Radiopharm Receives Strategic Investment for up to A$18 million

June 20 2024 - 8:41PM

Radiopharm Theranostics Limited (ASX:RAD)

(

Radiopharm or the

Company), a

developer of diagnostic and therapeutic radiopharmaceutical

products, has entered into strategic agreements with Lantheus

Holdings, Inc. (LNTH.NASDAQ), a leading radiopharmaceutical-focused

company, and its affiliates (

Lantheus). Lantheus

has agreed to make an initial equity investment of A$7.5 million

(US$4.99 million) and will have an option to invest a further A$7.5

million (US$5 million) within 6 months on the same terms.

Additionally, Radiopharm has agreed to transfer two of its early

preclinical assets to Lantheus for A$3.0 million (US$2.0 million)

pursuant to a separate transfer and development agreement.

The net proceeds of Lantheus’ investment will be used by the

Company for drug manufacturing, clinical trials and general working

capital.

Subject to shareholder approval for the purposes of ASX Listing

Rule 7.1, under a subscription agreement entered into with

Radiopharm (Subscription Agreement), Lantheus has

subscribed for up to:

a) A$7.5 million (US$4.99 million) at

A$0.05 (US$0.033) per share;b) unlisted options with a six-month

term after the date the subscription shares are issued to invest up

to an additional A$7.5 million (US$5 million) at A$0.05 (US$0.033)

per share; andc) one option for every four shares subscribed for

(inclusive of any shares further subscribed for in the next six

months), exercisable at A$0.06 per option expiring in August

2026.

Under a separate transfer and development agreement, Radiopharm

has assigned and sub-licensed two of its preclinical assets to

Lantheus for A$3.0 million (US$2.0 million). Assets covered under

the agreement are a TROP2 targeting nanobody and a LRRC15 targeting

mAb.

B. Riley Securities is acting as financial advisor to the

Company on the Lantheus transactions.

Further terms of Lantheus investment

Under the Subscription Agreement, and subject to shareholder

approval at an upcoming extraordinary general meeting, Lantheus

will be issued up to:

- 149,625,180 shares under the Placement amounting to a

subscription amount of US$4.99 million (A$7.5 million)

(Lantheus Shares), subject to 12 months

escrow;

- 149,925,040 unlisted options with an exercise price of A$0.05

(5 cents) and an expiry date six months from the date of issue of

the Lantheus Shares (Lantheus Options), with 12

months escrow applying to any shares issued on exercise of the

options; and

- 37,406,295 options (i.e. one (1) new option for every four (4)

new Lantheus Shares issued) with an exercise price of A$0.06 and an

expiry date approximately 2 years from the date the Lantheus Shares

are issued (Lantheus Placement Options),

- subject to and upon exercise of the Lantheus Options, up to

37,481,260 additional options (on the basis of one (1) new option

for every four (4) new Lantheus Shares issued upon exercise of the

Lantheus Options) with an exercise price of A$0.06 and an expiry

date approximately 2 years from the date the Lantheus Shares are

issued (Second Tranche Lantheus Options),

(together, the Lantheus Interests).

Other key terms of the Subscription Agreement (noting undefined

terms have the meanings ascribed to them in the Subscription

Agreement) include:

- Other key terms of the Lantheus Options, Lantheus Placement

Options and Second Tranche Lantheus Options are:

- Subject to compliance with the Australian Corporations Act, the

options may be exercised during the exercise period and, within

five Business Days of exercise, the Company will:

- allot and issue the number of Shares as specified in the

Exercise Notice and for which the Exercise Price has been received

by the Company in cleared funds; and

- apply for official quotation on the ASX of Shares issued

pursuant to the exercise of the Subscription Option; and

- Shares issued as a result of the exercise of an option will be

fully paid and rank pari passu in all respects with all other

Shares then on issue.

- The Company provides standard warranties regarding its standing

and the issue of the Lantheus Interests and the Company indemnifies

Lantheus against any loss to Lantheus’ investment in the Company

which Lantheus suffers or is liable for arising directly or

indirectly from a warranty being untrue or inaccurate.

Lantheus provides standard warranties regarding its standing.

- Lantheus may terminate the agreement before completion if:

- the Company is prevented from issuing or allotting the Lantheus

Shares by the order of a court of competent jurisdiction or by a

government agency;

- The Australian Securities and Investment Commission or the

Takeovers Panel commences, or threatens to commence, any inquiry,

hearing investigation or regulatory action or issues any order or

interim order or other proceedings in relation to the Company, the

Lantheus Shares or the Lantheus Options;

- the Company commits a material breach of the Subscription

Agreement; or

- any of the Company warranties cease to be true and

accurate.

- Lantheus may terminate the Subscription Agreement if

Shareholder approval (in the form contemplated above) is not

obtained within a three-month period.

- As is customary with these types of arrangements, the agreement

contains typical investor protections such as negative covenants

and representations and warranties by the Company.

Other key terms of the transfer and development agreement

include:

- The Company and its subsidiary, Radiopharm Theranostics (USA),

Inc., a Nevada corporation, together have agreed to transfer and

assign to Lantheus each of their title, and interest in the TROP2

targeting nanobody and a LRRC15 targeting mAb assets, including all

data and information regarding the compounds and technologies;

and

- As is customary with these types of arrangements, the agreement

contains typical assignee protections such as risk allocation

clauses and representations and warranties made by the Company and

Radiopharm Theranostics (USA), Inc. in respect of each entity’s

standing and its ownership of and rights in the assets being

assigned and sold.

Authorised on behalf of the Radiopharm Theranostics

board of directors by Executive Chairman Paul Hopper.

For more information:

Riccardo CanevariCEO & Managing DirectorP: +1 862 309 0293E:

rc@radiopharmtheranostics.com

Paul Hopper Executive Chairman E:

paulhopper@lifescienceportfolio.com

Matt WrightNWR CommunicationsP: +61 451 896 420E:

matt@nwrcommunications.com.au

Follow Radiopharm Theranostics: Website –

https://radiopharmtheranostics.com/ Twitter –

https://twitter.com/TeamRadiopharm Linked In –

https://www.linkedin.com/company/radiopharm-theranostics/

Not an offer of securitiesThis announcement

does not constitute an offer to sell, or a solicitation of an offer

to buy, securities in the United States or any other jurisdiction.

Any securities described in this announcement have not been, and

will not be, registered under the US Securities Act of 1933 and may

not be offered or sold in the United States except in transactions

exempt from, or not subject to, the registration requirements of

the US Securities Act and applicable US state securities laws.

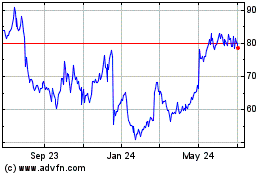

Lantheus (NASDAQ:LNTH)

Historical Stock Chart

From May 2024 to Jun 2024

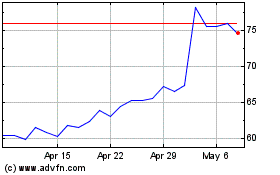

Lantheus (NASDAQ:LNTH)

Historical Stock Chart

From Jun 2023 to Jun 2024