Amended Statement of Beneficial Ownership (sc 13d/a)

February 16 2022 - 8:25AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule

13D/A

(Rule 13d-101)

Information to be Included in Statements Filed Pursuant to

§ 240.13d-1(a) and Amendments Thereto Filed

Pursuant to § 240.13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

Republic

First Bancorp, Inc.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

760416107

(CUSIP Number)

George E. Norcross, III

350 Royal Palm Way, Suite 500

Palm Beach, Florida 33480

(561) 500-4600

With

a Copy to:

H. Rodgin Cohen

Mitchell S. Eitel

Sullivan & Cromwell LLP

125 Broad Street

New York, NY 10004

212-558-4000

(Name, address and telephone number of person authorized to receive notices and communications)

February 15, 2022

(Date

of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ☐.

Note: Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

| CUSIP No. 760416107 |

|

SCHEDULE 13D |

|

Page

2

of 10 |

|

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

George E. Norcross, III |

| 2 |

|

Check the Appropriate Box

If a Member of a Group (See Instructions) a. ☒ b. ☐

|

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds (See

Instructions) PF |

| 5 |

|

Check Box If Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of

Organization United States of

America |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

674,572 |

| |

8 |

|

Shared Voting Power

0 |

| |

9 |

|

Sole Dispositive Power

674,572 |

| |

10 |

|

Shared Dispositive Power

0 |

|

|

|

|

|

|

|

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

674,572(1) |

| 12 |

|

Check Box If the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13 |

|

Percent of Class

Represented By Amount in Row (11) 1.1%(2) |

| 14 |

|

Type of Reporting Person

(See Instructions) IN |

| (1) |

The Reporting Person is reporting on this Schedule 13D as a member of a “group” with the other

Reporting Persons. The group beneficially owns 5,706,583 shares of Common Stock owned by all of the Reporting Persons in the aggregate, representing approximately 9.6% of the outstanding shares of Common Stock. See Item 5. |

| (2) |

For purposes of calculating beneficial ownership percentages in this statement on Schedule 13D, the total

number of shares of Common Stock outstanding as of November 5, 2021 is 59,454,998, as reported by the Issuer in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2021, filed with the SEC on November 8, 2021.

|

|

|

|

|

|

| CUSIP No. 760416107 |

|

SCHEDULE 13D |

|

Page

3

of 10 |

|

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

Avery Conner Capital Trust |

| 2 |

|

Check the Appropriate Box

If a Member of a Group (See Instructions) a. ☒ b. ☐

|

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds (See

Instructions) AF, WC |

| 5 |

|

Check Box If Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of

Organization

Florida |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

4,219,627(3) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

4,219,627(3) |

|

|

|

|

|

|

|

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

4,219,627(1) |

| 12 |

|

Check Box If the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13 |

|

Percent of Class

Represented By Amount in Row (11) 7.1%(2) |

| 14 |

|

Type of Reporting Person

(See Instructions) OO |

| (3) |

4,219,627 shares of Common Stock held by the Avery Conner Capital Trust, of which Philip A. Norcross, Susan D.

Hudson, Geoffrey B. Hudson and Rose M. Guida serve as Trustees and may be deemed to have shared beneficial ownership as Trustees. |

|

|

|

|

|

| CUSIP No. 760416107 |

|

SCHEDULE 13D |

|

Page

4

of 10 |

|

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

Philip A. Norcross |

| 2 |

|

Check the Appropriate Box

If a Member of a Group (See Instructions) a. ☒ b. ☐

|

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds (See

Instructions) PF, OO See Item 3 |

| 5 |

|

Check Box If Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of

Organization United States of

America |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

400,000 |

| |

8 |

|

Shared Voting Power

4,219,627(3) |

| |

9 |

|

Sole Dispositive Power

400,000 |

| |

10 |

|

Shared Dispositive Power

4,219,627(3) |

|

|

|

|

|

|

|

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

4,619,627(1), (3) |

| 12 |

|

Check Box If the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13 |

|

Percent of Class

Represented By Amount in Row (11) 7.8%(2) |

| 14 |

|

Type of Reporting Person

(See Instructions) IN |

|

|

|

|

|

| CUSIP No. 760416107 |

|

SCHEDULE 13D |

|

Page

5

of 10 |

|

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

Susan D. Hudson, in her capacity as a Trustee |

| 2 |

|

Check the Appropriate Box

If a Member of a Group (See Instructions)

a. ☒ b. ☐ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds (See

Instructions) OO See Item 3 |

| 5 |

|

Check Box If Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of

Organization United States of

America |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

4,219,627(3) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

4,219,627(3) |

|

|

|

|

|

|

|

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

4,219,627(1), (3) |

| 12 |

|

Check Box If the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13 |

|

Percent of Class

Represented By Amount in Row (11) 7.1%(2) |

| 14 |

|

Type of Reporting Person

(See Instructions) IN |

|

|

|

|

|

| CUSIP No. 760416107 |

|

SCHEDULE 13D |

|

Page

6

of 10 |

|

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

Geoffrey B. Hudson, in his capacity as a Trustee |

| 2 |

|

Check the Appropriate Box

If a Member of a Group (See Instructions)

a. ☒ b. ☐ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds (See

Instructions) OO See Item 3 |

| 5 |

|

Check Box If Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of

Organization United States of

America |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

4,219,627(3) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

4,219,627(3) |

|

|

|

|

|

|

|

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

4,219,627(3) |

| 12 |

|

Check Box If the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13 |

|

Percent of Class

Represented By Amount in Row (11) 7.1%(2) |

| 14 |

|

Type of Reporting Person

(See Instructions) IN |

|

|

|

|

|

| CUSIP No. 760416107 |

|

SCHEDULE 13D |

|

Page

7

of 10 |

|

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

Rose M. Guida, in her capacity as a Trustee |

| 2 |

|

Check the Appropriate Box

If a Member of a Group (See Instructions)

