Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 03 2023 - 5:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission file number: 001-33668

SUPERCOM LTD.

(Translation of registrant’s name into English)

3, Rothschild Street

Tel Aviv 6688106

Israel

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SUPERCOM LTD.

On August 3, 2023, SuperCom Ltd. (the “Company”) consummated a public offering (the “Offering”) of an aggregate of 3,235,295 units (the “Units”) at a public offering price of $0.85 per Unit,

resulting in aggregate gross proceeds of approximately $2.75 million. Each Unit consists of (i) one ordinary share, NIS 2.5 par value per share (the “ordinary shares”), or one pre-funded warrant to purchase one ordinary share (the “Pre-Funded

Warrants”) with an exercise price of $0.00001 per share, which such Pre-Funded Warrants issued in lieu of ordinary shares to ensure that any purchaser in the Offering does not exceed certain beneficial ownership limitations, and (ii) one warrant to

purchase one ordinary share (the “Warrants”) exercisable from time to time at an exercise price of $0.85 per share. The Warrants are immediately exercisable and will expire five years after the date of issuance. The Pre-Funded Warrants are

immediately exercisable and will remain exercisable until exercised in full. The ordinary shares or Pre-Funded Warrants and accompanying Warrants included in each Unit were issued separately. The Units have no stand-alone rights and were not issued

or certificated.

In connection with the Offering, on August 2, 2023, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with a certain institutional investor (the “Purchaser”).

Pursuant to the terms of the Purchase Agreement, the Company agreed to certain restrictions on future stock offerings, including that, until 60 days following the Closing Date, the Company will not issue (or enter into any agreement to issue) any

ordinary shares or Ordinary Shares Equivalents (as defined in the Purchase Agreement), subject to certain exceptions, and will not file any registration statements, subject to certain exceptions.

Also in connection with the Offering, on August 2, 2023, the Company entered into a placement agent agreement (the “Placement Agent Agreement”) with Maxim Group LLC (the “Placement Agent”),

pursuant to which the Placement Agent agreed to act as placement agent on a “best efforts” basis in connection with the Offering. The Company paid the Placement Agent an aggregate fee equal to 7.0% of the gross proceeds raised in the Offering. The

Company reimbursed the Placement Agent for its expenses in connection with the Offering.

The Placement Agent Agreement and the Purchase Agreement contain customary representations, warranties and agreements by the Company, customary conditions to closing, indemnification obligations of

the Company, the Placement Agent or the Purchaser, as the case may be, other obligations of the parties and termination provisions.

A Registration Statement on Form S-1 (the “Registration Statement”) relating to the Offering (File No. 333-273291) was initially filed by the Company with U.S. Securities and Exchange Commission

(the “SEC”) on July 17, 2023, and was declared effective by the SEC on August 2, 2023. The Offering was made by means of a prospectus forming a part of the effective Registration Statement.

In connection with the Offering, the Company also entered into a warrant amendment agreement (the “Warrant Amendment”) with the Purchaser. Under the Warrant Amendment, the Company agreed to amend its

existing warrants to purchase up to an aggregate of 2,082,484 ordinary shares that were previously issued to the Purchaser on March 31, 2023 and July 27, 2022, to reduce the exercise price of the such warrants to $0.85 per share, and extend the

termination date of such warrants to August 3, 2028.

The foregoing summaries of the Offering, the securities to be issued in connection therewith, and the Purchase Agreement, the Placement Agent Agreement, the Warrant Amendment, the Pre-Funded

Warrants and the Warrants do not purport to be complete and are qualified in their entirety by reference to the definitive transaction documents, copies of which are filed as Exhibits 10.1, 10.2, 10.3, 4.1 and 4.2, respectively, to this Report on

Form 6-K and are incorporated herein by reference.

The Company issued a press release announcing the pricing of the Offering on August 2, 2023. A copy of the press release is furnished herewith as Exhibit 99.1. The information in this paragraph,

including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any

of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference to this Report on Form 6-K in such filing.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded with the inline XBRL document)

|

* Filed herewith.

