Filed Pursuant to Rule 424(b)(3)

Registration No. 333-260126

PROSPECTUS SUPPLEMENT NO. 8

(TO PROSPECTUS DATED JULY 12, 2022)

TMC THE METALS

COMPANY INC.

Up to 264,438,297

Common Shares

Up to 9,500,000 Warrants

This prospectus supplement no. 8 (this “Supplement”)

supplements the prospectus dated July 12, 2022 (the “Prospectus”) relating to the issuance by us of up to an aggregate

of 24,500,000 of our common shares, without par value (“Common Shares”), which consists of (i) up to 9,500,000 Common

Shares that are issuable upon the exercise of private placement warrants (the “Private Placement Warrants”) originally issued

in a private placement in connection with the initial public offering of our predecessor company, Sustainable Opportunities Acquisition

Corp. (“SOAC”), at an exercise price of $11.50 per Common Share, and (ii) up to 15,000,000 Common Shares that are issuable

upon the exercise of 15,000,000 warrants issued in connection with the initial public offering of SOAC (the “Public Warrants,”

and together with the Private Placement Warrants, the “Warrants”).

The Prospectus and this Supplement also relate to

the resale from time to time by the Selling Securityholders named in the Prospectus (the “Selling Securityholders”) of up

to (i) 9,500,000 Private Placement Warrants, (ii) 9,500,000 Common Shares that may be issued upon exercise of the Private Placement

Warrants, (iii) 11,578,620 Common Shares that may be issued upon exercise of the Allseas Warrant (as defined in the Prospectus),

(iv) 6,759,000 Common Shares held by SOAC’s sponsor, Sustainable Opportunities Holdings LLC (the “Sponsor”), SOAC’s

former directors and certain of their transferees (collectively, the “Founder Shares”), (v) 11,030,000 Common Shares

issued in the PIPE Financing (as defined in the Prospectus), (vi) 131,178,480 Common Shares issued to certain shareholders of DeepGreen

(as defined in the Prospectus) pursuant to the Business Combination Agreement (as defined in the Prospectus), (vii) 77,277,244 Common

Shares issuable to certain shareholders of DeepGreen upon the conversion of DeepGreen Earnout Shares (as defined in the Prospectus) pursuant

to the Business Combination Agreement, (viii) 1,241,000 Common Shares issuable to the Sponsor and its transferees upon the conversion

of Sponsor Earnout Shares (as defined in the Prospects) and (ix) 873,953 Common Shares issued to certain service providers to DeepGreen.

The Prospectus provides you with a general description

of such securities and the general manner in which we and the Selling Securityholders may offer or sell the securities. More specific

terms of any securities that we and the Selling Securityholders may offer or sell may be provided in a prospectus supplement that describes,

among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement

may also add, update or change information contained in the Prospectus.

We will not receive any proceeds from the sale of

Common Shares or Private Placement Warrants by the Selling Securityholders or of Common Shares by us pursuant to the Prospectus, except

with respect to amounts received by us upon exercise of the Warrants.

However, we will pay the expenses, other than any

underwriting discounts and commissions, associated with the sale of securities pursuant to the Prospectus.

We registered certain of the securities for

resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling

Securityholders. Our registration of the securities covered by the Prospectus does not mean that either we or the Selling

Securityholders will issue, offer or sell, as applicable, any of the securities. The Selling Securityholders may offer and sell the

securities covered by the Prospectus in a number of different ways and at varying prices. We provide more information about how the

Selling Securityholders may sell the shares or Warrants in the section entitled “Plan of Distribution” in the

Prospectus.

This Supplement incorporates into the Prospectus

the information contained in our attached current report on Form 8-K which was filed with the Securities and Exchange Commission on December

22, 2022.

You should read this Supplement in conjunction with

the Prospectus, including any supplements and amendments thereto. This Supplement is qualified by reference to the Prospectus except to

the extent that the information in this Supplement supersedes the information contained in the Prospectus. This Supplement is not complete

without, and may not be delivered or utilized except in connection with, the Prospectus, including any supplements and amendments thereto.

