0001556739FALSE00015567392023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 2, 2023

THRYV HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35895 | 13-2740040 |

(State or Other Jurisdiction of Incorporation) | (Commission

File Number) | (IRS Employer Identification No.) |

2200 West Airfield Drive, P.O. Box 619810 D/FW Airport, TX | 75261 |

| (Address of Principal Executive Offices) | (Zip Code) |

(972) 453-7000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | THRY | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 2, 2023, Thryv Holdings, Inc. (the “Company”) issued a press release announcing its earnings for the nine months ended September 30, 2023. This press release is attached as Exhibit 99.1 and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

The Company will hold a conference call on November 2, 2023. A copy of the investor presentation to be discussed at the conference call is being furnished as Exhibit 99.2, and is incorporated herein by reference and available on the Company’s website.

The information in Item 2.02 and Item 7.01 of this Current Report is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in Item 2.02 and Item 7.01 of this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| | | | | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

|

THRYV HOLDINGS, INC. | |

| | | |

Date: November 2, 2023 | By: | /s/ Paul D. Rouse | |

| Name: Paul D. Rouse | |

| Title: Chief Financial Officer, Executive Vice President and Treasurer | |

Thryv Exceeds Third Quarter 2023 SaaS Guidance, Raises Full-Year SaaS Outlook

–Company achieves 19% SaaS revenue growth

–Q3 SaaS Adjusted EBITDA exceeds guidance range by over $3 million

–Subscribers increased 29%

–Delivers strong operating cash flow of $45.9 million

DALLAS, November 2, 2023 – Thryv Holdings, Inc. (NASDAQ:THRY) (“Thryv” or the “Company”), the provider of Thryv®, the leading small business software platform, reported SaaS revenue growth of 19% year-over-year in the third quarter of 2023.

“We are reporting a strong third quarter as we continue to focus on driving profitable SaaS growth in 2023,” said Joe Walsh, Thryv Chairman and CEO. “Our SaaS revenue and EBITDA surpassed expectations, reinforcing our commitment to cost effectively scaling our business. SaaS subscribers showed continued strength and we increased our clients through ongoing innovation, cross-selling opportunities and operational execution. We are continuing to evolve our Thryv platform to deliver solutions that solve problems small businesses face. ”

In August, the Company announced the beta program for Thryv Command Center, an industry-first freemium offering that will be a core driver in its product-led growth initiative. Thryv Command Center enables SMBs to centralize all their communication through a modular, easily expandable, and customizable platform. The market’s reception has been strong as evidenced by the fast-growing number of users. Thryv Command Center continues the planned roll out of new centers to drive future growth and complements the Thryv Marketing Center and Thryv Business Center, as well as the company’s continued international expansion.

“We are pleased with our results this quarter and with our ability to raise our full-year guidance for SaaS revenue and EBITDA,” said Paul Rouse, Thryv Chief Financial Officer. "We achieved impressive free cash conversion, even with Adjusted EBITDA appearing lower due to the accounting treatment related to the extension of our printed directories. Moreover, our robust free cash flow enabled us to substantially reduce our debt by $42.5 million on our Term Loan. As we move forward, our primary focus remains on accelerating profitable growth in the SaaS business while upholding a strong and healthy balance sheet.”

Third Quarter 2023 Highlights:

Financial Highlights

•Total SaaS1 revenue was $67.4 million, a 19% increase year-over-year

•Total Marketing Services2 revenue was $116.5 million, a 48% decrease year-over-year, primarily driven by the timing of revenue recognition of the Company's printed directories

•Consolidated total revenue was $183.8 million, a decrease of 35% year-over-year

•Consolidated net loss was $27.0 million, or $(0.78) per diluted share, compared to net income of $13.3 million, or $0.37 per diluted share, for the third quarter of 2022

•Consolidated Adjusted EBITDA was $7.3 million, representing an Adjusted EBITDA margin of 4%

•Total SaaS Adjusted EBITDA loss was $0.5 million, representing an Adjusted EBITDA margin of (0.7)%.

•Total Marketing Services Adjusted EBITDA was $7.8 million, representing an Adjusted EBITDA margin of 7%

•Consolidated Gross Profit was $103.6 million

•Consolidated Adjusted Gross Profit3 was $110.6 million

•SaaS Gross Profit was $42.9 million, representing a Gross Profit Margin of 64%

•SaaS Adjusted Gross Profit was $44.8 million, representing an Adjusted Gross Profit Margin of 67%

•Operating cash flow was $45.9 million

SaaS Metrics

•SaaS monthly Average Revenue per Unit (“ARPU”)4 decreased to $365 for the third quarter of 2023, compared to $377 in the third quarter of 2022

•Total SaaS clients increased 29% year-over-year to 66 thousand for the third quarter of 2023

•Seasoned Net Dollar Retention5 was 92% for the third quarter of 2023, an increase of 300 bps sequentially

•SaaS monthly active users6 increased 22% year-over-year to 45 thousand active users for the third quarter of 2023

•ThryvPay total payment volume was $63 million, an increase of 57% year-over-year

1 Total SaaS revenue in the U.S. and International segments was $64.7 million and $2.7 million for the three months ended September 30, 2023, respectively.

2 Total Marketing Services revenue in the U.S. and International segments was $92.9 million and $23.6 million for the three months ended September 30, 2023, respectively.

3 Defined as Gross profit adjusted to exclude the impact of depreciation and amortization expense and stock-based compensation expense.

4 Defined as total client billings for a particular month divided by the number of clients that have one or more revenue-generating solutions in that same month.

5 Seasoned Net Dollar Retention is defined as net dollar retention excluding clients acquired over the previous 12 months.

6 Defined as a client with one or more users who log into our SaaS solutions at least once during the calendar month.

Outlook

Based on information available as of November 2, 2023, Thryv is issuing guidance7 for the fourth quarter of 2023 and full year 2023 as indicated below:

| | | | | | | | | | | | | | | | | |

| | | 4th Quarter | | Full Year |

| (in millions) | | | 2023 | | 2023 |

| SaaS Revenue | | | $70.25 - $71.25 | | $260 - $261 |

| SaaS Adjusted EBITDA | | | $3.5 - $4.0 | | $9.0 - $9.5 |

| | | | | | | | | | | | | | | | | | | | |

| | | | 4th Quarter | | Full Year |

| (in millions) | | | | 2023 | | 2023 |

| Marketing Services Revenue | | | | $159 - $164 | | $650 - $655 |

| Marketing Services Adjusted EBITDA | | | | $47 - $49 | | $177 - $179 |

Earnings Conference Call Information

Thryv will host a conference call on Thursday, November 2, 2023 at 8:30 a.m. (Eastern Time) to discuss the Company's third quarter 2023 results.

