Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

September 08 2023 - 5:23PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO § 240.13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 6)*

(Title of Class of Securities)

57064P107

(CUSIP Number)

1001 Cathedral Street, Fourth Floor

Baltimore, MD 21201

(888) 610-8895

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because

of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to

be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter

disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that

section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

PF

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

United States

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

60,744,655 [See Item 4 and 5]

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

NONE

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

60,744,655 [See Item 5]

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

NONE

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

60,744,655

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

63% [See Item 5]

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

IN

|

|

|

|

|

|

The following constitutes Amendment No. 6 to the Schedule 13D filed by the Reporting Person. This Amendment No. 5 amends Item 4, Item 5, and Item 7, as set forth below. All other items remain

unchanged.

| Item 4. |

Purpose of Transaction.

|

Item 4 is hereby amended by the addition of the following:

On September 8, 2023, the Reporting Person entered into an amendment agreement with the Issuer dated as of April 28, 2023 (the “Amended Agreement”). Pursuant to the Amended Agreement, the Reporting Person will join the Board of Directors of the

Issuer. The Reporting Person has agreed to not sell shares of the Issuer prior to December 31, 2023. Additionally, at the 2024 Annual Meeting, the Reporting Person has agreed to vote his shares of common stock in favor of Michael Palmer, Glenn

Tongue, Matthew Smith, and the Reporting Person.

In the letter to the Board of Directors dated September 8, 2023, the Reporting Person expresses his hope to resume buying shares pending changes to the company’s capital allocation policy and his desire for the board to increase dividend payments.

Except as set forth above, the Reporting Person has no present plans or intentions that would result in or relate to any of the transactions described in subparagraphs (a) through (j) of Item 4 of Schedule 13D. The Reporting Person reserves the

right to change his plans at any time.

| Item 5. |

Interest in Securities of the Issuer

|

|

|

(a)

|

The Reporting Person is the beneficial owner of 60,744,655 shares of Class A Common Stock, constituting approximately 63% of the class outstanding. Specifically, the Reporting Person is the holder of record

of 2,991,467 shares of Class A Common Stock purchased in open market transactions and acquired pursuant to redemption of Common Units of MarketWise, LLC. Additionally, the Reporting Person has the right to acquire 57,753,188 shares of

Class A Common Stock underlying the Reporting Person’s Common Units of MarketWise, LLC: (i) 55,186,545 shares of Class A Common Stock underlying Common Units of MarketWise, LLC held of record by the Reporting Person and (ii) 2,566,643

shares of Class A Common Stock underlying Common Units of MarketWise, LLC held by a limited liability company over which the Reporting Person has beneficial ownership. As of June 30, 2023, there were 37,480,687 shares of Class A Common

Stock outstanding according to the Issuer. In accordance with Rule 13d-3(d)(1)(i), the 57,753,188 shares of Class A Common Stock underlying the Common Units of MarketWise, LLC beneficially owned by the Reporting Person are deemed to be

outstanding for the purpose of computing the percentage of outstanding securities of the class owned by the Reporting Person only. |

| |

(b)

|

The Reporting Person has sole power to dispose or to direct the disposition of 60,744,655 shares of Class A Common Stock. The Reporting Person has sole power to vote or direct the vote of all of his shares of Class A Common Stock,

subject to the voting agreement described in Item 4 relating to the 2024 Annual Meeting.

|

| |

(c)

|

The chart below describes transactions since the most recent filing of Schedule 13D on August 28, 2023 by the Reporting Person in shares of Class A Common Stock:

|

|

Transaction

Date

|

|

|

Transaction Type

|

|

|

Number of

Shares

|

|

|

Price per

Share

|

|

|

08/30/2023

|

|

|

Open Market Sale

|

|

|

|

45,000

|

|

|

$

|

1.30

|

|

|

08/31/2023

|

|

|

Open Market Sale

|

|

|

|

44,000

|

|

|

$

|

1.34

|

|

|

08/31/2023

|

|

|

Private Sale of MarketWise LLC Common Units and Class B Common Shares

|

|

|

|

6,311,026

|

|

|

$

|

2.00

|

|

| |

(d)

|

No other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the Class A Common Stock owned by the Reporting Person.

|

| Item 7. |

Material to be Filed as Exhibits.

|

|

|

|

Description of Document

|

| |

|

|

|

99.1

|

|

Amended and Restated Registration Rights Agreement dated July 21, 2021, by and among MarketWise, Inc., Ascendant Sponsor LP, and certain members of Ascendant Sponsor LP and of MarketWise, LLC (incorporated

herein by reference to Exhibit 10.1 in MarketWise, Inc.’s Form 8-K filed with the SEC on July 28, 2021. (previously filed)

|

| |

|

|

|

99.2

|

|

Letter, dated January 20, 2023, from Frank Porter Stansberry to the Board of Directors of Marketwise, Inc. (previously filed)

|

| |

|

|

|

99.3

|

|

Letter, dated March 13, 2023, from Frank Porter Stansberry to MarketWise Shareholders (previously filed)

|

| |

|

|

|

99.4

|

|

Settlement Agreement, dated as of April 28, 2023 by and between MarketWise, Inc., F. Porter Stansberry and Stokes Holdings Inc. (incorporated herein by reference to Exhibit 10.1 in MarketWise, Inc.’s Form 8-K

filed with the SEC on May 2, 2023).

