Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-255586

PROSPECTUS

LIFEMD

INC.

152,912

Shares of Common Stock

This

prospectus relates to the offering and resale by the Investors or their registered assigns (each a “Selling Stockholder”

and collectively the “Selling Stockholders”) identified herein of up to 152,912 shares of Common Stock of the Company, issued

pursuant to that certain Securities Purchase Agreement, dated February 11, 2021, by and among the Company and the Selling Stockholders

(the “Purchase Agreement”). The Private Placement Shares were offered for resale by the Investors pursuant to a prospectus

dated May 20, 2021. The ongoing offer and sale by Selling Stockholders of the Private Placement Shares is being made pursuant to this

prospectus.

For

a more detailed description of our common stock, see the section entitled “Description of Capital Stock — Common Stock”

beginning on page 10 of this prospectus. For a more detailed description of our warrants, see the section entitled “Description

of Capital Stock — Warrants” beginning on page 11 of this prospectus. For a more detailed description of the securities the

Selling Stockholders are offering, see the section entitled “Selling Stockholders” beginning on page 7 of this prospectus.

The Selling Stockholders may from time to time sell, transfer or otherwise dispose of any or all of the securities in a number of different

ways and at varying prices. See “Plan of Distribution” beginning on page 8 of this prospectus for more information.

Our

Common Stock is quoted on The Nasdaq Capital Market (the “Nasdaq”) under the symbol “LFMD.” On June 30, 2022

the closing price as reported on the Nasdaq was $2.04 per share. This price will fluctuate based on the demand for our Common Stock.

The

Selling Stockholders may offer all or part of the shares for resale from time to time through public or private transactions, at either

prevailing market prices or at privately negotiated prices.

An

investment in our common stock involves a high degree of risk. You should carefully review the risks and uncertainties referred to under

the heading “Risk Factors” beginning on page 6 of this prospectus and under any similar headings in any amendment or supplement

to this prospectus or in any filing with the Securities and Exchange Commission that is incorporated by reference herein.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is July 7, 2022

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

You

should rely only on the information contained or incorporated by reference in this prospectus and any related prospectus supplement.

We have not, and the selling stockholders have not, authorized anyone to provide you with different information. No one is making offers

to sell or seeking offers to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that

the information contained in this prospectus and any prospectus supplement is accurate only as of the date on the front of this prospectus

or the prospectus supplement, as applicable, and that any information incorporated by reference in this prospectus or any prospectus

supplement is accurate only as of the date given in the document incorporated by reference, regardless of the time of delivery of this

prospectus, any applicable prospectus supplement or any sale of our common stock. Our business, financial condition, results of operations

and prospects may have changed since that date.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled

“Where You Can Find More Information.”

This

prospectus and the information incorporated herein by reference includes trademarks, service marks and trade names owned by us or others.

All trademarks, service marks and trade names included or incorporated by reference into this prospectus or any applicable prospectus

supplement are the property of their respective owners.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus and in the documents

we incorporate by reference. This summary is not complete and does not contain all of the information that you should consider before

investing in our securities. To fully understand this offering and its consequences to you, you should read this entire prospectus carefully,

including the information referred to under the heading “Risk Factors” in this prospectus beginning on page 6, the

financial statements and other information incorporated by reference in this prospectus when making an investment decision. This is only

a summary and may not contain all the information that is important to you. You should carefully read this prospectus, including the

information incorporated by reference therein, and any other offering materials, together with the additional information described under

the heading “Where You Can Find More Information”.

The

Company

The

following is a summary of what we believe to be the most important aspects of our business and the offering of our securities under this

prospectus. We urge you to read this entire prospectus, including the more detailed consolidated financial statements, notes to the consolidated

financial statements and other information incorporated by reference from our other filings with the SEC or included in any applicable

prospectus supplement. Investing in our securities involves risks. Therefore, carefully consider the risk factors set forth in any prospectus

supplements and in our most recent annual and quarterly filings with the SEC, as well as other information in this prospectus and any

prospectus supplements and the documents incorporated by reference herein or therein, before purchasing our securities. Each of the risk

factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment

in our securities.

Business

Overview and Strategy

We

are a direct-to-patient telehealth technology company that provides a smarter, cost-effective, and convenient way for Americans to access

healthcare. We believe the traditional model of visiting a doctor’s office, visiting a local pharmacy, and returning to see a doctor

for follow up care or prescription refills is inefficient, costly, and slow, and discourages many individuals from seeking much needed

medical care. The U.S. healthcare system is undergoing a paradigm shift, thanks to new technologies and the emergence of telehealth.

Direct-to-patient telehealth companies, like LifeMD, Inc., are leading the shift by connecting consumers digitally to licensed healthcare

professionals for care across various needs, such as virtual primary care, men’s sexual health, dermatology, and others.

Our

telehealth platform provides patients with access to licensed providers for diagnoses, virtual care, and prescription medications, often

delivered on a recurring basis. In addition to our telehealth offerings, we sell complementary nutritional supplements and over-the-counter

(“OTC”) products. Many of our products are available on a subscription basis, where patients can subscribe to receive regular

shipments of prescribed medications or products. This creates convenience and discounted pricing opportunities for patients and recurring

revenue streams for us. Our customer acquisition strategy combines strategic brand-building media placements, influencer partnerships,

and direct response advertising methods across highly scalable marketing channels (i.e., national TV, streaming TV, streaming audio,

YouTube, podcasts, Out of Home, print, magazines, online search, social media, and digital).

