Qorvo® (Nasdaq:QRVO), a leading global provider of connectivity and

power solutions, today announced financial results for the

Company’s fiscal 2023 second quarter ended October 1, 2022.

On a GAAP basis, revenue for Qorvo’s fiscal 2023 second quarter

was $1.158 billion, gross margin was 46.5%, operating income was

$262 million and diluted earnings per share was $1.82. On a

non-GAAP basis, gross margin was 49.2%, operating income was $338

million and diluted earnings per share was $2.66.

Bob Bruggeworth, president and chief executive officer of Qorvo,

said, “Qorvo delivered a solid September quarter, supported by a

large customer launch and strength in defense and power. In the

December quarter, Qorvo is continuing to adjust to weakening

end-market demand while taking steps to significantly reduce

inventory in the channel. Across our businesses, we remain

encouraged by customer design win activity and content and

integration trends. We are introducing new technologies and new

products to drive growth and expand content in diverse markets,

including defense, power, infrastructure, automotive, IoT

connectivity and smartphones.”

Strategic Highlights

- Achieved fourth consecutive quarter of sequential growth in

Silicon Carbide (SiC) business and signed agreement with SK Siltron

for long-term supply of SiC wafers

- Released portfolio of advanced fourth-generation SiC

surface-mount FETs optimized for high-power applications such as

DC-to-DC converters, fast DC chargers, and onboard chargers

- Released 5-watt GaN power amplifier module for 4.5 - 4.6 GHz

massive-MIMO cellular base stations and announced GaN power module

for upcoming DOCSIS 4.0 broadband cable systems

- Introduced highly compact PMIC designed to enable

reconfigurability and reduce time to market in space-constrained

applications including home automation and networking systems

- Achieved Matter® 1.0 certification and commenced shipments of

Matter development kits featuring ConcurrentConnect™ technology,

simplifying design of IoT gateway and connected devices

- Broadened smart home product portfolio leveraging UWB and

Matter system solutions and expanded UWB design engagements serving

enterprise applications, including indoor navigation

- Expanded connectivity and sensing design wins supporting

top-tier automakers for applications including infotainment,

connectivity, secure car access and EV smart interiors

- Secured broad range of Wi-Fi 6 and Wi-Fi 6E design wins in

support of 2023 platforms and launched 5 GHz and 6 GHz filters for

European band Wi-Fi 6E and Wi-Fi 7 applications

- Launched commercial trials of Qorvo Omnia™ COVID-19 diagnostic

test platform with multiple retail healthcare outlets and began

production of flu A/B cartridges for clinical trials in support of

National Institutes of Health (NIH) initiatives

- Increased shipments of Phase 7 LE solutions and secured

additional design wins, including LB, MHB and UHB integrated

placements across multiple smartphone OEMs

- Commenced first production shipments of high-performance

MEMS-based antenna solutions and expanded customer engagements to

include top-tier smartphone OEMs

- Expanded content at Korea-based OEM with first LB PAD win in

their flagship smartphone, complementing wins in MHB main and

secondary transmit, tuning and Wi-Fi applications, in support of

upcoming 2023 flagship launch

- Introduced highly integrated MHB PAD combining main path and

diversity receive content, in support of future cellular

architectures

Financial Commentary and Outlook

Grant Brown, chief financial officer of Qorvo, said, “Qorvo

delivered September quarterly revenue and EPS above the high end of

our guidance while also reducing inventories. Looking forward, we

anticipate ongoing weakness across end markets, primarily consumer,

and a more acute inventory correction at our Android-based

smartphone customers. Despite the challenging environment, we

expect to deliver strong free cash flow in fiscal 2023 while

investing to drive diversified long-term growth. On this outlook

and projected free cash flow, the board of directors has approved a

$2 billion share repurchase authorization.”

Qorvo's current outlook for the December 2022 quarter is:

- Quarterly revenue of $700 million to $750 million

- Non-GAAP gross margin between 43% and 44%

- Non-GAAP diluted earnings per share in the range of $0.50 to

$0.75

Qorvo’s actual quarterly results may differ from these

expectations and projections, and such differences may be

material.