For analysts to register for this conference call, please use this link. After registering, a confirmation email will be sent, including dial-in details and a unique code for entry. We recommend registering a day in advance or at a minimum thirty minutes prior to the start of the call. To listen to the webcast, please use this link or visit Thryv's Investor Relations website at investor.thryv.com. A live webcast will also be available on the Investor Relations section of the Company's website at investor.thryv.com.

If you are unable to participate in the conference call, a replay will be available. To access the replay, please dial (800) 770-2030 or (647) 362-9199 and enter “87769.”

7 These statements are forward-looking and actual results may materially differ. Refer to the “Forward-Looking Statements” section below for information on the factors that could cause our actual results to materially differ from these forward-looking statements.

Final Results

Thryv Holdings, Inc. and Subsidiaries

Consolidated Statements of Operations and Comprehensive Income (Loss)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| (in thousands, except share and per share data) | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 183,822 | | | $ | 280,650 | | | $ | 680,798 | | | $ | 923,020 | |

| Cost of services | 80,178 | | | 105,011 | | | 262,261 | | | 321,543 | |

| Gross profit | 103,644 | | | 175,639 | | | 418,537 | | | 601,477 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 74,755 | | | 89,891 | | | 226,781 | | | 275,659 | |

| General and administrative | 48,267 | | | 54,670 | | | 149,642 | | | 159,514 | |

| Impairment charges | — | | | — | | | — | | | 222 | |

| Total operating expenses | 123,022 | | | 144,561 | | | 376,423 | | | 435,395 | |

| | | | | | | |

| Operating (loss) income | (19,378) | | | 31,078 | | | 42,114 | | | 166,082 | |

| Other income (expense): | | | | | | | |

| Interest expense | (15,131) | | | (13,720) | | | (47,911) | | | (40,584) | |

| Interest expense, related party | — | | | (850) | | | — | | | (3,505) | |

| Other components of net periodic pension (cost) benefit | (1,902) | | | (3,928) | | | (3,888) | | | 5,295 | |

| Other income (expense) | (876) | | | 6,941 | | | (1,242) | | | 15,567 | |

| (Loss) income before income tax benefit (expense) | (37,287) | | | 19,521 | | | (10,927) | | | 142,855 | |

| Income tax benefit (expense) | 10,241 | | | (6,241) | | | 9,173 | | | (38,062) | |

| Net (loss) income | $ | (27,046) | | | $ | 13,280 | | | $ | (1,754) | | | $ | 104,793 | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation adjustment, net of tax | (1,842) | | | (7,920) | | | (4,332) | | | (12,611) | |

| Comprehensive (loss) income | $ | (28,888) | | | $ | 5,360 | | | $ | (6,086) | | | $ | 92,182 | |

| | | | | | | |

| Net (loss) income per common share: | | | | | | | |

| Basic | $ | (0.78) | | | $ | 0.39 | | | $ | (0.05) | | | $ | 3.06 | |

| Diluted | $ | (0.78) | | | $ | 0.37 | | | $ | (0.05) | | | $ | 2.86 | |

| | | | | | | |

| Weighted-average shares used in computing basic and diluted net (loss) income per common share: | | | | | | | |

| Basic | 34,848,899 | | | 34,269,274 | | | 34,619,794 | | | 34,289,333 | |

| Diluted | 34,848,899 | | | 35,811,473 | | | 34,619,794 | | | 36,698,395 | |

Thryv Holdings, Inc. and Subsidiaries

Consolidated Balance Sheets

| | | | | | | | | | | |

| (in thousands, except share data) | September 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 14,676 | | | $ | 16,031 | |

Accounts receivable, net of allowance of $13,764 in 2023 and $14,766 in 2022 | 198,828 | | | 284,698 | |

Contract assets, net of allowance of $23 in 2023 and $33 in 2022 | 1,471 | | | 2,583 | |

| Taxes receivable | 19,087 | | | 11,553 | |

| Prepaid expenses | 22,801 | | | 25,092 | |

| Indemnification asset | — | | | 26,495 | |

| Deferred costs | 15,085 | | | 9,544 | |

| Other current assets | 2,624 | | | 2,320 | |

| Total current assets | 274,572 | | | 378,316 | |

| Fixed assets and capitalized software, net | 37,951 | | | 42,334 | |

| Goodwill | 567,773 | | | 566,004 | |

| Intangible assets, net | 24,268 | | | 34,715 | |

| Deferred tax assets | 114,406 | | | 113,859 | |

| Other assets | 21,412 | | | 42,649 | |

| Total assets | $ | 1,040,382 | | | $ | 1,177,877 | |

| | | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 8,138 | | | $ | 18,972 | |

| Accrued liabilities | 97,720 | | | 126,810 | |

| Current portion of unrecognized tax benefits | 23,415 | | | 31,919 | |

| Contract liabilities | 27,119 | | | 41,854 | |

| Current portion of long-term debt | 70,000 | | | 70,000 | |

| Other current liabilities | 9,522 | | | 10,937 | |

| Total current liabilities | 235,914 | | | 300,492 | |

| Term Loan, net | 253,874 | | | 345,256 | |

| ABL Facility | 57,393 | | | 54,554 | |

| Pension obligations, net | 76,076 | | | 72,590 | |

| Other liabilities | 20,029 | | | 22,718 | |

| Total long-term liabilities | 407,372 | | | 495,118 | |

| Commitments and contingencies | | | |

| Stockholders' equity | | | |

Common stock - $0.01 par value, 250,000,000 shares authorized; 62,521,026 shares issued and 35,164,339 shares outstanding at September 30, 2023; and 61,279,379 shares issued and 34,593,837 shares outstanding at December 31, 2022 | 625 | | | 613 | |

| Additional paid-in capital | 1,143,493 | | | 1,105,701 | |

Treasury stock - 27,356,687 shares at September 30, 2023 and 26,685,542 shares at December 31, 2022 | (485,768) | | | (468,879) | |

| Accumulated other comprehensive loss | (20,593) | | | (16,261) | |

| Accumulated deficit | (240,661) | | | (238,907) | |

| Total stockholders' equity | 397,096 | | | 382,267 | |

| Total liabilities and stockholders' equity | $ | 1,040,382 | | | $ | 1,177,877 | |

