false000140170800014017082024-01-192024-01-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_______________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 19, 2024

_______________________________

NanoString Technologies, Inc.

(Exact name of registrant as specified in its charter)

________________________________

| | | | | | | | |

| Delaware | 001-35980 | 20-0094687 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

530 Fairview Avenue North

Seattle, Washington 98109

(Address of principal executive offices, including zip code)

(206) 378-6266

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | NSTG | The NASDAQ Stock Market LLC |

| | (The NASDAQ Global Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act). ¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 19, 2024, the Compensation and Human Capital Committee (the “Committee”) of the Board of Directors of NanoString Technologies, Inc. (the “Company”, “we”, “us,” and “our”) awarded retention bonuses, payable on or prior to February 2, 2024, to each of R. Bradley Gray (Chief Executive Officer, $2,565,000 retention bonus), K. Thomas Bailey (Chief Financial Officer, $1,250,000 retention bonus), and Joseph M. Beechem (Chief Scientific Officer and Senior Vice President, Research and Development, $835,000 retention bonus) pursuant to the terms and conditions of retention bonus letters in substantially the form filed herewith as Exhibit 10.1 (the “Retention Bonus Agreement”). Under the Retention Bonus Agreement, each executive will be required to repay the after-tax amount of the retention bonus to the Company in the event that such executive’s employment terminates for any reason other than a “qualifying termination” (as defined in the Retention Bonus Agreement) prior to the earlier of (x) December 31, 2024 and (y) a “change in control” of the Company (as defined in the Retention Bonus Agreement).

The above summary of the retention bonuses is qualified in its entirety by reference to the complete terms and conditions as set forth in the Retention Bonus Agreement, the form of which is filed herewith as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

On January 25, 2024, the Committee approved the payment of a 2023 annual bonus to Joseph M. Beechem (Chief Scientific Officer and Senior Vice President, Research and Development), in the amount of $136,600. This bonus will be paid on or before February 2, 2024. R. Bradley Gray (Chief Executive Officer) and K. Thomas Bailey (Chief Financial Officer) voluntarily forfeited their participation in the 2023 annual bonus program and will not receive 2023 bonuses.

Additionally, the Company adopted changes to its Outside Director Compensation Policy with effect for the 2024 calendar year to eliminate annual equity awards and to instead pay each non-employee director an annual cash retainer in the amount of $225,000, which is equal to the annual value of the eliminated equity awards. Fifty percent (50%) of this cash retainer will be paid on or before February 2, 2024 and 50% will be paid in March 2024. Regular board and committee retainer fee amounts remain unchanged and will be paid quarterly in advance.

Item 8.01 Other Events.

As previously disclosed by the Company, on November 17, 2023, after a trial in the U.S. District Court for the District of Delaware in the matter of 10x Genomics, Inc. et al v. NanoString Technologies, Inc., No. 21-CV-653-MFK, a jury verdict was entered in favor of plaintiffs, 10x Genomics, Inc. and Prognosys Biosciences, Inc. (the “Plaintiffs”). This verdict has created uncertainty regarding our financial condition and prospects and negatively impacted our ability to raise additional capital. We are continuing to evaluate the impact of the verdict on our business, results of operations, and financial condition.

Subsequent to the November 2023 verdict, we began actively exploring strategic, financial, and restructuring alternatives together with our financial and legal advisors. We currently have no commitments to undertake any specific transaction, and there can be no assurance that we will be able to complete additional or alternative financings or execute any business development or restructuring transactions or other strategic alternatives, and some of these initiatives may be more successfully implemented and achieved through a court-supervised reorganization process.

We are engaged in discussions with the holders of our 6.95% Senior Secured Notes due 2026 (the “2026 Notes”) regarding the prospect of additional debt financing as well as possible modifications to, and relief from, certain covenants in the indenture governing the 2026 Notes (the “2026 Notes Indenture”). We received from the holders of the 2026 Notes notices of Events of Default (as such term is defined in the 2026 Notes Indenture) and reservations of rights under the 2026 Notes Indenture. These notices state that one or more Events of Default have occurred and are continuing, including with respect to a failure to enter into control agreements with respect to our Controlled Accounts (as such term is defined in the 2026 Notes Indenture). Under the terms of the 2026 Notes Indenture, at any time that an Event of Default has occurred and is continuing certain holders of the Notes or the Trustee may (i) cause the debt owed thereunder to become immediately due or payable and/or (ii) acting through a trustee, exercise remedies with respect to the collateral securing our obligations under the 2026 Notes Indenture, which collateral consists of substantially all of the property and assets of the Company and its subsidiaries. To date, no notice of acceleration has been given and no remedies have been taken.