Selected Financial Information

The following tables set forth selected GAAP and non-GAAP

financial information for Qorvo for the periods indicated. See the

more detailed financial information for Qorvo, including

reconciliations of GAAP and non-GAAP financial information,

attached.

| |

|

SELECTED GAAP RESULTS |

|

| |

|

(Unaudited) |

|

| |

|

(In millions, except for percentages and EPS) |

|

| |

|

For the quarter endedOctober 1, 2022 |

|

For the quarter endedJuly 2, 2022 |

|

Change vs. Q1FY 2023 |

|

|

Revenue |

$ |

1,158.1 |

|

$ |

1,035.4 |

|

$ |

122.7 |

|

|

| Gross profit |

$ |

538.9 |

|

$ |

375.3 |

|

$ |

163.6 |

|

|

| Gross margin |

|

46.5 |

% |

|

36.2 |

% |

|

10.3 |

|

ppt |

| Operating expenses |

$ |

277.4 |

|

$ |

273.4 |

|

$ |

4.0 |

|

|

| Operating income |

$ |

261.6 |

|

$ |

101.9 |

|

$ |

159.7 |

|

|

| Net income |

$ |

188.6 |

|

$ |

68.9 |

|

$ |

119.7 |

|

|

| Weighted average diluted

shares |

|

103.7 |

|

|

106.1 |

|

|

(2.4 |

) |

|

| Diluted EPS |

$ |

1.82 |

|

$ |

0.65 |

|

$ |

1.17 |

|

|

| |

|

SELECTED NON-GAAP RESULTS1 |

|

| |

|

(Unaudited) |

|

| |

|

(In millions, except for percentages and EPS) |

|

| |

|

For the quarter endedOctober 1, 2022 |

|

For the quarter endedJuly 2, 2022 |

|

Change vs. Q1FY 2023 |

|

|

Revenue |

$ |

1,158.1 |

|

$ |

1,035.4 |

|

$ |

122.7 |

|

|

| Gross profit |

$ |

570.2 |

|

$ |

518.2 |

|

$ |

52.0 |

|

|

| Gross margin |

|

49.2 |

% |

|

50.0 |

% |

|

(0.8 |

) |

ppt |

| Operating expenses |

$ |

232.5 |

|

$ |

233.8 |

|

$ |

(1.3 |

) |

|

| Operating income |

$ |

337.7 |

|

$ |

284.4 |

|

$ |

53.3 |

|

|

| Net income |

$ |

276.2 |

|

$ |

238.4 |

|

$ |

37.8 |

|

|

| Weighted average diluted

shares |

|

103.7 |

|

|

106.1 |

|

|

(2.4 |

) |

|

| Diluted EPS |

$ |

2.66 |

|

$ |

2.25 |

|

$ |

0.41 |

|

|

| |

|

SELECTED GAAP RESULTS |

|

| |

|

(Unaudited) |

|

| |

|

(In millions, except for percentages and EPS) |

|

| |

|

For the quarter ended October 1, 2022 |

|

For the quarter ended October 2, 2021 |

|

Change vs. Q2 FY 2022 |

|

|

Revenue |

$ |

1,158.1 |

|

$ |

1,255.2 |

|

$ |

(97.1 |

) |

|

| Gross profit |

$ |

538.9 |

|

$ |

621.6 |

|

$ |

(82.7 |

) |

|

| Gross margin |

|

46.5 |

% |

|

49.5 |

% |

|

(3.0 |

) |

ppt |

| Operating expenses |

$ |

277.4 |

|

$ |

259.2 |

|

$ |

18.2 |

|

|

| Operating income |

$ |

261.6 |

|

$ |

362.4 |

|

$ |

(100.8 |

) |

|

| Net income |

$ |

188.6 |

|

$ |

319.2 |

|

$ |

(130.6 |

) |

|

| Weighted average diluted

shares |

|

103.7 |

|

|

112.4 |

|

|

(8.7 |

) |

|

| Diluted EPS |

$ |

1.82 |

|

$ |

2.84 |

|

$ |

(1.02 |

) |

|

| |

|

SELECTED NON-GAAP RESULTS1 |

|

| |

|

(Unaudited) |

|

| |

|

(In millions, except for percentages and EPS) |

|

| |

|

For the quarter ended October 1, 2022 |

|

For the quarter ended October 2, 2021 |

|

Change vs. Q2 FY 2022 |

|

|

Revenue |

$ |

1,158.1 |

|

$ |

1,255.2 |

|

$ |

(97.1 |

) |

|

| Gross profit |

$ |

570.2 |

|

$ |

657.5 |

|

$ |

(87.3 |

) |

|

| Gross margin |

|

49.2 |

% |

|

52.4 |

% |

|

(3.2 |

) |

ppt |

| Operating expenses |

$ |

232.5 |

|

$ |

222.1 |

|

$ |

10.4 |

|

|

| Operating income |

$ |

337.7 |

|

$ |

435.4 |

|

$ |

(97.7 |

) |

|

| Net income |

$ |

276.2 |

|

$ |

384.5 |

|

$ |

(108.3 |

) |

|

| Weighted average diluted

shares |

|

103.7 |

|

|

112.4 |

|

|

(8.7 |

) |

|

| Diluted EPS |

$ |

2.66 |

|

$ |

3.42 |

|

$ |

(0.76 |

) |

|

1 Excludes stock-based compensation expense, amortization of

intangible assets, acquisition and integration related costs,

charges associated with a long-term capacity reservation agreement,

loss (gain) on assets, start-up costs, restructuring related

charges, (gain) loss on investments, other expense and an

adjustment of income taxes.

