As filed with the Securities and Exchange Commission

on August 3, 2023

REGISTRATION NO. 333-268921

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST- EFFECTIVE AMENDMENT NO.

2

TO

FORM S-4

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF

1933

LIBERTY MEDIA CORPORATION

(Exact name of Registrant as specified

in its charter)

| Delaware |

4833 |

37-1699499 |

| (State or other jurisdiction |

(Primary Standard Industrial |

(I.R.S. Employer |

| of incorporation or organization) |

Classification code number) |

Identification No.) |

12300 Liberty Boulevard, Englewood,

Colorado 80112, (720) 875-5400

(Address, including zip code, and

telephone number, including area code, of Registrant’s

principal executive offices)

| |

|

| Renee L. Wilm |

Copy to: |

| Chief Legal Officer & Chief Administrative Officer |

C. Brophy Christensen |

| Liberty Media Corporation |

O’Melveny & Myers LLP |

| 12300 Liberty Boulevard |

Two Embarcadero Center |

| Englewood, Colorado 80112 |

28th Floor San Francisco, CA 94111 |

| (720) 875-5400 |

(415) 984-8700 |

(Name, address, including zip code, and telephone number,

including area code, of agent for service) |

|

Approximate date of commencement

of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective

and all other conditions to the proposed transactions described herein have been satisfied or waived, as applicable.

If the securities being registered

on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction

G, check the following box: ¨

If this Form is filed to

register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier registration statement for the same offering. x File No. 333-268921

Indicate by check mark whether

the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

x |

Accelerated filer |

¨ |

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ |

| |

|

Emerging growth company |

¨ |

If an emerging growth

company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

If applicable, place an X in the box to

designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border

Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border

Third-Party Tender Offer) ¨

EXPLANATORY NOTE

This Post-Effective Amendment No. 2 to Form S-4

amends the Registration Statement on Form S-4 of Liberty Media Corporation (the “Registrant”) (Registration No. 333-268921),

as amended prior to the date hereto (the “Registration Statement”), which was declared effective by the Securities and Exchange

Commission (the “Commission”) on June 9, 2023 (the “Effective Date”). All capitalized terms used but not otherwise

defined in this Post-Effective Amendment No. 2 shall have the meanings ascribed to them in the Registration Statement.

At 5:00 p.m. New York City time, August 3,

2023, the Registrant will effect a reclassification of (i) each outstanding share of Liberty SiriusXM common stock into one share of the

corresponding series of new Liberty SiriusXM common stock and 0.2500 of a share of the corresponding series of Liberty Live common stock,

and (ii) each outstanding share of Liberty Formula One common stock into one share of the corresponding series of new Liberty Formula

One common stock and 0.0428 of a share of the corresponding series of Liberty Live common stock.

This Post-Effective Amendment No. 2 is being filed for the purposes

of replacing Exhibit 8.2: Form of Opinion of Skadden, Arps, Slate, Meagher, & Flom LLP regarding certain tax matters

previously filed with the Registration Statement, with a final, executed version of Exhibit 8.2. The Registration Statement is hereby

amended, as appropriate, to reflect the replacement of such exhibit.

Item 21. Exhibits And Financial Statement Schedules.

(a) Exhibits.

The following is a complete list of Exhibits filed as part of this Registration Statement.

| Exhibit No. |

|

Document |

| 2.1 |

|

Form of Reorganization Agreement between the Registrant and Atlanta Braves Holdings, Inc.* |

| 3.1 |

|

Form of Amended and Restated Certificate of Incorporation of the Registrant to be in effect at the time of the Reclassification.* |

| 3.2 |

|

Amended and Restated Bylaws of the Registrant (incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K as filed on August 6, 2015 (File No. 001-35707).* |

| 4.1 |

|

Specimen Certificate for Shares of the Registrant’s Series A Liberty SiriusXM common stock, par value $0.01 per share.* |

| 4.2 |

|

Specimen Certificate for Shares of the Registrant’s Series B Liberty SiriusXM common stock, par value $0.01 per share.* |

| 4.3 |

|

Specimen Certificate for Shares of the Registrant’s Series C Liberty SiriusXM common stock, par value $0.01 per share.* |

