false

0001687187

0001687187

2024-01-26

2024-01-26

0001687187

us-gaap:CommonClassAMember

2024-01-26

2024-01-26

0001687187

METC:NinePercentageSeniorNotesDue2026Member

2024-01-26

2024-01-26

0001687187

us-gaap:CommonClassBMember

2024-01-26

2024-01-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): January 26, 2024

Ramaco Resources, Inc.

(Exact name of Registrant

as specified in its Charter)

| Delaware |

001-38003 |

38-4018838 |

(State

or other jurisdiction of

incorporation)

|

(Commission

File Number) |

(IRS

Employer Identification No.) |

250 West Main Street, Suite 1900

Lexington, Kentucky 40507

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (859)

244-7455

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Class

A common stock, $0.01 par value |

METC |

NASDAQ Global Select Market |

| 9.00% Senior Notes due 2026 |

METCL |

NASDAQ Global Select Market |

| Class B common stock, $0.01 par value |

METCB |

NASDAQ Global Select Market |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry Into Material Definitive

Agreement.

The information included in Item 5.02 of this

Current Report on Form 8-K with respect to the Separation Agreement (as defined below) is incorporated by reference in this Item

1.01.

Item 5.02. Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Evan

H. Jenkins as General Counsel and Secretary

On January 30,

2024, the Board appointed Evan H. Jenkins as the Company’s General Counsel and Secretary. Mr. Jenkins’s first day with the

Company will be February 12, 2024 (the “Start Date”). Mr. Jenkins, age 63, has served as Senior Vice President of

Government Affairs at the United States Chamber of Commerce in Washington, D.C. since September 2022. Also, since

December 2022, Mr. Jenkins has served as president of The Ramaco Foundation and a member of its board of directors,

helping direct the foundation’s philanthropic efforts. From October 2018 to February 2022, Mr. Jenkins served

as Justice and the Chief Justice (2021 Term) of the Supreme Court of Appeals of West Virginia. Prior to that Mr. Jenkins served

as a Congressman in the U.S. House of Representatives representing West Virginia’s 3rd Congressional District from

January 2015 until September 2018.

Pursuant to the terms

of his offer letter, Mr. Jenkins will receive an annual base salary of $500,000 and will be eligible, under the Company’s annual

incentive plan, to receive cash bonuses dependent on Company and individual performance. For fiscal year 2024, Mr. Jenkins will receive

a guaranteed cash bonus applicable to calendar year 2024 if he remains employed when bonuses for fiscal year 2024 are paid. Mr. Jenkins

will also be eligible for incentive compensation under the Company’s Long-Term Incentive Plan. Any such award will be subject to

the terms and conditions of the Plan and applicable award agreement, which may include both performance and time-based vesting. In recognition

of other compensation awards that Mr. Jenkins may forfeit from his former employer and subject to the approval of the compensation

committee of the Board, the Company will grant Mr. Jenkins 50% of his 2024 Plan award at the time of commencement of his employment,

based on the Company’s Class A and Class B stock prices at the last trading day of calendar year 2023. Mr. Jenkins

is eligible to participate in the Company’s benefit programs as made generally available to other senior executives.

There are no arrangements

or understandings between Mr. Jenkins and any other person pursuant to which he was selected as an officer of the Company. Mr. Jenkins

does not have any family relationship with any director or executive officer of the Company or any person nominated or chosen by the Company

to be a director or executive officer.

In connection with Mr. Jenkins’s

appointment as an officer, the Company will enter into an indemnification agreement with Mr. Jenkins in the form entered into with

the Company’s other directors and executive officers effective as of the Start Date (the “Indemnification Agreement”),

which requires the Company to indemnify Mr. Jenkins to the fullest extent permitted under Delaware law against liability that may

arise by reason of his service to the Company, and to advance certain expenses incurred as a result of any proceeding against him as to

which he could be indemnified. The form of indemnification agreement is filed as Exhibit 10.2 to the Company’s Registration

Statement on Form S-1 (File No. 333-215363), as originally filed on January 11, 2017.

Appointment of Jeremy

R. Sussman as Assistant Secretary; Promotion of Tyler Adkins to Senior Vice President of Law and Assistant Secretary

Also, on

January 30, 2024, the Board appointed Mr. Jeremy R. Sussman, the Company’s Chief Financial Officer, as an Assistant

Secretary, and promoted Mr. Tyler Adkins, the Company’s Vice President and Assistant General Counsel, to Senior Vice President

of Law and Assistant Secretary.

Separation Agreement

On January 30, 2024,

the Board of Directors (the “Board”) of Ramaco Resources, Inc. (the “Company) accepted the resignation of Barkley

J. Sturgill, Jr. as the Company’s Senior Vice President, General Counsel and Secretary effective January 31, 2024.

In connection with Mr. Sturgill’s

resignation, on January 26, 2024 (the “Separation Date”), the Company entered into an Employment Separation Agreement

with Mr. Sturgill (the “Separation Agreement”). Pursuant to the Separation Agreement, the Company will pay Mr. Sturgill

a lump sum payment of $120,000.00 payable on the 7th day following the execution date of the Severance Agreement. In addition,

the Company will pay Mr. Sturgill the Company Performance portion of his total bonus opportunity for 2023, adjusted for achievement

of the Company’s performance metrics.

Pursuant to the Separation

Agreement and notwithstanding anything to the contrary in the Company’s Long-Term Incentive Plan (the “Plan”) or any

award agreements thereunder, all restricted stock and restricted stock units granted to Mr. Sturgill pursuant to the Plan that are

outstanding and unvested as of the Separation Date (the “Unvested Equity”), will continue to vest pursuant to terms applicable

to the Unvested Equity as if Mr. Sturgill had remained in the continuous employment of the Company through June 30, 2024. Any

Unvested Equity that does not become vested by June 30, 2024 will be forfeited at such time for no consideration.