Non-GAAP Financial Measures

In addition to disclosing financial results calculated in

accordance with United States (U.S.) generally accepted accounting

principles (GAAP), this earnings release contains some or all of

the following non-GAAP financial measures: (i) non-GAAP gross

profit and gross margin, (ii) non-GAAP operating income and

operating margin, (iii) non-GAAP net income, (iv) non-GAAP net

income per diluted share, (v) non-GAAP operating expenses (research

and development; selling, general and administrative), (vi) free

cash flow, (vii) EBITDA, (viii) non-GAAP return on invested capital

(ROIC), and (ix) net debt or positive net cash. Each of these

non-GAAP financial measures is either adjusted from GAAP results to

exclude certain expenses or derived from multiple GAAP measures,

which are outlined in the “Reconciliation of GAAP to Non-GAAP

Financial Measures” tables, attached, and the “Additional Selected

Non-GAAP Financial Measures and Reconciliations” tables,

attached.

In managing Qorvo's business on a consolidated basis, management

develops an annual operating plan, which is approved by our Board

of Directors, using non-GAAP financial measures. In developing and

monitoring performance against this plan, management considers the

actual or potential impacts on these non-GAAP financial measures

from actions taken to reduce costs with the goal of increasing

gross margin and operating margin. In addition, management relies

upon these non-GAAP financial measures to assess whether research

and development efforts are at an appropriate level, and when

making decisions about product spending, administrative budgets,

and other operating expenses. Also, we believe that non-GAAP

financial measures provide useful supplemental information to

investors and enable investors to analyze the results of operations

in the same way as management. We have chosen to provide this

supplemental information to enable investors to perform additional

comparisons of our operating results, to assess our liquidity and

capital position and to analyze financial performance excluding the

effect of expenses unrelated to operations, certain non-cash

expenses and stock-based compensation expense, which may obscure

trends in Qorvo's underlying performance.

We believe that these non-GAAP financial measures offer an

additional view of Qorvo's operations that, when coupled with the

GAAP results and the reconciliations to corresponding GAAP

financial measures, provide a more complete understanding of

Qorvo's results of operations and the factors and trends affecting

Qorvo's business. However, these non-GAAP financial measures should

be considered as a supplement to, and not as a substitute for, or

superior to, the corresponding measures calculated in accordance

with GAAP.

Our rationale for using these non-GAAP financial measures, as

well as their impact on the presentation of Qorvo's operations, are

outlined below:

Non-GAAP gross profit and gross margin. Non-GAAP gross profit

and gross margin exclude amortization of intangible assets,

stock-based compensation expense and certain non-cash expenses. We

believe that exclusion of these costs in presenting non-GAAP gross

profit and gross margin facilitates a useful evaluation of our

historical performance and projected costs and the potential for

realizing cost efficiencies.

We view amortization of acquisition-related intangible assets,

such as the amortization of the cost associated with an acquired

company’s research and development efforts, trade names, and

customer relationships, as items arising from pre-acquisition

activities, determined at the time of an acquisition, rather than

ongoing costs of operating Qorvo’s business. While these intangible

assets are continually evaluated for impairment, amortization of

the cost of purchased intangible assets is a static expense, which

is not typically affected by operations during any particular

period. Although we exclude the amortization of purchased

intangible assets from these non-GAAP financial measures,

management believes that it is important for investors to

understand that such intangible assets were recorded as part of

purchase price accounting and contribute to revenue generation.We

believe that presentation of non-GAAP gross profit and gross margin

and other non-GAAP financial measures that exclude the impact of

stock-based compensation expense assists management and investors

in evaluating the period-over-period performance of Qorvo's ongoing

operations because (i) the expenses are non-cash in nature, and

(ii) although the size of the grants is within our control, the

amount of expense varies depending on factors such as short-term

fluctuations in stock price volatility and prevailing interest

rates, which can be unrelated to the operational performance of

Qorvo during the period in which the expense is incurred and

generally are outside the control of management. Moreover, we

believe that the exclusion of stock-based compensation expense in

presenting non-GAAP gross profit and gross margin and other

non-GAAP financial measures is useful to investors to understand

the impact of the expensing of stock-based compensation to Qorvo's

gross profit and gross margins and other financial measures in

comparison to prior periods. We also believe that the adjustments

to profit and margin related to certain non-cash expenses do not

constitute part of Qorvo's ongoing operations and therefore the

exclusion of these items provides management and investors with

better visibility into the actual revenue and actual costs required

to generate revenues over time and facilitates a useful evaluation

of our historical and projected performance. We believe disclosure

of non-GAAP gross profit and gross margin has economic substance

because the excluded expenses do not represent continuing cash

expenditures and, as described above, we have little control over

the timing and amount of the expenses in question.