| 4.4 |

|

Specimen certificate for shares of the Registrant’s Series A Liberty Formula One Common Stock, par value $0.01 per share.* |

| 4.5 |

|

Specimen certificate for shares of the Registrant’s Series B Liberty Formula One Common Stock par value $0.01 per share.* |

| 4.6 |

|

Specimen Certificate for Shares of the Registrant’s Series C Liberty Formula One Common Stock, par value $0.01 per share.* |

| 4.7 |

|

Specimen Certificate for Shares of the Registrant’s Series A Liberty Live Common Stock, par value $0.01 per share.* |

| 4.8 |

|

Specimen Certificate for Shares of the Registrant’s Series B Liberty Live Common Stock, par value $0.01 per share.* |

| 4.9 |

|

Specimen Certificate for Shares of the Registrant’s Series C Liberty Live Common Stock, par value $0.01 per share.* |

| 4.10 |

|

The Registrant undertakes to furnish to the Securities and Exchange Commission, upon request, a copy of all instruments with respect to long-term debt not filed herewith. |

| 5.1 |

|

Opinion of O’Melveny & Myers LLP as to the legality of the securities being registered.* |

| 8.1 |

|

Opinion of Skadden, Arps, Slate, Meagher & Flom LLP regarding certain tax matters.* |

| 8.2 |

|

Opinion of Skadden, Arps, Slate, Meagher & Flom LLP regarding certain tax matters. |

| 10.1 |

|

Form of Tax Sharing Agreement between the Registrant and Atlanta Braves Holdings, Inc.* |

| 10.2 |

|

Form of Services Agreement between the Registrant and Atlanta Braves Holdings, Inc.* |

| 10.3 |

|

Form of Facilities Sharing Agreement between the Registrant and Atlanta Braves Holdings, Inc.* |

| 10.4 |

|

Form of Aircraft Time Sharing Agreements between the Registrant and Atlanta Braves Holdings, Inc.* |

| 10.5 |

|

Form of Registration Rights Agreement between the Registrant and Atlanta Braves Holdings, Inc.* |

| 23.1 |

|

Consent of KPMG LLP (Liberty Media Corporation).* |

| 23.2 |

|

Consent of KPMG LLP (Atlanta Braves Holdings, Inc.).* |

| 23.3 |

|

Consent of O’Melveny & Myers LLP (included in Exhibit 5.1).* |

| 23.4 |

|

Consent of Skadden, Arps, Slate, Meagher & Flom LLP (included in Exhibit 8.1).* |

| 23.5 |

|

Consent of Skadden, Arps, Slate, Meagher & Flom LLP (included in Exhibit 8.2). |

| 24.1 |

|

Power of Attorney.* |

| 99.1 |

|

Form of Proxy Card.* |

| 107 |

|

Filing Fee Table.* |

* Previously filed.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended, the Registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the City of Englewood, state of Colorado, on this 3rd day of August, 2023.

| |

LIBERTY MEDIA CORPORATION |

| |

|

| |

By: |

/s/ Renee L. Wilm |

| |

Name: |

Renee L. Wilm |

| |

Title: |

Chief Legal Officer and Chief Administrative Officer |

Pursuant to the requirements of the Securities Act,

this registration statement has been signed below by the following persons in the capacities and on the dates indicated.

| Name |

|

Title |

|

Date |

| |

|

|

|

|

|

*

|

|

Chairman of the Board and Director |

|

August 3, 2023 |

| John C. Malone |

|

*

|

|

President, Chief Executive Officer

(Principal Executive Officer) and Director |

|

August 3, 2023 |

| Gregory B. Maffei |

|

*

|

|

Chief Accounting Officer and Principal Financial Officer (Principal Financial Officer and Principal Accounting Officer) |

