SolarEdge Technologies, Inc. (Nasdaq: SEDG), a global leader in

smart energy technology, today announced its financial results for

the second quarter ended June 30, 2021.

Second Quarter 2021 Highlights

- Revenues of $480.1 million

- Revenues from solar segment of $431.5 million

- GAAP gross margin of 32.5%

- Non-GAAP gross margin of 33.9%

- Gross margin from solar segment of 37.4%

- GAAP net income of $45.1 million

- Non-GAAP net income of $72.5 million

- GAAP net diluted earnings per share (“EPS”) of $0.82

- Non-GAAP net diluted EPS of $1.28

- 1.64 Gigawatts (AC) of inverters shipped

“We are happy to finish the second quarter of 2021 with record

revenues in both our solar and non-solar businesses and with

continued strong demand for our products in the various geographies

and across the different segments,” said Zvi Lando, Chief Executive

Officer of SolarEdge. “We are successfully navigating through the

challenging supply chain environment while continuing to support

our customers’ growth and expansion with new and existing

products.”

Second Quarter 2021 Summary

The Company reported revenues of $480.1 million, up 18% from

$405.5 million in the prior quarter and up 45% from $331.9 million

in the same quarter last year.

Revenues from the solar segment were $431.5 million, up 15% from

$376.4 million in the prior quarter and up 39% from $310.1 million

in the same quarter last year.

GAAP gross margin was 32.5%, down from 34.5% in the prior

quarter and up from 31.0% in the same quarter last year.

Non-GAAP gross margin was 33.9%, down from 36.5% in the prior

quarter and up from 32.4% in the same quarter last year.

Gross margin from the solar segment was 37.4%, down from 39.7%

in the prior quarter and up from 33.8% in the same quarter last

year.

GAAP operating expenses were $100.6 million, up 5% from $95.9

million in the prior quarter and up 38% from $73.0 million in the

same quarter last year.

Non-GAAP operating expenses were $81.5 million, up 7% from $76.2

million in the prior quarter and up 33% from $61.1 million in the

same quarter last year.

GAAP operating income was $55.6 million, up 26% from $44.1

million in the prior quarter and up 85% from $30.0 million in the

same quarter last year.

Non-GAAP operating income was $81.3 million, up 13% from $71.9

million in the prior quarter and up 75% from $46.6 million in the

same quarter last year.

GAAP net income was $45.1 million, up 50% from $30.1 million in

the prior quarter and up 23% from $36.7 million in the same quarter

last year.

Non-GAAP net income was $72.5 million, up 31% from $55.5 million

in the prior quarter and up 39% from $52.1 million in the same

quarter last year.

GAAP net diluted EPS was $0.82, up from $0.55 in the prior

quarter and up from $0.70 in the same quarter last year.

Non-GAAP net diluted EPS was $1.28, up from $0.98 in the prior

quarter and up from $0.97 in the same quarter last year.

Cash flow from operating activities was $38.7 million, up from

$24.1 million in the prior quarter and down from $59.3 million in

the same quarter last year.

As of June 30, 2021, cash, cash equivalents, bank deposits,

restricted bank deposit and marketable securities totaled $509.3

million, net of debt, compared to $515.2 million on March 31,

2021.

Outlook for the Third Quarter 2021

The Company also provides guidance for the third quarter ending

September 30, 2021 as follows:

- Revenues to be within the range of $520 million to $540

million

- Non-GAAP gross margin expected to be within the range of 32% to

34%

- Revenues from solar segment to be within the range of $460

million to $480 million

- Gross margin from solar segment expected to be within the range

of 35% to 37%

Conference Call

The Company will host a conference call to discuss these results

at 4:30 p.m. ET on Monday, August 2, 2021. The call will be

available, live, to interested parties by dialing 888-204-4368. For

international callers, please dial +1 323-994-2093. The Conference

ID number is 3169869. A live webcast will also be available in the

Investors Relations section of the Company’s website at:

http://investors.solaredge.com.

A replay of the webcast will be available in the Investor

Relations section of the Company’s web site approximately two hours

after the conclusion of the call and will remain available for

approximately 30 calendar days.