For the three months ended July 2, 2022, non-GAAP gross profit

and gross margin also exclude charges associated with a long-term

capacity reservation agreement. Unprecedented disruption resulting

from measures taken in China to control the COVID-19 pandemic and

the conflict in Ukraine have negatively impacted demand for 5G

handsets in China and EMEA within a short period of time. As a

result of these extraordinary circumstances, we did not meet the

minimum purchase commitments under a long-term capacity reservation

agreement with a foundry supplier. This resulted in shortfall

charges that have been recorded in our cost of goods sold. We

believe these charges are not reflective of the performance of our

ongoing business as they were the result of unprecedented

disruption resulting from the COVID-19 pandemic and the conflict in

Ukraine.

Non-GAAP operating income and operating margin. Non-GAAP

operating income and operating margin exclude stock-based

compensation expense, amortization of intangible assets,

acquisition and integration related costs, gain or loss on assets,

asset impairments, start-up costs, restructuring related charges,

charges associated with a long-term capacity reservation agreement

and certain non-cash expenses. We believe that presentation of a

measure of operating income and operating margin that excludes

amortization of intangible assets and stock-based compensation

expense is useful to both management and investors for the same

reasons as described above with respect to our use of non-GAAP

gross profit and gross margin. We believe that acquisition and

integration related costs, gain or loss on assets, asset

impairments, start-up costs, restructuring related charges, charges

associated with a long-term capacity reservation agreement and

certain non-cash expenses do not constitute part of Qorvo's ongoing

operations and therefore, the exclusion of these costs provides

management and investors with better visibility into the actual

costs required to generate revenues over time and facilitates a

useful evaluation of our historical and projected performance. We

believe disclosure of non-GAAP operating income and operating

margin has economic substance because the excluded expenses are

either unrelated to ongoing operations or do not represent current

cash expenditures.

Non-GAAP net income and non-GAAP net income per diluted share.

Non-GAAP net income and non-GAAP net income per diluted share

exclude the effects of stock-based compensation expense,

amortization of intangible assets, acquisition and integration

related costs, gain or loss on assets, asset impairments, start-up

costs, restructuring related charges, charges associated with a

long-term capacity reservation agreement, certain non-cash

expenses, gain or loss on investments, other expense (income) and

also reflect an adjustment of income taxes. The income tax

adjustment primarily represents the use of research and development

tax credit carryforwards, deferred tax expense (benefit) items not

affecting taxes payable, adjustments related to the deemed and

actual repatriation of historical foreign earnings, non-cash

expense (benefit) related to uncertain tax positions and other

items unrelated to the current fiscal year or that are not

indicative of our ongoing business operations. We believe that

presentation of measures of net income and net income per diluted

share that exclude these items is useful to both management and

investors for the reasons described above with respect to non-GAAP

gross profit and gross margin and non-GAAP operating income and

operating margin. We believe disclosure of non-GAAP net income and

non-GAAP net income per diluted share has economic substance

because the excluded expenses are either unrelated to ongoing

operations or do not represent current cash expenditures.

Non-GAAP operating expenses (research and development and

selling, general and administrative). Non-GAAP research and

development and selling, general and administrative expenses

exclude stock-based compensation expense, amortization of

intangible assets and certain non-cash expenses (primarily

acquisition and integration related costs). We believe that

presentation of measures of these operating expenses that exclude

amortization of intangible assets and stock-based compensation

expense is useful to both management and investors for the same

reasons as described above with respect to our use of non-GAAP

gross profit and gross margin. We believe that acquisition and

integration related costs and certain non-cash expenses do not

constitute part of Qorvo's ongoing operations and therefore, the

exclusion of these costs provides management and investors with

better visibility into the actual costs required to generate

revenues over time and facilitates a useful evaluation of our

historical and projected performance. We believe disclosure of

these non-GAAP operating expenses has economic substance because

the excluded expenses are either unrelated to ongoing operations or

do not represent current cash expenditures.

Free cash flow. Qorvo defines free cash flow as net cash

provided by operating activities during the period minus property

and equipment expenditures made during the period, and free cash

flow margin is calculated as free cash flow as a percentage of

revenue. We use free cash flow as a supplemental financial measure

in our evaluation of liquidity and financial strength. Management

believes that this measure is useful as an indicator of our ability

to service our debt, meet other payment obligations and make

strategic investments. Free cash flow should be considered in

addition to, rather than as a substitute for, net income as a

measure of our performance and net cash provided by operating

activities as a measure of our liquidity. Additionally, our

definition of free cash flow is limited, in that it does not

represent residual cash flows available for discretionary

expenditures due to the fact that the measure does not deduct the

payments required for debt service and other contractual

obligations. Therefore, we believe it is important to view free

cash flow as a measure that provides supplemental information to

our entire statement of cash flows.

