Penns Woods Bancorp, Inc. (NASDAQ:PWOD) today reported that net

income from core operations (�operating earnings�), which excludes

net security gains and losses, increased to $2,383,000 and

$8,913,000 for the three and twelve months ended December 31, 2007

compared to $2,100,000 and $8,539,000 for the same periods of 2006.

Operating earnings per share for the three months ended December

31, 2007 increased 13.0% or $0.07 to $0.61 basic and dilutive

compared to the three months ended December 31, 2006. Operating

earnings for the fourth quarter of 2007 represent a $0.01 basic and

dilutive increase from the previous three month period as core

earnings continued to build upon the $0.05 increase from the second

to third quarters of 2007. In addition, the $0.01 growth in

operating earnings per share represents the fourth consecutive

quarter of increases. Operating earnings for the twelve months

ended December 31, 2007 were positively impacted by continued

strong credit quality, which has led to a reduction in the

provision for loan losses, strong noninterest income of 17.3% of

core revenue (interest income and noninterest income excluding net

security gains and losses), and a reduction in tax expense due to a

shift in the investment portfolio to tax-exempt bonds and

additional federal tax credits related to low income housing

partnerships. The impact of these items resulted in basic and

dilutive operating earnings increasing 5.5% to $2.29 for the twelve

months ended December 31, 2007 compared to $2.17 for the twelve

months ended December 31, 2006. Net income, as reported under U.S.

Generally Accepted Accounting Principles, for the three and twelve

months ended December 31, 2007 was $1,939,000 and $8,877,000 as

compared to $2,294,000 and $9,647,000 for the same periods of 2006.

Comparable results were impacted by a decrease in after-tax

securities gains of $638,000 (from $194,000 to a loss of $444,000)

and $1,144,000 (from $1,108,000 to a loss of $36,000) from 2006 to

2007 for the three and twelve month periods being compared. Basic

and dilutive earnings per share for the three months ended December

31, 2007 were $0.50 compared to $0.59 for the three months ended

December 31, 2006. The twelve months ended December 31, 2007 had

basic and dilutive earnings per share of $2.28 compared to $2.45

for the twelve months ended December 31, 2006. Return on average

assets and return on average equity were 1.25% and 10.68% for the

three months ended December 31, 2007 as compared to 1.56% and

12.18% for the corresponding period of 2006. Earnings for the

twelve months ended December 31, 2007 correlate to a return on

average assets and return on average equity of 1.49% and 12.14% as

compared to 1.67% and 12.93% for the twelve months ended December

31, 2006. The net interest margin for the three and twelve months

ended December 31, 2007 was 3.93% and 3.95% as compared to 3.97%

and 4.06% for the corresponding periods of 2006. The minimal

decrease in the net interest margin was due to the cost of interest

bearing liabilities continuing to increase at a rate greater than

the increase in the yield on earning assets over the past twelve

months. However, for the three month period ended December 31, 2007

compared to the same period of 2006, the interest rate spread

between the yield on earning assets and the cost of interest

bearing liabilities improved by 5 basis points (�bp�). The increase

in the cost of interest bearing liabilities was driven primarily by

the cost of time deposits increasing 24 bp for the three months

ended December 31, 2007 and 62 bp for the twelve month period as

compared to the previous year. The increase in cost of time

deposits was impacted by the Federal Open Market Committee rate

increases during 2006, utilization of brokered deposits, and our

strategic decision to gather time deposits as part of marketing

campaigns associated with branch promotions. Loan growth and a

shift in the investment portfolio toward tax-exempt bonds paved the

way for the increase in yield on earning assets of 21 bp for the

twelve month period ended December 31 2007 as compared to 2006.

�During the fourth quarter, the financial sector has been

negatively impacted as one large institution after another

announced sub prime loan related write downs. We, as a community

bank, take pride in not participating in subprime lending or the

purchase of investment securities with subprime loans as underlying

collateral. However, we, as with other banks and individuals, do

invest in financial sector companies with the majority of these

investments currently having a market value below our cost basis.

