00017189392024Q2false12/31http://fasb.org/us-gaap/2024#ResearchAndDevelopmentExpensehttp://fasb.org/us-gaap/2024#ResearchAndDevelopmentExpense0.2http://fasb.org/us-gaap/2024#ResearchAndDevelopmentExpense111xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureiso4217:EURutr:Yidai:patentidai:trademarkidai:leaseidai:office00017189392024-01-012024-06-3000017189392024-08-1200017189392024-06-3000017189392023-12-3100017189392024-04-012024-06-3000017189392023-04-012023-06-3000017189392023-01-012023-06-300001718939us-gaap:CommonStockMember2023-03-310001718939us-gaap:AdditionalPaidInCapitalMember2023-03-310001718939us-gaap:TreasuryStockCommonMember2023-03-310001718939us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001718939us-gaap:RetainedEarningsMember2023-03-310001718939us-gaap:NoncontrollingInterestMember2023-03-3100017189392023-03-310001718939us-gaap:CommonStockMember2023-04-012023-06-300001718939us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001718939us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001718939us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001718939us-gaap:RetainedEarningsMember2023-04-012023-06-300001718939us-gaap:CommonStockMember2023-06-300001718939us-gaap:AdditionalPaidInCapitalMember2023-06-300001718939us-gaap:TreasuryStockCommonMember2023-06-300001718939us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001718939us-gaap:RetainedEarningsMember2023-06-300001718939us-gaap:NoncontrollingInterestMember2023-06-3000017189392023-06-300001718939us-gaap:CommonStockMember2024-03-310001718939us-gaap:AdditionalPaidInCapitalMember2024-03-310001718939us-gaap:TreasuryStockCommonMember2024-03-310001718939us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001718939us-gaap:RetainedEarningsMember2024-03-310001718939us-gaap:NoncontrollingInterestMember2024-03-3100017189392024-03-310001718939us-gaap:CommonStockMember2024-04-012024-06-300001718939us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001718939us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001718939us-gaap:RetainedEarningsMember2024-04-012024-06-300001718939us-gaap:CommonStockMember2024-06-300001718939us-gaap:AdditionalPaidInCapitalMember2024-06-300001718939us-gaap:TreasuryStockCommonMember2024-06-300001718939us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001718939us-gaap:RetainedEarningsMember2024-06-300001718939us-gaap:NoncontrollingInterestMember2024-06-300001718939us-gaap:CommonStockMember2022-12-310001718939us-gaap:AdditionalPaidInCapitalMember2022-12-310001718939us-gaap:TreasuryStockCommonMember2022-12-310001718939us-gaap:ReceivablesFromStockholderMember2022-12-310001718939us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001718939us-gaap:RetainedEarningsMember2022-12-310001718939us-gaap:NoncontrollingInterestMember2022-12-3100017189392022-12-310001718939us-gaap:CommonStockMember2023-01-012023-06-300001718939us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001718939us-gaap:TreasuryStockCommonMember2023-01-012023-06-300001718939us-gaap:ReceivablesFromStockholderMember2023-01-012023-06-300001718939us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001718939us-gaap:RetainedEarningsMember2023-01-012023-06-300001718939us-gaap:ReceivablesFromStockholderMember2023-06-300001718939us-gaap:CommonStockMember2023-12-310001718939us-gaap:AdditionalPaidInCapitalMember2023-12-310001718939us-gaap:TreasuryStockCommonMember2023-12-310001718939us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001718939us-gaap:RetainedEarningsMember2023-12-310001718939us-gaap:NoncontrollingInterestMember2023-12-310001718939us-gaap:CommonStockMember2024-01-012024-06-300001718939us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001718939us-gaap:TreasuryStockCommonMember2024-01-012024-06-300001718939us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001718939us-gaap:RetainedEarningsMember2024-01-012024-06-300001718939us-gaap:SubsequentEventMemberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2024-07-132024-07-130001718939us-gaap:CommonClassAMemberus-gaap:SubsequentEventMemberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2024-07-130001718939us-gaap:SubsequentEventMemberidai:PromissoryNotePayableWithinThreeTradingDaysOfEffectiveResaleRegistrationStatementMember2024-07-130001718939us-gaap:SubsequentEventMemberidai:PromissoryNotePayableAugust312024Member2024-07-130001718939us-gaap:SubsequentEventMemberidai:PromissoryNotePayableMember2024-07-130001718939us-gaap:CommonClassAMember2019-04-250001718939us-gaap:CommonClassAMemberidai:VariousEmployeesMember2019-04-252019-04-250001718939us-gaap:CommonClassAMember2023-02-150001718939us-gaap:CommonClassAMember2024-06-300001718939us-gaap:BankTimeDepositsMember2024-06-300001718939us-gaap:BankTimeDepositsMember2023-12-310001718939idai:TopThreeCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-01-012024-06-300001718939idai:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-01-012024-06-300001718939idai:CustomerTwoMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-01-012024-06-300001718939idai:CustomerThreeMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-01-012024-06-300001718939idai:TopThreeCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-12-310001718939idai:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-12-310001718939idai:CustomerTwoMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-12-310001718939idai:CustomerThreeMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-12-310001718939idai:TopThreeCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-04-012024-06-300001718939idai:SAndP500BankMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-04-012024-06-300001718939idai:MasterCardMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-04-012024-06-300001718939idai:TritonMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-04-012024-06-300001718939idai:TopThreeCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-04-012023-06-300001718939idai:SAndP500BankMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-04-012023-06-300001718939idai:MasterCardMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-04-012023-06-300001718939idai:TritonMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-04-012023-06-300001718939idai:TopThreeCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-06-300001718939idai:SAndP500BankMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-06-300001718939idai:MasterCardMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-06-300001718939idai:TritonMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-06-300001718939idai:TopFourCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-300001718939idai:SAndP500BankMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-300001718939idai:MasterCardMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-300001718939idai:FISMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-300001718939idai:TritonMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-3000017189392023-01-012023-12-310001718939idai:ProfessionalServicesOverTimeMember2024-04-012024-06-300001718939idai:ProfessionalServicesOverTimeMember2023-04-012023-06-300001718939idai:ProfessionalServicesOverTimeMember2024-01-012024-06-300001718939idai:ProfessionalServicesOverTimeMember2023-01-012023-06-300001718939idai:LicenseFeesOverTimeMember2024-04-012024-06-300001718939idai:LicenseFeesOverTimeMember2023-04-012023-06-300001718939idai:LicenseFeesOverTimeMember2024-01-012024-06-300001718939idai:LicenseFeesOverTimeMember2023-01-012023-06-3000017189392023-03-232023-03-230001718939idai:NonConvertiblePromissoryNotesPayableMemberidai:MaltaLoanReceiptThreeMember2024-06-300001718939idai:NonConvertiblePromissoryNotesPayableMemberidai:MaltaLoanReceiptThreeMember2023-12-310001718939idai:NonConvertiblePromissoryNotesPayableMemberidai:MaltaLoanReceiptTwoMember2024-06-300001718939idai:NonConvertiblePromissoryNotesPayableMemberidai:MaltaLoanReceiptTwoMember2023-12-310001718939idai:NonConvertiblePromissoryNotesPayableMemberidai:MaltaLoanReceiptOneMember2024-06-300001718939idai:NonConvertiblePromissoryNotesPayableMemberidai:MaltaLoanReceiptOneMember2023-12-310001718939idai:NonConvertiblePromissoryNotesPayableMember2024-06-300001718939idai:NonConvertiblePromissoryNotesPayableMember2023-12-310001718939idai:LoansFromMalteseGovernmentMemberidai:TrustStampMaltaLimitedMember2020-07-080001718939idai:LoansFromMalteseGovernmentMemberidai:TrustStampMaltaLimitedMember2020-07-082020-07-080001718939idai:LoansFromMalteseGovernmentMemberidai:TrustStampMaltaLimitedMember2024-01-012024-06-300001718939idai:LoansFromMalteseGovernmentMemberidai:TrustStampMaltaLimitedMember2020-05-012020-05-3100017189392020-05-012020-05-3100017189392020-05-310001718939idai:LoansFromMalteseGovernmentMemberidai:TrustStampMaltaLimitedMembersrt:MinimumMember2020-05-012020-05-310001718939idai:LoansFromMalteseGovernmentMemberidai:TrustStampMaltaLimitedMembersrt:MaximumMember2020-05-012020-05-310001718939idai:LoansFromMalteseGovernmentMemberidai:TrustStampMaltaLimitedMember2023-01-012023-06-300001718939us-gaap:FairValueInputsLevel3Member2022-12-310001718939us-gaap:FairValueInputsLevel3Member2023-01-012023-12-310001718939us-gaap:FairValueInputsLevel3Member2023-12-310001718939us-gaap:FairValueInputsLevel3Member2024-01-012024-06-300001718939us-gaap:FairValueInputsLevel3Member2024-06-300001718939us-gaap:CommonClassAMember2016-12-162016-12-1600017189392016-12-1600017189392020-06-300001718939idai:FairValueOfWarrantLiabilityMember2024-06-300001718939idai:FairValueOfWarrantLiabilityMember2023-12-310001718939idai:FairValueOfWarrantsMembersrt:MinimumMember2024-06-300001718939idai:FairValueOfWarrantsMembersrt:MaximumMember2024-06-300001718939us-gaap:MeasurementInputExercisePriceMembersrt:MinimumMember2024-06-300001718939us-gaap:MeasurementInputExercisePriceMembersrt:MaximumMember2024-06-300001718939us-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MinimumMember2024-06-300001718939us-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MaximumMember2024-06-300001718939us-gaap:MeasurementInputExpectedDividendRateMember2024-06-300001718939us-gaap:MeasurementInputPriceVolatilityMembersrt:MinimumMember2024-06-300001718939us-gaap:MeasurementInputPriceVolatilityMembersrt:MaximumMember2024-06-300001718939us-gaap:MeasurementInputExpectedTermMember2024-06-300001718939idai:WarrantIssuanceNovember92016Member2024-06-300001718939idai:WarrantIssuanceNovember92016Member2023-12-310001718939idai:January232020Member2024-06-300001718939idai:January232020Member2023-12-310001718939idai:SecondWarrantIssuanceJanuary232020Member2024-06-300001718939idai:SecondWarrantIssuanceJanuary232020Member2023-12-310001718939idai:April182023Member2024-06-300001718939idai:April182023Member2023-12-310001718939idai:June52023Member2024-06-300001718939idai:June52023Member2023-12-310001718939idai:December212023Member2024-06-300001718939idai:December212023Member2023-12-310001718939idai:FirstWarrantIssuanceApril32024Member2024-06-300001718939idai:FirstWarrantIssuanceApril32024Member2023-12-310001718939idai:SecondWarrantIssuanceApril32024Member2024-06-300001718939idai:SecondWarrantIssuanceApril32024Member2023-12-310001718939idai:ThirdWarrantIssuanceApril32024Member2024-06-300001718939idai:ThirdWarrantIssuanceApril