EBITDA. Qorvo adjusts GAAP net income for interest expense,

interest income, income tax expense (benefit), depreciation and

intangible amortization expense, stock-based compensation and other

charges that are not representative of Qorvo's ongoing operations

(including asset impairments, investment activity,

acquisition-related costs, certain charges associated with a

long-term capacity reservation agreement and restructuring-related

costs) when presenting EBITDA. Management believes that this

measure is useful to evaluate our ongoing operations and as a

general indicator of our operating cash flow (in conjunction with a

cash flow statement which also includes among other items, changes

in working capital and the effect of non-cash charges).

Non-GAAP ROIC. Return on invested capital (ROIC) is a non-GAAP

financial measure that management believes provides useful

supplemental information for management and the investor by

measuring the effectiveness of our operations' use of invested

capital to generate profits. We use ROIC to track how much value we

are creating for our shareholders. Non-GAAP ROIC is calculated by

dividing annualized non-GAAP operating income, net of an adjustment

for income taxes (as described above), by average invested capital.

Average invested capital is calculated by subtracting the average

of the beginning balance and the ending balance of equity plus net

debt, less certain goodwill.

Net debt or positive net cash. Net debt or positive net cash is

defined as unrestricted cash, cash equivalents and short-term

investments minus any borrowings under our credit facility and the

principal balance of our senior unsecured notes. Management

believes that net debt or positive net cash provides useful

information regarding the level of Qorvo's indebtedness by

reflecting cash and investments that could be used to repay

debt.

Inventory days on hand. Inventory days on hand is defined as (a)

average net inventory for the period, divided by (b) the result of

non-GAAP cost of goods sold for the period divided by the number of

days in the period.

Forward-looking non-GAAP financial measures. Our earnings

release contains forward-looking free cash flow, gross margin,

income tax rate and diluted earnings per share. We provide these

non-GAAP measures to investors on a prospective basis for the same

reasons (set forth above) that we provide them to investors on a

historical basis. We are unable to provide a reconciliation of the

forward-looking non-GAAP financial measures to the most directly

comparable forward-looking GAAP financial measures without

unreasonable effort due to variability and difficulty in making

accurate projections for items that would be required to be

included in the GAAP measures, such as stock-based compensation,

acquisition and integration related costs, restructuring related

charges, gain or loss on assets, asset impairments, gain or loss on

investments and the provision for income taxes. We believe such

reconciliations would imply a degree of precision that would be

confusing or misleading to investors.

Limitations of non-GAAP financial measures. The primary material

limitations associated with the use of non-GAAP financial measures

as an analytical tool compared to the most directly comparable GAAP

financial measures are these non-GAAP financial measures (i) may

not be comparable to similarly titled measures used by other

companies in our industry, and (ii) exclude financial information

that some may consider important in evaluating our performance,

thus limiting their usefulness as a comparative tool. We compensate

for these limitations by providing full disclosure of the

differences between these non-GAAP financial measures and the

corresponding GAAP financial measures, including a reconciliation

of the non-GAAP financial measures to the corresponding GAAP

financial measures, to enable investors to perform their own

analysis of our gross profit and gross margin, operating expenses,

operating income, net income, net income per diluted share and net

cash provided by operating activities. We further compensate for

the limitations of our use of non-GAAP financial measures by

presenting the corresponding GAAP measures more prominently.

Qorvo will conduct a conference call at 5:00 p.m. ET today to

discuss today’s press release. The conference call will be

broadcast live over the Internet and can be accessed by any

interested party at https://www.qorvo.com (under “Investors”). A

telephone playback of the conference call will be available

approximately two hours after the call’s completion and can be

accessed by dialing 412-317-6671 and using the passcode 13733149.

The playback will be available through the close of business

November 9, 2022.

About QorvoQorvo (Nasdaq:QRVO) supplies

innovative semiconductor solutions that make a better world

possible. We combine product and technology leadership,

systems-level expertise and global manufacturing scale to quickly

solve our customers’ most complex technical challenges. Qorvo

serves diverse high-growth segments of large global markets,

including consumer electronics, smart home/IoT, automotive, EVs,

battery-powered appliances, network infrastructure, healthcare and

aerospace/defense. Visit www.qorvo.com to learn how our diverse and

innovative team is helping connect, protect and power our

planet.

Qorvo is a registered trademark of Qorvo, Inc. in the U.S. and

in other countries. All other trademarks are the property of their

respective owners.