** Furnished herewith.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

SuperCom Ltd.

|

|

|

By: /s/ Ordan Trabelsi

|

|

|

Name: Ordan Trabelsi

|

|

|

Title: Chief Executive Officer

|

Date: August 3, 2023

Exhibit 10.3

August 2, 2023

Holder of Warrants to Purchase Common Stock set forth on Exhibit A attached

hereto

Re: Amendment to Existing Warrants

Dear Holder:

Reference is hereby made to the public offering on or about the date hereof (the “Offering”) by SuperCom Ltd., a company formed under the laws of the State of Israel (the “Company”),

of its units consisting of one ordinary share, NIS 2.5 par value per share (the “Ordinary Shares”), of the Company and one warrant to subscribe for one

Ordinary Share for no additional consideration (the “Warrants” and together with the Ordinary Shares, the “Securities”).

This letter confirms that, in consideration for the undersigned (the “Holder”) participation in the Offering and purchase of Securities in the Offering in the amount of $2,750,000 (the “Purchase

Commitment”), the Company hereby amends, effective as of the closing of the Offering, the warrants to purchase Ordinary Shares set forth on Exhibit A hereto

(the “Existing Warrants”) by (i) reducing the Exercise Price (as defined therein) of the Existing Warrants to $0.85 per share and (ii) amending the expiration

date of the Existing Warrants to five (5) years following the date of closing of the Offering (collectively, the “Warrant Amendment”) (For avoidance of doubt,

if the expiration date of the Existing Warrants is later than (5) years following the date of closing of the Offering, the expiration date shall not be amended). The Warrant Amendment shall be effective upon the closing the Offering and the

satisfaction of the other terms and conditions referenced below.

The Warrant Amendment is subject to the consummation of the Offering and the Holder’s satisfaction of the full

Purchase Commitment. In the event that either (i) the Offering is not consummated, or (ii) the Holder does not satisfy the full Purchase Commitment, the Warrant Amendment shall be null and void and the provisions of the Existing Warrants in effect

prior to the date hereof shall remain in effect.

Except as expressly set forth herein, the terms and provisions of the Existing Warrants shall remain in full force

and effect after the execution of this letter and shall not be in any way changed, modified or superseded except by the terms set forth herein.

From and after the effectiveness of the Warrant Amendment, the Company agrees to promptly deliver to the Holder, upon

request, amended Existing Warrants that reflect the Warrant Amendments in exchange for the surrender for cancellation of the Holder’s Existing Warrants to be amended as provided herein. For any registered Existing Warrants or if the shares of Common

Stock underlying the Existing Warrants are registered for resale on a registration statement, the Company shall file a prospectus supplement to the applicable registration statement in connection with the amendments hereunder by the closing of the

Offering.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have caused this agreement to be duly executed by their respective authorized

signatories as of the date first indicated above.

|

SUPERCOM LTD.

|

|

|

|

|

|

By:

|

/s/ Ordan Trabelsi

|

|

|

Name:

|

Ordan Trabelsi

|

|

|

Title:

|

President & CEO

|

|

Name of Holder: Armistice Capital Master Fund Ltd

Signature of Authorized Signatory of Holder:

Name of Authorized Signatory:

[Signature Page to SuperCom Warrant Amendment Agreement]

EXHIBIT A

EXISTING WARRANTS

|

Transaction/Warrant Date

|

|

Shares

|

|

|

Strike Price

|

|

|

March 31, 2023

|

|

|

1,517,615

|

|

|

$

|

1.66

|

|

|

July 27, 2022

|

|

|

564,869

|

|

|

$

|

1.66

|

|

Exhibit 99.1

SuperCom Announces Pricing of $2.75 Million Public Offering

TEL AVIV, Israel, Aug. 2, 2023 /PRNewswire/ -- SuperCom (NASDAQ: SPCB) ("SuperCom" or the "Company"), a global provider of secured solutions for the e-Government, IoT and Cybersecurity sectors, today announced the pricing of its public offering of 3,235,295 units at a public offering price

of $0.85 per unit with a single institutional investor. Each unit consists of one ordinary share (or a prefunded warrant in lieu thereof) and one warrant to purchase one ordinary share. The common warrants will be immediately exercisable at an

exercise price of $0.85 per share and will expire five years from the date of issuance. The ordinary shares (or pre-funded warrants in lieu thereof) and accompanying warrants can only be purchased together in this public offering, but will be issued

separately and will be immediately separable upon issuance.

