As filed with the Securities and Exchange Commission on December 6, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

|

|

Ponce Financial Group, Inc. |

(Exact Name of Registrant as Specified in its Charter) |

Maryland |

|

87-1893965 |

(State or Other Jurisdiction of Incorporation or Organization) |

|

I.R.S. Employer Identification No. |

2244 Westchester Avenue Bronx, NY 10462 |

(Address of Principal Executive Offices) |

|

Ponce Financial Group, Inc. 2023 Long Term Incentive Plan |

(Full Title of the Plan) |

|

|

|

Carlos P. Naudon |

|

Copy to: |

President and Chief Executive Officer |

Douglas P. Faucette, Esq. |

Ponce Financial Group, Inc. |

Locke Lord LLP |

2244 Westchester Avenue |

701 8th Street, N.W., Suite 700 |

Bronx, New York 10462 |

Washington, D.C., 20010 |

(718) 931-9000 |

(202) 220-6900 |

(Name, Address and Telephone |

|

Number of Agent for Service) |

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer |

[ ] |

|

Accelerated filer |

[ ] |

Non-accelerated filer |

[X] |

|

Smaller reporting company |

[X] |

|

|

|

Emerging growth company |

[ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

___________________

This Registration Statement shall become effective upon filing in accordance with Section 8(a) of the Securities Act and 17 C.F.R. Section 230.462 under the Securities Act.

PART I.

Items 1 and 2. Plan Information and Registrant Information and Employee Plan Annual Information.

The documents containing the information specified in Part I of Form S-8 have been or will be sent or given to participants in the Incentive Plan as specified by Rule 428(b)(1) promulgated by the Securities and Exchange Commission (the “Commission”) under the Securities Act by Ponce Financial Group, Inc. (the “Company” or the “Registrant”).

Such documents are not being filed with the Commission, but constitute (along with the documents incorporated by reference into this Registration Statement pursuant to Item 3 of Part II hereof) prospectuses that meet the requirements of Section 10(a) of the Securities Act.

PART II.

Item 3. Incorporation of Documents by Reference.

The following documents, which have heretofore been filed by the Registrant with the Commission pursuant to the Securities Act and pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated by reference herein and shall be deemed to be a part hereof:

|

|

|

|

● |

The Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed on March 21, 2023, including information specifically incorporated by reference into such Annual Report on Form 10-K from our Definitive Proxy Statement on Schedule 14A for our 2023 Annual General Meeting of Shareholders filed on April 28, 2023; |

|

|

|

|

● |

The Registrant’s Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, filed on May 15, 2023, August 4, 2023, and November 9, 2023, respectively; |

|

|

|

|

● |

The Registrant’s Current Reports on Form 8-K filed on April 17, 2023, May 2, 2023, May 16, 2023, May 24, 2023, June 16, 2023, June 28, 2023, August 16, 2023, September 27, 2023, October 31, 2023, and November 20, 2023; and |

|

|

|

|

● |

The Description of Registrant’s Securities contained on Exhibit 4.2 to the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed on March 21, 2023, including any amendments or reports filed for the purpose of updating such description. |

In addition, all documents subsequently filed by the Registrant with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment to this Registration Statement which indicate that all securities offered hereby have been sold or which deregister all securities remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents. Notwithstanding the foregoing, unless specifically stated to the contrary, none of the information that the Registrant discloses under Items 2.02 or 7.01 of any Current Report on Form 8-K that it may from time to time furnish to the Commission will be incorporated by reference into, or otherwise included in, this Registration Statement.

Any statement, including financial statements, contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or therein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

None.

Item 6. Indemnification of Directors and Officers.

Articles 10 and 11 of the Articles of Incorporation of the Company set forth circumstances under which directors, officers, employees and agents of the Company may be insured or indemnified against liability which they incur in their capacities as such. References to the “Corporation” in the Articles of Incorporation mean the Company.

ARTICLE 10. Indemnification, etc. of Directors and Officers.

A. Indemnification. The Corporation shall indemnify (1) its current and former directors and officers, whether serving the Corporation or at its request any other entity, to the fullest extent required or permitted by the MGCL now or hereafter in force, including the advancement of expenses under the procedures and to the fullest extent permitted by law, and (2) other employees and agents to such extent as shall be authorized by the Board of Directors and permitted by law; provided, however, that, except as provided in Section B of this Article 10 with respect to proceedings to enforce rights to indemnification, the Corporation shall indemnify any such indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding (or part thereof) was authorized by the Board of Directors of the Corporation.