32024Member2023-12-310001718939us-gaap:CommonClassAMember2016-11-090001718939us-gaap:CommonClassAMemberidai:TrustedMailMember2020-01-310001718939us-gaap:CommonClassAMember2020-01-310001718939idai:TrustedMailMember2020-01-012020-01-310001718939us-gaap:CommonClassAMember2020-01-012020-01-310001718939us-gaap:CommonClassAMemberidai:SecondCenturyVenturesLlcMemberidai:WarrantPurchaseAgreementMember2021-12-210001718939idai:SecondCenturyVenturesLlcMemberidai:WarrantPurchaseAgreementMember2021-12-212021-12-210001718939idai:TrustedMailMemberidai:SecondCenturyVenturesLlcMemberidai:WarrantPurchaseAgreementMember2021-12-212021-12-210001718939us-gaap:CommonClassAMemberidai:SecondCenturyVenturesLlcMember2024-06-300001718939idai:RegisteredDirectOfferingMemberidai:SecuritiesPurchaseAgreementMember2023-04-142023-04-140001718939idai:RegisteredDirectOfferingMemberidai:SecuritiesPurchaseAgreementMember2023-04-140001718939us-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2023-04-182023-04-180001718939us-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2023-04-140001718939idai:SecuritiesPurchaseAgreementMember2023-04-182023-04-180001718939idai:SecuritiesPurchaseAgreementMember2023-04-180001718939idai:April182023Memberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2023-12-212023-12-210001718939idai:April182023Memberidai:ArmisticeCapitalMasterFundLtdMember2023-12-210001718939idai:April182023Memberus-gaap:CommonClassAMemberidai:ArmisticeCapitalMasterFundLtdMember2023-12-210001718939idai:April182023Memberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2023-12-210001718939idai:April182023Memberidai:NoticeToExerciseMember2023-12-310001718939idai:April182023Memberus-gaap:CommonClassAMember2024-02-070001718939idai:April182023Memberus-gaap:CommonClassAMember2024-02-270001718939idai:RegisteredDirectOfferingMemberidai:SecuritiesPurchaseAgreementMember2023-06-012023-06-010001718939idai:RegisteredDirectOfferingMemberidai:SecuritiesPurchaseAgreementMember2023-06-0100017189392023-06-012023-06-010001718939us-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2023-06-010001718939idai:SecuritiesPurchaseAgreementMember2023-06-052023-06-050001718939idai:SecuritiesPurchaseAgreementMember2023-06-050001718939idai:RegisteredDirectOfferingMemberidai:SecuritiesPurchaseAgreementMember2023-06-052023-06-050001718939idai:PreFundedWarrantsMember2023-06-122023-06-120001718939idai:PreFundedWarrantsMember2023-06-120001718939idai:PreFundedWarrantsMember2023-06-232023-06-230001718939idai:PreFundedWarrantsMember2023-06-230001718939idai:December212023Memberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2023-12-212023-12-210001718939idai:June52023Memberidai:ArmisticeCapitalMasterFundLtdMember2023-12-210001718939idai:June52023Memberus-gaap:CommonClassAMemberidai:ArmisticeCapitalMasterFundLtdMember2023-12-210001718939idai:December212023Member2023-12-212023-12-210001718939idai:June52023Memberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2023-12-210001718939idai:June52023Memberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2023-12-212023-12-210001718939idai:InstitutionalInvestorMember2023-12-012023-12-310001718939idai:December212023Memberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2024-01-012024-06-300001718939idai:RegisteredDirectOfferingMemberidai:SecuritiesPurchaseAgreementMember2023-12-210001718939idai:December212023Memberus-gaap:CommonClassAMemberidai:ArmisticeCapitalMasterFundLtdMember2023-12-210001718939us-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2023-12-2100017189392023-12-212023-12-210001718939idai:RegisteredDirectOfferingMemberidai:SecuritiesPurchaseAgreementMember2023-12-212023-12-210001718939idai:December212023Memberidai:ArmisticeCapitalMasterFundLtdMember2023-12-212023-12-210001718939idai:December212023Memberidai:ArmisticeCapitalMasterFundLtdMember2023-12-210001718939idai:December212023Memberus-gaap:CommonClassAMemberidai:NoticeToExerciseMemberidai:ArmisticeCapitalMasterFundLtdMember2023-12-210001718939idai:December212023Memberidai:ExistingWarrantsMemberidai:ArmisticeCapitalMasterFundLtdMember2023-12-212023-12-210001718939idai:December212023Memberus-gaap:CommonClassAMemberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2023-12-212023-12-210001718939idai:December212023Memberus-gaap:CommonClassAMemberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2023-12-210001718939idai:December212023Memberus-gaap:CommonClassAMemberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2024-06-302024-06-300001718939us-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2024-04-032024-04-030001718939us-gaap:CommonClassAMemberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2024-04-030001718939idai:WarrantAMemberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2024-04-030001718939idai:WarrantBMemberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2024-04-030001718939idai:WarrantCMemberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2024-04-030001718939idai:PreFundedWarrantsMember2024-05-242024-05-240001718939idai:PreFundedWarrantsMember2024-05-240001718939idai:WarrantAMemberus-gaap:PrivatePlacementMemberidai:SecuritiesPurchaseAgreementMember2024-06-300001718939idai:PreFundedWarrantsMemberus-gaap:SubsequentEventMember2024-07-012024-08-130001718939idai:PreFundedWarrantsMemberus-gaap:SubsequentEventMember2024-08-130001718939srt:MinimumMemberus-gaap:ComputerEquipmentMember2024-06-300001718939srt:MaximumMemberus-gaap:ComputerEquipmentMember2024-06-300001718939us-gaap:ComputerEquipmentMember2024-06-300001718939us-gaap:ComputerEquipmentMember2023-12-310001718939us-gaap:FurnitureAndFixturesMember2024-06-300001718939us-gaap:FurnitureAndFixturesMember2023-12-310001718939us-gaap:PatentsMember2024-06-300001718939us-gaap:PatentsMember2023-12-310001718939us-gaap:TrademarksAndTradeNamesMember2024-06-300001718939us-gaap:TrademarksAndTradeNamesMember2023-12-310001718939us-gaap:PatentsMember2024-01-012024-06-300001718939us-gaap:PatentsMember2024-01-022024-01-020001718939us-gaap:PatentsMember2024-01-302024-01-300001718939us-gaap:PatentsMember2024-03-192024-03-190001718939idai:OptionsRsusAndGrantsMember2024-01-012024-06-300001718939idai:OptionsRsusAndGrantsMember2023-01-012023-06-300001718939us-gaap:WarrantMember2024-01-012024-06-300001718939us-gaap:WarrantMember2023-01-012023-06-300001718939idai:GrantsMembersrt:ManagementMember2024-04-012024-06-300001718939idai:GrantsMembersrt:ManagementMember2023-04-012023-06-300001718939us-gaap:EmployeeStockOptionMembersrt:ManagementMember2024-04-012024-06-300001718939us-gaap:EmployeeStockOptionMembersrt:ManagementMember2023-04-012023-06-300001718939us-gaap:RestrictedStockUnitsRSUMembersrt:ManagementMember2024-04-012024-06-300001718939us-gaap:RestrictedStockUnitsRSUMembersrt:ManagementMember2023-04-012023-06-300001718939idai:GrantsMemberidai:VariousEmployeesMember2024-04-012024-06-300001718939idai:GrantsMemberidai:VariousEmployeesMember2023-04-012023-06-300001718939us-gaap:EmployeeStockOptionMemberidai:VariousEmployeesMember2024-04-012024-06-300001718939us-gaap:EmployeeStockOptionMemberidai:VariousEmployeesMember2023-04-012023-06-300001718939us-gaap:RestrictedStockUnitsRSUMemberidai:VariousEmployeesMember2024-04-012024-06-300001718939us-gaap:RestrictedStockUnitsRSUMemberidai:VariousEmployeesMember2023-04-012023-06-300001718939idai:GrantsMembersrt:ManagementMember2024-01-012024-06-300001718939idai:GrantsMembersrt:ManagementMember2023-01-012023-06-300001718939us-gaap:EmployeeStockOptionMembersrt:ManagementMember2024-01-012024-06-300001718939us-gaap:EmployeeStockOptionMembersrt:ManagementMember2023-01-012023-06-300001718939us-gaap:RestrictedStockUnitsRSUMembersrt:ManagementMember2024-01-012024-06-300001718939us-gaap:RestrictedStockUnitsRSUMembersrt:ManagementMember2023-01-012023-06-300001718939idai:GrantsMemberidai:VariousEmployeesMember2024-01-012024-06-300001718939idai:GrantsMemberidai:VariousEmployeesMember2023-01-012023-06-300001718939us-gaap:EmployeeStockOptionMemberidai:VariousEmployeesMember2024-01-012024-06-300001718939us-gaap:EmployeeStockOptionMemberidai:VariousEmployeesMember2023-01-012023-06-300001718939us-gaap:RestrictedStockUnitsRSUMemberidai:VariousEmployeesMember2024-01-012024-06-300001718939us-gaap:RestrictedStockUnitsRSUMemberidai:VariousEmployeesMember2023-01-012023-06-3000017189392022-01-012022-12-3100017189392024-01-012024-03-310001718939us-gaap:EmployeeStockOptionMembersrt:MinimumMember2024-01-012024-06-300001718939us-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-01-012024-06-300001718939us-gaap:EmployeeStockOptionMember2024-01-012024-06-300001718939us-gaap:EmployeeStockOptionMember2024-06-300001718939us-gaap:RestrictedStockUnitsRSUMember2024-06-300001718939us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300001718939us-gaap:RestrictedStockUnitsRSUMember2022-12-310001718939us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001718939us-gaap:RestrictedStockUnitsRSUMember2023-12-310001718939idai:CostOfServicesProvidedMember2024-04-012024-06-300001718939idai:CostOfServicesProvidedMember2023-04-012023-06-300001718939idai:CostOfServicesProvidedMember2024-01-012024-06-300001718939idai:CostOfServicesProvidedMember2023-01-012023-06-300001718939us-gaap:ResearchAndDevelopmentExpenseMember2024-04-012024-06-300001718939us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001718939us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-06-300001718939us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001718939us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-04-012024-06-300001718939us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-04-012023-06-300001718939us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-06-300001718939us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-06-300001718939us-gaap:RelatedPartyMember2024-06-300001718939us-gaap:RelatedPartyMember2023-12-310001718939us-gaap:RelatedPartyMember2024-04-012024-06-300001718939us-gaap:RelatedPartyMember2023-04-012023-06-300001718939us-gaap:RelatedPartyMember2024-01-012024-06-300001718939us-gaap:RelatedPartyMember2023-01-012023-06-300001718939us-gaap:RelatedPartyMember2020-11-152020-11-150001718939idai:MaltaGrantAgreementMember2020-07-310001718939idai:MaltaGrantAgreementMember2023-01-012023-06-300001718939idai:MaltaGrantAgreementMember2022-01-250001718939idai:MaltaGrantAgreementMember2022-01-252022-01-250001718939idai:MaltaGrantAgreementMember2024-01-012024-06-300001718939srt:MinimumMember2024-06-300001718939srt:MaximumMember2024-06-3000017189392023-03-032023-03-030001718939us-gaap:SubsequentEventMemberus-gaap:SecuredDebtMember2024-07-090001718939us-gaap:SubsequentEventMemberus-gaap:SecuredDebtMember2024-07-092024-07-090001718939us-gaap:SubsequentEventMemberus-gaap:SecuredDebtMember2024-07-182024-07-180001718939idai:AgileLendingLLCMemberus-gaap:SecuredDebtMemberus-gaap:SubsequentEventMember2024-07-090001718939idai:PrepaidWarrantMemberidai:BoumerangIncMemberus-gaap:SubsequentEventMember2024-08-060001718939us-gaap:SubsequentEventMemberidai:BoumerangIncMember2024-08-062024-08-060001718939us-gaap:SubsequentEventMemberidai:BoumerangIncMember2024-08-060001718939us-gaap:SubsequentEventMember2024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the quarterly period ended June 30, 2024

