Form 8-K - Current report

March 04 2024 - 4:27PM

Edgar (US Regulatory)

0001620459false00016204592024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported): | February 28, 2024 |

| | |

JAMES RIVER GROUP HOLDINGS, LTD. |

(Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Bermuda | 001-36777 | 98-0585280 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

Wellesley House, 2nd Floor, 90 Pitts Bay Road, Pembroke HM08, Bermuda

(Address of principal executive offices)

(Zip Code)

(441) 278-4580

(Registrant's telephone number, including area code)

| | |

|

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8‑K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a‑12 under the Exchange Act (17 CFR 240.14a‑12)

☐ Pre-commencement communications pursuant to Rule 14d‑2(b) under the Exchange Act (17 CFR 240.14d‑2(b))

☐ Pre-commencement communications pursuant to Rule 13e‑4(c) under the Exchange Act (17 CFR 240.13e‑4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, par value $0.0002 per share | JRVR | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

2023 Short-Term Incentive Plan Payouts

On February 28, 2024, the Board of Directors (the “Board”) of James River Group Holdings, Ltd. (the “Company”) approved the use of discretion to increase the cash incentive award amounts for the 2023 performance period under the Company’s Short-Term Incentive Plan (the “STI Plan”) above those that would have otherwise been payable based on the actual achievement of the applicable performance targets under the plan. The Board’s approval follows the recommendation of members of the Compensation and Human Capital Committee (the “Compensation Committee”) to exercise such discretion.

The exercise of discretion, which is permitted under the STI Plan, involved the Company’s Adjusted Combined Ratio and Adjusted EBIT metrics of the STI Plan, which were negatively impacted by multiple strategic activities undertaken by the Company in 2023. The strategic activities consist of the Company’s sale of the renewal rights of the Company’s individual risk worker’s compensation business, the Company’s pending sale of its subsidiary JRG Reinsurance Company Ltd. (the “JRG Re Transaction”), and the Company’s exploration of strategic alternatives. Specifically, the calculation of the Adjusted EBIT performance measure was adjusted to exclude (i) actual expenses pertaining to the three strategic actions to the extent that they would have otherwise been included in the calculation of the 2023 Adjusted EBIT performance measure, and (ii) the loss on the sale of JRG Reinsurance Company Ltd. (“JRG Re”). The amount payable in connection with the achievement of the group Adjusted Combined Ratio performance measure utilized the threshold performance amount of 99.9% in recognition of the management team’s contributions to the strategic objectives of the Company. The segment adjusted combined ratio performance goals applicable to segment business leaders were not adjusted.

Below are the amounts of modified payouts for the executive officers who are expected to be the named executive officers in our 2024 compensation disclosure and analysis:

| | | | | | | | |

| Name and Title | STI Plan Payout | Payout (% of Target) |

| Frank N. D’Orazio, Chief Executive Officer | $773,300 | 80.0 | % |

| Sarah C. Doran, Chief Financial Officer | $457,600 | 80.0 | % |

| Richard J. Schmitzer, President and Chief Executive Officer, Excess and Surplus Lines segment | $556,063 | 83.0 | % |

| Daniel J. Heinlein, President and Chief Executive Officer, JRG Re | $269,556 | 71.7 | % |

| Michael J. Hoffmann, Chief Underwriting Officer | $265,200 | 80.0 | % |

| Terence M. McCafferty, President and Chief Executive Officer, Specialty Admitted Insurance segment* | $385,325 | 88.7 | % |

| * Mr. McCafferty left the Company on December 2, 2023. Pursuant to a Separation and Release Agreement by and among Mr. McCafferty, the Company and certain subsidiaries of the Company, Mr. McCafferty’s payout under the STI Plan is consistent with a qualified retirement from the Company, and is a pro-rated amount for the portion of 2023 that he was employed by the Company. The amount is determined based upon the level of achievement of the performance goals for the 2023 fiscal year, as adjusted for the use of discretion as described above. |

Treatment of RSUs in Connection with the JRG Re Transaction

On the date of consummation of the JRG Re Transaction, Daniel J. Heinlein, President and Chief Executive Officer of JRG Re, is expected to remain an employee of JRG Re under its new ownership by the acquiror, and no longer be employed by a subsidiary of the Company. Mr. Heinlein holds unvested service based restricted share units (“Service-Based RSUs”) and restricted share units that vest based upon service and achievement of certain performance measures (“Performance-Based RSUs”). Pursuant to the terms of such awards, unvested restricted share units would be forfeited upon Mr. Heinlein ceasing to be employed by a subsidiary of the Company in connection with the JRG Re Transaction. The Board, following the recommendation of members of the Compensation Committee, waived the service requirements for such awards and authorized (i) the Service-Based RSUs to be settled with a payment in cash in an amount equal to the number of unvested Service-Based RSUs held by Mr. Heinlein, multiplied

by the closing sales price of a common share of the Company on the Nasdaq Stock Market as of or immediately preceding the closing date of the JRG Re Transaction, and (ii) pro-rata settlement of the Performance-Based RSUs in an amount of shares determined based upon actual performance during the three year performance period. Pro-rated amounts will be determined based upon the period that Mr. Heinlein was employed by a subsidiary of the Company during the applicable performance period, and payments of the applicable award will be made at the same time that payment is made in the ordinary course following completion of the applicable performance period.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| JAMES RIVER GROUP HOLDINGS, LTD. |

| |

Dated: March 4, 2024 | By: /s/ Sarah C. Doran |

| Sarah C. Doran |

| Chief Financial Officer |

Document and Entity Information

|

Feb. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity Registrant Name |

JAMES RIVER GROUP HOLDINGS, LTD.

|

| Entity Central Index Key |

0001620459

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

D0

|

| Entity File Number |

001-36777

|

| Entity Tax Identification Number |

98-0585280

|

| Entity Address, Address Line One |

90 Pitts Bay Road

|

| Entity Address, Address Line Two |

2nd Floor

|

| Entity Address, Address Line Three |

Wellesley House

|

| Entity Address, City or Town |

Pembroke

|

| Entity Address, Postal Zip Code |

HM08

|

| Entity Address, Country |

BM

|

| City Area Code |

441

|

| Local Phone Number |

278-4580

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, par value $0.0002 per share

|

| Trading Symbol |

JRVR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

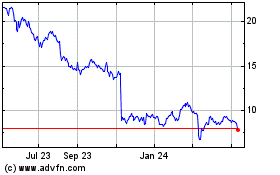

James River (NASDAQ:JRVR)

Historical Stock Chart

From Jun 2024 to Jul 2024

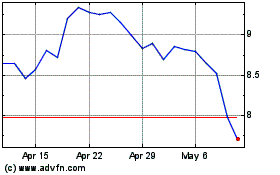

James River (NASDAQ:JRVR)

Historical Stock Chart

From Jul 2023 to Jul 2024