Penns Woods Bancorp, Inc. Announces Extension of Stock Repurchase Program

April 22 2008 - 2:45PM

Business Wire

Ronald A. Walko, President and CEO of Penns Woods Bancorp, Inc.,

(NASDAQ:PWOD) has announced that the Company�s Board of Directors

has authorized the extension of its repurchase plan of up to

197,000 shares, or approximately 5%, of the outstanding shares of

the Company for an additional year to April 30, 2009. To date,

75,227, or 38% of the total 197,000 shares have been repurchased.

Repurchases are authorized to be made by the Company from time to

time at the prevailing market prices on the open market in block

trades or in privately negotiated transactions as, in management�s

opinion, market conditions warrant. Shares repurchased will be held

in Treasury. �The repurchase plan serves as a tool that assists the

Company in managing its capital position effectively and provides

added liquidity for shareholders,� commented Mr. Walko. �The

repurchase plan, in addition to our strong dividend yield, provides

a strong base to meet our objective to provide an acceptable return

to our shareholders.� Penns Woods Bancorp, Inc. is the parent

company of Jersey Shore State Bank, which operates thirteen branch

offices providing financial services in Lycoming, Clinton, and

Centre Counties. Investment and insurance products are offered

through the bank�s subsidiary, The M Group, Inc. D/B/A The

Comprehensive Financial Group. Note: This press release may contain

certain �forward-looking statements� including statements

concerning plans, objectives, future events or performance and

assumptions and other statements, which are statements other than

statements of historical fact. The Company cautions readers that

the following important factors, among others, may have affected

and could in the future affect actual results and could cause

actual results for subsequent periods to differ materially from

those expressed in any forward-looking statement made by or on

behalf of the Company herein: (i) the effect of changes in laws and

regulations, including federal and state banking laws and

regulations, and the associated costs of compliance with such laws

and regulations either currently or in the future as applicable;

(ii) the effect of changes in accounting policies and practices, as

may be adopted by the regulatory agencies as well as by the

Financial Accounting Standards Board, or of changes in the

Company�s organization, compensation and benefit plans; (iii) the

effect on the Company�s competitive position within its market area

of the increasing consolidation within the banking and financial

services industries, including the increased competition from

larger regional and out-of-state banking organizations as well as

non-bank providers of various financial services; (iv) the effect

of changes in interest rates; and (v) the effect of changes in the

business cycle and downturns in the local, regional or national

economies. Previous press releases and additional information can

be obtained from the Company�s website at www.jssb.com.

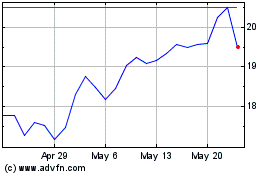

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jun 2024 to Jul 2024

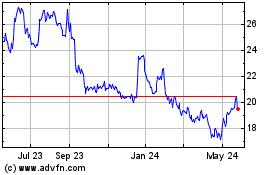

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jul 2023 to Jul 2024