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from ______________ to _____________

Commission file number: 001-41252

T Stamp Inc. (D/B/A Trust Stamp)

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 7372 | | 81-3777260 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Number) | | (IRS Employer Identification Number) |

3017 Bolling Way NE, Floor 2, Atlanta, Georgia 30305

(Address of registrant’s principal executive offices) (Zip code)

Registrant’s telephone number, including area code (404) 806-9906

Securities registered under Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

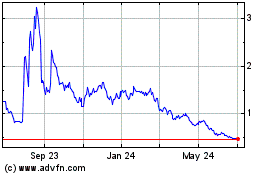

| Class A Common Stock, $0.01 par value per share | | IDAI | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the issuer (1) has filed reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | o | | Accelerated filer | o |

| Non-accelerated filer | x | | Smaller reporting company | x |

| | | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 USC. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of August 12, 2024, there were 16,780,931 shares of Class A Common Stock, par value $0.01 per share, of the registrant outstanding.

T STAMP INC.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements.

T STAMP INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| (unaudited) | | |

| ASSETS | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 659,533 | | | $ | 3,140,747 | |

Accounts receivable, net (includes unbilled receivables of $4,440 and $143,219 as of June 30, 2024 and December 31, 2023, respectively) | 517,380 | | | 686,327 | |

| Related party receivables | 24,921 | | | 44,087 | |

| Prepaid expenses and other current assets | 726,612 | | | 826,781 | |

| Total Current Assets | 1,928,446 | | | 4,697,942 | |

| Capitalized internal-use software, net | 1,509,180 | | | 1,472,374 | |

| Goodwill | 1,248,664 | | | 1,248,664 | |

| Intangible assets, net | 192,619 | | | 223,690 | |

| Property and equipment, net | 43,512 | | | 56,436 | |

| Operating lease right-of-use assets | 229,370 | | | 164,740 | |

| Other assets | 41,567 | | | 29,468 | |

| Total Assets | $ | 5,193,358 | | | $ | 7,893,314 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 1,104,638 | | | $ | 1,232,118 | |

| Related party payables | 53,087 | | | 82,101 | |

| Accrued expenses | 1,539,378 | | | 1,143,890 | |

| Deferred revenue | 182,000 | | | 10,800 | |

| Income tax payable | — | | | 1,975 | |

| Short-term operating lease liabilities | 123,431 | | | 81,236 | |

| Short-term financial liabilities | — | | | 162,130 | |

| Total Current Liabilities | 3,002,534 | | | 2,714,250 | |

| | | |

| Warrant liabilities | 251,668 | | | 256,536 | |

Notes payable, including accrued interest of $28,808 and $40,317, as of June 30, 2024 and December 31, 2023, respectively | 953,799 | | | 953,877 | |

| Long-term operating lease liabilities | 73,520 | | | 53,771 | |

| Total Liabilities | 4,281,521 | | | 3,978,434 | |

| | | |

| Commitments, Note 10 | | | |

| | | |

| Stockholders’ Equity: | | | |

Common stock $0.01 par value, 50,000,000 shares authorized, 11,384,139 and 9,198,089 shares issued, and 11,384,139 and 9,143,355 outstanding at June 30, 2024 and December 31, 2023, respectively | 113,841 | | | 91,434 | |