Since

inception, we have helped more than 550,000 customers and patients, providing them greater access to high-quality, convenient, and affordable

care in all 50 states. Our telehealth revenue increased 70% for the three months ended March 31, 2022 as compared to the three months

ended March 31, 2021. Total revenue from recurring subscriptions is approximately 91%. In addition to our telehealth business, we own

85.6% of WorkSimpli, which operates PDFSimpli, a rapidly growing software-as-a-service (“SaaS”) platform for converting,

signing, editing, and sharing PDF documents. This business has seen 31% year over year revenue growth, with recurring revenue of 98%.

We

believe that telehealth platforms like ours will fundamentally shift how individuals perceive and access healthcare in the United States,

by necessity and by preference. With the average wait time to see a physician in the United States now greater than 29 days, according

to a 2018 Merritt Hawkins Survey, and the United States’ projected significant shortfall of licensed physicians by 2030, we believe

the U.S. healthcare infrastructure must change to accommodate patients. Timely and convenient access to healthcare and prescription medications

is a critical factor in improving quality of care and patient outcomes. Our mission is to radically change healthcare with our portfolio

of direct-to-patient telehealth brands that encompass on-demand medical treatment, online pharmacy, and OTC products. We want our brands

to be top-of-mind for consumers considering telehealth.

In

the United States, healthcare spending is currently $4.0 trillion and is expected to grow to $6.2 trillion by 2028, according to the

Centers for Medicare and Medicaid Services. Physician services and prescription medications account for approximately 30% of healthcare

spending, or over $1 trillion annually, and we believe that we have the infrastructure, medical expertise, and technical know-how necessary

to help shift a substantial portion of this market to an online, virtual format. We believe that we are well positioned to capitalize

on this large-scale shift in healthcare.

We

believe that an amazing customer experience, incredible healthcare, and new customer acquisition form the heart of our business. As is

exemplified with our first brand, Shapiro MD, we have built a full line of proprietary and patented OTC products for male and female

hair loss, U.S. Food and Drug Administration (“FDA”) approved OTC minoxidil, and now a telehealth platform offering that

gives consumers access to virtual medical treatment and, when appropriate, a full line of oral and topical prescription medications for

hair loss. Our men’s brand, RexMD, currently offers access to provider-based treatment through telehealth for men’s health

conditions, such as sexual health and hair loss. RexMD continues to expand its treatment offerings to address additional chronic indications

present in men’s health. We have built a platform that allows us to efficiently launch telehealth brands and offerings wherever

we identify a market need. Our platform is supported by a driven team of digital marketing and branding experts, data analysts, designers,

and engineers focused on building enduring brands.

Our

Brand Portfolio and Virtual Primary Care Platform

We

have built a strategic portfolio of wholly-owned telehealth platform brands supported by an affiliated, 50-state physician network and

an integrated national network of third party pharmacies that address large unmet needs in men’s health, hair loss, virtual primary

care, and dermatology. We continue to experience aggressive growth across our brands.

Our

process across each brand and condition we treat is to guide consumers through a medical intake process and product selection, after

which a licensed U.S. physician conducts a virtual consultation and, if appropriate, prescribes prescription medications and/or recommends

OTC products. Prescription medications and OTC products are filled by pharmacy fulfillment partners and shipped directly to the patient.

The number of patients and customers we serve across the nation continues to increase at a robust pace, with more than 550,000 individuals

having purchased our products and services to date.

Hair

Loss: ShapiroMD

Launched

in 2017, ShapiroMD is a telehealth platform brand that offers access to virtual medical treatment, prescription medications, patented-doctor

formulated OTC products, an FDA approved medical device for male and female hair loss, and female specific topical compounded medications

for hair loss through our telehealth platform. ShapiroMD has emerged as a leading destination for hair loss treatment across the United

States and has served more than 250,000 customers and patients since inception with a 4.9-star Trustpilot rating.

Men’s

Health: RexMD

Launched

in 2019, RexMD is a men’s telehealth platform brand that offers access to virtual medical treatment for a variety of men’s

health needs. After treatment from a licensed physician, if appropriate, one of our partner pharmacies will dispense and ship prescription

medications and OTC products directly to the customer. Since RexMD’s initial launch in the erectile dysfunction treatment market,

it has expanded into additional indications, including but not limited to, premature ejaculation, testosterone, and hair loss. Our vision

for RexMD is to become a leading telehealth destination for men. RexMD has emerged as a leading men’s telehealth platform across

the United States and has served more than 300,000 customers and patients since inception with a 4.5-star Trustpilot rating.

Variable

Interest Entity: LifeMD Primary Care

Beta

launched in the fourth quarter of 2021, LifeMD PC is a personalized, subscription-based virtual primary care platform. The LifeMD PC

clinic provides patients in all 50 states with 24/7 access to a high-quality provider for their primary care, urgent care and chronic

care needs. LifeMD PC offers a mobile first platform that incorporates virtual consultations and treatment, prescription medications,

diagnostics, and imaging. LifeMD PC capabilities are supported by robust partnerships as further discussed below. No revenue was recorded

related to the LifeMD PC during the three months ended March 31, 2022.