Thryv Holdings, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| (in thousands) | 2023 | | 2022 |

| Cash Flows from Operating Activities | | | |

| Net (loss) income | $ | (1,754) | | | $ | 104,793 | |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 46,940 | | | 65,954 | |

| Amortization of deferred commissions | 10,304 | | | 8,396 | |

| Amortization of debt issuance costs | 4,080 | | | 4,327 | |

| Deferred income taxes | 808 | | | (23,222) | |

| Provision for credit losses and service credits | 15,594 | | | 18,325 | |

| Stock-based compensation expense | 16,653 | | | 10,140 | |

| Other components of net periodic pension cost (benefit) | 3,888 | | | (5,295) | |

| Impairment charges | — | | | 222 | |

| Loss (gain) on foreign currency exchange rates | 164 | | | (4,447) | |

| Non-cash loss (gain) from the remeasurement of the indemnification asset | 10,734 | | | (1,472) | |

| Bargain purchase gain | — | | | (10,245) | |

| Other | — | | | 1,961 | |

| Changes in working capital items, excluding acquisitions: | | | |

| Accounts receivable | 59,238 | | | (8,930) | |

| Contract assets | 1,111 | | | 2,226 | |

| Prepaid expenses and other assets | 23,489 | | | 8,089 | |

| Accounts payable and accrued liabilities | (63,469) | | | (36,956) | |

| Other liabilities | (24,132) | | | (29,645) | |

| Net cash provided by operating activities | 103,648 | | | 104,221 | |

| | | |

| Cash Flows from Investing Activities | | | |

| Additions to fixed assets and capitalized software | (22,920) | | | (19,345) | |

| Acquisition of a business, net of cash acquired | (8,897) | | | (22,793) | |

| Other | (215) | | | — | |

| Net cash (used in) investing activities | (32,032) | | | (42,138) | |

| | | |

| Cash Flows from Financing Activities | | | |

| | | |

| | | |

| Payments of Term Loan | (95,000) | | | (73,164) | |

| Payments of Term Loan, related party | — | | | (8,347) | |

| | | |

| | | |

| Proceeds from ABL Facility | 697,234 | | | 746,689 | |

| Payments of ABL Facility | (694,395) | | | (727,762) | |

| Proceeds from exercises of stock warrants | 15,899 | | | 64 | |

| Other | 4,124 | | | 4,824 | |

| Net cash (used in) financing activities | (72,138) | | | (57,696) | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (707) | | | (1,610) | |

| (Decrease) increase in cash, cash equivalents and restricted cash | (1,229) | | | 2,777 | |

| Cash, cash equivalents and restricted cash, beginning of period | 18,180 | | | 13,557 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 16,951 | | | $ | 16,334 | |

| | | |

| Supplemental Information | | | |

| Cash paid for interest | $ | 44,029 | | | $ | 42,435 | |

| Cash paid for income taxes, net | $ | 7,605 | | | $ | 53,673 | |

| | | |

| Non-cash investing and financing activities | | | |

| Repurchase of Treasury stock as a result of the settlement of the indemnification asset | $ | 15,760 | | | $ | — | |

The following tables summarize the operating results of the Company's reportable segments:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Change |

| (in thousands) | 2023 (1) | | 2022 | | Amount | | % |

| Revenue | | | | | | | |

| Thryv U.S. | | | | | | | |

| Marketing Services | $ | 92,884 | | | $ | 197,174 | | | $ | (104,290) | | | (52.9) | % |

| SaaS | 64,650 | | | 55,353 | | | 9,297 | | | 16.8 | % |

| Thryv International | | | | | | | |

| Marketing Services | 23,578 | | | 26,833 | | | (3,255) | | | (12.1) | % |

| SaaS | 2,710 | | | 1,290 | | | 1,420 | | | 110.1 | % |

| Consolidated Revenue | $ | 183,822 | | | $ | 280,650 | | | $ | (96,828) | | | (34.5) | % |

| | | | | | | |

| Segment Gross Profit | | | | | | | |

| Thryv U.S. | | | | | | | |

| Marketing Services | $ | 50,610 | | | $ | 126,846 | | | $ | (76,236) | | | (60.1) | % |

| SaaS | 40,957 | | | 33,827 | | | 7,130 | | | 21.1 | % |

| Thryv International | | | | | | | |

| Marketing Services | 10,166 | | | 14,351 | | | (4,185) | | | (29.2) | % |

| SaaS | 1,911 | | | 615 | | | 1,296 | | | NM |

| Consolidated Segment Gross Profit | $ | 103,644 | | | $ | 175,639 | | | $ | (71,995) | | | (41.0) | % |

| | | | | | | |

| Segment EBITDA | | | | | | | |

| Thryv U.S. | | | | | | | |

| Marketing Services | $ | 5,369 | | | $ | 61,802 | | | $ | (56,433) | | | (91.3) | % |

| SaaS | 1,986 | | | 398 | | | 1,588 | | | NM |

| Thryv International | | | | | | | |

| Marketing Services | 2,466 | | | 5,807 | | | (3,341) | | | (57.5) | % |

| SaaS | (2,490) | | | (2,575) | | | 85 | | | 3.3 | % |

| Consolidated Adjusted EBITDA | $ | 7,331 | | | $ | 65,432 | | | $ | (58,101) | | | (88.8) | % |

(1) Thryv International includes Yellow's results of operations subsequent to the Yellow Acquisition.