Treasury stock, at cost: 0 and 54,734 shares held as of June 30, 2024 and December 31, 2023, respectively | — | | | — | |

| Additional paid-in capital | 56,591,713 | | | 54,375,622 | |

| Accumulated other comprehensive income | 175,059 | | | 139,670 | |

| Accumulated deficit | (56,130,215) | | | (50,853,285) | |

| Total T Stamp Inc. Stockholders’ Equity | 750,398 | | | 3,753,441 | |

| Non-controlling interest | 161,439 | | | 161,439 | |

| Total Stockholders’ Equity | 911,837 | | | 3,914,880 | |

| Total Liabilities and Stockholders’ Equity | $ | 5,193,358 | | | $ | 7,893,314 | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these statements.

T STAMP INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the three months ended June 30, | | For the six months ended June 30, | |

| | 2024 | | 2023 | | 2024 | | 2023 | |

| Net revenue | | $ | 500,395 | | | $ | 460,804 | | | $ | 1,074,071 | | | $ | 919,438 | | |

| Operating Expenses: | | | | | | | | | |

| Cost of services (exclusive of depreciation and amortization shown separately below) | | 247,435 | | | 203,928 | | | 542,033 | | | 420,887 | | |

| Research and development | | 564,736 | | | 574,397 | | | 1,016,578 | | | 1,206,766 | | |

| Selling, general, and administrative | | 2,132,395 | | | 1,877,616 | | | 4,624,088 | | | 3,847,173 | | |

| Depreciation and amortization | | 181,195 | | | 187,272 | | | 365,996 | | | 406,454 | | |

| Total Operating Expenses | | 3,125,761 | | | 2,843,213 | | | 6,548,695 | | | 5,881,280 | | |

| Operating Loss | | (2,625,366) | | | (2,382,409) | | | (5,474,624) | | | (4,961,842) | | |

| Non-Operating Income (Expense): | | | | | | | | | |

| Interest expense, net | | (16,773) | | | (9,793) | | | (35,322) | | | (19,994) | | |

| Change in fair value of warrant liability | | 2,408 | | | 6,955 | | | 4,868 | | | 5,615 | | |

| Other income | | 41,739 | | | 217,605 | | | 234,852 | | | 261,547 | | |

| Other expense | | (369) | | | (2,726) | | | (6,704) | | | (3,144) | | |

| Total Other Income (Expense), Net | | 27,005 | | | 212,041 | | | 197,694 | | | 244,024 | | |

| Net Loss before Taxes | | (2,598,361) | | | (2,170,368) | | | (5,276,930) | | | (4,717,818) | | |

| Income tax expense | | — | | | — | | | — | | | — | | |

| Net loss before non-controlling interest | | (2,598,361) | | | (2,170,368) | | | (5,276,930) | | | (4,717,818) | | |

| Net loss attributable to non-controlling interest | | — | | | — | | | — | | | — | | |

| Net loss attributable to T Stamp Inc. | | $ | (2,598,361) | | | $ | (2,170,368) | | | $ | (5,276,930) | | | $ | (4,717,818) | | |

| Basic and diluted net loss per share attributable to T Stamp Inc. | | $ | (0.21) | | | $ | (0.32) | | | $ | (0.47) | | | $ | (0.80) | | |

| Weighted-average shares used to compute basic and diluted net loss per share | | 12,227,476 | | 6,757,320 | | 11,169,735 | | 5,897,089 | |

| | | | | | | | | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these statements.

T STAMP INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the three months ended June 30, | | For the six months ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net loss including non-controlling interest | | $ | (2,598,361) | | | $ | (2,170,368) | | | $ | (5,276,930) | | | $ | (4,717,818) | |

| Other Comprehensive Income (Loss): | | | | | | — | | | — | |

| Foreign currency translation adjustments | | 3,698 | | | (7,604) | | | 35,389 | | | (49,046) | |

| Total Other Comprehensive Income (Loss) | | 3,698 | | | (7,604) | | | 35,389 | | | (49,046) | |

| Comprehensive loss | | (2,594,663) | | | (2,177,972) | | | (5,241,541) | | | (4,766,864) | |

| Comprehensive loss attributable to non-controlling interest | | — | | | — | | | — | | | — | |

| Comprehensive loss attributable to T Stamp Inc. | | $ | (2,594,663) | | | $ | (2,177,972) | | | $ | (5,241,541) | | | $ | (4,766,864) | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these statements.

T STAMP INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(unaudited)

FOR THE THREE MONTHS ENDED JUNE 30, 2024 AND 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Treasury Stock | | Accumulated

Other

Comprehensive

Income | | Accumulated

Deficit | | Non-controlling

Interest | | Total |

| Shares | | Amount | Shares | | Amount |

| Balance, March 31, 2023 | 5,121,607 | | $ | 51,216 | | | 39,479,741 | | — | | $ | — | | | $ | 195,810 | | | $ | (41,847,176) | | | $ | 161,439 | | | $ | (1,958,970) | |

| Exercise of prefunded warrants to common stock | 1,553,250 | | 15,533 | | (13,979) | | — | | — | | — | | — | | — | | 1,554 |

| Exercise of options to common stock | 1,740 | | 17 | | (17) | | — | | — | | — | | — | | — | | — |

| Issuance of common stock, prefunded warrants, and common stock warrants, net of fees | 1,312,468 | | 13,124 | | 7,451,188 | | — | | — | | — | | — | | — | | 7,464,312 |

| Issuance of common stock in relation to vested restricted stock units, to wholly owned subsidiary | (16,821) | | (168) | | 52,707 | | 16,821 | | — | | — | | — | | — | | 52,539 |

| Stock-based compensation | — | | — | | 97,737 | | — | | — | | — | | — | | — | | 97,737 |

| Currency translation adjustment | — | | — | | — | | — | | — | | (7,604) | | — | | — | | (7,604) |

| Net loss attributable to T Stamp Inc. | — | | — | | — | | — | | — | | — | | (2,170,368) | | — | | (2,170,368) |

| Balance, June 30, 2023 | 7,972,244 | | $ | 79,722 | | | 47,067,377 | | 16,821 | | $ | — | | | $ | 188,206 | | | $ | (44,017,544) | | | $ | 161,439 | | | $ | 3,479,200 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Treasury Stock | | Accumulated

Other

Comprehensive

Income | | Accumulated

Deficit | | Non-controlling

Interest | | Total |

| Shares | | Amount | Shares | | Amount |

| Balance, March 31, 2024 | 10,099,672 | | $ | 100,997 | | | $ | 54,641,448 | | | — | | $ | — | | | $ | 171,361 | | | $ | (53,531,854) | | | $ | 161,439 | | | $ | 1,543,391 | |

| Exercise of prefunded warrants to common stock | 542,100 | | 5,421 | | | (5,421) | | | — | | — | | | — | | | — | | | — | | | — | |

| Issuance of common stock in relation to vested restricted stock units and grants | 242,377 | | 2,423 | | | (36,919) | | | — | | | — | | | — | | | — | | | — | | | (34,496) | |

| Issuance of common stock, prefunded warrants, and common stock warrants, net of fees | 499,990 | | 5,000 | | | 1,685,480 | | | — | | — | | | — | | | — | | | — | | | 1,690,480 | |

| Stock-based compensation | — | | — | | | 307,125 | | | — | | — | | | — | | | — | | | — | | | 307,125 | |

| Currency translation adjustment | — | | — | | | — | | | — | | — | | | 3,698 | | | — | | | — | | | 3,698 | |

| Net loss attributable to T Stamp Inc. | — | | — | | | — | | | — | | — | | | — | | | (2,598,361) | | | — | | | (2,598,361) | |

| Balance, June 30, 2024 | 11,384,139 | | $ | 113,841 | | | $ | 56,591,713 | | | — | | $ | — | | | $ | 175,059 | | | $ | (56,130,215) | | | $ | 161,439 | | | $ | 911,837 | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these statements.