Dermatology:

NavaMD

Launched

in the first quarter of 2021, NavaMD is a female-oriented, tele-dermatology brand that offers access to virtual medical treatment from

dermatologists and other providers, and, if appropriate, prescription oral and compounded topical medications to treat dermatological

conditions such as aging and acne. In addition to the brand’s telehealth offerings, NavaMD’s proprietary products leverage

intellectual property and proprietary formulations licensed from Restorsea, a leading medical grade skincare technology platform.

Restorsea’s

clinically proven skincare technology platform is the result of more than $50 million invested in R&D and intellectual property development,

and Restorsea has received at least 35 patents along with broad industry and academic acclaim, with its breakthrough clinical results

having been published in the peer-reviewed Journal of Drugs in Dermatology and Journal of Clinical and Aesthetic Dermatology. NavaMD

is one of the first direct-to-patient brands to offer this advanced skincare technology.

Allergy,

Asthma & Immunology: Cleared

In

January 2022, the Company acquired Cleared, a telehealth brand that provides personalized treatments for allergy, asthma, and immunology.

Its offerings include in-home tests for both environmental and food allergies, prescriptions for allergies and asthma, and FDA-approved

immunotherapies for treating chronic allergies. Cleared leverages a network of medical professionals and providers in all 50 states,

a growing pipeline of pharmaceutical partners, and treatments and tests that cost up to 50 percent less than the brand-name competition.

The offerings include free consultations and ongoing care from U.S.-licensed allergists and nurses.

Majority

Owned Subsidiary: WorkSimpli

WorkSimpli

operates PDFSimpli, an online SaaS platform that allows users to create, edit, convert, sign and share PDF documents. WorkSimpli was

acquired through the purchase of 51% of the membership interests of WorkSimpli Software, LLC, a Puerto Rico limited liability company,

which operates a marketing-driven software solutions business. In addition to WorkSimpli’s growth business model, this acquisition

added deep search engine optimization and search engine marketing expertise to the Company. On January 22, 2021, the Company increased

its ownership of WorkSimpli to 85.6%.

WorkSimpli

was ranked in the top 4,160 websites globally, in which it was also ranked in the top 563 for specific countries with more than 19 million

registrants globally. Since its launch, WorkSimpli has converted or edited over 14 terabytes of documents for customers from the legal,

financial, real-estate and academic sectors. WorkSimpli had over 102,000 active subscriptions as of December 31, 2021.

In

February 2022, WorkSimpli closed on an Asset Purchase Agreement with East Fusion FZCO, a Dubai, UAE corporation (the “Seller”),

whereby WorkSimpli acquired substantially all of the assets associated with the Seller’s business offering subscription-based resume

building software through SaaS online platforms.

Cleared

Acquisition

On

January 18, 2022, the Company acquired Cleared Technologies PBC, a Delaware public benefit corporation (“Cleared”), a rapidly

growing nationwide allergy telehealth platform that provides personalized treatments for allergy, asthma, and immunology.

Customers

Our

customer base includes men and women seeking virtual primary care and virtual medical treatment for hair loss, men’s sexual health

issues, dermatology, and allergy and asthma. No single customer accounted for more than 10% of net sales for the years ended December

31, 2021 and 2020.

Corporate

Information

LifeMD,

Inc. was formed in the State of Delaware on May 24, 1994, under our prior name, Immudyne, Inc. We changed our name to Conversion Labs,

Inc. on June 22, 2018 and then subsequently, on February 22, 2021, we changed our name to LifeMD, Inc. Further, in connection with changing

our name, we changed our trading symbol to LFMD.

On

April 1, 2016, the original operating agreement of Immudyne PR LLC (“Immudyne PR”), a joint venture to market the Company’s

skincare products, was amended and restated and the Company increased its ownership and voting interest in Immudyne PR to 78.2%. Concurrent

with the name change of the parent company to Conversion Labs, Inc., Immudyne PR was renamed to Conversion Labs PR LLC. On April 25,

2019, the operating agreement of Conversion Labs PR was amended and restated in its entirety to increase the Company’s ownership

and voting interest in Conversion Labs PR to 100%. On February 22, 2021, concurrent with the name of the parent company to LifeMD, Inc.,

Conversion Labs PR LLC was renamed to LifeMD PR, LLC.

In

June 2018, the Company closed the strategic acquisition of 51% of LegalSimpli Software, LLC, which operates a SaaS application for converting,

editing, signing, and sharing PDF documents called PDFSimpli. In addition to LegalSimpli Software, LLC’s growth business model,

this acquisition added deep search engine optimization and search engine marketing expertise to the Company. On July 15, 2021, LegalSimpli

Software, LLC, changed its name to WorkSimpli Software, LLC, (“WorkSimpli”). Effective January 22, 2021, the Company consummated

a transaction to restructure the ownership of WorkSimpli and concurrently increased its ownership stake in WorkSimpli to 85.6%.

On

January 18, 2022, the Company acquired Cleared, a rapidly growing nationwide allergy telehealth platform that provides personalized treatments

for allergy, asthma, and immunology.