About SolarEdge

SolarEdge is a global leader in smart energy technology. By

leveraging world-class engineering capabilities and with a

relentless focus on innovation, SolarEdge creates smart energy

solutions that power our lives and drive future progress. SolarEdge

developed an intelligent inverter solution that changed the way

power is harvested and managed in photovoltaic (PV) systems. The

SolarEdge DC optimized inverter seeks to maximize power generation

while lowering the cost of energy produced by the PV system.

Continuing to advance smart energy, SolarEdge addresses a broad

range of energy market segments through its PV, storage, EV

charging, batteries, UPS, electric vehicle powertrains, and grid

services solutions. SolarEdge is online at www.solaredge.com.

Use of Non-GAAP Financial Measures

The Company has presented certain non-GAAP financial measures in

this release, such as non-GAAP net income, non-GAAP net diluted

EPS, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP

operating income and non-GAAP gross margin from sale of solar

products. Generally, a non-GAAP financial measure is a numerical

measure of a company's performance, financial position, or cash

flows that either exclude or include amounts that are not normally

excluded or included in the most directly comparable measure

calculated and presented in accordance with generally accepted

accounting principles in the United States, or GAAP. Reconciliation

of each non-GAAP financial measure to the most directly comparable

GAAP financial measure can be found in the accompanying tables to

this release. These non-GAAP financial measures do not reflect a

comprehensive system of accounting, differ from GAAP measures with

the same captions and may differ from non-GAAP financial measures

with the same or similar captions that are used by other companies.

As such, these non-GAAP measures should be considered as a

supplement to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP.

The Company uses these non-GAAP financial measures to analyze

its operating performance and future prospects, develop internal

budgets and financial goals, and to facilitate period-to-period

comparisons. The Company believes that these non-GAAP financial

measures reflect an additional way of viewing aspects of its

operations that, when viewed with its GAAP results, provide a more

complete understanding of factors and trends affecting its

business.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995

This release contains forward looking statements which are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements

include information, among other things, concerning: our possible

or assumed future results of operations; future demands for solar

energy solutions; business strategies; technology developments;

financing and investment plans; dividend policy; competitive

position; industry and regulatory environment; general economic

conditions; potential growth opportunities; and the effects of

competition. These forward-looking statements are often

characterized by the use of words such as “anticipate,” “believe,”

“could,” “seek,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “will,” “would” or

similar expressions and the negative or plural of those terms and

other like terminology.

Forward-looking statements are only predictions based on our

current expectations and our projections about future events. These

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to be materially

different from those expressed or implied by the forward-looking

statements. Given these factors, you should not place undue

reliance on these forward-looking statements. These factors

include, but are not limited to, the matters discussed in the

section entitled “Risk Factors” of our Annual Report on Form 10-K/A

for the year ended December 31, 2020, filed on February 19, 2021

and our quarterly reports filed on Form 10-Q, Current Reports on

Form 8-K and other reports filed with the SEC. All information set

forth in this release is as of August 2, 2021. The Company

undertakes no duty or obligation to update any forward-looking

statements contained in this release as a result of new

information, future events or changes in its expectations.

SOLAREDGE TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS

OF INCOME

(In thousands)

Three months ended

June 30,

Six months ended

June 30,

2021

2020

2021

2020

Revenues

$

480,057

$

331,851

$

885,546

$

763,069

Cost of revenues

323,865

228,888

589,280

520,098

Gross profit

156,192

102,963

296,266

242,971

Operating expenses:

Research and development

52,664

38,098

99,641

74,793

Sales and marketing

29,458

20,936

56,369

45,189

General and administrative

19,370

13,964

39,219

30,149

Other operating expenses (income), net

(859

)

-

1,350

(4,900

)

Total

operating expenses

100,633

72,998

196,579

145,231

Operating income

55,559

29,965

99,687

97,740

Financial income (expenses), net

(1,743

)

11,565

(7,840

)

(5,040

)

