending us through

an NDA to sign. As recently as October 22, in a discussion with [REDACTED], he further indicated our financing had no question marks and

our bid was “actionable”.

As

it stands now, you are requesting that we begin an entire process anew.

Why

do we need to do this? What has changed at the Board level to suddenly require the Board to re-interrogate our ability as an acquiror,

only months after a banker on your team (that was much more senior than you at Bank of America) had already vetted us as an acquirer?

From: Steele, Robert - GCIB SF

Sent: Sunday, January 2, 2022 4:01 PM

To: Wyatt, William; Song, Steve; Chan, Tony

Cc: [REDACTED]

Subject: RE: Donerail: NB LOI to Acquire

Turtle Beach

Will,

We want to clarify that in July 2021 we

never stated your financing was adequate, but instead communicated there was a potential path to a transaction if you 1) meaningfully

increased your offer price after you received the information you indicated was required to do so under an NDA, which was subsequently

provided to you, and then 2) provided additional information about your financing sources in order to validate the fundability of your

offer. The Turtle Beach Board continues to ask for the information that is missing from your LOI because Donerail has yet to provide an

overview of its financing plan sufficient for the Board to fully evaluate your offer to acquire the Company. Your continued refusal to

furnish the missing information about your financing plan is preventing BofA Securities from qualifying Donerail’s ability to finance

an acquisition of the Company, and is therefore preventing the Board from verifying Donerail’s LOI as bonafide. BofA Securities

stands ready to assist the Board in evaluating your financing plan and offer, and the Board encourages you to provide the information

requested, especially as the limited materials previously provided are now almost 6 months old and we need a current view of your financing

plan.

To expedite the process of learning more

about your financing plan, BofA Securities will reach out directly to the contacts you listed at [REDACTED]

and the contacts you provided several months ago at [REDACTED] to obtain information about

Donerail’s sources of equity and debt financing. Please let us know if [REDACTED] is

no longer your source of debt financing, or if there any other sources of financing that we should contact.

The Board again requests that you provide

the other items that were previously requested:

* Proposed timeline (that further describes

“as promptly as practicable”) to complete your due diligence and to consummate a transaction, including a description of any

material conditions affecting your timing.

* An unredacted request list you need to

complete your due diligence, that provides further detail behind the high-level topics that were listed in the proposal.

* The resources (including any external

consultants and advisors) you are planning to utilize as part of your due diligence, if any, beyond the legal counsel information provided

in the proposal letter.

* A description of any other contingencies

that may impact Donerail’s ability and/or willingness to continue dialogue with the Company as an acquirer and consummate the acquisition

according to the terms laid out in your proposal.

Sincerely

The BofA Team

From: Wyatt, William

Sent: Sunday, January 2, 2022 4:22 PM

To: Hung, Yie-Hsin

Cc: [REDACTED]

Subject: Re: Donerail: NB LOI to Acquire

Turtle Beach

Yie-Hsin,

The assertions that Rob has made in his

email below are categorically false, and in fact, we had multiple people on the phone with [REDACTED]

over the summer that would also confirm that Rob is misrepresenting the communication from Bank of America over the summer.

This is now the second time that he has

lied in writing, with evidentiary support against him, and his integrity and reputation have been severely and irreparably damaged.

As such, we direct this to you.

For the third time, we will provide

you any and all information requested following the signing of an NDA. Please sign the NDA, return it to us for signature, and we can

move forward.

Thank you.

From: Wyatt, William

Sent: Wednesday, January 5, 2022 1:39 PM

To: Hung, Yie-Hsin

Cc: [REDACTED]

Subject: RE: Donerail: NB LOI to Acquire

Turtle Beach

Yie-Hsin –

This email is a follow-up to the email

that I sent three days ago that you have yet to respond to.

We have become aware that your financial

representatives at Bank of America have, without asking our approval, begun reaching out to certain investment partners of ours to meet.

Proactively contacting financing partners without receiving consent to do so is yet another highly atypical action that this Board and

its representatives have taken as it relates to our proposal to acquire the Company.

I’m happy to note that should you

have requested our consent to contact any investment partner of ours, we would have gladly assessed such a request in good faith, as we

have done in the past. (In fact, as you know, over the summer when your advisors requested to speak with certain parties, we agreed to

that request and actually arranged the meetings ourselves.)