THE

OFFERING

This

prospectus relates to the offer and sale from time to time of up to an aggregate of 152,912 shares of the Company’s Common Stock

by the Selling Stockholders.

In

connection with the Private Offering, under the terms of the Registration Rights Agreement entered into with the Selling Stockholders

on the same date and in connection with the Securities Purchase Agreement, we must register with the U.S. Securities and Exchange Commission

152,912 shares of common stock. The number of shares ultimately offered for resale by the Selling Stockholders depends upon the liquidity

and market price of our common stock.

| Common

Stock to be offered by the Selling Stockholders: |

|

152,912

shares of Common Stock. |

| |

|

|

| Common

Stock outstanding prior to this offering (1) |

|

30,796,429 |

| |

|

|

| Common

stock to be outstanding after the offering (1) |

|

30,949,341

|

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of common stock by the Selling Stockholders. All of the net proceeds from the sale of

our Common Stock will go to the Selling Stockholders as described below in the sections entitled “Selling Stockholders”

and “Plan of Distribution”. We have agreed to bear the expenses relating to the registration of the Common Stock for

the Selling Stockholders. |

| |

|

|

| Risk

factors |

|

Investing

in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth

in the “Risk Factors” section beginning on page 6 before deciding to invest in our securities. |

| |

|

|

| Trading

symbol |

|

Our

common stock is currently quoted on the Nasdaq under the trading symbol “LFMD”. |

| (1) |

The

number of shares of our Common Stock outstanding prior to and to be outstanding immediately after this offering, as set forth in

the table above, is based on 30,796,429 shares outstanding as of June 29, 2022, and including or excluding the following as of such

date: |

| |

● |

Excludes

4,349,598 shares of Common Stock issuable upon exercise of outstanding options with a weighted average exercise price of $6.85 per

share. |

| |

|

|

| |

●

|

Excludes

3,859,637 shares of Common Stock issuable upon exercise of warrants outstanding having a weighted average exercise price of $5.60

per share; |

| |

|

|

| |

● |

Excludes

1,457,750 shares of outstanding Restricted Stock Units with a weighted-average exercise price of $8.07 per share; |

| |

|

|

| |

● |

Excludes

152,912 shares of Common Stock issuable upon exercise of the Private Placement Shares offered in this offering; and |

| |

|

|

| |

● |

Excludes

1,299,389 shares of common stock issuable upon conversion of our Series B Preferred Stock. |

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. Prior to making a decision about investing in our common stock, you should

consider carefully the specific risk factors discussed in the section entitled “Risk Factors” contained in our most recent

Annual Report on Form 10-K for the year ended December 31, 2021 as filed with the SEC, and which are incorporated in this prospectus

by reference in their entirety, as well as any amendment or updates to our risk factors reflected in subsequent filings with the SEC,

including any prospectus supplement hereto. These risks and uncertainties are not the only risks and uncertainties we face. Additional

risks and uncertainties not presently known to us, or that we currently view as immaterial, may also impair our business. If any of the

risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur, our business, financial

condition, results of operations and cash flow could be materially and adversely affected. In that case, the trading price of our common

stock could decline and you might lose all or part of your investment.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, the documents that we incorporate by reference and any free writing prospectuses that we may authorize for use in connection

with this offering contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933,

as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking

statements can generally be identified as such because the context of the statement will include words such as “may,” “will,”

“intend,” “plan,” “believe,” “anticipate,” “expect,” “estimate,”

“predict,” “potential,” “continue,” “likely,” or “opportunity,” the negative

of these words or words of similar import. Similarly, statements that describe our future plans, strategies, intentions, expectations,

objectives, goals or prospects are also forward-looking statements. Discussions containing these forward-looking statements may be found,

among other places, in the “Business” and “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” sections incorporated by reference from our most recent Annual Report on Form 10-K and our Quarterly Reports on

Form 10-Q for the quarterly periods ended subsequent to our filing of such Annual Report on Form 10-K, as well as any amendments thereto

reflected in subsequent filings with the SEC.

These

forward-looking statements are based largely on our expectations and projections about future events and future trends affecting our

business, and are subject to risks and uncertainties that could cause actual results to differ materially from those anticipated in the

forward-looking statements. The risks and uncertainties include, among others, those noted in the “Risk Factors” section

of this prospectus and in any applicable prospectus supplement or free writing prospectus, and those included in the documents that we

incorporate by reference herein and therein.

New

risks and uncertainties emerge from time to time, and it is not possible for us to predict all of the risks and uncertainties that could

have an impact on the forward-looking statements, including without limitation, risks and uncertainties relating to:

| |

● |

changes

in the market acceptance of our products; |

| |

● |

increased

levels of competition; |

| |

● |

changes

in political, economic or regulatory conditions generally and in the markets in which we operate; |

| |

● |

our

relationships with our key customers; |

| |

● |

our

ability to retain and attract senior management and other key employees; |

| |

● |

our

ability to quickly and effectively respond to new technological developments; |

| |

● |

our

ability to protect our trade secrets or other proprietary rights, operate without infringing upon the proprietary rights of others

and prevent others from infringing on our proprietary rights; |

| |

● |

our

ability to successfully commercialize our products on a large enough scale to generate profitable operations; |

| |

● |

business

interruptions resulting from geo-political actions, including war, and terrorism or disease outbreaks (such as the recent outbreak

