Kratos Announces Completion of Refinancing Transaction

February 22 2022 - 4:01PM

Kratos Defense & Security Solutions, Inc. (Nasdaq:KTOS), a

leading National Security Solutions provider, today announced the

refinancing of its outstanding $90 million Revolving Credit

Facility and $300 million 6.5% Senior Secured Notes, with a new

5-year $200 million Revolving Credit Facility and 5-year $200

million Term Loan A (collectively, the “New Credit Facility”). The

Company has drawn approximately $200 million under the Term Loan A

and $100 million on the new Revolving Credit Facility, with $100

million remaining in borrowing capacity. Mandatory amortization on

the Term Loan A is 2.5% in each of the first and second years and

5.0% in each of the third, fourth and fifth years, with the

remaining outstanding balance due at maturity. Based on the current

borrowing rates under the New Credit Facility and the current

amount drawn, the Company expects to save approximately $10 to $13

million in cash interest payments annually. The redemption of the

Company’s outstanding $300 million 6.5% Senior Secured Notes due

November 2025 is expected to close on March 14, 2022 (the

“Redemption Date”), for an amount of cash equal to 103.25% of the

principal amount thereof plus accrued and unpaid interest thereon

to, but excluding, the Redemption Date (the “Redemption Offer”).

As a result of the refinancing of the Company’s

existing 6.5% Senior Notes and the existing Revolving Credit

Facility, the Company expects to record one-time charges of

approximately $13 to $15 million in its fiscal first quarter,

comprised of the 3.25% call premium and the write-off of the

deferred financing costs associated with the original financing

transactions.

Deanna Lund, Kratos’ Executive Vice President

and Chief Financial Officer, said, “The cost of this refinancing

including the call premium is expected to be recouped in

approximately 12 months, with expected savings of approximately $10

to $13 million in cash interest payments annually, based on current

interest rates and the amount currently drawn. This refinancing

further positions Kratos to remain focused internally – on

executing our strategic plan and continuing to make targeted

investments to organically grow the business.”

Eric DeMarco, President and CEO of Kratos, said,

“Kratos’ mission is to rapidly develop and deliver the right

products and systems at an affordable cost to our customers, which

we believe is a winning business model for all of our stakeholders.

This successful refinancing by Deanna and her team is an incredibly

positive event for the entire Kratos enterprise.”

Truist Securities, Inc. was the lead arranger

for Kratos’ New Credit Facility.

About Kratos Defense & Security

Solutions

Kratos Defense & Security Solutions,

Inc. (NASDAQ:KTOS) develops and fields transformative,

affordable technology, platforms, and systems for United States

National Security related customers, allies, and commercial

enterprises. Kratos is changing the way breakthrough

technologies for these industries are rapidly brought to market

through proven commercial and venture capital backed approaches,

including proactive research, and streamlined development

processes. At Kratos, affordability is a technology, and

we specialize in unmanned systems, satellite communications,

cyber security/warfare, microwave electronics, missile defense,

hypersonic systems, training and combat systems and next generation

turbo jet and turbo fan engine development. For more information go

to www.kratosdefense.com.

Notice

Regarding

Forward-Looking

Statements

All statements in this press release are made as

of February 22, 2022. Except as required by applicable law, Kratos

undertakes no obligation to publicly update or revise these

statements, whether as a result of new information, future events

or otherwise. This press release may contain “forward-looking

statements” within the meaning of federal securities laws,

including statements related to the expected timing, final terms

and completion of the Redemption Offer, the expected reduction in

annual interest expense to be realized by the Company as a result

of the Redemption Offer and the recently completed refinancing

transaction and similar statements concerning anticipated future

events and expectations that are not historical facts. Kratos

cautions you that these statements are not guarantees of future

performance and are subject to numerous evolving risks and

uncertainties that Kratos may not currently be able to accurately

predict or assess, including the risk that Kratos is unable to

redeem all of the Senior Secured Notes in the Redemption Offer,

within the anticipated timeline or at all, risks associated with

fluctuations in the financial markets and other risks and

uncertainties that are described in further detail in Kratos’

reports filed with the Securities and Exchange Commission,

including Kratos’ Annual Report on Form 10-K for the fiscal year

ended December 26, 2021. There can be no assurance that the

Redemption Offer transaction will be completed, or that the

expected annual savings of interest expense will be realized as

described herein or at all. Any of these factors could cause actual

results to differ materially from expectations Kratos expresses or

implies in this press release.

Press

Contact:Yolanda White858-812-7302 Direct

Investor

Information:877-934-4687investor@kratosdefense.com

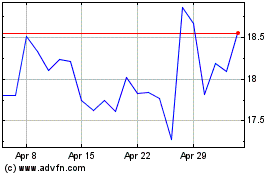

Kratos Defense and Secur... (NASDAQ:KTOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

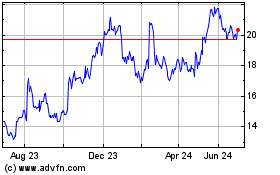

Kratos Defense and Secur... (NASDAQ:KTOS)

Historical Stock Chart

From Apr 2023 to Apr 2024