Since inception, we have not achieved profitable operations or positive cash flows from operations. It is currently difficult to estimate future liquidity requirements, due to uncertainty regarding final rulings related to the November 2023 verdict, including potential damages that may be awarded to the Plaintiffs, and additional pending intellectual property litigation. As a result, substantial doubt exists about our ability to continue as a going concern. While the November 2023 verdict does not currently prevent us from continuing to sell GeoMx products anywhere in the world, the verdict or any future attempts by the Plaintiffs to obtain injunctive relief may negatively impact future product sales. As a result of the verdict and pending litigation and the impact or potential impact on our revenue trajectory and cash resources, we may be unable to

generate sufficient cash flows to meet our capital needs and financial obligations, including debt service, liquidity covenants and other obligations due to third parties. Our ability to raise additional capital is also constrained given the uncertainty about our financial condition and prospects.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exhibit No. | | Description | | Form | | File No. | | Filing Date | | Exhibit | | Filed Herewith |

| 10.1 | | | | | | | | | | | | X |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) | | | | | | | | | | X |

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K includes statements that are, or may be deemed, “forward-looking statements.” In some cases, these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or, in each case, their negative or other variations thereon or comparable terminology, although not all forward-looking statements contain these words. These forward-looking statements reflect the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity and the development of the industry in which we operate may differ materially from the forward-looking statements contained herein. Any forward-looking statements that we make in this Form 8-K speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this Form 8-K or to reflect the occurrence of unanticipated events. Our forward-looking statements in this Form 8-K include, but are not limited to, statements about our evaluation of our strategic options, the potential consequences of not being able to raise additional liquidity, our ability to continue as a going concern, a potential court-supervised reorganization process and other statements regarding our strategy and future operations, performance and prospects, among others. These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects. There can be no assurance that future developments affecting us will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | NanoString Technologies, Inc. |

| | | |

| Date: | January 25, 2024 | By: | /s/ R. Bradley Gray |

| | | R. Bradley Gray |

| | | President and Chief Executive Officer |

Form of Insider Retention Bonus Letter

NANOSTRING TECHNOLOGIES, INC.

January [●], 2024

[●]

BY HAND

Re: Retention Bonus Opportunity

Dear [●]:

To encourage you to continue employment with NanoString Technologies, Inc. (the “Company”), you are being provided an opportunity to earn a retention bonus subject to the terms and conditions described in this letter agreement (this “Agreement”), which will be effective as of the date you execute and return a copy of this Agreement.

1.Retention Bonus. Subject to the terms and conditions set forth below, you will receive a cash lump sum payment in an amount equal to $[●] (the “Retention Bonus”) no later than February 2, 2024. You agree that, if your employment with the Company terminates for any reason (other than a Qualifying Termination) prior to the earlier of (x) December 31, 2024, and (y) a Change in Control, then you will be required to repay to the Company the after-tax amount of the Retention Bonus within ten (10) days following such termination of employment (and in all events by December 31, 2024).

2.Certain Definitions. For purposes of this Agreement:

(a)“Cause” shall have the meaning ascribed to such term in the Employment Agreement.

(b)“Change in Control” means (i) a Change in Control as defined in the Equity Plan, or (ii) a restructuring following which the stockholders of the Company immediately prior to such restructuring (and their respective affiliates) collectively own (directly or indirectly and in substantially the same proportion as in effect immediately prior to such restructuring) less than fifty percent (50%) of the voting equity securities of the Company or its ultimate parent immediately following such restructuring; provided that, for the avoidance of doubt, a sale of the assets comprising any one business line of the Company does not constitute a Change in Control for purposes of this definition.

(c)“Disability” shall have the meaning ascribed to such term in the Employment Agreement.