of COVID-19, or the novel coronavirus); |

| |

● |

our

ability to continue as a going concern; |

| |

● |

our

need to raise additional funds in the future; |

| |

● |

our

ability to successfully implement our business plan; |

| |

● |

being

able to scale our telehealth platform built to improve the experience and medical care provided to patients across the country; |

| |

● |

intellectual

property claims brought by third parties; and |

| |

● |

the

impact of any industry regulation. |

In

addition, past financial and/or operating performance is not necessarily a reliable indicator of future performance, and you should not

use our historical performance to anticipate results or future period trends. We can give no assurances that any of the events anticipated

by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial

condition. Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events

or circumstances that arise after the filing of this prospectus or any applicable prospectus supplement or free writing prospectus, or

documents incorporated by reference herein and therein, that include forward-looking statements.

SELLING

STOCKHOLDERS

This

prospectus relates to the possible resale by the Selling Stockholders of the shares of Common Stock that have been issued to the Selling

Stockholders in the Offering pursuant to the Purchase Agreement. We are filing the registration statement of which this prospectus forms

a part pursuant to the provisions of the Registration Rights Agreement, which we entered into with the Selling Stockholders on February

11, 2021 concurrently with our execution of the Purchase Agreement, in which we agreed to provide certain registration rights with respect

to sales by the Selling Stockholders of the shares of Common Stock that have been issued to the Selling Stockholders under the Purchase

Agreement.

On

February 11, 2021, the Company consummated the closing of a private placement offering, whereby pursuant to the Purchase Agreement entered

into by the Company and the Investors the Company sold to such Investors an aggregate of 608,696 shares of Common Stock, for an aggregate

purchase price of $14,000,008. The purchase price was funded on February 11, 2021 and resulted in net proceeds to the Company of approximately

$13.4 million.

BTIG,

LLC acted as exclusive Placement Agent for the Offering and received cash compensation equal to 3% of the Purchase Price.

The

table below lists the Selling Stockholders and other information regarding the beneficial ownership of the shares of common stock by

each of the Selling Stockholders. The second column lists the number of shares of common stock beneficially owned by each Selling Stockholder,

based on its ownership of the shares of common stock and warrants, as of the date hereof. The third column lists the shares of common

stock being offered by this prospectus by the Selling Stockholders.

In

accordance with the terms of the Registration Rights Agreement, this prospectus generally covers the resale of the Shares of Common Stock

issued to the Selling Stockholders in the Offering. The fourth column assumes the sale of all of the shares offered by the Selling Stockholders

pursuant to this prospectus.

The

Selling Stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

| Name of Selling Stockholder | |

Shares of Common Stock

Beneficially

Owned Prior to

Offering | | |

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus | | |

Shares of Common Stock

Beneficially

Owned After

Offering (1) | |

| Aaron Jackson | |

| 8,696 | | |

| 8,696 | | |

| - | |

| Alexander Mironov | |

| 2,857 | | |

| 2,857 | | |

| - | |

| BLP Dinari Investments LLC | |

| 21,739 | | |

| 21,739 | | |

| - | |

| Aaron Yormak 2018 GST Trust | |

| 6,522 | | |

| 6,522 | | |

| - | |

| Brian Yormak 2018 GST Trust | |

| 21,739 | | |

| 21,739 | | |

| - | |

| Jacob Yormak 2018 GST Trust | |

| 8,696 | | |

| 8,696 | | |

| - | |

| Jeff and Paula Yormak, Individuals | |

| 17,391 | | |

| 17,391 | | |

| - | |

| William Yormak 2018 GST Trust | |

| 6,522 | | |

| 6,522 | | |

| - | |

| Eric Aroesty | |

| 4,348 | | |

| 4,348 | | |

| - | |

| Theta Capital LLC | |

| 5,706 | | |

| 5,706 | | |

| - | |

| Joe Lucosky | |

| 4,348 | | |

| 4,348 | | |

| - | |

| Joshua Mark | |

| 870 | | |

| 870 | | |

| - | |

| Commonwealth Opportunity Platform LLC | |

| 21,739 | | |

| 21,739 | | |

| - | |

| Wes Edens | |

| 10,870 | | |

| 10,870 | | |

| - | |

| Family Trust Under Article V of the Wesley R. Edens 2011 Annuity Trust Agreement | |

| 10,869 | | |

| 10,869 | | |

| - | |

| | |

| 152,912 | | |

| 152,912 | | |

| - | |

| (1) |

Assumes

that the Selling Stockholder sells all of its shares being offered pursuant to this prospectus. |

| |

|

| (2) |

The

shares of Common Stock to be offered were issued to the Selling Stockholder pursuant to the Offering. |

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of common stock by the Selling Stockholders. All of the net proceeds from the sale of our

common stock will go to the Selling Stockholders as described below in the sections entitled “Selling Stockholders” and “Plan

of Distribution”. We have agreed to bear the expenses relating to the registration of the common stock for the Selling Stockholders.

PLAN

OF DISTRIBUTION

We

are registering the shares of common stock previously issued to permit the resale of these shares of common stock by the holders of the

common stock from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling

stockholders of the shares of common stock. We will bear all fees and expenses incident to our obligation to register the shares of common

stock.