|

August 3, 2023 |

| Brian J. Wendling |

|

*

|

|

Director |

|

August 3, 2023 |

| Robert R. Bennett |

|

*

|

|

Director |

|

August 3, 2023 |

| Derek Chang |

|

*

|

|

Director |

|

August 3, 2023 |

| Brian M. Deevy |

|

*

|

|

Director |

|

August 3, 2023 |

| M. Ian G. Gilchrist |

|

*

|

|

Director |

|

August 3, 2023 |

| Evan D. Malone |

|

*

|

|

Director |

|

August 3, 2023 |

| Larry E. Romrell |

|

*

|

|

Director |

|

August 3, 2023 |

| Andrea L. Wong |

| *By: |

/s/ Renee L. Wilm |

|

| |

Renee L. Wilm |

|

| |

Attorney-in-fact |

|

Exhibit 8.2

Skadden,

Arps, Slate, Meagher & Flom llp

One

Manhattan West

New

York, NY 10001

TEL: (212) 735-3000

FAX: (212) 735-2000

WWW.SKADDEN.COM

FIRM/AFFILIATE

OFFICES

BOSTON

CHICAGO

HOUSTON

LOS ANGELES

PALO ALTO

WASHINGTON, D.C.

WILMINGTON

BEIJING

BRUSSELS

FRANKFURT

HONG KONG

LONDON

MUNICH

PARIS

SÃO PAULO

SEOUL

SHANGHAI

SINGAPORE

TOKYO

TORONTO |

August 3, 2023

Liberty Media Corporation

12300 Liberty Boulevard

Englewood, Colorado 80112

|

Ladies and Gentlemen:

We have acted as special tax counsel to Liberty

Media Corporation, a Delaware corporation (“Liberty”), in connection with specified aspects of the amendment and

restatement of Liberty’s certificate of incorporation, pursuant to which (i) Liberty’s existing Liberty SiriusXM

common stock (“Old Liberty SiriusXM Common Stock”) and Liberty Formula One common stock (“Old Liberty

Formula One Common Stock”) will be reclassified into three new tracking stocks to be designated as Liberty SiriusXM common

stock (“New Liberty SiriusXM Common Stock”), Liberty Formula One common stock (“New Liberty Formula One

Common Stock”), and Liberty Live common stock (“Liberty Live Common Stock”) and, in connection

therewith, provide for the attribution of the businesses, assets, and liabilities of Liberty’s existing Liberty SiriusXM Group

and Formula One Group among Liberty’s newly created Liberty SiriusXM Group, Formula One Group, and Liberty Live Group;

(ii) each outstanding share of Old Liberty SiriusXM Common Stock will be reclassified into one newly issued share of the

corresponding series of New Liberty SiriusXM Common Stock and 0.2500 of a newly issued share of the corresponding series of Liberty

Live Common Stock; and (iii) each outstanding share of Old Liberty Formula One Common Stock will be reclassified into one newly

issued share of the corresponding series of New Liberty Formula One Common Stock and 0.0428 of a newly issued share of the

corresponding series of Liberty Live Common Stock (collectively, the “Reclassification”). Liberty has requested

our opinion (the “Opinion”) regarding the U.S. federal income tax consequences of the Reclassification.1

In rendering this Opinion, we have examined originals

or copies, certified or otherwise identified to our satisfaction, of (i) the existing certificate of incorporation of Liberty that

will be in effect immediately before the Reclassification; (ii) the amended and restated certificate of incorporation of Liberty

that will be in effect immediately after the Reclassification; (iii) the registration statement on Form S-4 (File No. 333-268921)

filed by Liberty with the Securities and Exchange Commission (the “SEC”) on December 20, 2022, including the joint

proxy statement/prospectus that forms a part thereof and the exhibits attached thereto, as amended through the date hereof (the “Registration

Statement”); (iv) all other submissions to the SEC related to the Registration Statement; (v) the officer’s

certificate furnished to us by Liberty, dated as of the date hereof, together with the exhibits attached thereto (the “Liberty

Officer’s Certificate”); and (vi) such other documents as we have considered necessary or appropriate as a basis

for this Opinion. In our examination, we have assumed the genuineness of all signatures, the legal capacity of all natural persons, the

authenticity of all documents submitted to us as originals, the conformity to originals of all documents submitted to us as certified,

photostatic, electronic, or facsimile copies, and the authenticity of the originals of such documents.

_____________________________

1

Unless otherwise indicated, all “section”

references in this Opinion are to the Internal Revenue Code of 1986, as amended (the “Code”).