This press release includes "forward-looking

statements" within the meaning of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, but are not limited to,

statements about our plans, objectives, representations and

contentions, and are not historical facts and typically are

identified by use of terms such as "may," "will," "should,"

"could," "expect," "plan," "anticipate," "believe," "estimate,"

"predict," "potential," "continue" and similar words, although some

forward-looking statements are expressed differently. You should be

aware that the forward-looking statements included herein represent

management's current judgment and expectations, but our actual

results, events and performance could differ materially from those

expressed or implied by forward-looking statements. We do not

intend to update any of these forward-looking statements or

publicly announce the results of any revisions to these

forward-looking statements, other than as is required under U.S.

federal securities laws. Our business is subject to numerous risks

and uncertainties, including those relating to fluctuations in our

operating results; our substantial dependence on developing new

products and achieving design wins; our dependence on several large

customers for a substantial portion of our revenue; continued

volatility and uncertainty in customer demand, worldwide economies

and financial markets resulting from the impact of the COVID-19

pandemic, conflict in Ukraine or other macroeconomic factors; a

loss of revenue if defense and aerospace contracts are canceled or

delayed; our dependence on third parties; risks related to sales

through distributors; risks associated with the operation of our

manufacturing facilities; business disruptions; poor manufacturing

yields; increased inventory risks and costs, including under

long-term supply agreements, due to timing of customers’ forecasts;

our inability to effectively manage or maintain evolving

relationships with chipset suppliers; our ability to continue to

innovate in a very competitive industry; underutilization of

manufacturing facilities; unfavorable changes in interest rates,

pricing of certain precious metals, utility rates and foreign

currency exchange rates; our acquisitions and other strategic

investments failing to achieve financial or strategic objectives;

our ability to attract, retain and motivate key employees; warranty

claims, product recalls and product liability; changes in our

effective tax rate; changes in the favorable tax status of certain

of our subsidiaries; enactment of international or domestic tax

legislation, or changes in regulatory guidance; risks associated

with environmental, health and safety regulations, and climate

change; risks from international sales and operations; economic

regulation in China; changes in government trade policies,

including imposition of tariffs and export restrictions; we may not

be able to generate sufficient cash to service all of our debt;

restrictions imposed by the agreements governing our debt; our

reliance on our intellectual property portfolio; claims of

infringement of third-party intellectual property rights; security

breaches and other similar disruptions compromising our

information; theft, loss or misuse of personal data by or about our

employees, customers or third parties; provisions in our governing

documents and Delaware law may discourage takeovers and business

combinations that our stockholders might consider to be in their

best interests; and volatility in the price of our common stock.

These and other risks and uncertainties, which are described in

more detail under "Risk Factors" in Part I, Item 1A. of our Annual

Report on Form 10-K for the year ended April 2, 2022 and Qorvo's

subsequent reports and statements filed with the Securities and

Exchange Commission, could cause actual results and developments to

be materially different from those expressed or implied by any of

these forward-looking statements.

Financial Tables to Follow

QORVO, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME(In

thousands, except per share data)(Unaudited)

| |

Three Months Ended |

|

Six Months Ended |

| |

October 1, 2022 |

|

October 2, 2021 |

|

October 1, 2022 |

|

October 2, 2021 |

|

Revenue |

$ |

1,158,057 |

|

|

$ |

1,255,248 |

|

|

$ |

2,193,415 |

|

|

$ |

2,365,599 |

|

| |

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

Cost of goods sold |

|

619,130 |

|

|

|

633,695 |

|

|

|

1,279,238 |

|

|

|

1,197,863 |

|

|

Research and development |

|

168,164 |

|

|

|

158,377 |

|

|

|

336,732 |

|

|

|

310,456 |

|

|

Selling, general and administrative |

|

97,752 |

|

|

|

93,489 |

|

|

|

199,567 |

|

|

|

183,788 |

|

|

Other operating expense |

|

11,449 |

|

|

|

7,327 |

|

|

|

14,457 |

|

|

|

14,030 |

|

|

Total costs and expenses |

|

896,495 |

|

|

|

892,888 |

|

|

|

1,829,994 |

|

|

|

1,706,137 |

|

| |

|

|

|

|

|

|

|

| Operating income |

|

261,562 |

|

|

|

362,360 |

|

|

|

363,421 |

|

|

|

659,462 |

|

| Interest expense |

|

(16,904 |

) |

|

|

(15,327 |

) |

|

|

(34,156 |

) |

|

|

(30,606 |

) |

| Other income (expense),

net |

|

2,214 |

|

|

|

4,754 |

|

|

|

(2,848 |

) |

|

|

21,545 |

|

| |

|

|

|

|

|

|

|

| Income before income taxes |

|

246,872 |

|

|

|

351,787 |

|

|

|

326,417 |

|

|

|

650,401 |

|

| Income tax expense |

|

(58,257 |

) |

|

|

(32,598 |

) |

|

|

(68,918 |

) |

|

|

(45,586 |

) |

| Net income |

$ |

188,615 |

|

|

$ |

319,189 |

|

|

$ |

257,499 |

|

|

$ |

604,815 |

|

| |

|

|

|

|

|

|

|

| Net income per share,

diluted |

$ |

1.82 |

|

|

$ |

2.84 |

|

|

$ |

2.46 |

|

|

$ |

5.35 |

|

| |

|

|

|

|

|

|

|

| Weighted average outstanding

diluted shares |

|

103,674 |

|

|

|

112,411 |

|

|

|

104,817 |

|

|

|

113,088 |

|

QORVO, INC. AND

SUBSIDIARIESRECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL MEASURES(In thousands, except per share

