CEC Disappoints Yet Again in 4Q - Analyst Blog

February 28 2013 - 12:19PM

Zacks

CEC Entertainment Inc.’s (CEC) adjusted

earnings of 8 cents per share in the fourth quarter of 2012 missed

the Zacks Consensus Estimate by 11.1% and the year-ago earnings by

60%. The downfall in earnings can be attributed to lower revenues

coupled with higher costs.

On a reported basis (including asset impairment charges), loss

per share was 3 cents in the fourth quarter of 2012 compared to

earnings per share 15 cents in the year-ago period.

Total revenues tumbled 0.4% year over year to $177.8 million in

the fourth quarter, which fell shy of the Zacks Consensus Estimate

of $180.0 million. The drop in revenues was due to lower comparable

store sales (down 2.2%).

The company’s cost structure, which includes cost of food,

beverage, entertainment and merchandise, increased 10 basis points

(bps) year over year to 16.2% as a percentage of company store

sales, mainly due to an increase in cheese prices. Also, an

increase in depreciation and amortization expense, labor expenses

and other operating expenses led to a 110 bps contraction in

restaurant margin to 14.6%.

Full-Year Update

Earnings per share decreased 14.2% to $2.47 in 2012 despite a

benefit of 17 cents from share repurchase. Earnings per share

missed the Zacks Consensus Estimate by 10.2%. Total revenues also

fell 2.2% to $803.5 million owing to a 2.9% plunge in comps.

Revenues also fell shy of the Zacks Consensus Estimate by 1.7%.

Store Update

During the reported quarter, CEC opened 5 company-owned stores

and closed 2. On the franchisee front, there was no opening or

closure in the quarter.

At the end of 2012, the company had 514 company-operated stores

and 51 franchised stores. For 2013, the company expects to open 15

new company-owned stores and relocate one store.

Outlook

For fiscal 2013, the company expects comparable sales growth to

remain in the range of 1%–2%, down from the prior expectation of

2%-3%.

Uncertainty over the payroll tax holiday and rising gasoline

prices compelled CEC to reduce the comps guidance. Through week

seven of 2013, comparable store sales have already decreased

3.2%.

CEC expects earnings per share in the range of $2.70—$2.85, down

from the prior expectation of $2.80—$3.00.

Our Take

The key takeaways from CEC’s fourth quarter earnings were

continued underperformance on top- and bottom- lines and margins

pressure. The company has been missing the Zacks Consensus Estimate

on both lines for the past two quarters.

Even in the first half of 2012, its performance was not

satisfactory. The reduction in 2013 guidance to reflect the

elimination of payroll tax holiday and increased gasoline prices

also limits visibility for the coming months.

Yet another downward trend in comps for the first quarter of

2013 also evokes pessimism over the stock. Although the company

continues to make efforts to increase traffic to enhance sales and

comps, its initiatives are yet to attain fruition.

CEC currently retains a Zacks Rank #4 (Sell). Others players in

the same industry, which look attractive at current levels include

Red Robin Gourmet Burgers Inc. (RRGB) carrying a

Zacks Rank #1 (Strong Buy) and AFC Enterprises

Inc. (AFCE) and Burger King Worldwide

Inc. (BKW) carrying a Zacks Rank #2 (Buy).

AFC ENTERPRISES (AFCE): Free Stock Analysis Report

BURGER KING WWD (BKW): Free Stock Analysis Report

CEC ENTERTANMNT (CEC): Free Stock Analysis Report

RED ROBIN GOURM (RRGB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

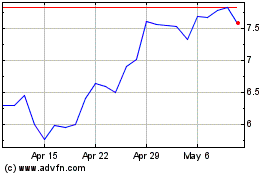

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Jun 2024 to Jul 2024

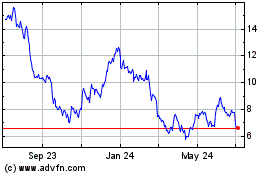

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Jul 2023 to Jul 2024