(d)“Employment Agreement” means your employment agreement with the Company as in effect as of the date hereof.

(e)“Equity Plan” means the NanoString Technologies, Inc. 2022 Equity Plan, as the same may be amended and/or restated from time to time.

(f)“Good Reason” shall have the meaning ascribed to such term in the Employment Agreement.

(g)“Qualifying Termination” means the termination of your employment with the Company (i) by the Company for a reason other than Cause, (ii) by you for Good Reason, or (iii) due to your death or Disability.

3.Withholding Taxes. The Company may withhold from any amounts payable to you hereunder such federal, state, and local taxes as the Company determines in its sole discretion may be required to be withheld pursuant to any applicable law or regulation.

4.No Right to Continued Employment. Nothing in this Agreement will confer upon you any right to continued employment with the Company (or its affiliates or their respective successors) or interfere in any way with the right of the Company (or its affiliates or their respective successors) to terminate your employment at any time.

5.Other Benefits. Any amounts payable pursuant to this Agreement will be considered special payments to you and will not be taken into account in computing the amount of compensation for purposes of determining any bonus, incentive, pension, retirement, death, or other benefit under any other bonus, incentive, pension, retirement, insurance, or other employee benefit plan of the Company, unless such plan or agreement expressly provides otherwise, or as otherwise set forth in this Agreement.

6.2024 Corporate Bonus Waiver. By signing below, you acknowledge and agree that the payment of the Retention Bonus is in lieu of any bonus pursuant to the Company’s corporate bonus programs that you may have otherwise been eligible to receive in respect of service during the 2024 calendar year and you hereby waive any and all rights that you have or may have had to any bonuses pursuant to the Company’s corporate bonus programs in respect of service during the 2024 calendar year.

7.Confidentiality. By signing below, you agree to maintain in confidence the existence of this Agreement, and the contents and terms of this Agreement and only to disclose such information to attorneys, accountants, governmental entities, and family members who have a reasonable need to know such information; provided, that nothing in this Section 7 will prohibit disclosures required by applicable law. Any violation of this confidentiality section shall result in disciplinary action as determined by the Company in its sole discretion, up to and including cancellation of any future retention bonus opportunity, immediate repayment of the Retention Bonus, and/or termination by the Company for Cause.

8.Governing Law. This Agreement will be governed by, and construed under and in accordance with, the internal laws of the State of Delaware, without reference to rules relating to conflicts of laws.

9.Counterparts. This Agreement may be executed in one or more counterparts, each of which will be deemed to be an original but all of which taken together will constitute one and the same instrument.

10.Entire Agreement; Amendment. This Agreement constitutes the entire agreement between you and the Company with respect to the subject matter hereof and supersedes any and all prior agreements or understandings between you and the Company with respect to the subject matter hereof, whether written or oral. This Agreement may be amended or modified only by a written instrument executed by you and the Company.

* * *

[The remainder of this page is intentionally left blank.]

This Agreement is intended to be a binding obligation on you and the Company. If this Agreement accurately reflects your understanding as to the terms and conditions of your retention bonus opportunity, please sign, date, and return to me one copy of this Agreement by no later than January 24, 2024. You should make a copy of the executed Agreement for your records.

NANOSTRING TECHNOLOGIES, INC.

By: ______________________________

Name:

Title:

The above terms and conditions accurately reflects my understanding regarding the terms and conditions of my retention bonus opportunity, and I hereby confirm my agreement to the same.

______________________________

[●]

Date: January ___, 2024

[Signature page to [●] Retention Bonus Opportunity Letter]

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

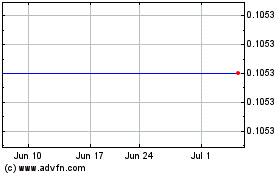

NanoString Technologies (NASDAQ:NSTG)

Historical Stock Chart

From Apr 2024 to May 2024

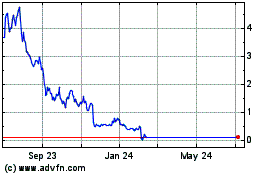

NanoString Technologies (NASDAQ:NSTG)

Historical Stock Chart

From May 2023 to May 2024