0001826681false0001826681us-gaap:CommonStockMember2023-08-092023-08-0900018266812023-08-092023-08-090001826681strc:RedeemableWarrantMember2023-08-092023-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 09, 2023 |

Sarcos Technology and Robotics Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39897 |

85-2838301 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

650 South 500 West, Suite 150 |

|

Salt Lake City, Utah |

|

84101 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (888) 927-7296 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

STRC |

|

The Nasdaq Stock Market LLC |

Redeemable warrants, exercisable for shares of Common Stock at an exercise price of $69.00 per share |

|

STRCW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 9, 2023, Sarcos Technology and Robotics Corporation (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2023, and certain other information. A copy of the press release is furnished herewith as Exhibit 99.1. The information furnished in this Current Report under this Item 2.02 and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure.

The Company announces material information to the public through a variety of means, including filings with the SEC, public conference calls, the Company’s website (www.sarcos.com), its investor relations website (https://www.sarcos.com/investor-relations/), and its news site (https://www.sarcos.com/company/news/#press-releases). The Company uses these channels, as well as its social media, including its Twitter (@Sarcos_Robotics) and LinkedIn accounts (https://www.linkedin.com/company/sarcos/), to communicate with investors and the public news and developments about the Company, its products and other matters. Therefore, the Company encourages investors, the media, and others interested in the Company to review the information it makes public in these locations, as such information could be deemed to be material information.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Sarcos Technology and Robotics Corporation |

|

|

|

|

Date: |

August 9, 2023 |

By: |

/s/ Andrew Hamer |

|

|

Name: Title: |

Andrew Hamer

Chief Financial Officer |

Exhibit 99.1

Sarcos Technology and Robotics Corporation Announces Second Quarter 2023 Financial Results

SALT LAKE CITY— August 9, 2023—Sarcos Technology and RoboticsCorporation (“Sarcos”) (NASDAQ: STRC and STRCW), a leader in the design, development, and manufacture of advanced robotic systems, solutions and software that redefine human possibilities, today announced financial results for the quarter ended June 30, 2023.

Second Quarter and Recent Highlights

•Optimized ongoing operations, taking steps to improve efficiency and reduce cash spend

•Formed new Advanced Technologies software business division to drive emerging artificial intelligence (AI) SaaS revenue opportunities; bolstered by an expanded contract from the Air Force Research Laboratory (AFRL) for continued development of AI driven technologies

•Announced an agreement with Blattner Company to develop an autonomous robotic solar construction system

“As we announced on July 12, 2023, we are realigning the business and focusing our operations to capitalize on our most promising revenue opportunities, including Guardian® Sea Class, aviation and solar solutions, and our newly announced Advanced Technologies division,” said Laura Peterson, Interim President and Chief Executive Officer at Sarcos. “Additionally, we made the difficult, but strategic decision to reduce our workforce by approximately 25% and optimize our manufacturing facilities by consolidating our Pittsburgh manufacturing into our Salt Lake City location.

“I am confident these strategic decisions are right for Sarcos at this point in its growth as evidenced by recent milestones including our agreement with Blattner Company to develop an autonomous robotic solar construction system, our extended agreement with the Air Force Research Laboratory to continue to develop AI and software and services, and our agreement with VideoRay to develop underwater robotic systems.

“In addition, we have taken steps to significantly reduce our future cash usage and ended the quarter with $75 million in cash. We believe we have sufficient liquidity to operate into 2025 without additional financing.”

Financial results

Second quarter 2023 total revenue was $1.3 million, compared to $3.0 million during the second quarter of 2022.

Total operating expenses for the second quarter of 2023 were $31.2 million, compared to operating expenses of $32.0 million during the second quarter of 2022. In connection with the July 12, 2023, announced restructuring, the Company incurred charges of $5.1 million in the second quarter of 2023, including $4.4 million due to the write-down of inventory and $0.7 million related to the impairment of certain fixed assets. Cost of revenue decreased to $0.9 million in Q2 2023 as compared to $3.1 million in Q2 2022, mainly due to decreased labor and material expenses charged to product development contracts. Second quarter 2023 gross margin was 26%, compared to negative 4% in the second quarter of 2022.

Research and development expenses increased to $11.7 million as compared to $7.6 million in the second quarter of 2022, due to increased labor and overhead expense as a result of increased headcount (due in part to the RE2 acquisition) and increased direct materials charges. General and administrative expenses decreased

to $8.3 million in Q2 2023 as compared to $18.1 million in Q2 2022, primarily due to decreased stock-based compensation.