Additionally, the Company

will contribute employer matching contributions to Mr. Sturgill’s individual account under the Company-sponsored 401(k) plan

(at the matching percentage provided for in the plan) with respect to one hundred percent (100%) of Mr. Sturgill’s deferral

contributions to the plan through the Separation Date. The Separation Agreement contains customary non-competition, non-solicitation and

mutual non-disparagement covenants.

The description of the

Separation Agreement set forth above does not purport to be complete and is qualified in its entirety by the full text of the Separation

Agreement, a copy of which is attached hereto as Exhibit 10.1, and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On February 1,

2024, the Company issued a press release announcing Mr. Jenkins’s appointment as General Counsel and Secretary of the

Company and the declaration of a quarterly cash dividend on the Company’s Class B common stock. The Company’s board

of directors approved and declared a quarterly cash dividend of $0.2416 per share of Class B common stock. The dividend is payable

on March 15, 2024 to shareholders of record as of March 1, 2024. A copy of this press release is attached hereto as

Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information set forth in this Item 7.01

of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as

amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

Ramaco Resources, Inc. |

| |

|

| |

By: |

/s/ Randall W. Atkins |

| |

|

Name: Randall W. Atkins |

| |

|

Title: Chairman and Chief Executive Officer |

Date: February 1, 2024

Exhibit

10.1

EXECUTION COPY

EMPLOYEE SEPARATION AGREEMENT

This Employee Separation Agreement

(this “Agreement”) is entered into as of January 31, 2024 by and between: (a) Barkely J. Sturgill, Jr.,

an individual residing in Lexington, Kentucky (“Employee”); and (b) Ramaco Resources, Inc., a Delaware corporation

with its principal place of business in Lexington, Kentucky, together with its subsidiaries and affiliates (collectively, the “Company”),

with each of Employee and the Company being hereafter referred to as a “Party” and collectively the “Parties,”

upon the following premises:

WHEREAS, Employee is employed

by the Company in the position of Senior Vice President, General Counsel and Secretary;

WHEREAS, Employee’s

last day of employment with the Company is January 31, 2024 (the “Separation Date”), and Employee shall be deemed

to resign from any and all positions as an officer of the Company as of the Separation Date;

WHEREAS, Employee and Company

have had disagreements regarding the benefits and compensation to be received by Employee in connection with his separation from employment

with the Company;

WHEREAS, Employee and Company,

in connection with Employee’s separation from employment with the Company, desire to enter into this Agreement to resolve any and

all disputes regarding the benefits and compensation to be received by Employee; and

WHEREAS, Employee acknowledges

the sufficiency of the consideration to be provided to him under the terms of this Agreement for the general release and waiver contained

in Section 4 and the other promises by Employee herein and also acknowledges that the Company’s obligations under this Agreement

are contingent upon Employee’s fulfillment of his obligations under this Agreement.

NOW, THEREFORE, in consideration

of the mutual covenants and agreements contained herein, the Parties agree to resolve all matters between them as follows:

Section 1 Separation

of Employment. Employee acknowledges and agrees that his employment with the Company ends on the Separation Date and that, as of the

Separation Date, he will hold no position with the Company or any divisions, subsidiaries, or affiliates thereof as an employee, officer,

director, or contractor, and hereby agrees to and waives and releases all claims for reinstatement or re-employment with the Company,

and further agrees not to seek employment or any other affiliation with the Company or any divisions, subsidiaries, or affiliates thereof,

either as an employee or an independent contractor at any time.

Section 2 Consideration.

In consideration of the general release and waiver in Section 4 below, and the other promises and representations by Employee in

this Agreement, the Company agrees as follows:

(a) Separation

Compensation. The Company will provide Employee with separation pay in the gross amount of $120,000.00 (“Separation Pay”).

The Separation Pay will be subject to all applicable payroll withholding taxes and other deductions required by law. The Company will

pay the Separation Pay to Employee in a single lump sum payment via direct deposit as soon as administratively feasible following the

seventh (7th) day after Employee signs this Agreement. The Company’s obligation to pay the Separation Pay is conditioned

upon Employee not revoking this Agreement and further upon his fulfillment of all terms, conditions, and obligations set forth in this

Agreement.

(b) 2023

Bonus Payment. The Company will pay Employee the Company performance portion of his total target bonus opportunity for 2023, adjusted

for achievement of Company performance metrics (the “2023 Bonus”). The Employee is not entitled to and will not receive

any portion of the target bonus opportunity for 2023 calculated based on individual performance metrics or which are at the discretion

of the Company. The Company will pay the 2023 Bonus to Employee in a single lump sum cash payment via direct deposit at the same time

the Company pays annual performance bonuses to other executives for 2023, subject to applicable payroll withholding taxes and other deductions

required by law. Employee acknowledges and agrees that he is not entitled to receive the 2023 Bonus or any performance bonus for the year

2023, except as provided by this Agreement. Employee further acknowledges that the Company’s obligation to pay the 2023 Bonus is

conditioned upon Employee not revoking this Agreement and further upon his fulfillment of all terms, conditions, and obligations set forth

in this Agreement.