That notwithstanding, it is my regret

to inform you that given this Board’s historical decision to release private information to the public without the consent of us

or our financing partners, as you and the balance of this Board chose to do with the release of a redacted co-investment document that

was previously provided to you, neither of the two parties that you have contacted thus far have a desire to speak to you or your advisors

without an NDA in place.

It is a shame that, as we have shown in

the past, such conversations were once readily available, but the recent decisions made by you and the other Board members have engendered

such a gross distrust in the marketplace that an NDA is needed to have any type of conversation.

As such, we’ll now request for

the fourth time: please sign the NDA, return it to us for signature, and we can move forward.

Thank you.

From: Chan, Tony

Sent: Sunday, January 9, 2022 7:05 PM

To: Wyatt, William

Cc: [REDACTED]

Subject: RE: Donerail: NB LOI to Acquire

Turtle Beach

Mr. Wyatt,

Please see attached on behalf of the Board.

BofA Securities noted in its email to you on January 2nd that it would be reaching out to contacts you had previously provided to obtain

additional information about your financing package, including an individual listed in the “Contacts” section of the most

recent LOI, which specifically stated that he (as a signatory) would “be pleased to provide further detail or answer any questions

you may have regarding [the] Proposal”. It would also be customary for a company’s financial advisers to seek to learn more

about a potential purchaser’s financing sources and the bid process letter that you have been sent a number of times specifically

stated that BofA would do so. The Company had previously noted that it would be happy to provide assurances that it would not release

any confidential materials included in your financing package. Based on your most recent email, we assume that was not sufficient, so

I have attached an NDA that should address your stated concern and allow BofA to obtain the information requested and have discussions

with your financing sources in order to evaluate your financing package. Please sign and return a copy at your earliest convenience.

Best regards,

Tony

From: Wyatt, William

Sent: Monday, January 10, 2022 10:04 AM

To: Hung, Yie-Hsin

Cc: [REDACTED]

Subject: RE: Donerail: NB LOI to Acquire

Turtle Beach

Yie-Hsin –

We have received the Board’s (re-iterated)

request to exclude the Board from i) any communication regarding our proposal; ii) from any communication regarding our legal concerns;

and iii) from any communication regarding any “other matter”.

It is now noted that Bill Keitel has requested

that the Board not be communicated with at all about any shareholder matter whatsoever. Unfortunately, we will not be able to honor that

request, and frankly, we think such a request is ridiculous.

First and foremost, we believe that

it is the Board’s duty to serve shareholders and that it is categorically inappropriate to request that all communication from a

large shareholder be outsourced to personnel outside the Company. Engaging with shareholders to protect their interests in extreme circumstances

is, quite frankly, part of the exact work that you are paid (quite handsomely) to do.

Secondly, as we have mentioned before,

given the evidence that exists that the Company’s own representatives are, at times, intentionally misrepresenting key facts to

you and the rest of the Board regarding our involvement and our intentions – a matter that is being handled separately – we

have no choice but to continue to direct communication to you in an effort to ensure full transparency, expediency and Board accountability.

I’m sure you understand.

Separately, upon receiving Tony’s

email yesterday, we were quickly able to consult and assess your counsel’s revised prospective path forward. After we reviewed,

we do suggest reverting focus back on the signing of the prior NDA that the Board of Turtle Beach has already provided to us to sign (and

has begun to negotiate).

That NDA, as you know, was provided by

Bank of America after our financing structure and package was deemed “credible” and “fundable” by one of the most

senior bankers at the bank, after his team’s review. As you know, upon receiving that NDA from the Turtle Beach Board, we spent

the time and energy to review it with our legal team, assessed precedent language to ensure we were inserting appropriate and on-market

clauses, and while the signing of that NDA would create meaningful restrictions for us as shareholders, we find it to be far more comprehensive

in nature and constructive to our bidding effort than the one paragraph document that your counsel sent through last night.

We’d choose to pursue that path.

