Statement of Changes in Beneficial Ownership (4)

May 28 2020 - 10:11AM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Simplot Scott R. |

2. Issuer Name and Ticker or Trading Symbol

SemiLEDs Corp

[

LEDS

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

1099 WEST FRONT STREET |

3. Date of Earliest Transaction

(MM/DD/YYYY)

5/26/2020 |

|

(Street)

BOISE, ID 83702

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 5/26/2020 | | C(1) | | 100000 | A | $3.00 | 1089934 | I | See Footnote (2) |

| Common Stock | | | | | | | | 31036 | I | See Footnote (4) |

| Common Stock | 5/26/2020 | | C(1) | | 100000 | D | $3.00 | 400000 | I | See Footnote (5) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Convertible Unsecured Promissory Note | $3.00 | 5/26/2020 | | C (2) | | $300000.00 (2) | | 11/25/2019 | (3) | Common Stock | 500000 | $300000.00 | 400000 (4) | I | See Footnote (5) |

| Explanation of Responses: |

| (1) | On February 7, 2020, J.R. Simplot Company, the sole owner of Simplot Taiwan Inc., assigned a Convertible Unsecured Promissory Note initially issued to J.R. Simplot Company in the original principal amount of $1,500,000 (the "Note"), to Simplot Taiwan Inc. for no consideration. The Note is convertible into Common Stock at any time at a conversion price of $3.00 per share. On May 26, 2020, Simplot Taiwan Inc. converted $300,000 of the Note into 100,000 shares of Common Stock. |

| (2) | Consists of shares of Common Stock owned of record by Simplot Taiwan Inc., an Idaho corporation. Simplot Taiwan Inc. is wholly owned by J.R. Simplot Company, a Nevada corporation. Mr. Simplot is the chairman of J.R. Simplot Company, and so may be deemed to have shared voting and investment power over such shares. Mr. Simplot disclaims beneficial ownership of such shares, except to the extent of his pecuniary interest therein. |

| (3) | The Note has no expiration date. |

| (4) | Consists of 31,036 shares of Common Stock owned of record by JRS Properties III LLLP, an Idaho limited liability limited partnership. The sole general partner of JRS Properties III LLLP is JRS Management, L.L.C., an Idaho limited liability company. Mr. Simplot and Stephen A. Beebe are the managers of JRS Management, L.L.C., and so Mr. Simplot may be deemed to have shared voting and investment power over such shares. Mr. Simplot disclaims beneficial ownership of such shares, except to the extent of his pecuniary interest therein. |

| (5) | Consists of the number of shares into which the remaining principal balance of the Note is convertible following the conversion described above. The Note is convertible into Common Stock at any time at a conversion price of $3.00 per share. Mr. Simplot is the chairman of J.R. Simplot Company, and so may be deemed to have shared voting and investment power over the shares into which such Note is convertible. Mr. Simplot disclaims beneficial ownership of such shares, except to the extent of his pecuniary interest therein. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Simplot Scott R.

1099 WEST FRONT STREET

BOISE, ID 83702 | X | X |

|

|

Signatures

|

| /s/ Scott R. Simplot | | 5/28/2020 |

| **Signature of Reporting Person | Date |

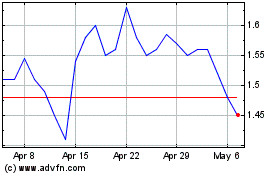

SemiLEDS (NASDAQ:LEDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

SemiLEDS (NASDAQ:LEDS)

Historical Stock Chart

From Apr 2023 to Apr 2024