(c) Continued

Equity Vesting. Notwithstanding anything to the contrary in the Ramaco Resources, Inc. Long-Term Incentive Plan (the “Equity

Incentive Plan”) or any award agreements thereunder, all restricted stock and restricted stock units granted to Employee pursuant

to the Equity Incentive Plan that are outstanding and unvested as of the Separation Date (the “Unvested Equity”), shall

continue to vest pursuant to terms applicable to the Unvested Equity as if Employee had remained in the continuous employment of the Company

through June 30, 2024. Any Unvested Equity that does not become vested by June 30, 2024 shall be forfeited at such time for

no consideration. For the avoidance of any doubt, the Parties represent, warrant and agree that (i) the following restricted stock

units, which are the first tranche of such units to vest pursuant to a February 20, 2023 award to Employee issued pursuant to the

Equity Incentive Plan, will vest on January 31, 2024, and that the balance of that February 20, 2023 award shall be forfeited

at that time: 4,805 shares of Class A Common Stock, $0.01 par value, and 961 shares of Class B Common Stock, $0.01 par value;

and (ii) the following restricted stock awards, which were the subject of the February 16, 2021 award to Employee pursuant to

the Equity Incentive Plan, will fully vest on June 30, 2024, and that the balance of that February 16, 2021 award shall be forfeited

at that time: 86,262 shares of Class A Common Stock, $0.01 par value, and 17,252 shares of Class B Common Stock, $0.01 par value.

Employee acknowledges that

(i) vesting of the Unvested Equity is conditioned upon Employee not revoking this Agreement and further upon his fulfillment of all

terms, conditions, and obligations set forth in this Agreement, (ii) any material breach of this Agreement by Employee will result

in forfeiture of any Unvested Equity that has not vested as of the time of the breach. Except as provided in this Section 2(d), Employee

shall have no other rights with respect equity awards granted to Employee under the Equity Incentive Plan or otherwise.

(d) 401(k) Contribution.

The Company acknowledges and agrees that it will contribute employer matching contributions to Employee’s individual account under

the Company-sponsored 401(k) plan (at the matching percentage provided for in the plan) with respect to one hundred percent (100%)

of Employee of deferral contributions to the plan through the Separation Date.

(e) Settlement

of Compensation and Benefit Entitlement; Tax Consequences. Employee acknowledges and agrees that prior to entering into this Agreement

that Company and Employee disputed the amount of compensation and benefits that Employee is entitled to in connection with Employee’s

separation of employment described in this Agreement and the payments and benefits set forth in this Section 2 are the agreed upon

settlement of such dispute. Employee has no other right to payments or benefits under any severance plan, change in control plan, employment

agreement, bonus plan, equity plan or any other compensation or benefit plan, program, policy, or arrangement except as set forth in this

Agreement. Employee further acknowledges and agrees that these payments and promises represent good and valuable consideration for the

promises and agreements he is providing in this Separation Agreement, including the general release and waiver of claims in Section 4.

Employee agrees that he is solely responsible for his portion of all federal, state, and/or local income taxes with regard to any of the

payments described in this Section 2, and that neither the Company nor any of its representatives have provided advice regarding

the taxability or tax consequences of any consideration set forth in this Agreement.

Section 3 Final

Compensation Payments / Benefits.

(a) Employee

acknowledges and agrees that he has been paid by the Company for all time worked through the Separation Date. If Employee has not already,

he will be notified in writing of his eligibility pursuant to the Consolidated Omnibus Budget Reconciliation Act (“COBRA”)

to elect continuation coverage under the Company’s health insurance benefit program if he chooses. The COBRA qualifying event date

will be the Separation Date.

(b) Except

as provided in this Agreement, Employee acknowledges and agrees that the payments and benefits described above represent all compensation,

pay, contributions, reimbursements, and benefits, regardless of whether in the form of cash, stock or otherwise, to which he is or could

be entitled under any policy, plan, practice or agreement made available by the Company, or under any federal, state, or local law. Employee

further acknowledges and agrees that his participation in all the Company-sponsored benefit plans and incentive programs for employees

and executives shall be discontinued as of the Separation Date, except as specifically provided in this Agreement.

Section 4 Employee

General Release, Waiver, Indemnification, and Covenant Not to Sue.

(a) Employee

General Release and Waiver. Employee for himself, his heirs, executors, administrators, trustees, legal representatives, successors

and assigns (hereinafter collectively referred to as the “Releasors”), hereby irrevocably and unconditionally waives, releases,

and forever discharges the Company and its past, present, and future affiliates and related entities, parent and subsidiary corporations,

divisions, predecessors, successors and assigns, and each of its and their respective past, present, or future shareholders, members,

owners, officers, directors, trustees, fiduciaries, managers, administrators, agents, attorneys, insurers, and representatives (hereinafter

collectively referred to as “Releasees”) from any and all claims, charges, demands, sums of money, actions, rights, promises,

agreements, causes of action, obligations and liabilities of any kind or nature whatsoever, at law or in equity, whether known or unknown,

existing or contingent, suspected or unsuspected, apparent or concealed (hereinafter collectively referred to as “claims”)

which the Releasors now or in the future may have or claim to have against any of the Releasees based upon or arising out of any facts,

acts, conduct, omissions, transactions, occurrences, contracts, claims, events, causes, matters or things of any conceivable kind or character

whatsoever existing or occurring or claimed to exist or to have occurred at any time up to and including the date Employee signs this

Agreement, including, but not limited to any and all claims relating to or arising during or out of Employee’s status as an employee

of the Company, including but not limited to, any claims arising under Title VII of the Civil Rights Act of 1964, as amended, the Age

Discrimination in Employment Act, as amended (“ADEA”), the Older Workers Benefit Protection Act (“OWBPA”), the

Americans with Disabilities Act, the Employee Retirement Income Security Act of 1974, as amended, and the Worker Adjustment and Retraining

Notification Act; any claims for breach of express or implied contract, wrongful or retaliatory discharge, defamation or any other tort

or other common law action; any claims to any form of compensation, benefits, attorneys’ fees or costs; any claims for loss or damage

to personal property, including personal tools used or stored on Company property; and any other claims arising under federal, state,

or local law. To the extent permitted by applicable law, Employee agrees that he will not bring a lawsuit against any of the Releasees

asserting any of the claims released herein. Employee further agrees that if any action is brought on his behalf with regard to the claims

released herein, he will not accept any payments therefore.