a. ☒ b. ☐ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds (See

Instructions) OO See Item 3 |

| 5 |

|

Check Box If Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of

Organization United States of

America |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

4,219,627(3) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

4,219,627(3) |

|

|

|

|

|

|

|

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

4,219,627(3) |

| 12 |

|

Check Box If the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13 |

|

Percent of Class

Represented By Amount in Row (11) 7.1%(2) |

| 14 |

|

Type of Reporting Person

(See Instructions) IN |

|

|

|

|

|

| CUSIP No. 760416107 |

|

SCHEDULE 13D/A |

|

Page

8

of 10 |

|

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

Gregory B. Braca |

| 2 |

|

Check the Appropriate Box

If a Member of a Group (See Instructions) a. ☒ b. ☐

|

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds (See

Instructions) PF |

| 5 |

|

Check Box If Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of

Organization United States of

America |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

412,384 |

| |

8 |

|

Shared Voting Power

0 |

| |

9 |

|

Sole Dispositive Power

412,384 |

| |

10 |

|

Shared Dispositive Power

0 |

|

|

|

|

|

|

|

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

412,384(1) |

| 12 |

|

Check Box If the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13 |

|

Percent of Class

Represented By Amount in Row (11) 0.7%(2) |

| 14 |

|

Type of Reporting Person

(See Instructions) IN |

|

|

|

|

|

| CUSIP No. 760416107 |

|

SCHEDULE 13D/A |

|

Page

9

of 10 |

This Amendment No. 4 (“Amendment No. 4”) amends the statement on Schedule 13D filed with

the Securities and Exchange Commission on January 31, 2022, as amended prior to the date of this Amendment No. 4 (the “Original Schedule 13D”) as specifically set forth herein (as so amended, the “Schedule 13D”). Except

as provided herein, each Item of the Original Schedule 13D remains unchanged.

| Item 4. |

Purpose of the Transaction. |

Item 4 of the Original Schedule 13D is hereby amended to add the following immediately prior to the last paragraph of this item:

On February 15, 2022, the Group delivered a letter to the Board (the “February 15 Letter”), the text of which is set forth

below:

Dear Directors:

We read with interest your statement released on Friday regarding your willingness to consider proposals, and we were

encouraged by the authorization of Keefe, Bruyette & Woods, Inc. to engage with us. Raymond James & Associates, Inc. (“Raymond James”) is acting as our financial advisor, and your advisors are welcome to reach out to John Roddy at

Raymond James, or, as we mentioned before, should feel free to connect with Rodge Cohen or Mitch Eitel at Sullivan & Cromwell LLP. We continue to believe we can construct an attractive transaction that meets our mutual needs and the needs of

your constituencies.

|

| Very truly yours,

George E. Norcross, III

Gregory Braca

Philip A. Norcross |

The Reporting Persons cannot predict the Issuer’s response to the February 15 Letter.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

Item 6 of the Original Schedule 13D is hereby amended to add the following immediately prior to the last paragraph of this item:

Certain Reporting Persons have engaged Raymond James & Associates, Inc. (“Raymond James”) as their financial advisor on

behalf of the Group. Pursuant to the letter agreement setting forth the terms of such engagement, such Reporting Persons have agreed to pay Raymond James certain fees in the event of consummation of certain transactions contemplated in this and

prior Schedule 13D filings by the Reporting Persons. The amount of such fees will be determined based on the size and structure of the applicable transaction actually consummated. Such potential fees include, among others, a fee payable upon

completion of an acquisition of significant additional shares in the Issuer as well as participation in the management and Board of the Issuer. In addition, in the event no such transaction occurs, in certain circumstances, the Reporting Persons

must pay Raymond James an amount equal to 10% of their net profits on the securities of the Issuer after expenses.

|

|

|

|

|

| CUSIP No. 760416107 |

|

SCHEDULE 13D/A |

|

Page

10

of 10 |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certifies that the information set forth in this

statement is true, complete and correct.

Date: February 15, 2022

|

|

|

| George E. Norcross, III |

|

|

| By: |

|

/s/ George E. Norcross, III |

|

| Avery Conner Capital Trust |

|

|

| By: |

|

/s/ Philip A. Norcross |

| Name: |

|

Philip A. Norcross |

| Title: |

|

Trustee |

|

| Philip A. Norcross |

|

|

| By: |

|

/s/ Philip A. Norcross |

|

| Susan D. Hudson |

|

|

| By: |

|

/s/ Susan D. Hudson |

|

| Geoffrey B. Hudson |

|

|

| By: |

|

/s/ Geoffrey B. Hudson |

|

| Rose M. Guida |

|

|

| By: |

|

/s/ Rose M. Guida |

|

| Gregory B. Braca |

|

|

| By: |

|

/s/ Gregory B. Braca |

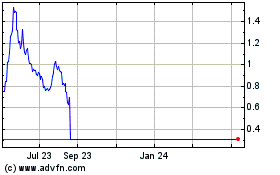

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Oct 2024 to Nov 2024

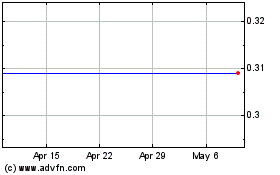

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Nov 2023 to Nov 2024