UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No.

)

Filed

by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary

Proxy Statement

¨ Confidential,

For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive

Proxy Statement

x Definitive

Additional Materials

¨ Soliciting

Material Pursuant to 240.14a-12

Ramaco Resources, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No

fee required.

¨ Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

¨ Fee

paid previously with preliminary materials.

¨ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): June 8, 2023

Ramaco Resources, Inc.

(Exact name of Registrant

as specified in its Charter)

| Delaware |

001-38003 |

38-4018838 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

250 West Main Street, Suite 1900

Lexington, Kentucky 40507

(Address of principal

executive offices)

Registrant’s telephone

number, including area code: (859) 244-7455

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

METC |

NASDAQ Global Select Market |

| 9.00% Senior Notes due 2026 |

METCL |

NASDAQ Global Select Market |

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

On June 8, 2023, Ramaco Resources, Inc.

(the “Company”) issued a press release announcing that the Company released an investor presentation (the “Investor

Presentation”) that may be used by the Company in connection with the solicitation of proxies for a special meeting of stockholders

to be held on June 12, 2023 (the “Special Meeting”). A copy of the press release is attached hereto as Exhibit 99.1

and is incorporated herein by reference.

A copy of the Investor Presentation is attached

hereto as Exhibit 99.2 and is incorporated herein by reference.

A copy of the transcript of the Investor Presentation

(the “Transcript”) is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

A

copy of the Investor Presentation, the Transcript, and a link to an audio recording of the Investor Presentation are also posted under

the “Investors” section of the Company’s website, www.ramacoresources.com.

The statements under this Item 7.01 and Exhibits 99.1, 99.2 and 99.3

are being furnished pursuant to Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise be subject to the liabilities of that section, nor shall they be deemed incorporated by

reference into any filings under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Additional Information and Where to Find It

On April 26, 2023, the Company filed a definitive

proxy statement (the “Proxy Statement”) with the U.S. Securities and Exchange Commission (the “SEC”) relating

to the stockholder proposal to amend and restate the Company’s amended and restated certificate of incorporation, which, among other

things, includes (1) the reclassification of the Company’s existing common stock as shares of Class A common stock, par

value $0.01 per share (“Class A Common Stock”), (2) the creation of a separate class of common stock, the Class B

common stock, par value $0.01 per share (“Class B Tracking Stock”), and (3) the provision to the Company’s

board of directors of the option, in its sole discretion, to exchange all outstanding shares of the Class B Tracking Stock into shares

of Class A Common Stock based on an exchange ratio determined by a 20-day trailing volume-weighted average price for each class of

stock (the “Charter Amendment Proposal”).

The Company commenced mailing on or about May 5,

2023 of the Proxy Statement and other relevant documents to its stockholders as of April 21, 2023, the record date, for voting on

the Charter Amendment Proposal. This Current Report on Form 8-K does not contain all the information that should be considered concerning

the Charter Amendment Proposal and is not intended to form the basis of any investment decision or any other decision in respect of the

amendment and restatement of the Company’s amended and restated certificate of incorporation contemplated thereby. The Company’s

stockholders and other interested persons are advised to read the Proxy Statement and other documents filed in connection with the Charter

Amendment Proposal, as these materials contain important information about the Company and the Charter Amendment Proposal. The Company’s

stockholders are able to obtain copies of the Proxy Statement, and other documents filed with the SEC, free of charge at the SEC’s

website at www.sec.gov, or by directing a request to: Attn: Secretary, 250 West Main Street, Suite 1900, Lexington, Kentucky 40507.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this Current Report on Form 8-K

may be considered forward-looking statements. Forward-looking statements generally relate to future events or the Company’s future

financial or operating performance, and other “forward-looking statements” (as such term is defined in the Private Securities

Litigation Reform Act of 1995), which include statements relating to the Charter Amendment Proposal. In some cases, you can identify forward-looking

statements by terminology such as “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,”

“potential,” “seem,” “seek,” “future,” “outlook,” or the negatives of these

terms or similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These

forward-looking statements are subject to a number of risks and uncertainties. If any of these risks materialize or our assumptions prove

incorrect, actual results could differ materially from the results implied by these forward-looking statements.

These forward-looking statements are based upon

estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain. Factors that

may cause actual results to differ materially from current expectations include, but are not limited to: (1) the inability to recognize

the anticipated benefits of the Charter Amendment Proposal; (2) costs related to the implementation of the Charter Amendment Proposal;

(3) changes in applicable laws or regulations; (4) the possibility that the Company may be adversely affected by other economic,

business and/or competitive factors; (5) the Company’s estimates of expenses and profitability; (6) the failure to realize

anticipated pro forma results or projections and underlying assumptions; and (7) other risks and uncertainties set forth in the sections

entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2022 the form of prospectus included as part of the Registration Statement

on Form S-1/A filed with the SEC on April 7, 2023 relating to the Class B common stock, and in any subsequent filings with

the SEC. There may be additional risks that the Company does not presently know or currently believe are immaterial that could also cause

actual results to differ from those contained in the forward-looking statements.

Nothing in this Current Report on Form 8-K

should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any

of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking

statements, which speak only as of the date they are made. The Company does not undertake any duty, and the Company expressly disclaims

any obligation, to update or alter this Current Report on Form 8-K or any projections or forward-looking statements, whether as a

result of new information, future events or otherwise.

Participants in the Solicitation

The Company and its directors and executive officers

may be deemed participants in the solicitation of proxies from the Company’s stockholders with respect to the Charter Amendment

Proposal. A list of the names of those directors and executive officers and a description of their interests in the Company is contained

in the definitive proxy statement that the Company filed with the SEC in connection with the Special Meeting to approve the Charter Amendment

Proposal and is available free of charge at the SEC’s website at www.sec.gov, or by directing a request to Attn: Secretary, 250

West Main Street, Suite 1900, Lexington, Kentucky 40507.

No Offer or Solicitation

This Current Report on Form 8-K shall not

constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Charter Amendment Proposal.

This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy or subscribe for any

securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RAMACO RESOURCES, INC. |

| |

|

| |

By: |

/s/ Randall W. Atkins |

| |

Name:

Title: |

Randall W. Atkins

Chairman and Chief Executive Officer |

Dated: June 8, 2023

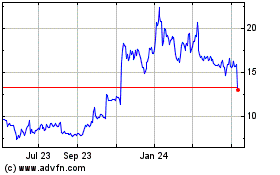

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Dec 2024 to Jan 2025

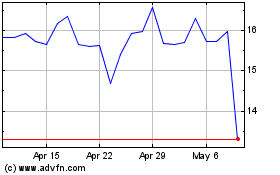

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Jan 2024 to Jan 2025