Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

March 08 2024 - 5:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2024

Commission File Number: 001-40086

Portage Biotech Inc.

(Translation of registrant’s name into English)

Clarence Thomas Building, P.O. Box 4649, Road Town, Tortola, British

Virgin Islands, VG1110

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

INCORPORATION BY REFERENCE

This report on Form 6-K (including

any exhibits attached hereto) shall be deemed to be incorporated by reference into the registration statements on Form F-3 (File No. 333-253468)

and Form S-8 (File No. 333-275842) of Portage Biotech Inc. (including any prospectuses forming a part of such registration statements)

and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently

filed or furnished.

On March 7, 2024, Portage Biotech Inc. (the “Company”)

received written notice (the “Notice”) from The Nasdaq Stock Market, LLC (“Nasdaq”) indicating that the Company

is not in compliance with the $1.00 minimum bid price requirement for continued listing on The Nasdaq Capital Market, as set forth in

Nasdaq Listing Rule 5550(a)(2). The Notice has no effect at this time on the listing of the Company’s ordinary shares (the “Ordinary

Shares”), which continue to trade on The Nasdaq Capital Market under the symbol “PRTG”.

In accordance with Nasdaq Listing Rule 5810(c)(3)(A),

the Company has a period of 180 calendar days, or until September 3, 2024, to regain compliance with the minimum bid price requirement.

To regain compliance, the closing bid price of the Company’s Ordinary Shares must meet or exceed $1.00 per share for a minimum of

ten consecutive business days during this 180-day period.

If the Company is not in compliance by September

3, 2024, the Company may qualify for a second 180 calendar day compliance period. If the Company does not qualify for, or fails to regain

compliance during, the second compliance period, then Nasdaq will notify the Company of its determination to delist its Ordinary Shares,

at which point the Company would have an opportunity to appeal the delisting determination to a Nasdaq hearings panel.

The Company intends to actively monitor the closing

bid price of its Ordinary Shares and may, if appropriate, consider implementing available options to regain compliance with the minimum

bid price requirement under the Nasdaq Listing Rules.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

This report on Form 6-K contains forward-looking

statements, including, but not limited to, statements regarding the Company’s ability to regain compliance with the minimum bid

price requirement, the Company’s intentions to actively monitor the closing bid price of its Ordinary Shares and the Company’s

plans to consider implementing available options to regain compliance with the minimum bid price requirement. The Company’s actual

results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these

risks and uncertainties, including the risk that the Company may not meet the minimum bid price requirement during any compliance period

or in the future, the risk that the Company may not otherwise meet the requirements for continued listing under the Nasdaq Listing Rules,

the risk that Nasdaq may not grant the Company relief from delisting if necessary, the risk that the Company may not ultimately meet applicable

Nasdaq requirements if any such relief is necessary, among other risks and uncertainties. A further description of the risks and uncertainties

relating to the business of the Company is contained in the Company’s most recent annual report on Form 20-F, as well as any amendments

thereto reflected in subsequent filings with the Securities and Exchange Commission. The Company undertakes no duty or obligation to update

any forward-looking statements contained in this report as a result of new information, future events or changes in its expectations.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

PORTAGE BIOTECH INC.

| By: |

/s/ Allan Shaw |

|

| |

Allan Shaw |

|

| |

Chief Financial Officer |

|

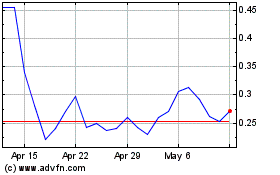

Portage Biotech (NASDAQ:PRTG)

Historical Stock Chart

From Jun 2024 to Jul 2024

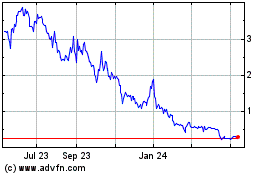

Portage Biotech (NASDAQ:PRTG)

Historical Stock Chart

From Jul 2023 to Jul 2024