T STAMP INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(unaudited)

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Treasury Stock | | Stockholders’

Notes

Receivable | | Accumulated

Other

Comprehensive

Income | | Accumulated

Deficit | | Non-controlling

Interest | | Total |

| Shares | | Amount | Shares | | Amount |

| Balance, January 1, 2023 | 4,854,302 | | $ | 48,543 | | | $ | 39,496,183 | | | 56,513 | | $ | — | | | $ | (18,547) | | | $ | 237,252 | | | $ | (39,299,726) | | | $ | 161,439 | | | $ | 625,144 | |

| Exercise of warrants to common stock | 1,553,250 | | 15,533 | | | (13,979) | | | — | | — | | | — | | | — | | | — | | | — | | | 1,554 | |

| Exercise of options to common stock | 1,740 | | 17 | | | 1,983 | | | — | | — | | | — | | | — | | | — | | | — | | | 2,000 | |

| Issuance of common stock, prefunded warrants, and common stock warrants, net of fees | 1,312,468 | | 13,124 | | | 7,451,188 | | | — | | — | | | — | | | — | | | — | | | — | | | 7,464,312 | |

| Issuance of common stock in relation to vested restricted stock units, to wholly owned subsidiary | 245,725 | | 2,457 | | | (25,261) | | | (39,692) | | | — | | | — | | | — | | | — | | | — | | | (22,804) | |

| Reverse stock split rounding | 4,759 | | 48 | | | (48) | | | — | | — | | | — | | | — | | | — | | | — | | | — | |

| Repayment of shareholders loan through in-kind services | — | | — | | | — | | | — | | — | | | 18,547 | | | — | | | — | | | — | | | 18,547 | |

| Stock-based compensation | — | | — | | | 157,311 | | | — | | — | | | — | | | — | | | — | | | — | | | 157,311 | |

| Currency translation adjustment | — | | — | | | — | | | — | | — | | | — | | | (49,046) | | | — | | | — | | | (49,046) | |

| Net loss attributable to T Stamp Inc. | — | | — | | | — | | | — | | — | | | — | | | — | | | (4,717,818) | | | — | | | (4,717,818) | |

| Balance, June 30, 2023 | 7,972,244 | | $ | 79,722 | | | $ | 47,067,377 | | | 16,821 | | $ | — | | | $ | — | | | $ | 188,206 | | | $ | (44,017,544) | | | $ | 161,439 | | | $ | 3,479,200 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Treasury Stock | | Accumulated

Other

Comprehensive

Income | | Accumulated

Deficit | | Non-controlling

Interest | | Total |

| Shares | | Amount | Shares | | Amount |

| Balance, January 1, 2024 | 9,143,355 | | $ | 91,434 | | | $ | 54,375,622 | | | 54,734 | | $ | — | | | $ | 139,670 | | | $ | (50,853,285) | | | $ | 161,439 | | | $ | 3,914,880 | |

| Exercise of prefunded warrants to common stock | 1,424,100 | | 14,241 | | | (14,241) | | | — | | — | | | — | | | — | | | — | | | — | |

| Issuance of common stock in relation to vested restricted stock units and grants | 316,694 | | 3,166 | | | (60,159) | | | (54,734) | | — | | | — | | | — | | | — | | | (56,993) | |

| Issuance of common stock, prefunded warrants, and common stock warrants, net of fees | 499,990 | | 5,000 | | | 1,685,480 | | | — | | — | | | — | | | — | | | — | | | 1,690,480 | |

| Stock-based compensation | — | | — | | | 605,011 | | | — | | — | | | — | | | — | | | — | | | 605,011 | |

| Currency translation adjustment | — | | — | | | — | | | — | | — | | | 35,389 | | | — | | | — | | | 35,389 | |

| Net loss attributable to T Stamp Inc. | — | | — | | | — | | | — | | — | | | — | | | (5,276,930) | | | — | | | (5,276,930) | |

| Balance, June 30, 2024 | 11,384,139 | | $ | 113,841 | | | $ | 56,591,713 | | | — | | $ | — | | | $ | 175,059 | | | $ | (56,130,215) | | | $ | 161,439 | | | $ | 911,837 | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these statements.

T STAMP INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | | | | | | | | | |

| For the six months ended June 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net loss attributable to T Stamp Inc. | $ | (5,276,930) | | | $ | (4,717,818) | |

| Net loss attributable to non-controlling interest | — | | | — | |

| Adjustments to reconcile net loss to cash flows used in operating activities: | | | |

| Depreciation and amortization | 365,996 | | | 406,454 | |

| Stock-based compensation | 605,011 | | | 157,311 | |

| Change in fair value of warrant liability | (4,868) | | | (5,615) | |

| Repayment of shareholder loan through in-kind services | — | | | 18,547 | |

| Impairment of assets | 1,112 | | | 16,819 | |

| Gain on sale of property and equipment | — | | | (216,189) | |

| Non-cash interest | 28,808 | | | 19,904 | |

| Non-cash lease expense | 78,964 | | | 109,879 | |

| Non-cash write off of mobile hardware | (162,130) | | | (15,775) | |

| Loss on retirement of equipment | 2,955 | | | 17,589 | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | 168,947 | | | 521,685 | |

| Related party receivables | 19,166 | | | (1,551) | |

| Prepaid expenses and other current assets | 100,169 | | | 83,041 | |

| Other assets | (12,099) | | | (9,063) | |

| Accounts payable | (127,480) | | | (171,183) | |

| Accrued expense | 395,488 | | | (437,365) | |

| Related party payables | (29,014) | | | (134,824) | |

| Deferred revenue | 171,200 | | | 887,218 | |

| Income tax payable | (1,975) | | | (5,616) | |

| Operating lease liabilities | (80,248) | | | (104,817) | |

| Net cash flows from operating activities | (3,756,928) | | | (3,581,369) | |

| Cash flows from investing activities: | | | |

| Proceeds from sale of property, plant and equipment | — | | | 377,360 | |

| Capitalized internally developed software costs | (315,192) | | | (356,892) | |

| Patent application costs | (38,810) | | | (37,717) | |

| Purchases of property and equipment | (9,084) | | | — | |

| Net cash flows from investing activities | (363,086) | | | (17,249) | |

| Cash flows from financing activities: | | | |

| Proceeds from exercise of warrants to common stock | — | | | 1,554 | |

| Proceeds from exercise of options to common stock | — | | | 2,000 | |

| Proceeds from common stock, prefunded warrants, and common stock warrants, net of fees | 1,690,480 | | | 7,464,312 | |

| Forfeited common stock shares to satisfy taxes | (56,993) | | | (22,804) | |

| Principal payments on financial liabilities | — | | | (29,715) | |

| Net cash flows from financing activities | $ | 1,633,487 | | | $ | 7,415,347 | |

| Effect of foreign currency translation on cash | 5,313 | | | (35,809) | |

| Net change in cash and cash equivalents | (2,481,214) | | | 3,780,920 | |

| Cash and cash equivalents, beginning of period | 3,140,747 | | | 1,254,494 | |

| Cash and cash equivalents, end of period | $ | 659,533 | | | $ | 5,035,414 | |

| | | |

T STAMP INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | | | | | | | | | |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid during the period for interest | $ | 2,356 | | | $ | 570 | |

| | | |

| Supplemental disclosure of non-cash activities: | | | |

| Adjustment to operating lease right-of-use assets related to renewed leases | $ | 143,594 | | | $ | 82,185 | |

| Adjustment to operating lease operating lease liabilities related to renewed leases | $ | 142,192 | | | $ | 83,298 | |

| Adjustment to operating lease right-of-use assets related to terminated leases | $ | — | | | $ | 82,095 | |

| Adjustment to operating lease liabilities related to terminated leases | $ | — | | | $ | 77,648 | |

| Prepaid rent expense reclassified upon termination of leases | $ | — | | | $ | 5,335 | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these statements.

T STAMP INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Description of Business, Summary of Significant Accounting Policies, and Going Concern

Description of Business — T Stamp Inc. was incorporated in the State of Delaware on April 11, 2016. T Stamp Inc. and its subsidiaries (“Trust Stamp”, “we”, “us”, “our” or the “Company”) develops and markets artificial intelligence-powered software solutions for enterprise and government partners and peer-to-peer markets.