Notwithstanding the foregoing,

the Parties agree that this release shall not: (a) apply to any claims arising after the date Employee signs this Agreement; (b) relate

to Employee’s express rights under this Agreement or prevent Employee from instituting any action to enforce the terms of this Agreement;

or (c) affect Employee’s right to challenge the validity of this Agreement’s waiver of rights pursuant to the ADEA and/or

OWBPA. Additionally, nothing in this Agreement shall, or is intended to, interfere with Employee’s rights under federal, state or

local civil rights or employment discrimination laws to file or otherwise institute a charge of discrimination, to participate in a proceeding

with any appropriate federal, state or local government agency enforcing discrimination laws, or to cooperate with any such agency in

its investigation, none of which shall constitute a breach of this Agreement. Employee agrees that he shall not, however, be entitled

to any relief, recovery, or payments in connection with any charge, complaint, or proceeding brought against any of the Releasees, regardless

of who filed or initiated any such charge, complaint, or proceeding. Moreover, for the avoidance of doubt, nothing in this Agreement shall

restrict or impede Employee from providing truthful information to governmental or regulatory bodies, or from making any other disclosures

that are protected or required by law, regulation or judicial process.

(b) Claims.

To the fullest extent permitted by law, and subject to the provisions of this Agreement, Employee represents, affirms, agrees, and covenants

that (i) he has not filed or caused to be filed on his behalf any claim for relief against any Releasee, and no outstanding claims

for relief have been filed or asserted against any Releasee on his behalf; and (ii) he will not file, commence, prosecute, or participate

in any judicial or arbitral action or proceeding against any Releasees based upon or arising out of any act, omission, transaction, occurrence,

contract, claim or event existing or occurring on or before the date he signs this Agreement except as required by law.

Section 5 Confidentiality

of Agreement. Employee expressly acknowledges that it is to his benefit, and is his desire, all discussions concerning the terms thereof

shall be kept confidential, and he shall not disclose same to any person other than his financial advisor, counsel, and spouse or domestic

partner, or except as may be required by law. Employee further agrees that he will instruct all such individuals of their obligation to

keep such information confidential, except as required by law. Employee acknowledges and agrees that the Company will likewise keep all

discussions concerning the terms of such agreements confidential, provided, however, that (i) the Company may disclose

the terms of this Agreement in periodic reports filed under the Securities Exchange Act of 1934, as amended, and in registration statements

filed under the Securities Act of 1933, as amended, and may attach a copy of this Agreement as an exhibit, to any such periodic reports

and registration statements, (ii) the Company may disclose and share the terms and/or the Parties’ discussions with its own

employees or executives as needed, accountants, counsel, outside directors, outside auditors, or agents or representatives of any governmental

regulatory agency or any securities self-regulatory organization, and (iii) the Company may disclose and share the terms and/or the

Parties’ discussions as required by law, in response to demands for discovery, or in accordance with court orders.

Section 6 Return

of Company Property. Employee represents that he has returned to the Company all keycards, keys, identification badges, passwords,

pin codes, company-sponsored credit cards, online accounts, company-provided laptops, tablets, mobile phones, business plans, financial

reports and forecasts, and all other property, documents, records and information (including all copies), in whatever form (paper or electronic)

and media (including back-up tapes, external hard drives, computer disks, CDs or flash drives) of or belonging to the Company, or that

contain any information furnished or made available to Employee by the Company, however and wherever obtained, maintained and/or located.

Section 7 Post-Employment

Obligations.

(a) Definitions.

As used in this Section 7, the following terms will have the following meanings:

“Business”

means (1) the development, promotion, or operation of mines suitable for the extraction of metallurgical coal or rare earth minerals;

or (2) the distribution or sale of any such ores or minerals.

“Competing Business”

means any business, individual, partnership, firm, corporation or other entity which engages in any business competing with the Business

that is either (i) in the Restricted Area, or, (ii) otherwise would be directly beneficial or profitable to the then present

operations and properties of the Company or any of its affiliates. For the purposes of clarity, should any business, individual, partnership,

firm, corporation or other entity have assets, operations, coal and mineral properties, other coal related businesses or rare earth elements

deposits or mining operations such business, individual, partnership, firm, corporation or other entity shall not be considered a Competing

Business if the business thereof is not subject to or described in (i) or otherwise by (ii) in the preceding sentence.

“Restricted Area”

means the geographic area encompassed within a radius of fifteen (15) air miles from any mine or mineral deposit that was owned, operated,

developed, or promoted by the Company at any time within the last two (2) years of Employee’s employment with the Company.

“Governmental Authority”

means any governmental, quasi-governmental, state, county, city, or other political subdivision of the United States or any other country,

or any agency, court, or instrumentality, foreign or domestic, or statutory or regulatory body thereof.

“Legal Requirement”

means any law, statute, code, ordinance, order, rule, regulation, judgment, decree, injunction, franchise, permit, certificate, license,

authorization, or other directional requirement (including, without limitation, any of the foregoing that relates to environmental standards

or controls, energy regulations and occupational, safety and health standards or controls including those arising under environmental

laws) of any Governmental Authority.

“Prohibited Period”

means the period beginning with the Separation Date and ending on January 31, 2025.