Income before income taxes

53,816

41,530

91,847

92,700

Income taxes

8,724

4,862

16,679

13,784

Net income

$

45,092

$

36,668

$

75,168

$

78,916

SOLAREDGE TECHNOLOGIES INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

June 30,

December 31,

2021

2020

ASSETS CURRENT ASSETS: Cash and cash equivalents $

524,112

$

827,146

Short-term bank deposits

13,562

60,096

Restricted bank deposits

2,504

2,611

Marketable securities

145,686

143,687

Trade receivables, net of allowances of $2,826 and $2,886,

respectively

343,652

218,706

Inventories, net

321,915

331,696

Prepaid expenses and other current assets

137,480

135,399

Total current assets

1,488,911

1,719,341

LONG-TERM ASSETS: Marketable securities

457,362

147,434

Deferred tax assets, net

19,962

11,676

Property, plant and equipment, net

340,319

303,408

Operating lease right-of-use assets, net

38,302

41,600

Intangible assets, net

61,855

67,818

Goodwill

135,981

140,479

Other long-term assets

21,633

5,353

Total long-term assets

1,075,414

717,768

Total assets $

2,564,325

$

2,437,109

LIABILITIES AND STOCKHOLDERS’ EQUITY CURRENT LIABILITIES:

Trade payables, net $

141,174

$

162,051

Employees and payroll accruals

58,340

63,738

Current maturities of bank loans and accrued interest

139

16,894

Warranty obligations

64,855

62,614

Deferred revenues and customers advances

16,144

24,648

Accrued expenses and other current liabilities

118,933

106,154

Total current liabilities

399,585

436,099

LONG-TERM LIABILITIES: Convertible senior notes, net

620,082

573,350

Warranty obligations

167,312

142,380

Deferred revenues

128,109

115,372

Deferred tax liabilities, net

-

8,593

Finance lease liabilities

25,525

26,173

Operating lease liabilities

31,153

35,194

Other long-term liabilities

14,766

14,191

Total long-term liabilities

986,947

915,253

COMMITMENTS AND CONTINGENT LIABILITIES STOCKHOLDERS’ EQUITY: Common

stock of $0.0001 par value - Authorized: 125,000,000 shares as of

June 30, 2021 and December 31, 2020; issued and outstanding:

52,263,976 and 51,560,936 shares as of June 30, 2021 and December

31, 2020, respectively

5

5

Additional paid-in capital

625,268

603,891

Accumulated other comprehensive income (loss)

(3,536

)

3,857

Retained earnings

556,056

478,004

Total stockholders’ equity

1,177,793

1,085,757

Total liabilities and stockholders’

equity $

2,564,325

$

2,437,109

SOLAREDGE TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(In thousands)

Six months ended

June 30,

2021

2020

Cash flows provided

by operating activities:

Net income

$

75,168

$

78,916

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation of property, plant and

equipment

14,008

10,646

Amortization of intangible assets

4,871

4,615

Amortization of debt discount and debt

issuance costs

1,450

-

Amortization of premium and accretion of

discount on available-for-sale marketable securities, net

3,558

373

Stock-based compensation expenses

47,205

26,734

Deferred income taxes, net

(3,931

)

(6,424

)

Loss from disposal of assets

2,051

-

Exchange rate fluctuations and other

items, net

12,983

(452

)

Changes in assets and liabilities:

Inventories, net

13,229

(94,230

)

Prepaid expenses and other assets

(20,356

)

37,066

Trade receivables, net

(128,564

)

116,045

Trade payables, net

(20,120

)

(1,823

)

Employees and payroll accruals

9,734

1,457

Warranty obligations

27,298

20,198

Deferred revenues and customers

advances

4,524

(31,834

)

Other liabilities

19,660

5,768

Net cash provided by operating

activities

62,768

167,055

Cash flows from

investing activities:

Investment in available-for-sale

marketable

securities

(422,470

)

(36,815

)

Proceeds from sales and maturities of

available-for-

sale marketable securities

103,763

89,739

Purchase of property, plant and

equipment

(65,267

)

(53,706

)

Withdrawal from bank deposits, net

46,534

25,634

Other investing activities

1,442

2,024

Net cash provided by (used in) investing

activities

$

(335,998

)

$

26,876

Cash flows from

financing activities:

Repayment of bank loans

$

(16,385

)

$

(15,119

)

Proceeds from bank loans

-

15,113

Proceeds from exercise of stock-based

awards and payment of withholding taxes

(4,196

)

9,114

Other financing activities

(625

)

(112

)

Net cash provided by (used in) financing

activities

(21,206

)

8,996

Increase (decrease) in cash and cash

equivalents

(294,436

)

202,927

Cash and cash equivalents at the beginning

of the

period

827,146

223,901

Effect of exchange rate differences on

cash and cash

equivalents

(8,598

)