Trust Stamp develops proprietary artificial intelligence-powered solutions, researching and leveraging machine learning, artificial intelligence, biometric science, cryptography, and data mining, to deliver insightful identity and trust predictions that identify and defend against fraudulent identity attacks, protect sensitive user information, and extend the reach of digital services through global accessibility. We utilize the power and agility of technologies such as GPU processing, edge-computing, neural networks, and large language models to process and protect data faster and more effectively than has ever previously been possible in order to deliver results at a disruptively low cost for usage across multiple industries, including:

•Banking/FinTech

•KYC/AML Compliance

•Humanitarian and Development Services

•Government and Law Enforcement, including Alternative to Detention programs

•Cryptocurrency and Digital Assets

•Biometrically Secured Email and Digital Communications

•P2P Transactions, Social Media, and Sharing Economy

•Real Estate, Travel, and Healthcare

As our portfolio of intellectual property and solutions has developed, we have started to seek applications for our technology outside our traditional focus on identity and trust. We anticipate licensing our technology in numerous fields, typically through established partners who will integrate our technology into field-specific applications.

Reverse Split — On February 15, 2023 our Board of Directors approved and, as of February 20, 2023, the holders of a majority of our voting capital stock approved an amendment (the “Certificate of Amendment”) to the Company’s Amended and Restated Certificate of Incorporation and approved to effect a reverse split of our issued and outstanding shares of Class A Common Stock at a ratio of one share for every five shares currently held, rounded up to the nearest whole share – whereby every five (5) outstanding shares of Class A Common Stock was combined and became one (1) share of Class A Common Stock, rounding up to the nearest whole number of shares (the “Reverse Split”). All share and per share amounts have been updated to reflect the Reverse Split in these unaudited condensed consolidated financial statements. The Reverse Split was effective for trading on the market opening of Nasdaq on March 23, 2023. The Reverse Stock Split effective March 23, 2023, was ratified by the Company’s stockholders by written consent pursuant to a definitive proxy statement filed with the Securities and Exchange Commission on April 13, 2023. Written consent from the majority of stockholders was received as of May 13, 2023.

Amended and Restated Certificate of Incorporation — On July 6, 2023, the Company received confirmation of the acceptance of its Third Amended and Restated Certificate of Incorporation (the "Third Restated Certificate") from the Secretary of State of Delaware. The Third Restated Certificate was approved by the Company’s stockholders by written consent pursuant to a definitive proxy statement filed with the Securities and Exchange Commission on April 13, 2023. Written consent from the majority of stockholders was received as of May 13, 2023. The Third Restated Certificate maintained the 50,000,000 authorized shares of Common Stock and eliminated the authorized Preferred Stock. The Third Restated Certificate also created a classified Board of Directors of the Company with three classes of directors who will stand for election in staggered years.

Going Concern — The accompanying unaudited condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company is a business that has not yet generated profits, with a net loss during the six months ended June

30, 2024 of $5.28 million, negative net operating cash outflows of $3.76 million for the same period, working capital of negative $1.07 million and an accumulated deficit of $56.13 million as of June 30, 2024.

The Company’s ability to continue as a going concern in the next twelve months following the date the unaudited condensed consolidated financial statements were available to be issued is dependent upon its ability to produce revenues and/or obtain financing sufficient to meet current and future obligations and deploy such to produce profitable operating results. Management has evaluated these conditions and plans to generate revenue and raise capital as needed to satisfy the Company’s capital needs. While the negotiation of significant additional revenue is well advanced, it has not reached a stage that allows it to be factored into a going concern evaluation. In addition, although the Company has previously been successful in raising capital as needed and has already made plans to do so as well as restructuring expenses to meet the Company’s cash needs, no assurance can be given that the Company will be successful in its capital raising efforts. These factors, among others, raise substantial doubt about the ability of the Company to continue as a going concern for a reasonable period.

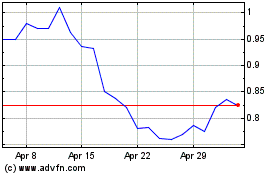

On July 13, 2024, T Stamp Inc. entered into a Securities Purchase Agreement (the “SPA”) with a certain investor (the “Purchaser”). Pursuant to the terms of the SPA, the Purchaser agreed, at the closing of the SPA (the “Closing”) and upon the terms and subject to the conditions set forth in the SPA, to purchase from the Company 4,597,701 shares of Class A Common Stock, par value $0.01 of the Company (the “Class A Common Stock”) at $0.435 per share, which was equal to the closing price of the Company’s Class A Common Stock on the Nasdaq Stock Market on July 11, 2024. The total purchase price for the shares was agreed to be paid pursuant to three promissory notes issued by the Purchaser to the Company comprised of (i) a $500,000 promissory note payable on July 31, 2024, which was paid on July 25, 2024; (ii) a $500,000 promissory note payable on August 31, 2024; and (iii) a $1,000,000 promissory note payable within three (3) trading days of an effective resale registration statement as contemplated by the Registration Rights Agreement. The Company filed a resale registration statement on Form S-3 for this purpose on July 18, 2024 (File No.: 333-280884), which is currently under review by the Commission. As of the date of this Quarterly Report on Form 10-Q, the resale registration statement is not yet effective. None of the promissory notes accrue interest, and each may be repaid before their respective due dates.

On July 13, 2024 (the “Closing Date”), the Closing of the SPA occurred, and the Company issued 4,597,701 shares of Class A Common Stock to the Purchaser at $0.435 in exchange for the three promissory notes described above, totaling $2,000,000 in combined principal. The Closing of the SPA was subject to a number of customary closing conditions, including, but not limited to, the Company’s entry into a Registration Rights Agreement, the execution of which were conditions to the Closing of the SPA. Additionally, as part of the Closing of the SPA, the Purchaser executed a Voting Limitation Agreement.

Basis of Presentation — The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with US Generally Accepted Accounting Principles (“US GAAP”) and pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”). The accompanying unaudited condensed consolidated financial statements have been prepared on a basis which assumes that the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business.

Basis of Consolidation — The accompanying unaudited condensed consolidated financial statements reflect the activity of the Company and its subsidiaries, Trusted Mail Inc. (“Trusted Mail”), Finnovation LLC (“Finnovation”), Trust Stamp Malta Limited (“Trust Stamp Malta”), AIID Payments Limited, Biometric Innovations Limited (“Biometrics”), Trust Stamp Rwanda Limited, Metapresence Limited, Trust Stamp Denmark ApS, Quantum Foundation, TSI GovTech Corporation, Global Server Management Inc., Cheltenham AI LTD, and Trust Stamp Nigeria Limited. All significant intercompany transactions and accounts have been eliminated.

Further, we continue to consolidate Tstamp Incentive Holdings (“TSIH”) which we consider to be a variable interest entity.

In the opinion of management, these condensed consolidated financial statements reflect all adjustments necessary (which adjustments are of a normal and recurring nature) for the fair presentation of the Company's financial position as of June 30, 2024 and December 31, 2023, and the results of operations for the three and six months ended June 30, 2024 and 2023. The results of operations for the three and six months ended June 30, 2024 are not necessarily indicative of results expected for the full year. Certain information and footnote disclosures normally included in the consolidated financial statements prepared in accordance with GAAP have been omitted pursuant to the rules and regulations of the SEC. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial

statements and the notes to consolidated financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2023. The accounting policies employed are substantially the same as those shown in note 1 of the notes to consolidated financial statements included therein.

Variable Interest Entity — On April 9, 2019, management created a new entity, TSIH. Furthermore, on April 25, 2019, the Company issued 320,513 shares of Class A Common Stock to TSIH, for the purpose of providing a pool of shares of Class A Common Stock of the Company that the Company’s Board of Directors (the “Board”) could use for employee stock awards and were recorded initially as Treasury stock. Since establishing TSIH, 264,000 shares were transferred to various employees as a stock award that were earned and outstanding. On February 15, 2023, Trust Stamp issued 206,033 shares of Class A Common Stock to TSIH to be used to satisfy vested employee stock awards. As of June 30, 2024, no shares of Class A Common Stock are held by TSIH as all shares have been issued pursuant to employee Restricted Stock Units.

The Company does not own any of the shares of Class A Common Stock of the Company held by TSIH. The Company considers this entity to be a variable interest entity (“VIE”) because it is thinly capitalized and holds no cash. Because the Company does not own shares in TSIH, management believes that this gives the Company a variable interest. Further, management of the Company also acts as management of TSIH and is the decision-maker as management grants shares held by TSIH to employees of the Company. As this VIE owns only shares in the Company and no other liabilities or assets, the Company is the primary beneficiary of TSIH and will consolidate the VIE.