The

selling stockholders may sell all or a portion of the shares of common stock held by them and offered hereby from time to time directly

or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers,

the selling stockholders will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of common

stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices

determined at the time of sale or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block

transactions, pursuant to one or more of the following methods:

| |

● |

on

any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale; |

| |

|

|

| |

● |

in

the over-the-counter market; |

| |

|

|

| |

● |

in

transactions otherwise than on these exchanges or systems or in the over-the-counter market; |

| |

|

|

| |

● |

through

the writing or settlement of options, whether such options are listed on an options exchange or otherwise; |

| |

|

|

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

● |

block

trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as

principal to facilitate the transaction; |

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

short

sales made after the date the Registration Statement is declared effective by the SEC; |

| |

|

|

| |

● |

agreements

between broker-dealers and the selling securityholders to sell a specified number of such shares at a stipulated price per share; |

| |

|

|

| |

● |

a

combination of any such methods of sale; and |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

selling stockholders may also sell shares of common stock under Rule 144 promulgated under the Securities Act of 1933, as amended, if

available, rather than under this prospectus. In addition, the selling stockholders may transfer the shares of common stock by other

means not described in this prospectus. If the selling stockholders effect such transactions by selling shares of common stock to or

through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts,

concessions or commissions from the selling stockholders or commissions from purchasers of the shares of common stock for whom they may

act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers

or agents may be in excess of those customary in the types of transactions involved). In connection with sales of the shares of common

stock or otherwise, the selling stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short

sales of the shares of common stock in the course of hedging in positions they assume. The selling stockholders may also sell shares

of common stock short and deliver shares of common stock covered by this prospectus to close out short positions and to return borrowed

shares in connection with such short sales. The selling stockholders may also loan or pledge shares of common stock to broker-dealers

that in turn may sell such shares.

The

selling stockholders may pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they

default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock

from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision

of the Securities Act amending, if necessary, the list of selling stockholders to include the pledgee, transferee or other successors

in interest as selling stockholders under this prospectus. The selling stockholders also may transfer and donate the shares of common

stock in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial

owners for purposes of this prospectus.

To

the extent required by the Securities Act and the rules and regulations thereunder, the selling stockholders and any broker-dealer participating

in the distribution of the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities

Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions

or discounts under the Securities Act. At the time a particular offering of the shares of common stock is made, a prospectus supplement,

if required, will be distributed, which will set forth the aggregate amount of shares of common stock being offered and the terms of

the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation

from the selling stockholders and any discounts, commissions or concessions allowed or re-allowed or paid to broker-dealers.

Under

the securities laws of some states, the shares of common stock may be sold in such states only through registered or licensed brokers

or dealers. In addition, in some states the shares of common stock may not be sold unless such shares have been registered or qualified

for sale in such state or an exemption from registration or qualification is available and is complied with.

There

can be no assurance that any selling stockholder will sell any or all of the shares of common stock registered pursuant to the registration

statement, of which this prospectus forms a part.

The

selling stockholders and any other person participating in such distribution will be subject to applicable provisions of the Securities

Exchange Act of 1934, as amended, and the rules and regulations thereunder, including, without limitation, to the extent applicable,

Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares of common stock by the selling

stockholders and any other participating person. To the extent applicable, Regulation M may also restrict the ability of any person engaged

in the distribution of the shares of common stock to engage in market-making activities with respect to the shares of common stock. All

of the foregoing may affect the marketability of the shares of common stock and the ability of any person or entity to engage in market-making

activities with respect to the shares of common stock.

We

will pay all expenses of the registration of the shares of common stock pursuant to the registration rights agreement, estimated to be

$63,238.55 in total, including, without limitation, Securities and Exchange Commission filing fees and expenses of compliance with state

securities or “blue sky” laws; provided, however, a selling stockholder will pay all underwriting discounts and selling commissions,

if any. We will indemnify the selling stockholders against liabilities, including some liabilities under the Securities Act in accordance

with the registration rights agreements or the selling stockholders will be entitled to contribution. We may be indemnified by the selling

stockholders against civil liabilities, including liabilities under the Securities Act that may arise from any written information furnished

to us by the selling stockholder specifically for use in this prospectus, in accordance with the related registration rights agreements

or we may be entitled to contribution.

Once

sold under the registration statement, of which this prospectus forms a part, the shares of common stock will be freely tradable in the

hands of persons other than our affiliates.

DESCRIPTION

OF CAPITAL STOCK

General

The

following description of our capital stock and certain provisions of our certificate of incorporation, as amended, and bylaws are summaries

and are qualified by reference to our certificate of incorporation, as amended, and our bylaws.

Our

authorized capital stock consists of 100,000,000 shares of common stock, all with a par value of $0.01 per share and 5,000,000 shares

of preferred stock, all with a par value of $0.0001 per share.

As

of June 29, 2022, we had 302 holders of record of our common stock, which excludes stockholders whose shares were held in nominee or

street name by brokers. The actual number of common stockholders is greater than the number of record holders and includes stockholders

who are beneficial owners, but whose shares are held in street name by brokers and other nominees. This number of holders of record also

does not include stockholders whose shares may be held in trust by other entities.