Second quarter 2023 net loss was $28.7 million or $1.12 per share, compared to a net loss of $23.1 million or $0.95 per share in the second quarter of the prior year.

Second quarter 2023 non-GAAP net loss was $21.9 million or $0.86 per diluted share. Reconciliation of net loss to non-GAAP net loss is included at the end of this release.

Please note, on July 5, 2023, Sarcos effected a 1-for-6 reverse stock of the Company's outstanding shares of common stock. All share and per share amounts have been retroactively adjusted for all periods presented to reflect the reverse stock split.

Sarcos ended the quarter with $75.1 million in unrestricted cash, cash equivalents, and marketable securities.

Financial guidance

Sarcos believes that its third quarter 2023 total revenue will range between $1.1 and $1.4 million. The Company anticipates incurring additional restructuring expense related to the reduction of headcount of approximately $6.0 million, net, during the third quarter of 2023, which includes approximately $1.5 million in cash severance and benefit payments. The restructuring is expected to reduce personnel related cash usage by approximately $14.6 million annually beginning in 2024.

The Company estimates cash used in operating activities to average approximately $5.5 million per month during the third quarter of 2023. Sarcos intends to manage its average monthly cash usage to approximately $3.0 million in 2024.

Conference call and webcast

A conference call and audio webcast with analysts and investors will be held today at 4:30 p.m. Eastern Time/1:30 p.m. Pacific Time to discuss the results and answer questions.

•To access the conference call, please pre-register using this link. Registrants will receive confirmation with dial-in details.

•Live and archived webcast will be available on Sarcos investor relations website at investor.sarcos.com.

About Sarcos Technology and Robotics Corporation

Sarcos Technology and Robotics Corporation (NASDAQ: STRC and STRCW) designs, develops, and manufactures a broad range of advanced mobile robotic systems, solutions, and software that redefine human possibilities and are designed to enable the safest most productive workforce in the world. Sarcos robotic solutions address the challenging, unstructured, industrial environments for markets that require a high degree of accuracy, efficiency and can benefit from task autonomy. For more information, please visit www.sarcos.com and connect with us on LinkedIn at www.linkedin.com/company/sarcos.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding Sarcos’ product development, products to be commercialized, financial results and performance and cash use, market and revenue opportunities and customer demand. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions. Generally, statements that are not historical facts, including statements concerning possible, intended, or assumed future actions, business strategies, events, business conditions or results of operations, are

forward-looking statements. These statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “aim,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends” or “continue” or similar expressions. Such forward-looking statements involve risks and uncertainties that may cause actual events, results, or performance to differ materially from those indicated by such statements. These forward-looking statements are based on Sarcos’ management’s current expectations and beliefs, as well as a number of assumptions concerning future events. However, there can be no assurance that the events, results, or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and Sarcos is not under any obligation and expressly disclaims any obligation, to update, alter or otherwise revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law.

Readers should carefully review the statements set forth in the reports which Sarcos has filed or will file from time to time with the Securities and Exchange Commission (the “SEC”), in particular the risks and uncertainties set forth in the sections of those reports entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements,” for a description of risks facing Sarcos and that could cause actual events, results or performance to differ from those indicated in the forward-looking statements contained herein. The documents filed by Sarcos with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov.

SARCOS TECHNOLOGY AND ROBOTICS CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