Our Common Shares and Public Warrants are listed

on Nasdaq under the symbols “TMC” and “TMCWW,” respectively. On December 21, 2022, the closing price of our Common

Shares was $0.60 and the closing price for our Public Warrants was $0.0501.

Investing in our securities involves a high degree

of risk. See “Risk Factors” beginning on page 13 of the Prospectus and in the other documents that are incorporated by reference

in the Prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this Supplement is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December

22, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 22, 2022

TMC THE METALS COMPANY INC.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada |

001-39281 |

Not Applicable |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| |

|

|

595 Howe Street, 10th Floor

Vancouver, British Columbia |

|

V6C 2T5 |

(Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (604) 631-3115

Not

applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| TMC Common Shares without par value |

|

TMC |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, each whole warrant exercisable for one TMC Common Share, each at an exercise price of $11.50 per share |

|

TMCWW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. | Entry into a Material Definitive Agreement. |

On December 22, 2022,

TMC the metals company Inc. (the “Company”) entered into an At-The-Market Equity Distribution Agreement (the “Agreement”)

with Stifel, Nicolaus & Company, Incorporated and Wedbush Securities Inc., as sales agents (the “Agents”), pursuant

to which the Company may, from time to time, issue and sell its common shares, without par value, with an aggregate offering price of

up to $30 million (the “Shares”) through the Agents.

The offer and sales of the

Shares made pursuant to the Agreement, if any, will be made under the Company’s effective “shelf” registration statement

on Form S-3 (File No. 333-267479) filed with the U.S. Securities and Exchange Commission (the “SEC”) on September 16,

2022, as amended, and declared effective by the SEC on October 14, 2022, the base prospectus contained therein, and a prospectus

supplement related to the offering of the Shares dated December 22, 2022.

Under the terms of the Agreement,

the Agents may sell the Shares at market prices by any method that is deemed to be an “at the market offering” as defined

in Rule 415 under the Securities Act of 1933, as amended.

Subject to the terms and conditions

of the Agreement, the Agents will use their commercially reasonable efforts to sell the Shares from time to time, based upon the Company’s

instructions. The Company has no obligation to sell any of the Shares, and may at any time suspend sales under the Agreement or terminate

the Agreement in accordance with its terms. The Company has provided the Agents with customary indemnification rights, and the Agents

will be entitled to a fixed commission of up to 3.0% of the aggregate gross proceeds from the Shares sold. The Agreement contains customary

representations and warranties, and the Company is required to deliver customary closing documents and certificates in connection with

sales of the Shares. The Company has agreed to reimburse the Agents for the fees and disbursements of its counsel, payable upon execution

of the Agreement, in an amount not to exceed $75,000 in connection with the establishment of this at-the-market offering program.

The legal opinion of Fasken

Martineau DuMoulin LLP, counsel to the Company, relating to the Shares is filed as Exhibit 5.1 hereto.

The foregoing description

of the Agreement is not complete and is qualified in its entirety by reference to the full text of such agreement, a copy of which is

filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference. Certain information relating

to Part II, Item 14 of the above referenced registration statement under the heading “Other Expenses of Issuance and Distribution”

with respect to the sale of the Shares under the Agreement is being filed as Exhibit 99.1 to this Current Report on Form 8-K

to be incorporated by reference into such registration statement.

This Current Report on Form 8-K

shall not constitute an offer to sell or the solicitation of any offer to buy the Shares, nor shall there be an offer, solicitation or

sale of the Shares in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of such state.

| Item 9.01. | Financial Statements and Exhibits. |

The following exhibits are being filed herewith:

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TMC THE METALS COMPANY INC. |

| |

|

|

| Date: December 22, 2022 |

By: |

/s/ Craig Shesky |

| |

Name: |

Craig Shesky |

| |

Title: |

Chief Financial Officer |

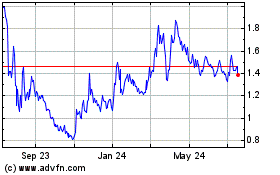

TMC the Metals (NASDAQ:TMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

TMC the Metals (NASDAQ:TMC)

Historical Stock Chart

From Apr 2023 to Apr 2024