UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission File Number 001-40617

Regencell Bioscience Holdings Limited

9/F Chinachem Leighton Plaza

29 Leighton Road

Causeway Bay, Hong Kong

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Pursuant to Nasdaq Rule 5250(c)(2), Regencell

Bioscience Holdings Limited (the “Company”) hereby furnishes its unaudited condensed consolidated interim balance sheets and

statement of operations and comprehensive loss for its six months ended on December 31, 2023, which are attached as Exhibit 99.1 to this

Form 6-K.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: June 20, 2024 |

|

|

| |

|

|

| |

Regencell Bioscience Holdings Limited |

| |

|

|

| |

By: |

/s/ Yat-Gai Au |

| |

|

Name: |

Yat-Gai Au |

| |

|

Title: |

Chief Executive Officer and

Chairman of the Board of Directors |

Exhibit 99.1

Regencell Bioscience Holdings Limited Announces

First Half 2024 Financial Results

HONG KONG, June 20, 2024 – Regencell Bioscience

Holdings Limited (Nasdaq: RGC) (the “Company”), today announced its unaudited condensed consolidated interim financial results

for the six months ended December 31, 2023.

Results of Operations

Operating Expenses

| | |

For the Six Months Ended | | |

For the Six Months Ended | | |

| | |

| |

| | |

December 31, | | |

December 31, | | |

Change | | |

Change | |

| | |

2023 | | |

2022 | | |

Amount | | |

% | |

| OPERATING EXPENSES: | |

| | |

| | |

| | |

| |

| Selling and marketing | |

$ | 97,062 | | |

$ | 98,093 | | |

$ | (1,031 | ) | |

| (1 | )% |

| General and administrative (including share-based compensation of approximately $0.3 million and $0.5 million for the six-month ended December 31, 2023 and 2022 respectively) | |

| 1,730,043 | | |

| 1,981,253 | | |

| (251,210 | ) | |

| (13 | )% |

| Research and development (including reversal of share-based compensation of approximately $0.1 million and share-based compensation of approximately $0.4 million for the six-month ended December 31, 2023 and 2022 respectively) | |

| 484,750 | | |

| 1,350,173 | | |

| (865,423 | ) | |

| (64 | )% |

| Total operating expenses | |

| 2,311,855 | | |

| 3,429,519 | | |

| (1,117,664 | ) | |

| (33 | )% |

During the six-month period ended December 31,

2023, we incurred total operating expenses of approximately $2.3 million, a decrease of approximately $1.1 million, or 33%, as compared

to total operating expenses of approximately $3.4 million during the six-month period ended December 31, 2022.

Selling and marketing expenses decreased by approximately

$1 thousand, or 1%, to approximately $0.1 million for the six-month period ended December 31, 2023 from approximately $0.1 million for

the six-month period ended December 31, 2022. Selling and marketing expenses mainly related to digital marketing promotions and they remained

at a stable level for both periods.

General and administrative expenses decreased

by approximately $0.3 million, or 13%, to approximately $1.7 million for the six-month period ended December 31, 2023 from approximately

$2.0 million for the six-month period ended December 31, 2022. The decrease was mainly attributable to (i) decrease in share-based compensation

for general and administrative personnel of approximately $0.2 million and (ii) decrease in corporate apartment expenses of approximately

$0.1 million as fewer corporate apartments were rented for the six-month period ended December 31, 2023.

Research and development expenses decreased by

approximately $0.9 million, or 64%, to approximately $0.5 million for the six-month period ended December 31, 2023 from approximately

$1.4 million for the six-month period ended December 31, 2022. The decrease was mainly attributable to (i) an approximately $0.3 million

decrease in expenses for medication and materials for product development; (ii) an approximately $0.5 million decrease in expenses for

share-based compensation for research and development personnel; and (iii) an approximately $0.1 million decrease in salary expenses during

the six-month period ended December 31, 2023.

Other income, net

| | |

For the Six Months Ended | | |

For the Six Months Ended | | |

| | |

| |

| | |

December 31, | | |

December 31, | | |

Change | | |

Change | |

| | |

2023 | | |

2022 | | |

Amount | | |

% | |

| OTHER INCOME AND EXPENSE: | |

| | |

| | |

| | |

| |

| Other income | |

$ | 227,290 | | |

$ | 114,283 | | |

$ | 113,007 | | |

| 99 | % |

| Other expense | |

| (101,328 | ) | |

| (4 | ) | |

| (101,324 | ) | |

| 2,533,100 | % |

| Total other income, net | |

| 125,962 | | |

| 114,279 | | |

| 11,683 | | |

| 10 | % |

Total other income, net was approximately $0.1

million for the six-month period ended December 31, 2023 and total other income, net was approximately $0.1 million for the six-month

period ended December 31, 2022.

Other income mainly consisted of cash received

from a government grant and interest income. The increase was mainly due to an increase in interest income of approximately $0.1 million

from time deposit placed at bank.

Other expense mainly consisted of donation incurred

during the six-month period ended December 31, 2023. The increase was mainly due to increase of donations made of approximately $0.1 million.