data)(Unaudited)

| |

Three Months Ended |

| |

October 1, 2022 |

|

July 2, 2022 |

|

October 2, 2021 |

| |

|

|

|

|

|

|

GAAP operating income |

$ |

261,562 |

|

|

$ |

101,859 |

|

|

$ |

362,360 |

|

|

Stock-based compensation expense |

|

31,789 |

|

|

|

35,414 |

|

|

|

28,691 |

|

|

Amortization of intangible assets |

|

32,787 |

|

|

|

33,652 |

|

|

|

36,577 |

|

|

Acquisition and integration related costs |

|

8,642 |

|

|

|

6,308 |

|

|

|

6,040 |

|

|

Charges associated with a long-term capacity reservation

agreement |

|

— |

|

|

|

110,000 |

|

|

|

— |

|

|

(Gain) loss on assets, start-up costs, restructuring and other

non-cash expenses |

|

2,917 |

|

|

|

(2,868 |

) |

|

|

1,750 |

|

| Non-GAAP operating income |

$ |

337,697 |

|

|

$ |

284,365 |

|

|

$ |

435,418 |

|

| |

|

|

|

|

|

| GAAP net income |

$ |

188,615 |

|

|

$ |

68,884 |

|

|

$ |

319,189 |

|

|

Stock-based compensation expense |

|

31,789 |

|

|

|

35,414 |

|

|

|

28,691 |

|

|

Amortization of intangible assets |

|

32,787 |

|

|

|

33,652 |

|

|

|

36,577 |

|

|

Acquisition and integration related costs |

|

8,642 |

|

|

|

6,308 |

|

|

|

6,040 |

|

|

Charges associated with a long-term capacity reservation

agreement |

|

— |

|

|

|

110,000 |

|

|

|

— |

|

|

(Gain) loss on assets, start-up costs, restructuring and other

non-cash expenses |

|

2,917 |

|

|

|

(2,868 |

) |

|

|

1,750 |

|

|

(Gain) loss on investments |

|

(967 |

) |

|

|

1,375 |

|

|

|

(3,673 |

) |

|

Other expense |

|

1,629 |

|

|

|

5,198 |

|

|

|

103 |

|

|

Adjustment of income taxes |

|

10,814 |

|

|

|

(19,559 |

) |

|

|

(4,133 |

) |

| Non-GAAP net income |

$ |

276,226 |

|

|

$ |

238,404 |

|

|

$ |

384,544 |

|

| |

|

|

|

|

|

| GAAP weighted average

outstanding diluted shares |

|

103,674 |

|

|

|

106,080 |

|

|

|

112,411 |

|

|

Dilutive stock-based awards |

|

— |

|

|

|

— |

|

|

|

— |

|

| Non-GAAP weighted average

outstanding diluted shares |

|

103,674 |

|

|

|

106,080 |

|

|

|

112,411 |

|

| |

|

|

|

|

|

| Non-GAAP net income per share,

diluted |

$ |

2.66 |

|

|

$ |

2.25 |

|

|

$ |

3.42 |

|

| |

|

|

|

|

|

QORVO, INC. AND

SUBSIDIARIESRECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL MEASURES(Unaudited)