B. Procedure. If a claim under Section A of this Article 10 is not paid in full by the Corporation within sixty (60) days after a written claim has been received by the Corporation, except in the case of a claim for an advancement of expenses, in which case the applicable period shall be twenty (20) days, the indemnitee may at any time thereafter bring suit against the Corporation to recover the unpaid amount of the claim. If successful in whole or in part in any such suit, or in a suit brought by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the indemnitee shall also be entitled to be reimbursed the expense of prosecuting or defending such suit. It shall be a defense to any action for advancement of expenses that the Corporation has not received both (i) an undertaking as required by law to repay such advances in the event it shall ultimately be determined that the standard of conduct has not been met and (ii) a written affirmation by the indemnitee of his good faith belief that the standard of conduct necessary for indemnification by the Corporation has been met. In (i) any suit brought by the indemnitee to enforce a right to indemnification hereunder (but not in a suit brought by the indemnitee to enforce a right to an advancement of expenses) it shall be a defense that, and (ii) any suit by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking the Corporation shall be entitled to recover such expenses upon a final adjudication that, the indemnitee has not met the applicable standard for indemnification set forth in the MGCL. Neither the failure of the Corporation (including its Board of Directors, independent legal counsel, or its stockholders) to have made a determination prior to the commencement of such suit that indemnification of the indemnitee is proper in the circumstances because the indemnitee has met the applicable standard of conduct set forth in the MGCL, nor an actual determination by the Corporation (including its Board of Directors, independent legal counsel, or its stockholders) that the indemnitee has not met such applicable standard of conduct, shall create a presumption that the indemnitee has not met the applicable standard of conduct or, in the case of such a suit brought by the indemnitee, be a defense to such suit. In any suit brought by the indemnitee to enforce a right to indemnification or to an advancement of expenses hereunder, or by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the burden of proving that the indemnitee is not entitled to be indemnified, or to such advancement of expenses, under this Article 10 or otherwise shall be on the Corporation.

C. Non-Exclusivity. The rights to indemnification and to the advancement of expenses conferred in this Article 10 shall not be exclusive of any other right that any Person may have or hereafter acquire under any statute, these Articles, the Corporation’s Bylaws, any agreement, any vote of stockholders or the Board of Directors, or otherwise.

D. Insurance. The Corporation may maintain insurance, at its expense, to insure itself and any director, officer, employee or agent of the Corporation or another corporation, partnership, joint venture, trust or other enterprise against any expense, liability or loss, whether or not the Corporation would have the power to indemnify such Person against such expense, liability or loss under the MGCL.

E. Miscellaneous. The Corporation shall not be liable for any payment under this Article 10 in connection with a claim made by any indemnitee to the extent such indemnitee has otherwise actually received payment under any insurance policy, agreement, or otherwise, of the amounts otherwise indemnifiable hereunder. The rights to indemnification and to the advancement of expenses conferred in Sections A and B of this Article 10 shall be contract rights and such rights shall continue as to an indemnitee who has ceased to be a director or officer and shall inure to the benefit of the indemnitee’s heirs, executors and administrators.

F. Limitations Imposed by Federal Law. Notwithstanding any other provision set forth in this Article 10, in no event shall any payments made by the Corporation pursuant to this Article 10 exceed the amount permissible under applicable federal law, including, without limitation, Section 18(k) of the Federal Deposit Insurance Act and the regulations promulgated thereunder.

Any repeal or modification of this Article 10 shall not in any way diminish any rights to indemnification or advancement of expenses of such director or officer or the obligations of the Corporation arising hereunder with respect to events occurring, or claims made, while this Article 10 is in force.

ARTICLE 11. Limitation of Liability. An officer or director of the Corporation, as such, shall not be liable to the Corporation or its stockholders for money damages, except (A) to the extent that it is proved that the Person actually received an improper benefit or profit in money, property or services, for the amount of the benefit or profit in money, property or services actually received; or (B) to the extent that a judgment or other final adjudication adverse to the Person is entered in a proceeding based on a finding in the proceeding that the Person’s action, or failure to act, was the result of active and deliberate dishonesty and was material to the cause of action adjudicated in the proceeding; or (C) to the extent otherwise provided by the MGCL. If the MGCL is amended to further eliminate or limit the personal liability of officers and directors, then the liability of officers and directors of the Corporation shall be eliminated or limited to the fullest extent permitted by the MGCL, as so amended.