Provision for income taxes

As we incurred a loss for the six-month period

ended December 31, 2023 and 2022, no provision for income taxes was made. No significant penalties

or interest relating to income taxes have been incurred during the six-month period ended December 31, 2023 and 2022.

Net loss

Our net loss decreased by approximately $1.1 million,

or 34%, to approximately $2.2 million for the six-month period ended December 31, 2023, from approximately $3.3 million for the six-month

period ended December 31, 2022. Such change was a result of the combination of the changes described above.

Net loss attributable to Regencell Bioscience

Holdings Limited

After deducting non-controlling interests of approximately

$0.1 million, net loss attributable to our holding company, Regencell Bioscience Holdings Limited decreased from approximately $3.3 million

net loss for the six-month period ended December 31, 2022 to approximately $2.2 million net loss for the six-month period ended December

31, 2023.

Basic and diluted loss per share

Basic and diluted losses per share were $0.16

for the six-month period ended December 31, 2023, compared to $0.25 in the same period of 2022. For

the six-month period ended December 31, 2023 and 2022, there were no dilutive shares.

Cash

As of December 31, 2023, we had cash of approximately

$4.8 million compared to approximately $1.6 million as of June 30, 2023. The increase of cash was mainly due to the receipt of proceeds

of investment at maturity in November 2023 amounted to approximately $10.2 million and offset by an reinvestment of $5 million in November

2023.

UNAUDITED CONDENSED CONSOLIDATED INTERIM

FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

UNAUDITED CONDENSED CONSOLIDATED INTERIM BALANCE SHEETS

| | |

As of

December 31, | | |

As of

June 30, | |

| | |

2023 | | |

2023 | |

| | |

| | |

| |

| Current assets | |

$ | 9,832,741 | | |

$ | 11,621,343 | |

| Other assets | |

| 642,424 | | |

| 1,000,412 | |

| Total assets | |

| 10,475,165 | | |

| 12,621,755 | |

| Total liabilities | |

| 312,554 | | |

| 632,320 | |

| Total shareholders’ equity | |

| 10,162,611 | | |

| 11,989,435 | |

| Total liabilities and shareholders’ equity | |

$ | 10,475,165 | | |

$ | 12,621,755 | |

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENTS

OF

OPERATIONS AND COMPREHENSIVE LOSS

| | |

For the Six Months Ended | |

| | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| OPERATING EXPENSES: | |

| | |

| |

| Selling and marketing expenses | |

$ | 97,062 | | |

$ | 98,093 | |

| General and administrative expenses (including share-based compensation of approximately $0.3 million and $0.5 million for the six-month ended December 31, 2023 and 2022 respectively) | |

| 1,730,043 | | |

| 1,981,253 | |

| Research and development expenses (including reversal of share-based compensation of approximately $0.1 million and share-based compensation of approximately $0.4 million for the six-month ended December 31, 2023 and 2022 respectively) | |

| 484,750 | | |

| 1,350,173 | |

| Total operating expenses | |

| 2,311,855 | | |

| 3,429,519 | |

| | |

| | | |

| | |

| LOSS FROM OPERATIONS | |

$ | (2,311,855 | ) | |

$ | (3,429,519 | ) |

| | |

| | | |

| | |

| OTHER INCOME AND EXPENSE | |

| | | |

| | |

| Other income | |

| 227,290 | | |

| 114,283 | |

| Other expense | |

| (101,328 | ) | |

| (4 | ) |

| Total other income, net | |

| 125,962 | | |

| 114,279 | |

| | |

| | | |

| | |

| LOSS BEFORE INCOME TAX EXPENSE | |

| (2,185,893 | ) | |

| (3,315,240 | ) |

| | |

| | | |

| | |

| PROVISION FOR INCOME TAXES | |

| - | | |

| - | |

| | |

| | | |

| | |

| NET LOSS | |

$ | (2,185,893 | ) | |

$ | (3,315,240 | ) |

| | |

| | | |

| | |

| NET LOSS ATTRIBUTABLE TO: | |

| | | |

| | |

| Shareholders of the Company | |

| (2,066,622 | ) | |

| (3,227,378 | ) |

| Non-controlling interests | |

| (119,271 | ) | |

| (87,862 | ) |

| | |

$ | (2,185,893 | ) | |

$ | (3,315,240 | ) |

| | |

| | | |

| | |

| OTHER COMPREHENSIVE LOSS | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 44,094 | | |

| - | |

| | |

| | | |

| | |

| COMPREHENSIVE LOSS | |

$ | (2,141,799 | ) | |

$ | (3,315,240 | ) |

| | |

| | | |

| | |

| NET COMPREHENSIVE LOSS ATTRIBUTABLE TO: | |

| | | |

| | |

| Shareholders of the Company | |

| (2,022,528 | ) | |

| (3,227,378 | ) |

| Non-controlling interests | |

| (119,271 | ) | |

| (87,862 | ) |

| | |

$ | (2,141,799 | ) | |

$ | (3,315,240 | ) |

| | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF ORDINARY SHARES | |

| | | |

| | |

| Basic and diluted | |

| 13,012,866 | | |

| 13,012,866 | |

| LOSS PER SHARE | |

| | | |

| | |

| Basic and diluted | |

$ | (0.16 | ) | |

$ | (0.25 | ) |

About Regencell Bioscience

Holdings Limited

We are a holding company

incorporated on October 30, 2014 under the laws of the Cayman Islands, and conduct our business in Hong Kong through our wholly-owned

subsidiary, Regencell Bioscience Limited, a company incorporated in Hong Kong on May 12, 2015, and Regencell Limited, a company incorporated

in Hong Kong on November 20, 2014. We are an early-stage bioscience company that focuses on research, development and commercialization

of Traditional Chinese Medicine (“TCM”) for the treatment of neurocognitive disorders

and degeneration, specifically Attention Deficit Hyperactivity Disorder (“ADHD”) and