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, | | Change |

| (in thousands) | 2023 (1) | | 2022 (2) | | Amount | | % |

| Revenue | | | | | | | |

| Thryv U.S. | | | | | | | |

| Marketing Services | $ | 377,868 | | | $ | 632,277 | | | $ | (254,409) | | | (40.2) | % |

| SaaS | 182,927 | | | 153,863 | | | 29,064 | | | 18.9 | % |

| Thryv International | | | | | | | |

| Marketing Services | 113,183 | | | 133,715 | | | (20,532) | | | (15.4) | % |

| SaaS | 6,820 | | | 3,165 | | | 3,655 | | | 115.5 | % |

| Consolidated Revenue | $ | 680,798 | | | $ | 923,020 | | | $ | (242,222) | | | (26.2) | % |

| | | | | | | |

| Segment Gross Profit | | | | | | | |

| Thryv U.S. | | | | | | | |

| Marketing Services | $ | 231,807 | | | $ | 415,130 | | | $ | (183,323) | | | (44.2) | % |

| SaaS | 114,480 | | | 95,328 | | | 19,152 | | | 20.1 | % |

| Thryv International | | | | | | | |

| Marketing Services | 67,498 | | | 89,694 | | | (22,196) | | | (24.7) | % |

| SaaS | 4,752 | | | 1,325 | | | 3,427 | | | NM |

| Consolidated Segment Gross Profit | $ | 418,537 | | | $ | 601,477 | | | $ | (182,940) | | | (30.4) | % |

| | | | | | | |

| Segment EBITDA | | | | | | | |

| Thryv U.S. | | | | | | | |

| Marketing Services | $ | 84,866 | | | $ | 211,871 | | | $ | (127,005) | | | (59.9) | % |

| SaaS | 10,231 | | | (3,769) | | | 14,000 | | | NM |

| Thryv International | | | | | | | |

| Marketing Services | 44,851 | | | 64,449 | | | (19,598) | | | (30.4) | % |

| SaaS | (4,709) | | | (7,402) | | | 2,693 | | | 36.4 | % |

| Consolidated Adjusted EBITDA | $ | 135,239 | | | $ | 265,149 | | | $ | (129,910) | | | (49.0) | % |

(1) Thryv International includes Yellow's results of operations subsequent to the Yellow Acquisition.

(2) Thryv U.S. includes Vivial's results of operations subsequent to the Vivial Acquisition.

Non-GAAP Measures

Our results included in this press release include Adjusted EBITDA, Adjusted EBITDA margin and Adjusted Gross Profit, which are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP measures are presented for supplemental informational purposes only and are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Please refer to the supplemental information presented in the tables below for a reconciliation of Adjusted EBITDA to Net (loss) income and Adjusted Gross Profit to Gross profit. Both Net (loss) income and Gross profit are the most comparable GAAP financial measure to Adjusted EBITDA and Adjusted Gross Profit, respectively. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue.

We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and allow for greater transparency with respect to important metrics used by our management for financial and operational decision-making. We believe that these measures provide additional tools for investors to use in comparing our core financial performance over multiple periods with other companies in our industry. However, it is important to note that the particular items we exclude from, or include in, our non-GAAP financial measures may differ from the items excluded from, or included in, similar non-GAAP financial measures used by other companies in the same industry.

The following is a reconciliation of Adjusted EBITDA to its most directly comparable GAAP measure, Net (loss) income:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of Adjusted EBITDA | | | | | | | |

| Net (loss) income | $ | (27,046) | | | $ | 13,280 | | | $ | (1,754) | | | $ | 104,793 | |

| Interest expense | 15,131 | | | 14,570 | | | 47,911 | | | 44,089 | |

| Depreciation and amortization expense | 15,842 | | | 23,393 | | | 46,940 | | | 65,954 | |

Stock-based compensation expense (1) | 5,462 | | | 4,402 | | | 16,653 | | | 10,140 | |

Restructuring and integration expenses (2) | 3,584 | | | 3,790 | | | 12,845 | | | 14,439 | |

| Income tax (benefit) expense | (10,241) | | | 6,241 | | | (9,173) | | | 38,062 | |

Transaction costs (3) | — | | | 1,461 | | | 373 | | | 4,797 | |

Other components of net periodic pension cost (benefit) (4) | 1,902 | | | 3,928 | | | 3,888 | | | (5,295) | |

Non-cash (gain) loss from remeasurement of indemnification asset (5) | — | | | (585) | | | 10,734 | | | (1,472) | |

| Impairment charges | — | | | — | | | — | | | 222 | |

Other (6) | 2,697 | | | (5,048) | | | 6,822 | | | (10,580) | |

| Adjusted EBITDA | $ | 7,331 | | | $ | 65,432 | | | $ | 135,239 | | | $ | 265,149 | |

(1)We record stock-based compensation expense related to the amortization of grant date fair value of the Company’s stock-based compensation awards.

(2)For the three and nine months ended September 30, 2023 and 2022, expenses relate to periodic efforts to enhance efficiencies and reduce costs, and include severance benefits, and costs associated with abandoned facilities and system consolidation.

(3)Expenses related to the Yellow acquisition, Vivial acquisition and other transaction costs.

(4)Other components of net periodic pension cost (benefit) is from our non-contributory defined benefit pension plans that are currently frozen and incur no additional service costs. The most significant component of Other components of net periodic pension cost (benefit) relates to periodic mark-to-market pension remeasurement.

(5)In connection with the YP Acquisition, the seller indemnified us for future potential losses associated with certain federal and state tax positions taken in tax returns filed by the seller prior to the acquisition date.

(6)Other primarily represents foreign exchange-related expense. Additionally, during the nine months ended September 30, 2022, Other includes the bargain purchase gain as a result of the Vivial Acquisition.

The following tables set forth reconciliations of Adjusted Gross Profit and Adjusted Gross Margin, to their most directly comparable GAAP measures, Gross profit and Gross margin:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| Thryv U.S. | | Thryv International | | |

| (in thousands) | Marketing Services | | SaaS | | Marketing Services | | SaaS | | Total |

| Reconciliation of Adjusted Gross Profit | | | | | | | | | |

| Gross profit | $ | 50,610 | | | $ | 40,957 | | | $ | 10,166 | | | $ | 1,911 | | | $ | 103,644 | |

| Plus: | | | | | | | | | |

| Depreciation and amortization expense | 2,298 | | | 1,602 | | | 2,587 | | | 299 | | | 6,786 | |

| Stock-based compensation expense | 103 | | | 71 | | | — | | | — | | | 174 | |

| Adjusted Gross Profit | $ | 53,011 | | | $ | 42,630 | | | $ | 12,753 | | | $ | 2,210 | | | $ | 110,604 | |

| Gross Margin | 54.5 | % | | 63.4 | % | | 43.1 | % | | 70.5 | % | | 56.4 | % |

| Adjusted Gross Margin | 57.1 | % | | 65.9 | % | | 54.1 | % | | 81.5 | % | | 60.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| Thryv U.S. | | Thryv International | | |

| (in thousands) | Marketing Services | | SaaS | | Marketing Services | | SaaS | | Total |

| Reconciliation of Adjusted Gross Profit | | | | | | | | | |

| Gross profit | $ | 126,846 | | | $ | 33,827 | | | $ | 14,351 | | | $ | 615 | | | $ | 175,639 | |