1,544

Cash and cash equivalents at the end of

the period

$

524,112

$

428,372

SOLAREDGE TECHNOLOGIES INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (Unaudited)

(In thousands, except share and

per share data)

Reconciliation of GAAP to

Non-GAAP Gross Profit

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Gross profit (GAAP)

156,192

140,074

102,963

296,266

242,971

Revenues from finance component

(99)

(86)

----

(185)

----

Stock-based compensation

4,291

5,790

2,359

10,081

4,632

Cost of product adjustment

----

----

----

----

313

Amortization and depreciation of acquired

assets

2,401

2,312

2,325

4,713

4,681

Gross profit (Non-GAAP)

162,785

148,090

107,647

310,875

252,597

Reconciliation of GAAP to

Non-GAAP Gross Margin

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Gross margin (GAAP)

32.5%

34.5%

31.0%

33.5%

31.8%

Revenues from finance component

0.0%

0.0%

----

0.0%

----

Stock-based compensation

0.9%

1.4%

0.7%

1.1%

0.6%

Cost of product adjustment

----

----

----

----

0.0%

Amortization and depreciation of acquired

assets

0.5%

0.6%

0.7%

0.5%

0.6%

Gross margin (Non-GAAP)

33.9%

36.5%

32.4%

35.1%

33.1%

Reconciliation of GAAP to

Non-GAAP Operating expenses

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Operating expenses (GAAP)

100,633

95,946

72,998

196,579

145,231

Stock-based compensation - R&D

(9,805)

(8,798)

(5,847)

(18,603)

(11,225)

Stock-based compensation - S&M

(5,780)

(5,435)

(3,445)

(11,215)

(6,637)

Stock-based compensation - G&A

(4,176)

(3,130)

(2,310)

(7,306)

(4,240)

Amortization and depreciation of acquired

assets - R&D

(9)

(12)

(25)

(21)

(51)

Amortization and depreciation of acquired

assets - S&M

(236)

(237)

(292)

(473)

(588)

Amortization and depreciation of acquired

assets - G&A

(7)

(8)

(9)

(15)

(17)

Assets sale (disposal)

----

62

----

62

----

Other operating income (expenses)

859

(2,209)

----

(1,350)

4,900

Operating expenses (Non-GAAP)

81,479

76,179

61,070

157,658

127,373

SOLAREDGE TECHNOLOGIES INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (Unaudited)

(In thousands, except share and

per share data)

Reconciliation of GAAP to

Non-GAAP Operating income

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Operating income (GAAP)

55,559

44,128

29,965

99,687

97,740

Revenues from finance component

(99)

(86)

----

(185)

----

Cost of product adjustment

----

----

----

----

313

Stock-based compensation

24,052

23,153

13,961

47,205

26,734

Amortization and depreciation of acquired

assets

2,653

2,569

2,651

5,222

5,337

Assets (sale) disposal

----

(62)

----

(62)

----

Other operating (income) expenses

(859)

2,209

----

1,350

(4,900)

Operating income (Non-GAAP)

81,306

71,911

46,577

153,217

125,224

Reconciliation of GAAP to

Non-GAAP Financial expenses (income), net

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Financial expenses (income), net

(GAAP)

1,743

6,097

(11,565)

7,840

5,040

Notes due 2025

(726)

(724)

----

(1,450)

----

Non cash interest

(1,439)

(1,336)

(1,200)

(2,775)

(2,328)

Currency fluctuation related to lease

standard

(1,300)

2,289

(892)

989

141

Amortization and depreciation of acquired

assets

----

----

----

----

(982)

Financial expenses (income), net

(Non-GAAP)

(1,722)

6,326

(13,657)

4,604

1,871

Reconciliation of GAAP to

Non-GAAP Tax on income

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Tax on income (GAAP)

8,724

7,955

4,862

16,679

13,784

Deferred taxes

1,789

2,141

3,236

3,930

6,772

Tax on income (Non-GAAP)

10,513

10,096

8,098

20,609

20,556

SOLAREDGE TECHNOLOGIES INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (Unaudited)

(In thousands, except share and

per share data)

Reconciliation of GAAP to

Non-GAAP Net income

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Net income (GAAP)