June 30, 2023 |

|

|

December 31, 2022 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

25,566 |

|

|

$ |

35,159 |

|

Marketable securities |

|

|

49,579 |

|

|

|

79,337 |

|

Accounts receivable |

|

|

1,280 |

|

|

|

1,866 |

|

Unbilled receivables |

|

|

1,527 |

|

|

|

4,160 |

|

Inventories, net |

|

|

3,723 |

|

|

|

3,562 |

|

Prepaid expenses and other current assets |

|

|

3,594 |

|

|

|

5,015 |

|

Total current assets |

|

|

85,269 |

|

|

|

129,099 |

|

Property and equipment, net |

|

|

6,763 |

|

|

|

7,640 |

|

Intangible assets, net |

|

|

17,479 |

|

|

|

19,116 |

|

Operating lease assets |

|

|

10,692 |

|

|

|

11,283 |

|

Other non-current assets |

|

|

463 |

|

|

|

487 |

|

Total assets |

|

$ |

120,666 |

|

|

$ |

167,625 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

4,597 |

|

|

$ |

3,620 |

|

Accrued liabilities |

|

|

4,049 |

|

|

|

6,025 |

|

Current operating lease liabilities |

|

|

1,040 |

|

|

|

887 |

|

Total current liabilities |

|

|

9,686 |

|

|

|

10,532 |

|

Operating lease liabilities |

|

|

11,736 |

|

|

|

12,387 |

|

Other non-current liabilities |

|

|

195 |

|

|

|

256 |

|

Total liabilities |

|

|

21,617 |

|

|

|

23,175 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock, $0.0001 par value, 165,000,000 shares authorized as of June 30, 2023, and December 31, 2022; 25,841,889 and 25,708,519 shares issued and outstanding as of June 30, 2023, and December 31, 2022, respectively |

|

|

3 |

|

|

|

3 |

|

Additional paid-in capital |

|

|

451,815 |

|

|

|

447,085 |

|

Accumulated other comprehensive loss |

|

|

(12 |

) |

|

|

(17 |

) |

Accumulated deficit |

|

|

(352,757 |

) |

|

|

(302,621 |

) |

Total stockholders’ equity |

|

|

99,049 |

|

|

|

144,450 |

|

Total liabilities and stockholders’ equity |

|

$ |

120,666 |

|

|

$ |

167,625 |

|

See Sarcos 10-Q filing dated August 9, 2023, for accompanying notes to the consolidated financial statements.

SARCOS TECHNOLOGY AND ROBOTICS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue, net |

|

$ |

1,277 |

|

|

$ |

3,038 |

|

|

$ |

3,573 |

|

|

$ |

3,781 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue (exclusive of items shown separately below) |

|

|

943 |

|

|

|

3,146 |

|

|

|

2,729 |

|

|

|

3,634 |

|

Research and development |

|

|

11,706 |

|

|

|

7,569 |

|

|

|

21,109 |

|

|

|

13,450 |

|

General and administrative |

|

|

8,252 |

|

|

|

18,146 |

|

|

|

17,987 |

|

|

|

35,938 |

|

Sales and marketing |

|

|

4,410 |

|

|

|

2,586 |

|

|

|

8,151 |

|

|

|

4,797 |

|

Intangible amortization expense |

|

|

819 |

|

|

|

574 |

|

|

|

1,638 |

|

|

|

574 |

|

Asset write-down and restructuring |

|

|

5,106 |

|

|

|

— |

|

|

|

5,106 |

|

|

|

— |

|

Total operating expenses |

|

|

31,236 |

|

|

|

32,021 |

|

|

|

56,720 |

|

|

|

58,393 |

|

Loss from operations |

|

|

(29,959 |

) |

|

|

(28,983 |

) |

|

|

(53,147 |

) |

|

|

(54,612 |

) |

Interest income, net |

|

|

874 |

|

|

|

148 |

|

|

|

1,973 |

|

|

|

159 |

|

Gain on warrant liability |

|

|

439 |

|

|

|

4,113 |

|

|

|

3 |

|

|

|

10,527 |

|

Other (loss) income, net |

|

|

(11 |

) |

|

|

(2 |

) |

|

|

1,038 |

|

|

|

— |

|

Loss before income tax (expense) benefit |

|

|

(28,657 |

) |

|

|

(24,724 |

) |

|

|

(50,133 |

) |

|

|

(43,926 |

) |

Income tax (expense) benefit |

|

|

(3 |

) |

|

|

1,606 |

|

|

|

(3 |

) |

|

|

1,606 |

|

Net loss |

|

$ |

(28,660 |

) |

|

$ |

(23,118 |

) |

|

$ |

(50,136 |

) |

|

$ |

(42,320 |

) |

Net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(1.12 |

) |

|

$ |

(0.95 |

) |

|

$ |

(1.97 |

) |

|

$ |

(1.79 |

) |

Weighted-average shares used in computing net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

25,512,057 |

|

|

|

24,379,549 |

|

|

|

25,491,654 |

|

|

|

23,685,766 |

|

See Sarcos 10-Q filing dated August 9, 2023, for accompanying notes to the consolidated financial statements.