Major Customers and Concentration of Risks — Financial instruments that potentially subject the Company to significant concentrations of credit risk consist primarily of Cash and cash equivalents, and Accounts receivable. We maintain our Cash and cash equivalents with high-quality financial institutions, mainly in the United States; the composition of which are regularly monitored by us. The Federal Deposit Insurance Corporation covers $250,000 for substantially all depository accounts. The Company from time to time may have amounts on deposit in excess of the insured limits. As of June 30, 2024 and December 31, 2023, the Company had $206,821 and $2,620,765 in U.S. bank accounts, respectively, which exceeded these insured amounts. Management believes minimal credit risk exists with respect to these financial institutions and the Company has not experienced any losses on such amounts.

For Accounts receivable, we are exposed to credit risk in the event of nonpayment by customers to the extent the amounts are recorded in the consolidated balance sheets. We extend different levels of credit and maintain reserves for potential credit losses based upon the expected collectability of Accounts receivable. We manage credit risk related to our customers by performing periodic evaluations of credit worthiness and applying other credit risk monitoring procedures.

Three customers represented 95.42% or 48.95%, 38.80%, and 7.67% of the balance of total Accounts receivable as of June 30, 2024 and three customers represented 91.11% or 53.55%, 30.43%, and 7.13% of the balance of total Accounts receivable as of December 31, 2023. The Company seeks to mitigate its credit risk with respect to Accounts receivable by contracting with large commercial customers and government agencies, and regularly monitoring the aging of Accounts receivable balances. As of June 30, 2024 and December 31, 2023, the Company had not experienced any significant losses on its Accounts receivable.

During the three months ended June 30, 2024, the Company sold to primarily three customers which made up approximately 96.21% of total Net revenue, and consisted of 67.33%, 17.38%, and 11.50% from an S&P 500 Bank, Mastercard and Triton, respectively.

Additionally, during the three months ended June 30, 2023, the Company sold to primarily three customers which made up approximately 90.67% of total Net revenue, and consisted of 48.97%, 31.33%, and 10.37% from an S&P 500 Bank, Mastercard, and Triton, respectively.

During the six months ended June 30, 2024, the Company sold to primarily three customers which made up approximately 95.37% of total Net revenue, and consisted of 62.39%, 22.72%, and 10.26% from an S&P 500 Bank, Mastercard and Triton, respectively.

Additionally, during the six months ended June 30, 2023, the Company sold to primarily four customers which made up approximately 92.73% of total Net revenue, and consisted of 44.57%, 28.21%, 10.22%, and 9.73% from an S&P 500 Bank, Mastercard, FIS, and Triton, respectively.

Property and Equipment, Net — Property and equipment, net is stated at cost less accumulated depreciation. Depreciation is recognized using the straight-line method over the estimated useful lives of the respective assets. Maintenance and

repairs that do not improve or extend the useful lives of the assets are expensed when incurred, whereas additions and major improvements are capitalized. Upon sale or retirement of assets, the cost and related accumulated depreciation are derecognized from the consolidated balance sheet and any resulting gain or loss is recorded in the consolidated statements of operations in the period realized.

Accounting for Impairment of Long-Lived Assets — Long-lived assets with finite lives include Property and equipment, net, Capitalized internal-use software, Operating lease right-of-use assets, and Intangible assets, net subject to amortization. The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset or asset group may not be recoverable. Recoverability of assets held and used is measured by comparison of the carrying amount of an asset or an asset group to estimated undiscounted future net cash flows expected to be generated by the asset or asset group. If the carrying amount of an asset exceeds these estimated future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the assets exceeds the fair value of the asset or asset group. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell.

As of June 30, 2024, the Company determined that $1 thousand of Capitalized internal-use software were impaired. The impaired Capitalized internal-use software was expensed to Research and development during the six months ended June 30, 2024. As of December 31, 2023, the Company determined that $19 thousand of Capitalized internal-use software and $12 thousand of Intangible assets was impaired. The impaired Capitalized internal-use software was expensed to Research and development during the year ended December 31, 2023.

Goodwill — Goodwill is accounted for in accordance with Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 350, Intangibles—Goodwill and Other. The Company allocates the cost of an acquired business to the assets acquired and liabilities assumed based on their estimated fair values at the date of acquisition. The excess of the purchase consideration transferred over the fair value of the net assets acquired, including other Intangible assets, net, is recorded as Goodwill. Goodwill is tested for impairment at the reporting unit level at least quarterly or more frequently when events or circumstances occur that indicate that it is more likely than not that an impairment has occurred. In assessing Goodwill for impairment, the Company first assesses qualitative factors to determine whether it is necessary to perform the quantitative goodwill impairment test. In the qualitative assessment, the Company considers factors including economic conditions, industry and market conditions and developments, overall financial performance and other relevant entity-specific events in determining whether it is more likely than not that the fair value of the reporting unit is less than the carrying amount. Should the Company conclude that it is more likely than not that the recorded Goodwill amounts have been impaired, the Company would perform the impairment test. Goodwill impairment exists when a reporting unit’s carrying value exceeds its fair value. Significant judgment is applied when Goodwill is assessed for impairment. There were no impairment charges to Goodwill as of June 30, 2024 and December 31, 2023.

Remaining Performance Obligations — The Company’s arrangements with its customers often have terms that span over multiple years. However, the Company generally allows its customers to terminate contracts for convenience prior to the end of the stated term with less than twelve months’ notice. Revenue allocated to remaining performance obligations represents non-cancelable contracted revenue that has not yet been recognized, which includes deferred revenue and, in certain instances, amounts that will be invoiced. The Company has elected the practical expedient allowing the Company to not disclose remaining performance obligations for contracts with original terms of twelve months or less. Cancellable contracted revenue, which includes customer deposit liabilities, is not considered a remaining performance obligation. As of June 30, 2024 and December 31, 2023, the Company did not have any related performance obligations for contracts with terms exceeding twelve months.

Disaggregation of Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the three months ended June 30, | | For the six months ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Professional services (over time) | | $ | 414,145 | | | $ | 385,804 | | | $ | 901,571 | | | $ | 769,438 | |

| License fees (over time) | | 86,250 | | | 75,000 | | | 172,500 | | | 150,000 | |

| Total Revenue | | $ | 500,395 | | | $ | 460,804 | | | $ | 1,074,071 | | | $ | 919,438 | |

Recent Accounting Pronouncements Not Yet Adopted — In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740) – Improvements to Income Tax Disclosures. ASU 2023-09 requires enhancements and further transparency to certain income tax disclosures, most notably the tax rate reconciliation and income taxes paid. This ASU is effective for fiscal years beginning after December 15, 2024 on a prospective basis and retrospective application is

permitted. The Company is currently evaluating the impacts of the new standard but does not expect a material impact to its unaudited condensed consolidated financial statements or related disclosures.

In June 2022, the FASB issued ASU 2022-03, Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions. The amendments in this ASU clarify that an entity should measure the fair value of an equity security subject to contractual sale restriction the same way it measures an identical equity security that is not subject to such a restriction. The FASB said the contractual restriction on the sale of an equity security is not considered part of the unit of account of the equity security and, therefore, should not affect its fair value. The ASU is effective for public entities for fiscal years beginning after December 15, 2023, and interim periods within those fiscal years. Early adoption is permitted. The Company does not expect this guidance to have a material impact to its unaudited condensed consolidated financial statements or related disclosures.

2. Borrowings

Promissory Notes Payable

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Malta loan receipt 3 – June 3, 2022 | $ | 491,680 | | | $ | 507,035 | |

| Malta loan receipt 2 – August 10, 2021 | 303,582 | | | 313,063 | |

| Malta loan receipt 1 – February 9, 2021 | 62,325 | | | 64,271 | |

| Interest added to principal | 67,404 | | | 29,191 | |

| Total principal outstanding | 924,991 | | | 913,560 | |

| Plus: accrued interest | 28,808 | | | 40,317 | |

| Total promissory notes payable | $ | 953,799 | | | $ | 953,877 | |

In May 2020, the Company formed a subsidiary in the Republic of Malta, Trust Stamp Malta, with the intent to establish a research and development center with the assistance of potential grants and loans from the Maltese government. As part of the creation of this entity, we entered into an agreement with the government of Malta for a potentially repayable advance of up to €800 thousand or $858 thousand to assist in covering the costs of 75% of the first 24 months of payroll costs for any employee who begins 36 months from the execution of the agreement on July 8, 2020. On February 9, 2021 the Company began receiving funds and as of June 30, 2024, the balance received was $858 thousand which includes changes in foreign currency rates.