Any repeal or modification of the foregoing paragraph by the stockholders of the Corporation shall not adversely affect any right or protection of a director or officer of the Corporation existing at the time of such repeal or modification.

Item 7. Exemption From Registration Claimed.

Not applicable.

Item 8. List of Exhibits.

|

|

|

Regulation S-K Exhibit Number |

Document |

Reference to Prior Filing or Exhibit No. attached hereto |

|

|

|

4.1 |

Articles of Incorporation of Ponce Financial Group, Inc. |

Filed as Exhibit 3.1 to the Company’s Form S-1 Registration Statement, as amended, initially filed with the Commission on August 3, 2021 (Commission File No. 333-258394). |

4.2 |

Bylaws of Ponce Financial Group, Inc. |

Filed as Exhibit 3.2 to the Company’s Form S-1 Registration Statement, as amended, initially filed with the Commission on August 3, 2021 (Commission File No. 333-258394). |

4.3 |

Articles Supplementary to the Charter of Ponce Financial Group, Inc. |

Filed as Exhibit 3.1 to the Company’s current report on Form 8-K filed with the Commission on June 9, 2022 (Commission File No. 001-41255). |

Item 9. Undertakings.

The undersigned Company hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in the Volume of Securities Offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant's annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan's annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(5) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that, in the opinion of the Commission, such indemnification is against public policy as expressed in such Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer

or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification by it is against public policy as expressed in such Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on this Registration Statement on Form S-8 and has duly caused this Registration Statement on Form S-8 to be signed on its behalf by the undersigned, thereunto duly authorized, in the County of Bronx, State of New York, on this 6th day of December, 2023.

|

|

|

|

|

PONCE FINANCIAL GROUP, INC. |

|

|

|

|

By: |

/s/ Carlos P. Naudon |

|

|

Carlos P. Naudon |

|

|

President and Chief Executive Officer |

|

|

(Duly Authorized Representative) |

POWER OF ATTORNEY

We, the undersigned directors and officers of the Company hereby severally constitute and appoint Carlos P. Naudon as our true and lawful attorney and agent, to do any and all things in our names in the capacities indicated below which said Carlos P. Naudon may deem necessary or advisable to enable the Company to comply with the Securities Act of 1933, and any rules, regulations and requirements of the Securities and Exchange Commission, in connection with the registration statement on Form S-8 relating to the offering of the Company’s common stock issued under the Incentive Plan, including specifically, but not limited to, power and authority to sign for us in our names in the capacities indicated below the registration statement and any and all amendments (including post-effective amendments) thereto; and we hereby approve, ratify and confirm all that said Carlos P. Naudon shall do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement on Form S-8 has been signed by the following persons in the capacities and on the date indicated.

|

|

|

|

|

Signatures |

|

Title |

|

Date |

|

|

|

|

|

/s/ Carlos P. Naudon |

|

President, Chief Executive Officer and Director |

|

December 6, 2023 |

Carlos P. Naudon |

|

|

|

|

|

|

|

|

|

/s/ Sergio J. Vaccaro |

|

Executive Vice President and Chief Financial Officer |

|

December 6, 2023 |

Sergio J. Vaccaro |

|

|

|

|

|

|

|

|

|

/s/ Steven A. Tsavaris |

|

Executive Chairman and Director |

|

December 6, 2023 |

Steven A. Tsavaris |

|

|

|

|

|

|

|

|

|

/s/ James Demetriou |

|

Director |

|

December 6, 2023 |

James Demetriou |

|

|

|

|

|

|

|

|

|

/s/ William Feldman |

|

Director |

|

December 6, 2023 |

William Feldman |

|

|

|

|

|

|

|

|

|

/s/ Julio Gurman |

|

Director |

|

December 6, 2023 |

Julio Gurman |

|

|

|

|

|

|

|

|

|

/s/ Maria Alvarez |

|

Director |

|

December 6, 2023 |

Maria Alvarez |

|

|

|

|

|

|

|

|

|

/s/ James Perez |

|

Director |

|

December 6, 2023 |

James Perez |

|

|

|

|

|

|

|

|

|

/s/ Nick Lugo |

|

Director |

|

December 6, 2023 |

Nick Lugo |

|

|

|

|

|

|

|

Exhibit 5.1 701 8th Street, N.W. Suite 500 Washington, DC 20001 Telephone: 202-220-6900 Fax: 202-220-6945 www.lockelord.com |

December 6, 2023

Ponce Financial Group, Inc.