(b) Non-Competition;

Non-Solicitation Agreement. Employee and the Company agree to the non-competition and non-solicitation provisions of this Section 7

in consideration for the compensation identified in Section 2 and confidential information provided by the Company to Employee pursuant

to Section 8 of this Agreement, to protect the trade secrets and confidential information of the Company disclosed or entrusted to

Employee by the Company or created or developed by Employee for the Company, to protect the business goodwill of the Company or its affiliates

developed through the efforts of Employee and/or the business opportunities disclosed or entrusted to Employee by the Company, to facilitate

Employee’s future consulting services to the Company, to the extent requested by the Company under Section 10 below, and as

an additional inducement for the Company to enter into this Agreement.

(c) Non-Competition

Scope. Subject to the exceptions set forth in Section 7(d) and (e) below, Employee expressly covenants and agrees that

during the Prohibited Period and within the Restricted Area (i) Employee will refrain from carrying on or engaging in any Competing

Business or assisting another to do so, except as allowed in Section 7(e); and (ii) Employee will not become a senior managerial

or executive employee of, partner in, officer of, owner or member of (or an independent contractor to), control or participate in, loan

money to, any Competing Business

(d) Ownership

of Shares of a Public Company. Notwithstanding the restrictions contained in Section 7(c), Employee may own an aggregate of not

more than one half of one percent (0.5%) of the outstanding stock of any class of any corporation engaged in a Competing Business, if

such stock is listed on a national securities exchange or regularly traded in the over-the counter market by a member of a national securities

exchange, without violating the provisions of Section 7(c), provided that Employee does not have the power, directly or indirectly,

to control or direct the management or affairs of any such corporation and is not involved in the management of such corporation.

(e) Employee’s

Practice of Law. Nothing in this Section 7 shall be construed as prohibiting Employee from engaging in the practice of law in

association with or as a partner in a law firm with other attorneys as outside legal counsel for any client, subject to the Code of Professional

Responsibility as adopted by the Supreme Court of Kentucky. Employee shall comply with the letter and spirit of the duties, responsibilities

and obligations owed by him to the Company as Employee’s client or former client, as applicable, pursuant to the Code of Professional

Responsibility.

(f) Non-Solicitation.

Employee further expressly covenants and agrees that during the Prohibited Period, Employee will not, engage or employ, or solicit or

contact with a view to the engagement or employment of, or recommend or refer to any person or entity (other than the Company) for engagement

or employment any person who is an officer of the Company provided, however, that the prohibition contained herein shall not apply to

efforts by or contacts made by a third party to such officer without the engagement or other effort of Employee.

(g) Duty

to Notify Employer. Before accepting employment with any other person or entity during the Prohibited Period, Employee will inform

such person or entity of the restrictions and prohibitions contained in this Section 7. The Company reserves the right to provide

a copy of this Agreement to any such person or entity.

(h) Relief.

Employee and the Company agree and acknowledge that the limitations as to time, geographical area, and scope of activity to

be restrained as set forth in this Section 7 are reasonable and do not impose any greater restraint than is necessary to

protect the legitimate business interests of the Company. Employee and the Company also acknowledge that money damages would not be

sufficient remedy for any breach of this Section 7 by Employee, and the Company will be entitled to enforce the provisions of

this Section 7 by specific performance and injunctive relief as remedies for such breach or any threatened breach, and by

terminating payments then owing to Employee under this Agreement or otherwise. Such remedies will not be deemed the exclusive

remedies for a breach of this Section 7 but will be in addition to all remedies available at law or in equity, including the

recovery of damages from Employee. However, if it is determined that Employee has not committed a breach of this Section 7,

then the Company will resume the payments and benefits due under this Agreement and pay to Employee all payments and benefits that

had been suspended pending such determination.

(i) Reasonableness;

Enforcement. Employee hereby represents to the Company that Employee has read and understands, and agrees to be bound by, the terms

of this Section 7. Employee acknowledges that the scope and duration of the covenants contained in this Section 7 are the result

of arms-length bargaining and are fair and reasonable in light of (a) the nature and geographic scope of the operations of the business,

(b) Employee’s level of control over and contact with the Business in all jurisdictions in which it is conducted, and (c) the

amount of Confidential Information that Employee has received during Employee’s employment with the Company. It is the desire and

intent of the Parties that the provisions of this Section 7 be enforced to the fullest extent permitted under applicable Legal Requirements,

whether now or hereafter in effect and therefore, to the extent permitted by applicable Legal Requirements, Employee and the Company hereby

waive any provision of applicable Legal Requirements that would render any provision of this Section 7 invalid or unenforceable.

(j) Reformation.

The Company and Employee agree that the foregoing restrictions are reasonable under the circumstances and that any breach of the covenants

contained in this Section 7 would cause irreparable injury to the Company. Employee understands that the foregoing restrictions may

limit Employee’s ability to engage in certain business activities anywhere in the Restricted Area during the Prohibited Period,

but Employee acknowledges that Employee will receive sufficient consideration from the Company to justify such restriction. Further, Employee

acknowledges that Employee’s skills are such that Employee can be gainfully engaged or employed in noncompetitive employment, and

that the agreement not to compete will not prevent Employee from earning a living. Nevertheless, if any of the aforesaid restrictions

are found by a court of competent jurisdiction to be unreasonable, or overly broad as to geographic area or time, or otherwise unenforceable,

the parties intend for the restrictions herein set forth to be modified by the court making such determination so as to be reasonable

and enforceable and, as so modified, to be fully enforced. By agreeing to this contractual modification prospectively at this time, the

Company and Employee intend to make this provision enforceable under the law or laws of all applicable States, Provinces and other jurisdictions

so that the entire agreement not to compete and this Agreement as prospectively modified will remain in full force and effect and will

not be rendered void or illegal. Such modification will not affect the payments made to Employee under this Agreement.