Common

Stock

The

holders of common stock are entitled to one vote per share on all matters to be voted upon by the stockholders. Subject to preferences

that may be applicable to any outstanding preferred stock, the holders of common stock will be entitled to receive ratably such dividends,

if any, as may be declared from time to time by the board of directors out of funds legally available therefor. In the event of our liquidation,

dissolution or winding up, the holders of our common stock will be entitled to share ratably in all assets remaining after payment of

liabilities, subject to prior distribution rights of preferred stock, if any, then outstanding. The holders of our common stock will

have no preemptive or conversion rights or other subscription rights. There will be no redemption or sinking fund provisions applicable

to our common stock.

As

of June 29, 2022, we had 30,796,429 shares of our common stock outstanding.

Preferred

Stock

Pursuant

to the terms of our certificate of incorporation, our board of directors has the authority to issue preferred stock in one or more series

and to fix the designations, powers, preferences and rights, and the qualifications, limitations or restrictions thereof, including dividend

rights, conversion right, voting rights, terms of redemption, liquidation preferences and the number of shares constituting any class

or series, without further vote or action by the stockholders.

On

August 27, 2020, the board of directors established our Series B Preferred Stock that consists of 5,000 shares. The shares of Series

B Preferred Stock have a stated value of $1,000 per share and are convertible into Common Stock at the election of the holder of the

Series B Preferred Stock, at a price of $3.25 per share, subject to adjustment. Each holder of Series B Preferred Stock shall be entitled

to receive, with respect to each share of Series B Preferred Stock then outstanding and held by such holder, dividends at the rate of

thirteen percent (13%) per annum. As of June 29, 2022, we had 1,299,389 shares of common stock issuable upon conversion of our Series

B Preferred Stock.

On

October 4, 2021, the NASDAQ Stock Market approved the listing and registration of our 8.875% Series A Cumulative Perpetual Preferred

Stock that consist of 1,400,000 shares, par value $0.0001 per share (the “Series A Preferred Stock”). The liquidation preference

of each share of Series A Preferred Stock is $25.00. Each holder of Series A Preferred Stock shall be entitled to receive cumulative

distributions from, and including, the date of original issuance, in the amount of $2.21875 per share each year, which is equivalent

to 8.875% of the $25.00 liquidation preference per share.

The

issuance of shares of preferred stock may decrease the amount of earnings and assets available for distribution to the holders of common

stock, could adversely affect the rights and powers, including voting rights, of the common stock, and could have the effect of delaying,

deterring or preventing a change of control of us or an unsolicited acquisition proposal.

As

of June 29, 2022, there were 1,400,000 shares of preferred stock outstanding.

Stock

Options

As

of June 29, 2022, we had outstanding options to acquire 4,349,598 shares of our common stock, having a weighted-average exercise price

of $6.85 per share.

Warrants

As

of June 29, 2022, we had outstanding warrants to purchase an aggregate of 3,859,637 shares of our common stock, having a weighted-average

exercise price of $5.60 per share.

Anti-Takeover

Effects of Delaware Law and Our Certificate of Incorporation and Bylaws

The

following is a summary of certain provisions of Delaware law, our Certificate of Incorporation and our bylaws. This summary does not

purport to be complete and is qualified in its entirety by reference to the corporate law of Delaware and our Certificate of Incorporation

and bylaws.

Effect

of Delaware Anti-Takeover Statute. We are subject to Section 203 of the Delaware General Corporation Law, an anti-takeover law.

In general, Section 203 prohibits a Delaware corporation from engaging in any business combination (as defined below) with any interested

stockholder (as defined below) for a period of three years following the date that the stockholder became an interested stockholder,

subject to certain exceptions.

Section

203 defines “business combination” to include the following:

| |

● |

any

merger or consolidation involving the corporation and the interested stockholder; |

| |

|

|

| |

● |

any

sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder; |

| |

|

|

| |

● |

subject

to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation

to the interested stockholder; |

|

● |

subject

to limited exceptions, any transaction involving the corporation that has the effect of increasing the proportionate share of the

stock of any class or series of the corporation beneficially owned by the interested stockholder; or |

| |

|

|

| |

● |

the

receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided

by or through the corporation. |

In

general, Section 203 defines an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding voting

stock of the corporation, or who beneficially owns 15% or more of the outstanding voting stock of the corporation at any time within

a three-year period immediately prior to the date of determining whether such person is an interested stockholder, and any entity or

person affiliated with or controlling or controlled by any of these entities or persons.

Our

Charter Documents. Our charter documents include provisions that may have the effect of discouraging, delaying or preventing a change

in control or an unsolicited acquisition proposal that a stockholder might consider favorable, including a proposal that might result

in the payment of a premium over the market price for the shares held by our stockholders. Certain of these provisions are summarized

in the following paragraphs.

Effects

of authorized but unissued common stock. One of the effects of the existence of authorized but unissued common stock may be to enable

our board of directors to make more difficult or to discourage an attempt to obtain control of our Company by means of a merger, tender

offer, proxy contest or otherwise, and thereby to protect the continuity of management. If, in the due exercise of its fiduciary obligations,

the board of directors were to determine that a takeover proposal was not in our best interest, such shares could be issued by the board

of directors without stockholder approval in one or more transactions that might prevent or render more difficult or costly the completion

of the takeover transaction by diluting the voting or other rights of the proposed acquirer or insurgent stockholder group, by putting

a substantial voting block in institutional or other hands that might undertake to support the position of the incumbent board of directors,

by effecting an acquisition that might complicate or preclude the takeover, or otherwise.