SARCOS TECHNOLOGY AND ROBOTICS CORPORATION

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(50,136 |

) |

|

$ |

(42,320 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Stock-based compensation |

|

|

4,734 |

|

|

|

21,120 |

|

Depreciation of property and equipment |

|

|

843 |

|

|

|

594 |

|

Amortization of intangible assets |

|

|

1,638 |

|

|

|

574 |

|

Change in fair value of warrant liability |

|

|

(3 |

) |

|

|

(10,527 |

) |

Amortization of investment discount |

|

|

(1,365 |

) |

|

|

— |

|

Asset write-down and restructuring |

|

|

5,106 |

|

|

|

— |

|

Changes in operating assets and liabilities |

|

|

|

|

|

|

Accounts receivable |

|

|

586 |

|

|

|

463 |

|

Unbilled receivable |

|

|

2,634 |

|

|

|

(635 |

) |

Inventories |

|

|

(4,588 |

) |

|

|

(424 |

) |

Prepaid expenses and other current assets |

|

|

1,420 |

|

|

|

3,941 |

|

Other non-current assets |

|

|

615 |

|

|

|

356 |

|

Accounts payable |

|

|

1,005 |

|

|

|

(401 |

) |

Accrued liabilities |

|

|

(1,823 |

) |

|

|

1,242 |

|

Other non-current liabilities |

|

|

(651 |

) |

|

|

(1,907 |

) |

Net cash used in operating activities |

|

|

(39,985 |

) |

|

|

(27,924 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(673 |

) |

|

|

(690 |

) |

Acquisition of a business, net of cash acquired |

|

|

— |

|

|

|

(29,687 |

) |

Purchases of marketable securities |

|

|

(48,872 |

) |

|

|

(79,507 |

) |

Maturities of marketable securities |

|

|

80,000 |

|

|

|

— |

|

Net cash provided by (used in) investing activities |

|

|

30,455 |

|

|

|

(109,884 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

|

— |

|

|

|

551 |

|

Shares repurchased for payment of tax withholdings |

|

|

(61 |

) |

|

|

(6,596 |

) |

Payment of obligations under capital leases |

|

|

(2 |

) |

|

|

(2 |

) |

Net cash used in financing activities |

|

|

(63 |

) |

|

|

(6,047 |

) |

Net decrease in cash, cash equivalents |

|

|

(9,593 |

) |

|

|

(143,855 |

) |

Cash, cash equivalents at beginning of period |

|

|

35,159 |

|

|

|

217,114 |

|

Cash, cash equivalents at end of period |

|

$ |

25,566 |

|

|

$ |

73,259 |

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

Cash paid for income taxes |

|

$ |

3 |

|

|

$ |

— |

|

Supplemental disclosure of non-cash activities: |

|

|

|

|

|

|

Common stock and assumed equity awards in connection with a business acquisition |

|

$ |

— |

|

|

$ |

59,556 |

|

Purchases of property and equipment included in accounts payable at period-end |

|

$ |

12 |

|

|

$ |

— |

|

See Sarcos 10-Q filing dated August 9, 2023, for accompanying notes to the consolidated financial statements.

SARCOS TECHNOLOGY AND ROBOTICS CORPORATION

REVENUE BY TYPE

(Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

Product Development Contract Revenue |

|

$ |

1,274 |

|

|

$ |

2,982 |

|

Product Revenue |

|

|

3 |

|

|

|

56 |

|

Revenue, net |

|

$ |

1,277 |

|

|

$ |

3,038 |

|

SARCOS TECHNOLOGY AND ROBOTICS CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

To supplement our financial statements presented in accordance with GAAP and to provide investors with additional information regarding our financial results, we have presented in this release non-GAAP net loss and non-GAAP net loss per share, each of which are non-GAAP financial measures. Non-GAAP net loss and non-GAAP net loss per share are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly titled measures presented by other companies.

We define non-GAAP net loss as our GAAP measured net loss excluding the impacts of stock-based compensation expense, gain on forgiveness of notes payable, gain or loss on change in fair value of derivative instruments and warrant liabilities, expenses related to a business combination, asset write-down and restructuring, goodwill impairment and other non-recurring non-operating expenses. We define non-GAAP net loss per share as non-GAAP net loss divided by weighted average outstanding shares.

The most directly comparable GAAP measure to non-GAAP net loss is net loss. The most directly comparable GAAP measure to non-GAAP net loss per share is net loss per share. We believe excluding the impact of the previously listed items in calculating non-GAAP net loss and non-GAAP net loss per share can provide a useful measure for period-to-period comparisons of our core operating performance. We monitor, and have presented in this release, non-GAAP net loss and non-GAAP net loss per share because they are each a key measure used by our management and board of directors to understand and evaluate our operating performance and to establish budgets. We believe non-GAAP net loss and non-GAAP net loss per share help identify underlying trends in our business that could otherwise be masked by the effect of the expenses that we include in net loss but not in non-GAAP net loss. Accordingly, we believe non-GAAP net loss and non-GAAP net loss per share provide useful information to investors, analysts and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance.