Section 8 Non-Disclosure;

Confidentiality.

(a) Employee

agrees that he will not disclose or use for his benefit or the benefit of any other person or entity, any Protected Information (as defined

in in this Section 8(a)) of or belonging to the Company. “Protected Information” shall mean any information protected

by the attorney-client privilege and/or work product doctrine, and any other non-public information regarding the business of the Company,

including but not limited to customer and supplier information; contract terms; customer files; information regarding customer history,

needs, and preferences; information designated by customers to be kept confidential; supplier lists; financial information, such as sales

plans and forecasts; business or sales proposals; sales and earnings figures; cost and profitability information; pricing; corporate strategies,

sales tactics, marketing, underwriting methods, and other strategic plans; technical and project information, such as project designs;

sources of supply; project pricing or project management methods, templates, or tools; formulas; product or project development methods,

templates, or plans; research; underwriting; product testing plans, protocols and results; and private employee personnel records or data,

provided, however, that Protected Information does not include any information that is, or becomes, in the public domain

through no disclosure or other action (whether direct or indirect) by Employee; any information that is readily ascertainable from public

or published information or trade sources or is otherwise generally known and readily available to employees or agents of a competitor

(and not as a result of a violation of this Agreement by Employee or by other wrongful means); or any information that Employee did not

learn, directly or indirectly, as a result of employment with or work for or association with the Company. The obligations in this Section with

respect to a particular piece of Protected Information shall remain in effect until that piece of information enters the public domain

through no breach of contract or duty or other unlawful means.

(b) To

the extent that Protected Information constitutes a trade secret under applicable federal or state law, Employee cannot be held criminally

or civilly liable under any federal or state trade secret law for disclosing a trade secret (a) in confidence to a federal, state,

or local government official, either directly or indirectly, or to an attorney, solely for the purpose of reporting or investigating a

suspected violation of law, or (b) in a complaint or other document filed under seal in a lawsuit or other proceeding.

(c) Nothing

herein shall prohibit Employee from reporting to or cooperating with any governmental, regulatory or self-regulatory body or agency; from

testifying truthfully under oath pursuant to subpoena or other legal process; or from making disclosures that are otherwise protected

under applicable law or regulation. However, if Employee is required by subpoena or other legal process to disclose Protected Information,

he first will notify the Company promptly upon receipt of the subpoena or other notice, unless otherwise required by law, and will cooperate

in any action as may be necessary in order to protect such information and/or documents from disclosure.

Section 9 Nondisparagement.

Employee agrees that he will take no action which is intended or would reasonably be expected to harm the Company and its reputation,

or which would reasonably be expected to lead to unwanted or unfavorable publicity to the Company or its affiliates. Likewise, Company

agrees that it will take no action, by or through its agents, employees, officers or directors, which is intended or would reasonably

be expected to harm the Employee and his reputation, or which would reasonably be expected to lead to unwanted or unfavorable publicity

to the Employee. Nothing herein shall prevent the Parties from making any truthful statements in connection with any legal proceeding

or investigation by the Company or any governmental authority or securities self-regulatory organization, or in response to any request

for confirmation of employment from a prospective employer of Employee. Further, nothing will prevent Employee or the Company or its officers

and directors from (i) responding to a lawful subpoena, meeting regulatory obligations or reporting to a government agency, or complying

with any other legal obligation, or (ii) reporting possible violations of federal or state law or regulation (including securities

laws and regulations) to any governmental agency or entity or self-regulatory organization, cooperating with any governmental agency in

connection with any such possible violation, or making other disclosures or taking other actions that are protected under the whistleblower

provisions of federal or state law or regulation.

Section 10 Cooperation.

Employee will reasonably cooperate with the Company and its counsel in connection with any investigation, administrative, regulatory or

arbitration proceeding or litigation relating to any matter in which Employee was involved or of which the Company reasonably believes

Employee may have knowledge as a result of his association with the Company. Company agrees to indemnify Employee for any expenses incurred

as a result of that cooperation. In addition, Employee consents to be engaged by the Company to perform such services as the Company reasonably

may request in the Company’s discretion during the Prohibited Period and for one year following the termination of the Prohibited

Period, not to exceed one hundred (100) hours in any calendar year or twenty (20) hours in any calendar month, except as Employee and

the Company may otherwise agree in writing, and only during regular business hours, subject to accommodating reasonably Employee’s

other professional obligations, and provided that the provision of such services does not interfere with Employee’s obligations

to his then employer. Employee will be compensated under this Section 10 at the hourly rate of $350 per hour, with reimbursement

of reasonable out of pocket expenses approved in advance by the Company. Employee expressly acknowledges and agrees that such consulting

services shall be at the sole discretion of the Company and that the Company has provided no promise or assurances that Employee will

be engaged as a consultant.

Section 11 Representations.

Employee represents and warrants that no promise or inducement has been offered or made except as set forth herein and that he is entering

into this Agreement without reliance on any statement or representation made by or on behalf of the Company or any of the Releasees, except

as expressly set forth in this Agreement. Employee represents and warrants that he (a) has not sold, assigned, transferred, conveyed

or otherwise disposed of to any third party, by operation of law or otherwise, any action, claim, suit, charge, obligation, account, contract,

agreement, covenant, guarantee, controversy, judgment, damage, liability, or demand of any nature whatsoever relating to any matter covered

by this Agreement, and (b) has not filed and is not otherwise pursuing any legal action, claim or suit against any of the Releasees

of any kind or nature in or with any federal, state or local court, or other government agency which arose prior to Employee signing the

Agreement.

Section 12 Entire

Agreement.