Gross proceeds to the Company, before deducting placement agent fees and other offering expenses, are expected to be approximately $2.75

million. The offering is expected to close on August 3, 2023, subject to the satisfaction of customary closing conditions.

Maxim Group LLC is acting as sole placement agent in connection with this public offering.

The Company has also agreed that certain existing warrants to purchase up to a total of 2,082,484 ordinary shares of the Company that were

issued to such institutional investor on July 25, 2022 and March 31, 2023, will be amended effective upon the closing of the public offering so that the amended warrants will have an exercise price of $0.85 and will expire five years from the date of

the closing of this offering.

The securities described above (other than the amended warrants) are being offered pursuant to a Registration Statement on Form F-1, as

amended (File No. 333-273291) (the "Registration Statement"), previously filed with and subsequently declared effective by the U.S. Securities and Exchange Commission (the "SEC") on August 2, 2023. The public offering is being made only by means of

a prospectus which is a part of the Registration Statement. A preliminary prospectus relating to the public offering has been filed with the SEC. Copies of the final prospectus relating to the public offering, when available, will be filed with

the SEC and will be available on the SEC's website at http://www.sec.gov. Copies of the final prospectus relating to this public offering, when available, may be

obtained from Maxim Group LLC, 300 Park Avenue, 16th Floor, New York, NY 10022, at (212) 895-3745.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein, nor

shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction.

About SuperCom

Since 1988, SuperCom has been a global provider of traditional and digital identity solutions, providing advanced safety, identification,

and security solutions to governments and organizations, both private and public, throughout the world. Through its proprietary e-Government platforms and innovative solutions for traditional and biometrics enrollment, personalization, issuance and

border control services, SuperCom has inspired governments and national agencies to design and issue secure Multi-ID documents and robust digital identity solutions to its citizens and visitors. SuperCom offers a unique all-in-one field-proven RFID

& mobile technology and product suite, accompanied by advanced complementary services for various industries including healthcare and homecare, security and safety, community public safety, law enforcement, electronic monitoring, livestock

monitoring, and building and access automation. For more information, please visit SuperCom's website, www.supercom.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. Statements preceded or followed by or that otherwise include the words "believes", "expects", "anticipates", "intends", "projects", "estimates", "plans", and similar expressions or

future or conditional verbs such as "will", "should", "would", "may" and "could" are generally forward-looking in nature and not historical or current facts. These forward-looking statements are subject to risks and uncertainties that could cause our

actual results to differ materially from the statements made. Examples of these statements include, but are not limited to, statements regarding business and economic trends, the levels of consumer, business and economic confidence generally, the

adverse effects of these risks on our business or the market price of our ordinary shares, and other risks and uncertainties described in the forward looking statements and in the section captioned "Risk Factors" in our Annual Report on Form 20-F for

the year ended December 31, 2022, filed with the U.S. Securities and Exchange Commission (the "SEC") on April 20, 2023, our reports on Form 6-K filed from time to time with the SEC and our other filings with the SEC. Except as required by law, we not

undertake any obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this press release.

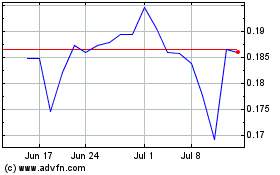

SuperCom (NASDAQ:SPCB)

Historical Stock Chart

From Mar 2024 to Apr 2024

SuperCom (NASDAQ:SPCB)

Historical Stock Chart

From Apr 2023 to Apr 2024