| |

Three Months Ended |

| (in thousands, except

percentages) |

October 1, 2022 |

|

July 2, 2022 |

|

October 2, 2021 |

|

GAAP gross profit/margin |

$ |

538,927 |

46.5 |

% |

|

$ |

375,250 |

36.2 |

% |

|

$ |

621,553 |

49.5 |

% |

|

Amortization of intangible assets |

|

27,574 |

2.4 |

|

|

|

28,083 |

2.7 |

|

|

|

30,876 |

2.5 |

|

|

Stock-based compensation expense |

|

3,704 |

0.3 |

|

|

|

4,502 |

0.5 |

|

|

|

4,949 |

0.4 |

|

|

Charges associated with a long-term capacity reservation

agreement |

|

— |

— |

|

|

|

110,000 |

10.6 |

|

|

|

— |

— |

|

|

Other non-cash expenses |

|

35 |

— |

|

|

|

354 |

— |

|

|

|

152 |

— |

|

| Non-GAAP gross

profit/margin |

$ |

570,240 |

49.2 |

% |

|

$ |

518,189 |

50.0 |

% |

|

$ |

657,530 |

52.4 |

% |

| |

Three Months Ended |

|

Non-GAAP Operating Income |

October 1, 2022 |

|

(as a percentage of sales) |

|

| |

|

|

GAAP operating income |

22.6 |

% |

|

Stock-based compensation expense |

2.7 |

|

|

Amortization of intangible assets |

2.8 |

|

|

Acquisition and integration related costs |

0.8 |

|

|

Gain on assets, start-up costs, restructuring and other non-cash

expenses |

0.3 |

|

| Non-GAAP operating income |

29.2 |

% |

| |

Three Months Ended |

|

Free Cash Flow(1) |

October 1, 2022 |

|

(in millions) |

|

| |

|

|

Net cash provided by operating activities |

$ |

267.4 |

|

| Purchases of property and

equipment |

|

(47.0 |

) |

| Free cash flow |

$ |

220.4 |

|

(1) Free Cash Flow is calculated as net cash provided by

operating activities minus property and equipment expenditures.

QORVO, INC. AND

SUBSIDIARIESADDITIONAL SELECTED NON-GAAP FINANCIAL

MEASURES AND RECONCILIATIONS(In thousands)(Unaudited)

| |

Three Months Ended |

| |

October 1, 2022 |

|

July 2, 2022 |

|

October 2, 2021 |

|

GAAP research and development expense |

$ |

168,164 |

|

$ |

168,568 |

|

$ |

158,377 |

| Less: |

|

|

|

|

|

|

Stock-based compensation expense |

|

10,445 |

|

|

8,966 |

|

|

8,614 |

|

Other non-cash expenses |

|

58 |

|

|

61 |

|

|

235 |

| Non-GAAP research and

development expense |

$ |

157,661 |

|

$ |

159,541 |

|

$ |

149,528 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

Three Months Ended |

| |

October 1, 2022 |

|

July 2, 2022 |

|

October 2, 2021 |

| GAAP selling, general and

administrative expense |

$ |

97,752 |

|

$ |

101,815 |

|

$ |

93,489 |

| Less: |

|

|

|

|

|

|

Stock-based compensation expense |

|

17,640 |

|

|

21,946 |

|

|

15,128 |

|

Amortization of intangible assets |

|

5,213 |

|

|

5,569 |

|

|

5,701 |

|

Other non-cash expenses |

|

17 |

|

|

17 |

|

|

76 |

| Non-GAAP selling, general and

administrative expense |

$ |

74,882 |

|

$ |

74,283 |

|

$ |

72,584 |

QORVO, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(In thousands)(Unaudited)

| |

October 1, 2022 |

|

April 2, 2022 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

911,570 |

|

$ |

972,592 |

|

Accounts receivable, net |

|

645,125 |

|

|

568,850 |

|

Inventories |

|

840,850 |

|

|

755,748 |

|

Other current assets |

|

123,739 |

|

|

152,675 |

|

Total current assets |

|

2,521,284 |

|

|

2,449,865 |

| |

|

|

|

| Property and equipment,

net |

|

1,222,924 |

|

|

1,253,591 |

| Goodwill |

|

2,757,124 |

|

|

2,775,634 |

| Intangible assets, net |

|

585,860 |

|

|

674,786 |

| Long-term investments |

|

29,452 |

|

|

31,086 |

| Other non-current assets |

|

258,088 |

|

|

324,110 |

|

Total assets |

$ |

7,374,732 |

|

$ |

7,509,072 |

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable and accrued liabilities |

$ |

621,129 |

|

$ |

568,101 |

|

Other current liabilities |

|

142,998 |

|

|

107,026 |

|

Total current liabilities |

|

764,127 |

|

|

675,127 |

| |

|

|

|

| Long-term debt |

|

2,047,398 |

|

|

2,047,098 |

| Other long-term

liabilities |

|

241,067 |

|

|

233,629 |

|

Total liabilities |

|

3,052,592 |

|

|

2,955,854 |

| |

|

|

|

| Stockholders’ equity |

|

4,322,140 |

|

|

4,553,218 |

|

Total liabilities and stockholders’ equity |

$ |

7,374,732 |

|

$ |

7,509,072 |

At Qorvo®Doug DeLietoVP, Investor Relations1.336.678.7968

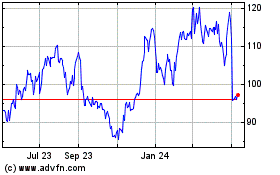

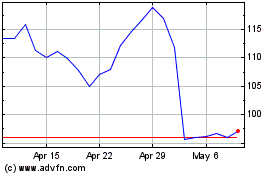

Qorvo (NASDAQ:QRVO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Qorvo (NASDAQ:QRVO)

Historical Stock Chart

From Nov 2023 to Nov 2024