As a result, we determined that certain equity investments had

declined in value to a point that their market price recovery would

not occur in the near term and therefore was deemed to be other

than temporary in nature. This decision resulted in a fourth

quarter charge of $834,000 to earnings to reduce our carrying value

of these investments,� commented Ronald A. Walko, President and

Chief Executive Officer of Penns Woods Bancorp, Inc. �Regarding the

asset quality of the loan portfolio, our continued commitment to

sound lending practices and credit standards has produced a

nonperforming loans to total loans ratio of only 0.37% at December

31, 2007 and annualized net loan charge-offs to average loans of

only 0.06% for the twelve month period, while maintaining a sound

allowance for loan losses to loans of 1.15% compared to 1.16% at

December 31, 2006,� added Mr. Walko. Total assets increased

$35,853,000 to $628,138,000 at December 31, 2007 compared to

December 31, 2006. A softening economic environment coupled with

our credit quality standards led to net loans remaining stable at

$356,348,000. Growth in the investment portfolio of $29,249,000

from December 31, 2006 to December 31, 2007 was primarily the

result of a leverage strategy initiated during the latter part of

2007. Total deposits decreased to $389,022,000 at December 31, 2007

compared to $395,191,000 at December 31, 2006 as higher cost

brokered time deposits were reduced by $16,194,000 to $8,834,000 at

December 31, 2007. �In light of the loan environment, the

investment leverage strategy allowed us to grow quality earning

assets at a spread to our funding cost that was accretive to both

the return on equity and return on assets, while providing

sufficient liquidity for future needs,� commented Mr. Walko.

Shareholders� equity decreased $4,035,000 to $70,559,000 at

December 31, 2007 as accumulated comprehensive income decreased

$5,094,000, and $972,000 in treasury stock was strategically

purchased as part of the previously announced stock buyback plan,

while net income outpaced dividends paid. The decrease in

accumulated comprehensive income is the result of a decrease in

market value of certain securities held in the investment portfolio

at December 31, 2007 compared to December 31, 2006, and the net

excess of the projected benefit obligation over the market value of

the plan assets of the defined benefit pension plan. The current

level of shareholders� equity equates to a book value per share of

$18.21 at December 31, 2007 compared to $19.12 at December 31, 2006

and an equity to asset ratio of 11.24% at December 31, 2007. Book

value per share, excluding accumulated comprehensive income, was

$19.12 at December 31, 2007 compared to $18.72 at December 31,

2006. During the three and twelve months ended December 31, 2007

cash dividends of $0.46 and $1.79 per share were paid to

shareholders compared to $0.44 and $1.73 for the three and twelve

months ended December 31, 2006. �We remain committed to providing a

healthy dividend yield in excess of four percent and conducting

stock repurchases on the open market. The current dividend yield in

excess of 5.5%, coupled with the purchase of 28,530 shares on the

open market during 2007, illustrates our commitment to building

shareholder value. The strength of our earnings has allowed us to

continue and maintain these programs,� commented Mr. Walko. The

range of closing prices for Penns Woods Bancorp, Inc. stock was

between $30.33 and $32.50 during the three months ended December

31, 2007 and between $30.33 and $37.75 during the twelve months

ended December 31, 2007. Penns Woods Bancorp, Inc. is the parent

company of Jersey Shore State Bank, which operates thirteen branch

offices providing financial services in Lycoming, Clinton, and

Centre Counties. Investment and insurance products are offered

through the bank�s subsidiary, The M Group, Inc. D/B/A The

Comprehensive Financial Group. NOTE: This press release contains

financial information determined by methods other than in

accordance with U.S. Generally Accepted Accounting Principles

("GAAP"). Management uses the non-GAAP measure of net income from

core operations in its analysis of the company's performance. This

measure, as used by the Company, adjusts net income determined in

accordance with GAAP to exclude the effects of special items,

including significant gains or losses that are unusual in nature.