| Plus: | | | | | | | | | |

| Depreciation and amortization expense | 4,593 | | | 1,287 | | | 3,739 | | | 195 | | | 9,814 | |

| Stock-based compensation expense | 85 | | | 22 | | | — | | | — | | | 107 | |

| Adjusted Gross Profit | $ | 131,524 | | | $ | 35,136 | | | $ | 18,090 | | | $ | 810 | | | $ | 185,560 | |

| Gross Margin | 64.3 | % | | 61.1 | % | | 53.5 | % | | 47.7 | % | | 62.6 | % |

| Adjusted Gross Margin | 66.7 | % | | 63.5 | % | | 67.4 | % | | 62.8 | % | | 66.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| Thryv U.S. | | Thryv International | | |

| (in thousands) | Marketing Services | | SaaS | | Marketing Services | | SaaS | | Total |

| Reconciliation of Adjusted Gross Profit | | | | | | | | | |

| Gross profit | $ | 231,807 | | | $ | 114,480 | | | $ | 67,498 | | | $ | 4,752 | | | $ | 418,537 | |

| Plus: | | | | | | | | | |

| Depreciation and amortization expense | 8,101 | | | 4,004 | | | 8,689 | | | 599 | | | 21,393 | |

| Stock-based compensation expense | 325 | | | 171 | | | — | | | — | | | 496 | |

| Adjusted Gross Profit | $ | 240,233 | | | $ | 118,655 | | | $ | 76,187 | | | $ | 5,351 | | | $ | 440,426 | |

| Gross Margin | 61.3 | % | | 62.6 | % | | 59.6 | % | | 69.7 | % | | 61.5 | % |

| Adjusted Gross Margin | 63.6 | % | | 64.9 | % | | 67.3 | % | | 78.5 | % | | 64.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| Thryv U.S. | | Thryv International | | |

| (in thousands) | Marketing Services | | SaaS | | Marketing Services | | SaaS | | Total |

| Reconciliation of Adjusted Gross Profit | | | | | | | | | |

| Gross profit | $ | 415,130 | | | $ | 95,328 | | | $ | 89,694 | | | $ | 1,325 | | | $ | 601,477 | |

| Plus: | | | | | | | | | |

| Depreciation and amortization expense | 13,381 | | | 3,278 | | | 11,771 | | | 337 | | | 28,767 | |

| Stock-based compensation expense | 251 | | | 63 | | | — | | | — | | | 314 | |

| Adjusted Gross Profit | $ | 428,762 | | | $ | 98,669 | | | $ | 101,465 | | | $ | 1,662 | | | $ | 630,558 | |

| Gross Margin | 65.7 | % | | 62.0 | % | | 67.1 | % | | 41.9 | % | | 65.2 | % |

| Adjusted Gross Margin | 67.8 | % | | 64.1 | % | | 75.9 | % | | 52.5 | % | | 68.3 | % |

Supplemental Financial Information

The following supplemental financial information provides Revenue, Adjusted EBITDA and Adjusted EBITDA Margin by (i) Marketing Services businesses in the U.S., International and in Total and (ii) SaaS businesses in the U.S., International and in Total. Total SaaS Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Total Marketing Services Adjusted EBITDA and Adjusted EBITDA margin are also non-GAAP financial measures. These non-GAAP financial measures are presented for supplemental informational purposes only and are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Please refer to the supplemental information presented in the tables below for a reconciliation of these non-GAAP financial measures to the corresponding segment financial measures presented in accordance with GAAP.

We believe that these non-GAAP financial measures provide useful information about our global SaaS and Marketing Services financial performance, enhance the overall understanding of our global SaaS and Marketing Services past financial performance and allow for greater transparency with respect to important metrics used by our management for financial and operational decision-making. We believe that these measures provide additional tools for investors to use in comparing our core financial performance over multiple periods.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| (in thousands) | Marketing Services | | SaaS |

| U.S. | | International | | Total | | U.S. | | International | | Total |

| Revenue | $ | 92,884 | | | $ | 23,578 | | | $ | 116,462 | | | $ | 64,650 | | | $ | 2,710 | | | $ | 67,360 | |

| Adjusted EBITDA | 5,369 | | | 2,466 | | | 7,835 | | | 1,986 | | | (2,490) | | | (504) | |

| Adjusted EBITDA Margin | 5.8 | % | | 10.5 | % | | 6.7 | % | | 3.1 | % | | (91.9) | % | | (0.7) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| (in thousands) | Marketing Services | | SaaS |

| U.S. | | International | | Total | | U.S. | | International | | Total |

| Revenue | $ | 197,174 | | | $ | 26,833 | | | $ | 224,007 | | | $ | 55,353 | | | $ | 1,290 | | | $ | 56,643 | |

| Adjusted EBITDA | 61,802 | | | 5,807 | | | 67,609 | | | 398 | | | (2,575) | | | (2,177) | |

| Adjusted EBITDA Margin | 31.3 | % | | 21.6 | % | | 30.2 | % | | 0.7 | % | | (199.6) | % | | (3.8) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| (in thousands) | Marketing Services | | SaaS |

| U.S. | | International | | Total | | U.S. | | International | | Total |

| Revenue | $ | 377,868 | | | $ | 113,183 | | | $ | 491,051 | | | $ | 182,927 | | | $ | 6,820 | | | $ | 189,747 | |

| Adjusted EBITDA | 84,866 | | | 44,851 | | | 129,717 | | | 10,231 | | | (4,709) | | | 5,522 | |

| Adjusted EBITDA Margin | 22.5 | % | | 39.6 | % | | 26.4 | % | | 5.6 | % | | (69.0) | % | | 2.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| (in thousands) | Marketing Services | | SaaS |

| U.S. | | International | | Total | | U.S. | | International | | Total |

| Revenue | $ | 632,277 | | | $ | 133,715 | | | $ | 765,992 | | | $ | 153,863 | | | $ | 3,165 | | | $ | 157,028 | |

| Adjusted EBITDA | 211,871 | | | 64,449 | | | 276,320 | | | (3,769) | | | (7,402) | | | (11,171) | |

| Adjusted EBITDA Margin | 33.5 | % | | 48.2 | % | | 36.1 | % | | (2.4) | % | | (233.9) | % | | (7.1) | % |