(a) This

Agreement and any agreements or documents specifically referenced herein for the purposes so referenced expresses the entire agreement

and understanding of the Parties with respect to the subject matter hereof, and supersedes any prior agreements or understandings, written

or oral, with respect to such subject matter.

(b) No

provision of this Agreement may be altered, modified and/or cancelled except upon the express written consent of the Parties. No claim

or right arising out of a breach or default under this Agreement can be discharged by a waiver of that claim or right unless the waiver

is in writing signed by the Party hereto to be bound by such waiver. A waiver by either Party hereto of a breach or default by the other

Party of any provision of this Agreement shall not be deemed a waiver of future compliance therewith and such provision shall remain in

full force and effect.

(c) The

Parties agree that any material breach by Employee of any of his promises, covenants, or agreements in this Agreement shall nullify all

obligations on the part of the Company to Employee hereunder.

Section 13 Severability.

If any provision of this Agreement (or portion thereof) is held to be overbroad, invalid or unenforceable, the Parties agree that such

provision (or portion thereof) shall be modified so that it is enforceable or, if modification is not possible, that it should be severed

and replaced by a valid, legal and enforceable provision which so far as possible achieves the Parties’ intent in agreeing to the

original provision. The remaining provisions of this Agreement shall not be affected or impaired by such modification or severance. The

Parties agree to perform all such further acts and to execute all such further documents as may be reasonably necessary to carry out the

provisions or intent of this Agreement.

Section 14 Choice

of Law / Dispute Resolution. All questions concerning the construction, validity and interpretation of this Agreement will be governed

by and construed in accordance with the domestic laws of the Commonwealth of Kentucky without giving effect to any choice of law or conflict

of law provision or rule (whether of the Commonwealth of Kentucky or any other jurisdiction) that would cause the application of

the laws of any jurisdiction other than the Commonwealth of Kentucky. Each of the Parties agrees that any dispute between the Parties

shall be resolved only in the state courts regularly sitting in Lexington, Kentucky and the appellate courts having jurisdiction of appeals

in such courts. EACH OF THE PARTIES HERETO IRREVOCABLY AND UNCONDITIONALLY WAIVES ALL RIGHT TO TRIAL BY JURY IN ANY PROCEEDING (WHETHER

BASED ON CONTRACT, TORT OR OTHERWISE) BETWEEN THE PARTIES.

Section 15 Acknowledgements

/ Execution of Agreement. Employee acknowledges that he received this Agreement on January 26, 2024. Employee further acknowledges

that: (a) he has been advised in writing to consult with an attorney before signing this Agreement; (b) he has read this Agreement

and understands the meaning and application of each of its terms, including the general release and covenant not to sue language set

forth in Section 4; (c) he has been given until February 17, 2024, a period exceeding 21 days, to consider whether to

accept or reject the Agreement; (d) he may at his option sign this Agreement prior to February 16, 2024, but is not required

to do so; and (e) if he elects to sign this Agreement, he is doing so without duress, of his own free will, and with the intent

of being bound by its terms. Following signature, Employee shall return an original signed copy (in accordance with Section 18 below

related to the sufficiency of electronic signatures) of the Agreement to E. Forrest Jones, Jr., Esquire, Jones & Associates,

P. O. Box 1989, Charleston, West Virginia 25327, efjones@efjones.com, on or before February 16,

2024. In return, Employee will receive a fully-executed copy of the Agreement. If Employee has not signed and returned this Agreement

as provided above, he will be deemed to have rejected the offer set forth herein, the Company’s offer of this Agreement will be

considered withdrawn, and Employee will receive no payments or benefits hereunder.

Section 16 Revocation

Period. Within a period of seven (7) days after signing this Agreement, Employee may revoke the release and waiver of claims

in Section 4(a) hereof to the limited extent that such release and waiver applies to claims arising under the Age Discrimination

in Employment Act (“ADEA”). If Employee chooses to revoke his release and waiver of ADEA claims within such time period, he

shall provide written notice of revocation by email to E. Forrest Jones, Jr., Esquire, Jones & Associates, P. O. Box 1989,

Charleston, West Virginia 25327, efjones@efjones.com. If such notice has not been received by midnight of the seventh (7th)

day following his signing, Employee will have waived his right of revocation. If Employee provides timely notice of revocation under this

Section 16, such revocation will be limited solely to Employee’s release and waiver of claims arising under the ADEA and will

have no effect whatsoever on Employee’s waiver and release of any and all other claims as set forth in Section 4(a) of

this Agreement.

Section 17 Effective

Date of Agreement. This Agreement shall not be effective or enforceable until it has been signed and returned by Employee as described

herein, and the revocation period described in Section 16 has expired.

Section 18 Counterparts;

Electronic Delivery. This Agreement may be executed in any number of counterparts (including via electronic mail), each of which will

be deemed an original, but all of which together will constitute but one and the same instrument. In the event that any signature to this

Agreement or any agreement or certificate delivered pursuant hereto, or any amendment thereof, is delivered by e-mail delivery of a “.pdf”

format data file, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature

is executed) with the same force and effect as if such “.pdf” signature page were an original thereof.

[The remainder of this

page has been intentionally left blank; signature page follows.]

IN WITNESS WHEREOF, the Parties

hereto have executed this Agreement as of the date(s) set forth below.

| Barkley J. Sturgill, Jr. |

|

Ramaco Resources, Inc. |

| |

|

|

| /s/ Barkley J. Sturgill, Jr.

|

|

By: |

/s/ Randall W. Atkins |

| |

|

Randall W. Atkins |

| |

|

Chief Executive Officer |

| Date: January 26, 2024 |

|

Date: January 26, 2024 |

Exhibit 99.1

Ramaco

Announces Hiring of Distinguished West Virginian as New General Counsel

First

Quarter 2024 Class B Dividend Declared

LEXINGTON,

KY., February 1, 2024 — Ramaco Resources, Inc.