Because certain of these items and their impact on the Company�s

performance are difficult to predict, management believes

presentation of financial measures excluding the impact of such

items provides useful supplemental information in evaluating the

operating results of the Company�s core businesses. These

disclosures should not be viewed as a substitute for net income

determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP performance measures that may be presented

by other companies. This press release may contain certain

�forward-looking statements� including statements concerning plans,

objectives, future events or performance and assumptions and other

statements, which are statements other than statements of

historical fact. The Company cautions readers that the following

important factors, among others, may have affected and could in the

future affect actual results and could cause actual results for

subsequent periods to differ materially from those expressed in any

forward-looking statement made by or on behalf of the Company

herein: (i) the effect of changes in laws and regulations,

including federal and state banking laws and regulations, and the

associated costs of compliance with such laws and regulations

either currently or in the future as applicable; (ii) the effect of

changes in accounting policies and practices, as may be adopted by

the regulatory agencies as well as by the Financial Accounting

Standards Board, or of changes in the Company�s organization,

compensation and benefit plans; (iii) the effect on the Company�s

competitive position within its market area of the increasing

consolidation within the banking and financial services industries,

including the increased competition from larger regional and

out-of-state banking organizations as well as non-bank providers of

various financial services; (iv) the effect of changes in interest

rates; and (v) the effect of changes in the business cycle and

downturns in the local, regional or national economies. Previous

press releases and additional information can be obtained from the

Company�s website at www.jssb.com. THIS INFORMATION IS SUBJECT TO

YEAR-END AUDIT ADJUSTMENT PENNS WOODS BANCORP, INC. CONSOLIDATED

BALANCE SHEET (UNAUDITED) � � � (In Thousands, Except Share Data)

December 31, � 2007 � � 2006 � % Change � � ASSETS

Noninterest-bearing balances $ 15,417 $ 15,348 0.4 %

Interest-bearing deposits in other financial institutions � 16 � �

25 � -36.0 % Total cash and cash equivalents 15,433 15,373 0.4 % �

Investment securities, available for sale, at fair value 214,455

185,200 15.8 % Investment securities held to maturity (fair value

of $279 and $286) 277 283 -2.1 % Loans held for sale 4,214 3,716

13.4 % Loans 360,478 360,384 0.0 % Less: Allowance for loan losses

� 4,130 � � 4,185 � -1.3 % Loans, net 356,348 356,199 0.0 %

Premises and equipment, net 6,774 6,737 0.5 % Accrued interest

receivable 3,343 2,939 13.7 % Bank-owned life insurance 12,375

11,346 9.1 % Investment in limited partnerships 5,439 4,950 9.9 %

Goodwill 3,032 3,032 0.0 % Other assets � 6,448 � � 2,510 � 156.9 %

TOTAL ASSETS $ 628,138 � $ 592,285 � 6.1 % � LIABILITIES

Interest-bearing deposits $ 314,351 $ 322,031 -2.4 %

Noninterest-bearing deposits � 74,671 � � 73,160 � 2.1 % Total

deposits 389,022 395,191 -1.6 % � Short-term borrowings 55,315

34,697 59.4 % Long-term borrowings, Federal Home Loan Bank (FHLB)

106,378 82,878 28.4 % Accrued interest payable 1,744 1,532 13.8 %

Other liabilities � 5,120 � � 3,393 � 50.9 % TOTAL LIABILITIES �

557,579 � � 517,691 � 7.7 % � SHAREHOLDERS' EQUITY Common stock,

par value $8.33, 10,000,000 shares authorized; 4,006,934 and

4,003,514 shares issued 33,391 33,362 0.1 % Additional paid-in

capital 17,888 17,810 0.4 % Retained earnings 27,707 25,783 7.5 %

Accumulated other comprehensive income (loss): Net unrealized

(loss) gain on available for sale securities (2,159 ) 2,139 -200.9

% Defined benefit plan (1,375 ) (579 ) 137.5 % Less: Treasury stock

at cost, 131,302 and 102,772 shares � (4,893 ) � (3,921 ) 24.8 %

TOTAL SHAREHOLDERS' EQUITY � 70,559 � � 74,594 � -5.4 % TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY $ 628,138 � $ 592,285 � 6.1 %