Liberty Media Corporation

August 3, 2023

Page 2

As to certain facts material to this Opinion, we

have relied upon the statements and representations set forth in the Liberty Officer’s Certificate. We have assumed that such statements

and representations are true, correct, and complete as of the date hereof and will continue to be true, correct, and complete without

regard to any qualification as to knowledge, belief, or otherwise. We have also assumed that the Reclassification will be consummated

in accordance with its terms and in the manner described in the Registration Statement, and that none of the material terms or conditions

contained therein will be waived or modified in any respect. This Opinion is expressly conditioned upon, among other things, the initial

and continuing accuracy of the facts, information, covenants, representations, and warranties set forth in the documents referred to

above, including those contained in the Liberty Officer’s Certificate. Any change or inaccuracy in or to such facts, information,

covenants, representations, or warranties (including on account of events occurring after the consummation of the Reclassification) could

affect one or more of the conclusions stated herein.

This Opinion is based on the Code, the Treasury

Department regulations promulgated thereunder, judicial decisions, published rulings and procedures of the Internal Revenue Service (the

“Service”), and such other authorities as we have considered relevant, all as in effect on the date hereof. It should

be noted that the authorities upon which this Opinion is based are subject to change at any time, possibly with retroactive effect. Any

change in such authorities could affect one or more of the conclusions expressed herein. Moreover, an opinion of counsel represents counsel’s

best judgment as to the outcome on the merits with respect to the matters addressed therein. Opinions of counsel are not binding on courts

or the Service, and there can be no assurance that this Opinion will be accepted by the Service or, if challenged, by a court.

Liberty Media Corporation

August 3, 2023

Page 3

Based upon and subject to the foregoing and the

conditions, limitations, assumptions and qualifications set forth herein, it is our opinion that, under current U.S. federal income tax

law:

| 1. | The Reclassification will qualify as a reorganization under section

368(a). |

| 2. | The New Liberty SiriusXM Common Stock, New Liberty Formula One Common

Stock, and Liberty Live Common Stock will be treated as stock of Liberty for U.S. federal

income tax purposes. |

| 3. | No income, gain or loss will be recognized by Liberty as a result

of the Reclassification. |

| 4. | Except with respect to cash received in lieu of fractional shares

of Liberty Live Common Stock, holders of Old Liberty SiriusXM Common Stock and holders of

Old Liberty Formula One Common Stock will not recognize income, gain, or loss as a result

of the Reclassification. |

| 5. | The New Liberty SiriusXM Common Stock, New Liberty Formula One Common

Stock, and Liberty Live Common Stock will not constitute “section 306 stock”

within the meaning of section 306(c). |

* * *

Liberty Media Corporation

August 3, 2023

Page 4

Except as set forth above, we express no opinion

or other views regarding the tax consequences of the Reclassification or any other transactions. This Opinion relates solely to the U.S.

federal income tax consequences of the Reclassification, and no opinion is expressed as to the tax consequences of the Reclassification

under any state, local, or foreign tax laws or under any U.S. federal tax laws other than those pertaining to income taxation. This Opinion

is expressed as of the date hereof, and we are under no obligation to supplement or revise this Opinion to reflect any legal developments

or factual matters or changes arising after the date hereof.

We are furnishing this Opinion to Liberty solely

in connection with the Reclassification and the Registration Statement. We hereby consent to the use of our name in the Registration

Statement and to the filing of this Opinion as an exhibit to the Registration Statement. In giving this consent, we do not admit that

we come within the category of persons whose consent is required under section 7 of the Securities Act of 1933, as amended, or the rules and

regulations of the SEC thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ Skadden, Arps, Slate, Meagher & Flom LLP |

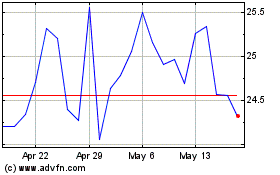

Liberty Media (NASDAQ:LSXMK)

Historical Stock Chart

From Apr 2024 to May 2024

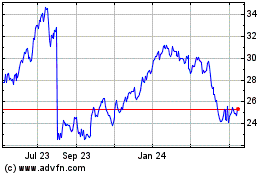

Liberty Media (NASDAQ:LSXMK)

Historical Stock Chart

From May 2023 to May 2024