Forward-Looking Statements

Certain statements contained herein are not historical facts, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and involve a number of risks and uncertainties. Statements that include the words “may”, “will”, “could”, “should”, “would”, “believe”, “anticipate”, “forecast”, “estimate”, “expect”, “preliminary”, “intend”, “plan”, “target”, “project”, “outlook”, “future”, “forward”, “guidance” and similar statements of a future or forward-looking nature identify forward-looking statements. These statements are not guarantees of future performance. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to, the risks related to the following: risks related to the ongoing COVID-19 pandemic, the Company’s ability to maintain adequate liquidity to fund operations; the Company’s future operating and financial performance; the Company’s ability to consummate acquisitions, or, if consummated, to successfully integrate acquired businesses into the Company’s operations, the Company’s ability to recognize the benefits of acquisitions, or the failure of an acquired company to achieve its plans and objectives; limitations on our operating and strategic flexibility and the ability to operate our business, finance our capital needs or expand business strategies under the terms of our credit facilities; our ability to retain existing business and obtain and retain new business; general economic or business conditions

affecting the markets we serve; declining use of print yellow page directories by consumers; our ability to collect trade receivables from clients to whom we extend credit; credit risk associated with our reliance on small and medium sized businesses as clients; our ability to attract and retain key managers; increased competition in our markets; our ability to obtain future financing due to changes in the lending markets or our financial position; our ability to maintain agreements with major Internet search and local media companies; reduced advertising spending and increased contract cancellations by our clients, which causes reduced revenue; and our ability to anticipate or respond effectively to changes in technology and consumer preferences as well as the risks and uncertainties set forth in the Company's most recent Annual Report on Form 10-K and subsequent Quarterly Reports on From 10-Q filed with the Securities and Exchange Commission. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by such cautionary statements.

If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. For these reasons, we caution you against relying on forward-looking statements. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. These forward-looking statements speak only as of the date hereof and, other than as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

About Thryv Holdings, Inc.

Thryv Holdings, Inc. (NASDAQ: THRY) is a global software and marketing services company that empowers small- to medium-sized businesses (“SMBs”) to grow and modernize their operations so they can compete and win in today's economy. Over 50,000 businesses use our award-winning SaaS platform, Thryv®, to manage their end-to-end operations, which has helped businesses across the U.S. and overseas grow their bottom line. Thryv also manages digital and print presence for approximately 400,000 businesses, connecting these SMBs to local consumers via proprietary local search portals and print directories. For more information about Thryv Holdings, Inc, visit thryv.com.

Media Contact:

Paige Blankenship

Thryv, Inc.

214-392-9609

paige.blankenship@thryv.com

Investor Contact:

Cameron Lessard

Thryv, Inc.

214.773.7022

cameron.lessard@thryv.com

###

Exhibit 99.2 3rd QUARTER 2023 INVESTOR PRESENTATION

2

3

4

5

6

7

8

9

10

11

12

13

14

15 Q3 2023

16 3rd QUARTER HIGHLIGHTS 3rd Quarter $ in thousands 2023 2022 YoY% Total SaaS Revenue $67,360 $56,643 18.9% Adjusted EBITDA (504) (2,177) Adjusted EBITDA Margin (0.7)% (3.8)% Total Marketing Services Revenue $116,462 $224,007 (48.0)% Adjusted EBITDA 7,835 67,609 Adjusted EBITDA Margin 6.7% 30.2% Consolidated Revenue $183,822 $280,650 (34.5)% Adjusted EBITDA 7,331 65,432 Adjusted EBITDA Margin 4.0% 23.3%

17 FINANCIAL REVIEW SAAS HIGHLIGHTS $56.6 $67.4 Revenue Q3-22 Q3-23 +19% YoY +29% YoY $365 $63M +57% YoY Revenue Growth Growing Subscribers ARPU ThryvPay TPVSeasoned Net Dollar Retention (NDR) 45K 92% +300 bps QoQ Monthly Active Users (MAU) +22% YoY (in millions)

18 (1) Marketing Services Billings excludes Vivial Holdings run-off products and Yellow Holdings Limited (NZ). Q3-23 Q3-22 Marketing Services Billings (millions)(1) $159.5 $198.1 YoY % (19)% (20)% FINANCIAL REVIEW TOTAL MARKETING SERVICES MARKETING SERVICES BILLINGS (YoY%) (23)%(22)%(23)%(21)%(22)%(22)%(21)%(21)%(22)%(21)%(21)%(22)%(19)%(17)%(20)%(17)%(19)%(22)%(19)% Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23

19 Q4 and FY 2023 OUTLOOK Q4 and FY 2023 SaaS Guidance Raised (in millions, USD) Q4 2023 FY 2023 MANAGEMENT COMMENTARY TOTAL MARKETING SERVICES REVENUE $159 to $164 $650 to $655 • Transition from 15 to 18 month print cycle creates a revenue recognition gap in FY-23 according to accounting policy; has no impact on billings and free cash flow Adjusted EBITDA $47 to $49 $177 to $179 • Marketing Services Adjusted EBITDA margins normalize after Q3-23 revenue recognition impact due to longer print directory cycle (in millions, USD) Q4 2023 FY 2023 MANAGEMENT COMMENTARY TOTAL SAAS REVENUE $70.25 to $71.25 $260.0 to $261.0 • Company expects growth of 20% Adjusted EBITDA $3.5 to $4.0 $9.0 to $9.5 • SaaS Adjusted EBITDA margins turn positive again after operating expenses are normalized

20

21 APPENDIX SEGMENT RESULTS Three Months Ended September 30, 2022 Thryv U.S. Thryv International (in thousands) Marketing Services SaaS Marketing Services SaaS Total Revenue $ 197,174 $ 55,353 $ 26,833 $ 1,290 $ 280,650 Segment Gross Profit 126,846 33,827 14,351 615 175,639 Segment Adjusted EBITDA 61,802 398 5,807 (2,575) 65,432 Three Months Ended September 30, 2023 Thryv U.S. Thryv International (in thousands) Marketing Services SaaS Marketing Services SaaS Total Revenue $ 92,884 $ 64,650 $ 23,578 $ 2,710 $ 183,822 Segment Gross Profit 50,610 40,957 10,166 1,911 103,644 Segment Adjusted EBITDA 5,369 1,986 2,466 (2,490) 7,331 Nine Months Ended September 30, 2023 Thryv U.S. Thryv International (in thousands) Marketing Services SaaS Marketing Services SaaS Total Revenue $ 377,868 $ 182,927 $ 113,183 $ 6,820 $ 680,798 Segment Gross Profit 231,807 114,480 67,498 4,752 418,537 Segment Adjusted EBITDA 84,866 10,231 44,851 (4,709) 135,239 Nine Months Ended September 30, 2022 Thryv U.S. Thryv International (in thousands) Marketing Services SaaS Marketing Services SaaS Total Revenue $ 632,277 $ 153,863 $ 133,715 $ 3,165 $ 923,020 Segment Gross Profit 415,130 95,328 89,694 1,325 601,477 Segment Adjusted EBITDA 211,871 (3,769) 64,449 (7,402) 265,149