PENNS WOODS BANCORP, INC. CONSOLIDATED STATEMENT OF INCOME

(UNAUDITED) � � � � � � � (In Thousands, Except Per Share Data)

Three Months Ended Twelve Months Ended December 31, December 31, �

2007 � � 2006 % Change � � 2007 � � 2006 % Change � � INTEREST AND

DIVIDEND INCOME: Loans including fees $ 6,539 $ 6,628 -1.3 % $

26,099 $ 24,878 4.9 % Investment Securities: Taxable 1,387 886 56.5

% 4,098 3,577 14.6 % Tax-exempt 1,086 1,034 5.0 % 4,357 4,027 8.2 %

Dividend and other interest income � 488 � � 289 68.9 % � 1,395 � �

1,271 9.8 % TOTAL INTEREST AND DIVIDEND INCOME � 9,500 � � 8,837

7.5 % � 35,949 � � 33,753 6.5 % � INTEREST EXPENSE: Deposits 2,736

2,656 3.0 % 10,951 8,908 22.9 % Short-term borrowings 539 282 91.1

% 1,639 1,503 9.0 % Long-term borrowings, FHLB � 1,122 � � 955 17.5

% � 3,857 � � 3,799 1.5 % TOTAL INTEREST EXPENSE � 4,397 � � 3,893

12.9 % � 16,447 � � 14,210 15.7 % � NET INTEREST INCOME 5,103 4,944

3.2 % 19,502 19,543 -0.2 % � PROVISION FOR LOAN LOSSES � 90 � � 150

-40.0 % � 150 � � 635 -76.4 % � NET INTEREST INCOME AFTER PROVISION

FOR LOAN LOSSES � 5,013 � � 4,794 4.6 % � 19,352 � � 18,908 2.3 % �

NON-INTEREST INCOME: Deposit service charges 592 593 -0.2 % 2,246

2,366 -5.1 % Securities gains (losses), net (673 ) 294 -328.9 % (54

) 1,679 -103.2 % Bank-owned life insurance 100 102 -2.0 % 410 374

9.6 % Gain on sale of loans 267 229 16.6 % 921 853 8.0 % Insurance

commissions 609 549 10.9 % 2,222 2,281 -2.6 % Other � 417 � � 322

29.5 % � 1,733 � � 1,476 17.4 % TOTAL NON-INTEREST INCOME � 1,312 �

� 2,089 -37.2 % � 7,478 � � 9,029 -17.2 % � NON-INTEREST EXPENSE:

Salaries and employee benefits 2,166 2,213 -2.1 % 9,078 8,833 2.8 %

Occupancy, net 319 311 2.6 % 1,306 1,137 14.9 % Furniture and

equipment 276 307 -10.1 % 1,126 1,201 -6.2 % Pennsylvania shares

tax 161 151 6.6 % 643 598 7.5 % Other � 1,496 � � 1,204 24.3 % �

5,163 � � 4,560 13.2 % TOTAL NON-INTEREST EXPENSE � 4,418 � � 4,186

5.5 % � 17,316 � � 16,329 6.0 % � INCOME BEFORE INCOME TAX

PROVISION 1,907 2,697 -29.3 % 9,514 11,608 -18.0 % INCOME TAX

(BENEFIT) PROVISION � (32 ) � 403 -107.9 % � 637 � � 1,961 -67.5 %

NET INCOME $ 1,939 � $ 2,294 -15.5 % $ 8,877 � $ 9,647 -8.0 % �

EARNINGS PER SHARE - BASIC $ 0.50 � $ 0.59 -15.3 % $ 2.28 � $ 2.45

-6.9 % � EARNINGS PER SHARE - DILUTED $ 0.50 � $ 0.59 -15.3 % $

2.28 � $ 2.45 -6.9 % � WEIGHTED AVERAGE SHARES OUTSTANDING - BASIC

� 3,878,127 � � 3,909,226 -0.8 % � 3,886,277 � � 3,934,138 -1.2 % �

WEIGHTED AVERAGE SHARES OUTSTANDING - DILUTED � 3,878,287 � �

3,909,693 -0.8 % � 3,886,514 � � 3,934,617 -1.2 % � DIVIDENDS PER

SHARE $ 0.46 � $ 0.44 4.5 % $ 1.79 � $ 1.73 3.5 % � PENNS WOODS

BANCORP, INC. AVERAGE BALANCES AND INTEREST RATES � � For the Three

Months Ended December 31, 2007 � December 31, 2006 Average Balance

� Interest � Average Rate Average Balance � Interest � Average Rate

ASSETS: Tax-exempt loans $ 7,663 $ 120 6.21 % $ 8,265 $ 126 6.05 %

All other loans � 354,473 � 6,460 � 7.23 % � 362,467 � 6,545 7.16 %

Total loans � 362,136 � 6,580 � 7.21 % � 370,732 � 6,671 7.14 % �

Taxable securities 115,883 1,874 6.47 % 85,588 1,173 5.48 %

Tax-exempt securities � 100,416 � 1,645 � 6.55 % � 97,798 � 1,566

6.41 % Total securities � 216,299 � 3,519 � 6.51 % � 183,386 �

2,739 5.97 % � Interest bearing deposits � 91 � 1 � 4.36 % � 125 �

2 6.35 % � Total interest-earning assets 578,526 � 10,100 � 6.95 %

554,243 � 9,412 6.75 % � Other assets � 43,219 � 34,168 � TOTAL

ASSETS $ 621,745 $ 588,411 � LIABILITIES AND SHAREHOLDERS' EQUITY:

Savings $ 55,693 100 0.71 % $ 58,422 112 0.76 % Super Now deposits

47,446 156 1.30 % 45,689 167 1.45 % Money Market deposits 22,610

125 2.19 % 23,059 125 2.15 % Time deposits � 196,925 � 2,355 � 4.74

% � 198,484 � 2,252 4.50 % Total Deposits � 322,674 � 2,736 � 3.36

% � 325,654 � 2,656 3.24 % � Short-term borrowings 49,792 539 4.29

% 25,111 282 4.46 % Long-term borrowings � 97,356 � 1,122 � 4.57 %

� 82,878 � 955 4.57 % Total borrowings � 147,148 � 1,661 � 4.48 % �

107,989 � 1,237 4.54 % � Total interest-bearing liabilities 469,822

� 4,397 � 3.71 % 433,643 � 3,893 3.56 % � Demand deposits 72,179

72,035 Other liabilities 7,085 7,408 Shareholders' equity � 72,659

� 75,325 � TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 621,745 $

588,411 Interest rate spread � 3.24 % 3.19 % Net interest

income/margin $ 5,703 � 3.93 % $ 5,519 3.97 % � � For the Three

Months Ended December 31, � 2007 2006 � Total interest income $

9,500 $ 8,837 Total interest expense � 4,397 � 3,893 � � Net

interest income 5,103 4,944 Tax equivalent adjustment � 600 � 575 �

� Net interest income (fully taxable equivalent) $ 5,703 $ 5,519 �

� � PENNS WOODS BANCORP, INC. AVERAGE BALANCES AND INTEREST RATES �

� � � � � For the Twelve Months Ended December 31, 2007 December

31, 2006 Average Balance Interest Average Rate Average Balance

Interest Average Rate ASSETS: Tax-exempt loans $ 7,857 $ 485 6.17 %

$ 8,173 $ 503 6.15 % All other loans � 353,528 � 25,779 � 7.29 % �

344,524 � 24,545 7.12 % Total loans � 361,385 � 26,264 � 7.27 % �

352,697 � 25,048 7.10 % � Taxable securities 93,480 5,474 5.86 %

91,767 4,837 5.27 % Tax-exempt securities � 99,728 � 6,602 � 6.62 %

� 92,692 � 6,102 6.58 % Total securities � 193,208 � 12,076 � 6.25

% � 184,459 � 10,939 5.93 % � Interest bearing deposits � 345 � 19

� 5.51 % � 152 � 11 7.24 % � Total interest-earning assets 554,938

� 38,359 � 6.91 % 537,308 � 35,998 6.70 % � Other assets � 42,602 �

40,413 � TOTAL ASSETS $ 597,540 $ 577,721 � LIABILITIES AND

SHAREHOLDERS' EQUITY: Savings $ 58,710 428 0.73 % $ 61,958 509 0.82

% Super Now deposits 46,596 611 1.31 % 47,294 655 1.38 % Money

Market deposits 23,920 540 2.26 % 23,905 493 2.06 % Time deposits �

198,029 � 9,372 � 4.73 % � 176,521 � 7,251 4.11 % Total Deposits �

327,255 � 10,951 � 3.35 % � 309,678 � 8,908 2.88 % � Short-term

borrowings 36,816 1,639 4.45 % 34,612 1,503 4.34 % Long-term

borrowings � 83,490 � 3,857 � 4.62 % � 83,237 � 3,799 4.56 % Total

borrowings � 120,306 � 5,496 � 4.57 % � 117,849 � 5,302 4.50 % �

Total interest-bearing liabilities 447,561 � 16,447 � 3.67 %

427,527 � 14,210 3.32 % � Demand deposits 69,953 69,668 Other

liabilities 6,924 5,899 Shareholders' equity � 73,102 � 74,627 �

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 597,540 $ 577,721

Interest rate spread � 3.24 % 3.38 % Net interest income/margin $

21,912 � 3.95 % $ 21,788 4.06 % � � For the Twelve Months Ended

December 31, � 2007 2006 � Total interest income $ 35,949 $ 33,753

Total interest expense � 16,447 � 14,210 � � Net interest income

19,502 19,543 Tax equivalent adjustment � 2,410 � 2,245 � � Net

interest income (fully taxable equivalent) $ 21,912 $ 21,788 � �

Quarter Ended � (Dollars in Thousands, Except Per Share Data) �

12/31/2007 � � 9/30/2007 � � 6/30/2007 � � 3/31/2007 � � 12/31/2006

� � Operating Data � Net income $ 1,939 � $ 2,322 � $ 2,335 � $

2,281 � $ 2,294 � Net interest income � 5,103 � � 4,865 � � 4,794 �

� 4,740 � � 4,944 � Provision for loan losses � 90 � � 10 � � 10 �

� 40 � � 150 � Net security (losses) gains � (673 ) � - � � 293 � �

326 � � 294 � Non-interest income, ex. net security (loss)gains �

1,985 � � 2,006 � � 1,893 � � 1,648 � � 1,795 � Non-interest

expense � 4,418 � � 4,430 � � 4,340 � � 4,128 � � 4,186 � �

Performance Statistics � Net interest margin � 3.93 % � 3.98 % �

3.95 % � 3.95 % � 3.97 % Annualized return on average assets � 1.25

% � 1.57 % � 1.58 % � 1.56 % � 1.56 % Annualized return on average

equity � 10.68 % � 13.21 % � 12.57 % � 12.13 % � 12.18 % Annualized

net loan charge-offs to avg loans � 0.06 % � 0.09 % � 0.05 % � 0.03

% � 0.01 % Net charge-offs � 52 � � 80 � � 49 � � 24 � � 10 �

Efficiency ratio � 62.3 � � 64.5 � � 64.9 � � 64.6 � � 62.1 � � Per

Share Data � Basic earnings per share $ 0.50 � $ 0.60 � $ 0.60 � $

0.59 � $ 0.59 � Diluted earnings per share � 0.50 � � 0.60 � � 0.60

� � 0.59 � � 0.59 � Dividend declared per share � 0.46 � � 0.45 � �

0.44 � � 0.44 � � 0.44 � Book value � 18.21 � � 18.46 � � 17.93 � �

19.06 � � 19.12 � Common stock price: High � 32.50 � � 35.00 � �

35.00 � � 37.75 � � 38.59 � Low � 30.33 � � 30.80 � � 33.86 � �

35.00 � � 36.20 � Close � 32.50 � � 31.99 � � 34.24 � � 35.50 � �

37.80 � Weighted average common shares: Basic � 3,878 � � 3,881 � �

3,889 � � 3,897 � � 3,909 � Fully Diluted � 3,878 � � 3,882 � �

3,889 � � 3,898 � � 3,910 � End-of-period common shares: Issued �

4,007 � � 4,006 � � 4,005 � � 4,005 � � 4,004 � Treasury � 131 � �

129 � � 118 � � 113 � � 103 � � Quarter Ended � (Dollars in

Thousands, Except Per Share Data) 12/31/2007 � 9/30/2007 �

6/30/2007 � 3/31/2007 � 12/31/2006 � � � � Financial Condition

Data: General Total assets $ 628,138 � � $ 613,329 � � $ 586,572 �

� $ 586,591 � � $ 592,285 � Loans, net � 356,348 � � � 353,623 � �

� 352,013 � � � 353,373 � � � 356,199 � Intangibles � 3,032 � � �

3,032 � � � 3,032 � � � 3,032 � � � 3,032 � Total deposits �

389,022 � � � 404,854 � � � 405,903 � � � 384,849 � � � 395,191 �

Noninterest-bearing � 74,671 � � � 72,990 � � � 70,000 � � � 70,928

� � � 73,160 � � Savings � 56,757 � � � 59,883 � � � 59,798 � � �

60,496 � � � 59,289 � NOW � 50,883 � � � 47,129 � � � 48,555 � � �

48,427 � � � 46,156 � Money Market � 21,029 � � � 22,295 � � �

23,422 � � � 24,124 � � � 23,137 � Time Deposits � 185,682 � � �

202,557 � � � 204,128 � � � 180,874 � � � 193,449 � Total

interest-bearing deposits � 314,351 � � � 331,864 � � � 335,903 � �

� 313,921 � � � 322,031 � � Core deposits* � 203,340 � � � 202,297

� � � 201,775 � � � 203,975 � � � 201,742 � Shareholders' equity �

70,559 � � � 71,552 � � � 69,720 � � � 74,182 � � � 74,594 � �

Asset Quality � Non-performing assets $ 1,320 � � $ 1,013 � � $

1,098 � � $ 1,019 � � $ 489 � Non-performing assets to total assets

� 0.21 % � � 0.17 % � � 0.19 % � � 0.17 % � � 0.08 % Allowance for

loan losses � 4,130 � � � 4,092 � � � 4,162 � � � 4,201 � � � 4,185

� Allowance for loan losses to total loans � 1.15 % � � 1.14 % � �

1.17 % � � 1.17 % � � 1.16 % Allowance for loan losses to

non-performing loans � 312.88 % � � 403.95 % � � 379.05 % � �

412.27 % � � 855.83 % Non-performing loans to total loans � 0.37 %

� � 0.28 % � � 0.31 % � � 0.28 % � � 0.14 % � Capitalization �

Shareholders' equity to total assets � 11.23 % � � 11.67 % � �

11.89 % � � 12.65 % � � 12.59 % � * Core deposits are defined as

total deposits less time deposits

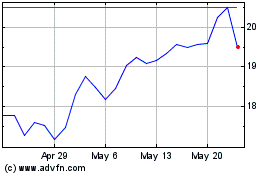

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jun 2024 to Jul 2024

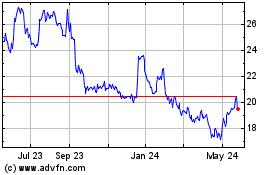

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jul 2023 to Jul 2024