2244 Westchester Avenue

Bronx, New York 10462

RE: Ponce Financial Group, Inc. – Registration Statement on Form S-8

Ladies and Gentlemen:

You have requested the opinion of this firm as to certain matters in connection with the registration on Form S-8 of shares of common stock, par value $0.01 per share (the “Shares”) of Ponce Financial Group, Inc. (the “Company”) in connection with the issuance of up to 1,920,368 Shares to be issued pursuant to the Company’s 2023 Long-Term Incentive Plan (the “Incentive Plan”).

In rendering the opinion expressed herein, we have reviewed the Articles of Incorporation and By-laws of the Company, the proceedings of the Company’s board of directors, the Incentive Plan, the Company’s Registration Statement on Form S-8 (the “Form S-8”), as well as applicable statutes and regulations governing the Company. We have assumed the authenticity, accuracy and completeness of all documents in connection with the opinion expressed herein. We have also assumed the legal capacity and genuineness of the signatures of persons signing all documents in connection with which the opinions expressed herein are rendered.

Based on the foregoing, we are of the opinion that following the effectiveness of the Form S-8, the Shares, when issued in accordance with the terms and conditions of the Incentive Plan, will be legally issued, fully paid and non-assessable.

This opinion has been prepared solely for the use of the Company in connection with the preparation and filing of the Form S-8, and shall not be used for any other purpose. We hereby consent to the use of this opinion in the Form S-8.

Very truly yours,

/s/ Locke Lord LLP

Locke Lord LLP

Exhibit 23.2

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated March 21, 2023, relating to the consolidated financial statements of Ponce Financial Group, Inc. appearing in the Ponce Financial Group, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022.

/s/ Mazars USA LLP

New York, New York

December 6, 2023

Exhibit 107.1

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Ponce Financial Group, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Security Type |

|

Security Class Title |

|

Fee

Calculation

Rule |

|

Amount

Registered(1) |

|

|

Proposed

Maximum

Offering

Price Per

Share(2) |

|

Maximum

Aggregate

Offering

Price |

|

Fee

Rate |

|

Amount of

Registration

Fee |

Equity |

|

Common Stock, par value $0.01 per share |

|

457(c) and (h) |

|

1,920,368 |

|

|

|

|

|

$9.07 |

|

$17,417,737.76 |

|

$0.00014760 |

|

$2,570.86 |

Total Offering Amounts |

|

|

|

|

|

|

|

|

|

|

|

$2,570.86 |

Total Fee Offsets |

|

|

|

|

|

|

|

|

|

|

|

$0 |

Net Fee Due |

|

|

|

|

|

|

|

|

|

|

|

$2,570.86 |

|

|

(1) |

This Registration Statement registers the maximum number of shares of common stock issuable under our 2023 Long-Term Incentive Plan (the “Plan”). The maximum number of shares that may be delivered pursuant to the exercise of stock options or SARs (all of which may be granted in the form of incentive stock options, and at least 480,092 shares of which must be premium options) is 1,371,691 and the number of shares that may be issued as restricted stock awards or restricted stock units is 548,677 without reducing available options or SARs. In the event that restricted stock or restricted stock units are awarded in excess of 548,677 shares, then the maximum number of options or SARs that can be issued is reduced by three (3) shares for each share of restricted stock or a restricted stock unit awarded in excess of 548,677 shares. If no options or SARs are issued under the Plan, a maximum of 845,877 shares in connection with restricted stock or restricted stock units could be issued. Pursuant to Rule 416(a) under the Securities Act of 1933, as amended, this Registration Statement shall also cover additional shares of common stock which become issuable under the Plan by reason of any stock split, stock dividend, recapitalization, or other similar transaction. |

(2) |

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h)(1) of the Securities Act of 1933. The price per share and aggregate offering price are based upon the average of the high and low asked prices of the Registrant’s common stock on December 1, 2023, as reported on the Nasdaq Global Market. |

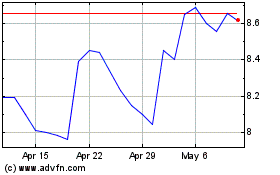

Ponce Financial (NASDAQ:PDLB)

Historical Stock Chart

From Apr 2024 to May 2024

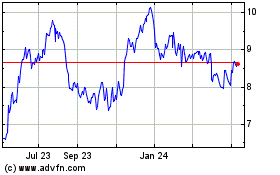

Ponce Financial (NASDAQ:PDLB)

Historical Stock Chart

From May 2023 to May 2024