To be sure, while the truncated document

that was sent through yesterday was straight-forward enough, it appears that in the creation of this new, one-paragraph partial confidentiality

agreement, your counsel missed precisely the concern that had our financing partners and us worried in the first place: there exists meaningful

doubt that this Board is willing to allow Donerail access to the information that it needs to consummate a transaction, and breaking apart

the NDA that Turtle Beach has already provided us into various smaller components, each to be negotiated, only serves to send a more profound

signal that this Board is attempting to stall Donerail’s efforts to acquire the Company and that Donerail is not welcome in its

bidding efforts.

Said differently, the very fact that you

would seek to break apart the NDA into smaller, individually negotiated documents to execute at various times, only heightens the level

of concern that we – and our financing partners – should have regarding this Board’s intentions.

As such, we’ll ask for a fifth

time: please sign the NDA that you have previously provided to us – and that we have sent back to you. I have reattached it here

for your convenience.

Lastly, I would be remiss not to ensure

that we highlight a very important matter that seems to be missed by you and the balance of the Board.

Signing an NDA with us to allow us access

to confidential information in an effort to solidify our financing is something that, we believe, the vast majority of Turtle Beach shareholders

would encourage you and this Board to do.

While our business model is unique,

we do not believe that Turtle Beach shareholders would view a constructive engagement with us, one of your largest shareholders, to sell

us the Company at an attractive price would be viewed as a waste of time or energy of this Board. In fact, we believe that engaging with

any bona fide buyer to sell the Company at an attractive price is precisely what this Board is tasked with doing.

Further, while you have information regarding

the financial wherewithal of [REDACTED], please note the below investment firms that are

current fee-paying clients of ours or have contractual commitments to us and have expressed a desire to partner with us on transactions

exactly like the one contemplated by our proposal. This should further detail our proximity to large pools of capital. As we have stated

before, we are willing to provide you with all contact details for these parties upon the signing of this NDA.

- Alternative

Investment Firm: $8 billion of assets with a long history in co-investments

- Single

Family Office: >$5 billion of assets with a long history in co-investments

- Large

Asset Manager: >$100 billion of assets with a long history in co-investments

- Large

Asset Manager: >$100 billion of assets with a long history in co-investments

We believe that if shareholders were aware

of this information, as you are, that this Board would be encouraged to take all steps necessary to provide us with the information needed

to cement our financing and proposal. It is simply impractical to say that we do not have the appropriate access to the capital needed

to consummate this transaction.

Again, we encourage you to sign the NDA

and allow us access as expeditiously as possible.

Sincere thanks,

Will

Nb – do you mind providing us with

Kelly Thompson’s email address? We do not have it, and it’s critical to ensure that she has transparency and accountability

to this dialogue, as well. Please forward this email to her. Thanks!

[End]

Despite the five separate, explicit requests by Donerail to have a comprehensive NDA be signed, no NDA was ever executed.

We

urge you to vote the WHITE proxy card to send the message to Turtle Beach Corporation’s leadership and Board

that shareholders deserve better. Vote the WHITE proxy card TODAY to support a superior slate of highly qualified

individuals, who will be better stewards of your investment. Please vote each and every WHITE proxy card you receive,

as you may own shares in more than one account. If you voted a Blue card from Turtle Beach, you have every right to change your vote by

voting on the enclosed WHITE proxy card. Only your latest dated vote counts.

About Donerail

The Donerail Group LP is a Los Angeles-based

investment adviser that employs a value-oriented investment lens focusing on special situations and event driven investments.

For Media:

Longacre Square Partners

Greg Marose / Ashley Areopagita, 646-386-0091

gmarose@longacresquare.com

/ aareopagita@longacresquare.com

For Investors:

Saratoga Proxy Consulting LLC

John Ferguson / Joe Mills, 212-257-1311

jferguson@saratogaproxy.com / jmills@saratogaproxy.com

Item 2: On April 29,

2022, Donerail uploaded the following materials to https://ResetTurtleBeach.com:

This regulatory filing also includes additional resources:

ex1todfan14a12526005_042922.pdf

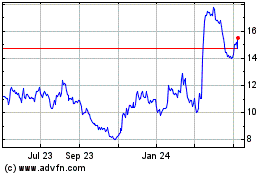

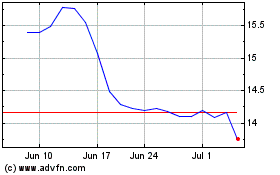

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Apr 2023 to Apr 2024