Autism Spectrum Disorder (“ASD”), as well as infectious diseases affecting people’s immune system such as COVID-19.

Our goal is to save and improve the lives of the patients, their families and caregivers and become a market leader for natural and holistic

treatments for neurological disorders and infectious diseases globally.

Our TCM formulae candidates are derived from a

TCM base formula and an adjustable formula developed by Regencell’s strategic partner, TCM Practitioner, Mr. Sik-Kee Au, based on

his TCM brain theory, known as “Sik-Kee Au TCM Brain Theory®” (“TCM Brain Theory”), and have been

demonstrated to reduce severity in patients’ ADHD and ASD conditions, as reflected in lower Autism

Treatment Evaluation Checklist (“ATEC”), Gilliam Autism Rating Scale (“GARS”), Vanderbilt ADHD Diagnostic Parent

Rating Scale (“VADRS”) and Swanson, Nolan, and Pelham (SNAP)-IV 26-item Parent Rating Scale (“SNAP-IV-26”)

assessment scores, using the personalized TCM formula in our first research study and standardized TCM formula in our second research

trial. The activity and specificity of the TCM base formula have been optimized by the TCM Practitioner in his prior ADHD and ASD treatments.

As of the date hereof, the TCM Practitioner has standardized the adjustable formula into three Fixed Adjusted Formulas for mild, moderate

and severe ADHD and ASD conditions. The TCM Brain Theory is not recognized in general literature of TCM or elsewhere. However, the TCM

Practitioner has prescribed the TCM formula based on his TCM Brain Theory for over 30 years to treat ADHD, ASD and many neurological illnesses,

disorders and degeneration and obtained satisfactory clinical treatment results. Such clinical treatment results are not supported by

controlled clinical data or trials.

We aim to launch three standardized liquid-based

TCM formulae candidates for mild, moderate and severe ADHD and ASD patients in Hong Kong first and subsequently to other markets as we

deem appropriate. To further verify the standardized medicine efficacy, the TCM Practitioner treated

the enrolled patients with the use of the standardized TCM formulae. The enrolled patients’ ages ranged from five to thirteen

years old. All enrolled patients completed a three-month treatment. Under the treatment by the TCM Practitioner, the enrolled patients

consumed liquid-based TCM twice a day, which was prepared based on standardized TCM formulae by our TCM Practitioner, and temporarily

stopped consuming any other medicines. All the enrolled patients and their parents were required to meet with the TCM Practitioner in

his clinic weekly and provide regular reports to update the patients’ symptoms and conditions by phone.

Cautionary

Note Regarding Forward-Looking Statements

This

press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,”

“anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,”

“is/are likely to,” “potential,” “continue” or other similar expressions. Statements that are not

historical facts, including statements about the Company’s beliefs and expectations, are forward-looking statements. Among other

things, the business outlook from management in this press release, as well as the Company’s strategic and operational plans, contain

forward-looking statements. The Company may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities

and Exchange Commission (“SEC”) on Forms 20-F and 6-K, in its annual reports to shareholders, in its and other written materials

and in oral statements made by its officers, directors or employees to third parties. Forward-looking statements involve inherent risks

and uncertainties.

A

number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but

not limited to the following: the Company’s goals and strategies; the Company’s future business development, financial condition

and results of operations; changes in the Company’s expenditures; general economic and business conditions globally; and assumptions

underlying or related to any of the foregoing.

Further

information regarding these and other risks is included in the Company’s annual report on Form 20-F and current report on Form 6-K

and other documents filed with the SEC. All information provided in this press release is as of the date hereof, and the Company does

not undertake any obligation to update any forward-looking statement, except as required under applicable laws.

CONTACT:

Regencell Bioscience Holdings Limited Investor

Relations

James Chung

IR@rgcbio.com

SOURCE:

Regencell Bioscience Holdings Limited

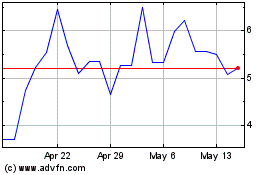

Regencell Bioscience (NASDAQ:RGC)

Historical Stock Chart

From May 2024 to Jun 2024

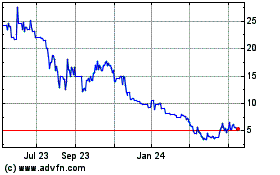

Regencell Bioscience (NASDAQ:RGC)

Historical Stock Chart

From Jun 2023 to Jun 2024