22 $ IN THOUSANDS Q1-22 Q2-22 Q3-22 Q4-22 FY22 Q1-23 Q2-23 Q3-23 YTD Q3-23 Net Income (Loss) $ 33,511 $ 58,002 $ 13,280 $ (50,445) $ 54,348 $ 9,314 $ 15,978 $ (27,046) $ (1,754) Interest expense 14,867 14,652 14,570 16,318 60,407 16,488 16,292 15,131 47,911 Depreciation and amortization expense 21,969 20,592 23,393 22,438 88,392 15,431 15,667 15,842 46,940 Stock-based compensation expense 1,928 3,810 4,402 4,488 14,628 5,393 5,798 5,462 16,653 Restructuring and integration expenses 5,827 4,822 3,790 3,365 17,804 5,340 3,921 3,584 12,845 Income tax expense (benefit) 9,621 22,200 6,241 6,565 44,627 4,496 (3,428) (10,241) (9,173) Transaction costs 1,720 1,616 1,461 1,322 6,119 373 — — 373 Other components of net periodic pension (benefit) cost (70) (9,153) 3,928 (39,317) (44,612) 121 1,865 1,902 3,888 (Gain) loss on remeasurement of indemnification asset (400) (487) (585) (676) (2,148) (756) 11,490 — 10,734 Impairment charges — 222 — 102,000 102,222 — — — — Other (5,256) (276) (5,048) 2,135 (8,445) 2,269 1,856 2,697 6,822 Adjusted EBITDA $ 83,717 $ 116,000 $ 65,432 $ 68,193 $ 333,342 $ 58,469 $ 69,439 $ 7,331 $ 135,239 0 APPENDIX NON-GAAP FINANCIAL RECONCILIATION *Figures may not foot due to rounding.

23 Reconciliation of Adjusted Gross Profit to Gross profit APPENDIX NON-GAAP FINANCIAL RECONCILIATION Three Months Ended September 30, 2023 Thryv U.S. Thryv International (in thousands) Marketing Services SaaS Marketing Services SaaS Consolidated Reconciliation of Adjusted Gross Profit Gross profit $ 50,610 $ 40,957 $ 10,166 $ 1,911 $ 103,644 Plus: Depreciation and amortization expense 2,298 1,602 2,587 299 6,786 Stock-based compensation expense 103 71 — — 174 Adjusted Gross Profit $ 53,011 $ 42,630 $ 12,753 $ 2,210 $ 110,604 Gross Margin 54.5 % 63.4 % 43.1 % 70.5 % 56.4 % Adjusted Gross Margin 57.1 % 65.9 % 54.1 % 81.5 % 60.2 % Three Months Ended September 30, 2022 Thryv U.S. Thryv International (in thousands) Marketing Services SaaS Marketing Services SaaS Consolidated Reconciliation of Adjusted Gross Profit Gross profit $ 126,846 $ 33,827 $ 14,351 $ 615 $ 175,639 Plus: Depreciation and amortization expense 4,593 1,287 3,739 195 9,814 Stock-based compensation expense 85 22 — — 107 Adjusted Gross Profit $ 131,524 $ 35,136 $ 18,090 $ 810 $ 185,560 Gross Margin 64.3 % 61.1 % 53.5 % 47.7 % 62.6 % Adjusted Gross Margin 66.7 % 63.5 % 67.4 % 62.8 % 66.1 %

24 Reconciliation of Adjusted Gross Profit to Gross profit APPENDIX NON-GAAP FINANCIAL RECONCILIATION Nine Months Ended September 30, 2023 Thryv U.S. Thryv International (in thousands) Marketing Services SaaS Marketing Services SaaS Consolidated Reconciliation of Adjusted Gross Profit Gross profit $ 231,807 $ 114,480 $ 67,498 $ 4,752 $ 418,537 Plus: Depreciation and amortization expense 8,101 4,004 8,689 599 21,393 Stock-based compensation expense 325 171 — — 496 Adjusted Gross Profit $ 240,233 $ 118,655 $ 76,187 $ 5,351 $ 440,426 Gross Margin 61.3 % 62.6 % 59.6 % 69.7 % 61.5 % Adjusted Gross Margin 63.6 % 64.9 % 67.3 % 78.5 % 64.7 % Nine Months Ended September 30, 2022 Thryv U.S. Thryv International (in thousands) Marketing Services SaaS Marketing Services SaaS Consolidated Reconciliation of Adjusted Gross Profit Gross profit $ 415,130 $ 95,328 $ 89,694 $ 1,325 $ 601,477 Plus: Depreciation and amortization expense 13,381 3,278 11,771 337 28,767 Stock-based compensation expense 251 63 — — 314 Adjusted Gross Profit $ 428,762 $ 98,669 $ 101,465 $ 1,662 $ 630,558 Gross Margin 65.7 % 62.0 % 67.1 % 41.9 % 65.2 % Adjusted Gross Margin 67.8 % 64.1 % 75.9 % 52.5 % 68.3 %

25 APPENDIX SUPPLEMENTAL FINANCIAL INFORMATION The supplemental financial information provides Revenue, Adjusted EBITDA and Adjusted EBITDA Margin by (i) Marketing Services businesses in the U.S., International and in Total and (ii) SaaS businesses in the U.S., International and in Total. Total SaaS Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Total Marketing Services Adjusted EBITDA and Adjusted EBITDA margin are also non-GAAP financial measures. Additionally, the supplemental financial information provides consolidated Free cash flow, which is also a non-GAAP measure. These non-GAAP financial measures are presented for supplemental informational purposes only and are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Three Months Ended September 30, 2023 (in thousands) Marketing Services SaaS U.S. International Total Marketing Services U.S. International Total SaaS Revenue $ 92,884 $ 23,578 $ 116,462 $ 64,650 $ 2,710 $ 67,360 Adjusted EBITDA 5,369 2,466 7,835 1,986 (2,490) (504) Adjusted EBITDA Margin 5.8 % 10.5 % 6.7 % 3.1 % (91.9) % (0.7) % Three Months Ended September 30, 2022 (in thousands) Marketing Services SaaS U.S. International Total Marketing Services U.S. International Total SaaS Revenue $ 197,174 $ 26,833 $ 224,007 $ 55,353 $ 1,290 $ 56,643 Adjusted EBITDA 61,802 5,807 67,609 398 (2,575) (2,177) Adjusted EBITDA Margin 31.3 % 21.6 % 30.2 % 0.7 % (199.6) % (3.8) % Three Months Ended September 30, (in thousands) 2023 2022 Net cash provided by operating activities $ 45,912 $ 47,318 Additions to fixed assets and capitalized software (8,904) (9,697) Free cash flow $ 37,008 $ 37,621