45,092

30,076

36,668

75,168

78,916

Revenues from finance component

(99)

(86)

----

(185)

----

Cost of product adjustment

----

----

----

----

313

Stock-based compensation

24,052

23,153

13,961

47,205

26,734

Amortization and depreciation of acquired

assets

2,653

2,569

2,651

5,222

6,319

Assets (sale) disposal

----

(62)

----

(62)

----

Other operating (income) expenses

(859)

2,209

----

1,350

(4,900)

Notes due 2025

726

724

----

1,450

----

Non cash interest

1,439

1,336

1,200

2,775

2,328

Currency fluctuation related to lease

standard

1,300

(2,289)

892

(989)

(141)

Deferred taxes

(1,789)

(2,141)

(3,236)

(3,930)

(6,772)

Net income (Non GAAP)

72,515

55,489

52,136

128,004

102,797

Reconciliation of GAAP to

Non-GAAP Net basic EPS

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Net basic earnings per share

(GAAP)

0.87

0.58

0.74

1.45

1.59

Revenues from finance component

(0.01)

0.00

----

(0.01)

----

Cost of product adjustment

----

----

----

----

0.01

Stock-based compensation

0.47

0.45

0.28

0.91

0.54

Amortization and depreciation of acquired

assets

0.05

0.05

0.05

0.10

0.13

Assets (sale) disposal

----

0.00

----

----

----

Other operating (income) expenses

(0.02)

0.04

----

0.03

(0.10)

Notes due 2025

0.01

0.01

----

0.03

----

Non cash interest

0.03

0.03

0.02

0.05

0.05

Currency fluctuation related to lease

standard

0.03

(0.05)

0.02

(0.02)

0.00

Deferred taxes

(0.04)

(0.04)

(0.06)

(0.07)

(0.14)

Net basic earnings per share

(Non-GAAP)

1.39

1.07

1.05

2.47

2.08

SOLAREDGE TECHNOLOGIES INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (Unaudited)

(In thousands, except share and

per share data)

Reconciliation of GAAP to

Non-GAAP Net diluted EPS

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Net diluted earnings per share

(GAAP)

0.82

0.55

0.70

1.36

1.51

Revenues from finance component

(0.01)

0.00

----

0.00

----

Cost of product adjustment

----

----

----

----

0.00

Stock-based compensation

0.42

0.40

0.24

0.81

0.47

Amortization and depreciation of acquired

assets

0.04

0.04

0.05

0.09

0.11

Assets (sale) disposal

----

0.00

----

----

----

Other operating (income) expenses

(0.01)

0.04

----

0.03

(0.09)

Notes due 2025

0.00

0.00

----

0.00

----

Non cash interest

0.03

0.03

0.02

0.05

0.05

Currency fluctuation related to lease

standard

0.02

(0.04)

0.02

(0.01)

0.00

Deferred taxes

(0.03)

(0.04)

(0.06)

(0.07)

(0.13)

Net diluted earnings per share

(Non-GAAP)

1.28

0.98

0.97

2.26

1.92

Reconciliation of GAAP to

Non-GAAP No. of shares used in Net diluted EPS

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Number of shares used in computing net

diluted earnings per share (GAAP)

52,076,208

55,997,136

52,536,437

51,903,123

52,357,838

Stock-based compensation

2,357,845

766,187

1,154,279

2,558,676

1,277,006

Notes due 2025

2,276,818

----

----

2,276,818

----

Number of shares used in computing net

diluted earnings per share (Non-GAAP)

56,710,871

56,763,323

53,690,716

56,738,617

53,634,844

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210802005664/en/

Investor Contacts SolarEdge Technologies, Inc. Ronen

Faier, Chief Financial Officer +1 510-498-3263

investors@solaredge.com

Sapphire Investor Relations, LLC Erica Mannion or Michael Funari

+1 617-542-6180 investors@solaredge.com

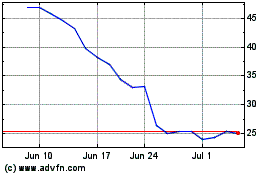

SolarEdge Technologies (NASDAQ:SEDG)

Historical Stock Chart

From Oct 2024 to Nov 2024

SolarEdge Technologies (NASDAQ:SEDG)

Historical Stock Chart

From Nov 2023 to Nov 2024