|

| |

|

|

|

99.5

|

|

Letter, dated August 11, 2023, from Frank Porter Stansberry to the Board of Directors of Marketwise, Inc. (previously filed)

|

| |

|

|

|

99.6

|

|

Letter, dated August 28, 2023, from Frank Porter Stansberry to the Board of Directors of Marketwise, Inc. (previously filed)

|

| |

|

|

|

|

|

Letter, dated September 8, 2023, from Frank Porter Stansberry to the Board of Directors Marketwise, Inc.

|

| |

|

|

|

99.8

|

|

Amendment to Settlement Agreement, dated September 8, 2023 by and between Marketwise, Inc., F. Porter Stansberry and Stokes Holdings Inc. (incorporated herein by reference to the relevant Exhibit in MarketWise,

Inc.’s Form 8-K filed with the SEC on September 8, 2023)

|

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

|

|

|

|

|

Date: September 8, 2023

|

|

|

|

/s/ Frank Porter Stansberry

|

| |

|

|

|

Frank Porter Stansberry

|

Exhibit 99.7

1001 N. Charles St., Fourth Floor

Baltimore, Maryland 21201

September 8, 2023

Board of Directors of MarketWise, Inc.

c/o Mark Gerhard, Chair

1125 N. Charles Street

Baltimore, MD 21201

Dear Members of the Board of Directors:

I greatly appreciate your invitation to join the board of directors of MarketWise Inc.

Given my strident criticism of the prior board and my recent criticism of the company’s results, both Amber and I thought it wise to memorialize where we have reached agreement regarding the company.

Amber and the entire board unanimously support my joining the board. I am likewise eager to work with Amber and the board to improve the company’s results. I recognize that I am no longer the executive chairman of the company — only one of ten

board members. All final decisions about the company’s operations will be Amber's to make, in consultation with the whole board.

Amber and I have spoken in detail about reducing the company’s overhead expenses, including the need to review our products and processes to determine where cuts can be made to increase efficiency, without compromising the company’s ability to

serve our customers. We are of the same mind about what needs to be done.

I look forward to serving the board in many ways, but a particular focus will be corporate communications with investors. Amber and I have spoken at length about our mutual desire for MarketWise to be a company that’s able to “show” investors

excellent results, thus reducing the need to “tell” them anything. We plan to work together to make sure that our quarterly earnings releases and our annual report contain all of the information we’d want to know about the business if our roles were

reversed with our shareholders. I intend to make sure that all investors have the information required to make well-reasoned estimates of the company’s intrinsic value on a per-share basis.

I have agreed to stop selling shares through at least the end of this year and, pending changes to the company’s capital allocation policy, my strong preference would be to resume buying shares, not selling them. I, speaking only for myself,

do not believe our company has yet demonstrated its earnings power as a public company or its singular ability to grow rapidly with very little capital investment. I am optimistic that working together, we can return the company to its previous

benchmarks.

While I understand that dividend policy is a decision of the whole board, I have spoken with Amber about my strong desire to see the company begin paying

out the majority of our earnings in the form of cash dividends. Increasing dividend payments, along with a return to revenue growth, would position the company as both a high growth and a high return on equity business. This would demonstrate, in the

most effective way possible, the incredible economics of our company. Amber and I agree that paying dividends should be a priority of the company’s capital allocation strategy.

We have mutually pledged not to disparage each other, publicly or privately. But I willingly pledge more: I pledge my full support to Amber and will remain her ally on our board. I know how much Amber’s loyalty and effort meant to me when I

was running the company. For more than a decade Amber was one of my most important and effective business partners. We, along with a handful of other senior executives, built this company and, in doing so, enjoyed some of the most rewarding years of

our careers. I would not join the board if I did not believe that Amber was the right executive to restore the company’s results and its culture.

MarketWise and Porter & Co. will immediately resume our co-promotional efforts, as our publishers see fit. These ‘arms-length’ marketing agreements are executed using industry standard terms and in accordance with MarketWise’s ethical

policies (including the approval of the Audit Committee). It is my hope that these arrangements will produce a significant amount of revenue for MarketWise going forward. I remain willing to sell Porter & Co. to MarketWise at a private market

multiple at any time, should the board desire such a transaction, although no such transaction is currently anticipated and no such transaction is required to ensure my full cooperation with the board.

I have agreed to drop all further legal action in regards to the company’s July 2021 merger with Ascendant Digital Acquisition Corporation and the warrant redemption which followed that transaction.

Sincerely,

/s/ F. Porter Stansberry

F. Porter Stansberry

Founder, Marketwise

2

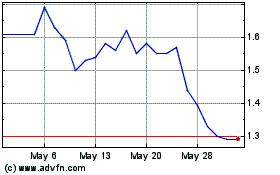

MarketWise (NASDAQ:MKTW)

Historical Stock Chart

From Apr 2024 to May 2024

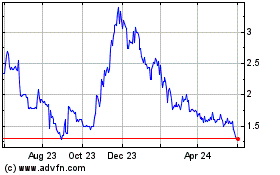

MarketWise (NASDAQ:MKTW)

Historical Stock Chart

From May 2023 to May 2024