(NASDAQ: METC, METCB, “Ramaco” or the “Company”) announced today it has hired Evan H. Jenkins, the former

Chief Justice of the West Virginia Supreme Court, former two term U.S. Congressman, and longtime West Virginia State Legislator as the

company’s new General Counsel. The Company also announced that current Vice President and Assistant General Counsel Tyler Adkins

will be promoted to Senior Vice President of Law.

Most recently, Jenkins has served as Senior Vice President Government

Affairs at the United States Chamber of Commerce in Washington, D.C., the world’s largest business organization. For the past two

years he has also served as president of The Ramaco Foundation and a member of its board of directors, helping direct Ramaco’s philanthropic

efforts.

Before joining the Chamber, Jenkins spent four years serving on the

Supreme Court of Appeals of West Virginia and was selected as its Chief Justice for the 2021 term. He has also had an extensive legislative

career for over 22 years at both the federal and state level. Jenkins represented West Virginia’s 3rd Congressional District in

the United States House of Representatives for two terms, and beforehand served three terms in the West Virginia Senate and three terms

in the West Virginia House of Delegates.

Earlier in his career, Jenkins served seven years as General Counsel

of the West Virginia Chamber of Commerce and fifteen years as Executive Director of the West Virginia State Medical Association. Jenkins

began his legal career more than 30 years ago practicing labor and employment law in Huntington, West Virginia.

“As our company has continued to grow, we have attempted to attract

and retain the highest caliber talent for all aspects of our now national operations in both Appalachia and the West,” said Randall

Atkins, Chairman and CEO of Ramaco Resources. “Since the dominant share of our mining assets and operations are now centered in

and around West Virginia, it gives me a distinct honor to welcome one of West Virginia’s most accomplished citizens as our new General

Counsel. I have known Evan and followed his deeply impressive career for decades. He will bring skills, temperament, and background to

Ramaco far beyond his position as our new General Counsel, and we look forward to his new role with us.”

Jenkins received his bachelor’s degree in business administration

from the University of Florida and his law degree from the Cumberland School of Law at Samford University.

Jenkins replaces Barkley J. Sturgill, Jr. who resigned as our

General Counsel effective January 31, 2024.

For additional information please see our Current Report on Form 8-K

which is expected to be filed with the Securities and Exchange Commission today.

RAMACO DECLARES FIRST QUARTER 2024 DIVIDEND FOR CLASS B TRACKING

STOCK

The

Board declared a quarterly cash dividend of $0.2416 per share on the CORE Resources Class B shares. This will be payable on

March 15, 2024, to shareholders of record on March 1, 2024. The past two quarterly Class B dividends annualize to $0.98

per share.

As previously reported, Ramaco's Board announced a 10% increase in

the Class A dividend in December 2023. This quarterly Class A common stock cash dividend of $0.1375 per share for the first

quarter of 2024 is payable on March 15, 2024, to shareholders of record on March 1, 2024.

For additional information please see our Current Report on Form 8-K

which is expected to be filed with the Securities and Exchange Commission later today.

About Ramaco Resources, Inc.

Ramaco

Resources, Inc. is an operator and developer of high-quality, low-cost metallurgical coal in southern West Virginia, southwestern Virginia and

southwestern Pennsylvania, as well as an emerging potential producer of rare earth elements and critical minerals. Its executive

offices are in Lexington, Kentucky, with operational offices in Charleston, West Virginia and Sheridan, Wyoming. The

Company currently has three active mining complexes in Central Appalachia and the Brook Mine in Sheridan, Wyoming, where

the company and researchers from the Department of Energy's National Energy Technology Laboratory have discovered potentially world-class

deposits of rare earth elements. Contiguous to the Wyoming mine it operates a research and pilot facility related to the production

of advanced carbon products and materials from coal. In connection with these activities, it holds a body of roughly 50 intellectual property

patents, pending applications, exclusive licensing agreements and various trademarks. For more information about us, please visit our

website at www.ramacoresources.com. For more information, contact investor relations at (859) 244-7455.

v3.24.0.1

Cover

|

Jan. 26, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 26, 2024

|

| Entity File Number |

001-38003

|

| Entity Registrant Name |

Ramaco Resources, Inc.

|

| Entity Central Index Key |

0001687187

|

| Entity Tax Identification Number |

38-4018838

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

250 West Main Street

|

| Entity Address, Address Line Two |

Suite 1900

|

| Entity Address, City or Town |

Lexington

|

| Entity Address, State or Province |

KY

|

| Entity Address, Postal Zip Code |

40507

|

| City Area Code |

859

|

| Local Phone Number |

244-7455

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class

A common stock, $0.01 par value

|

| Trading Symbol |

METC

|

| Security Exchange Name |

NASDAQ

|

| 9.00% Senior Notes due 2026 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

9.00% Senior Notes due 2026

|

| Trading Symbol |

METCL

|

| Security Exchange Name |

NASDAQ

|

| Common Class B [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class B common stock, $0.01 par value

|

| Trading Symbol |

METCB

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=METC_NinePercentageSeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

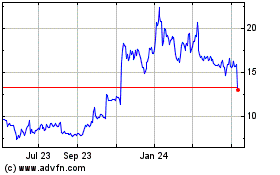

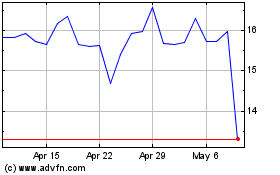

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Jan 2024 to Jan 2025