Cumulative

Voting. Our Certificate of Incorporation does not provide for cumulative voting in the election of directors, which would allow holders

of less than a majority of the stock to elect some directors.

Special

Meeting of Stockholders and Stockholder Action by Written Consent. A special meeting of stockholders may only be called by our president,

chief executive officer, chairman of the board of directors, board of directors or such officers or other persons as our board may designate

at any time and for any purpose or purposes as shall be stated in the notice of the meeting. A special meeting of stockholders may also

be called by the Chairman of the Board of Directors upon written notice of demand by the President of the Corporation or the holder(s)

of at least 25% of the outstanding voting shares of the Corporation.

Indemnification

of Officers and Directors. The Company shall indemnify its officers and directors under the circumstances and to the full extent

permitted by law. A director of the Company shall not be personally liable to the Company or its stockholders for monetary damages for

breach of fiduciary duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to the Company

or its stockholders, (ii) for acts or omissions not in good faith or which involved intentional misconduct or a knowing violation of

law, (iii) under Section 174 of the DGCL for unlawful payment of dividends or improper redemption of stock, or (iv) for any transaction

from which the director derived an improper personal benefit. If the DGCL is hereafter amended to authorize the further elimination or

limitation of the liability of directors, then the liability of a director of the Company, in addition to the limitation on personal

liability provided herein, shall be limited to the fullest extent permitted by the DGCL, as amended. Any repeal or modification of this

paragraph by the stockholders of the Company shall be prospective only, and shall not adversely affect any limitation on the personal

liability of a director of the Company existing at the time of such repeal or modification.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Worldwide Stock Transfer, LLC, One University Plaza, Suite 505, Hackensack, NJ 07601.

LEGAL

MATTERS

The

validity of our common stock being offered hereby has been previously passed upon for us by Lucosky Brookman LLP, Woodbridge, New Jersey.

EXPERTS

Our

consolidated balance sheets as of December 31, 2021 and 2020, and the related consolidated statements of operations, stockholders’

deficit, and cash flows for the fiscal years ended December 31, 2021 and 2020, have been audited by Friedman LLP, an independent registered

public accounting firm, as set forth in its report appearing herein and are included in reliance upon such report given on the authority

of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

are a reporting company and file our annual, quarterly and current reports, proxy statements and other information with the SEC. You

may read and obtain copies of our reports, proxy statements and other information we file with the SEC, at the SEC’s public reference

room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information about the operation of

the public reference room. Our SEC filings are also available at the SEC’s website at http://www.sec.gov.

INFORMATION

INCORPORATED BY REFERENCE

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede

that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or replaces that statement.

We

incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or

15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, between

the date of this prospectus and the termination of the offering of the securities described in this prospectus. We are not, however,

incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not

deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits

furnished pursuant to Item 9.01 of Form 8-K.

This

prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been

filed with the SEC:

| |

● |

Our

Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 7, 2022. |

| |

|

|

| |

● |

Our

Current Reports on Form 8-K filed with the SEC on February 22, 2022, February 7, 2022, February 2, 2022, January 19, 2022, January 12, 2022. |

| |

|

|

| |

● |

the

description of the Company’s Common Stock contained in the Company’ Registration Statement on Form 8-A (File No. 001-39785)

filed on December 9, 2020, including any amendment or report filed for the purpose of updating such description. |

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination

of this Offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior

to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will

also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports

and documents.

Pursuant

to Rule 412 under the Securities Act, any statement contained in the documents incorporated or deemed to be incorporated by reference

in this Registration Statement shall be deemed to be modified, superseded or replaced for purposes of this Registration Statement to

the extent that a statement contained herein or in any other subsequently filed document which also is incorporated or deemed to be incorporated

by reference in this Registration Statement modifies, supersedes or replaces such statement. Any such statement so modified, superseded

or replaced shall not be deemed, except as so modified, superseded or replaced, to constitute a part of this Registration Statement.

Upon

written or oral request made to us at the address or telephone number below, we will, at no cost to the requester, provide to each person,

including any beneficial owner, to whom this prospectus is delivered, a copy of any or all of the information that has been incorporated

by reference into this prospectus (other than an exhibit to a filing, unless that exhibit is specifically incorporated by reference into

that filing), but not delivered with this prospectus:

LifeMD,

Inc.

236

Fifth Avenue, Suite 400

New

York, NY 10001

(866)

351-5907

152,912

Shares of Common Stock

PROSPECTUS

July

7, 2022

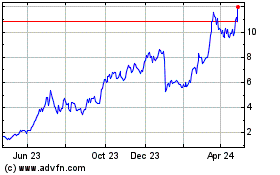

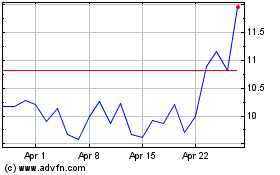

LifeMD (NASDAQ:LFMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

LifeMD (NASDAQ:LFMD)

Historical Stock Chart

From Apr 2023 to Apr 2024