Non-GAAP net loss and non-GAAP net loss per share are not prepared in accordance with GAAP and should not be considered in isolation of, or as an alternative to, measures prepared in accordance with GAAP. There are a number of limitations related to the use of non-GAAP net loss and non-GAAP net loss per share rather than net loss and net loss per share, which is for each the most directly comparable financial measure calculated and presented in accordance with GAAP. In addition, the expenses and other items that we exclude in our calculations of non-GAAP net loss and non-GAAP net loss per share may differ from the expenses and other items, if any, that other companies may exclude from non-GAAP net loss and non-GAAP net loss per share when they report their operating results, limiting the usefulness of non-GAAP net loss and non-GAAP net loss per share for comparative purposes.

In addition, other companies may use other measures to evaluate their performance, all of which could reduce the usefulness of non-GAAP net loss and non-GAAP net loss per share as tools for comparison.

The following table reconciles non-GAAP net loss to net loss, the most directly comparable financial measure calculated and presented in accordance with GAAP (in thousands, except share and per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net loss |

|

$ |

(28,660 |

) |

|

$ |

(23,118 |

) |

|

$ |

(50,136 |

) |

|

$ |

(42,320 |

) |

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

2,070 |

|

|

|

10,270 |

|

|

|

4,734 |

|

|

|

21,120 |

|

Gain on warrant liability |

|

|

(439 |

) |

|

|

(4,113 |

) |

|

|

(3 |

) |

|

|

(10,527 |

) |

Asset write-down and restructuring (1) |

|

|

5,106 |

|

|

|

— |

|

|

|

5,106 |

|

|

|

— |

|

Employee Retention Credit |

|

|

— |

|

|

|

— |

|

|

|

(1,019 |

) |

|

|

— |

|

Expenses related to business combinations (2) |

|

|

— |

|

|

|

1,053 |

|

|

|

— |

|

|

|

2,526 |

|

Income tax benefit related to business combinations |

|

|

— |

|

|

|

(1,606 |

) |

|

|

— |

|

|

|

(1,606 |

) |

Non-GAAP net loss |

|

$ |

(21,923 |

) |

|

$ |

(17,514 |

) |

|

$ |

(41,318 |

) |

|

$ |

(30,807 |

) |

Net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(1.12 |

) |

|

$ |

(0.95 |

) |

|

$ |

(1.97 |

) |

|

$ |

(1.79 |

) |

Non-GAAP net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.86 |

) |

|

$ |

(0.72 |

) |

|

$ |

(1.62 |

) |

|

$ |

(1.30 |

) |

Weighted-average shares used in computing net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

25,512,057 |

|

|

|

24,379,549 |

|

|

|

25,491,654 |

|

|

|

23,685,766 |

|

(1)Expenses related to our asset write-down and restructuring activities included $4.4 million due to the write-down of inventory and $0.7 million related to the impairment of certain fixed assets.

(2)Expenses related to our business combination with RE2, Inc., which are included within general and administrative expenses within the condensed consolidated statements of operations.

Investor Contact:

Moriah Shilton

310.622.8251

STRC@finprofiles.com

Press Contact

mediarelations@sarcos.com

v3.23.2

Document And Entity Information

|

Aug. 09, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 09, 2023

|

| Entity Registrant Name |

Sarcos Technology and Robotics Corporation

|

| Entity Central Index Key |

0001826681

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-39897

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

85-2838301

|

| Entity Address, Address Line One |

650 South 500 West, Suite 150

|

| Entity Address, City or Town |

Salt Lake City

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84101

|

| City Area Code |

(888)

|

| Local Phone Number |

927-7296

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

STRC

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrant Member |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for shares of Common Stock at an exercise price of $69.00 per share

|

| Trading Symbol |

STRCW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=strc_RedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

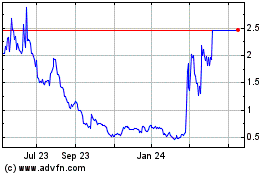

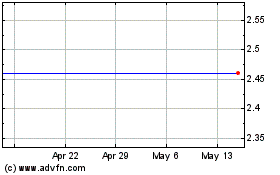

Palladyne AI (NASDAQ:STRC)

Historical Stock Chart

From Apr 2024 to May 2024

Palladyne AI (NASDAQ:STRC)

Historical Stock Chart

From May 2023 to May 2024