26 APPENDIX SUPPLEMENTAL FINANCIAL INFORMATION The supplemental financial information provides Revenue, Adjusted EBITDA and Adjusted EBITDA Margin by (i) Marketing Services businesses in the U.S., International and in Total and (ii) SaaS businesses in the U.S., International and in Total. Total SaaS Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Total Marketing Services Adjusted EBITDA and Adjusted EBITDA margin are also non-GAAP financial measures. Additionally, the supplemental financial information provides consolidated Free cash flow, which is also a non-GAAP measure. These non-GAAP financial measures are presented for supplemental informational purposes only and are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Nine Months Ended September 30, 2023 (in thousands) Marketing Services SaaS U.S. International Total Marketing Services U.S. International Total SaaS Revenue $ 377,868 $ 113,183 $ 491,051 $ 182,927 $ 6,820 $ 189,747 Adjusted EBITDA 84,866 44,851 129,717 10,231 (4,709) 5,522 Adjusted EBITDA Margin 22.5 % 39.6 % 26.4 % 5.6 % (69.0) % 2.9 % Nine Months Ended September 30, 2022 (in thousands) Marketing Services SaaS U.S. International Total Marketing Services U.S. International Total SaaS Revenue $ 632,277 $ 133,715 $ 765,992 $ 153,863 $ 3,165 $ 157,028 Adjusted EBITDA 211,871 64,449 276,320 (3,769) (7,402) (11,171) Adjusted EBITDA Margin 33.5 % 48.2 % 36.1 % (2.4) % (233.9) % (7.1) % Nine Months Ended September 30, (in thousands) 2023 2022 Net cash provided by operating activities $ 103,648 $ 104,221 Additions to fixed assets and capitalized software (22,920) (19,345) Free cash flow $ 80,728 $ 84,876

27

28 APPENDIX DEFINITIONS Definitions of key terms used in this presentation are as follows: • Total SaaS revenue consists of SaaS revenue recognized by our domestic and foreign operations. • Total Marketing Services revenue consists of SaaS revenue recognized by our domestic and foreign operations. • Total SaaS Adjusted EBITDA1 consists of Adjusted EBITDA recognized by our domestic and foreign operations. • Total Marketing Services1 Adjusted EBITDA consists of Adjusted EBITDA recognized by our domestic and foreign operations. • Adjusted EBITDA2: Defined as Net income (loss) plus Interest expense, Income tax expense (benefit), Depreciation and amortization expense, Loss on early extinguishment of debt, Restructuring and integration expenses, Transaction costs, Stock-based compensation expense, and non-operating expenses, such as, Other components of net periodic pension (benefit) cost, Non-cash (gain) loss from remeasurement of indemnification asset, and certain unusual and non-recurring charges that might have been incurred. • Adjusted Gross Profit and Adjusted Gross Profit Margin2: Defined as Gross profit and Gross margin, respectively, adjusted to exclude the impact of depreciation and amortization expense and stock-based compensation expense. • Average Revenue per Unit (“ARPU”): Defined as total client billings for a particular month divided by the number of clients that have one or more revenue-generating solutions in that same month • Seasoned Net Dollar Retention: Defined as net dollar retention excluding clients acquired over the previous 12 months. • SaaS Monthly Active Users: Defined as a client with one or more users who log into our SaaS solutions at least once during the calendar month. 1The supplemental financial information provides Revenue, Adjusted EBITDA and Adjusted EBITDA Margin by (i) Marketing Services businesses in the U.S., International and in Total and (ii) SaaS businesses in the U.S., International and in Total. Total SaaS Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Total Marketing Services Adjusted EBITDA and Adjusted EBITDA margin are also non- GAAP financial measures. These non-GAAP financial measures are presented for supplemental informational purposes only and are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. 2Results included in this presentation include Adjusted EBITDA, Adjusted EBITDA margin and Adjusted Gross Profit, which are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP measures are presented for supplemental informational purposes only and are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Please refer to the supplemental information presented in the tables in the Appendix for a reconciliation of Adjusted EBITDA to Net income (loss) and Adjusted Gross Profit to Gross profit. Both Net income (loss) and Gross profit are the most comparable GAAP financial measure to Adjusted EBITDA and Adjusted Gross Profit, respectively. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and allow for greater transparency with respect to important metrics used by our management for financial and operational decision-making. We believe that these measures provide additional tools for investors to use in comparing our core financial performance over multiple periods with other companies in our industry. However, it is important to note that the particular items we exclude from, or include in, our non-GAAP financial measures may differ from the items excluded from, or included in, similar non-GAAP financial measures used by other companies in the same industry.

v3.23.3

Cover Page

|

Nov. 02, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 02, 2023

|

| Entity Registrant Name |

THRYV HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35895

|

| Entity Tax Identification Number |

13-2740040

|

| Entity Address, Address Line One |

2200 West Airfield Drive, P.O. Box 619810

|

| Entity Address, City or Town |

D/FW Airport

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75261

|

| City Area Code |

972

|

| Local Phone Number |

453-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

THRY

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001556739

|

| Amendment Flag |

false

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

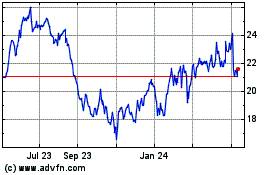

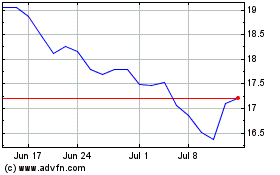

Thryv (NASDAQ:THRY)

Historical Stock Chart

From Apr 2024 to May 2024

Thryv (NASDAQ:THRY)

Historical Stock Chart

From May 2023 to May 2024