The Company will pay an annual interest rate of 2% over the European Central Banks (ECB) base rate as set on the beginning of the year in review. If the ECB rate is below negative 1%, the interest rate shall be fixed at 1%. The Company will repay a minimum of 10% of Trust Stamp Malta’s pre-tax profits per annum capped at 15% of the amount due to the Corporation until the disbursed funds are repaid. At this time, Trust Stamp Malta does not have any revenue-generating contracts and therefore, we do not believe any amounts shall be classified as current. The Malta loan interest rate increased from 4.5% for the six months ended June 30, 2023 to 6.5% for the six months ended June 30, 2024 due to the increased interest rate noted by the ECB.

3. Warrants

Liability Classified Warrants

The following table presents the change in the liability balance associated with the liability classified warrants, which are classified in Level 3 of the fair value hierarchy from January 1, 2023 to June 30, 2024:

| | | | | |

| Warrants ($) |

| Balance as of January 1, 2023 | $ | 261,569 | |

| Additional warrants issued | — | |

| Change in fair value | (5,033) | |

| Balance as of December 31, 2023 | $ | 256,536 | |

| Additional warrants issued | — | |

| Change in fair value | (4,868) | |

| Balance as of June 30, 2024 | $ | 251,668 | |

As of June 30, 2024, the Company has issued a customer a warrant to purchase up to $1.00 million of capital stock in a future round of financing at a 20% discount of the lowest price paid by another investor. The warrant was issued on November 9, 2016. There is no vesting period, and the warrant expires on November 30, 2026. The Company evaluated the provisions of ASC 480, Distinguishing Liabilities from Equity, noting the warrant should be classified as a liability due to its settlement being for a variable number of shares and potentially for a class of shares not yet authorized. The warrant was determined to have a fair value of $250 thousand which was recorded as a Deferred contract acquisition asset and to a Warrant liability during the year ended December 31, 2016 and was amortized as a revenue discount prior to the current periods presented. The fair value of the warrant was estimated on the date of grant by estimating the warrant’s intrinsic value on issuance using the estimated fair value of the Company as a whole and has a balance of $250 thousand as of June 30, 2024.

On December 16, 2016, the Company issued an investor warrant to purchase $50 thousand worth of shares of our Class A Common Stock. The warrants have no vesting period and expires on December 16, 2026. The warrant agreement states that the investor is entitled to the “number of shares of Common Stock with a Fair Market Value as of the Determination Date of $50,000”. The determination date is defined as the “date that is the earlier of (A) the conversion of the investor’s Note into the equity interests of the Company or (B) the maturity date of the Note.” The investor converted the referenced Note on June 30, 2020, therefore, defining the determination date. The number of shares to be purchased is settled as 6,418 shares as of June 30, 2020. The exercise price of the warrants is variable until the exercise date.

The Company used a Black-Scholes-Merton pricing model to determine the fair value of the warrants and uses this model to assess the fair value of the warrant liability. As of June 30, 2024, the warrant liability is recorded at $2 thousand which is a $5 thousand decrease, recorded to Change in fair value of warrant liability, from the balance of $7 thousand as of December 31, 2023.

The following assumptions were used to calculate the fair value of the warrant liability during the six months ended June 30, 2024:

| | | | | |

| Fair Value of Warrants | $0.26 — $0.64 |

| Exercise price | $0.43 — $0.49 |

| Risk free interest rate | 4.38%— 4.50% |

| Expected dividend yield | — | % |

| Expected volatility | 79.25% — 79.59% |

| Expected term | 3 years |

Equity Classified Warrants

| | | | | | | | | | | | | | | | | | | | |

| Warrant Issuance Date | | Strike Price | | June 30, 2024 | | December 31, 2023 |

| November 9, 2016 | | $ | 3.12 | | | 80,128 | | 80,128 |

| January 23, 2020 | | $ | 8.00 | | | 186,442 | | 186,442 |

| January 23, 2020 | | $ | 8.00 | | | 524,599 | | 524,599 |

| April 18, 2023 | | $ | 1.34 | | | — | | 775,330 |

| June 5, 2023 | | $ | 1.34 | | | 1,173,030 | | 1,279,700 |

| December 21, 2023 | | $ | 1.34 | | | 3,600,000 | | 3,600,000 |

| April 3, 2024 | | $ | — | | | 957,910 | | — |

| April 3, 2024 | | $ | 0.97 | | | 2,000,000 | | — |

| April 3, 2024 | | $ | 1.06 | | | 1,600,000 | | — |

| Total warrants outstanding | | | | 10,122,109 | | 6,446,199 |

November 9, 2016

The Company has issued a customer a warrant to purchase 80,128 shares of Class A Common Stock with an exercise price of $3.12 per share. The warrant was issued on November 9, 2016. There is no vesting period, and the warrant expires on November 30, 2026.

January 23, 2020

In January 2020, the Company issued REach®, a related party, a warrant to purchase 186,442 shares of the Company’s Class A Common Stock at an exercise of $8.00 per share in exchange for the cancellation of a $100 thousand SAFE issued on August 18, 2017 by the Company’s affiliate Trusted Mail Inc. with a value of $125 thousand. The warrants were issued on January 23, 2020. There is no vesting period, and the warrants expire on December 20, 2024.

January 23, 2020

In January 2020, the Company issued SCV, a related party, a warrant to purchase 932,111 shares of the Company’s Class A Common Stock at a strike price of $8.00 per share in exchange for $300 thousand in cash and “Premium” sponsorship status with a credited value of $100 thousand per year for 3 years totaling $300 thousand. This “premium” sponsorship status provides the Company with certain benefits in marketing and networking, such as the Company being listed on the investor’s website, as well as providing the Company certain other promotional opportunities organized by the investor. The warrants were issued on January 23, 2020. There is no vesting period, and the warrants expire on December 20, 2024.

On December 21, 2021, SCV executed a Notice of Exercise for certain of its warrants to purchase 407,512 shares of Class A Common Stock at an exercise price of $8.00 per share for a total purchase price of $3.26 million. The closing occurred on January 10, 2022 and resulted in total cash proceeds of $3.26 million to the Company for the warrant exercise.

The warrants to purchase the remaining 524,599 shares of the Company’s Class A Common Stock remain outstanding as of June 30, 2024.

April 18, 2023

On April 14, 2023, the Company entered into a securities purchase agreement (“SPA”) with Armistice Capital Master Fund Ltd. Pursuant to which the Company agreed to issue and sell to the investor (i) in a registered direct offering, 563,380 shares of Class A Common Stock, par value $0.01 per share of the Company at a price of $3.30 per share, and pre-funded warrants to purchase up to 1,009,950 shares of Class A Common Stock, at a price of $3.299 per prefunded warrant, at an exercise price of $0.001 per share of Class A Common Stock, and (ii) in a concurrent private placement, common stock purchase warrants, exercisable for an aggregate of up to 1,573,330 shares of Class A Common Stock, at an exercise price of $3.30 per share. On April 18, 2023, the Company sold 563,380 shares of Class A Common Stock to the institutional investor at a price of $3.30 per share for total proceeds $1,859,154. Additionally, on same date, the institutional investor purchased and exercised the 1,009,950 pre-funded warrants, for total proceeds to the Company of $3,332,835, resulting in

an aggregate issuance by the Company of 1,573,330 shares of Class A Common Stock for net proceeds of $4,778,550 from the registered direct offering after deducting placement fee and legal expense of $363,439 and $50,000, respectively.

On December 21, 2023, the Company entered into an Inducement Agreement with Armistice Capital Master Fund Ltd. Pursuant to the terms of the Inducement Agreement, the exercise price for the warrants to purchase the remaining 1,573,330 shares of Class A Common Stock of the Company was reduced to $1.34 for a total purchase price of $2,108,262.

On December 21, 2023, the remaining 1,573,330 common stock purchase warrants to purchase shares of Class A Common Stock of the Company at a price of $1.34 per warrant were exercised for total proceeds of $2,108,262.

As of December 31, 2023, the Company had received Notice to Exercise for 798,000 common stock purchase warrants resulting in an issuance by the Company of 798,000 shares of Class A Common Stock. Due to the beneficial ownership limitation provisions in the Inducement Agreement, as of December 31, 2023 the remaining 775,330 common stock purchase warrants exercised on December 21, 2023 were unissued and held in abeyance for benefit of the institutional investor until notice from the institutional investor that the shares may be issued in compliance with the beneficial ownership limitation. On February 7, 2024 and February 27, 2024, the Company issued 320,000 and 455,330 shares, respectively.

All warrants related to this investment have been exercised and are no longer outstanding as of June 30, 2024.

June 5, 2023